Malibu Boats (MBUU)

Malibu Boats faces an uphill battle. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Malibu Boats Will Underperform

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

- Annual revenue growth of 4.6% over the last five years was below our standards for the consumer discretionary sector

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 14.9% annually

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

Malibu Boats doesn’t measure up to our expectations. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than Malibu Boats

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Malibu Boats

Malibu Boats’s stock price of $34.07 implies a valuation ratio of 24.5x forward P/E. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the weaker revenue growth you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Malibu Boats (MBUU) Research Report: Q3 CY2025 Update

Recreational boats manufacturer Malibu Boats (NASDAQ:MBUU) announced better-than-expected revenue in Q3 CY2025, with sales up 13.5% year on year to $194.7 million. Its non-GAAP profit of $0.15 per share was 57.9% above analysts’ consensus estimates.

Malibu Boats (MBUU) Q3 CY2025 Highlights:

- Revenue: $194.7 million vs analyst estimates of $186.8 million (13.5% year-on-year growth, 4.3% beat)

- Adjusted EPS: $0.15 vs analyst estimates of $0.10 (57.9% beat)

- Adjusted EBITDA: $11.78 million vs analyst estimates of $10.41 million (6.1% margin, 13.2% beat)

- Operating Margin: -0.4%, up from -3.3% in the same quarter last year

- Market Capitalization: $626.8 million

Company Overview

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats was established to enhance the on-water experience. The company's initial objective was to produce boats that offered exceptional performance and quality for water skiing enthusiasts, leading to its recognition as a reputable brand among watermen.

Today, Malibu Boats offers a wide range of products including performance sport boats and luxury models across eight brands that cater to a more leisurely boating experience. The company's brands span namesake Malibu, Cobalt , Pursuit, and Cobia. Some of these brands were developed organically while others joined the company's portfolio through acquisitions.

Malibu Boats serves the watersport and marine enthusiast, and customers tend to be higher-income individuals or families that have the extra disposable income for a boat that is clearly not a primary vehicle. Malibu Boats generates most of its revenue from selling its range of watercraft, utilizing a broad dealer network and direct sales strategies. The company seeks to maintain its industry position by developing innovative features, such as its patented Surf Gate technology.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the sports boats and luxury watercraft market include Brunswick (NYSE:BC), Marine Products Corporation (NYSE:MPX), and MasterCraft Boat Holdings (NASDAQ:MCFT).

