Robinhood (HOOD)

Not many stocks excite us like Robinhood. Its fusion of growth, outstanding profitability, and encouraging prospects makes it a beloved asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Robinhood

With a mission to democratize finance, Robinhood (NASDAQ:HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

- Market share has increased over the last three years as its 46.4% annual revenue growth was exceptional

- Notable projected revenue growth of 30.6% for the next 12 months hints at market share gains

- Superior platform functionality and low servicing costs lead to a best-in-class gross margin of 92.5%

We expect great things from Robinhood. This is one of our favorite consumer internet stocks.

Is Now The Time To Buy Robinhood?

Is Now The Time To Buy Robinhood?

At $106.65 per share, Robinhood trades at 29.6x forward EV/EBITDA. While this isn’t a screaming bargain, the long-term outlook is bright for the patient investor.

If you’re a fan of the business, we suggest making it a smaller position as our analysis shows high-quality companies outperform the market over a multi-year period regardless of valuation.

3. Robinhood (HOOD) Research Report: Q3 CY2025 Update

Financial services company Robinhood (NASDAQ:HOOD) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 100% year on year to $1.27 billion. Its GAAP profit of $0.61 per share was 12.1% above analysts’ consensus estimates.

Robinhood (HOOD) Q3 CY2025 Highlights:

- CFO Jason Warnick announced his intention to retire next year

- Revenue: $1.27 billion vs analyst estimates of $1.20 billion (100% year-on-year growth, 6% beat)

- EPS (GAAP): $0.61 vs analyst estimates of $0.54 (12.1% beat)

- Full-year expense guidance: top end of previous range

- Operating Margin: 49.8%, up from 23.7% in the same quarter last year

- Free Cash Flow was -$1.59 billion, down from $3.49 billion in the previous quarter

- Funded Customers: 26.8 million, up 2.5 million year on year

- Market Capitalization: $121.6 billion

Company Overview

With a mission to democratize finance, Robinhood (NASDAQ:HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Historically, the average person would pay high broker fees to place buy and sell orders. Robinhood’s founders, Vlad Tenev and Baiju Bhatt (mathematicians and roommates at Stanford), sought to lower the barriers to entry by pioneering commission-free trading.

Commission-free trading uses algorithms to take customer orders and route them to market makers. In exchange for sourcing the trade, the router takes a percentage of the market maker's profit. This is called payment for order flow, and it is a huge chunk of Robinhood’s trading revenue.

Today, Robinhood not only generates revenue from payment for order flow but also interest on margin trading loans, interest on uninvested cash, and subscription fees for Robinhood Gold. Robinhood Gold costs $5 per month and gives users access to premium features such as 24/7 trading, cheaper margin loans, boosted interest rates on uninvested cash, and research reports. Because it's a software company, Robinhood has fewer employees and a more efficient cost base than its legacy competitors.

Robinhood's long-term strategy is to increase its users and assets under custody by becoming a one-stop shop for consumer finance. It plans to achieve this by rolling out products like retirement accounts and credit cards. Investors under the age of 35 comprise a majority of Robinhood's user base as it has no account minimums and initially built its products exclusively for mobile devices.

4. Financial Technology

Financial technology companies benefit from the increasing consumer demand for digital payments, banking, and finance. Tailwinds fueling this trend include e-commerce along with improvements in blockchain infrastructure and AI-driven credit underwriting, which make access to money faster and cheaper. Despite regulatory scrutiny and resistance from traditional financial institutions, fintechs are poised for long-term growth as they disrupt legacy systems by expanding financial services to underserved population segments.

Robinhood’s competitors include Charles Schwab (NYSE:SCHW), Fidelity (NYSE:FNF), Interactive Brokers (NASDAQ:IBKR), Coinbase (NASDAQ:COIN), and private companies M1 Finance and Webull.

