Funko (FNKO)

Funko is in for a bumpy ride. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Funko Will Underperform

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

- Sales trends were unexciting over the last five years as its 7.7% annual growth was below the typical consumer discretionary company

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 36.2% annually

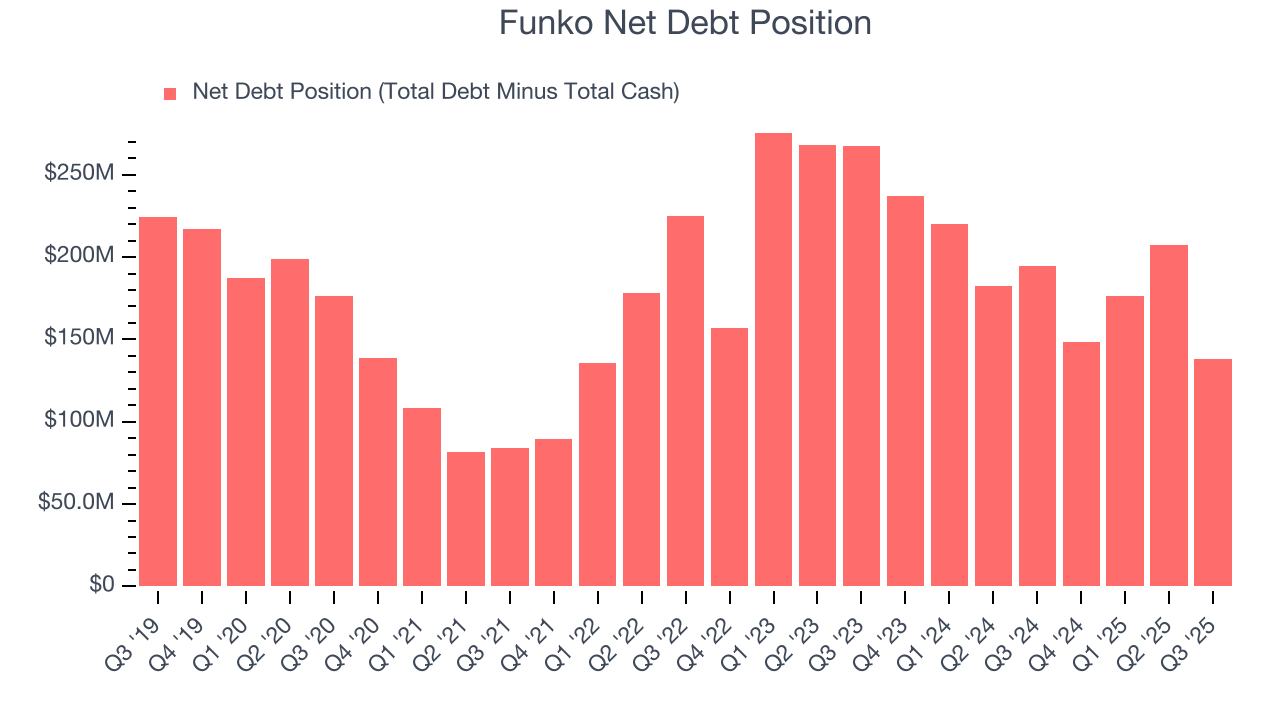

- High net-debt-to-EBITDA ratio of 7× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Funko doesn’t fulfill our quality requirements. There are more promising prospects in the market.

Why There Are Better Opportunities Than Funko

Why There Are Better Opportunities Than Funko

Funko’s stock price of $3.68 implies a valuation ratio of 5.1x forward EV-to-EBITDA. Funko’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Funko (FNKO) Research Report: Q3 CY2025 Update

Pop culture collectibles manufacturer Funko (NASDAQ:FNKO) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 14.3% year on year to $250.9 million. Its non-GAAP profit of $0.06 per share was significantly above analysts’ consensus estimates.

