Hamilton Lane (HLNE)

Hamilton Lane is one of our favorite stocks. Its impressive sales growth and high returns on capital tee it up for fast and profitable expansion.― StockStory Analyst Team

1. News

2. Summary

Why We Like Hamilton Lane

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ:HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

- Incremental sales over the last two years have been highly profitable as its earnings per share increased by 26.6% annually, topping its revenue gains

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

- Impressive 24.8% annual revenue growth over the last two years indicates it’s winning market share this cycle

Hamilton Lane is a market leader. The price seems reasonable in light of its quality, and we believe now is an opportune time to invest in the stock.

Why Is Now The Time To Buy Hamilton Lane?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Hamilton Lane?

Hamilton Lane’s stock price of $113.74 implies a valuation ratio of 20.2x forward P/E. Most companies in the financials sector may feature a cheaper multiple, but we think Hamilton Lane is priced fairly given its fundamentals.

Entry price certainly impacts returns, but over a long-term, multi-year period, business quality matters much more than where you buy a stock.

3. Hamilton Lane (HLNE) Research Report: Q4 CY2025 Update

Alternative investment management firm Hamilton Lane (NASDAQ:HLNE) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 18% year on year to $198.6 million. Its non-GAAP profit of $1.55 per share was 16.9% above analysts’ consensus estimates.

Hamilton Lane (HLNE) Q4 CY2025 Highlights:

- Management Fees: $153.2 million vs analyst estimates of $147.5 million (21.3% year-on-year growth, 3.9% beat)

- Revenue: $198.6 million vs analyst estimates of $193.9 million (18% year-on-year growth, 2.4% beat)

- Pre-tax Profit: $120.1 million (60.5% margin)

- Adjusted EPS: $1.55 vs analyst estimates of $1.33 (16.9% beat)

- Market Capitalization: $6.22 billion

Company Overview

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ:HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

Hamilton Lane provides clients with access to private market investments that are typically unavailable to average investors, including private equity, private credit, real assets, and secondary investments. The firm serves a diverse client base that includes public pension funds, sovereign wealth funds, insurance companies, endowments, foundations, and high-net-worth individuals.

The company operates through two primary business segments: customized separate accounts and specialized funds. In the customized separate accounts business, Hamilton Lane creates tailored investment portfolios for large institutional clients based on their specific investment objectives and risk profiles. For example, a state pension fund might engage Hamilton Lane to build and manage a private equity portfolio targeting specific sectors or geographies. The specialized funds segment offers commingled investment vehicles where multiple investors pool their capital to access diversified private market opportunities.

Hamilton Lane generates revenue primarily through management and advisory fees based on committed or invested capital, as well as performance fees (carried interest) when investments exceed certain return thresholds. The firm also provides data and technology solutions through its proprietary platforms, helping clients analyze private market trends and manage their portfolios.

The company leverages its extensive network of relationships with general partners (the managers of private funds) to source investment opportunities and conduct due diligence. This network, built over decades, allows Hamilton Lane to evaluate thousands of potential investments annually and select those that align with client objectives.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

Hamilton Lane competes with other private markets investment firms including Blackstone (NYSE:BX), KKR (NYSE:KKR), The Carlyle Group (NASDAQ:CG), and Partners Group (SWX:PGHN), as well as the alternative asset management divisions of traditional asset managers like BlackRock (NYSE:BLK).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Hamilton Lane’s 19.3% annualized revenue growth over the last five years was excellent. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Hamilton Lane’s annualized revenue growth of 24.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Hamilton Lane reported year-on-year revenue growth of 18%, and its $198.6 million of revenue exceeded Wall Street’s estimates by 2.4%.

