Entegris (ENTG)

Entegris keeps us up at night. Its underwhelming returns on capital show it struggled to generate meaningful profits for shareholders.― StockStory Analyst Team

1. News

2. Summary

Why We Think Entegris Will Underperform

With fabs representing the company’s largest customer type, Entegris (NASDAQ:ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

- Projected sales growth of 2.4% for the next 12 months suggests sluggish demand

- Lacking free cash flow margin got worse over the last five years as its investment needs accelerated

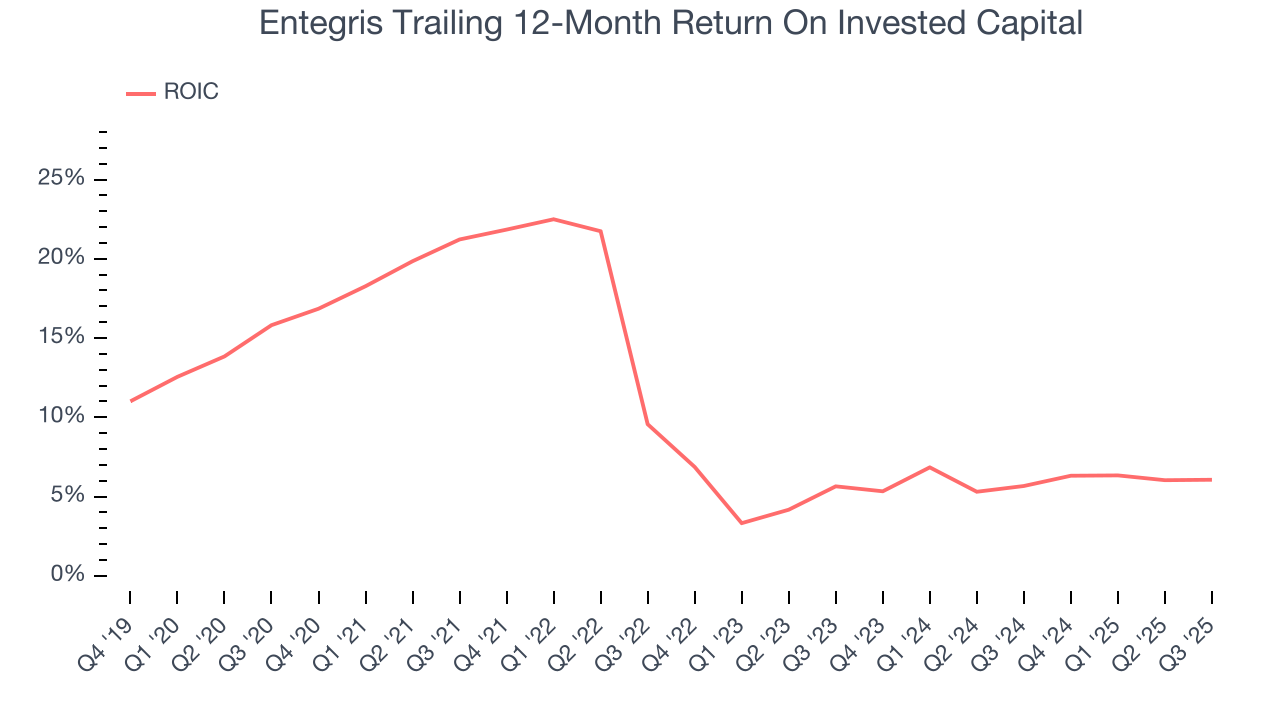

- ROIC of 9.6% reflects management’s challenges in identifying attractive investment opportunities, and its falling returns suggest its earlier profit pools are drying up

Entegris is skating on thin ice. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Entegris

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Entegris

Entegris is trading at $114.71 per share, or 40.8x forward P/E. This valuation multiple seems a bit much considering the quality you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Entegris (ENTG) Research Report: Q3 CY2025 Update

Semiconductor materials supplier Entegris (NASDAQ:ENTG) announced better-than-expected revenue in Q3 CY2025, but sales were flat year on year at $807.1 million. On the other hand, next quarter’s revenue guidance of $810 million was less impressive, coming in 2% below analysts’ estimates. Its non-GAAP profit of $0.72 per share was in line with analysts’ consensus estimates.

