Gilead Sciences (GILD)

We aren’t fans of Gilead Sciences. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Gilead Sciences Is Not Exciting

From its groundbreaking work in developing the first single-tablet regimens for HIV treatment, Gilead Sciences (NASDAQ:GILD) develops and markets innovative medicines for life-threatening diseases including HIV, viral hepatitis, COVID-19, and cancer.

- Sizable revenue base leads to growth challenges as its 4.8% annual revenue increases over the last five years fell short of other healthcare companies

- Projected sales growth of 3.1% for the next 12 months suggests sluggish demand

- A silver lining is that its excellent adjusted operating margin highlights the strength of its business model

Gilead Sciences is in the doghouse. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Gilead Sciences

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Gilead Sciences

Gilead Sciences’s stock price of $151.70 implies a valuation ratio of 18.5x forward P/E. Yes, this valuation multiple is lower than that of other healthcare peers, but we’ll remind you that you often get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Gilead Sciences (GILD) Research Report: Q4 CY2025 Update

Biopharmaceutical company Gilead Sciences (NASDAQ:GILD) announced better-than-expected revenue in Q4 CY2025, with sales up 5.2% year on year to $7.93 billion. On the other hand, the company’s full-year revenue guidance of $29.8 billion at the midpoint came in 1.2% below analysts’ estimates. Its non-GAAP profit of $1.86 per share was 1.9% above analysts’ consensus estimates.

Gilead Sciences (GILD) Q4 CY2025 Highlights:

- Revenue: $7.93 billion vs analyst estimates of $7.68 billion (5.2% year-on-year growth, 3.2% beat)

- Adjusted EPS: $1.86 vs analyst estimates of $1.83 (1.9% beat)

- Adjusted Operating Income: $3.09 billion vs analyst estimates of $3.10 billion (39% margin, in line)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.65 at the midpoint, missing analyst estimates by 1%

- Operating Margin: 25%, down from 32.5% in the same quarter last year

- Free Cash Flow Margin: 39.4%, up from 37.5% in the same quarter last year

- Market Capitalization: $188.2 billion

Company Overview

From its groundbreaking work in developing the first single-tablet regimens for HIV treatment, Gilead Sciences (NASDAQ:GILD) develops and markets innovative medicines for life-threatening diseases including HIV, viral hepatitis, COVID-19, and cancer.

