Fortrea (FTRE)

Fortrea faces an uphill battle. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Fortrea Will Underperform

Spun off from Labcorp in 2023 to focus exclusively on clinical research services, Fortrea (NASDAQ:FTRE) is a contract research organization that helps pharmaceutical, biotech, and medical device companies develop and bring their products to market through clinical trials and support services.

- Negative returns on capital show that some of its growth strategies have backfired, and its falling returns suggest its earlier profit pools are drying up

- Sales are projected to tank by 4.3% over the next 12 months as its demand continues evaporating

- Products and services are facing significant end-market challenges during this cycle as sales have declined by 2.9% annually over the last four years

Fortrea’s quality doesn’t meet our expectations. There are more appealing investments to be made.

Why There Are Better Opportunities Than Fortrea

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Fortrea

At $10.72 per share, Fortrea trades at 15.2x forward P/E. Yes, this valuation multiple is lower than that of other healthcare peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Fortrea (FTRE) Research Report: Q4 CY2025 Update

Clinical research company Fortrea Holdings (NASDAQ:FTRE) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 5.2% year on year to $660.5 million. The company’s full-year revenue guidance of $2.6 billion at the midpoint came in 4.9% below analysts’ estimates. Its non-GAAP profit of $0.09 per share was 43.8% below analysts’ consensus estimates.

Fortrea (FTRE) Q4 CY2025 Highlights:

- Revenue: $660.5 million vs analyst estimates of $666.8 million (5.2% year-on-year decline, 0.9% miss)

- Adjusted EPS: $0.09 vs analyst expectations of $0.16 (43.8% miss)

- Adjusted EBITDA: $54 million vs analyst estimates of $50.09 million (8.2% margin, 7.8% beat)

- EBITDA guidance for the upcoming financial year 2026 is $205 million at the midpoint, in line with analyst expectations

- Operating Margin: -2.1%, up from -8% in the same quarter last year

- Free Cash Flow Margin: 18.4%, up from 2.9% in the same quarter last year

- Market Capitalization: $955.4 million

Company Overview

Spun off from Labcorp in 2023 to focus exclusively on clinical research services, Fortrea (NASDAQ:FTRE) is a contract research organization that helps pharmaceutical, biotech, and medical device companies develop and bring their products to market through clinical trials and support services.

Fortrea operates through two main segments: Clinical Services and Enabling Services. The Clinical Services segment, which generates the majority of revenue, provides comprehensive clinical trial management from early-stage (Phase I) through late-stage (Phase IV) studies across more than 20 therapeutic areas including oncology, neurology, rare diseases, and cell and gene therapies.

The company's clinical pharmacology capabilities include specialized research units in the U.S. and U.K. with hundreds of beds for conducting early-phase trials. These facilities feature on-site pharmacies that can manufacture both sterile and non-sterile drug products, giving Fortrea significant capabilities in the critical early stages of drug development.

For later-stage trials, Fortrea offers flexible engagement models to meet varying client needs. Customers can choose full-service arrangements where Fortrea manages entire clinical programs, functional service provider models where Fortrea supplies specialized staff for specific activities, or hybrid approaches combining elements of both.

The Enabling Services segment provides complementary offerings including patient access solutions and technology platforms. The patient access team helps patients navigate insurance coverage and affordability challenges for medications, while technology solutions like the endpoint Clinical platform manage randomization and trial supply logistics.

Fortrea serves a global client base, operating in approximately 90 countries with particular expertise in complex therapeutic areas. A pharmaceutical company developing a novel cancer treatment might engage Fortrea to design and execute clinical trials, manage regulatory submissions, recruit patients, collect and analyze data, and ultimately help secure approval from regulatory agencies like the FDA or EMA.

4. Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

Fortrea competes with other major contract research organizations including IQVIA (NYSE:IQV), Syneos Health (private), Parexel (private), PPD (owned by Thermo Fisher Scientific, NYSE:TMO), and ICON plc (NASDAQ:ICLR).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $2.72 billion in revenue over the past 12 months, Fortrea has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Fortrea struggled to consistently generate demand over the last four years as its sales dropped at a 2.9% annual rate. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. Fortrea’s annualized revenue declines of 2.1% over the last two years align with its four-year trend, suggesting its demand has consistently shrunk.