5. Revenue Growth

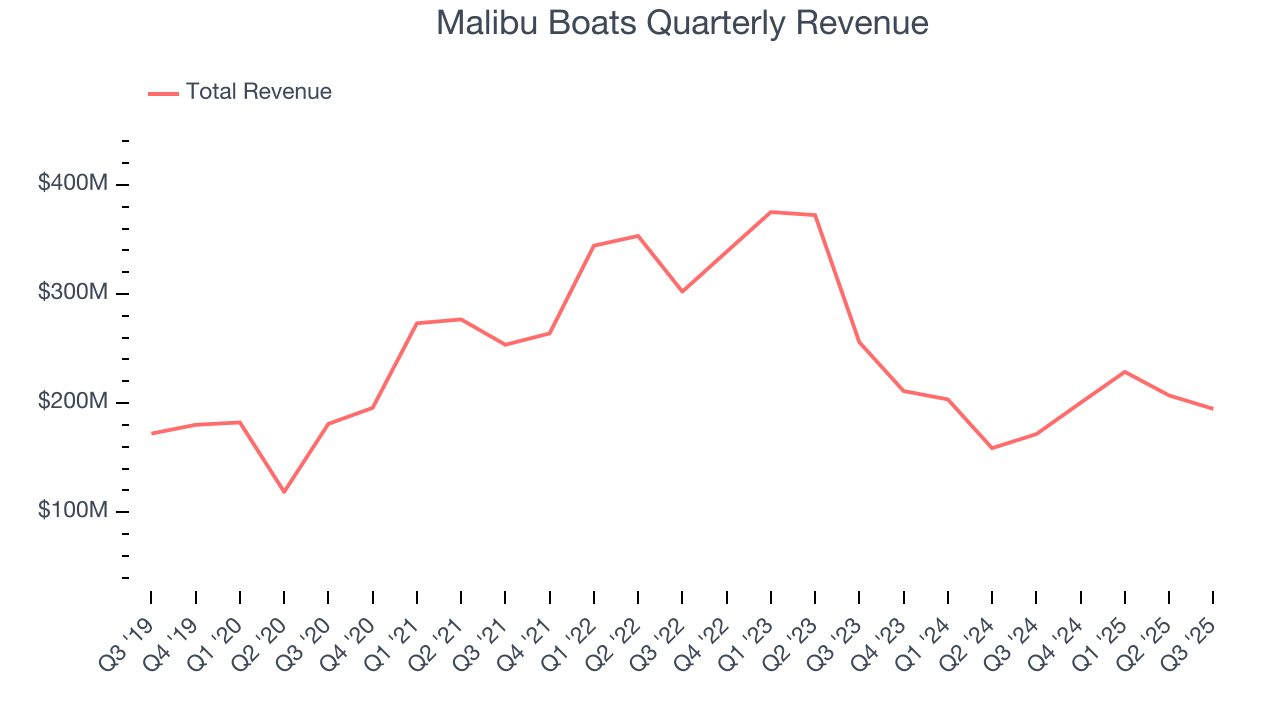

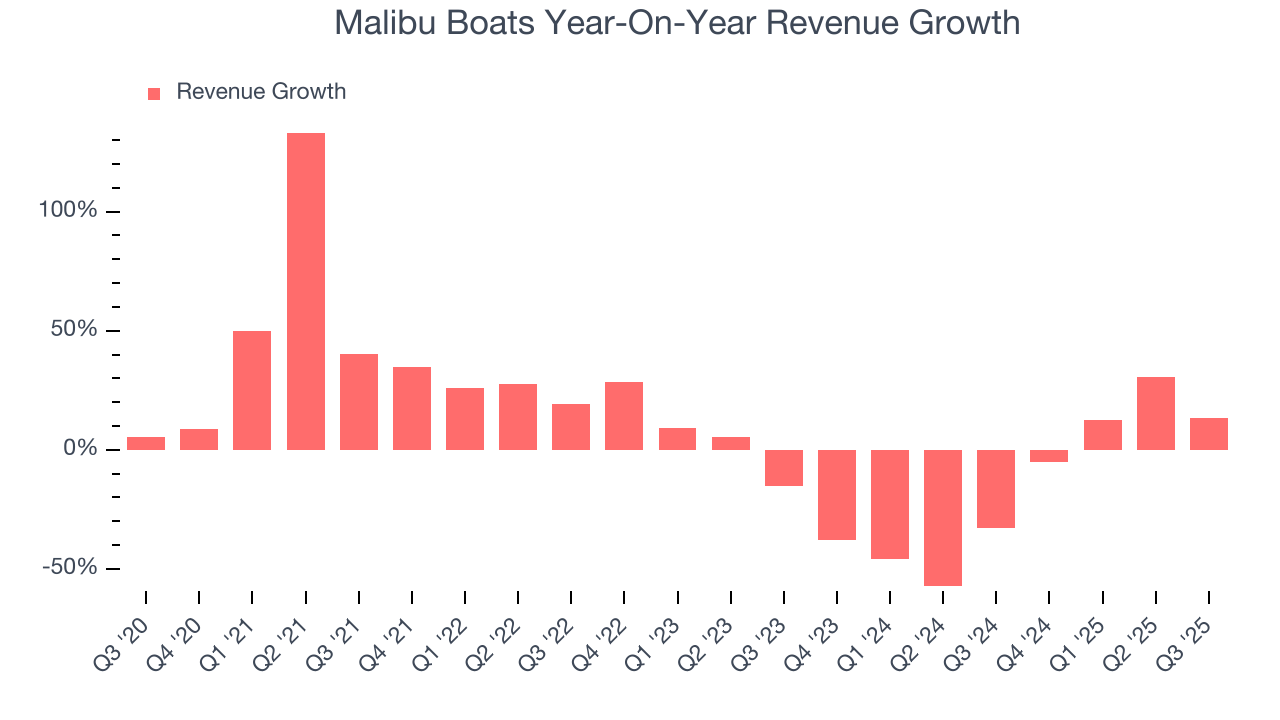

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Malibu Boats’s 4.6% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Malibu Boats’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 21.3% annually.

