Hasbro (HAS)

Hasbro is in for a bumpy ride. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hasbro Will Underperform

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ:HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

- Products and services have few die-hard fans as sales have declined by 3.4% annually over the last five years

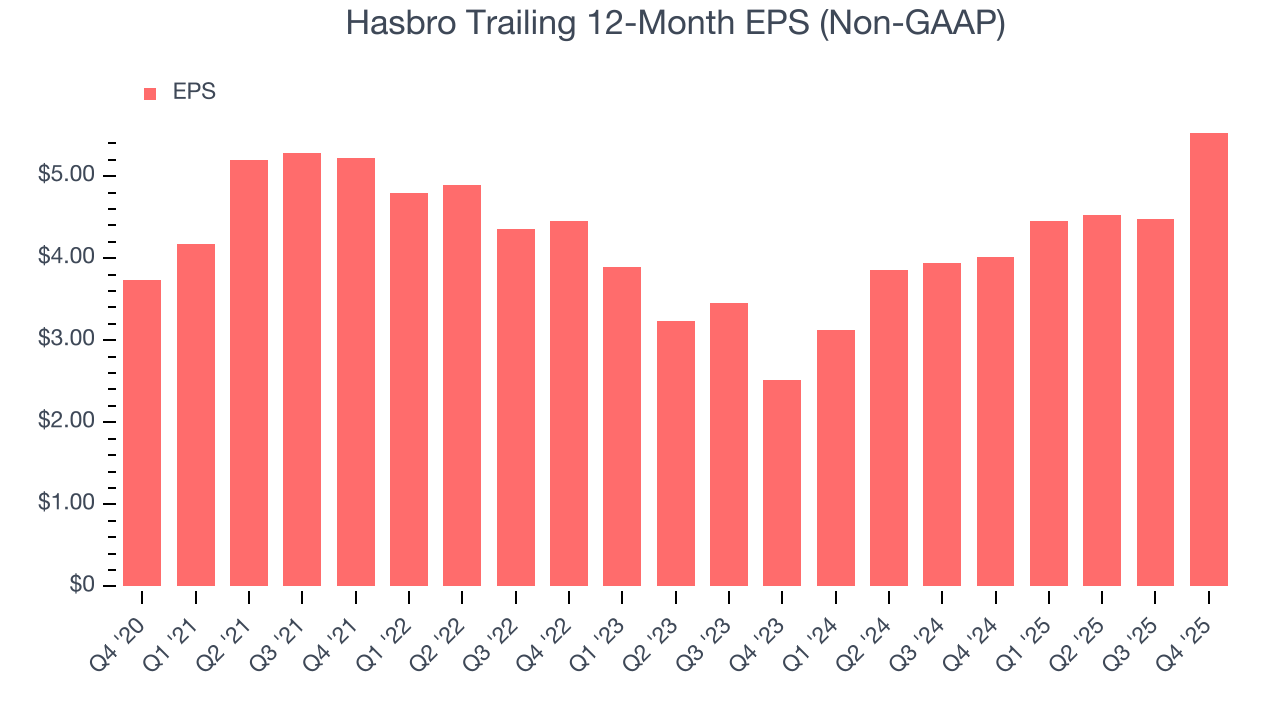

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 3.8% annually

- Historical operating margin losses point to an inefficient cost structure

Hasbro lacks the business quality we seek. You should search for better opportunities.

Why There Are Better Opportunities Than Hasbro

Why There Are Better Opportunities Than Hasbro

Hasbro’s stock price of $96.96 implies a valuation ratio of 18.3x forward P/E. This multiple is cheaper than most consumer discretionary peers, but we think this is justified.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Hasbro (HAS) Research Report: Q4 CY2025 Update

Toy and entertainment company Hasbro (NASDAQ:HAS) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 31.3% year on year to $1.45 billion. Its non-GAAP profit of $1.51 per share was 59.3% above analysts’ consensus estimates.

