First Solar (FSLR)

First Solar is in a league of its own. Its elite revenue growth and returns on capital demonstrate it can grow rapidly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why We Like First Solar

Headquartered in Arizona, First Solar (NASDAQ:FSLR) specializes in manufacturing solar panels and providing photovoltaic solar energy solutions.

- Impressive 25.4% annual revenue growth over the last two years indicates it’s winning market share this cycle

- Additional sales over the last five years increased its profitability as the 30.7% annual growth in its earnings per share outpaced its revenue

- Excellent operating margin highlights the strength of its business model, and its profits increased over the last five years as it scaled

First Solar is a standout company. The price seems reasonable relative to its quality, and we think now is a prudent time to invest.

Why Is Now The Time To Buy First Solar?

High Quality

Investable

Underperform

Why Is Now The Time To Buy First Solar?

First Solar is trading at $188.07 per share, or 10.9x forward P/E. Most industrials companies are more expensive, so we think First Solar is a good deal when considering its quality characteristics.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. If you can get an attractive entry price, that’s icing on the cake.

3. First Solar (FSLR) Research Report: Q4 CY2025 Update

Solar panel manufacturer First Solar (NASDAQ:FSLR) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 11.1% year on year to $1.68 billion. On the other hand, the company’s full-year revenue guidance of $5.05 billion at the midpoint came in 17.4% below analysts’ estimates. Its GAAP profit of $4.84 per share was 6.3% below analysts’ consensus estimates.

First Solar (FSLR) Q4 CY2025 Highlights:

- Revenue: $1.68 billion vs analyst estimates of $1.57 billion (11.1% year-on-year growth, 7% beat)

- EPS (GAAP): $4.84 vs analyst expectations of $5.17 (6.3% miss)

- Adjusted EBITDA: $691.1 million vs analyst estimates of $712.1 million (41.1% margin, 2.9% miss)

- EBITDA guidance for the upcoming financial year 2026 is $2.7 billion at the midpoint, below analyst estimates of $3.17 billion

- Operating Margin: 32.6%, up from 30.2% in the same quarter last year

- Free Cash Flow Margin: 63.6%, up from 32.9% in the same quarter last year

- Market Capitalization: $25.98 billion

Company Overview

Headquartered in Arizona, First Solar (NASDAQ:FSLR) specializes in manufacturing solar panels and providing photovoltaic solar energy solutions.

First Solar was established in 1999 and has grown to become a comprehensive provider of photovoltaic (PV) solar systems. The company utilizes its thin-film semiconductor technology to manufacture solar modules that distinguish it from competitors using traditional crystalline silicon technology. First Solar pioneered the commercialization of cadmium telluride (CdTe) solar cells, which offer advantages over other technologies. Over the years, the company has expanded its manufacturing capabilities globally, becoming one of the largest PV solar module manufacturers in the Western Hemisphere.

Today, First Solar is primarily a manufacturer of PV solar modules, employing advanced thin-film semiconductor technology to deliver high-performance and environmentally friendly solar energy. Utilizing CdTe as the absorption layer in their modules, First Solar harnesses its properties to efficiently convert solar energy while using significantly less material than conventional crystalline silicon modules. This approach not only enhances the performance of their modules in various climates but also reduces the overall environmental impact throughout the product's lifecycle.

First Solar generates revenue through the sale of PV solar modules and complete solar power systems to project developers, system integrators, and operators of renewable energy projects. While the bulk of the company's revenue comes from these one-time sales, First Solar also benefits from some recurring revenue streams. This recurring revenue is primarily derived from long-term contracts for services such as module recycling and maintenance, which help extend the life and efficiency of solar installations. Additionally, the company may secure repeat business from existing customers who expand or update their solar projects.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors in the solar industry include SunPower (NASDAQ:SPWR), Sunnova Energy (NYSE:NOVA), and SolarEdge (NASDAQ:SEDG).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, First Solar grew its sales at an exceptional 14% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. First Solar’s annualized revenue growth of 25.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, First Solar reported year-on-year revenue growth of 11.1%, and its $1.68 billion of revenue exceeded Wall Street’s estimates by 7%.

Looking ahead, sell-side analysts expect revenue to grow 16.2% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and indicates the market sees success for its products and services.

6. Gross Margin & Pricing Power

First Solar’s gross margin is good compared to other industrials businesses and signals it sells differentiated products, not commodities. As you can see below, it averaged an impressive 33.6% gross margin over the last five years. Said differently, First Solar paid its suppliers $66.41 for every $100 in revenue.