Entegris (ENTG) Q3 CY2025 Highlights:

- Revenue: $807.1 million vs analyst estimates of $802 million (flat year on year, 0.6% beat)

- Adjusted EPS: $0.72 vs analyst estimates of $0.72 (in line)

- Adjusted EBITDA: $220.7 million vs analyst estimates of $223.1 million (27.3% margin, 1.1% miss)

- Revenue Guidance for Q4 CY2025 is $810 million at the midpoint, below analyst estimates of $826.9 million

- Adjusted EPS guidance for Q4 CY2025 is $0.66 at the midpoint, below analyst estimates of $0.76

- Operating Margin: 15.2%, down from 16.9% in the same quarter last year

- Free Cash Flow Margin: 22.6%, up from 14.2% in the same quarter last year

- Inventory Days Outstanding: 129, down from 144 in the previous quarter

- Market Capitalization: $14.33 billion

Company Overview

With fabs representing the company’s largest customer type, Entegris (NASDAQ:ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris was founded in 1966 as Fluoroware, a company serving early microelectronics manufacturers. After merging with EMPAK in 1999 and rebranding itself Entegris, the company went public in 2000.

As chip performance advances, semiconductor manufacturing has involved increasing materials content per wafer and generally more process complexity due to smaller geometries, improved architectures, and new materials. These generally lead to ever-increasing requirements for materials purity, quality, and stability to optimize yields. Entegris provides filters, gas, and liquid delivery systems and specialty chemicals that are needed for advanced semiconductor manufacturing environments.

Entegris is organized into three segments to reflect its product portfolio and role in semiconductor manufacturing. The ‘Specialty Chemical and Engineered Materials’ segment offers products such as hazardous gasses and high-fidelity coatings. The ‘Microcontamination Control’ segment offers filters to ensure materials purity. The ‘Advanced Materials Handling’ segment offers technologies to safely and consistently transport materials and products throughout the manufacturing process.

Other competitors who provide materials and chemicals to semiconductor manufacturers include Pall Corporation (part of Danaher (NYSE:DHR)), Shin-Etsu Polymer (TYO:7970), Gemu Valves, and DuPont (NYSE:DD).