Funko (FNKO) Q3 CY2025 Highlights:

- Revenue: $250.9 million vs analyst estimates of $262 million (14.3% year-on-year decline, 4.2% miss)

- Adjusted EPS: $0.06 vs analyst estimates of -$0.09 (significant beat)

- Adjusted EBITDA: $24.43 million vs analyst estimates of $15 million (9.7% margin, 62.9% beat)

- Operating Margin: 2.6%, down from 4% in the same quarter last year

- Free Cash Flow was $3.38 million, up from -$4.08 million in the same quarter last year

- Market Capitalization: $217.6 million

Company Overview

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Funko was born from toy collector Mike Becker's desire to bring back low-tech, whimsically designed toys and collectibles from the past. Over time, Funko evolved from a nostalgia-focused concept to a leading pop culture product company, driven by its mission to connect fans with their favorite pop culture characters and stories.

Funko's core product line comprises collectibles like vinyl figures, bobbleheads, and plush items, underpinned by a wide array of licensing agreements with major entertainment companies. These products cater to the increasing demand for pop culture merchandise, tapping into fans’ desires to own physical representations of their favorite characters.

Revenue for Funko is generated through multiple channels, including specialty retailers, mass-market stores, and direct-to-consumer sales through its website. Its products appeal to a broad spectrum of consumers, from avid collectors and enthusiasts to casual fans.

4. Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

5. Revenue Growth

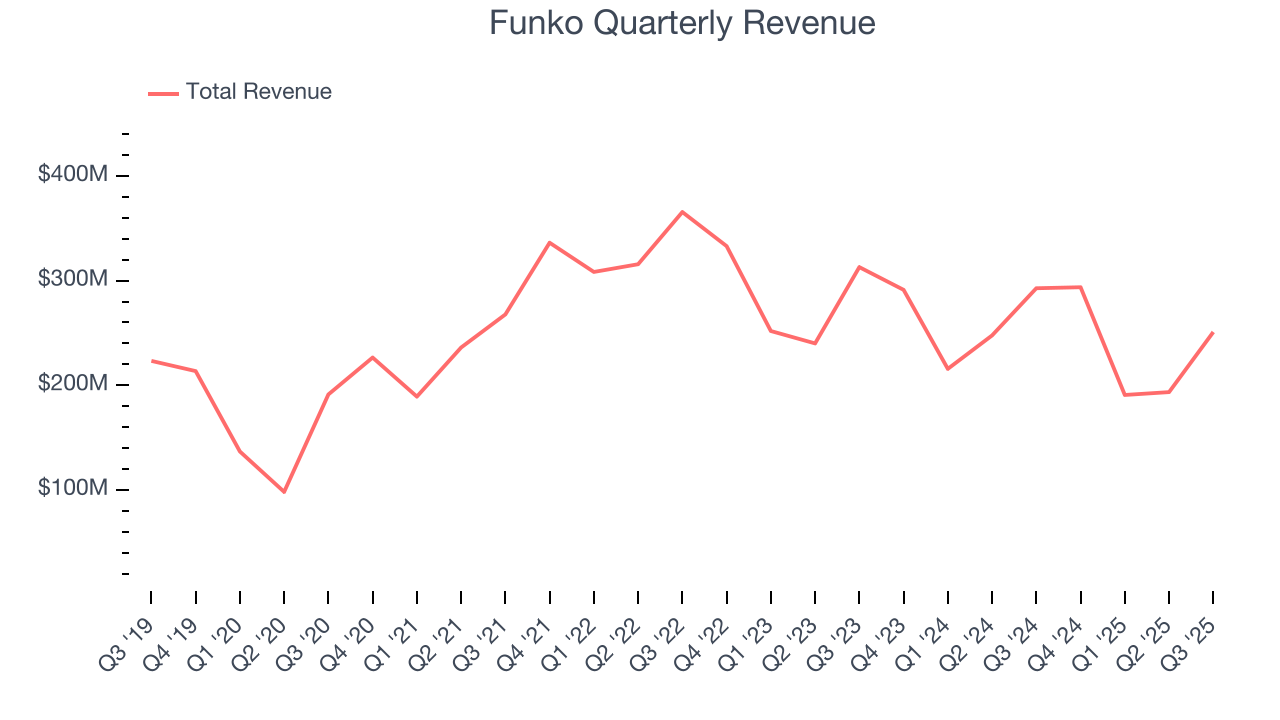

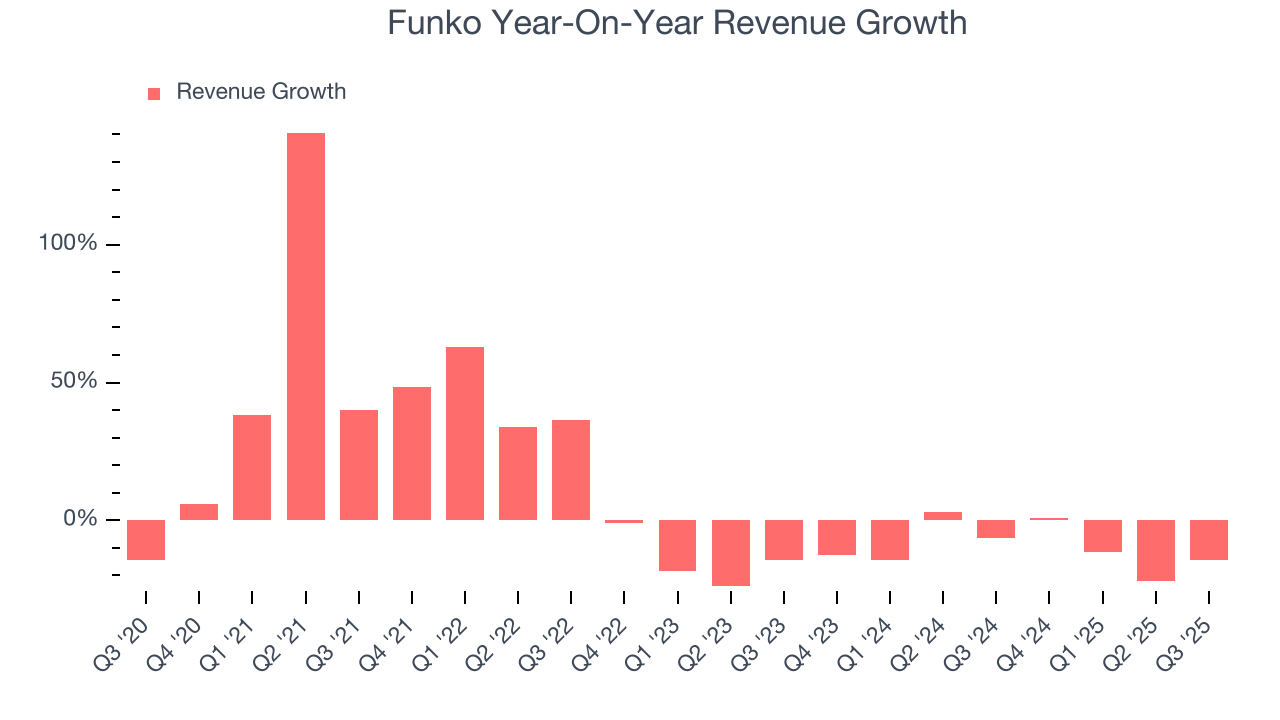

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Funko grew its sales at a sluggish 7.7% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Funko’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 9.7% annually.

This quarter, Funko missed Wall Street’s estimates and reported a rather uninspiring 14.3% year-on-year revenue decline, generating $250.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.4% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

