Kratos (KTOS)

We’re wary of Kratos. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why Kratos Is Not Exciting

Established with a commitment to supporting national security, Kratos (NASDAQ:KTOS) is a provider of advanced engineering, technology, and security solutions tailored for critical national security applications.

- Increased cash burn over the last five years raises questions about the return timeline for its investments

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its shrinking returns suggest its past profit sources are losing steam

- A bright spot is that its projected revenue growth of 17.3% for the next 12 months is above its two-year trend, pointing to accelerating demand

Kratos doesn’t meet our quality standards. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Kratos

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Kratos

Kratos’s stock price of $110.02 implies a valuation ratio of 161.4x forward P/E. This valuation multiple seems a bit much considering the quality you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Kratos (KTOS) Research Report: Q3 CY2025 Update

Aerospace and defense company Kratos (NASDAQ:KTOS) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 26% year on year to $347.6 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $325 million was less impressive, coming in 2.5% below expectations. Its non-GAAP profit of $0.14 per share was 17.5% above analysts’ consensus estimates.

Kratos (KTOS) Q3 CY2025 Highlights:

- Revenue: $347.6 million vs analyst estimates of $320.8 million (26% year-on-year growth, 8.3% beat)

- Adjusted EPS: $0.14 vs analyst estimates of $0.12 (17.5% beat)

- Adjusted EBITDA: $30.8 million vs analyst estimates of $28.43 million (8.9% margin, 8.3% beat)

- Revenue Guidance for Q4 CY2025 is $325 million at the midpoint, below analyst estimates of $333.3 million

- EBITDA guidance for the full year is $35.5 million at the midpoint, below analyst estimates of $118.5 million

- Operating Margin: 2%, in line with the same quarter last year

- Free Cash Flow was -$41.3 million compared to -$9.2 million in the same quarter last year

