Flywire (FLYW)

Flywire doesn’t impress us. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why Flywire Is Not Exciting

Initially created to solve the challenges of international student tuition payments, Flywire (NASDAQ:FLYW) provides specialized payment processing and software solutions that help educational institutions, healthcare systems, travel companies, and businesses manage complex payments.

- Extended payback periods on sales investments suggest the company’s platform isn’t resonating enough to drive efficient sales conversions

- High servicing costs result in a relatively inferior gross margin of 61.3% that must be offset through increased usage

- A bright spot is that its impressive 39.6% annual revenue growth over the last five years indicates it’s winning market share

Flywire doesn’t satisfy our quality benchmarks. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Flywire

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Flywire

Flywire’s stock price of $12.61 implies a valuation ratio of 2.5x forward price-to-sales. Flywire’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Flywire (FLYW) Research Report: Q3 CY2025 Update

Global payments company Flywire (NASDAQ:FLYW) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 27.6% year on year to $200.1 million. On top of that, next quarter’s revenue guidance ($147 million at the midpoint) was surprisingly good and 3.6% above what analysts were expecting. Its GAAP profit of $0.23 per share was 20.5% above analysts’ consensus estimates.

Flywire (FLYW) Q3 CY2025 Highlights:

- Revenue: $200.1 million vs analyst estimates of $185.8 million (27.6% year-on-year growth, 7.7% beat)

- EPS (GAAP): $0.23 vs analyst estimates of $0.19 (20.5% beat)

- Adjusted EBITDA: $57.1 million vs analyst estimates of $51.91 million (28.5% margin, 10% beat)

- Revenue Guidance for Q4 CY2025 is $147 million at the midpoint, above analyst estimates of $141.9 million

