FTAI Aviation (FTAI)

FTAI Aviation is in a league of its own. Its fast sales growth, strong unit economics, and bright outlook position it as a market-beating winner.― StockStory Analyst Team

1. News

2. Summary

Why We Like FTAI Aviation

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation (NASDAQ:FTAI) sells, leases, maintains, and repairs aircraft engines.

- Annual revenue growth of 46.9% over the past five years was outstanding, reflecting market share gains this cycle

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 57.6% outpaced its revenue gains

- Expected revenue growth of 32.1% for the next year suggests its market share will rise

We’re fond of companies like FTAI Aviation. The price looks fair when considering its quality, and we think now is a good time to buy the stock.

Why Is Now The Time To Buy FTAI Aviation?

High Quality

Investable

Underperform

Why Is Now The Time To Buy FTAI Aviation?

At $258.76 per share, FTAI Aviation trades at 37.6x forward P/E. Many industrials names may carry a lower valuation multiple, but FTAI Aviation’s price is fair given its business quality.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Over the long term, entry price doesn’t matter nearly as much as business fundamentals.

3. FTAI Aviation (FTAI) Research Report: Q4 CY2025 Update

Aircraft leasing company FTAI Aviation (NASDAQ:FTAI) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 32.7% year on year to $662 million. Its GAAP profit of $1.08 per share was 13.2% below analysts’ consensus estimates.

FTAI Aviation (FTAI) Q4 CY2025 Highlights:

- Revenue: $662 million vs analyst estimates of $690.5 million (32.7% year-on-year growth, 4.1% miss)

- EPS (GAAP): $1.08 vs analyst expectations of $1.24 (13.2% miss)

- Adjusted EBITDA: $277.2 million vs analyst estimates of $288.6 million (41.9% margin, 3.9% miss)

- EBITDA guidance for the upcoming financial year 2026 is $1.58 billion at the midpoint, above analyst estimates of $1.46 billion

- Operating Margin: 27%, in line with the same quarter last year

- Market Capitalization: $31.17 billion

Company Overview

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation (NASDAQ:FTAI) sells, leases, maintains, and repairs aircraft engines.

As mentioned, part of its business generates revenue through the leasing and maintenance of aviation assets. The CFM56 engine, which is the most common jet engine in commercial aircrafts today, comprises a large part of FTAI’s asset portfolio. This part of the business enjoys steady, recurring revenues tied to long-term leases since the useful life of these aviation assets can be multiple decades.

The other part of FTAI’s business develops and manufactures aftermarket components for aircraft engines such as the CFM56 model we mentioned earlier. FTAI parlays these aftermarket components to win maintenance business as well. In the area of maintenance, the company takes a modular approach to repairing and overhauling engines that saves both time and expense for customers such as airlines and lessors.

FTAI leases its aviation assets to airlines and other leasing companies. These customers tend to have a mix of owned and leased assets for reasons revolving around financial flexibility, capital availability, and shorter-term swings in travel demand. For these customers, “time on wing” is important, which is why FTAI wants to not only lease dependable assets but also wants to maintain and repair them in the most efficient manner possible.

4. Vehicle Parts Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Transportation parts distributors that boast reliable selection in sometimes specialized areas combined and quickly deliver products to customers can benefit from this theme. Additionally, distributors who earn meaningful revenue streams from aftermarket products can enjoy more steady top-line trends and higher margins. But like the broader industrials sector, transportation parts distributors are also at the whim of economic cycles that impact capital spending, transportation volumes, and demand for discretionary parts and components.

Competitors in the aircraft leasing industry include AerCap (NYSE:AER), Air Lease Corporation (NYSE:AL), and GATX Corporation (NYSE:GATX).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, FTAI Aviation’s sales grew at an incredible 46.9% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. FTAI Aviation’s annualized revenue growth of 46.3% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, FTAI Aviation pulled off a wonderful 32.7% year-on-year revenue growth rate, but its $662 million of revenue fell short of Wall Street’s rosy estimates.

Looking ahead, sell-side analysts expect revenue to grow 31.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and suggests the market is forecasting success for its products and services.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

FTAI Aviation has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 46.1% gross margin over the last five years. Said differently, roughly $46.12 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

FTAI Aviation’s gross profit margin came in at 44.3% this quarter , marking a 2.9 percentage point increase from 41.4% in the same quarter last year. On a wider time horizon, however, FTAI Aviation’s full-year margin has been trending down over the past 12 months, decreasing by 3.8 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

FTAI Aviation has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 20.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, FTAI Aviation’s operating margin rose by 16.8 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its expansion shows it’s one of the better Vehicle Parts Distributors companies as most peers saw their margins plummet.