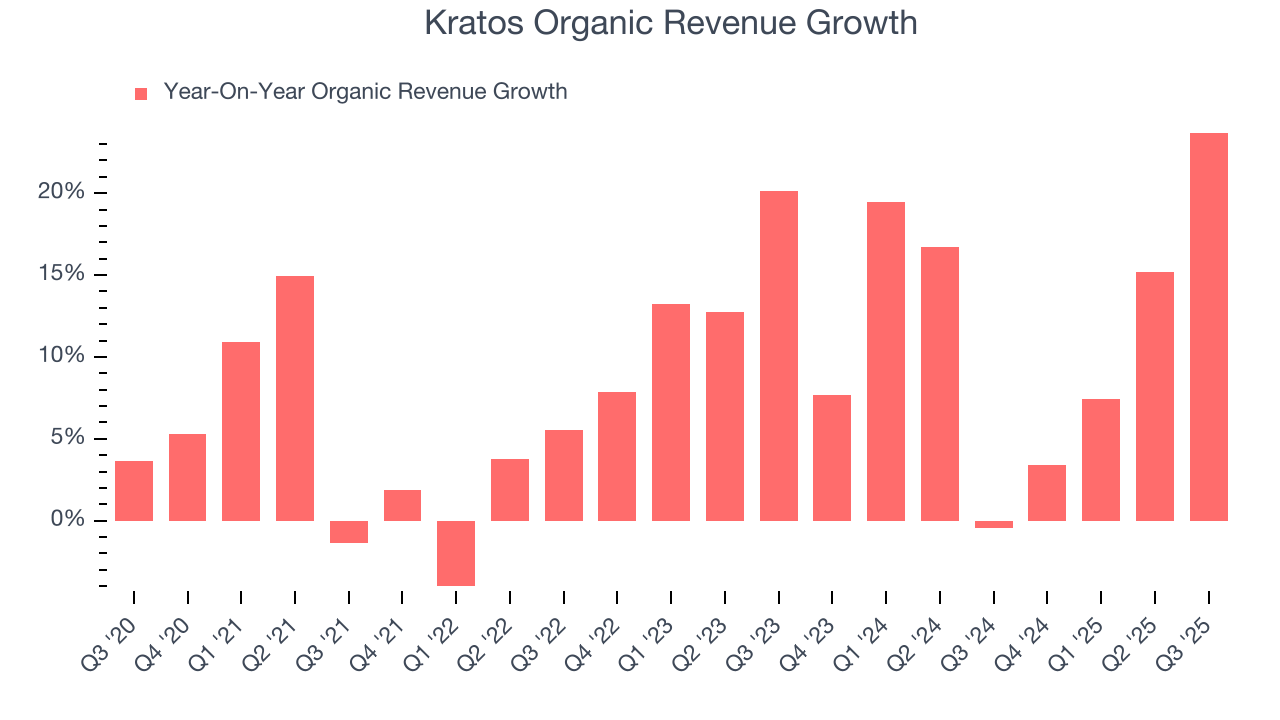

- Organic Revenue rose 23.7% year on year vs analyst estimates of 14.9% growth (880.7 basis point beat)

- Market Capitalization: $15.38 billion

Company Overview

Established with a commitment to supporting national security, Kratos (NASDAQ:KTOS) is a provider of advanced engineering, technology, and security solutions tailored for critical national security applications.

Kratos was originally founded in 1994 as Wireless Facilities, a company focused on wireless communications. Over time, the company transformed significantly through a strategic series of acquisitions that began aggressively around 2004. These acquisitions were aimed at expanding its footprint in the defense and national security sectors, making Kratos a notable player in advanced military technology, satellite communications, and unmanned systems.

Today, Kratos provides advanced technologies primarily focused on the defense sector. Products range from microwave electronics to ballistic missile systems. One key area is its unmanned systems, which include aerial drones like the UTAP-22 Mako. The UTAP-22 Mako is known for its capabilities in tactical missions alongside manned aircraft, thereby extending the operational scope of conventional forces without risking pilot lives. Another important area for Kratos is its satellite communication systems. These systems are crucial for managing satellites in space, ensuring they work correctly and stay on course. Kratos' technology helps control these satellites, which is vital for everything from checking the weather to ensuring national security. Through these products, Kratos serves a diverse range of end markets including defense, intelligence, and civil government sectors across the globe.

Kratos generates revenue primarily through contracts with government and defense agencies. These contracts often provide recurring revenue streams, which support the company’s financial stability. This recurring revenue comes from long-term contracts and ongoing service agreements, ensuring a steady income as they provide updates, maintenance, and other support services. For instance, in April 2021, Kratos secured a contract supporting the Army Ground Aerial Target Control System. This contract entails updating software, conducting cyber security inspections, and replacing parts.

4. Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Kratos’ competitors include Textron (NYSE:TXT) and Northrop Grumman (NYSE:NOC)