- Operating Margin: 16.1%, up from 12.9% in the same quarter last year

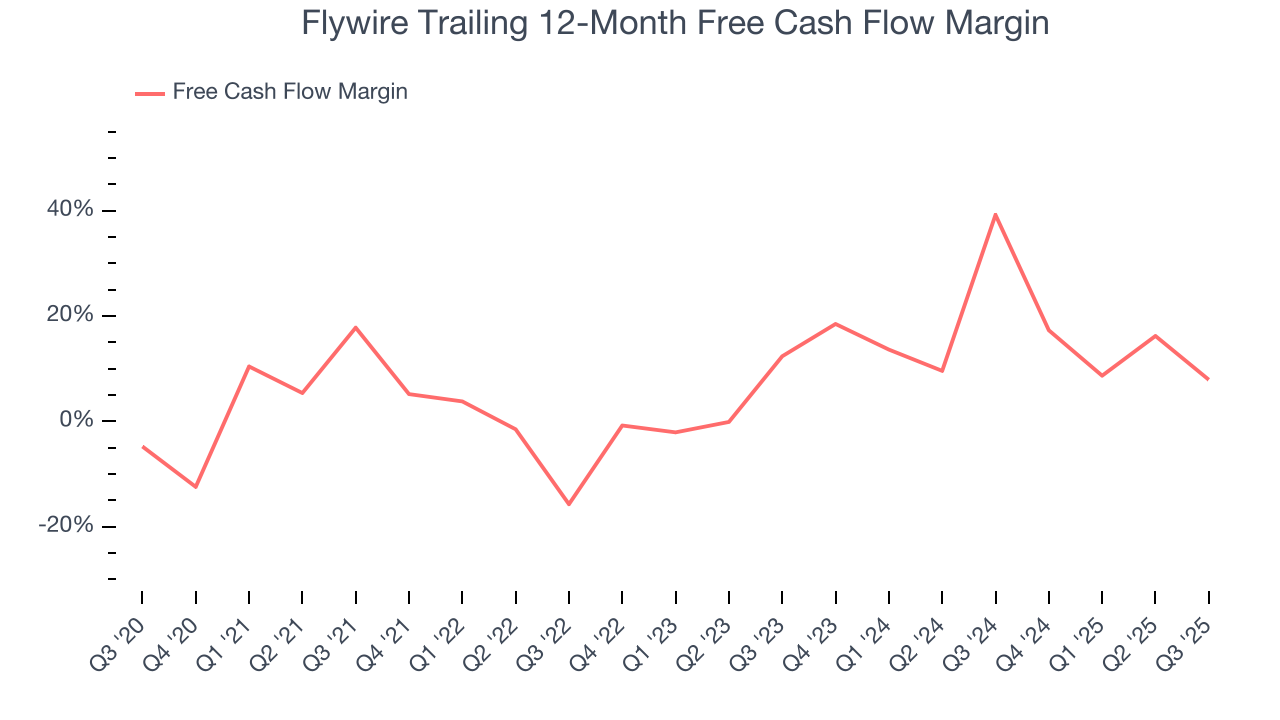

- Free Cash Flow Margin: 73.7%, up from 16.3% in the previous quarter

- Market Capitalization: $1.64 billion

Company Overview

Initially created to solve the challenges of international student tuition payments, Flywire (NASDAQ:FLYW) provides specialized payment processing and software solutions that help educational institutions, healthcare systems, travel companies, and businesses manage complex payments.

The company operates through a three-pronged approach it calls the "Flywire Advantage" – a next-gen payments platform, a proprietary global payment network, and vertical-specific software. This integrated system allows clients to accept payments in over 140 currencies across more than 240 countries and territories, with funds delivered in the client's preferred local currency.

Flywire's platform goes beyond basic payment processing by incorporating tailored invoicing, fraud detection, compliance monitoring, and reconciliation tools that integrate directly with clients' existing systems. For example, a university can use Flywire to allow international students to pay tuition in their local currency while the school receives funds in dollars, with the transaction automatically recorded in their enterprise resource planning system.

The company serves over 3,800 clients globally, including more than 2,800 educational institutions and 90+ healthcare systems. In healthcare, Flywire's software can analyze a patient's capacity to pay and offer personalized payment plans. For travel providers, it handles complex payments for tours, trips, and accommodations. In B2B transactions, it streamlines cross-border invoicing and payments.

Revenue comes from transaction fees and platform usage charges, with a "land and expand" strategy that typically begins with solving a specific payment challenge before clients adopt additional services. Flywire has established partnerships with major financial institutions like Bank of America and integrates with key industry software providers such as Ellucian in education and Epic Systems in healthcare.

4. Payments Software

Consumers want the ability to make payments whenever and wherever they prefer – and to do so without having to worry about fraud or other security threats. However, building payments infrastructure from scratch is extremely resource-intensive for engineering teams. That drives demand for payments platforms that are easy to integrate into consumer applications and websites.

Flywire competes with traditional payment processors like PayPal (NASDAQ:PYPL) and Stripe (private), global payment networks such as Western Union (NYSE:WU), vertical-specific payment solutions like TouchNet in education, and broader financial technology companies including Adyen (AMS:ADYEN) and Block (NYSE:SQ).