This quarter, Malibu Boats reported year-on-year revenue growth of 13.5%, and its $194.7 million of revenue exceeded Wall Street’s estimates by 4.3%.

Looking ahead, sell-side analysts expect revenue to decline by 2.7% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

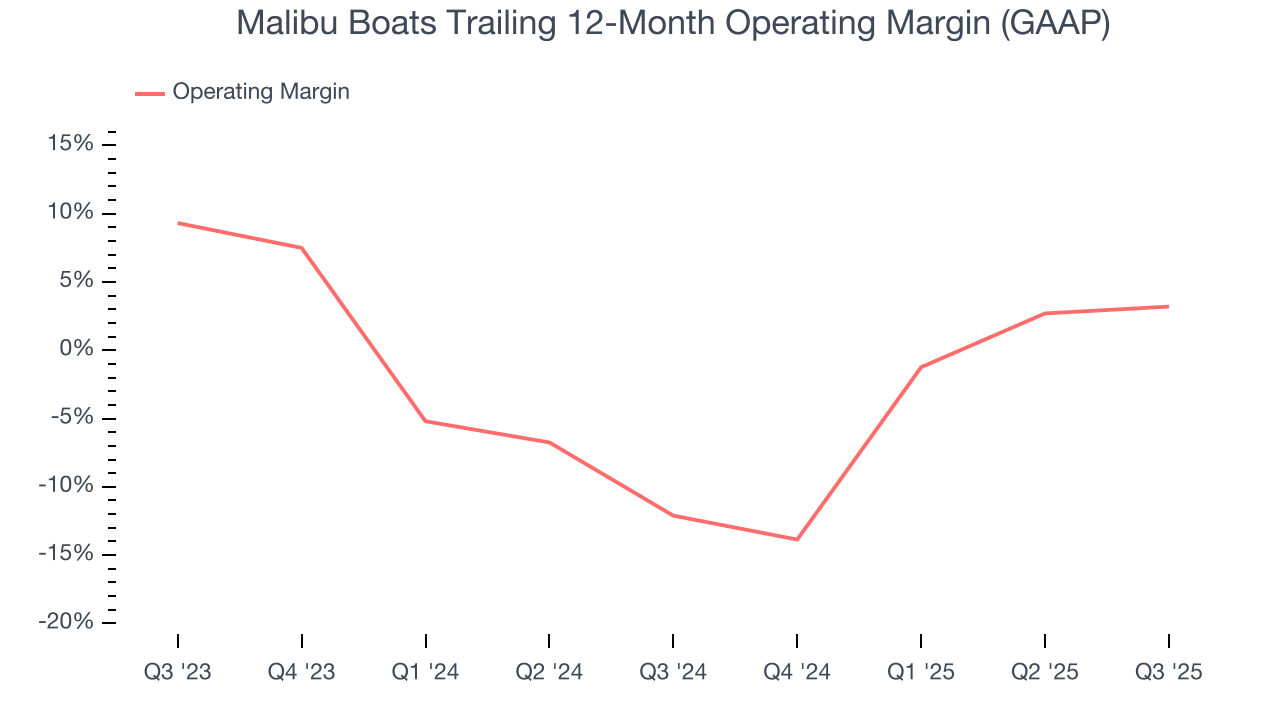

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Malibu Boats’s operating margin has risen over the last 12 months, but it still averaged negative 4% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q3, Malibu Boats generated a negative 0.4% operating margin. The company's consistent lack of profits raise a flag.