5. Revenue Growth

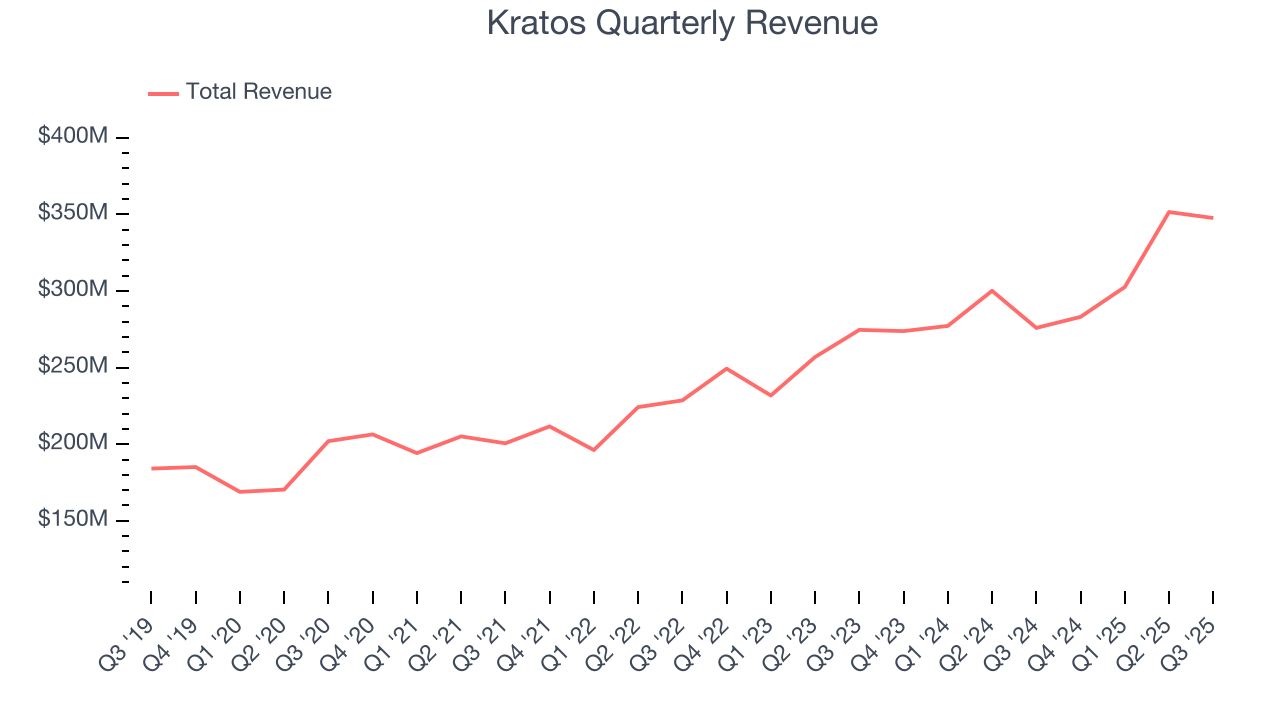

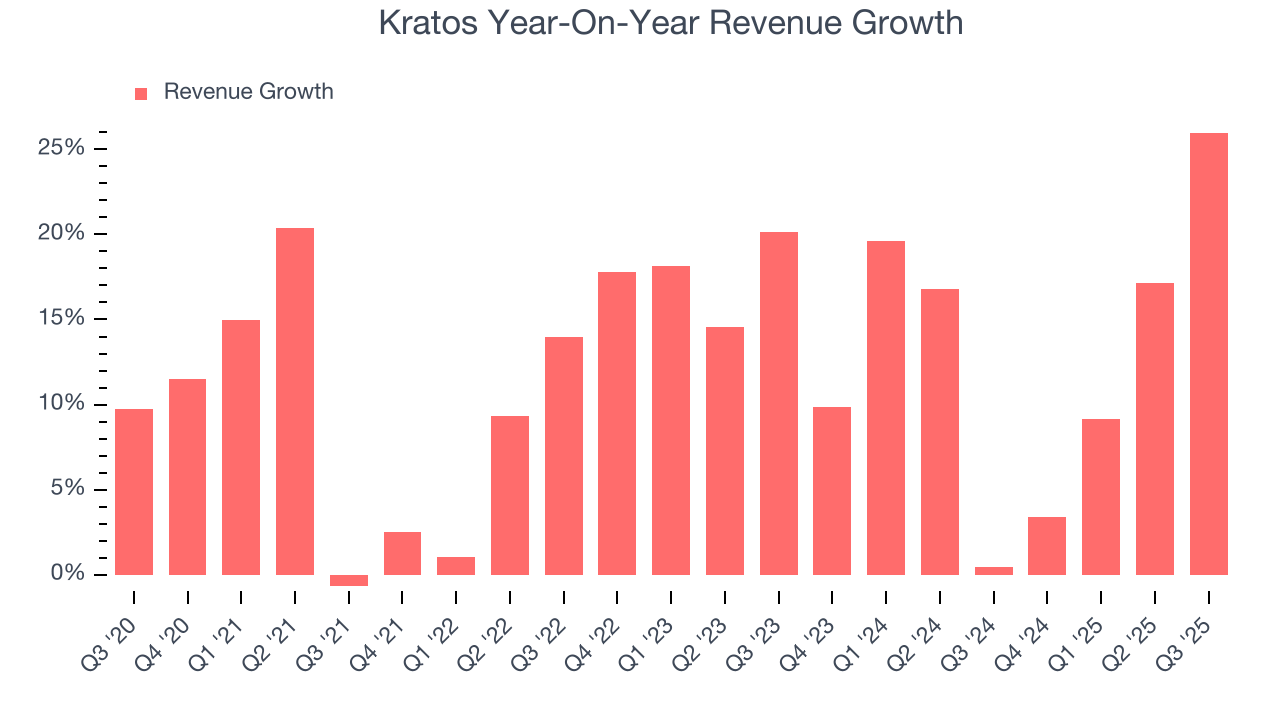

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Kratos’s sales grew at an excellent 12.1% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Kratos’s annualized revenue growth of 12.6% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Kratos’s organic revenue averaged 11.6% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Kratos reported robust year-on-year