Medpace (MEDP)

Medpace is interesting. Its revenue and EPS are soaring, showing it can grow quickly and become more profitable as it scales.― StockStory Analyst Team

1. News

2. Summary

Why Medpace Is Interesting

Founded in 1992 as a scientifically-driven alternative to traditional contract research organizations, Medpace (NASDAQ:MEDP) provides outsourced clinical trial management and research services to help pharmaceutical, biotechnology, and medical device companies develop new treatments.

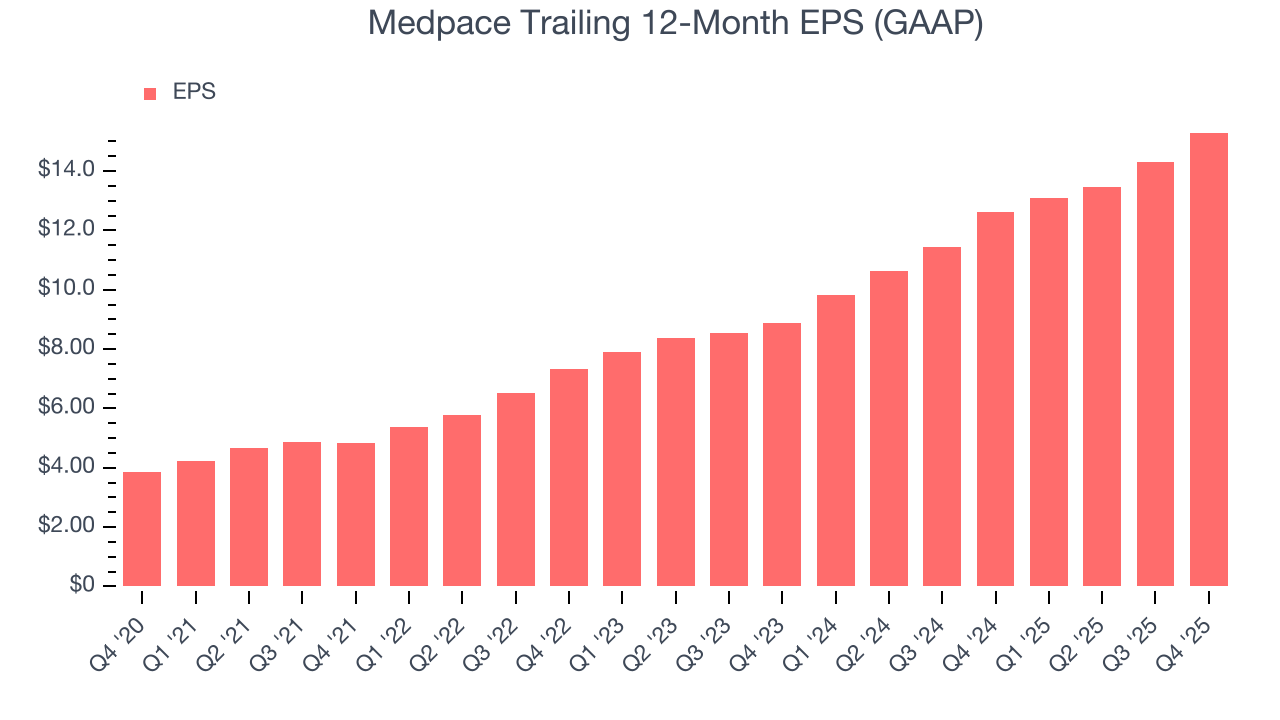

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 31.7% over the last five years outstripped its revenue performance