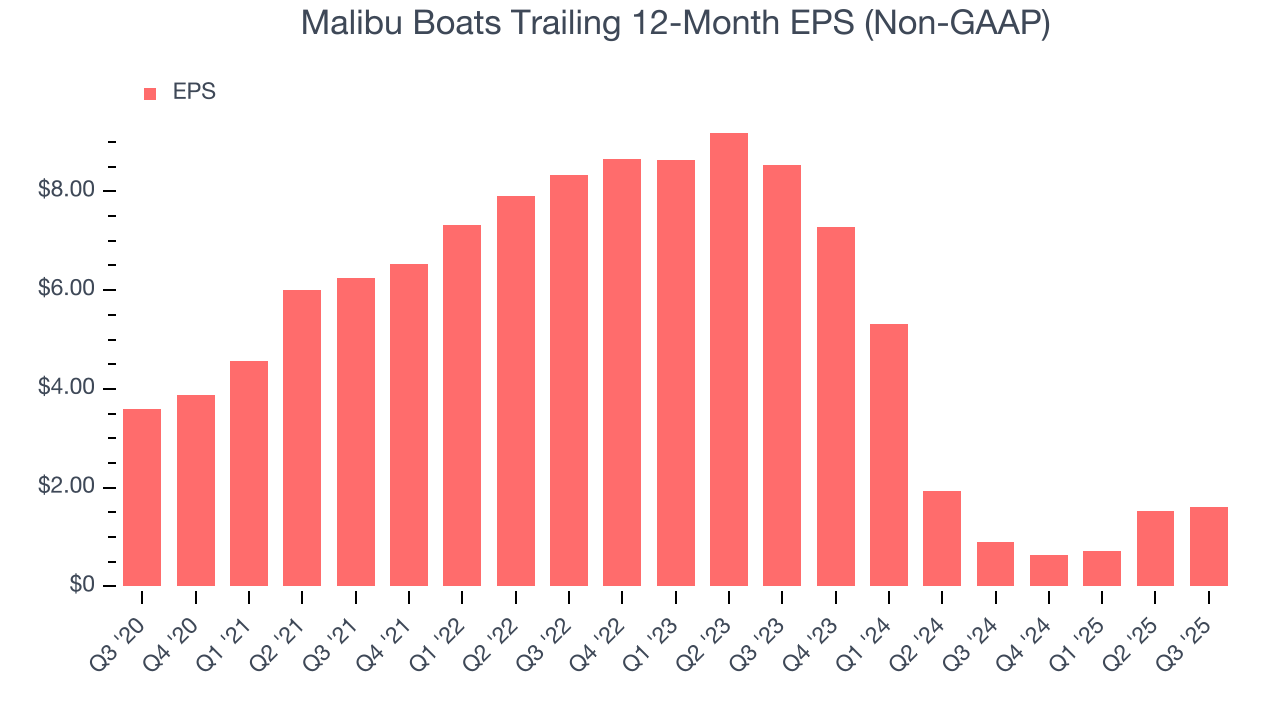

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Malibu Boats, its EPS declined by 14.9% annually over the last five years while its revenue grew by 4.6%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q3, Malibu Boats reported adjusted EPS of $0.15, up from $0.08 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Malibu Boats’s full-year EPS of $1.60 to shrink by 3.1%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