revenue growth of 26%, and its $347.6 million of revenue topped Wall Street estimates by 8.3%. Company management is currently guiding for a 14.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.4% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will catalyze better top-line performance.

6. Operating Margin

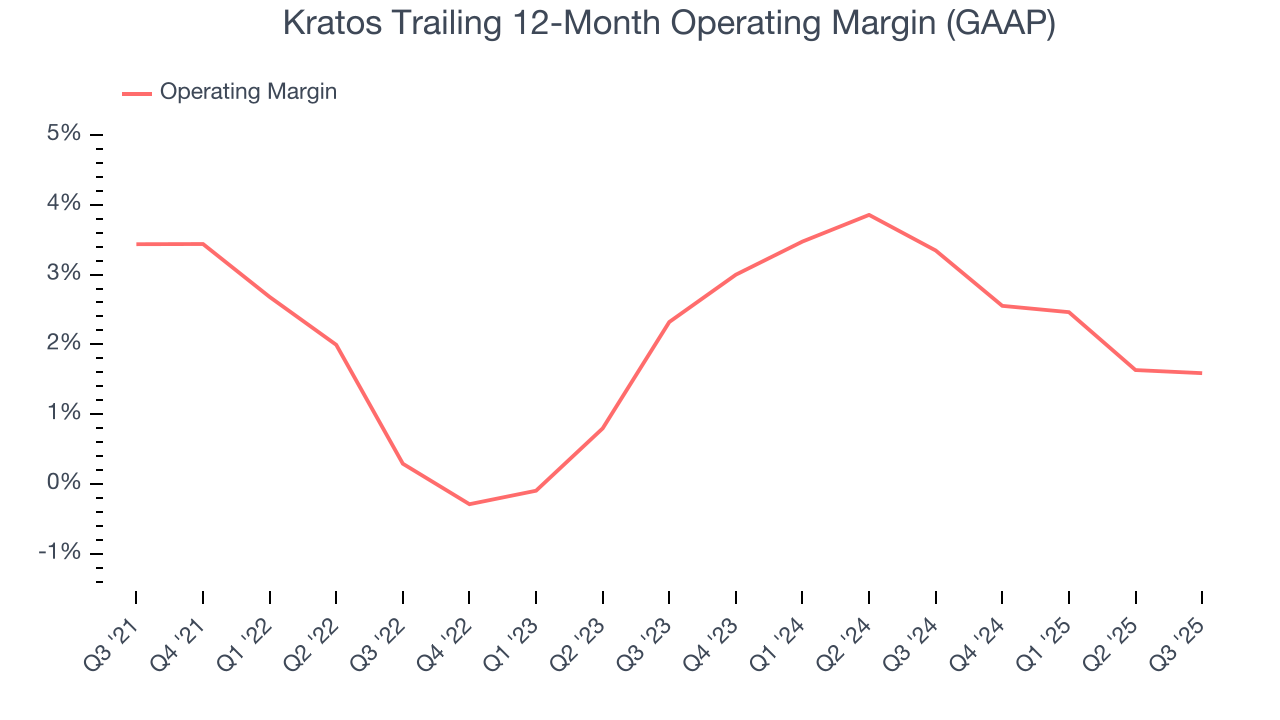

Kratos was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.2% was weak for an industrials business.

