Flywire (FLYW)

Flywire doesn’t excite us. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why Flywire Is Not Exciting

Initially created to solve the challenges of international student tuition payments, Flywire (NASDAQ:FLYW) provides specialized payment processing and software solutions that help educational institutions, healthcare systems, travel companies, and businesses manage complex payments.

- Competitive market means the company must spend more on sales and marketing to stand out even if the return on investment is low

- Gross margin of 60.1% reflects its relatively high servicing costs

- One positive is that its impressive 39.4% annual revenue growth over the last five years indicates it’s winning market share

Flywire’s quality is not up to our standards. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than Flywire

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Flywire

Flywire is trading at $13.28 per share, or 2.3x forward price-to-sales. Flywire’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Flywire (FLYW) Research Report: Q4 CY2025 Update

Global payments company Flywire (NASDAQ:FLYW) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 39.7% year on year to $157.5 million. Its GAAP loss of $0 per share was $0.01 above analysts’ consensus estimates.

Flywire (FLYW) Q4 CY2025 Highlights:

- Revenue: $157.5 million vs analyst estimates of $144.1 million (39.7% year-on-year growth, 9.3% beat)

- EPS (GAAP): $0 vs analyst estimates of -$0.01 ($0.01 beat)

- Adjusted EBITDA: $25.4 million vs analyst estimates of $23.16 million (16.1% margin, 9.7% beat)

- Operating Margin: -0.6%, up from -5.1% in the same quarter last year

- Free Cash Flow Margin: 1.1%, down from 76% in the previous quarter

- Market Capitalization: $1.3 billion

Company Overview

Initially created to solve the challenges of international student tuition payments, Flywire (NASDAQ:FLYW) provides specialized payment processing and software solutions that help educational institutions, healthcare systems, travel companies, and businesses manage complex payments.

The company operates through a three-pronged approach it calls the "Flywire Advantage" – a next-gen payments platform, a proprietary global payment network, and vertical-specific software. This integrated system allows clients to accept payments in over 140 currencies across more than 240 countries and territories, with funds delivered in the client's preferred local currency.

Flywire's platform goes beyond basic payment processing by incorporating tailored invoicing, fraud detection, compliance monitoring, and reconciliation tools that integrate directly with clients' existing systems. For example, a university can use Flywire to allow international students to pay tuition in their local currency while the school receives funds in dollars, with the transaction automatically recorded in their enterprise resource planning system.

The company serves over 3,800 clients globally, including more than 2,800 educational institutions and 90+ healthcare systems. In healthcare, Flywire's software can analyze a patient's capacity to pay and offer personalized payment plans. For travel providers, it handles complex payments for tours, trips, and accommodations. In B2B transactions, it streamlines cross-border invoicing and payments.

Revenue comes from transaction fees and platform usage charges, with a "land and expand" strategy that typically begins with solving a specific payment challenge before clients adopt additional services. Flywire has established partnerships with major financial institutions like Bank of America and integrates with key industry software providers such as Ellucian in education and Epic Systems in healthcare.

4. Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Flywire competes with traditional payment processors like PayPal (NASDAQ:PYPL) and Stripe (private), global payment networks such as Western Union (NYSE:WU), vertical-specific payment solutions like TouchNet in education, and broader financial technology companies including Adyen (AMS:ADYEN) and Block (NYSE:SQ).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Flywire’s 39.6% annualized revenue growth over the last five years was exceptional. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Flywire’s annualized revenue growth of 26.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Flywire reported wonderful year-on-year revenue growth of 39.7%, and its $157.5 million of revenue exceeded Wall Street’s estimates by 9.3%.

Looking ahead, sell-side analysts expect revenue to grow 13.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Flywire’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

7. Gross Margin & Pricing Power

For software companies like Flywire, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Flywire’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 60.5% gross margin over the last year. Said differently, Flywire had to pay a chunky $39.53 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Flywire has seen gross margins decline by 0.9 percentage points over the last 2 year, which is poor compared to software peers.

Flywire’s gross profit margin came in at 59.6% this quarter , marking a 3.7 percentage point decrease from 63.3% in the same quarter last year. Flywire’s full-year margin has also been trending down over the past 12 months, decreasing by 2.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