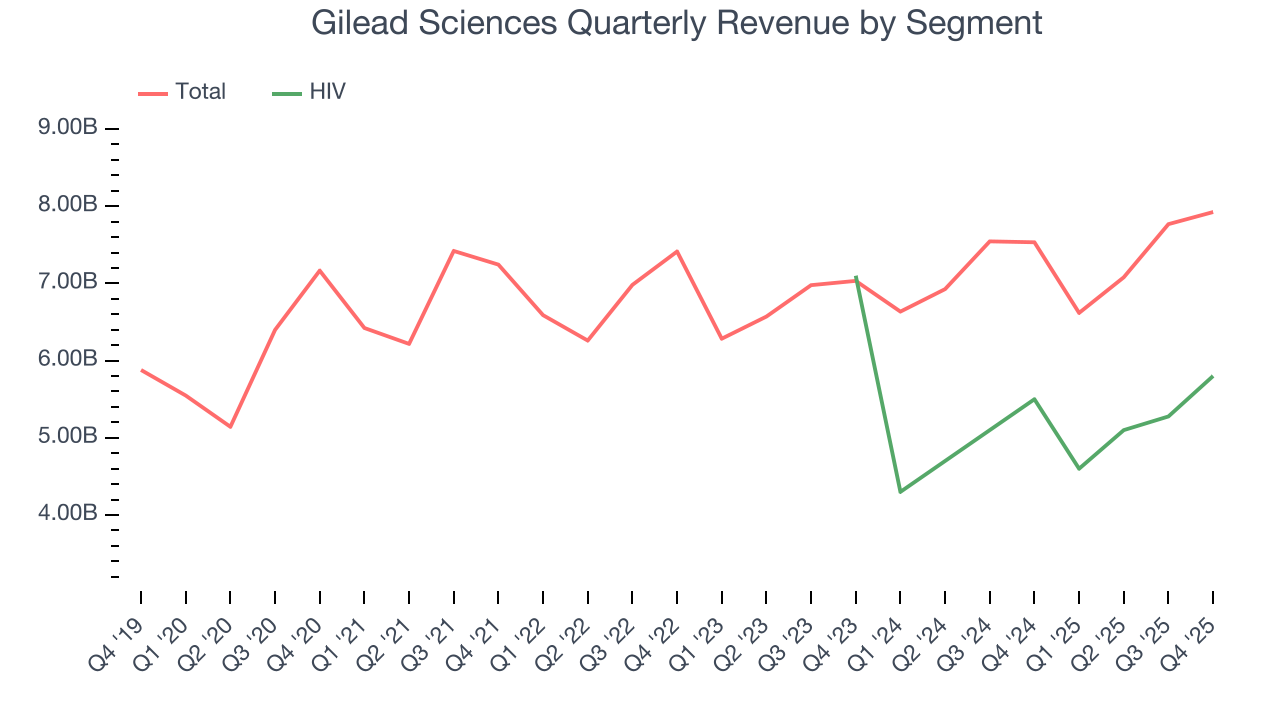

Gilead's product portfolio spans several critical therapeutic areas, with HIV treatments representing a significant portion of its business. The company's HIV medications include single-tablet regimens like Biktarvy and Genvoya, which combine multiple antiretroviral drugs into one daily pill, simplifying treatment for patients. Gilead also offers Descovy for HIV prevention (PrEP), helping high-risk individuals reduce their chance of contracting the virus.

In the viral hepatitis space, Gilead markets treatments for both hepatitis B and C, including Epclusa and Harvoni, which have revolutionized HCV treatment by offering high cure rates with shorter treatment durations compared to previous therapies. A patient with hepatitis C might take Epclusa once daily for 12 weeks and potentially be cured of their infection, a dramatic improvement over older interferon-based treatments that required longer treatment periods and had more side effects.

The company expanded into oncology with products like Yescarta and Tecartus, which are CAR T-cell therapies that reprogram a patient's own immune cells to target and destroy cancer cells. Trodelvy, another cancer medication, targets specific proteins on cancer cells to deliver chemotherapy directly to tumors while limiting damage to healthy tissues.

During the COVID-19 pandemic, Gilead's antiviral drug Veklury (remdesivir) became the first FDA-approved treatment for hospitalized COVID-19 patients, demonstrating the company's ability to respond rapidly to emerging health crises.

Gilead generates revenue through direct sales of its medications to wholesalers and distributors, who then supply hospitals, pharmacies, and other healthcare providers. The company also earns revenue through collaborations and licensing agreements with other pharmaceutical companies.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Gilead's competitors include major pharmaceutical companies such as Merck (NYSE:MRK), Johnson & Johnson (NYSE:JNJ), and GlaxoSmithKline (NYSE:GSK) in the HIV space; AbbVie (NYSE:ABBV) in hepatitis C; and Bristol Myers Squibb (NYSE:BMY), Novartis (NYSE:NVS), and Roche (OTCQX:RHHBY) in oncology.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $29.39 billion in revenue over the past 12 months, Gilead Sciences sports economies of scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

