iRhythm (IRTC)

iRhythm is interesting. Although it has burned cash, its growth shows it’s deploying the Jeff Bezos reinvestment strategy.― StockStory Analyst Team

1. News

2. Summary

Why iRhythm Is Interesting

Pioneering the shift from bulky, short-term heart monitors to sleek, wire-free patches, iRhythm Technologies (NASDAQ:IRTC) provides wearable cardiac monitoring devices and AI-powered analysis services that help physicians detect and diagnose heart rhythm disorders.

- Notable projected revenue growth of 17.2% for the next 12 months hints at market share gains

- Annual revenue growth of 23% over the past five years was outstanding, reflecting market share gains this cycle

- A downside is its poor expense management has led to adjusted operating margin losses

iRhythm has some noteworthy aspects. If you believe in the company, the price looks reasonable.

Why Is Now The Time To Buy iRhythm?

High Quality

Investable

Underperform

Why Is Now The Time To Buy iRhythm?

iRhythm’s stock price of $140.13 implies a valuation ratio of 45x forward EV-to-EBITDA. This lofty multiple could mean short-term stock-price swings, but big picture, we think the price is appropriate for the top-line growth you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. iRhythm (IRTC) Research Report: Q4 CY2025 Update

Medical technology company iRhythm Technologies (NASDAQ:IRTC) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 27.1% year on year to $208.9 million. The company’s full-year revenue guidance of $875 million at the midpoint came in 0.6% above analysts’ estimates. Its non-GAAP profit of $0.29 per share was significantly above analysts’ consensus estimates.

iRhythm (IRTC) Q4 CY2025 Highlights:

- Revenue: $208.9 million vs analyst estimates of $202 million (27.1% year-on-year growth, 3.4% beat)

- Adjusted EPS: $0.29 vs analyst estimates of $0.06 (significant beat)

- Adjusted EBITDA: $34.29 million vs analyst estimates of $27.91 million (16.4% margin, 22.9% beat)

- Operating Margin: 1.1%, up from -2.5% in the same quarter last year

- Market Capitalization: $4.96 billion

Company Overview

Pioneering the shift from bulky, short-term heart monitors to sleek, wire-free patches, iRhythm Technologies (NASDAQ:IRTC) provides wearable cardiac monitoring devices and AI-powered analysis services that help physicians detect and diagnose heart rhythm disorders.

The company's flagship product is the Zio System, which combines a small, adhesive, water-resistant patch that patients wear for up to 14 days with sophisticated cloud-based analytics. Unlike traditional Holter monitors that typically record for just 24-48 hours and require multiple wires, the Zio patch continuously records every heartbeat without disrupting daily activities, resulting in patient compliance rates of 98-99%.

When a physician prescribes a Zio Service, the patient wears the patch for the prescribed period, during which they can mark symptoms by pressing a button on the device. After the monitoring period, the patch is returned to iRhythm's independent diagnostic testing facility where the data—approximately 1.5 million heartbeats per patient—is uploaded to the cloud and analyzed using the company's FDA-cleared artificial intelligence algorithms.

Certified cardiographic technicians validate the AI findings before sending a comprehensive report to the prescribing physician. The company offers different monitoring solutions: the Zio Monitor and Zio XT for long-term continuous monitoring, and the Zio AT, which adds real-time transmission capabilities for more urgent cases requiring mobile cardiac telemetry.

iRhythm's business model operates as a healthcare service rather than just a device manufacturer. The company bills insurance companies and Medicare directly for its monitoring services, with approximately 86% of its revenue coming from third-party payers. This integrated approach allows iRhythm to maintain quality control throughout the diagnostic process.

The company has expanded its technology platform with the Zio Watch, developed in partnership with Verily (an Alphabet company). This wrist-worn wearable is designed to identify and monitor atrial fibrillation, a common heart rhythm disorder that increases stroke risk. iRhythm is also exploring opportunities to integrate its AI algorithms with other wearable devices.

4. Patient Monitoring

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

iRhythm's main competitors include BioTelemetry (acquired by Royal Philips), Preventice Solutions (acquired by Boston Scientific), and Bardy Diagnostics (acquired by Baxter International). The company also competes with traditional Holter monitor manufacturers like GE Healthcare, Philips Healthcare, and Welch Allyn (now part of Baxter International).

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $747.1 million in revenue over the past 12 months, iRhythm is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, iRhythm’s smaller revenue base allows it to grow faster if it can execute well.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, iRhythm’s sales grew at an excellent 23% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. iRhythm’s annualized revenue growth of 23.1% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, iRhythm reported robust year-on-year revenue growth of 27.1%, and its $208.9 million of revenue topped Wall Street estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 15.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and suggests the market sees success for its products and services.

