FTAI Infrastructure (FIP)

FTAI Infrastructure is intriguing. Although it has burned cash, its growth shows it’s deploying the Jeff Bezos reinvestment strategy.― StockStory Analyst Team

1. News

2. Summary

Why FTAI Infrastructure Is Interesting

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ:FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

- Annual revenue growth of 49.1% over the last four years was superb and indicates its market share increased during this cycle

- Projected revenue growth of 73.5% for the next 12 months is above its two-year trend, pointing to accelerating demand

- A blemish is its historical operating margin losses point to an inefficient cost structure

FTAI Infrastructure shows some promise. If you like the stock, the price looks reasonable.

Why Is Now The Time To Buy FTAI Infrastructure?

High Quality

Investable

Underperform

Why Is Now The Time To Buy FTAI Infrastructure?

At $6.20 per share, FTAI Infrastructure trades at 12x forward EV-to-EBITDA. Compared to companies in the industrials space, we think this multiple is warranted for the revenue growth you get.

It’s an opportune time to buy the stock if you see some misunderstanding of the business that is leading to mispricing in the market.

3. FTAI Infrastructure (FIP) Research Report: Q3 CY2025 Update

Infrastructure investment and operations firm FTAI Infrastructure (NASDAQ:FIP) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 68.7% year on year to $140.6 million. Its GAAP loss of $1.38 per share was significantly below analysts’ consensus estimates.

FTAI Infrastructure (FIP) Q3 CY2025 Highlights:

- Revenue: $140.6 million vs analyst estimates of $146.4 million (68.7% year-on-year growth, 4% miss)

- EPS (GAAP): -$1.38 vs analyst estimates of -$0.59 (significant miss)

- Operating Margin: -70.8%, down from -5.3% in the same quarter last year

- Free Cash Flow was -$90.71 million compared to -$12.08 million in the same quarter last year

- Market Capitalization: $606.5 million

Company Overview

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ:FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

The company’s operations are diversified across four strategic business units: Railroad, Ports and Terminals, Power and Gas, and Sustainability and Energy Transition. For instance, its Railroad business operates short lines and regional railroads, providing service to manufacturing facilities, while its Ports and Terminals business manages facilities like the Jefferson Terminal in Texas, which stores and handles various energy products. Additionally, the Power and Gas segment includes investments in facilities like power plants.

FTAI Infrastructure’s revenue primarily comes from fees generated through the operation and management of assets, structured around long-term contracts that provide stable, recurring income. It operates with a blend of fixed costs associated with infrastructure maintenance and variable costs driven by project-specific demands. This business model, emphasizing sectors with high entry barriers and critical services, enables FTAI Infrastructure to maintain dependable revenue streams.

4. Energy Products and Services

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Public competitors in the infrastructure sector include Brookfield Infrastructure (NYSE:BIP), Macquarie Infrastructure (NYSE:MIC), and AECOM (NYSE:ACM).