Hasbro (HAS) Q4 CY2025 Highlights:

- Revenue: $1.45 billion vs analyst estimates of $1.26 billion (31.3% year-on-year growth, 14.4% beat)

- Adjusted EPS: $1.51 vs analyst estimates of $0.95 (59.3% beat)

- Adjusted EBITDA: $372.2 million vs analyst estimates of $267.2 million (25.7% margin, 39.3% beat)

- EBITDA guidance for the upcoming financial year 2026 is $1.43 billion at the midpoint, above analyst estimates of $1.31 billion

- Operating Margin: 20.6%, up from 5.4% in the same quarter last year

- Free Cash Flow Margin: 24.4%, up from 18.9% in the same quarter last year

- Market Capitalization: $13.58 billion

Company Overview

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ:HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Hasbro's journey began in 1923, established by the Hassenfeld brothers as a small textile remnant company that sold school supplies. The company's transition into toy manufacturing was driven by a vision to create products that sparked imagination and joy in children. Eventually, Hasbro evolved into one of the world's largest toy makers.

Today, Hasbro provides an extensive portfolio of toys, board games, and digital gaming experiences that cater to a variety of ages and interests. The company offers everything from action figures and dolls to digital gaming platforms.

Hasbro generates revenue through product sales, licensing agreements, and digital gaming subscriptions. Its multifaceted business model includes partnerships with entertainment franchises, leveraging iconic characters and stories to create toys that complement various media. This synergy has created a unique value in the market, appealing to generations of consumers who cherish both nostalgia and modern media.

4. Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Competitors in the toy and entertainment sector include Mattel (NASDAQ:MAT), Funko (NASDAQ:FNKO), and Jakks Pacific (NASDAQ:JAKK).

