LeMaitre (LMAT)

LeMaitre has a few redeeming features, but overall it falls short. Far better stocks are available in the market.― StockStory Analyst Team

1. News

2. Summary

Why LeMaitre Is Not Exciting

Founded in 1983 and named after a pioneering vascular surgeon, LeMaitre Vascular (NASDAQGM:LMAT) develops and manufactures specialized medical devices used by vascular surgeons to treat peripheral vascular disease and other circulatory conditions.

- Modest revenue base of $249.6 million gives it less fixed cost leverage and fewer distribution channels than larger companies

- On the plus side, its incremental sales over the last five years have been highly profitable as its earnings per share increased by 19% annually, topping its revenue gains

LeMaitre doesn’t pass our quality test. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than LeMaitre

High Quality

Investable

Underperform

Why There Are Better Opportunities Than LeMaitre

At $96.42 per share, LeMaitre trades at 35.1x forward P/E. This multiple is higher than that of healthcare peers; it’s also rich for the business quality. Not a great combination.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. LeMaitre (LMAT) Research Report: Q4 CY2025 Update

Medical device company LeMaitre Vascular (NASDAQ:LMAT) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 15.7% year on year to $64.45 million. Guidance for next quarter’s revenue was better than expected at $66.6 million at the midpoint, 0.7% above analysts’ estimates. Its GAAP profit of $0.68 per share was 2.5% above analysts’ consensus estimates.

LeMaitre (LMAT) Q4 CY2025 Highlights:

- Revenue: $64.45 million vs analyst estimates of $62.93 million (15.7% year-on-year growth, 2.4% beat)

- EPS (GAAP): $0.68 vs analyst estimates of $0.66 (2.5% beat)

- Adjusted EBITDA: $20.86 million vs analyst estimates of $20.54 million (32.4% margin, 1.6% beat)

- Revenue Guidance for Q1 CY2026 is $66.6 million at the midpoint, roughly in line with what analysts were expecting

- EPS (GAAP) guidance for the upcoming financial year 2026 is $2.91 at the midpoint, beating analyst estimates by 12.6%

- Operating Margin: 29.2%, up from 23.1% in the same quarter last year

- Organic Revenue rose 15% year on year (beat)

- Market Capitalization: $2.06 billion

Company Overview

Founded in 1983 and named after a pioneering vascular surgeon, LeMaitre Vascular (NASDAQGM:LMAT) develops and manufactures specialized medical devices used by vascular surgeons to treat peripheral vascular disease and other circulatory conditions.

LeMaitre's product portfolio includes over 20 device families that address specific needs in vascular surgery. These range from biological patches made from bovine pericardium to catheters that remove blood clots from arteries, and from synthetic grafts that replace diseased blood vessels to specialized clips that connect vessels without sutures.

The company serves a focused customer base of vascular surgeons who perform procedures like carotid endarterectomy (removing plaque from neck arteries), peripheral bypass (rerouting blood around blocked leg arteries), and creating access points for dialysis. By targeting niche products with limited competition, LeMaitre has carved out a specialized position in the medical device market.

For example, a vascular surgeon might use LeMaitre's XenoSure patch to close an artery after removing plaque, or employ their Pruitt catheters to temporarily redirect blood flow during a delicate procedure. A surgeon creating dialysis access might choose LeMaitre's Artegraft, a biological graft made from processed bovine carotid artery.

LeMaitre generates revenue through direct sales of these devices, with a global sales force of over 130 representatives focusing primarily on the United States, Europe, Canada, and Asia Pacific regions. The company manufactures most of its products in-house at facilities in Massachusetts, with additional operations in Illinois and New Jersey for tissue processing.

Beyond device sales, LeMaitre also provides human tissue cryopreservation services through its RestoreFlow allograft business, processing and preserving human veins, arteries, and cardiac tissues for use in vascular reconstructions and cardiac repairs.

The company pursues growth through a combination of expanding its sales force, developing new products, and acquiring complementary devices from other companies—having completed over 20 acquisitions to enhance its product portfolio.

4. Surgical Equipment & Consumables - Specialty

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

LeMaitre Vascular competes with several larger medical device companies including Abbott, Baxter International, Becton Dickinson, Edwards Lifesciences, Getinge, Terumo Medical Corporation, and W.L. Gore & Associates, as well as specialized competitors like Artivion, LifeNet Health, and Silk Road Medical.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $249.6 million in revenue over the past 12 months, LeMaitre is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, LeMaitre’s 14% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. LeMaitre’s annualized revenue growth of 13.6% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, LeMaitre’s organic revenue averaged 13.5% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, LeMaitre reported year-on-year revenue growth of 15.7%, and its $64.45 million of revenue exceeded Wall Street’s estimates by 2.4%. Company management is currently guiding for a 11.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market is baking in success for its products and services.