5. Revenue Growth

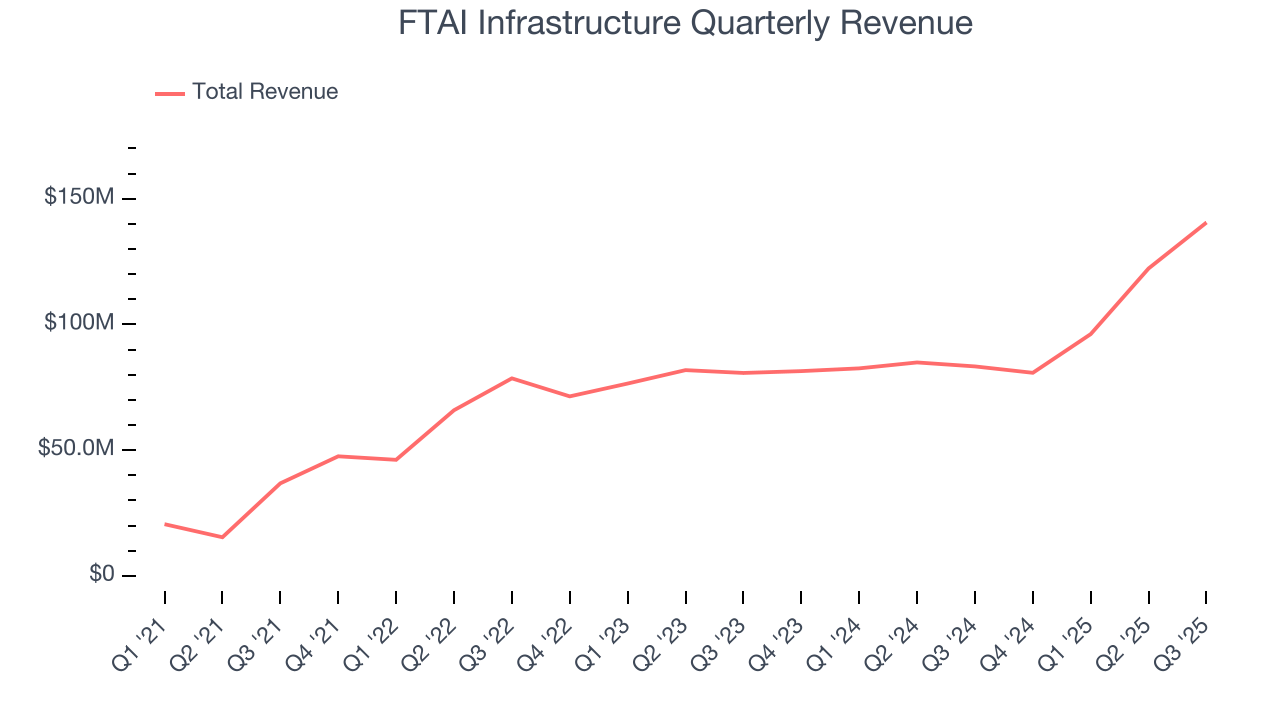

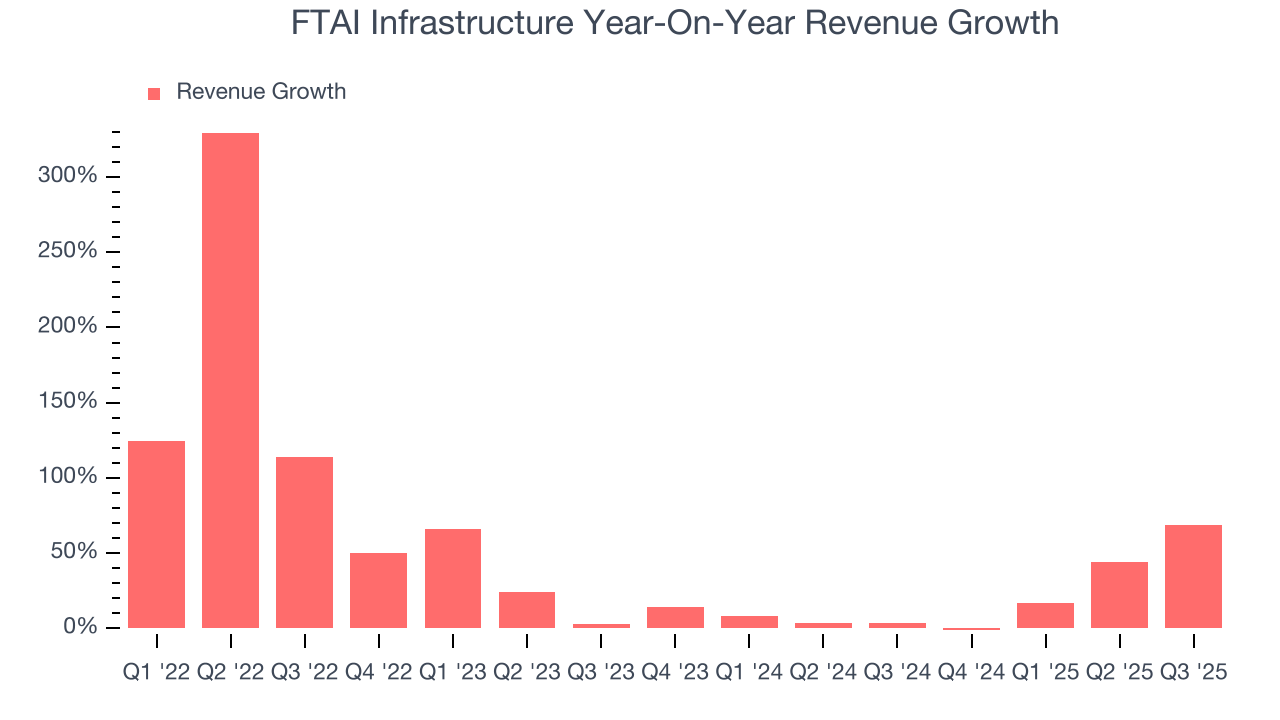

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, FTAI Infrastructure’s sales grew at an incredible 49.1% compounded annual growth rate over the last four years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. FTAI Infrastructure’s annualized revenue growth of 19% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, FTAI Infrastructure achieved a