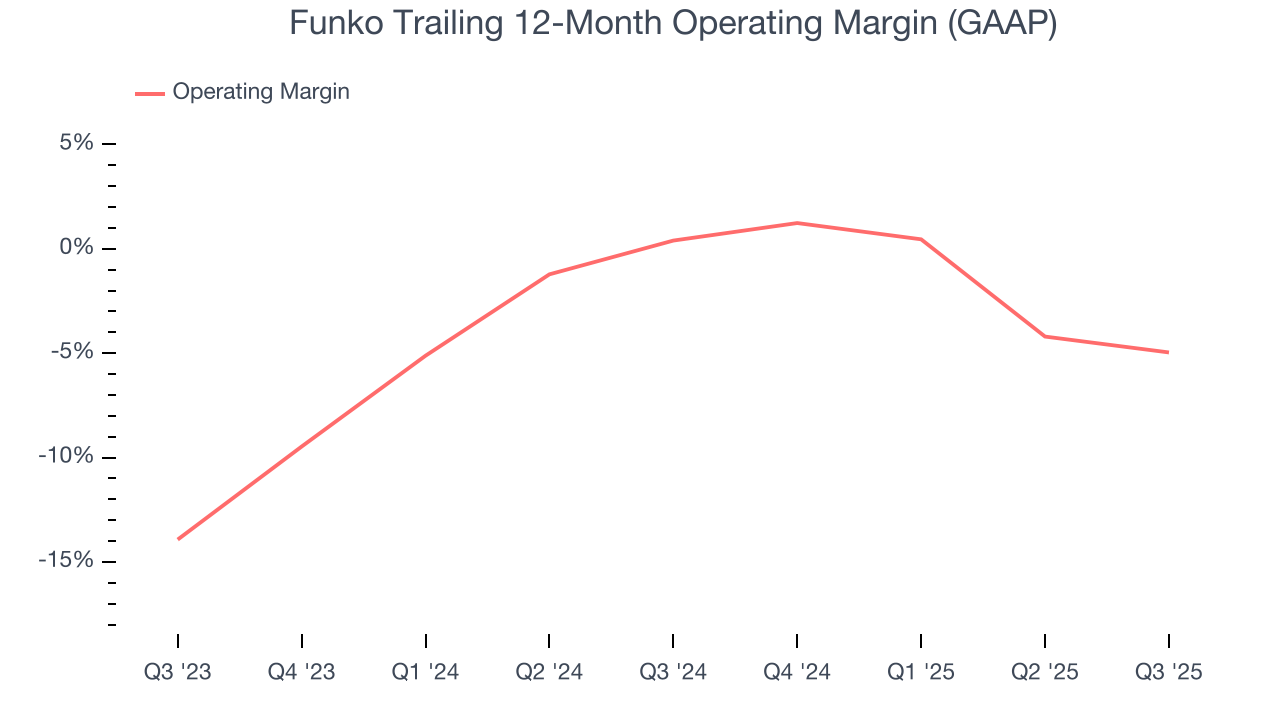

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Funko’s operating margin has been trending down over the last 12 months and averaged negative 2.1% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q3, Funko generated an operating margin profit margin of 2.6%, down 1.4 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