Looking at the trend in its profitability, Kratos’s operating margin decreased by 1.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Kratos’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Kratos generated an operating margin profit margin of 2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

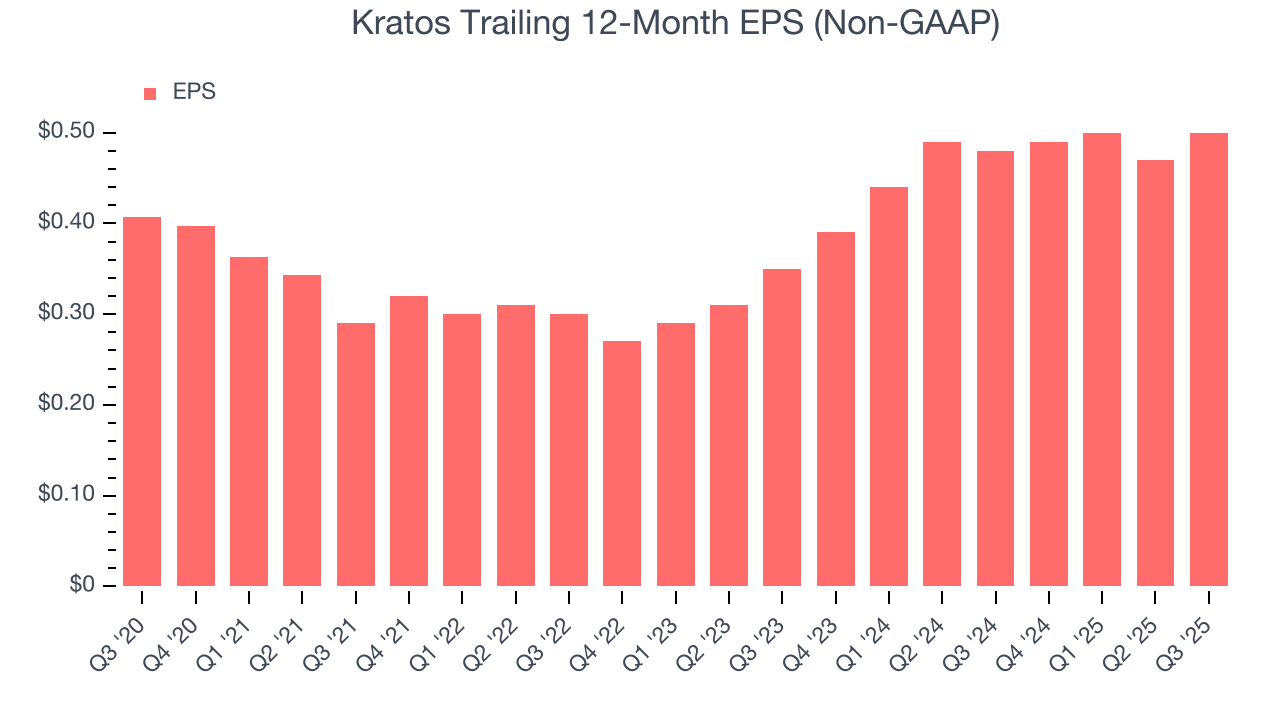

Kratos’s EPS grew at an unimpressive 4.2% compounded annual growth rate over the last five years, lower than its 12.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