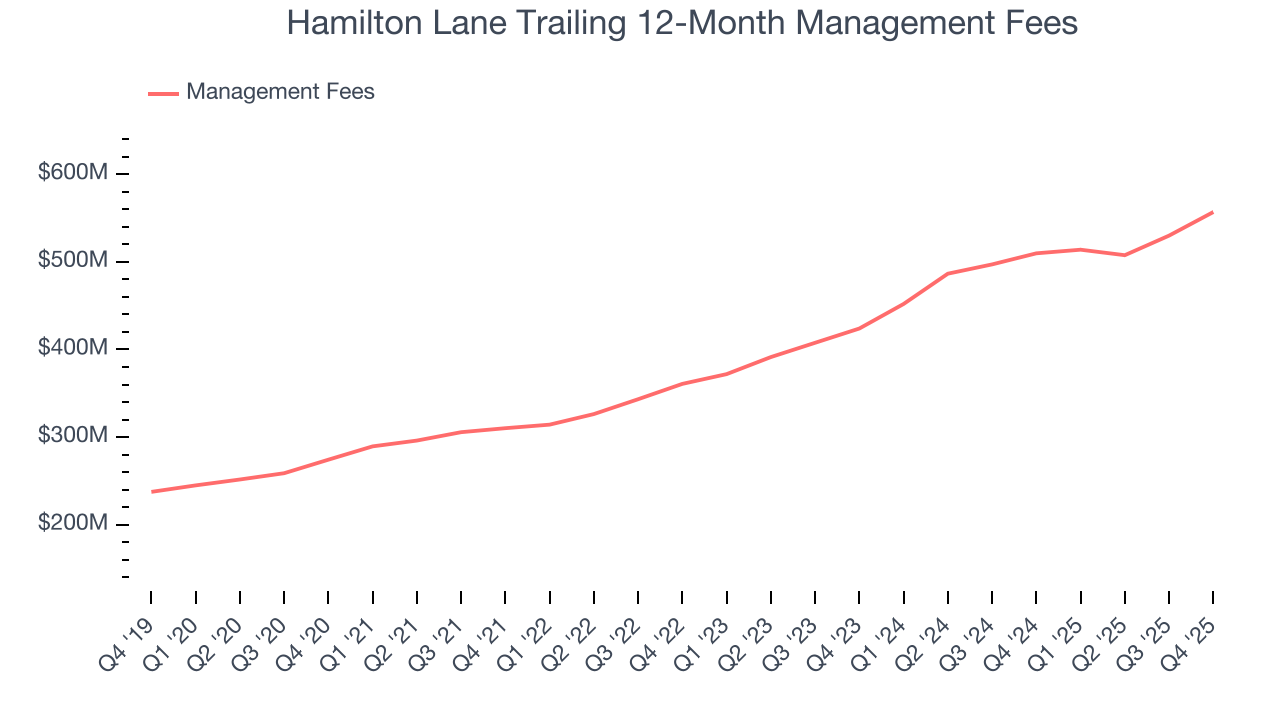

6. Management Fees

Management fees represent the core revenue stream for investment firms, calculated as a percentage of assets under management. These fees provide steady income regardless of investment performance.

Hamilton Lane’s management fees have grown at an annual rate of 15.2% over the last five years, better than the broader financials industry but slower than its total revenue. Ignoring performance fees that typically range from 10-20% of investment gains, this tells us its asset management division was a net detractor to the company. When analyzing Hamilton Lane’s management fees over the last two years, we can see that growth decelerated to 14.6% annually.

In Q4, Hamilton Lane’s management fees were $153.2 million, beating analysts’ expectations by 3.9%. This print was 21.3% higher than the same quarter last year.

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, Hamilton Lane’s pre-tax profit margin has fallen by 2.7 percentage points, going from 85.3% to 55.2%. It has also expanded by 3.7 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Hamilton Lane’s pre-tax profit margin came in at 60.5% this quarter. This result was 6.9 percentage points better than the same quarter last year.