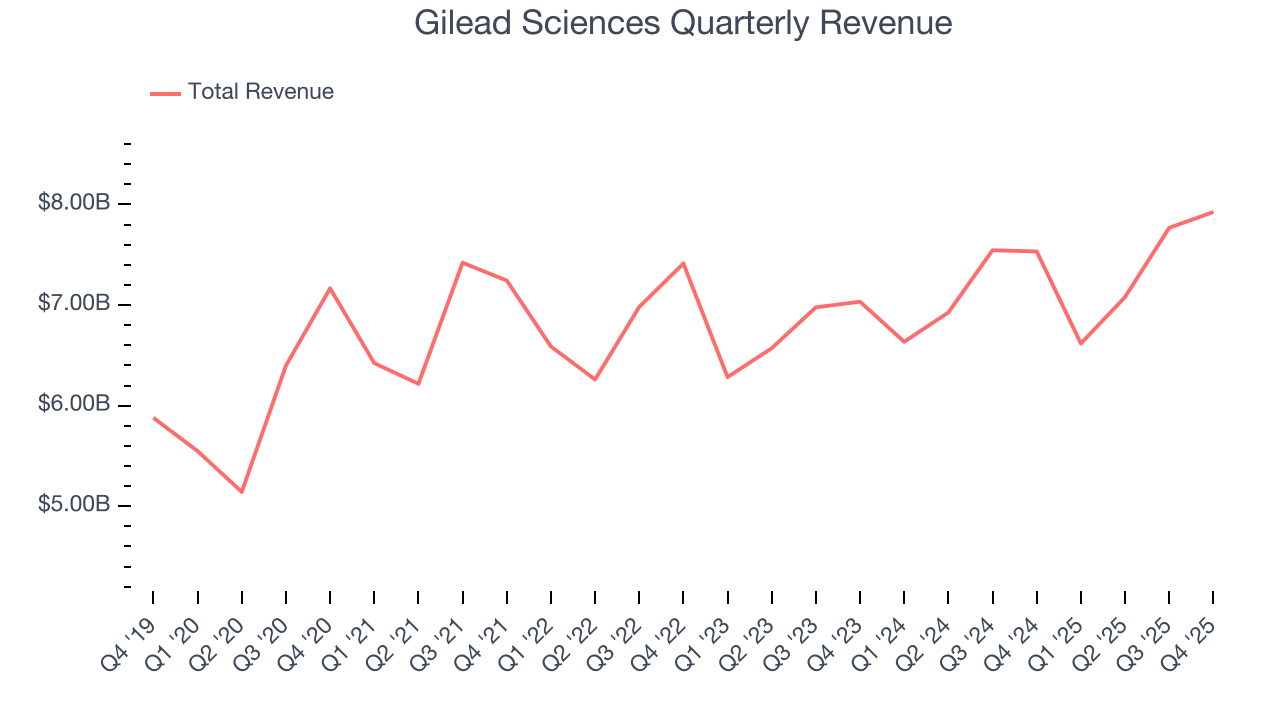

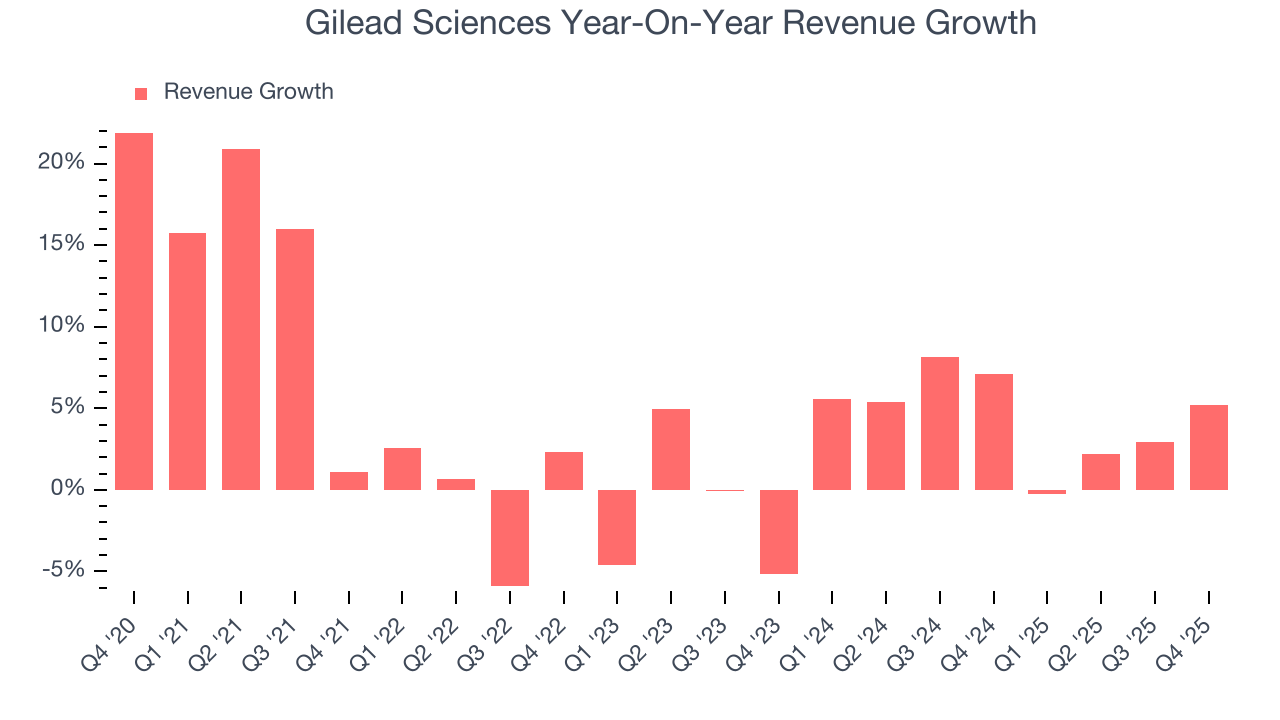

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Gilead Sciences grew its sales at a tepid 3.9% compounded annual growth rate. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Gilead Sciences’s annualized revenue growth of 4.6% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can better understand the company’s revenue dynamics by analyzing its most important segment, HIV. Over the last two years, Gilead Sciences’s HIV revenue was flat. This segment has lagged the company’s overall sales.

This quarter, Gilead Sciences reported year-on-year revenue growth of 5.2%, and its $7.93 billion of revenue exceeded Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