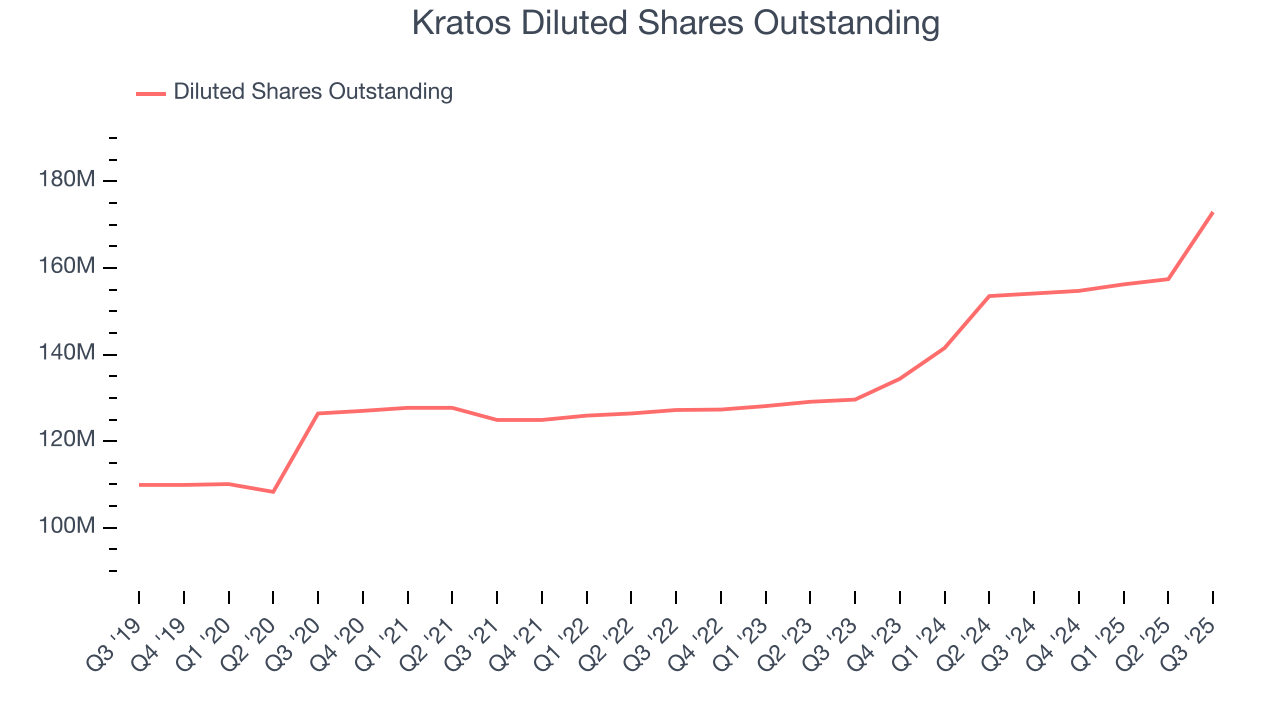

We can take a deeper look into Kratos’s earnings to better understand the drivers of its performance. As we mentioned earlier, Kratos’s operating margin was flat this quarter but declined by 1.8 percentage points over the last five years. Its share count also grew by 36.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Kratos, its two-year annual EPS growth of 19.5% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, Kratos reported adjusted EPS of $0.14, up from $0.11 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Kratos’s full-year EPS of $0.50 to grow 44.2%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

