Enphase (ENPH)

Enphase keeps us up at night. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Enphase Will Underperform

The first company to successfully commercialize the solar micro-inverter, Enphase (NASDAQ:ENPH) manufactures software-driven home energy products.

- Sales tumbled by 19.8% annually over the last two years, showing market trends are working against its favor during this cycle

- Earnings per share have contracted by 17.7% annually over the last two years, a headwind for returns as stock prices often echo long-term EPS performance

- Forecasted revenue decline of 17.1% for the upcoming 12 months implies demand will fall even further

Enphase doesn’t measure up to our expectations. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Enphase

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Enphase

At $49.28 per share, Enphase trades at 21.6x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Enphase (ENPH) Research Report: Q4 CY2025 Update

Home energy technology company Enphase (NASDAQ:ENPH) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 10.3% year on year to $343.3 million. On top of that, next quarter’s revenue guidance ($285 million at the midpoint) was surprisingly good and 8.3% above what analysts were expecting. Its non-GAAP profit of $0.71 per share was 21.4% above analysts’ consensus estimates.

Enphase (ENPH) Q4 CY2025 Highlights:

- Revenue: $343.3 million vs analyst estimates of $336.9 million (10.3% year-on-year decline, 1.9% beat)

- Adjusted EPS: $0.71 vs analyst estimates of $0.58 (21.4% beat)

- Adjusted EBITDA: $95.96 million vs analyst estimates of $91.21 million (27.9% margin, 5.2% beat)

- Revenue Guidance for Q1 CY2026 is $285 million at the midpoint, above analyst estimates of $263.3 million

- Operating Margin: 6.5%, down from 14.3% in the same quarter last year

- Free Cash Flow Margin: 11%, down from 41.6% in the same quarter last year

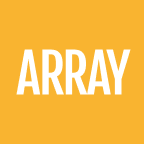

- Sales Volumes fell 34.9% year on year (26.2% in the same quarter last year)

- Market Capitalization: $4.77 billion

Company Overview

The first company to successfully commercialize the solar micro-inverter, Enphase (NASDAQ:ENPH) manufactures software-driven home energy products.

Enphase was founded in 2006 and changed the solar power sector by offering systems that increase energy production, simplify installation, and enhance the reliability of solar arrays. Over the years, Enphase has expanded globally, continuously extending its product line to include battery storage solutions and energy management software, solidifying its position in the solar energy technology market.

Enphase delivers energy products, primarily focusing on the solar power sector. Its product line includes microinverters, known for their compatibility with virtually all solar panels. These microinverters enhance solar energy harvest and system reliability, making them a cornerstone of efficient residential and commercial solar setups. Enphase's smart battery systems further complement their offerings, providing energy storage solutions for increased energy independence and resilience. With a strong emphasis on integration, these systems are designed to optimize energy usage and maximize savings.

Enphase has also expanded its product offerings to include electric vehicle (EV) chargers, meeting the growing demand for home energy solutions that complement solar power systems. The production of Enphase-branded EV chargers began in early 2023, aiming to enhance the integration of solar energy with electric vehicle charging. These chargers, compatible with a wide range of EVs in North America, offer homeowners the convenience of maximizing their use of solar energy.

Enphase targets segments within the solar market, including solar distributors, large installers, OEMs, strategic partners, and homeowners. Its products, especially microinverters, are integrated into solar modules by OEMs or bundled by distributors with other system components for resale. Strategic partnerships with industrial equipment suppliers and solar financing entities help broaden Enphase's market reach. The company generates recurring revenue through its suite of software solutions like the Enphase App and Solargraf, which support solar system design, installation, monitoring, and maintenance. These tools not only ensure ongoing customer engagement but also facilitate the broader adoption of Enphase systems, enhancing long-term customer relationships.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors in the solar industry include SunPower (NASDAQ:SPWR), Sunnova Energy (NYSE:NOVA), and SolarEdge (NASDAQ:SEDG).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Enphase’s 13.7% annualized revenue growth over the last five years was exceptional. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Enphase’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 19.8% over the last two years.