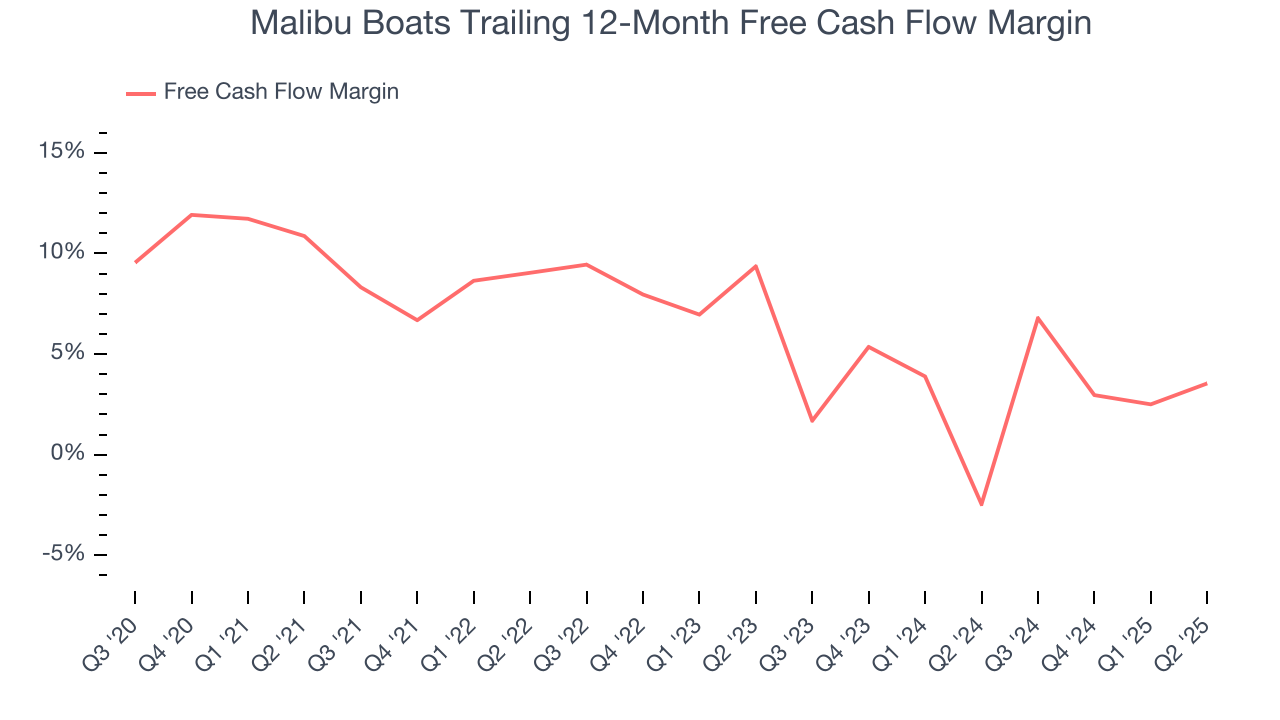

Malibu Boats has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7%, subpar for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

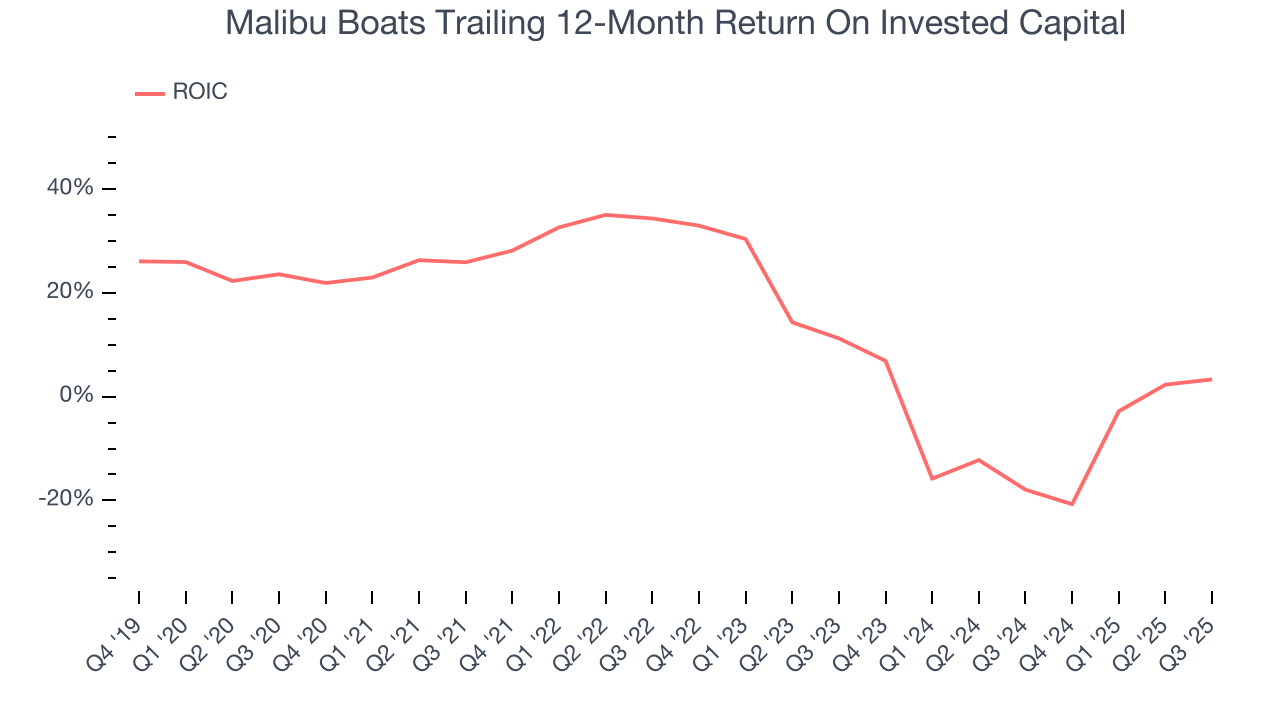

Malibu Boats historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.4%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Malibu Boats’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