5. Revenue Growth

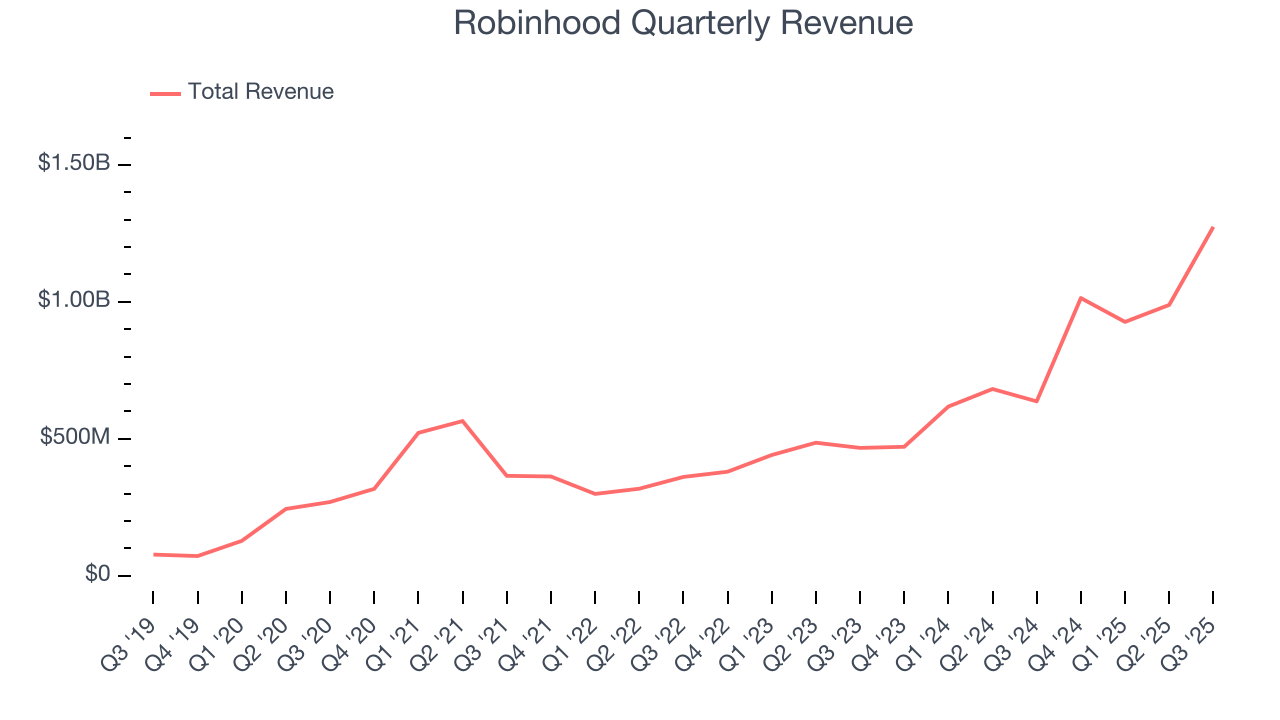

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Robinhood’s 46.4% annualized revenue growth over the last three years was incredible. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Robinhood reported magnificent year-on-year revenue growth of 100%, and its $1.27 billion of revenue beat Wall Street’s estimates by 6%.

Looking ahead, sell-side analysts expect revenue to grow 17.9% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and implies the market is baking in success for its products and services.

6. Funded Customers

User Growth

As a fintech company, Robinhood generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