4. Revenue Growth

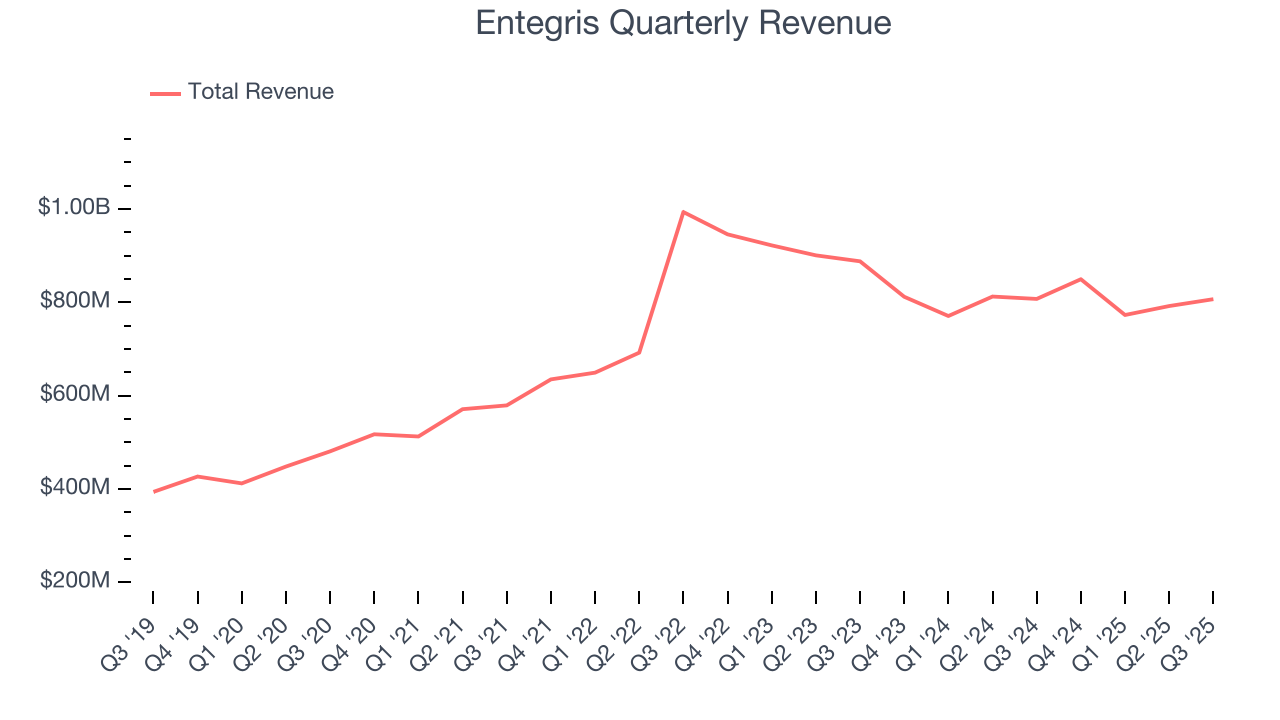

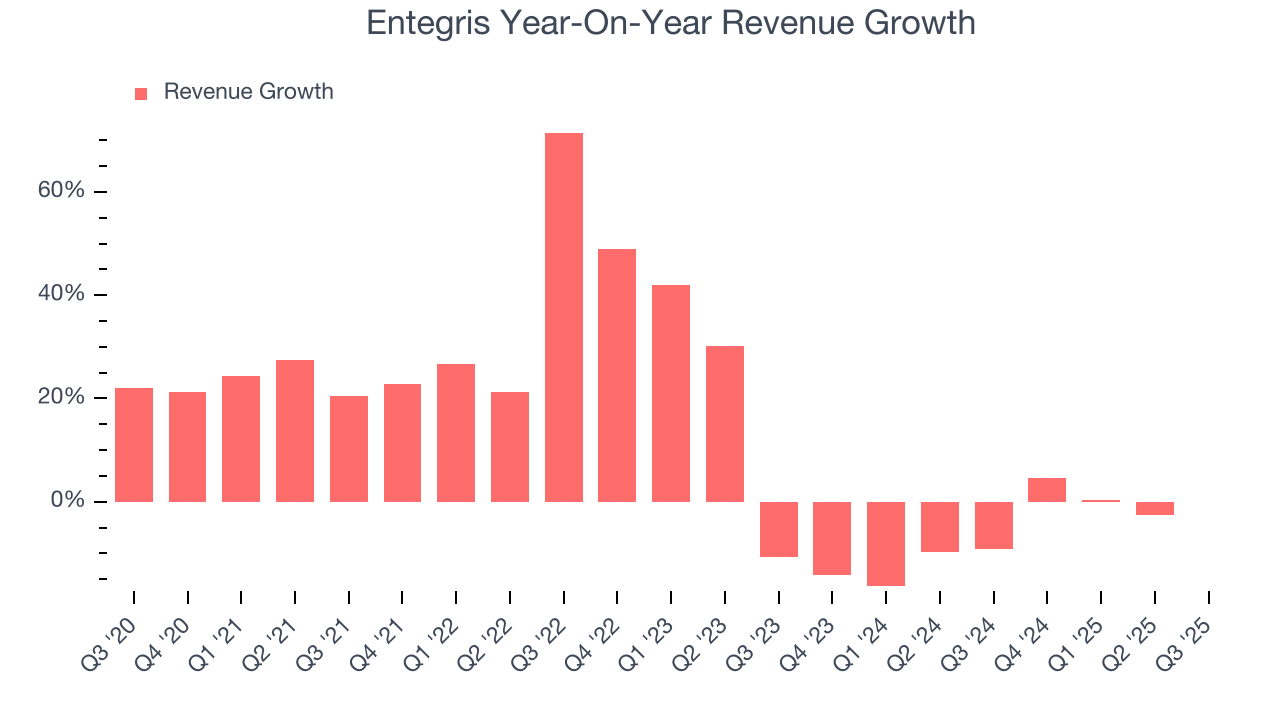

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Entegris’s sales grew at an impressive 12.7% compounded annual growth rate over the last five years. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Entegris’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.1% over the last two years.

This quarter, Entegris’s $807.1 million of revenue was flat year on year but beat Wall Street’s estimates by 0.6%. Adding to the positive news, Entegris’s flat sales marked an inflection from its revenue decline last quarter, news that will likely give some shareholders hope. Company management is currently guiding for a 4.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