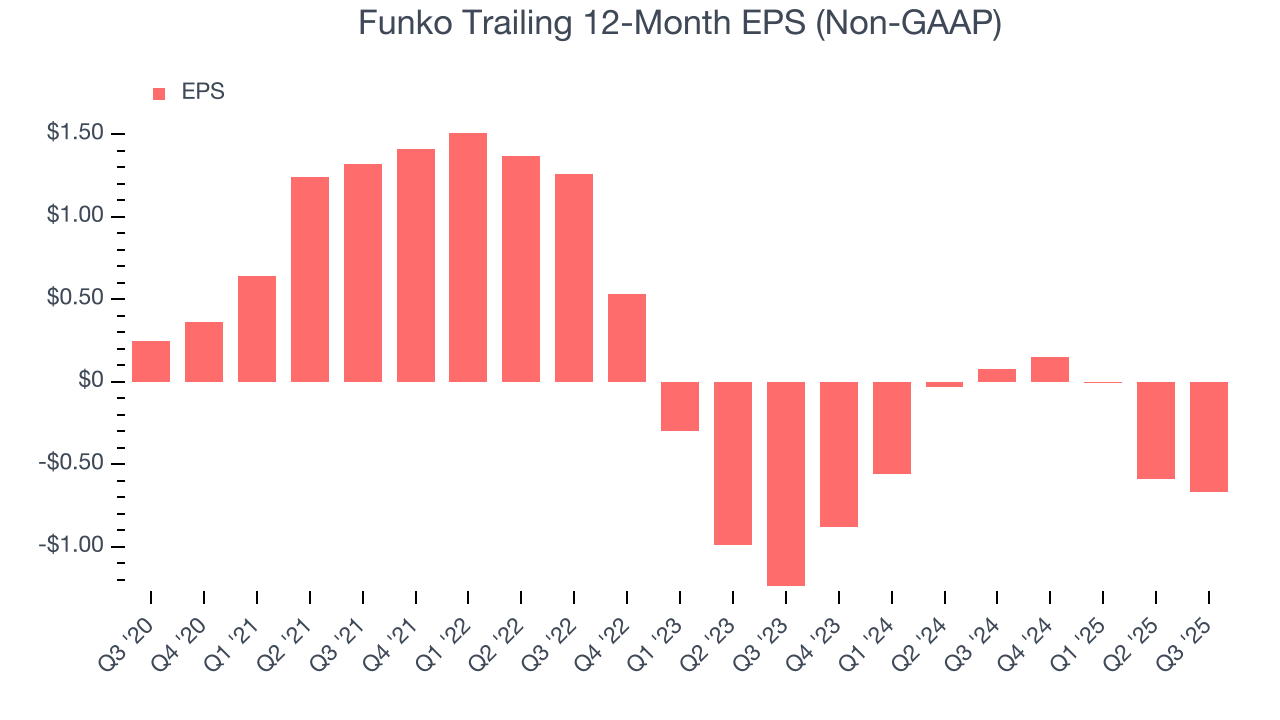

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Funko, its EPS declined by 36.2% annually over the last five years while its revenue grew by 7.7%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, Funko reported adjusted EPS of $0.06, down from $0.14 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Funko to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.67 will advance to negative $0.12.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

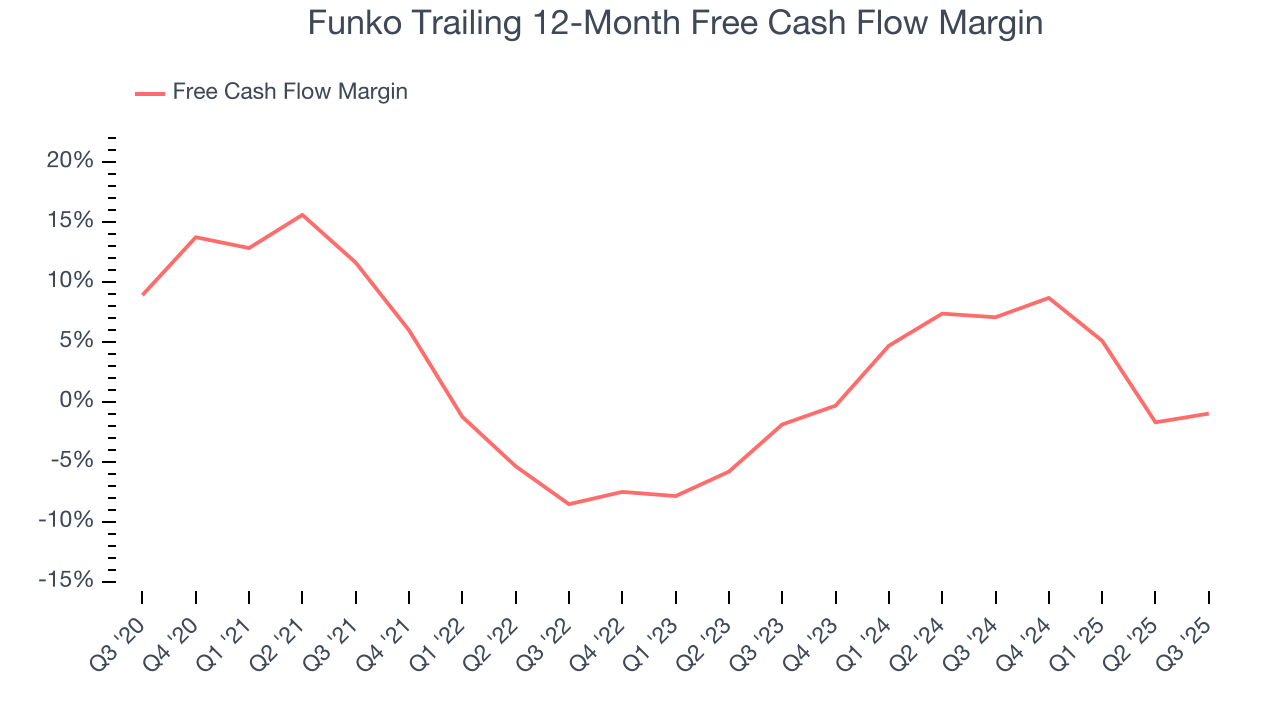

Funko has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.3%, lousy for a consumer discretionary business.