5. Revenue Growth

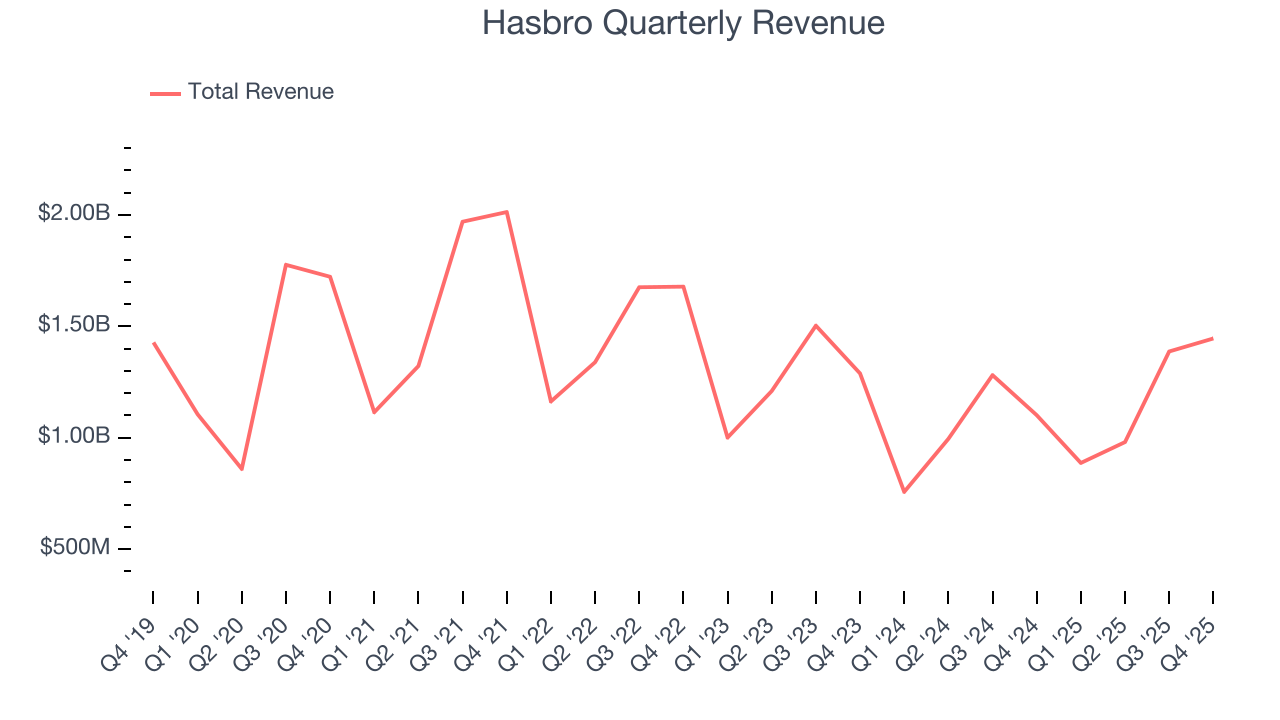

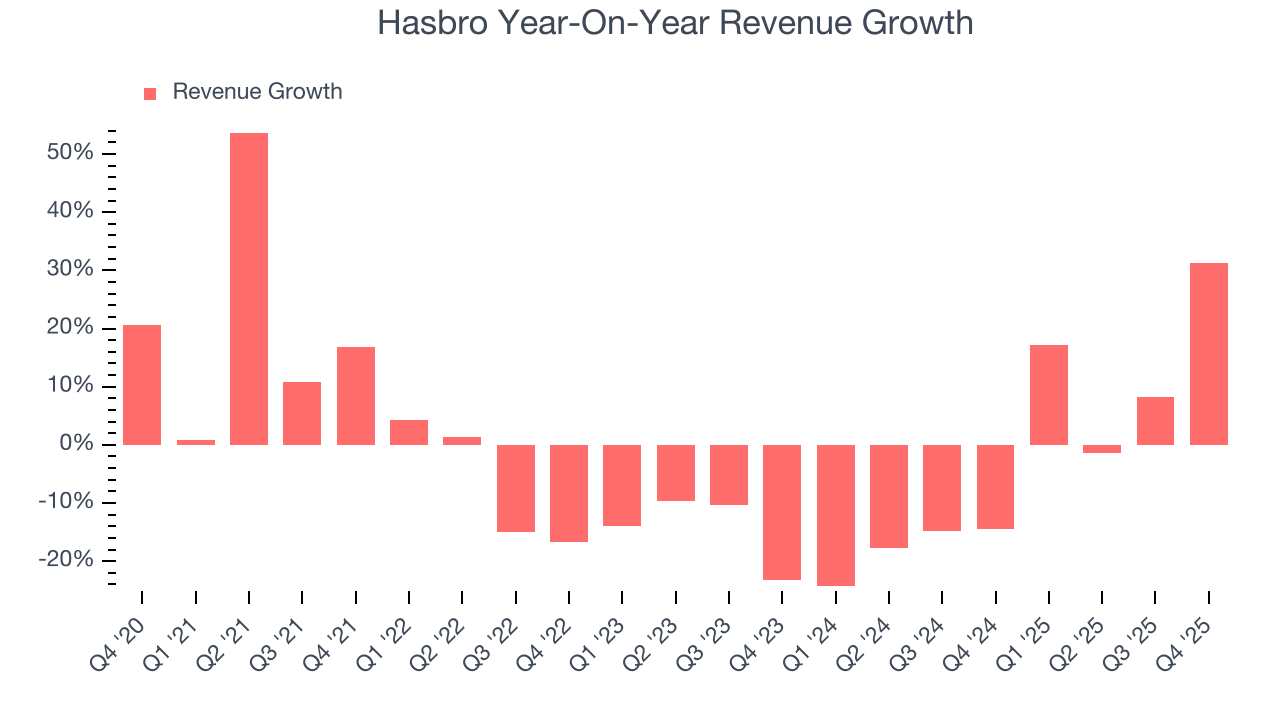

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Hasbro’s demand was weak and its revenue declined by 3% per year. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Hasbro’s annualized revenue declines of 3.1% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