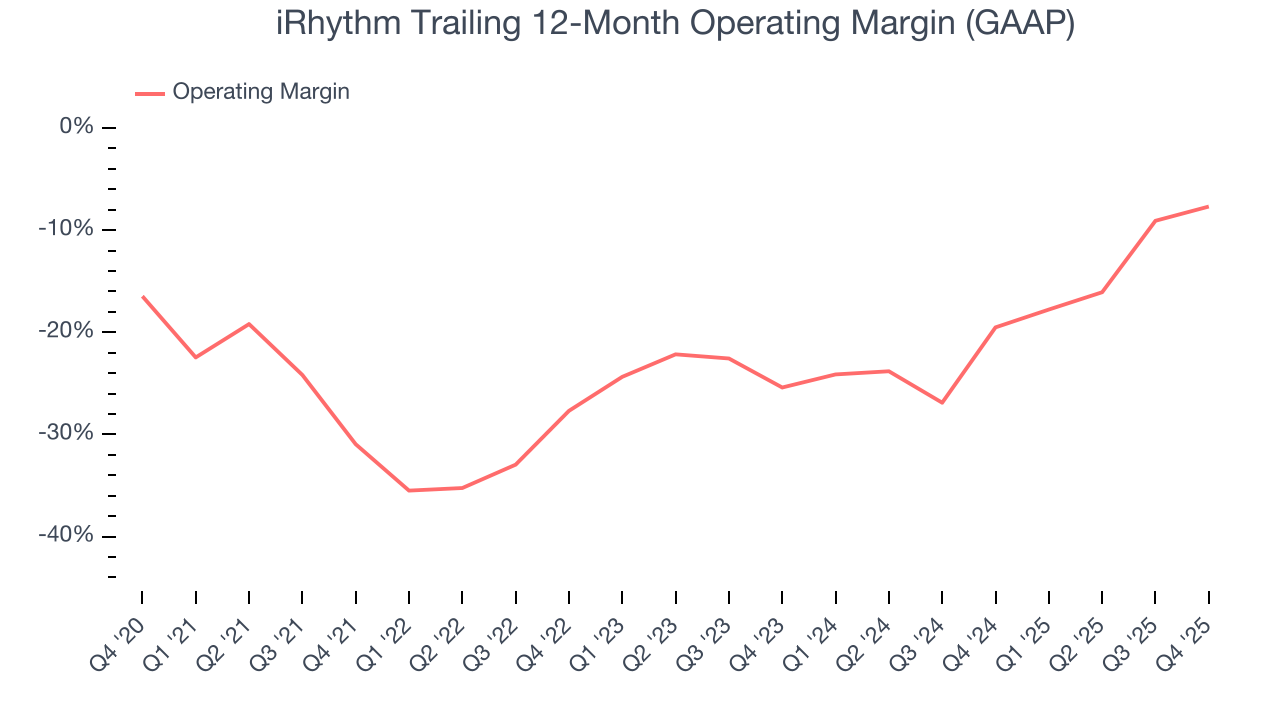

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although iRhythm was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 20% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, iRhythm’s operating margin rose by 23.3 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 17.7 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

This quarter, iRhythm generated an operating margin profit margin of 1.1%, up 3.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