7. Adjusted Operating Margin

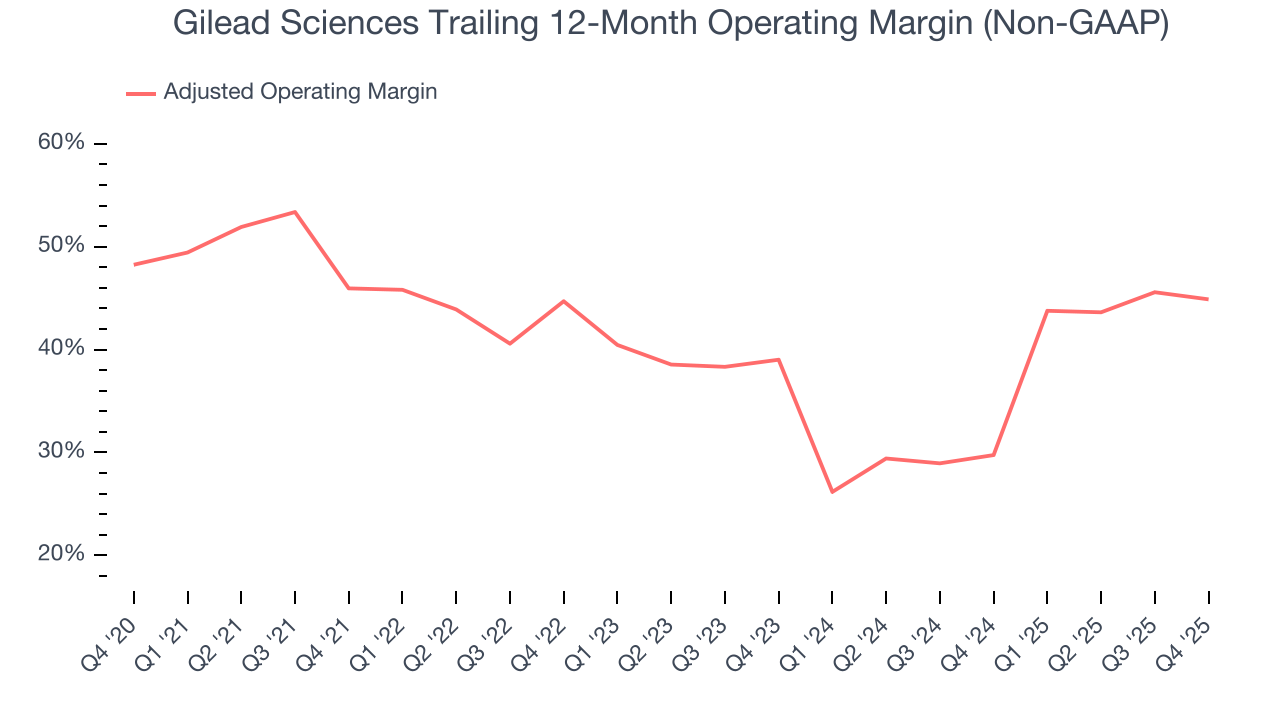

Gilead Sciences has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average adjusted operating margin of 40.8%.

Analyzing the trend in its profitability, Gilead Sciences’s adjusted operating margin decreased by 1.1 percentage points over the last five years, but it rose by 5.9 percentage points on a two-year basis. Still, shareholders will want to see Gilead Sciences become more profitable in the future.

In Q4, Gilead Sciences generated an adjusted operating margin profit margin of 39%, down 2.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