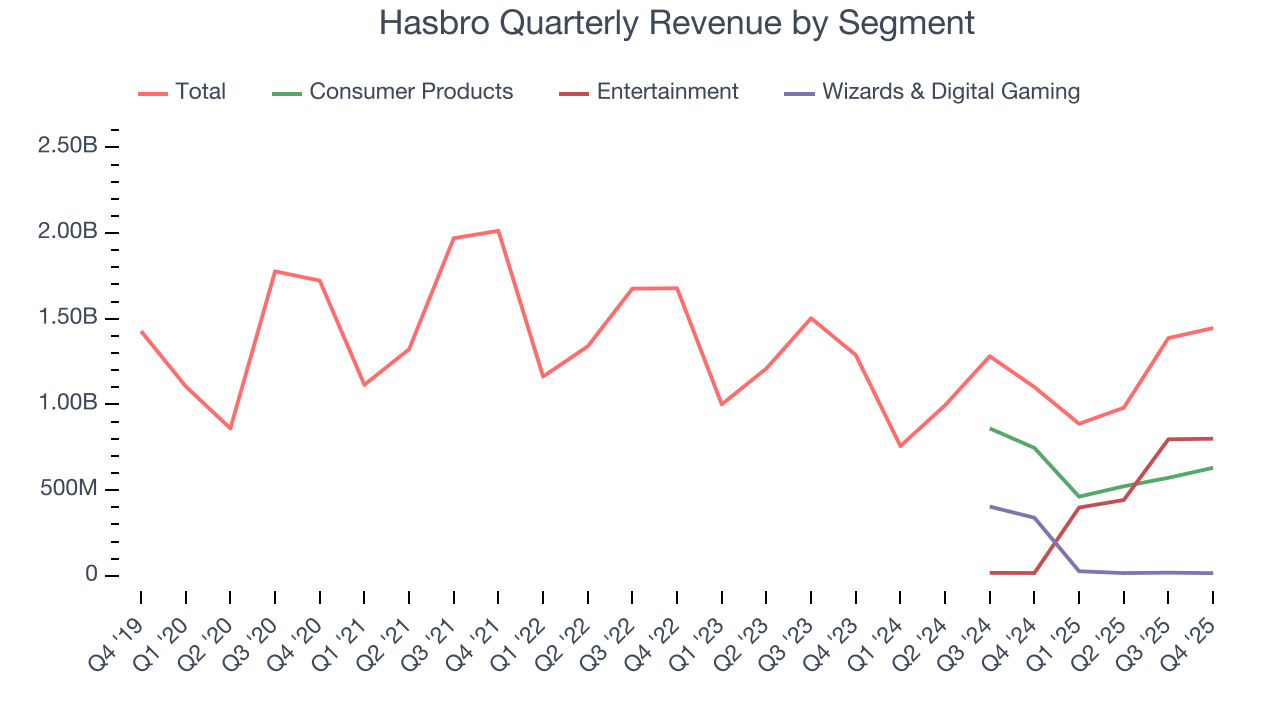

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Consumer Products, Entertainment, and Wizards & Digital Gaming, which are 43.6%, 55.3%, and 1.1% of revenue. Over the last two years, Hasbro’s Entertainment revenue (content) averaged 4,671% year-on-year growth while its Consumer Products (toys, games, apparel) and Wizards & Digital Gaming (Wizards of the Coast) revenues averaged 24.5% and 95.4% declines.

This quarter, Hasbro reported wonderful year-on-year revenue growth of 31.3%, and its $1.45 billion of revenue exceeded Wall Street’s estimates by 14.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