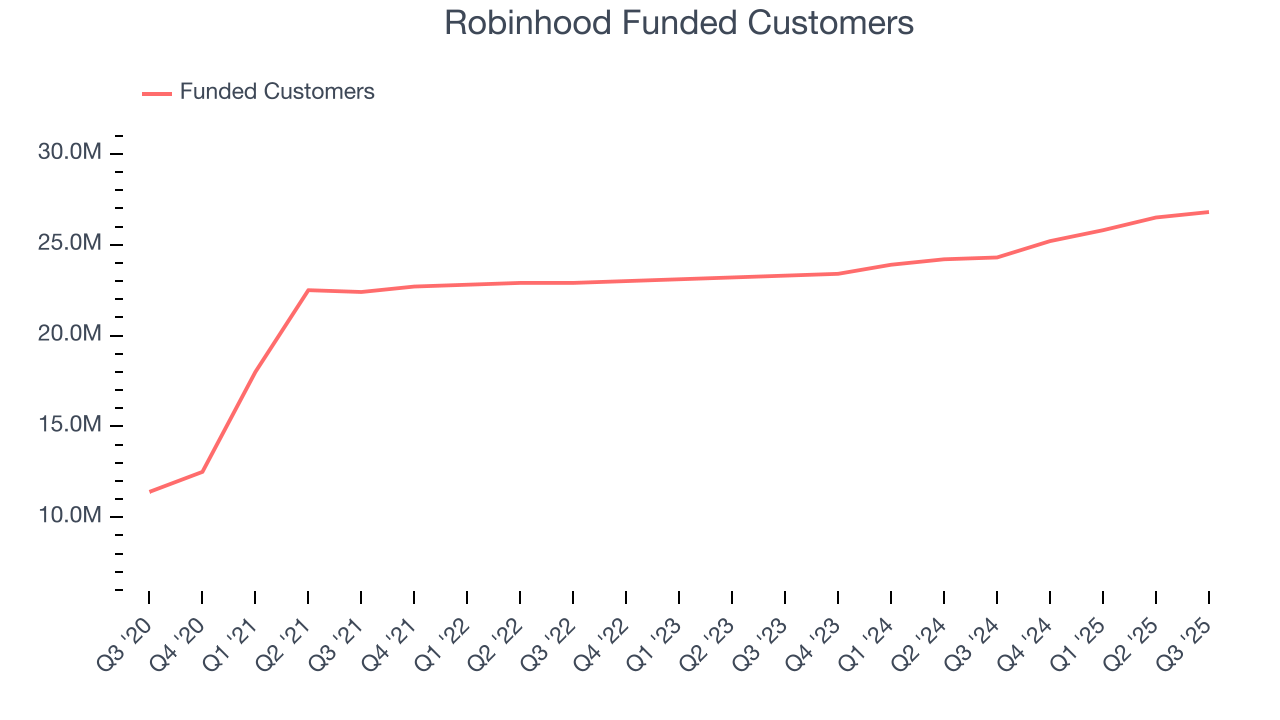

Over the last two years, Robinhood’s funded customers, a key performance metric for the company, increased by 6.2% annually to 26.8 million in the latest quarter. This growth rate is slightly below average for a consumer internet business. If Robinhood wants to reach the next level, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q3, Robinhood added 2.5 million funded customers, leading to 10.3% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