5. Revenue Growth

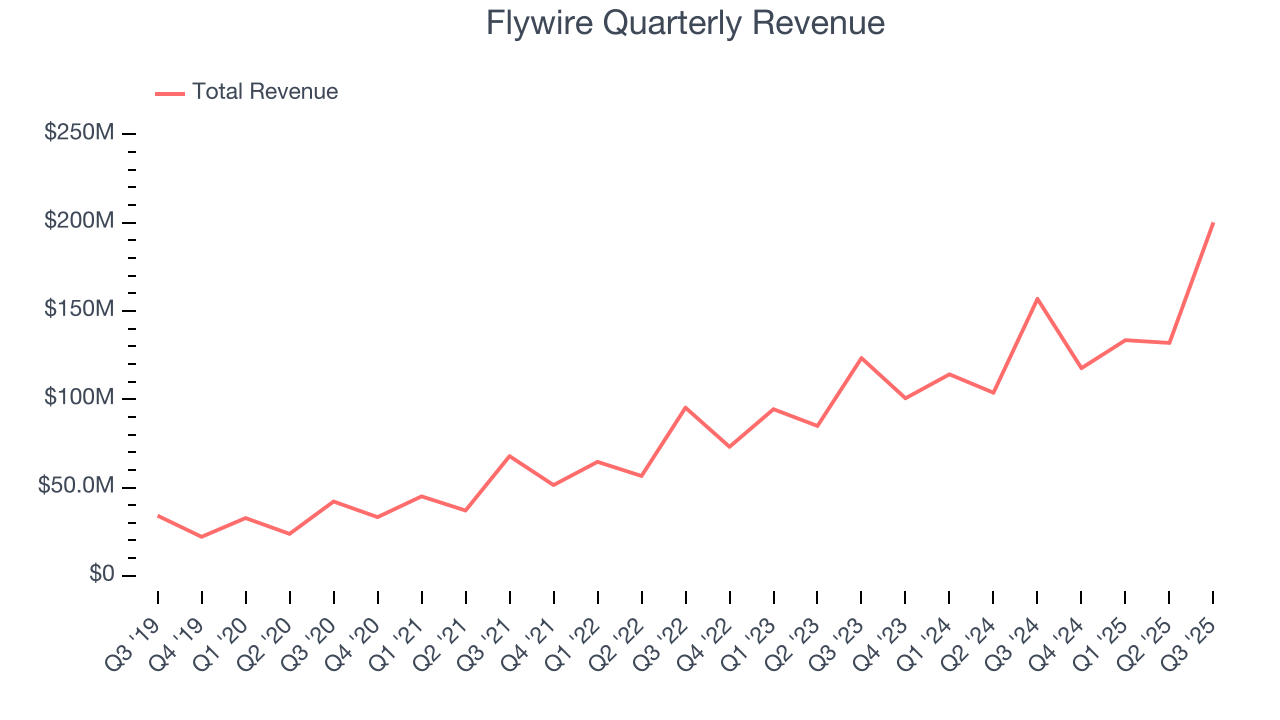

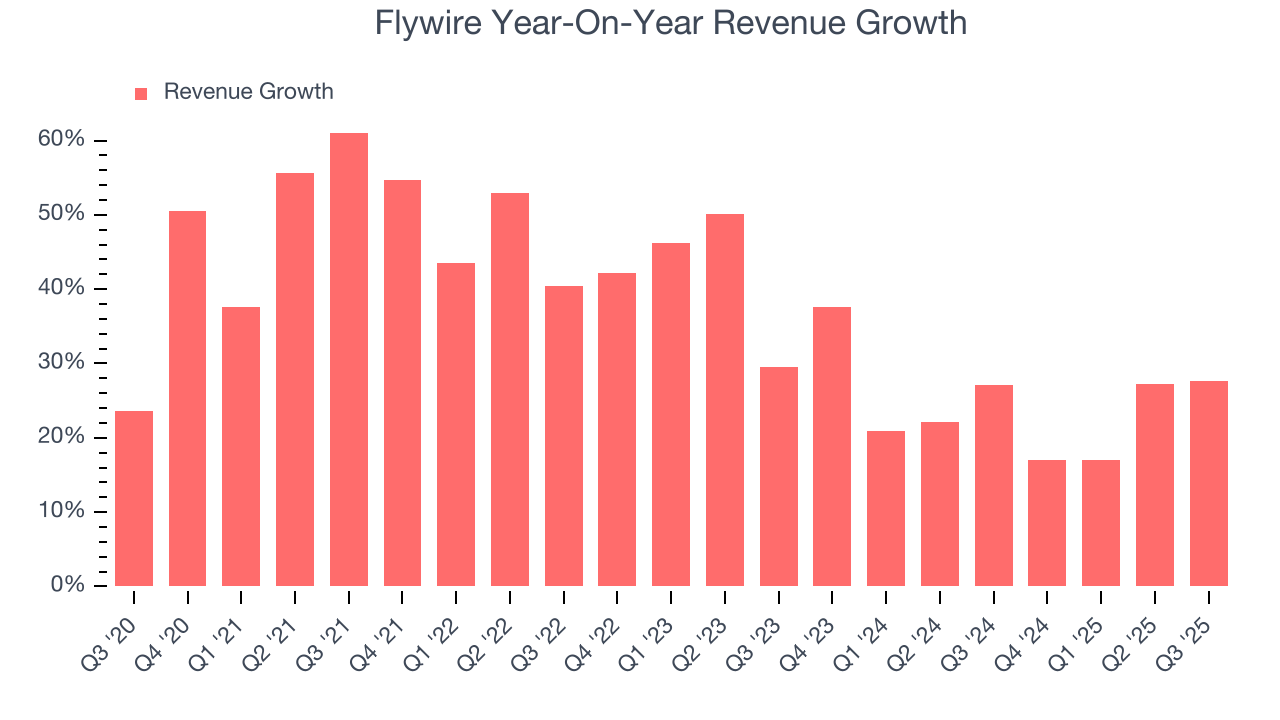

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Flywire grew its sales at an exceptional 37% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Flywire’s annualized revenue growth of 24.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Flywire reported robust year-on-year revenue growth of 27.6%, and its $200.1 million of revenue topped Wall Street estimates by 7.7%. Company management is currently guiding for a 25% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Flywire’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