7. Operating Margin

LeMaitre has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 22.5%.

Analyzing the trend in its profitability, LeMaitre’s operating margin rose by 3.6 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 8.2 percentage points on a two-year basis.

This quarter, LeMaitre generated an operating margin profit margin of 29.2%, up 6.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

LeMaitre’s EPS grew at an astounding 19% compounded annual growth rate over the last five years, higher than its 14% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into LeMaitre’s earnings to better understand the drivers of its performance. As we mentioned earlier, LeMaitre’s operating margin expanded by 3.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, LeMaitre reported EPS of $0.68, up from $0.49 in the same quarter last year. This print beat analysts’ estimates by 2.5%. Over the next 12 months, Wall Street expects LeMaitre’s full-year EPS of $2.47 to grow 4.5%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

LeMaitre has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 18.8% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that LeMaitre’s margin expanded by 6.2 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although LeMaitre hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 16.2%, impressive for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. LeMaitre’s ROIC has increased over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

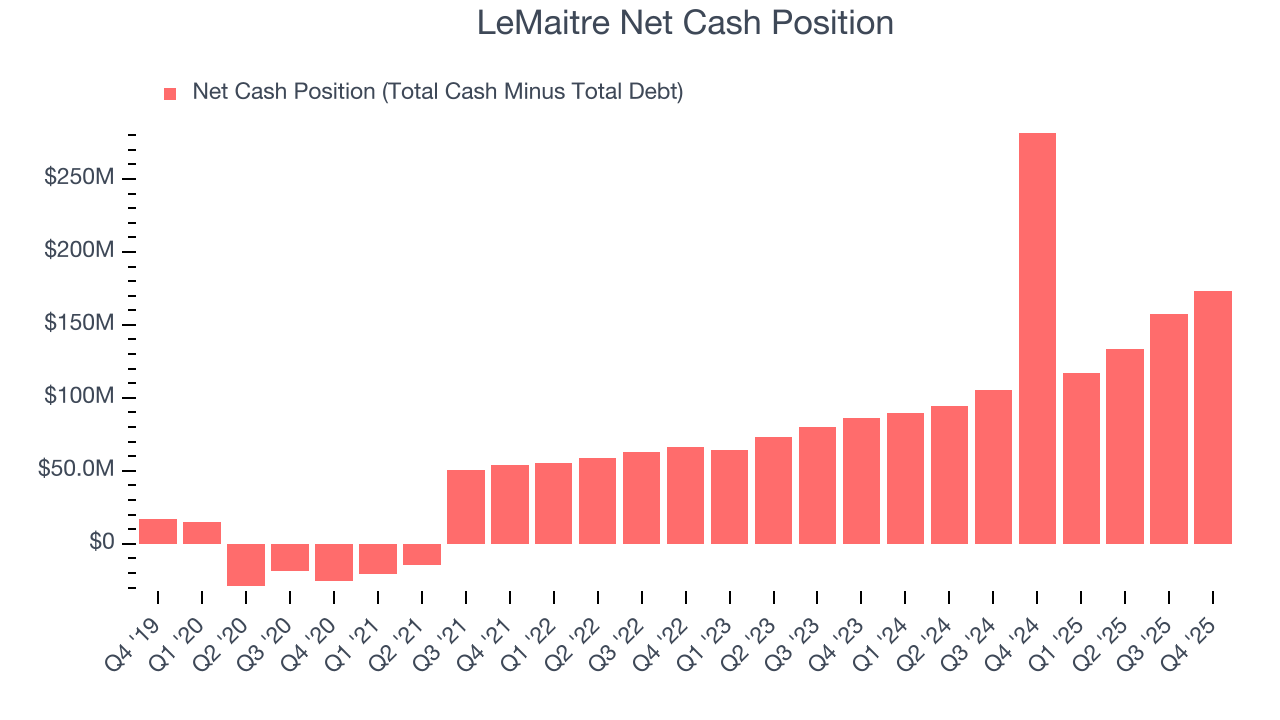

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

LeMaitre is a profitable, well-capitalized company with $359.1 million of cash and $185.6 million of debt on its balance sheet. This $173.5 million net cash position is 8.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from LeMaitre’s Q4 Results

We were impressed by how significantly LeMaitre blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 5.8% to $96.42 immediately following the results.

13. Is Now The Time To Buy LeMaitre?

Updated: February 25, 2026 at 11:49 PM EST

Before investing in or passing on LeMaitre, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

LeMaitre isn’t a bad business, but we’re not clamoring to buy it here and now. To kick things off, its revenue growth was solid over the last five years. And while LeMaitre’s subscale operations give it fewer distribution channels than its larger rivals, its rising cash profitability gives it more optionality.

LeMaitre’s P/E ratio based on the next 12 months is 35.1x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $103.67 on the company (compared to the current share price of $96.42).