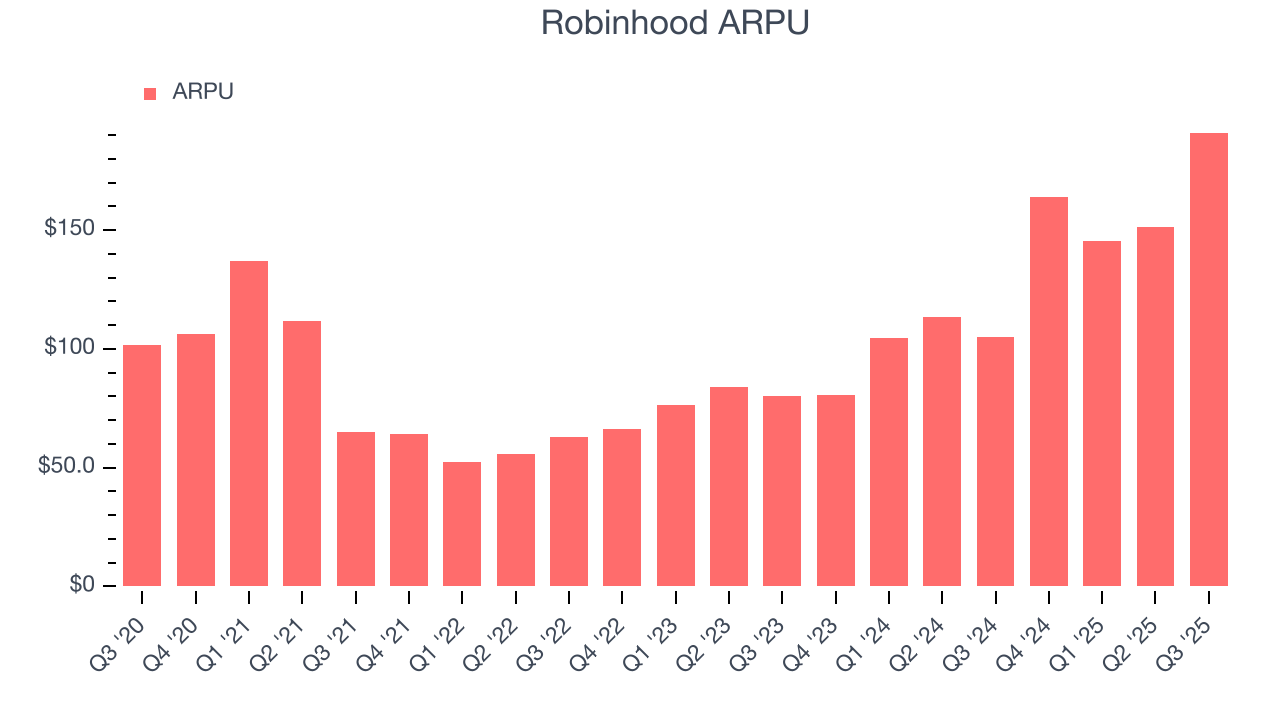

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in fees from each user. ARPU also gives us unique insights into the average transaction size on Robinhood’s platform and the company’s take rate, or "cut", on each transaction.

Robinhood’s ARPU growth has been exceptional over the last two years, averaging 47.7%. Its ability to increase monetization while growing its funded customers demonstrates its platform’s value, as its users are spending significantly more than last year.

This quarter, Robinhood’s ARPU clocked in at $191. It grew by 81.8% year on year, faster than its funded customers.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For fintech businesses like Robinhood, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include transaction/payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard customers, such as identity verification.