magnificent 68.7% year-on-year revenue growth rate, but its $140.6 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 75.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

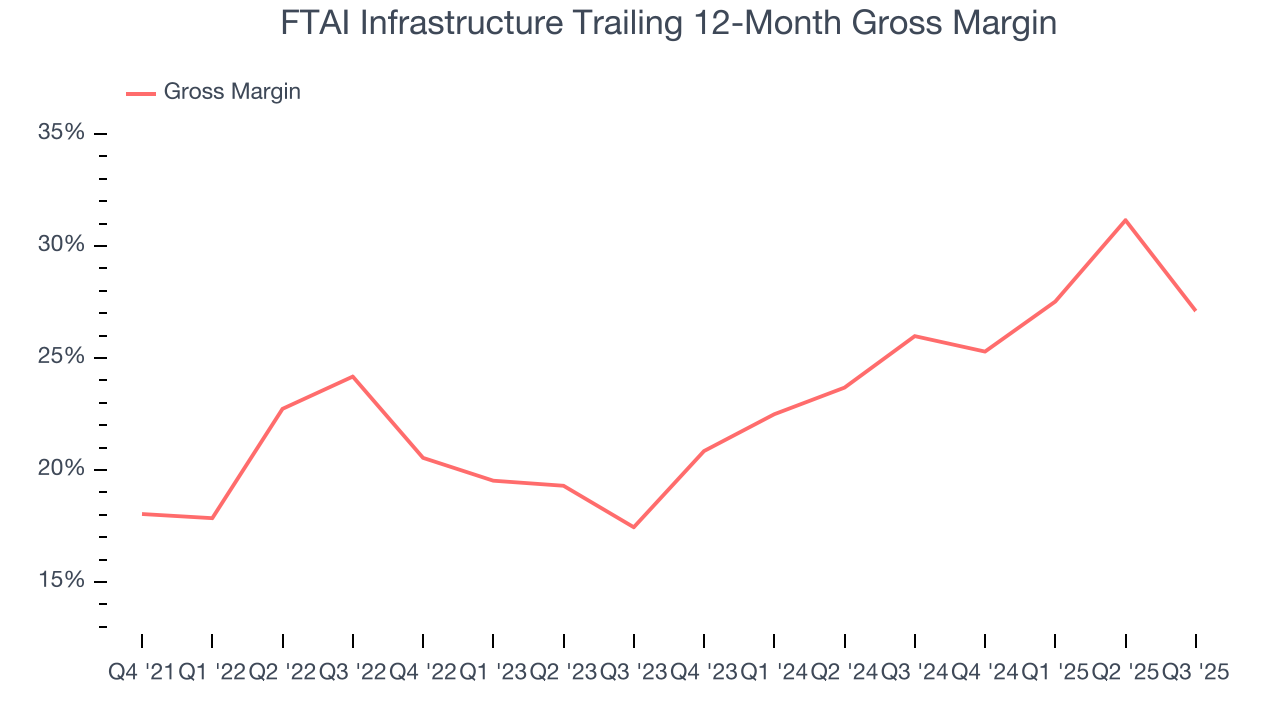

FTAI Infrastructure has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 23.2% gross margin over the last five years. That means FTAI Infrastructure paid its suppliers a lot of money ($76.77 for every $100 in revenue) to run its business.