5. Product Demand & Outstanding Inventory

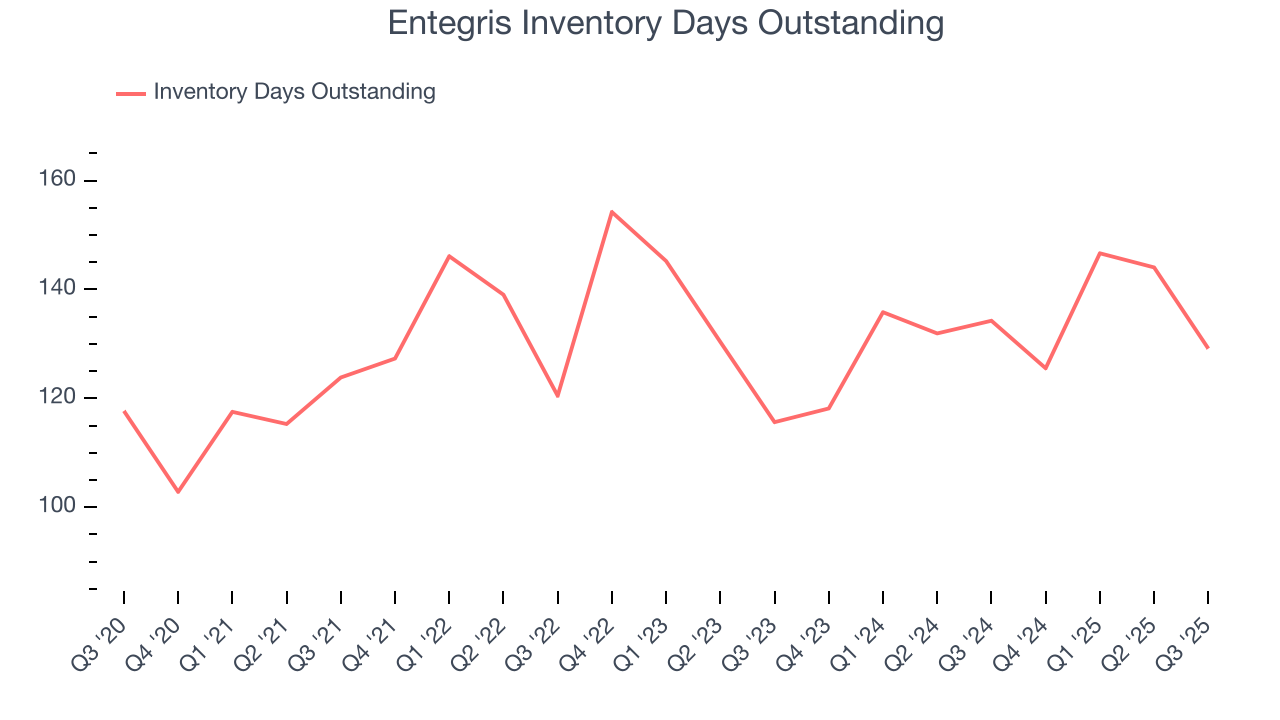

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Entegris’s DIO came in at 129, which is one day below its five-year average. At the moment, these numbers show no indication of an unusual inventory buildup.

