EVgo (EVGO)

We see potential in EVgo, but its cash burn shows it only has 19 months of runway left.― StockStory Analyst Team

1. News

2. Summary

Why We Like EVgo

Created through a settlement between NRG Energy and the California Public Utilities Commission, EVgo (NASDAQ:EVGO) is a provider of electric vehicle charging solutions, operating fast charging stations across the United States.

- Suboptimal cost structure is highlighted by its history of operating margin losses

- Cash-burning tendencies make us wonder if it can sustainably generate shareholder value

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

EVgo has some noteworthy aspects, but we’d refrain from buying the stock until its EBITDA can comfortably support its debt.

Why Is Now The Time To Buy EVgo?

High Quality

Investable

Underperform

Why Is Now The Time To Buy EVgo?

EVgo is trading at $2.31 per share, or 75.6x forward EV-to-EBITDA. Yes, the stock’s seemingly high valuation multiple could mean short-term volatility. But given its business quality, we think the multiple is justified.

Our analysis and backtests show it’s often prudent to pay up for high-quality businesses because they routinely outperform the market over a multi-year period almost regardless of the entry price.

3. EVgo (EVGO) Research Report: Q4 CY2025 Update

Electric vehicle charging company EVgo (NASDAQ:EVGO) announced better-than-expected revenue in Q4 CY2025, with sales up 75.5% year on year to $118.5 million. On the other hand, the company’s full-year revenue guidance of $440 million at the midpoint came in 8% below analysts’ estimates. Its GAAP loss of $0.04 per share was 45.3% above analysts’ consensus estimates.

EVgo (EVGO) Q4 CY2025 Highlights:

- Revenue: $118.5 million vs analyst estimates of $101.9 million (75.5% year-on-year growth, 16.3% beat)

- EPS (GAAP): -$0.04 vs analyst estimates of -$0.07 (45.3% beat)

- Adjusted EBITDA: $24.86 million vs analyst estimates of $3.62 million (21% margin, significant beat)

- EBITDA guidance for the upcoming financial year 2026 is $0 at the midpoint, below analyst estimates of $32.93 million

- Operating Margin: -10.4%, up from -51.9% in the same quarter last year

- Free Cash Flow was -$38.11 million compared to -$41.57 million in the same quarter last year

- Gigawatt-hours Sold: 99, up 15 year on year

- Market Capitalization: $382.6 million

Company Overview

Created through a settlement between NRG Energy and the California Public Utilities Commission, EVgo (NASDAQ:EVGO) is a provider of electric vehicle charging solutions, operating fast charging stations across the United States.

EVgo was established to address the growing demand for accessible electric vehicle (EV) charging infrastructure. The company operates a network of public fast charging stations across the United States, catering to the needs of EV owners in various settings, from urban centers to shopping malls and transportation hubs.

EVgo provides rapid charging solutions, allowing EV owners to charge their vehicles quickly and efficiently while on the go. A typical scenario involves an EV owner utilizing an EVgo station to recharge their vehicle during shopping or commuting, offering convenience and reducing range anxiety among EV users. The company’s revenue streams come from charging services provided to EV owners, who pay either per charge or through subscription models. EVgo's business model emphasizes accessibility and customer convenience, selling charging services directly to consumers through its stations and a mobile app for location and payment functionalities.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors in the in the electric vehicle charging industry include ChargePoint (NYSE:CHPT), Blink Charging (NASDAQ:BLNK), and Wallbox (NYSE:WBX)

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, EVgo grew its sales at an incredible 92.4% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. EVgo’s annualized revenue growth of 54.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its number of gigawatt-hours sold, which reached 99 in the latest quarter. Over the last two years, EVgo’s gigawatt-hours sold averaged 24.3% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, EVgo reported magnificent year-on-year revenue growth of 75.5%, and its $118.5 million of revenue beat Wall Street’s estimates by 16.3%.

Looking ahead, sell-side analysts expect revenue to grow 24.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and indicates the market is forecasting success for its products and services.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

EVgo’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.9% gross margin over the last five years. That means for every $100 in revenue, roughly $33.94 was left to spend on selling, marketing, R&D, and general administrative overhead.