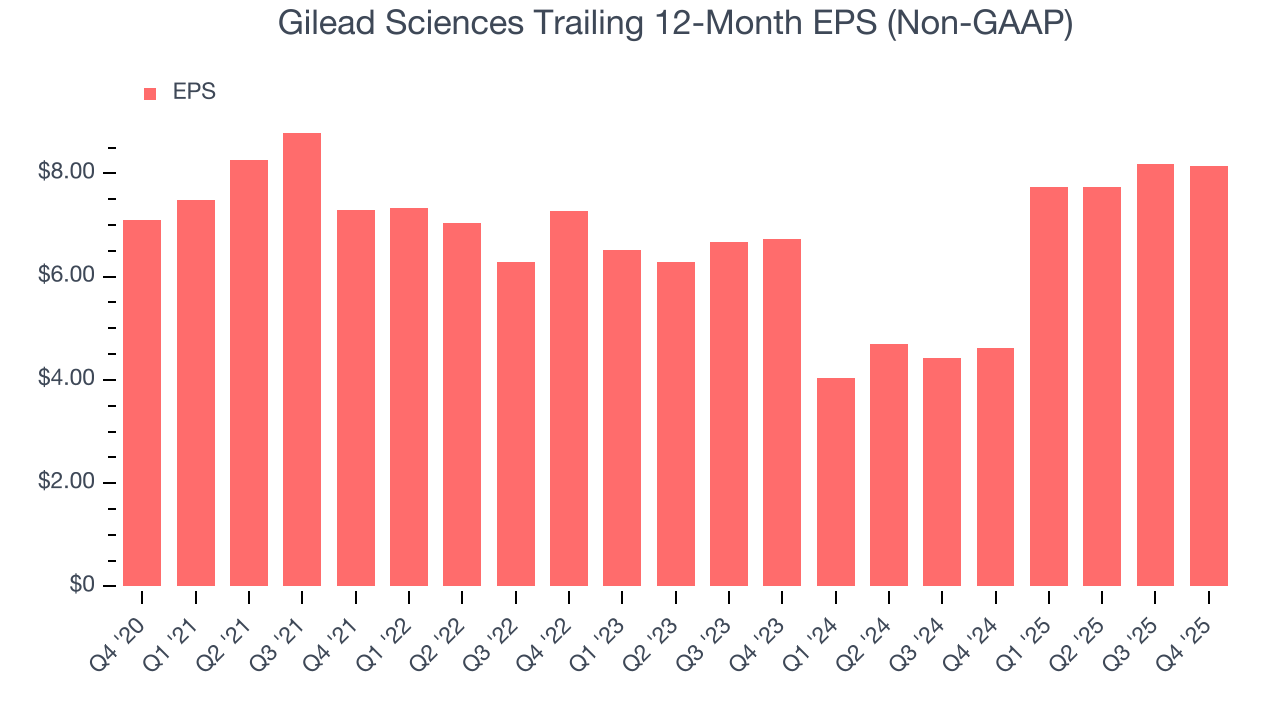

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Gilead Sciences’s unimpressive 2.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Gilead Sciences reported adjusted EPS of $1.86, down from $1.90 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.9%. Over the next 12 months, Wall Street expects Gilead Sciences’s full-year EPS of $8.15 to grow 7.6%.

9. Cash Is King

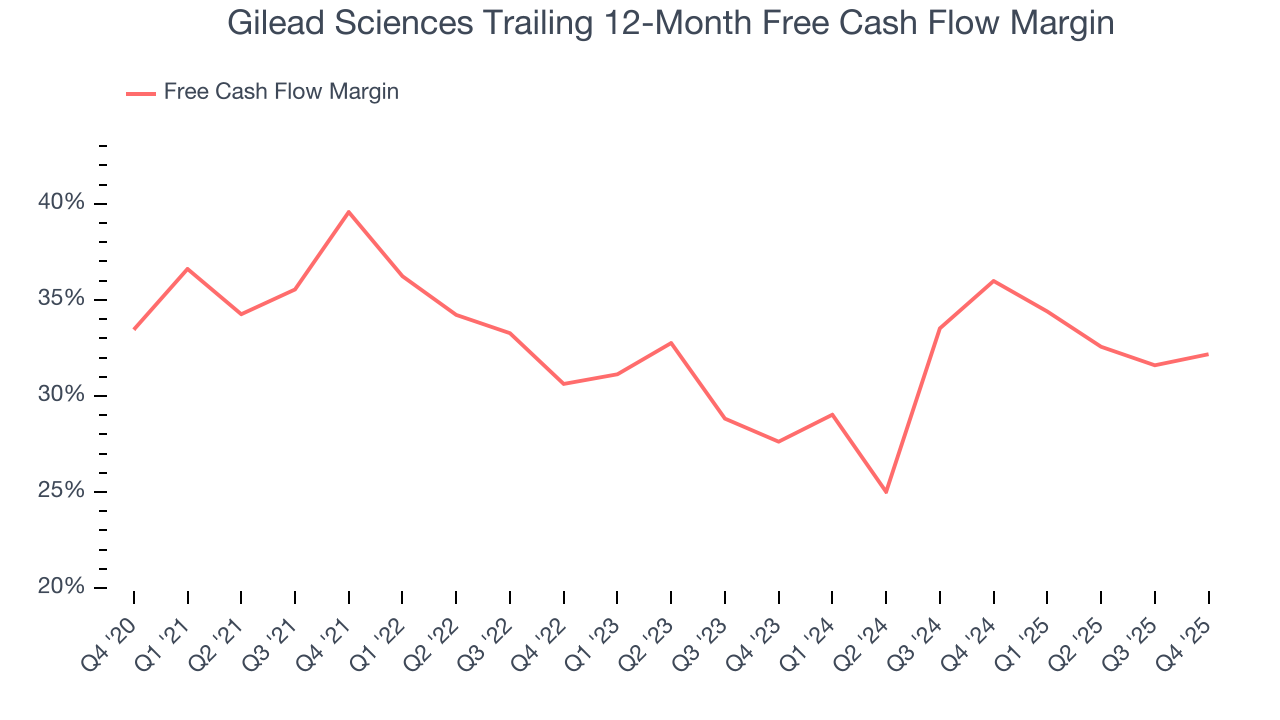

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Gilead Sciences has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the healthcare sector, averaging an eye-popping 33.2% over the last five years.