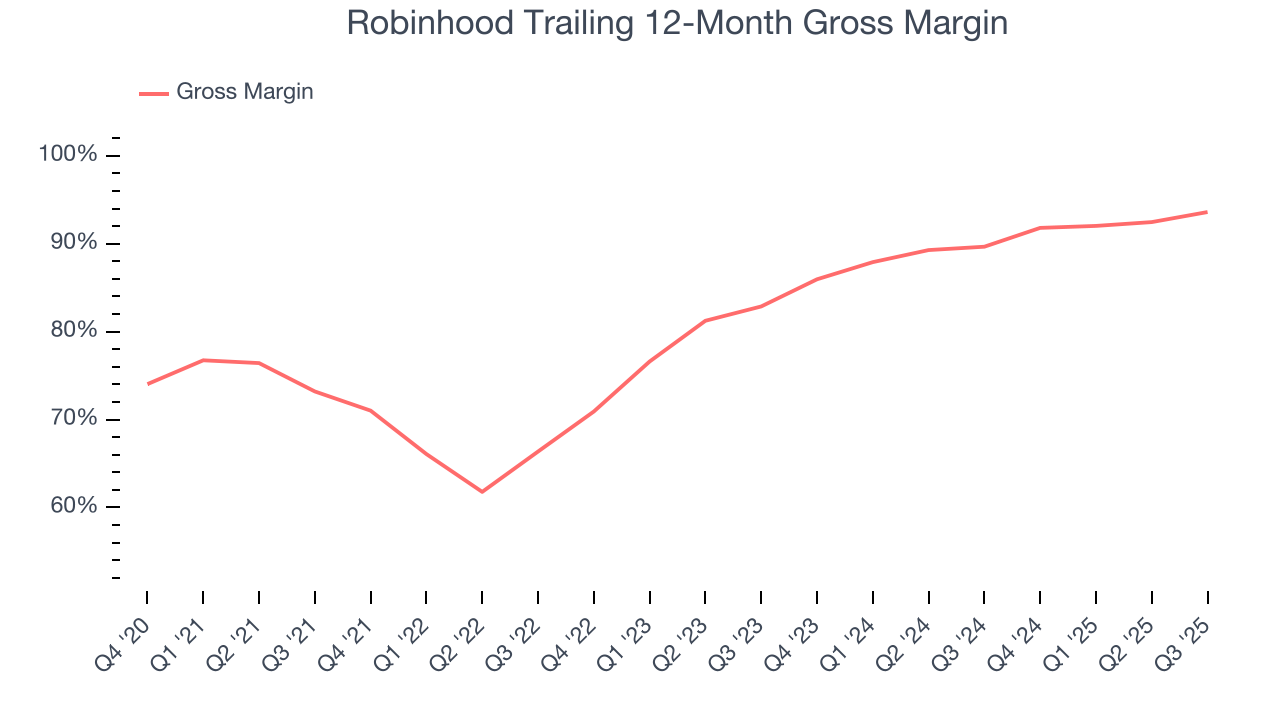

Robinhood’s gross margin is one of the best in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 92.2% gross margin over the last two years. That means Robinhood only paid its providers $7.83 for every $100 in revenue.

Robinhood’s gross profit margin came in at 93% this quarter, up 7 percentage points year on year. Robinhood’s full-year margin has also been trending up over the past 12 months, increasing by 3.9 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