6. Gross Margin & Pricing Power

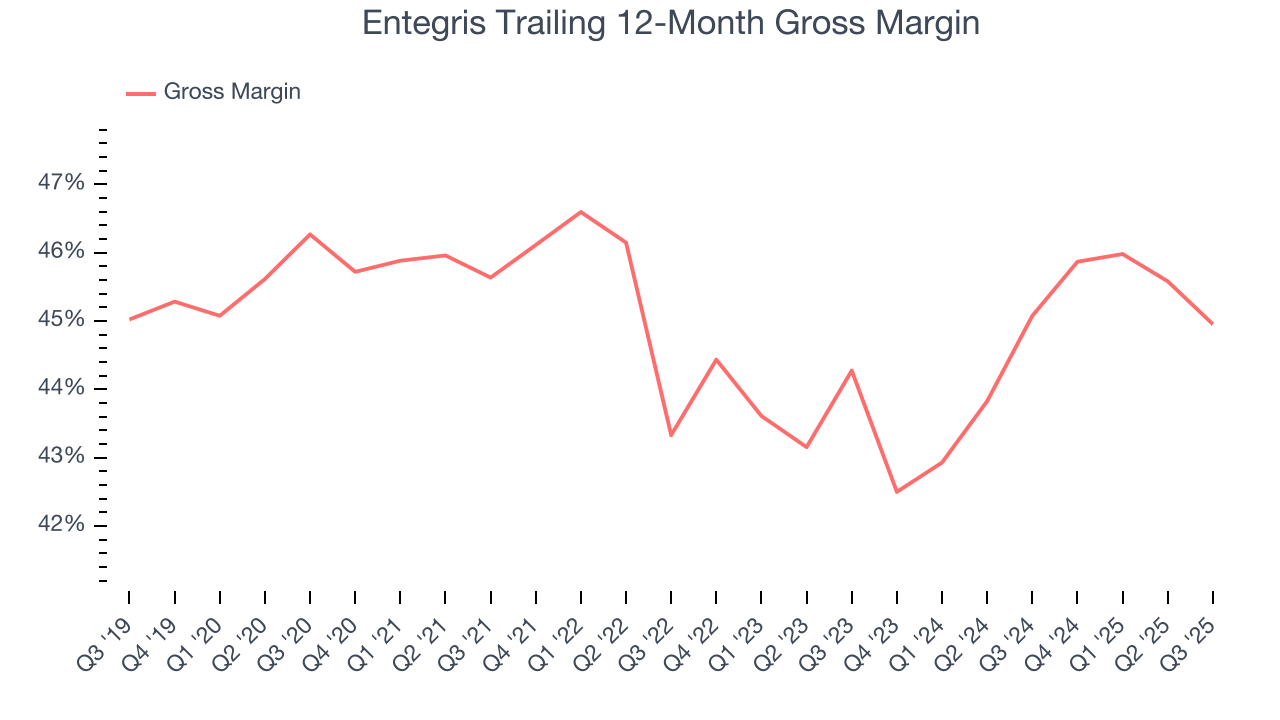

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Entegris’s gross margin is slightly below the average semiconductor company, indicating its products aren’t as mission-critical as its competitors. As you can see below, it averaged a 45% gross margin over the last two years. That means Entegris paid its suppliers a lot of money ($54.99 for every $100 in revenue) to run its business.

Entegris produced a 43.5% gross profit margin in Q3, marking a 2.5 percentage point decrease from 46% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

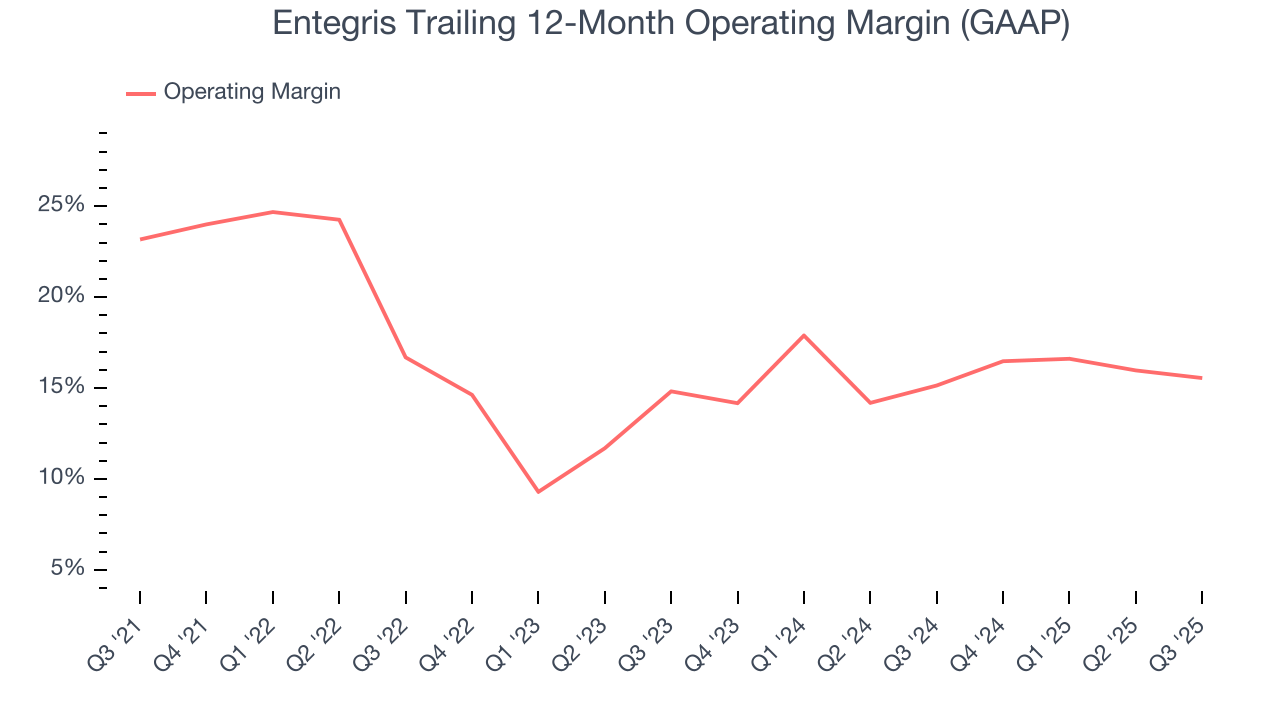

7. Operating Margin

Entegris’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 15.3% over the last two years. This profitability was higher than the broader semiconductor sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Entegris’s operating margin decreased by 7.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Entegris generated an operating margin profit margin of 15.2%, down 1.7 percentage points year on year. Since Entegris’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