This quarter, Fortrea missed Wall Street’s estimates and reported a rather uninspiring 5.2% year-on-year revenue decline, generating $660.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

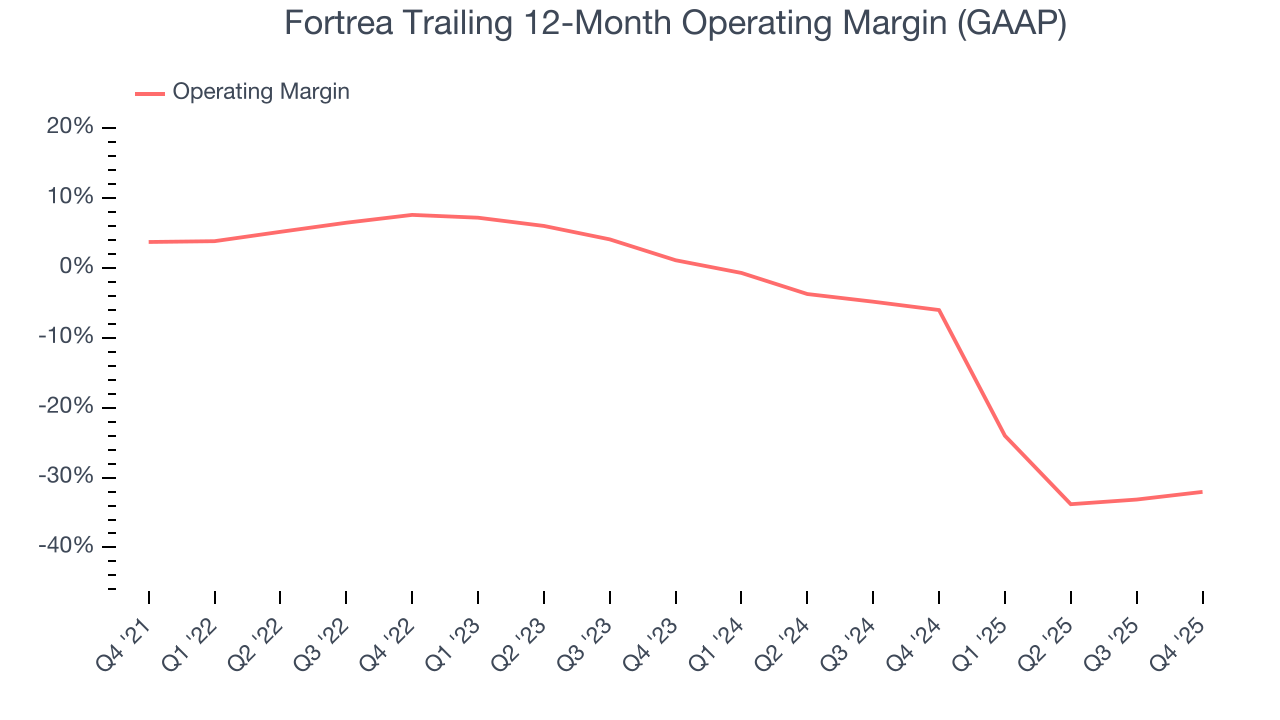

Fortrea’s high expenses have contributed to an average operating margin of negative 4.5% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Fortrea’s operating margin decreased by 35.8 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 33.2 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Fortrea generated a negative 2.1% operating margin. The company's consistent lack of profits raise a flag.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