7. Gross Margin & Pricing Power

For software companies like Flywire, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

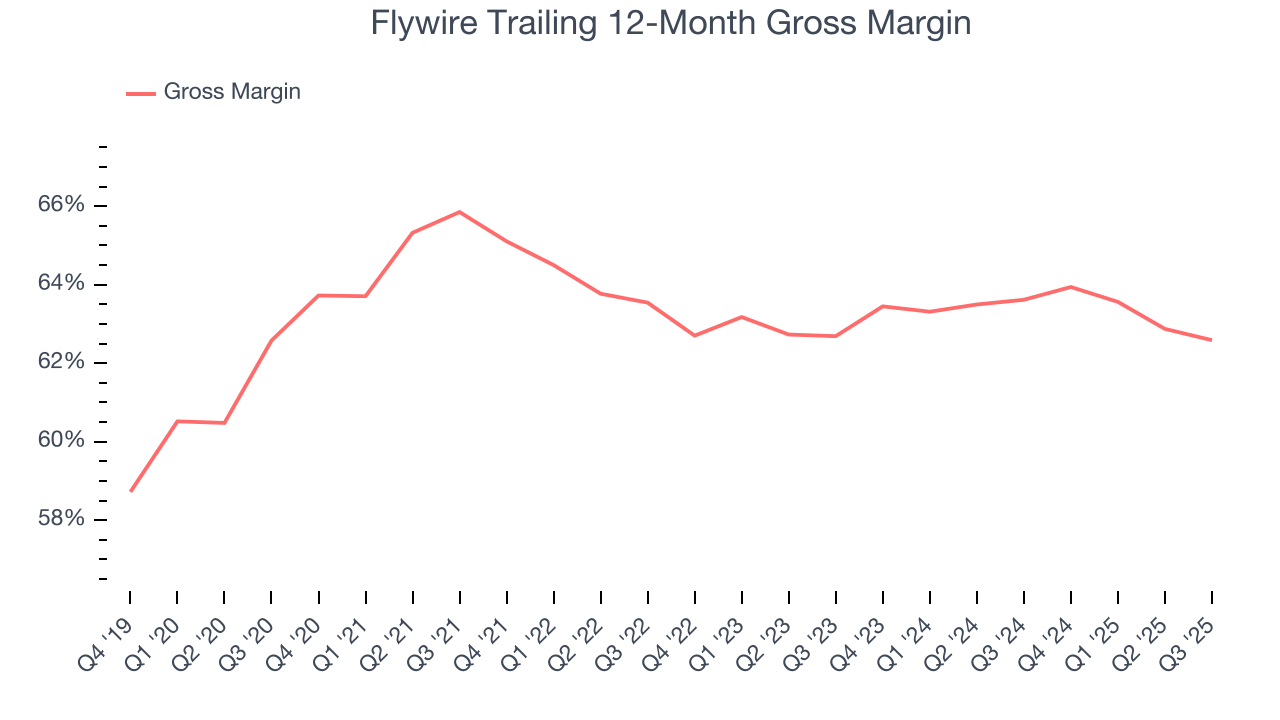

Flywire’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 62.6% gross margin over the last year. That means Flywire paid its providers a lot of money ($37.41 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Flywire has seen gross margins decline by 0.1 percentage points over the last 2 year, which is slightly worse than average for software.