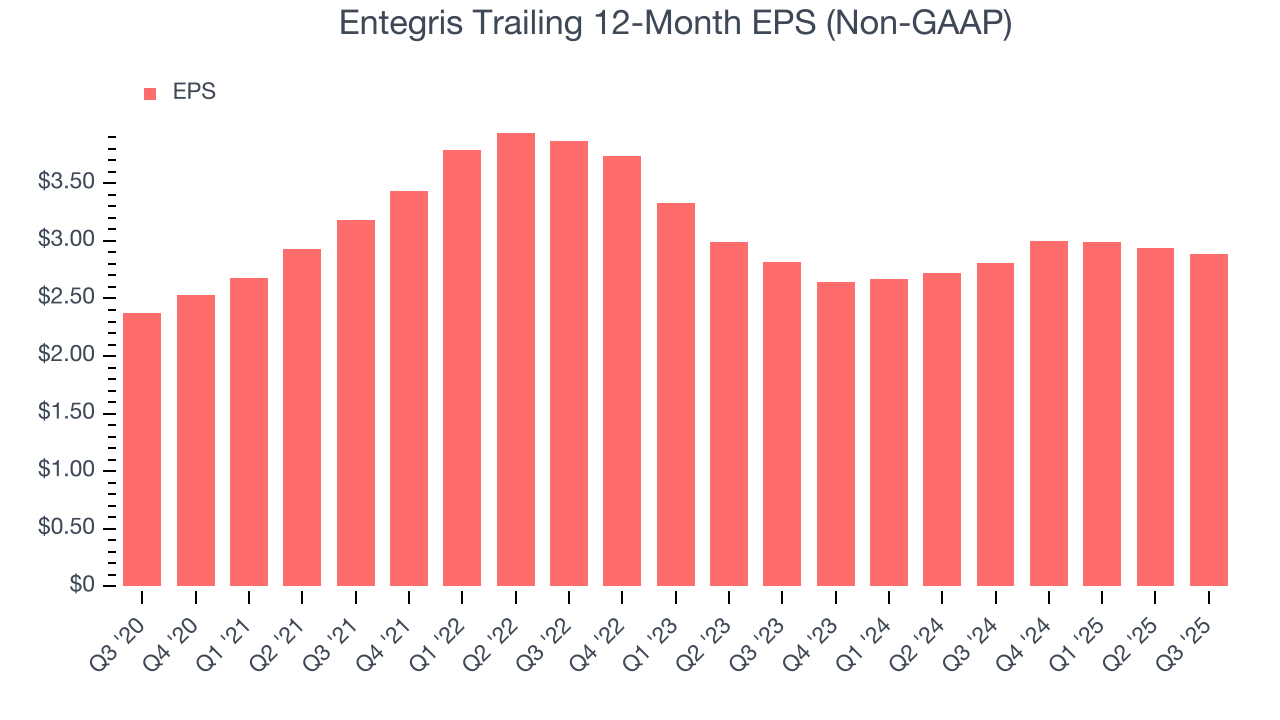

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

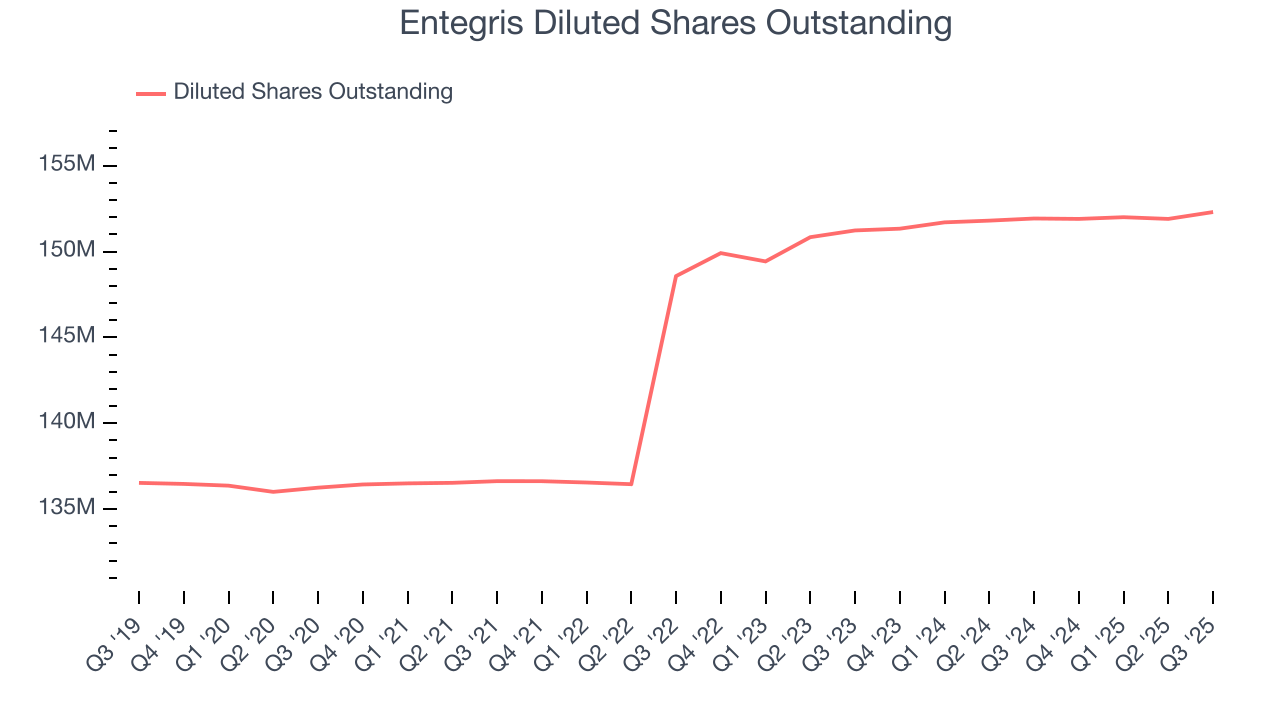

Entegris’s EPS grew at an unimpressive 4% compounded annual growth rate over the last five years, lower than its 12.7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Entegris’s earnings can give us a better understanding of its performance. As we mentioned earlier, Entegris’s operating margin declined by 7.6 percentage points over the last five years. Its share count also grew by 11.