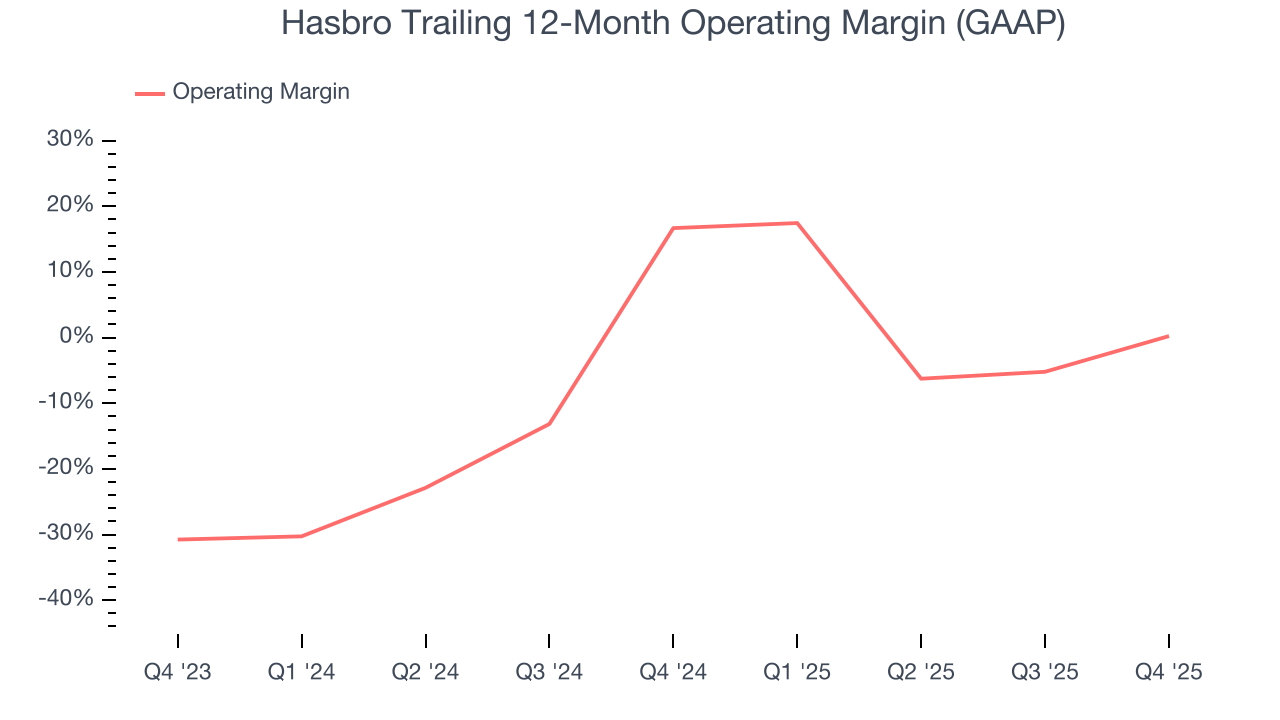

Hasbro’s operating margin has shrunk over the last 12 months and averaged 7.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Hasbro generated an operating margin profit margin of 20.6%, up 15.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hasbro’s EPS grew at a weak 8.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

In Q4, Hasbro reported adjusted EPS of $1.51, up from $0.46 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Hasbro’s full-year EPS of $5.53 to shrink by 4.2%.