Enphase also reports its number of units sold, which reached 1.31 million in the latest quarter. Over the last two years, Enphase’s units sold averaged 23.4% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Enphase’s revenue fell by 10.3% year on year to $343.3 million but beat Wall Street’s estimates by 1.9%. Company management is currently guiding for a 20% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 20.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not catalyze better top-line performance yet.

6. Gross Margin & Pricing Power

Enphase’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 39.7% gross margin over the last five years. Said differently, roughly $39.66 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, Enphase’s gross profit margin was 44.3%, marking a 33.6 percentage point increase from 10.7% in the same quarter last year. Enphase’s full-year margin has also been trending up over the past 12 months, increasing by 7.8 percentage points. If this move continues, it could suggest an environment where the company has better pricing power and stable or shrinking input costs (such as raw materials).

7. Operating Margin

Enphase has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Enphase’s operating margin decreased by 4.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Enphase generated an operating margin profit margin of 6.5%, down 7.8 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, R&D, and administrative overhead.

8. Earnings Per Share

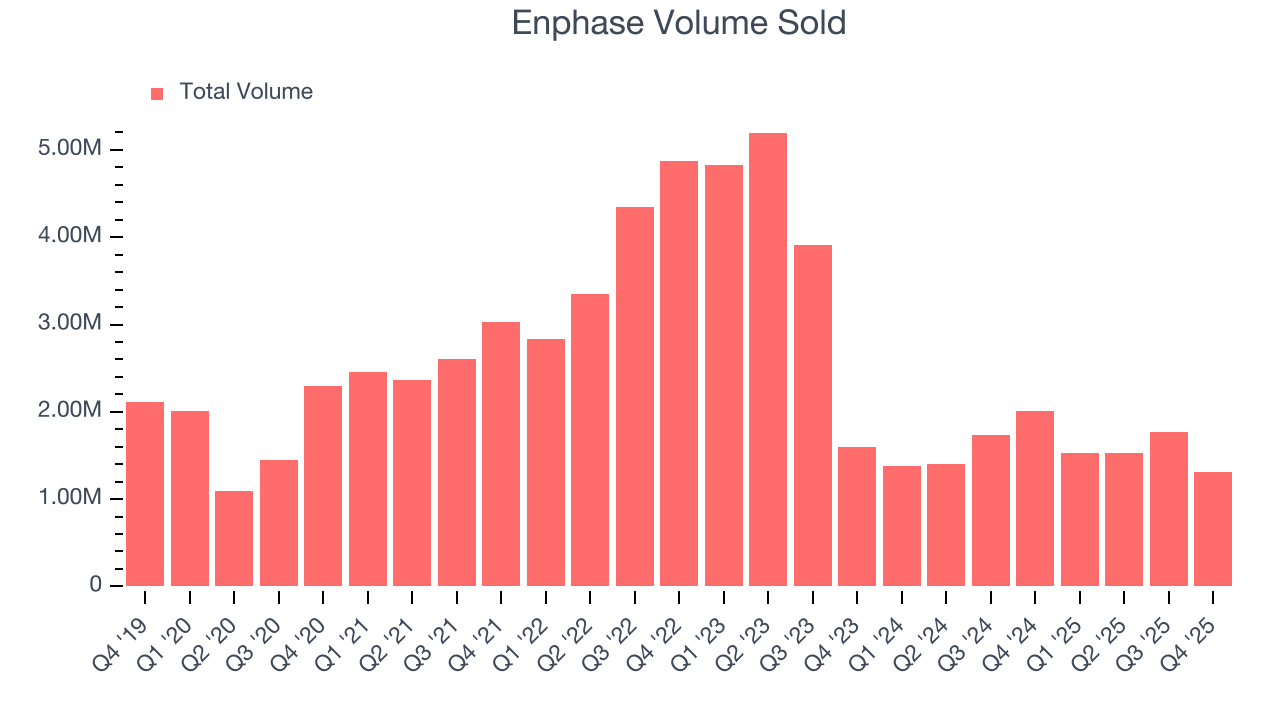

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Enphase’s EPS grew at a spectacular 16.8% compounded annual growth rate over the last five years, higher than its 13.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