Flywire’s gross profit margin came in at 63.9% this quarter, down 1.3 percentage points year on year. Flywire’s full-year margin has also been trending down over the past 12 months, decreasing by 1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. Operating Margin

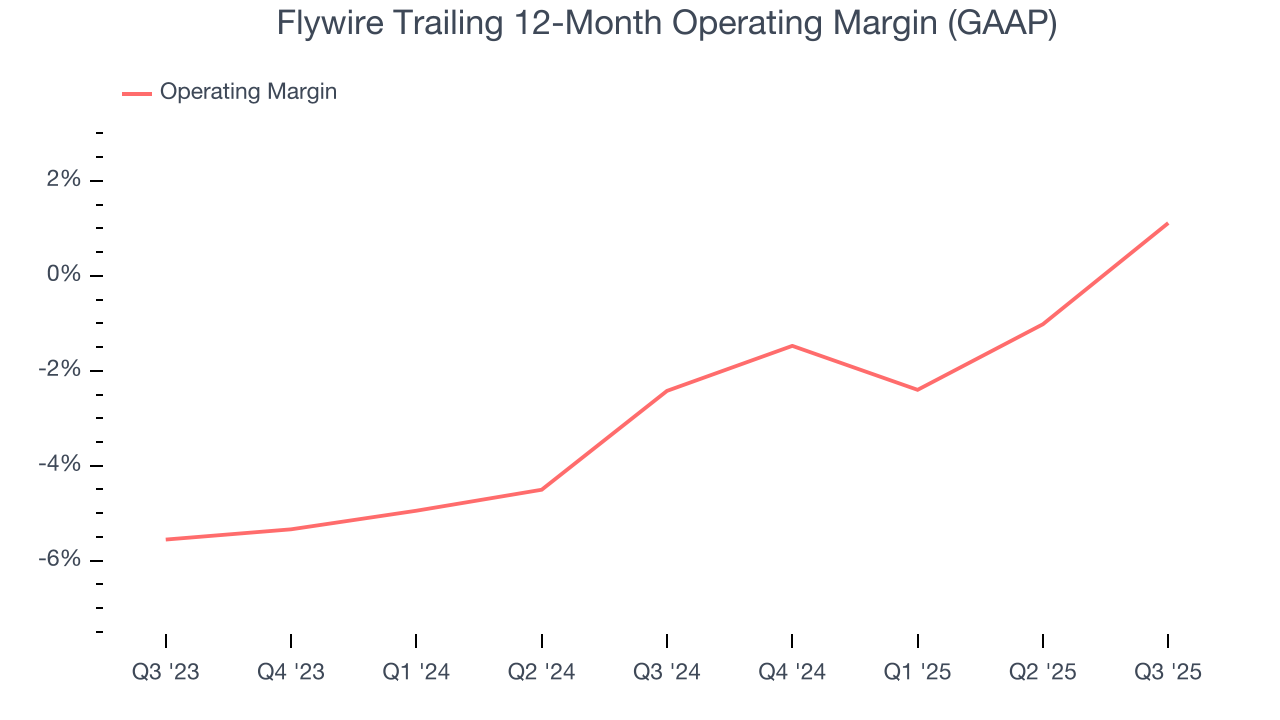

Flywire has done a decent job managing its cost base over the last year. The company has produced an average operating margin of 1.1%, higher than the broader software sector.

Looking at the trend in its profitability, Flywire’s operating margin rose by 3.5 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Flywire generated an operating margin profit margin of 16.1%, up 3.2 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Flywire has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.9%, subpar for a software business.