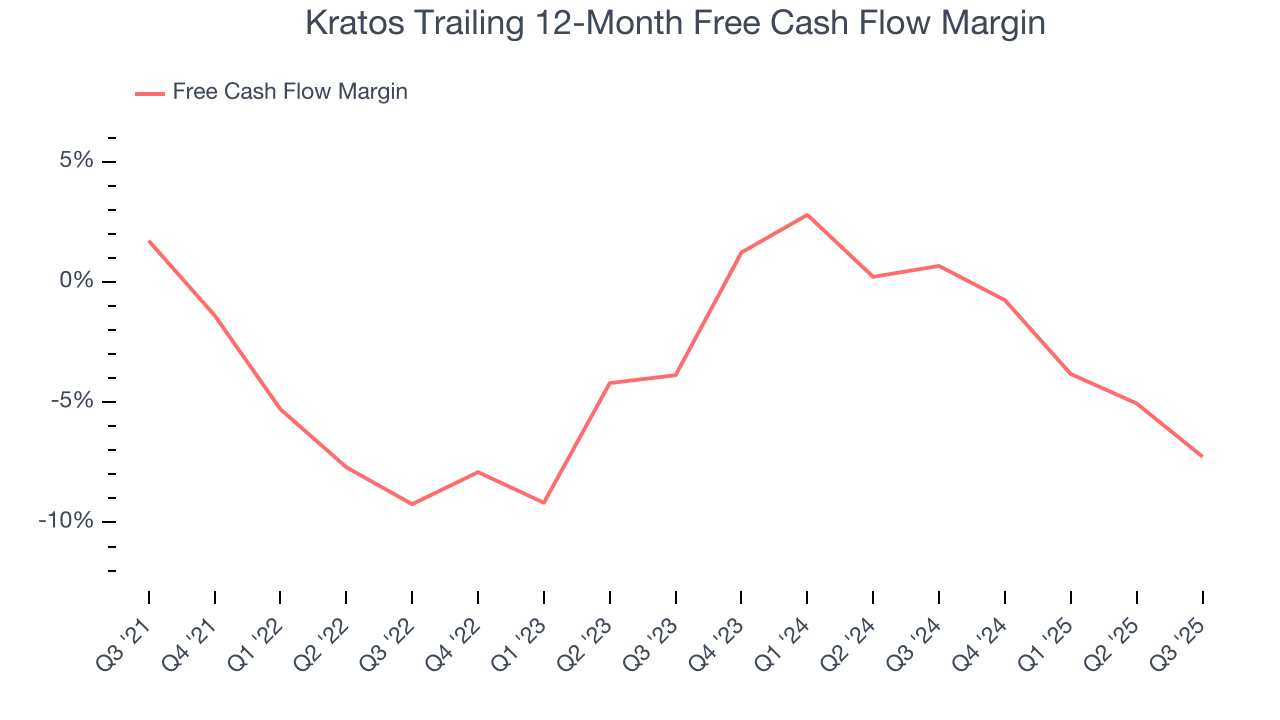

Kratos’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.7%, meaning it lit $3.74 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Kratos’s margin dropped by 9 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Kratos burned through $41.3 million of cash in Q3, equivalent to a negative 11.9% margin. The company’s cash burn increased from $9.2 million of lost cash in the same quarter last year.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

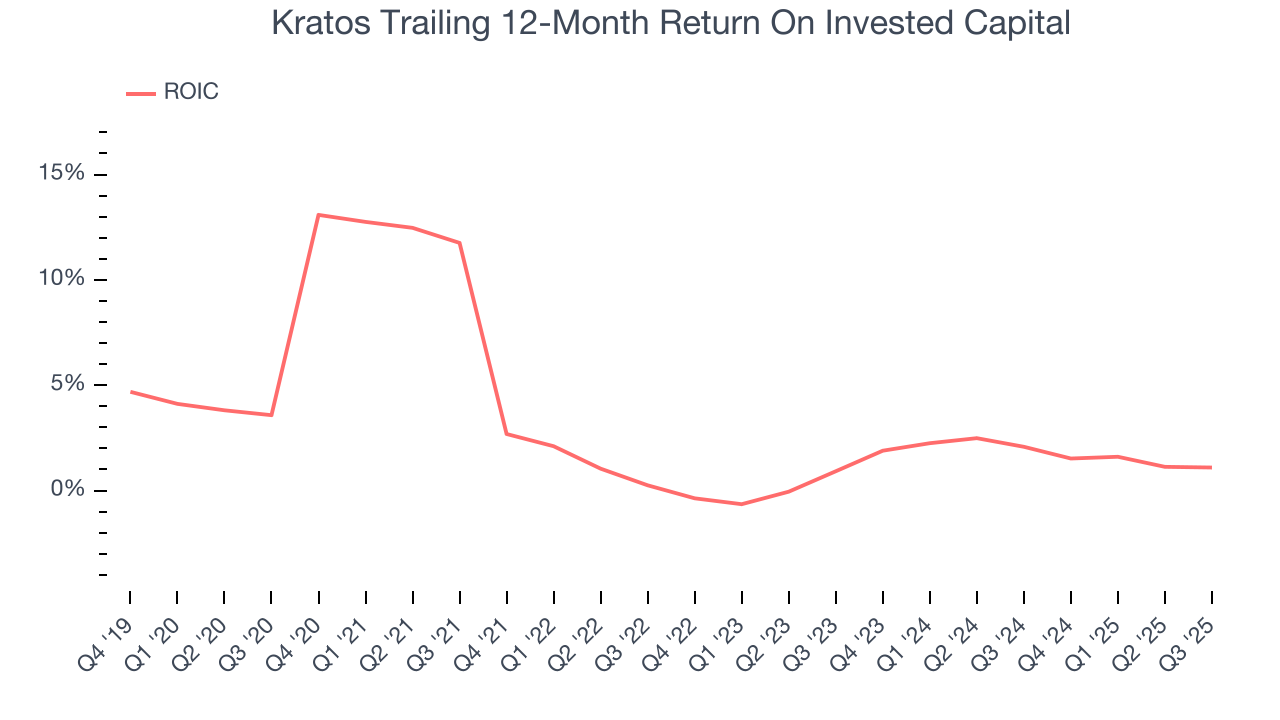

Kratos historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.2%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Kratos’s ROIC averaged 4.4 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