FTAI Infrastructure’s gross profit margin came in at 14.6% this quarter, marking a 10 percentage point decrease from 24.7% in the same quarter last year. Zooming out, however, FTAI Infrastructure’s full-year margin has been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

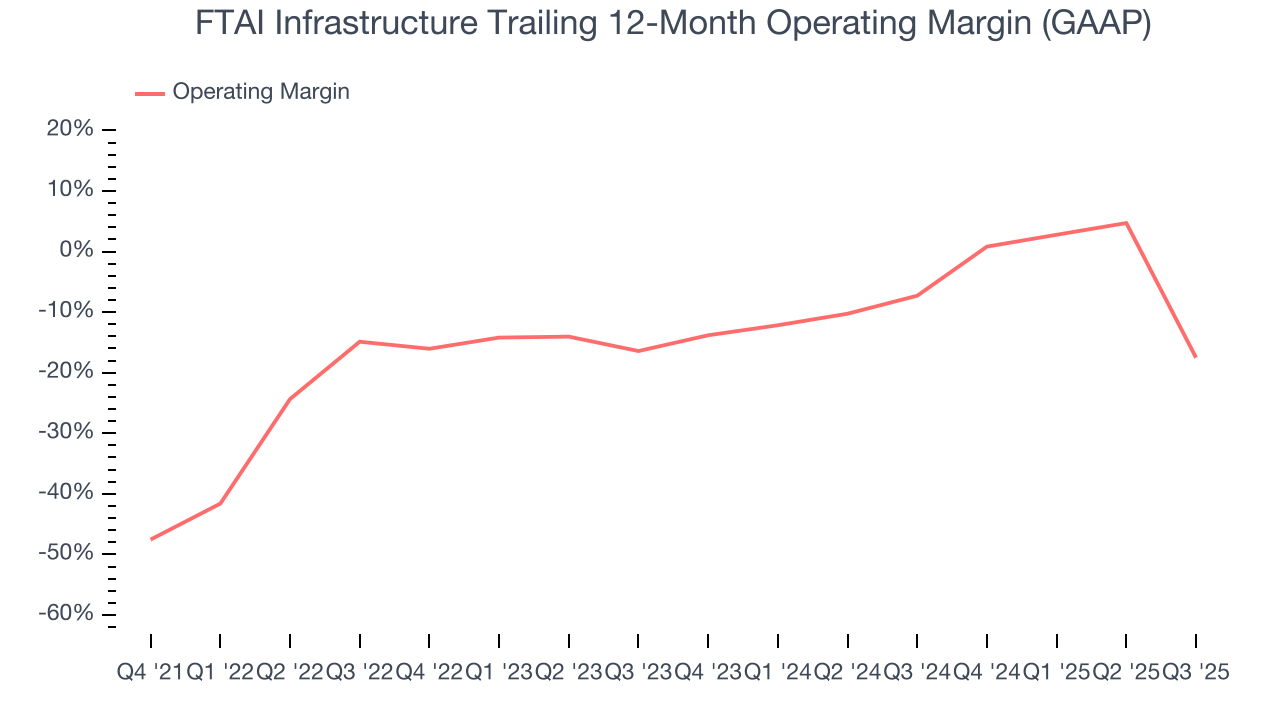

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

FTAI Infrastructure’s high expenses have contributed to an average operating margin of negative 17% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, FTAI Infrastructure’s operating margin rose by 41.7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, FTAI Infrastructure generated a negative 70.8% operating margin.