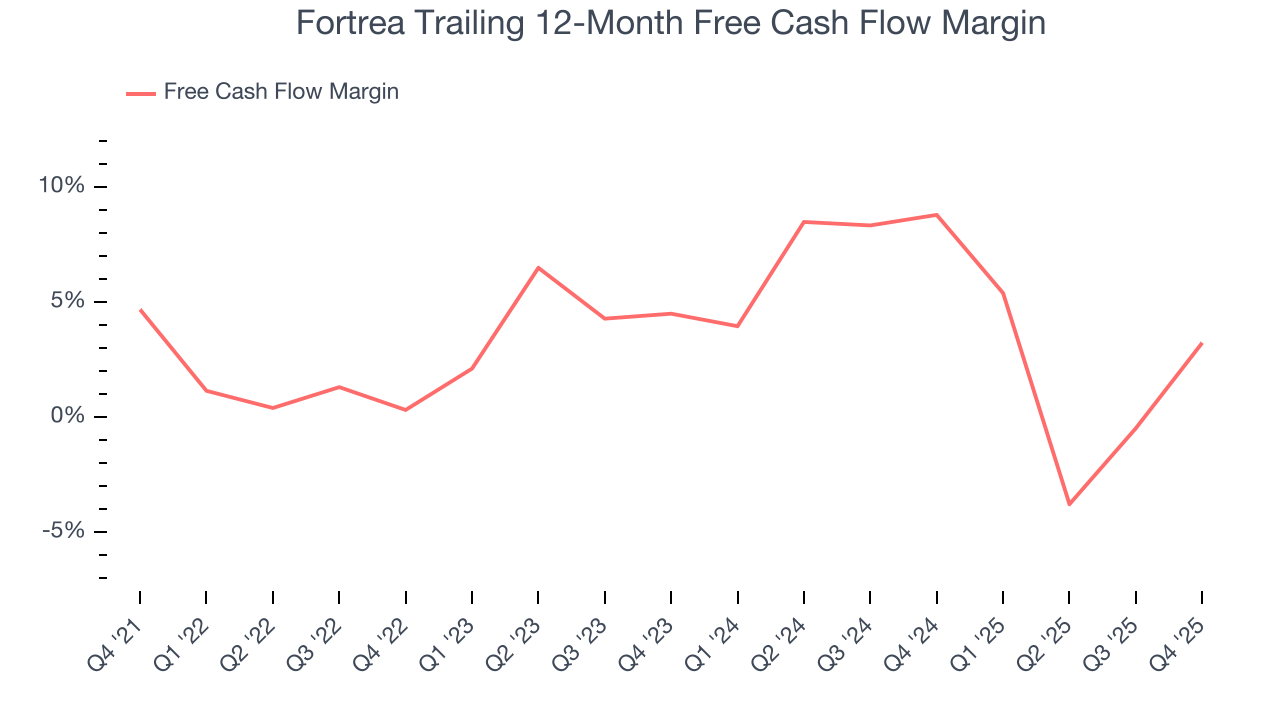

Fortrea has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.2%, subpar for a healthcare business.

Taking a step back, we can see that Fortrea’s margin dropped by 1.4 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of an investment cycle.

Fortrea’s free cash flow clocked in at $121.6 million in Q4, equivalent to a 18.4% margin. This result was good as its margin was 15.5 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

9. Balance Sheet Assessment

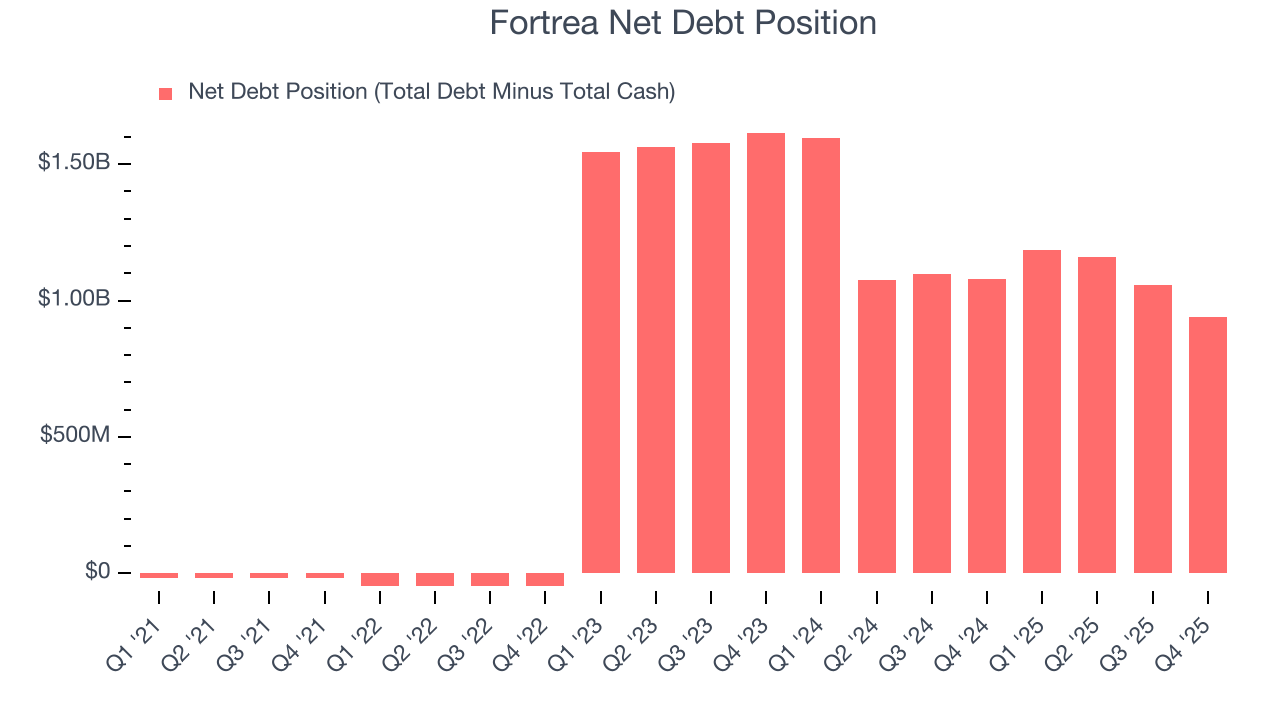

Fortrea reported $174.6 million of cash and $1.12 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $189.9 million of EBITDA over the last 12 months, we view Fortrea’s 5.0× net-debt-to-EBITDA ratio as safe. We also see its $45 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Fortrea’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.4% to $10.20 immediately after reporting.

11. Is Now The Time To Buy Fortrea?

Updated: March 1, 2026 at 11:45 PM EST

When considering an investment in Fortrea, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Fortrea falls short of our quality standards. To kick things off, its revenue has declined over the last four years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Fortrea’s diminishing returns show management's prior bets haven't worked out, and its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Fortrea’s P/E ratio based on the next 12 months is 15.2x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $14.62 on the company (compared to the current share price of $10.72).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.