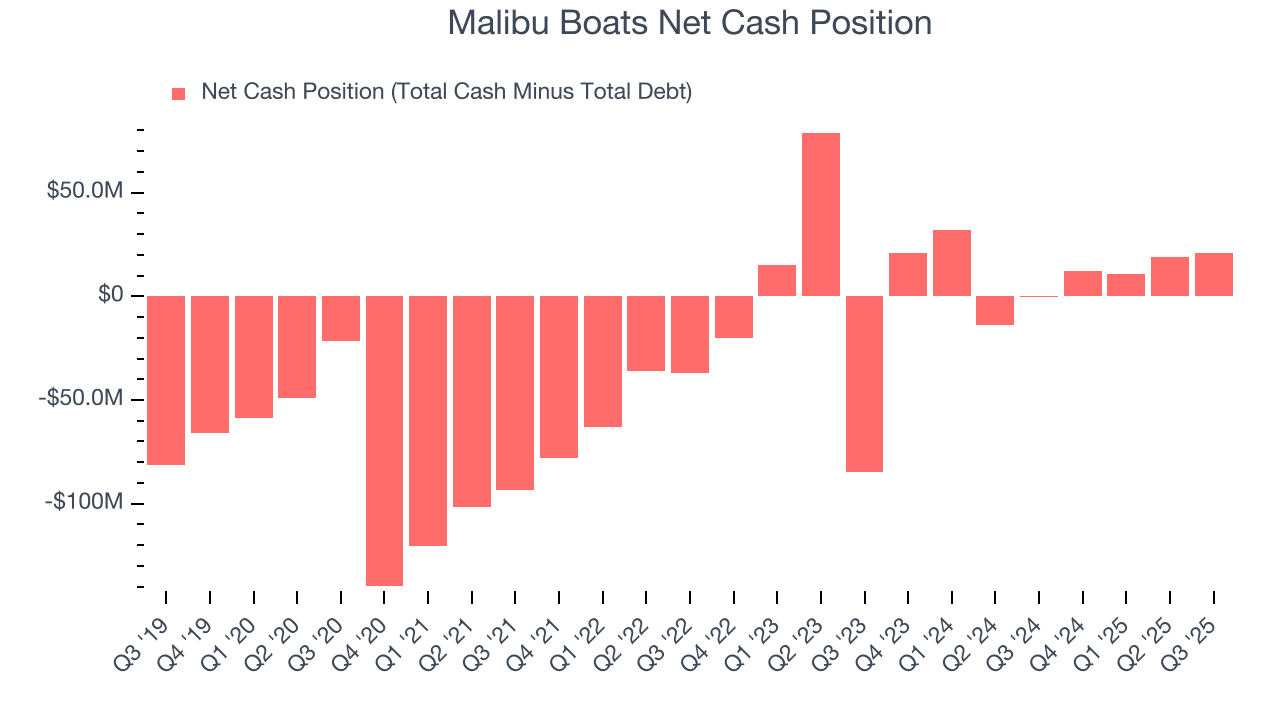

Malibu Boats is a profitable, well-capitalized company with $44.11 million of cash and $23 million of debt on its balance sheet. This $21.11 million net cash position is 3.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Malibu Boats’s Q3 Results

It was good to see Malibu Boats beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $32.57 immediately following the results.

12. Is Now The Time To Buy Malibu Boats?

Updated: February 3, 2026 at 10:17 PM EST

Before making an investment decision, investors should account for Malibu Boats’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Malibu Boats, we’ll be cheering from the sidelines. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Malibu Boats’s number of boats sold has disappointed, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

Malibu Boats’s P/E ratio based on the next 12 months is 24.5x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $34.83 on the company (compared to the current share price of $34.07).