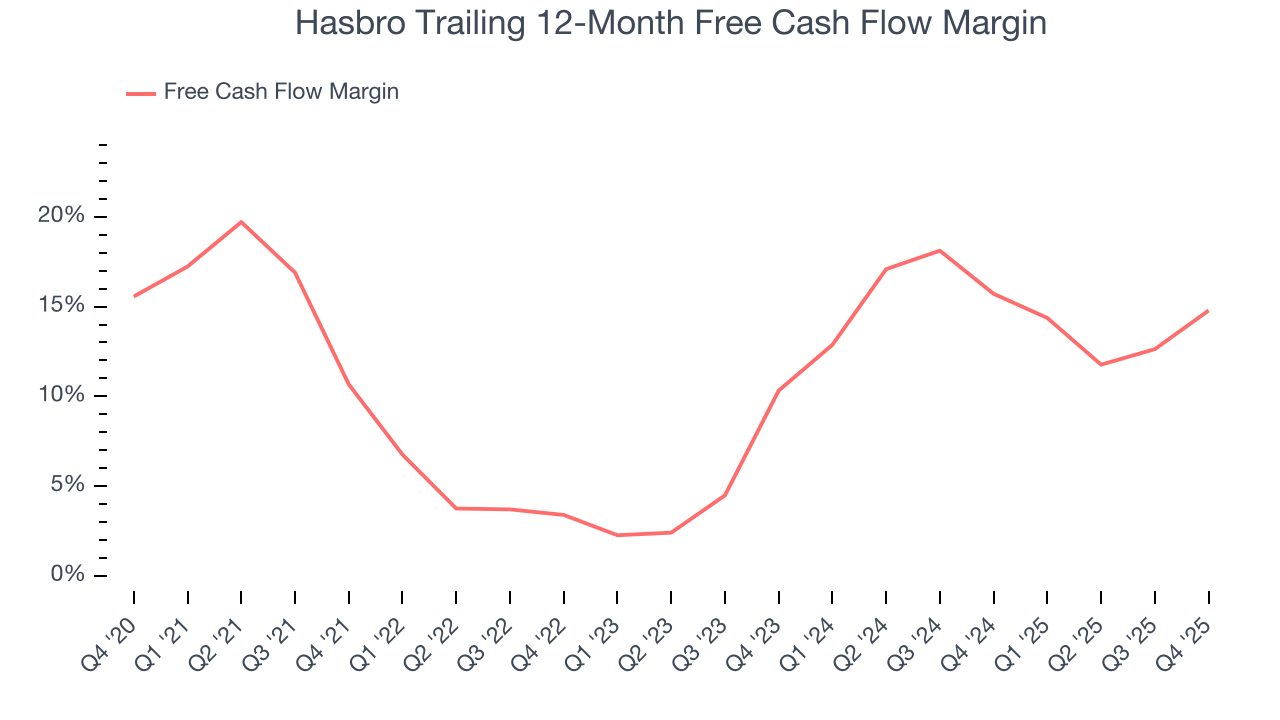

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Hasbro has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 15.2%, lousy for a consumer discretionary business.

Hasbro’s free cash flow clocked in at $353.1 million in Q4, equivalent to a 24.4% margin. This result was good as its margin was 5.5 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

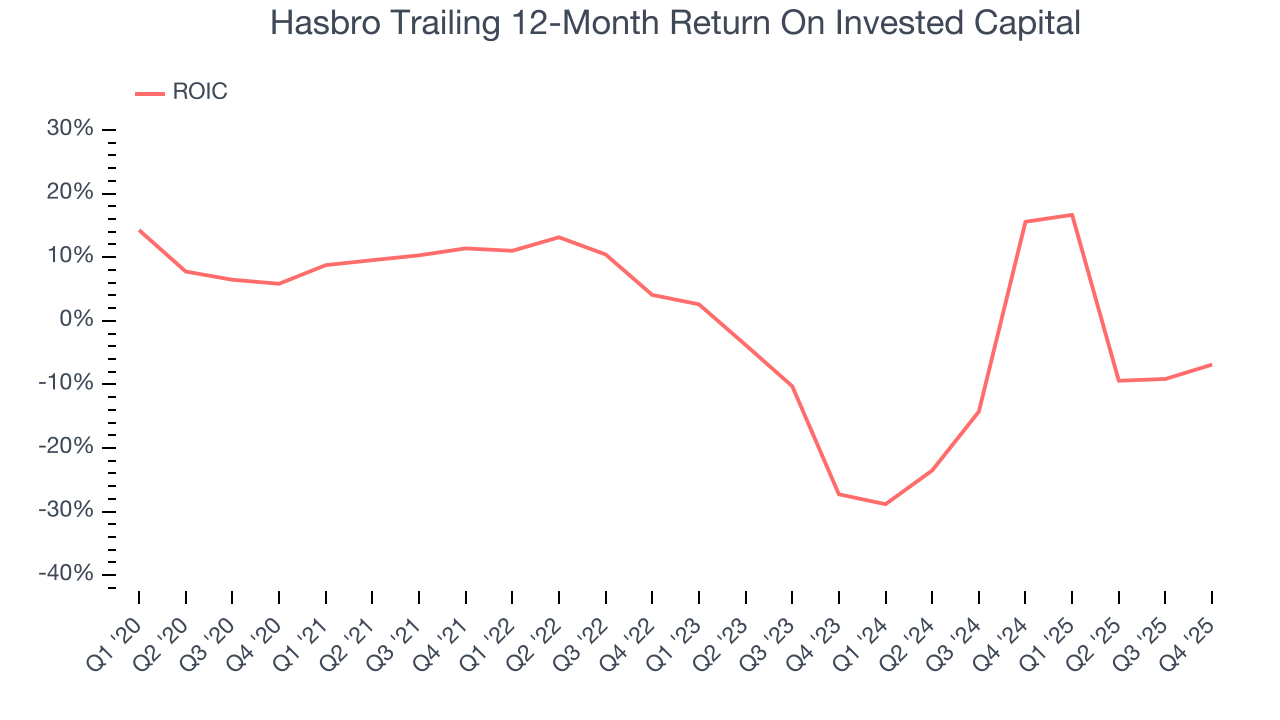

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Hasbro’s five-year average ROIC was negative 0.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hasbro’s ROIC averaged 3.4 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