Funko’s free cash flow clocked in at $3.38 million in Q3, equivalent to a 1.3% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

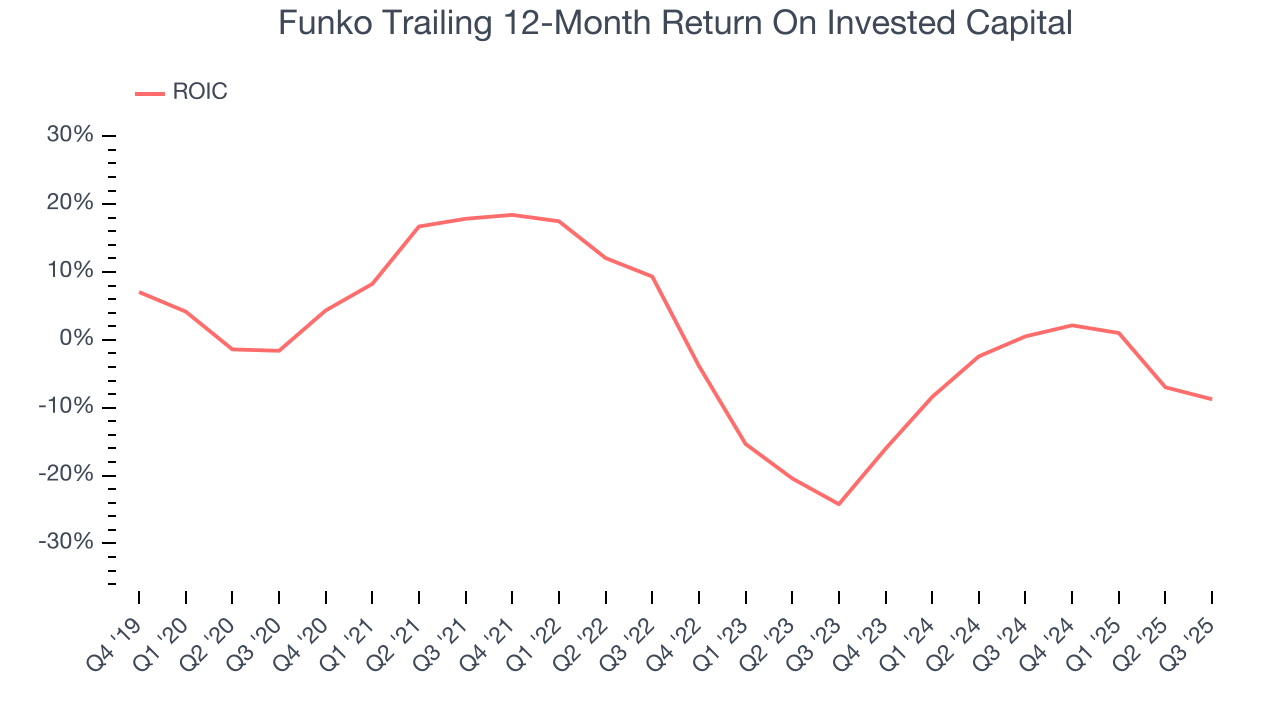

Funko’s five-year average ROIC was negative 1.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Funko’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

Funko reported $39.18 million of cash and $177.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $29.5 million of EBITDA over the last 12 months, we view Funko’s 4.7× net-debt-to-EBITDA ratio as safe. We also see its $6.97 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Funko’s Q3 Results

It was good to see Funko beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 15.9% to $3.50 immediately after reporting.

12. Is Now The Time To Buy Funko?

Updated: January 15, 2026 at 10:00 PM EST

Before making an investment decision, investors should account for Funko’s business fundamentals and valuation in addition to what happened in the latest quarter.

Funko falls short of our quality standards. To kick things off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Funko’s EV-to-EBITDA ratio based on the next 12 months is 5.1x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $4.25 on the company (compared to the current share price of $3.68).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.