8. Earnings Per Share

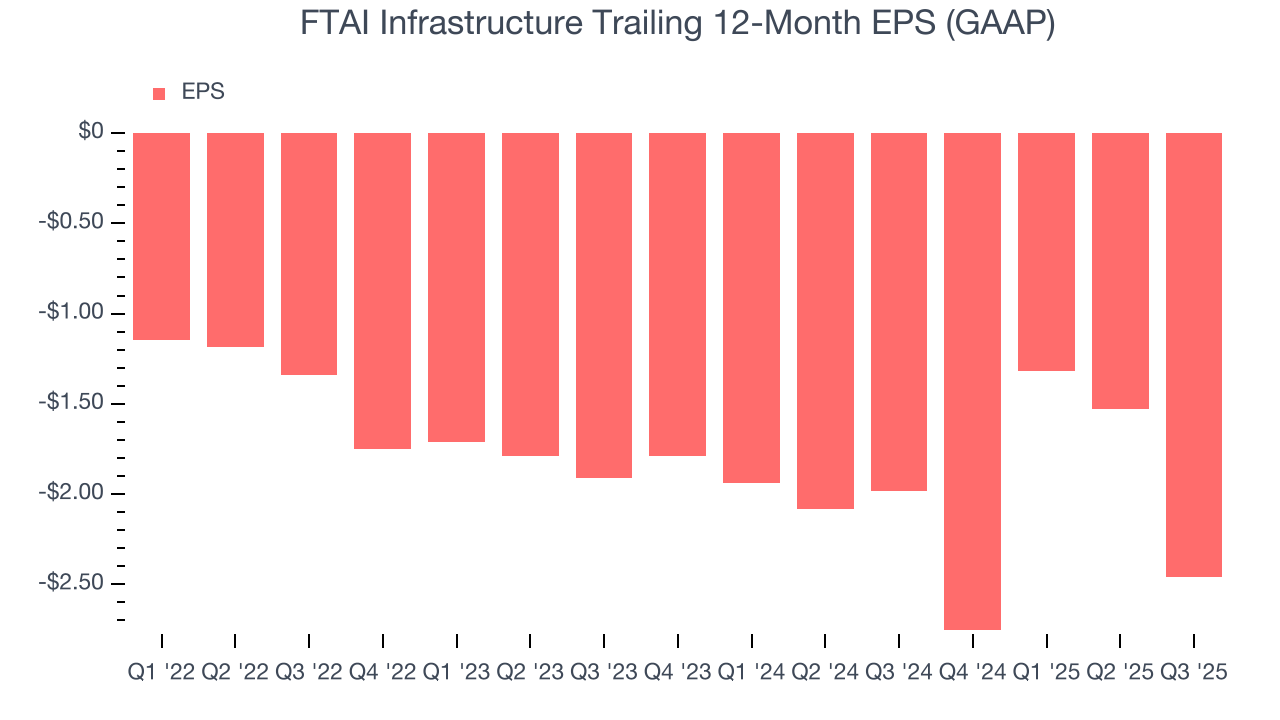

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

FTAI Infrastructure’s earnings losses deepened over the last four years as its EPS dropped 41% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For FTAI Infrastructure, its two-year annual EPS declines of 13.5% show it’s still underperforming. These results were bad no matter how you slice the data, but given it was successful in other measures of financial health, we’re hopeful FTAI Infrastructure can generate earnings growth in the future.

In Q3, FTAI Infrastructure reported EPS of negative $1.38, down from negative $0.45 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects FTAI Infrastructure to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.46 will advance to negative $1.36.