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Entegris reported adjusted EPS of $0.72, down from $0.77 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Entegris’s full-year EPS of $2.89 to grow 11.4%.

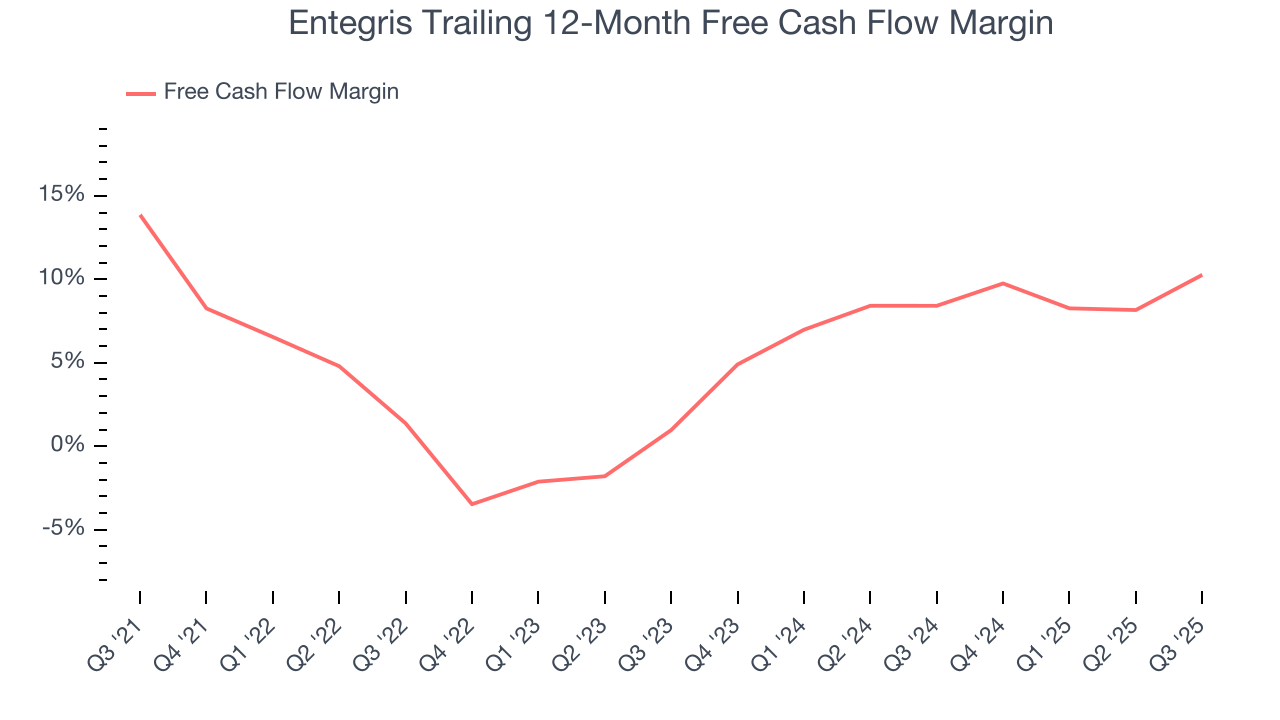

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Entegris has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.3%, subpar for a semiconductor business.

