Hertz (HTZ)

Hertz is up against the odds. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hertz Will Underperform

Started with a dozen Model T Fords, Hertz (NASDAQ:HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

- Annual sales declines of 4.7% for the past two years show its products and services struggled to connect with the market during this cycle

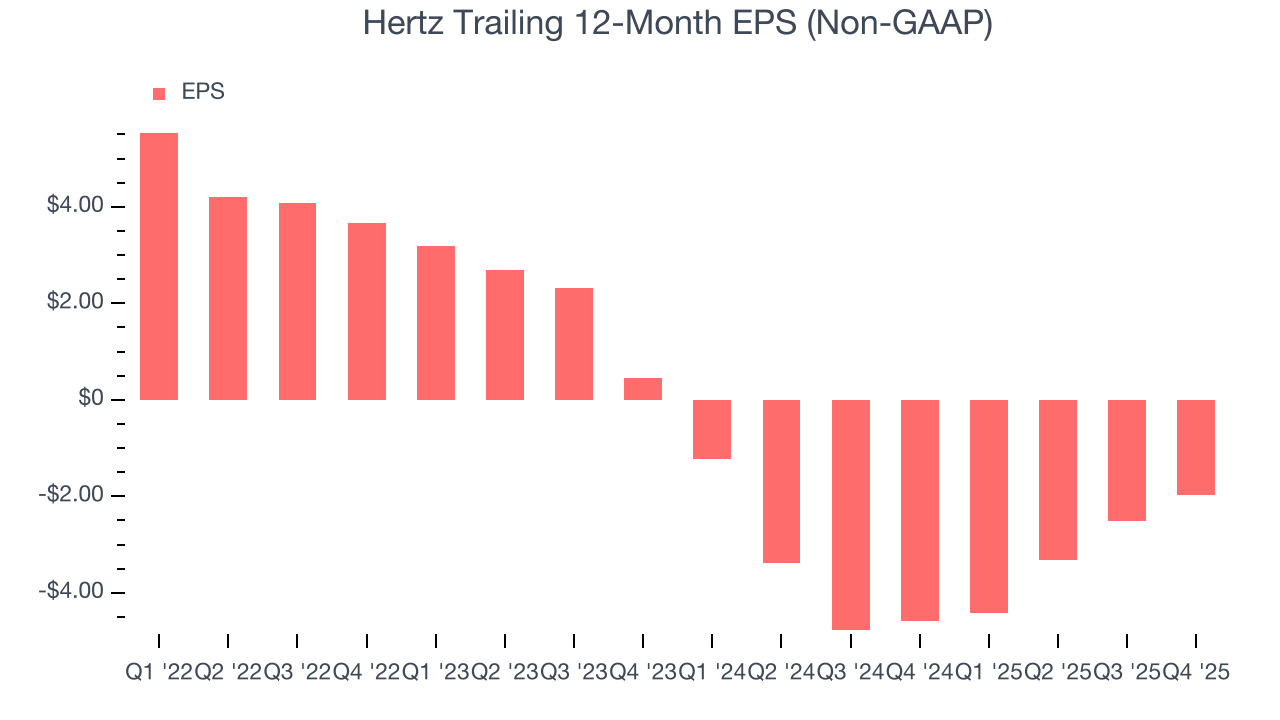

- Earnings per share have dipped by 21.5% annually over the past four years, which is concerning because stock prices follow EPS over the long term