We can take a deeper look into Enphase’s earnings to better understand the drivers of its performance. A five-year view shows that Enphase has repurchased its stock, shrinking its share count by 8.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Enphase, its two-year annual EPS declines of 17.7% mark a reversal from its (seemingly) healthy five-year trend. We hope Enphase can return to earnings growth in the future.

In Q4, Enphase reported adjusted EPS of $0.71, down from $0.94 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Enphase’s full-year EPS of $2.98 to shrink by 29.5%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Enphase has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 24.5% over the last five years.

Taking a step back, we can see that Enphase’s margin dropped by 15.2 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Enphase’s free cash flow clocked in at $37.84 million in Q4, equivalent to a 11% margin. The company’s cash profitability regressed as it was 30.6 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

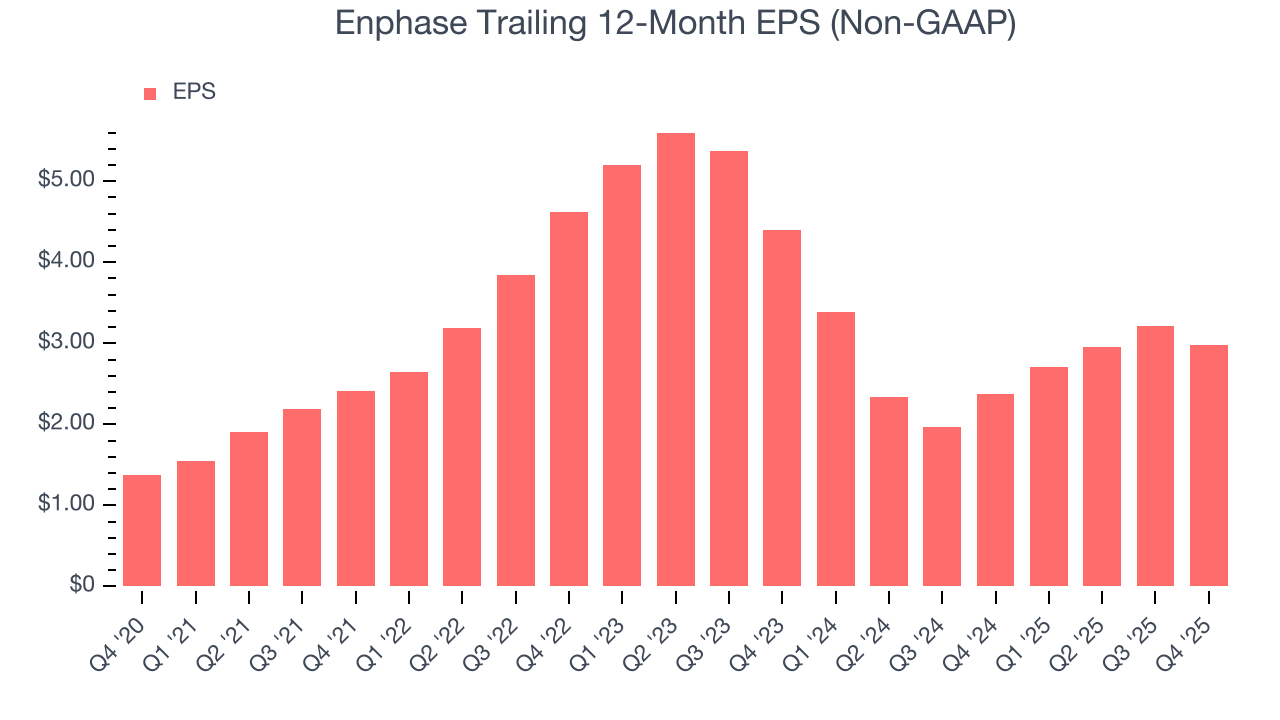

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Enphase hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its four-year average ROIC was 44.5%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Enphase’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