Entegris’s free cash flow clocked in at $182.8 million in Q3, equivalent to a 22.6% margin. This result was good as its margin was 8.4 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Entegris historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.6%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

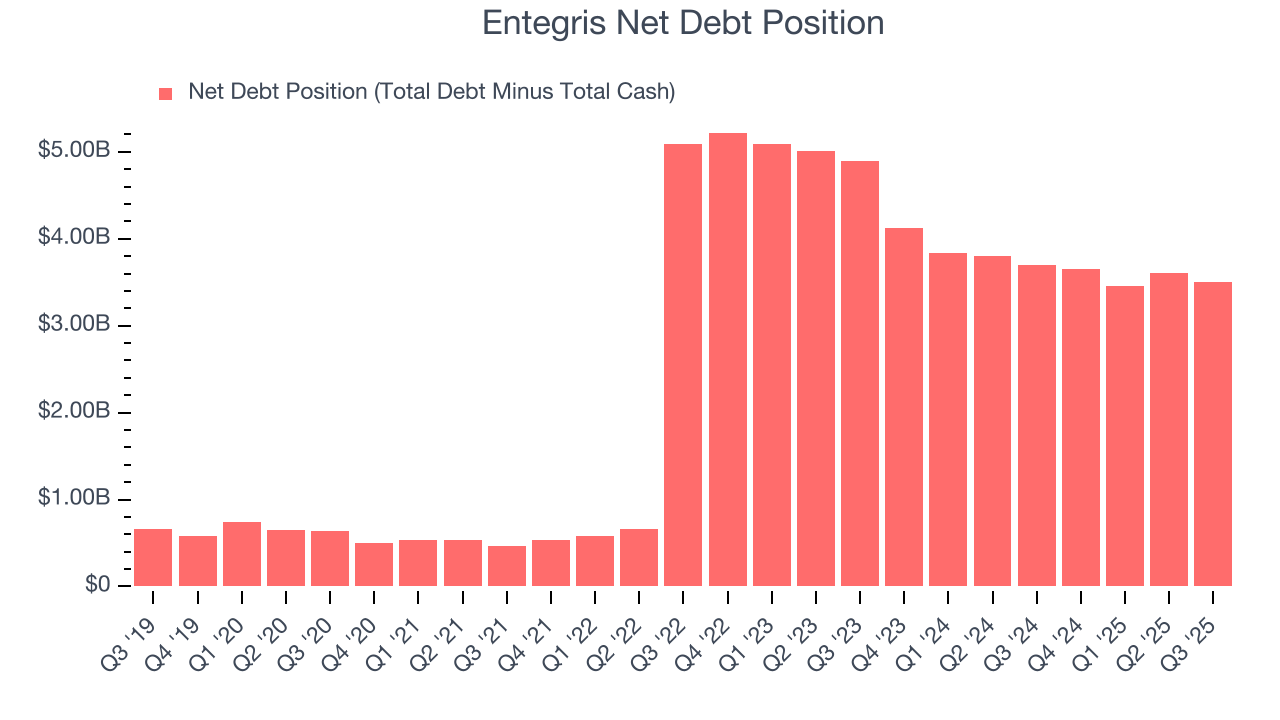

11. Balance Sheet Assessment

Entegris reported $399.8 million of cash and $3.91 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $906.5 million of EBITDA over the last 12 months, we view Entegris’s 3.9× net-debt-to-EBITDA ratio as safe. We also see its $104.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Entegris’s Q3 Results

We were impressed by Entegris’s strong improvement in inventory levels. On the other hand, its revenue guidance for next quarter missed and its EPS was in line with Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.1% to $92.65 immediately following the results.

13. Is Now The Time To Buy Entegris?

Updated: January 23, 2026 at 9:27 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We see the value of companies furthering technological innovation, but in the case of Entegris, we’re out. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. On top of that, the company’s low free cash flow margins give it little breathing room.

Entegris’s P/E ratio based on the next 12 months is 40.8x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $111.73 on the company (compared to the current share price of $114.71), implying they don’t see much short-term potential in Entegris.