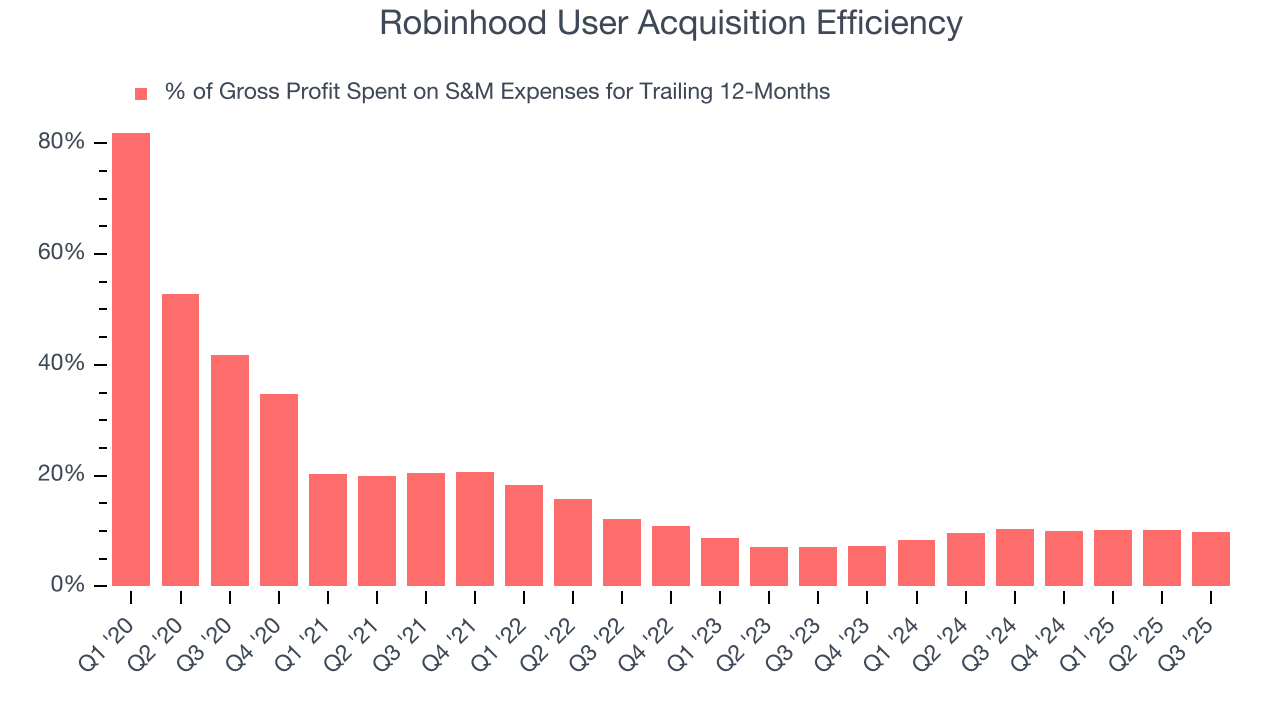

8. User Acquisition Efficiency

Consumer internet businesses like Robinhood grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Robinhood is extremely efficient at acquiring new users, spending only 9.9% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving Robinhood the freedom to invest its resources into new growth initiatives while maintaining optionality.

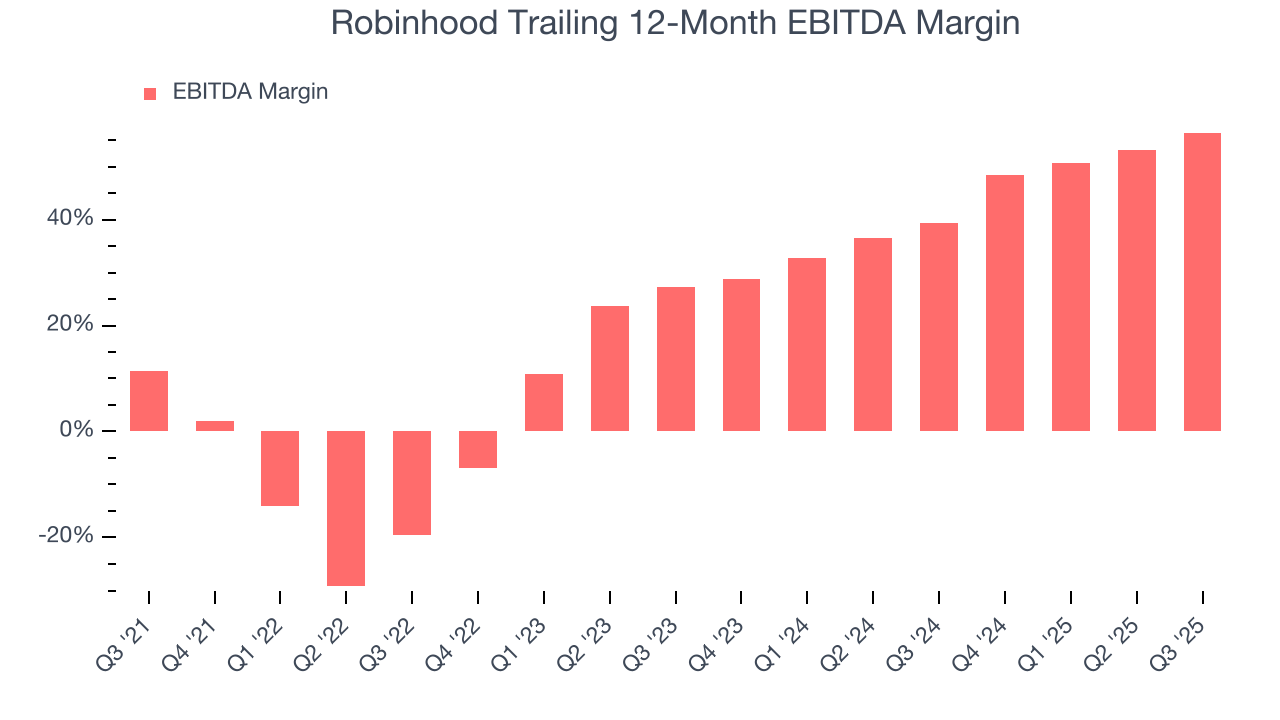

9. EBITDA

Robinhood has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 50.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Robinhood’s EBITDA margin rose by 76.1 percentage points over the last few years, as its sales growth gave it immense operating leverage.