Flywire’s free cash flow clocked in at $147.5 million in Q3, equivalent to a 73.7% margin. The company’s cash profitability regressed as it was 46.7 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

10. Balance Sheet Assessment

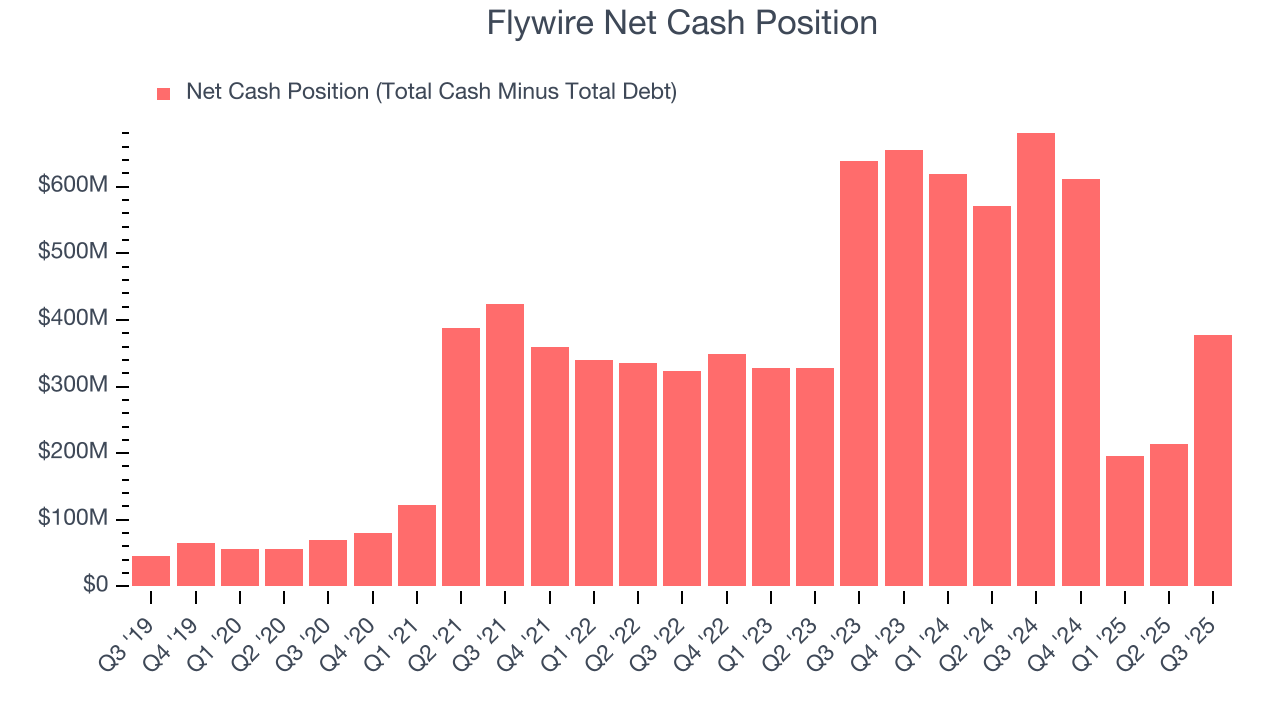

Companies with more cash than debt have lower bankruptcy risk.

Flywire is a profitable, well-capitalized company with $377.3 million of cash and no debt. This position is 23% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Flywire’s Q3 Results

We were impressed by how significantly Flywire blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 12.1% to $15.50 immediately following the results.

12. Is Now The Time To Buy Flywire?

Updated: January 30, 2026 at 9:29 PM EST

Before deciding whether to buy Flywire or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are some bright spots in Flywire’s fundamentals, but its business quality ultimately falls short. First off, its revenue growth was exceptional over the last five years. Investors should still be cautious, however, as Flywire’s customer acquisition is less efficient than many comparable companies.

Flywire’s price-to-sales ratio based on the next 12 months is 2.5x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $17.19 on the company (compared to the current share price of $12.61).