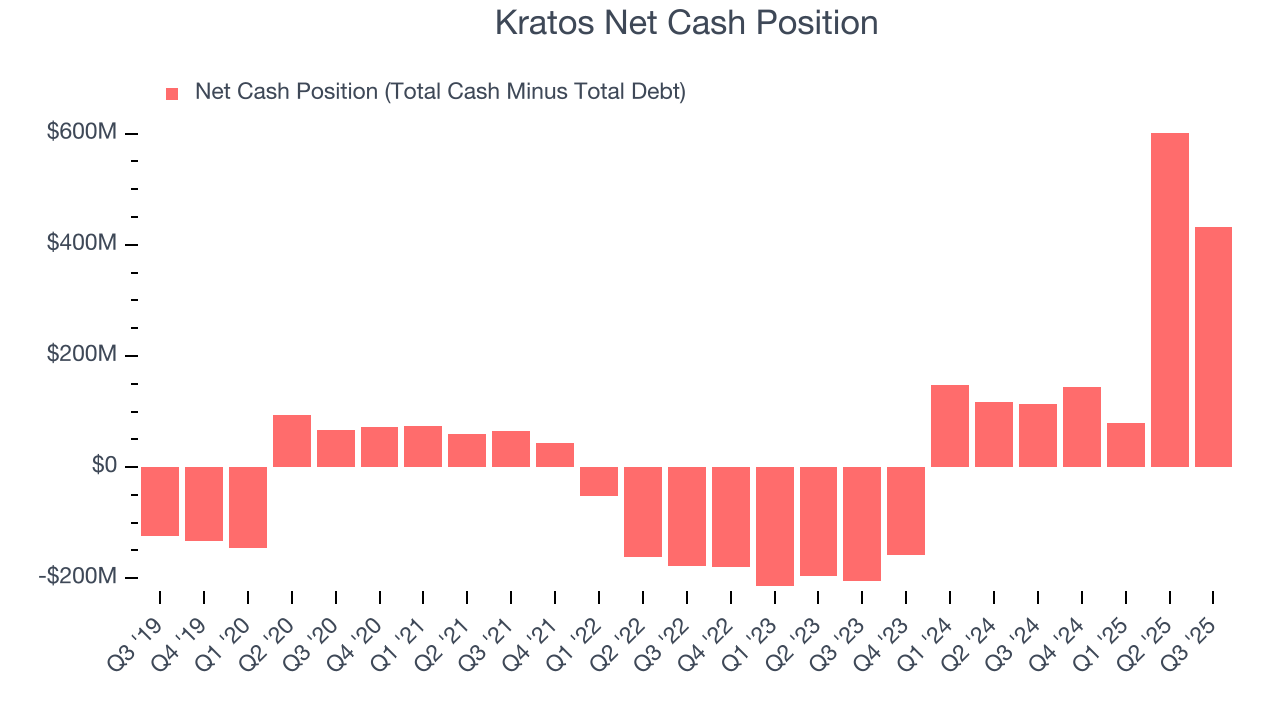

Kratos is a well-capitalized company with $565.9 million of cash and $134.3 million of debt on its balance sheet. This $431.6 million net cash position is 2.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Kratos’s Q3 Results

We were impressed by how significantly Kratos blew past analysts’ organic revenue and EBITDA expectations this quarter. On the other hand, its revenue and EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, we think this was a mixed quarter. The market seemed to be hoping for a stronger outlook, and the stock traded down 6.9% to $84 immediately following the results.

12. Is Now The Time To Buy Kratos?

Updated: January 24, 2026 at 10:21 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Kratos’s business quality ultimately falls short of our standards. Although its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months, its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its cash profitability fell over the last five years.

Kratos’s P/E ratio based on the next 12 months is 161.4x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $115.53 on the company (compared to the current share price of $110.02).