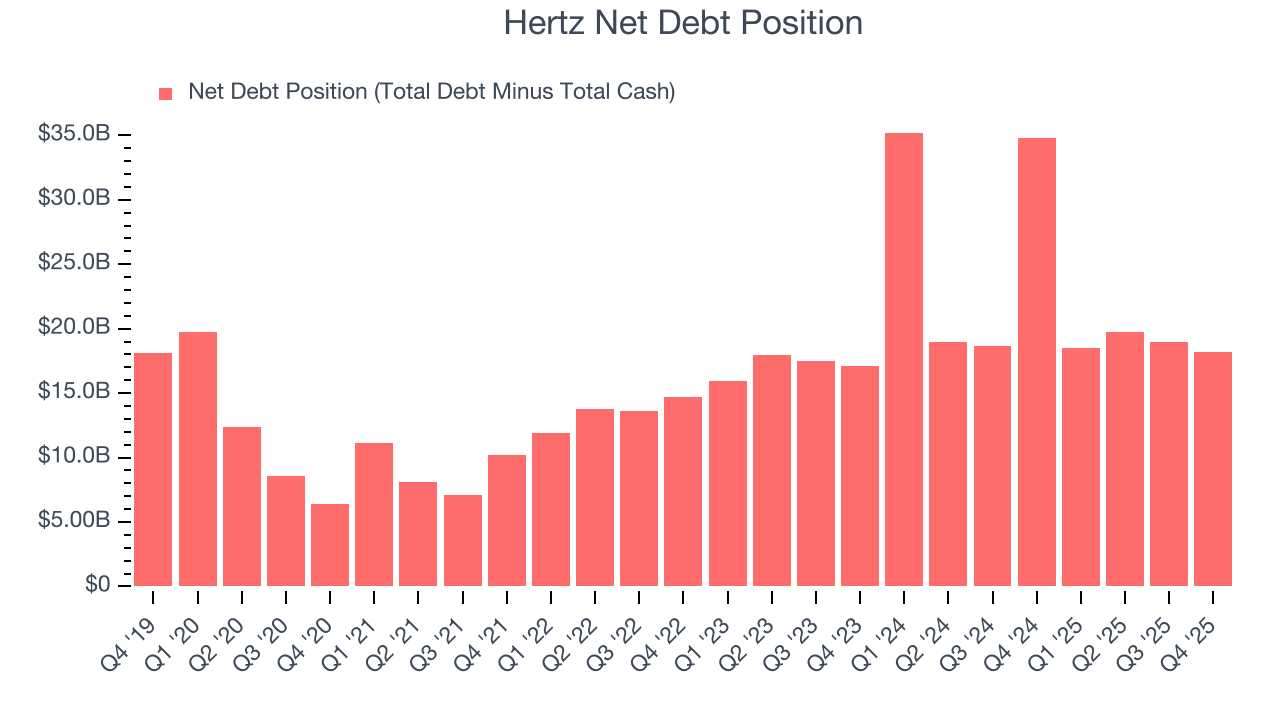

- 18× net-debt-to-EBITDA ratio makes lenders less willing to extend additional capital, potentially necessitating dilutive equity offerings

Hertz’s quality is insufficient. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Hertz

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hertz

Hertz is trading at $4.38 per share, or 128.7x forward EV-to-EBITDA. This valuation multiple seems a bit much considering the quality you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Hertz (HTZ) Research Report: Q4 CY2025 Update

Global car rental company Hertz (NASDAQ:HTZ) beat Wall Street’s revenue expectations in Q4 CY2025, but sales were flat year on year at $2.03 billion. Its non-GAAP loss of $0.63 per share was 22.2% below analysts’ consensus estimates.

Hertz (HTZ) Q4 CY2025 Highlights:

- Revenue: $2.03 billion vs analyst estimates of $2 billion (flat year on year, 1.5% beat)

- Adjusted EPS: -$0.63 vs analyst expectations of -$0.52 (22.2% miss)

- Adjusted EBITDA: -$205 million (-10.1% margin, 151% year-on-year decline)

- Adjusted EBITDA Margin: -10.1%, down from 19.7% in the same quarter last year

- Free Cash Flow was -$2.19 billion compared to -$332 million in the same quarter last year

- Market Capitalization: $1.38 billion

Company Overview

Started with a dozen Model T Fords, Hertz (NASDAQ:HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

Founded in 1918, Hertz was created to provide an accessible and convenient means of transportation for those without their own vehicles. Over the years, Hertz expanded its operations and fleet, becoming a key player in the car rental industry and eventually being acquired by John D. Hertz in 1923, who helped grow the company further.

Hertz offers a wide range of vehicle rental services to cater to the needs of both leisure and business travelers. Whether it's for a family vacation, a business trip, or a short-term replacement for a personal vehicle, Hertz provides flexible rental options across numerous categories, including economy, luxury, and commercial vehicles. The company's extensive network of locations at airports, cities, and neighborhoods ensures that customers can conveniently access their services wherever they go.

Hertz's revenue comes from vehicle rentals, leasing services, and sales of used rental cars through its Hertz Car Sales division. The business model focuses on providing value through competitive pricing, a diverse vehicle fleet, and customer loyalty programs like Hertz Gold Plus Rewards.

4. Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Public competitors in the car rental industry include Avis (NASDAQ:CAR) and Zoomcar (NASDAQ:ZCAR), while a prominent private competitor is Enterprise.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Hertz grew its sales at a solid 10.1% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Hertz’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.7% over the last two years.

This quarter, Hertz’s $2.03 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Hertz has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 22.1% gross margin over the last five years. That means Hertz paid its suppliers a lot of money ($77.92 for every $100 in revenue) to run its business.

In Q4, Hertz produced a 32.6% gross profit margin, up 34.2 percentage points year on year. Hertz’s full-year margin has also been trending up over the past 12 months, increasing by 22 percentage points. If this move continues, it could suggest an environment where the company has better pricing power and stable or shrinking input costs (such as raw materials).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hertz has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.7%, higher than the broader industrials sector.

Looking at the trend in its profitability, Hertz’s operating margin decreased by 30.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Hertz generated an operating margin profit margin of negative 11%, up 3.7 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hertz’s full-year EPS turned negative over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Hertz’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Hertz, its EPS declined by more than its revenue over the last two years, dropping 153%. This tells us the company struggled to adjust to shrinking demand.

Diving into the nuances of Hertz’s earnings can give us a better understanding of its performance. A two-year view shows Hertz has diluted its shareholders, growing its share count by 30.4%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings.

In Q4, Hertz reported adjusted EPS of negative $0.63, up from negative $1.18 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Hertz to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.97 will advance to negative $0.65.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Hertz’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 8%, meaning it lit $8.01 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Hertz’s margin dropped by 16.9 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Hertz burned through $2.19 billion of cash in Q4, equivalent to a negative 108% margin. The company’s cash burn increased from $332 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Hertz hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 19.3%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hertz’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Hertz burned through $2.19 billion of cash over the last year, and its $19.33 billion of debt exceeds the $1.17 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Hertz’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Hertz until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from Hertz’s Q4 Results

It was good to see Hertz narrowly top analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7.5% to $4.14 immediately following the results.

13. Is Now The Time To Buy Hertz?

Updated: March 4, 2026 at 11:15 PM EST

Are you wondering whether to buy Hertz or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Hertz falls short of our quality standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last four years makes it a less attractive asset to the public markets.

Hertz’s EV-to-EBITDA ratio based on the next 12 months is 128.7x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $4.42 on the company (compared to the current share price of $4.38).