9. Cash Is King

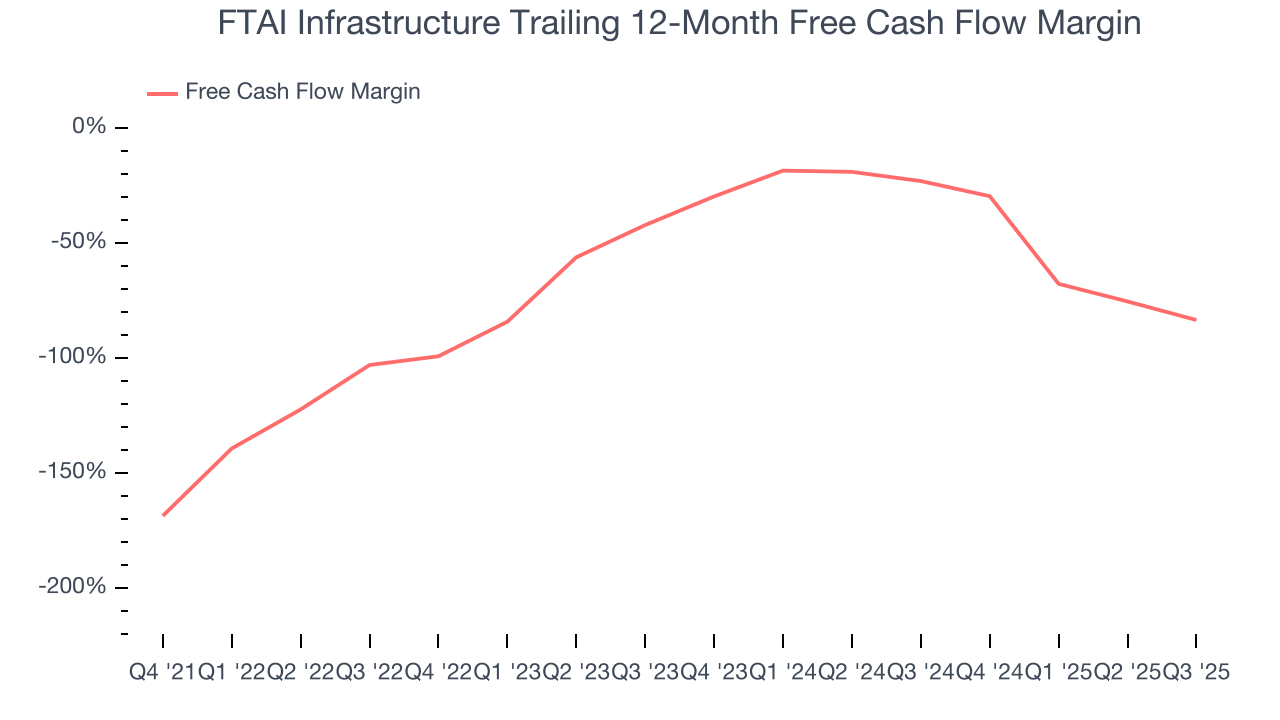

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

FTAI Infrastructure’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 70.8%, meaning it lit $70.83 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that FTAI Infrastructure’s margin expanded during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

FTAI Infrastructure burned through $90.71 million of cash in Q3, equivalent to a negative 64.5% margin. The company’s cash burn increased from $12.08 million of lost cash in the same quarter last year.

10. Key Takeaways from FTAI Infrastructure’s Q3 Results

This was an optically tough quarter as its revenue and EPS fell short of Wall Street’s estimates. However, the EPS miss was largely due to the one-time extinguishment of bad debt, causing EBITDA to nearly double to $71 million. The stock traded up 7.2% to $5.50 immediately following the results.

11. Is Now The Time To Buy FTAI Infrastructure?

Updated: January 21, 2026 at 10:17 PM EST

When considering an investment in FTAI Infrastructure, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are things to like about FTAI Infrastructure. First off, its revenue growth was exceptional over the last four years and is expected to accelerate over the next 12 months. And while its declining EPS over the last four years makes it a less attractive asset to the public markets, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

FTAI Infrastructure’s EV-to-EBITDA ratio based on the next 12 months is 11.8x. Looking at the industrials landscape right now, FTAI Infrastructure trades at a pretty interesting price. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $11.67 on the company (compared to the current share price of $6.00), implying they see 94.6% upside in buying FTAI Infrastructure in the short term.