Taking a step back, we can see that Gilead Sciences’s margin dropped by 7.4 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Gilead Sciences’s free cash flow clocked in at $3.12 billion in Q4, equivalent to a 39.4% margin. This result was good as its margin was 1.8 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

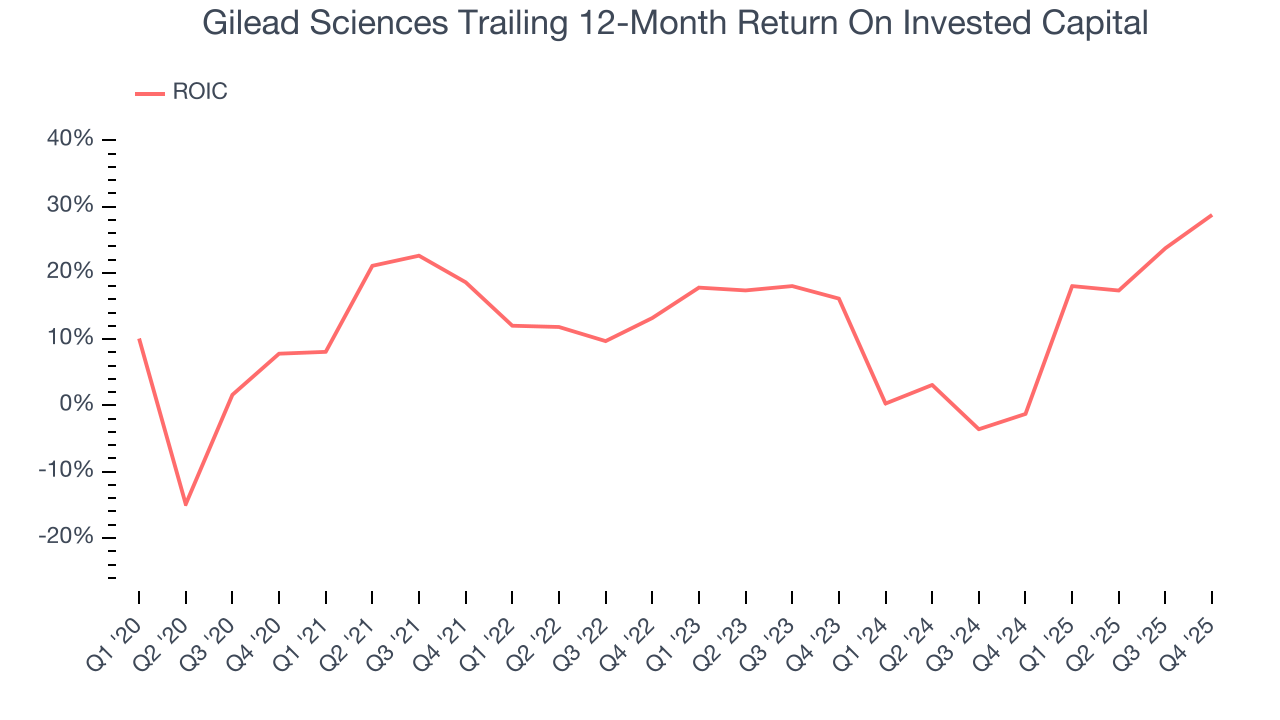

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Gilead Sciences hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 15.1%, impressive for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Gilead Sciences’s ROIC averaged 2.2 percentage point decreases each year. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Key Takeaways from Gilead Sciences’s Q4 Results

We enjoyed seeing Gilead Sciences beat analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance slightly missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.9% to $143.01 immediately following the results.

12. Is Now The Time To Buy Gilead Sciences?

Updated: February 10, 2026 at 4:17 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Gilead Sciences.

Gilead Sciences isn’t a bad business, but we’re not clamoring to buy it here and now. Although its revenue growth was uninspiring over the last five years and analysts expect growth to slow over the next 12 months, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. Investors should still be cautious, however, as Gilead Sciences’s cash profitability fell over the last five years.

Gilead Sciences’s P/E ratio based on the next 12 months is 16.8x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $139.24 on the company (compared to the current share price of $143.01).