First Solar produced a 39.5% gross profit margin in Q4 , marking a 2 percentage point increase from 37.5% in the same quarter last year. On a wider time horizon, however, First Solar’s full-year margin has been trending down over the past 12 months, decreasing by 3.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

First Solar has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.1%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, First Solar’s operating margin rose by 10.5 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, First Solar generated an operating margin profit margin of 32.6%, up 2.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

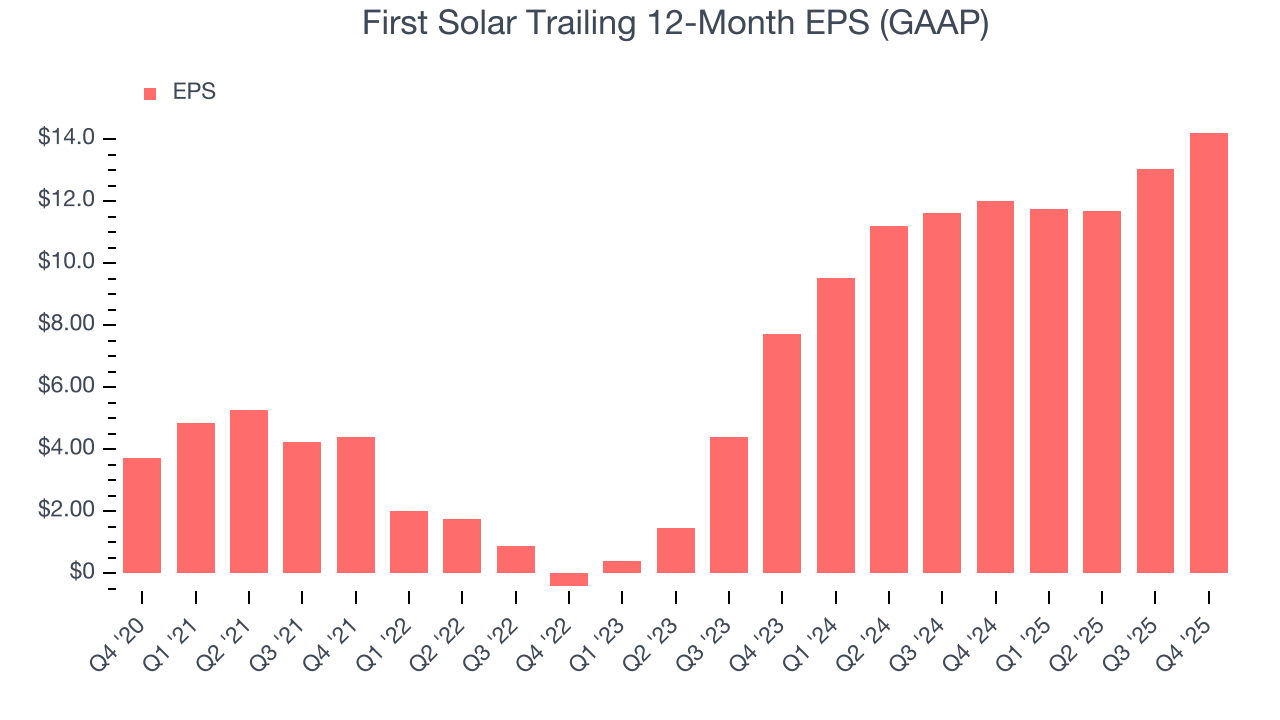

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

First Solar’s EPS grew at an astounding 30.6% compounded annual growth rate over the last five years, higher than its 14% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of First Solar’s earnings can give us a better understanding of its performance. As we mentioned earlier, First Solar’s operating margin expanded by 10.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For First Solar, its two-year annual EPS growth of 35.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, First Solar reported EPS of $4.84, up from $3.65 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects First Solar’s full-year EPS of $14.21 to grow 57.3%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

While First Solar posted positive free cash flow this quarter, the broader story hasn’t been so clean. First Solar’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.30 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Taking a step back, an encouraging sign is that First Solar’s margin expanded by 33.1 percentage points during that time. The company’s improvement and free cash flow generation this quarter show it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

First Solar’s free cash flow clocked in at $1.07 billion in Q4, equivalent to a 63.6% margin. This result was good as its margin was 30.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

First Solar’s five-year average ROIC was 14.5%, beating other industrials companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, First Solar’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

First Solar is a profitable, well-capitalized company with $2.86 billion of cash and $498.6 million of debt on its balance sheet. This $2.36 billion net cash position is 9.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from First Solar’s Q4 Results

We were impressed by how significantly First Solar blew past analysts’ revenue expectations this quarter. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 11.1% to $217.01 immediately following the results.

13. Is Now The Time To Buy First Solar?

Updated: March 10, 2026 at 12:16 AM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in First Solar.

First Solar is truly a cream-of-the-crop industrials company. For starters, its revenue growth was exceptional over the last five years. And while its cash burn raises the question of whether it can sustainably maintain growth, its impressive operating margins show it has a highly efficient business model. On top of that, First Solar’s rising cash profitability gives it more optionality.

First Solar’s P/E ratio based on the next 12 months is 10.7x. Scanning the industrials landscape today, First Solar’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $257.31 on the company (compared to the current share price of $195.05), implying they see 31.9% upside in buying First Solar in the short term.