In Q4, EVgo produced a 38% gross profit margin, in line with the same quarter last year. Zooming out, EVgo’s full-year margin has been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

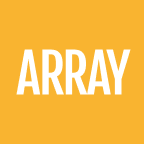

EVgo’s high expenses have contributed to an average operating margin of negative 72.3% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, EVgo’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

EVgo’s operating margin was negative 10.4% this quarter.

8. Earnings Per Share

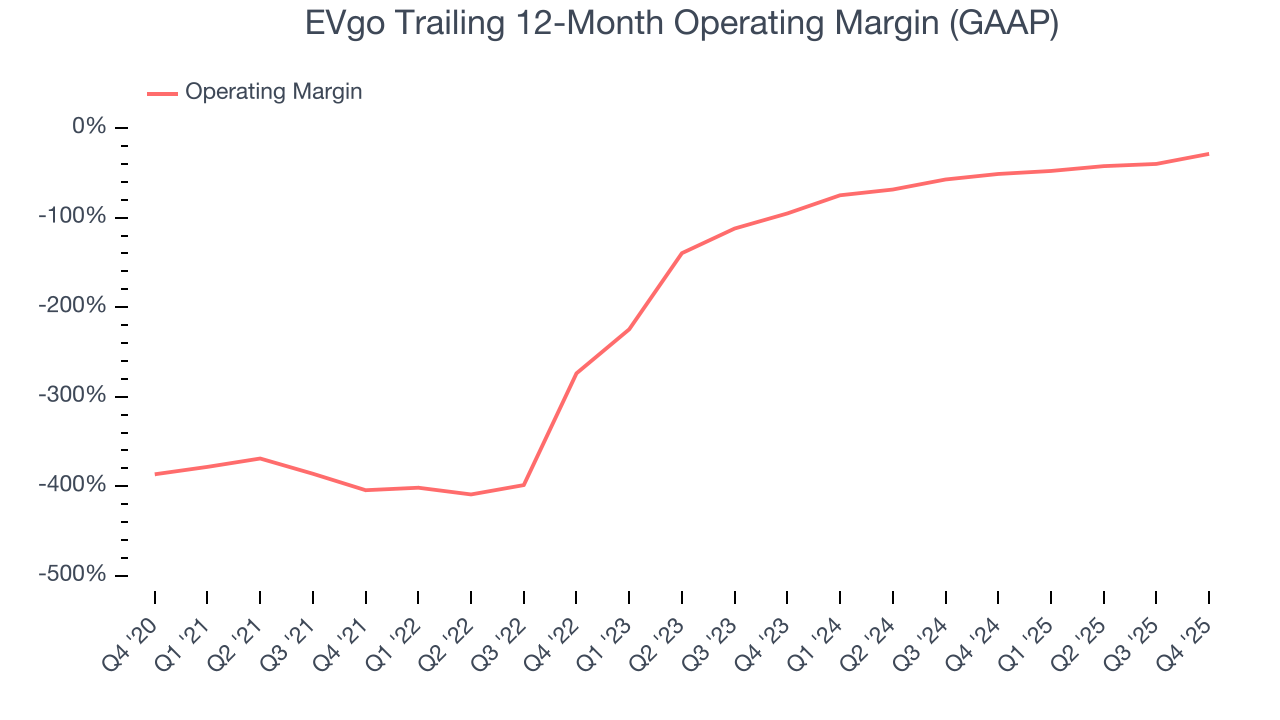

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although EVgo’s full-year earnings are still negative, it reduced its losses and improved its EPS by 13.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For EVgo, its two-year annual EPS growth of 19.2% was higher than its five-year trend. We love it when earnings improve, but a caveat is that its EPS is still in the red.

In Q4, EVgo reported EPS of negative $0.04, up from negative $0.11 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects EVgo to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.32 will advance to negative $0.31.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

EVgo’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 86%, meaning it lit $86.04 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that EVgo’s margin expanded during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

EVgo burned through $38.11 million of cash in Q4, equivalent to a negative 32.2% margin. The company’s cash burn was similar to its $41.57 million of lost cash in the same quarter last year.