This quarter, Robinhood generated an EBITDA margin profit margin of 58.2%, up 16.2 percentage points year on year. The increase was solid, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

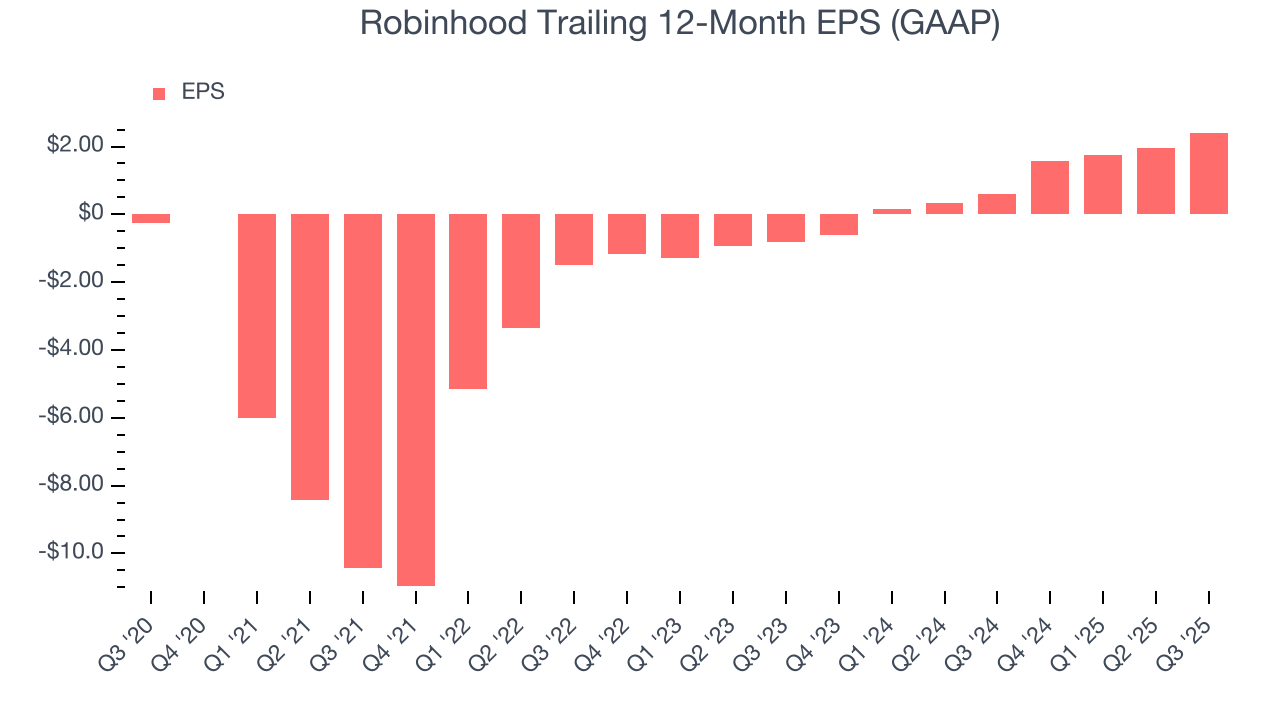

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, Robinhood reported EPS of $0.61, up from $0.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Robinhood’s full-year EPS of $2.41 to shrink by 11%.