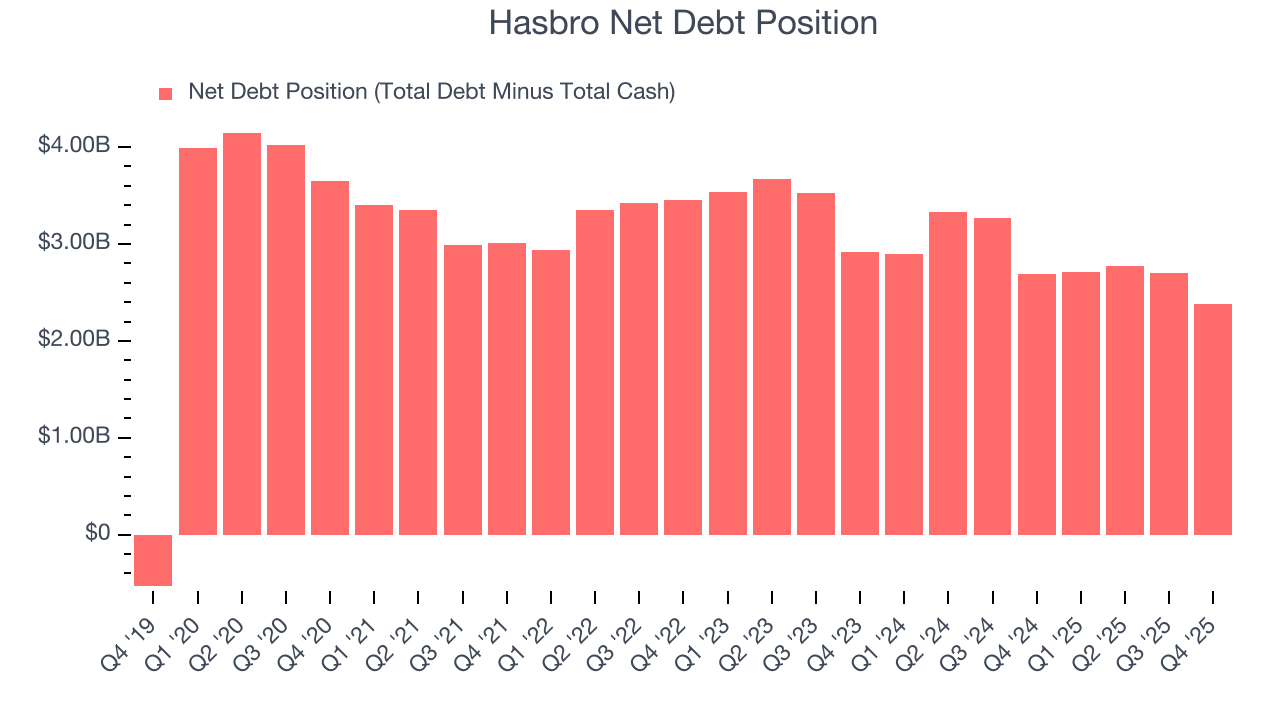

10. Balance Sheet Assessment

Hasbro reported $882 million of cash and $3.26 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.36 billion of EBITDA over the last 12 months, we view Hasbro’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $70 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Hasbro’s Q4 Results

It was good to see Hasbro beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $97.36 immediately following the results.

12. Is Now The Time To Buy Hasbro?

Updated: February 10, 2026 at 9:52 PM EST

When considering an investment in Hasbro, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Hasbro, we’ll be cheering from the sidelines. For starters, its revenue has declined over the last five years. On top of that, Hasbro’s weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders, and its projected EPS for the next year is lacking.

Hasbro’s P/E ratio based on the next 12 months is 17.6x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $96.23 on the company (compared to the current share price of $102.11), implying they don’t see much short-term potential in Hasbro.