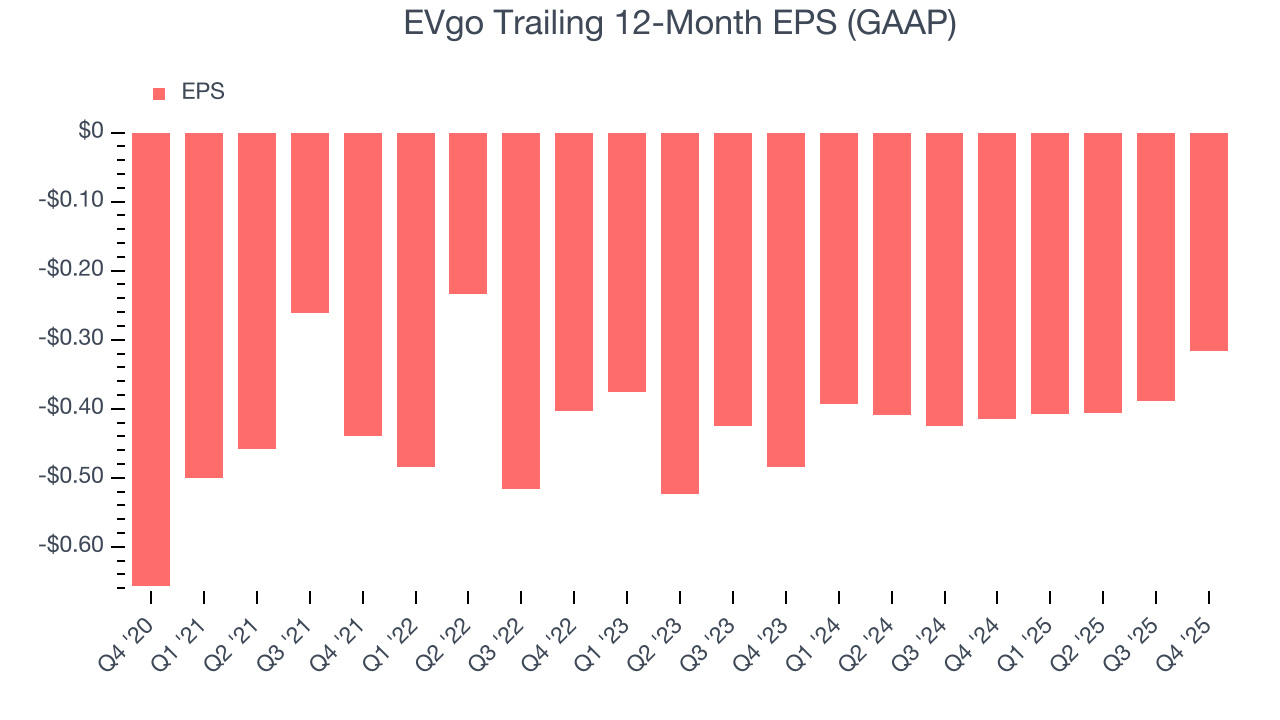

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

EVgo burned through $124.3 million of cash over the last year. With $200.5 million of cash on its balance sheet, the company has around 19 months of runway left (assuming its $96.6 million of debt isn’t due right away).

Unless the EVgo’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of EVgo until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from EVgo’s Q4 Results

It was good to see EVgo beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock traded up 4.8% to $2.97 immediately following the results.

12. Is Now The Time To Buy EVgo?

Updated: March 5, 2026 at 11:12 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Aside from its balance sheet, EVgo is a pretty good company. For starters, its revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its growth in unit sales was surging. Additionally, EVgo’s rising cash profitability gives it more optionality.

EVgo’s EV-to-EBITDA ratio based on the next 12 months is 75.6x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. We think a potential buyer of the stock should wait until the company’s debt falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $5.27 on the company (compared to the current share price of $2.31), implying they see 128% upside in buying EVgo in the short term.