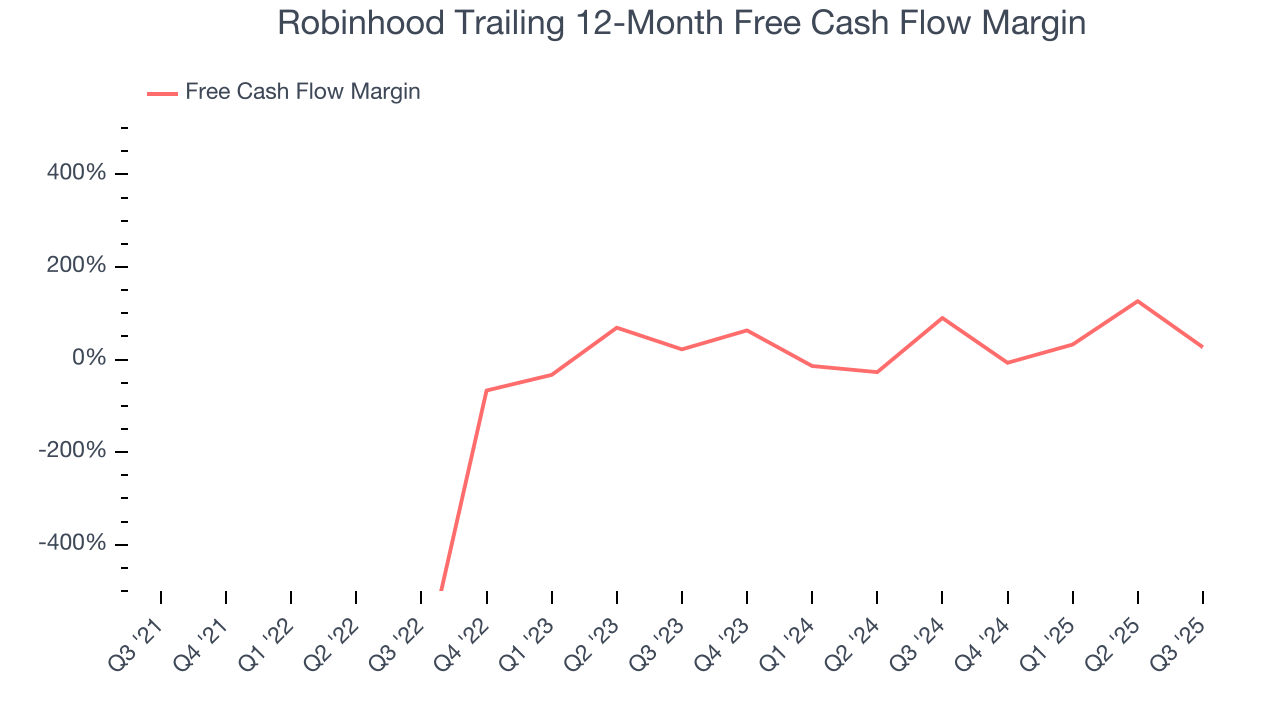

11. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Robinhood has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 49.6% over the last two years.

Taking a step back, we can see that Robinhood’s margin expanded meaningfully over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Robinhood burned through $1.59 billion of cash in Q3, equivalent to a negative 125% margin. The company’s cash flow turned negative after being positive in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

12. Balance Sheet Assessment

Robinhood reported $12.77 billion of cash and $15.67 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.37 billion of EBITDA over the last 12 months, we view Robinhood’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $14.01 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Robinhood’s Q3 Results

We enjoyed seeing Robinhood beat analysts’ revenue expectations this quarter. We were also glad it expanded its number of users. On the other hand, its number of funded customers was just in line, full-year operating expense guidance is at the top of the previously-provided range (implied profits therefore at the lower end), and the CFO is retiring. Overall, this print had many moving pieces. Investors were likely hoping for more, and shares traded down 2.8% to $138.75 immediately after reporting.

14. Is Now The Time To Buy Robinhood?

Updated: January 23, 2026 at 9:26 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Robinhood, you should also grasp the company’s longer-term business quality and valuation.

There are multiple reasons why we think Robinhood is an elite consumer internet company. For starters, its revenue growth was exceptional over the last three years. And while its projected EPS for the next year is lacking, its admirable gross margins are a wonderful starting point for the overall profitability of the business. On top of that, Robinhood’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Robinhood’s EV/EBITDA ratio based on the next 12 months is 29.7x. There’s some optimism reflected in this multiple, but we don’t mind owning an elite business, even if it’s slightly expensive. It’s often wise to hold investments like this for at least three to five years, as the power of long-term compounding negates short-term price swings that can accompany relatively high valuations.

Wall Street analysts have a consensus one-year price target of $149.29 on the company (compared to the current share price of $106.65).