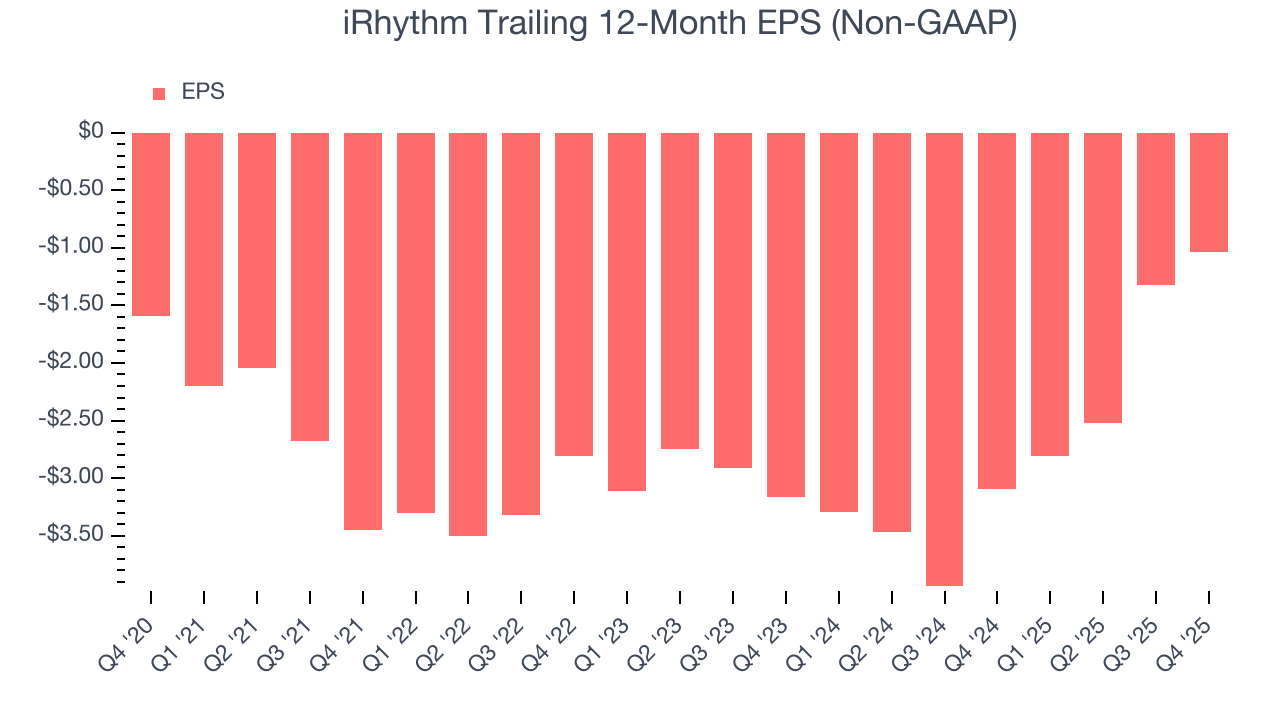

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although iRhythm’s full-year earnings are still negative, it reduced its losses and improved its EPS by 8.1% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q4, iRhythm reported adjusted EPS of $0.29, up from $0.01 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects iRhythm to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.04 will advance to negative $0.29.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

iRhythm’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 9.3%. This means it lit $9.32 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that iRhythm’s margin expanded by 23.7 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

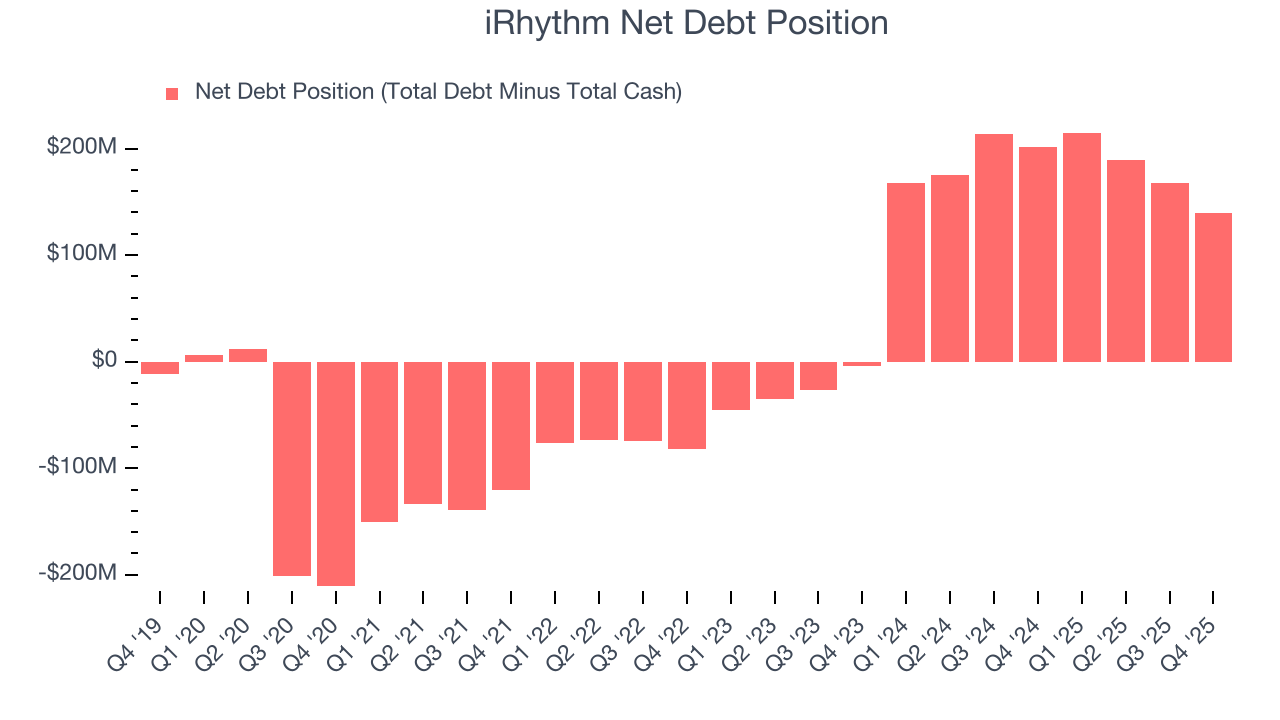

10. Balance Sheet Assessment

iRhythm reported $592.1 million of cash and $731.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $68.91 million of EBITDA over the last 12 months, we view iRhythm’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $4.34 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from iRhythm’s Q4 Results

It was good to see iRhythm beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.4% to $160.95 immediately after reporting.

12. Is Now The Time To Buy iRhythm?

Updated: February 26, 2026 at 11:44 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in iRhythm.

iRhythm possesses a number of positive attributes. To kick things off, its revenue growth was impressive over the last five years. And while its operating margins reveal poor profitability compared to other healthcare companies, its rising cash profitability gives it more optionality. On top of that, its expanding adjusted operating margin shows the business has become more efficient.

iRhythm’s EV-to-EBITDA ratio based on the next 12 months is 45x. When scanning the healthcare space, iRhythm trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $212.87 on the company (compared to the current share price of $140.13), implying they see 51.9% upside in buying iRhythm in the short term.