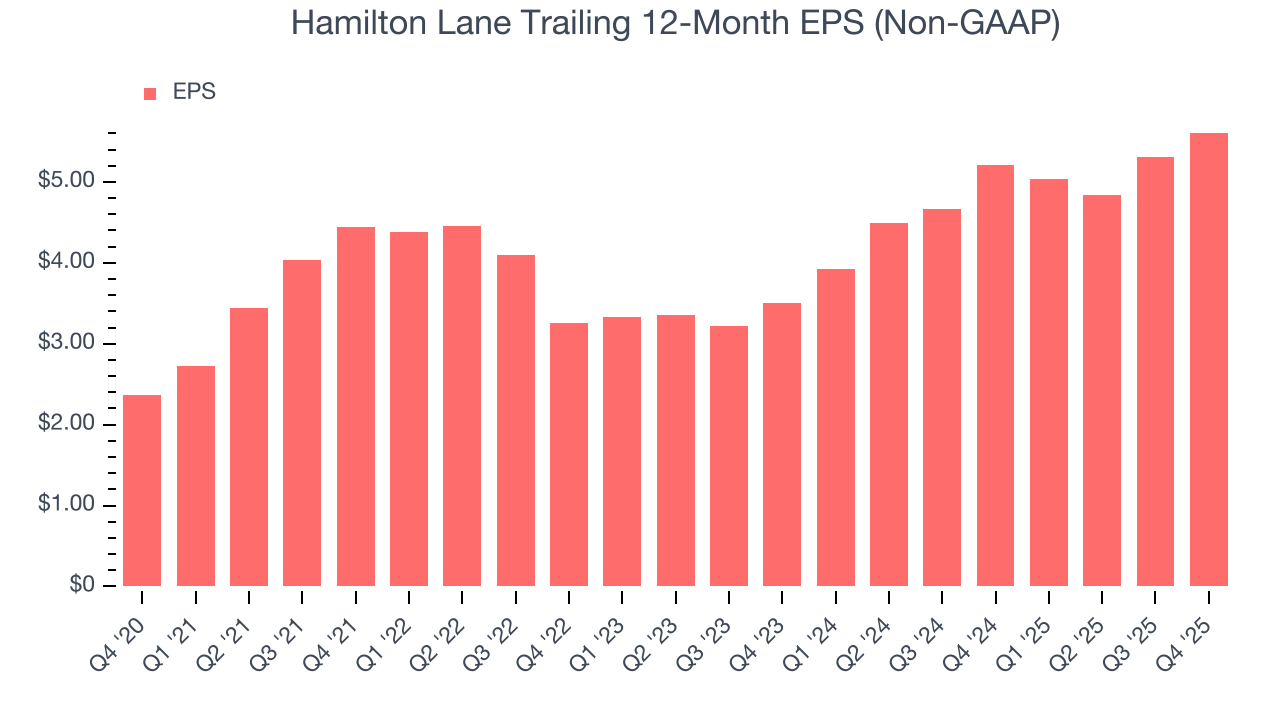

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hamilton Lane’s remarkable 18.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Hamilton Lane, its two-year annual EPS growth of 26.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Hamilton Lane reported adjusted EPS of $1.55, up from $1.25 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Hamilton Lane’s full-year EPS of $5.61 to grow 6.3%.

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Hamilton Lane has averaged an ROE of 35.9%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Hamilton Lane has a strong competitive moat.

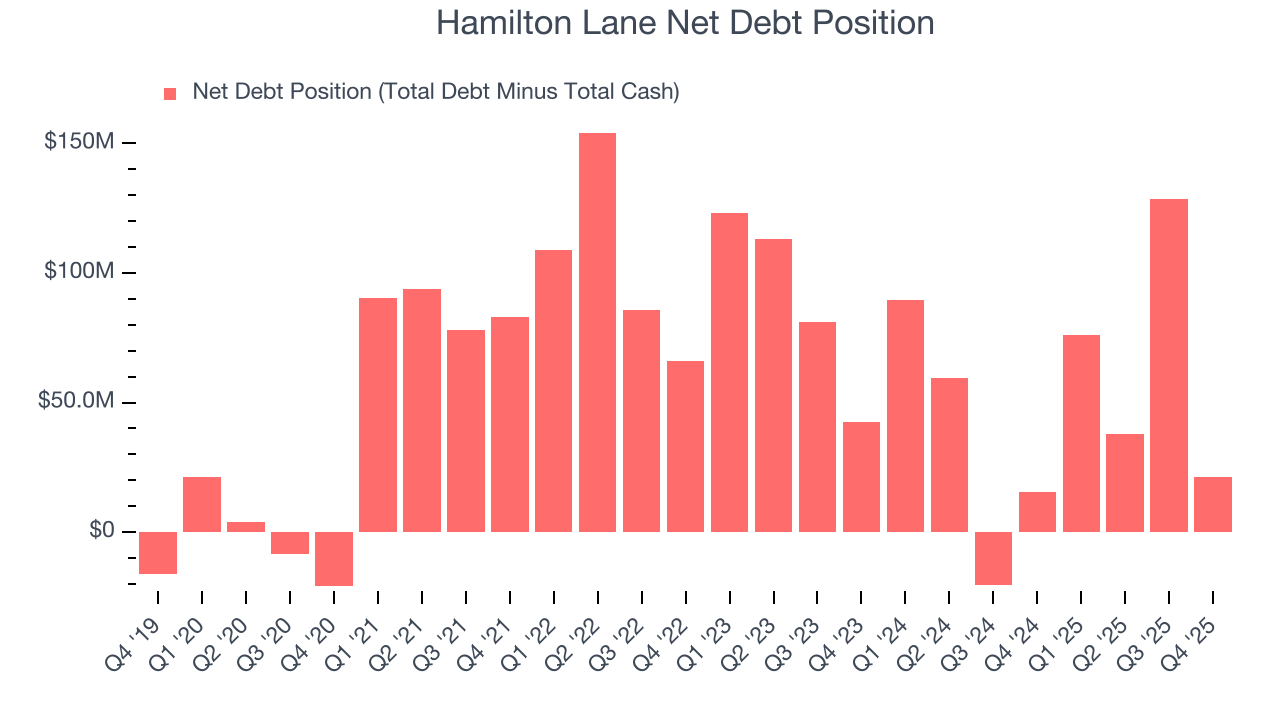

10. Balance Sheet Assessment

Hamilton Lane reported $338.5 million of cash and $359.8 million of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $405.8 million of EBITDA over the last 12 months, we view Hamilton Lane’s 0.1× net-debt-to-EBITDA ratio as safe. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Hamilton Lane’s Q4 Results

We were impressed by how significantly Hamilton Lane blew past analysts’ management fees expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock remained flat at $141.71 immediately following the results.

12. Is Now The Time To Buy Hamilton Lane?

Updated: February 19, 2026 at 11:54 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Hamilton Lane is truly a cream-of-the-crop financials company. First of all, the company’s revenue growth was impressive over the last five years. On top of that, its stellar ROE suggests it has been a well-run company historically, and its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders.

Hamilton Lane’s P/E ratio based on the next 12 months is 20.2x. Scanning the financials landscape today, Hamilton Lane’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $177.71 on the company (compared to the current share price of $113.74), implying they see 56.3% upside in buying Hamilton Lane in the short term.