This quarter, FTAI Aviation generated an operating margin profit margin of 27%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

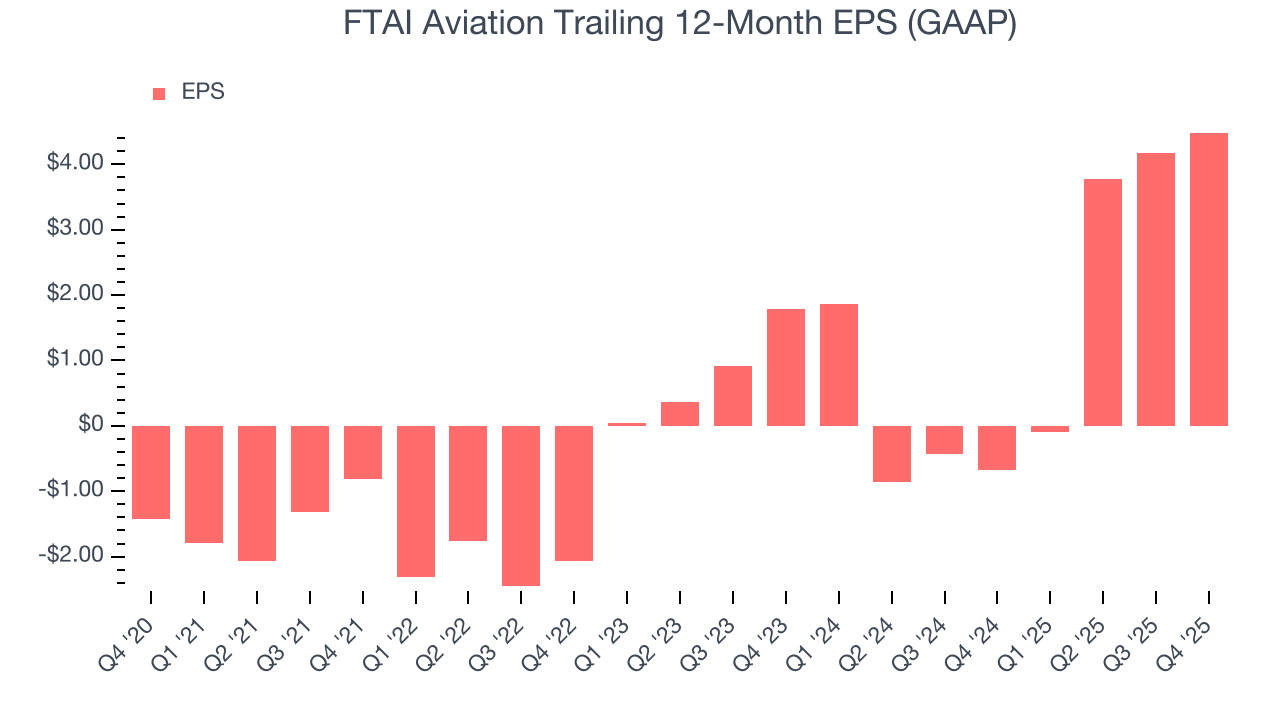

FTAI Aviation’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

FTAI Aviation’s EPS grew at an astounding 58.3% compounded annual growth rate over the last two years, higher than its 46.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, FTAI Aviation reported EPS of $1.08, up from $0.76 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects FTAI Aviation’s full-year EPS of $4.49 to grow 60.4%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

FTAI Aviation’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 87.9%, meaning it lit $87.87 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Taking a step back, an encouraging sign is that FTAI Aviation’s margin expanded during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although FTAI Aviation has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, FTAI Aviation’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

11. Balance Sheet Assessment

FTAI Aviation reported $300.5 million of cash and $3.45 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.19 billion of EBITDA over the last 12 months, we view FTAI Aviation’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $125.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from FTAI Aviation’s Q4 Results

We were impressed by FTAI Aviation’s optimistic full-year EBITDA guidance, which blew past analysts’ expectations. On the other hand, its revenue missed and its EBITDA in the quarter both fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.3% to $289.77 immediately following the results.

13. Is Now The Time To Buy FTAI Aviation?

Updated: March 8, 2026 at 11:28 PM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own FTAI Aviation, you should also grasp the company’s longer-term business quality and valuation.

There is a lot to like about FTAI Aviation. For starters, its revenue growth was exceptional over the last five years. And while its cash burn raises the question of whether it can sustainably maintain growth, its admirable gross margins indicate the mission-critical nature of its offerings. On top of that, FTAI Aviation’s impressive operating margins show it has a highly efficient business model.

FTAI Aviation’s P/E ratio based on the next 12 months is 37.6x. Scanning the industrials landscape today, FTAI Aviation’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $334.20 on the company (compared to the current share price of $258.76), implying they see 29.2% upside in buying FTAI Aviation in the short term.