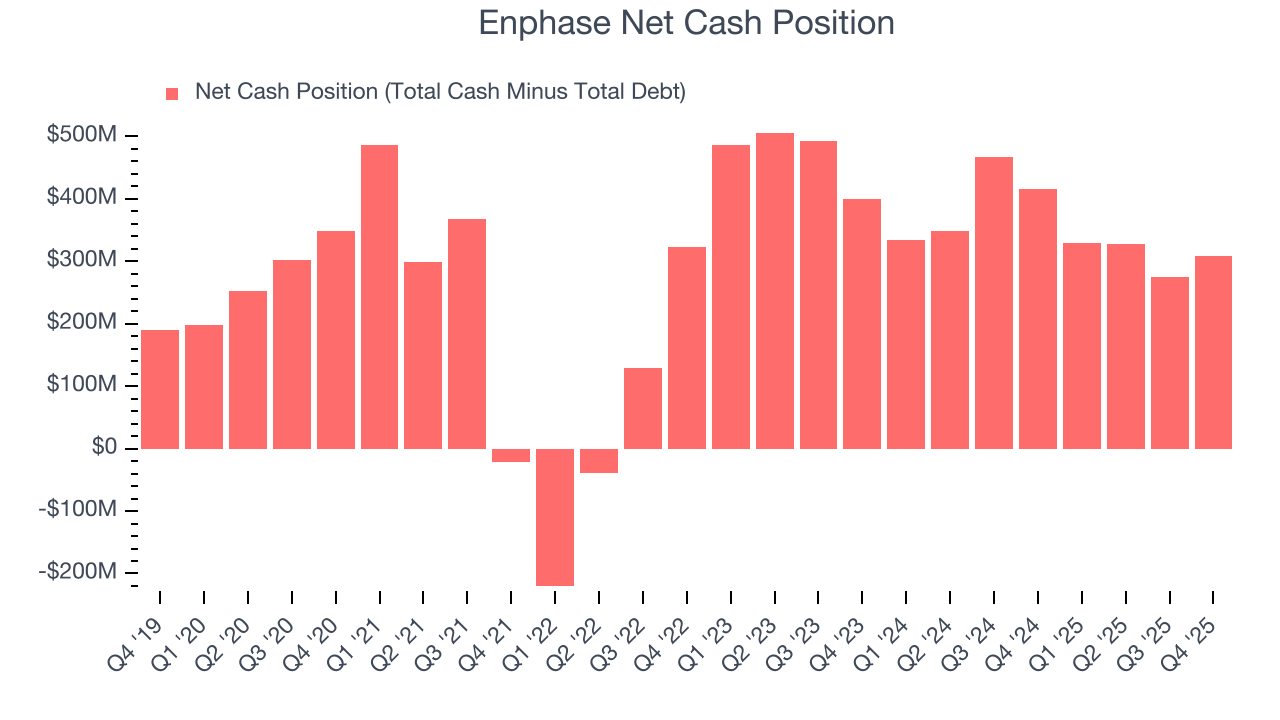

Enphase is a profitable, well-capitalized company with $1.51 billion of cash and $1.20 billion of debt on its balance sheet. This $308.5 million net cash position is 6.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Enphase’s Q4 Results

We were impressed by Enphase’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 5.9% to $39.08 immediately after reporting.

13. Is Now The Time To Buy Enphase?

Updated: February 25, 2026 at 11:30 PM EST

Are you wondering whether to buy Enphase or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Enphase doesn’t pass our quality test. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its projected EPS for the next year is lacking.

Enphase’s P/E ratio based on the next 12 months is 22.9x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $45.99 on the company (compared to the current share price of $48.42), implying they don’t see much short-term potential in Enphase.