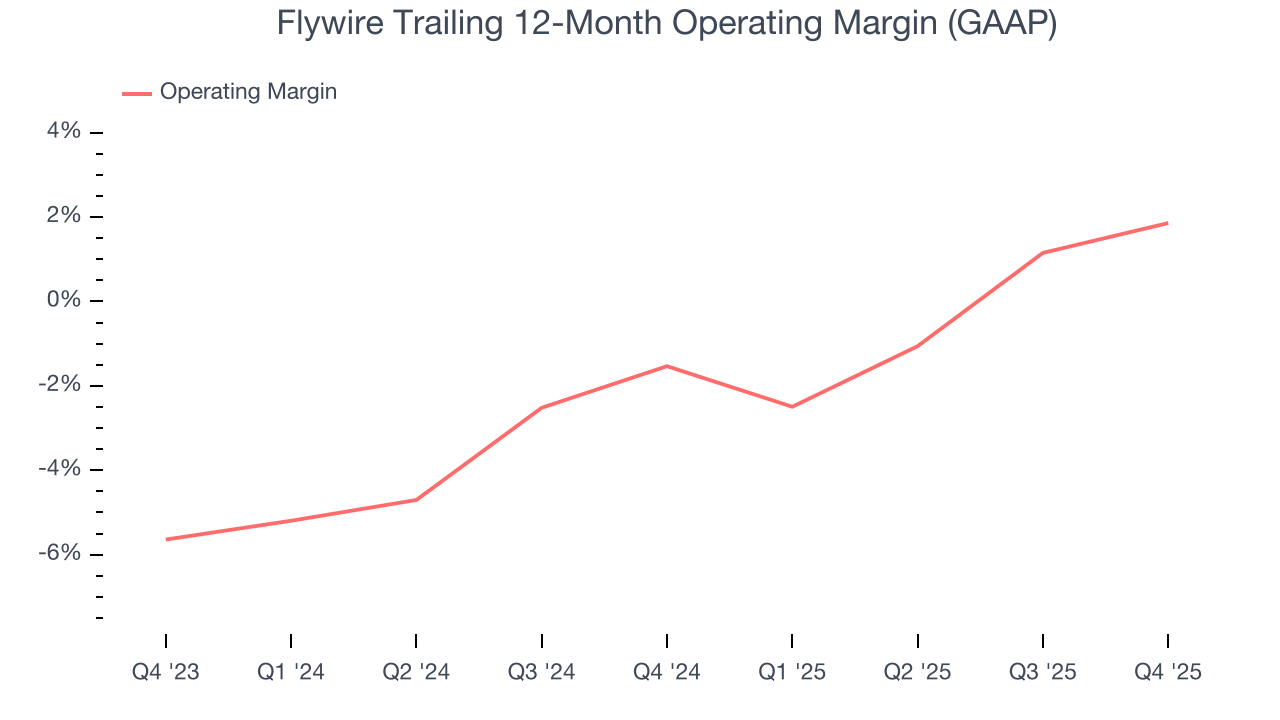

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Flywire has done a decent job managing its cost base over the last year. The company has produced an average operating margin of 1.9%, higher than the broader software sector.

Analyzing the trend in its profitability, Flywire’s operating margin rose by 3.4 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, Flywire’s breakeven margin was -0.6%, up 4.5 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Flywire has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 14.9%, subpar for a software business.

Flywire’s free cash flow clocked in at $1.8 million in Q4, equivalent to a 1.1% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Flywire’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 14.9% for the last 12 months will increase to 17%, giving it more flexibility for investments, share buybacks, and dividends.

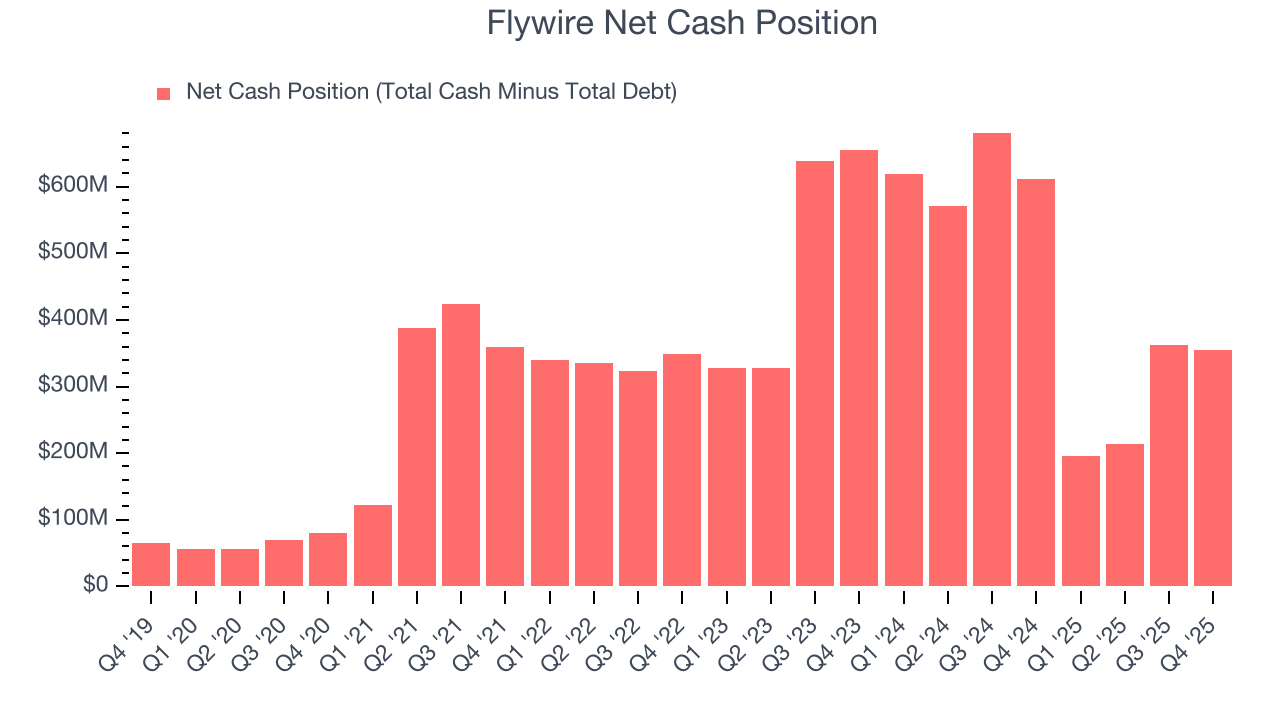

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Flywire is a profitable, well-capitalized company with $355 million of cash and no debt. This position is 27.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Flywire’s Q4 Results

We were impressed by how significantly Flywire blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 12% to $12.59 immediately following the results.

12. Is Now The Time To Buy Flywire?

Updated: March 5, 2026 at 9:44 PM EST

When considering an investment in Flywire, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are some bright spots in Flywire’s fundamentals, but its business quality ultimately falls short. First off, its revenue growth was exceptional over the last five years. We advise investors to be cautious with this one, however, as Flywire’s customer acquisition is less efficient than many comparable companies.

Flywire’s price-to-sales ratio based on the next 12 months is 2.3x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $16.38 on the company (compared to the current share price of $13.28).