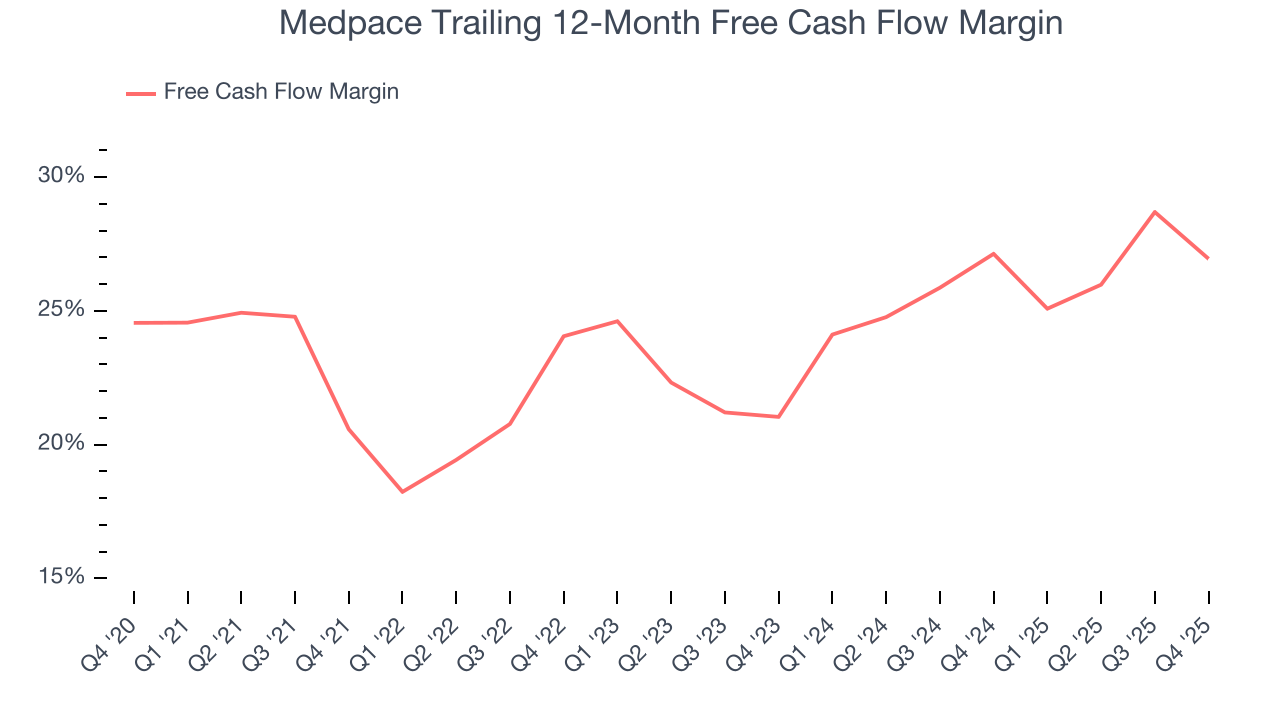

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends, and its growing cash flow gives it even more resources to deploy

- The stock is slightly expensive, and we suggest waiting until its quality rises or its valuation falls

Medpace shows some potential. The stock is up 209% over the last five years.

Why Should You Watch Medpace

High Quality

Investable

Underperform

Why Should You Watch Medpace

Medpace is trading at $510.64 per share, or 33.1x forward P/E. Medpace’s valuation is richer than that of other healthcare companies, on average.

If Medpace strings together a few solid quarters and proves it can be a high-quality company, we’d be more open to investing.

3. Medpace (MEDP) Research Report: Q4 CY2025 Update

Clinical research company Medpace Holdings (NASDAQ:MEDP) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 32% year on year to $708.5 million. The company expects the full year’s revenue to be around $2.81 billion, close to analysts’ estimates. Its GAAP profit of $4.67 per share was 11.4% above analysts’ consensus estimates.

Medpace (MEDP) Q4 CY2025 Highlights:

- Revenue: $708.5 million vs analyst estimates of $686.1 million (32% year-on-year growth, 3.3% beat)

- EPS (GAAP): $4.67 vs analyst estimates of $4.19 (11.4% beat)

- Adjusted EBITDA: $160.2 million vs analyst estimates of $154.2 million (22.6% margin, 3.9% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $17.09 at the midpoint, beating analyst estimates by 3.7%

- EBITDA guidance for the upcoming financial year 2026 is $620 million at the midpoint, above analyst estimates of $604 million

- Operating Margin: 21.6%, down from 23.4% in the same quarter last year

- Free Cash Flow Margin: 26.6%, down from 34.1% in the same quarter last year

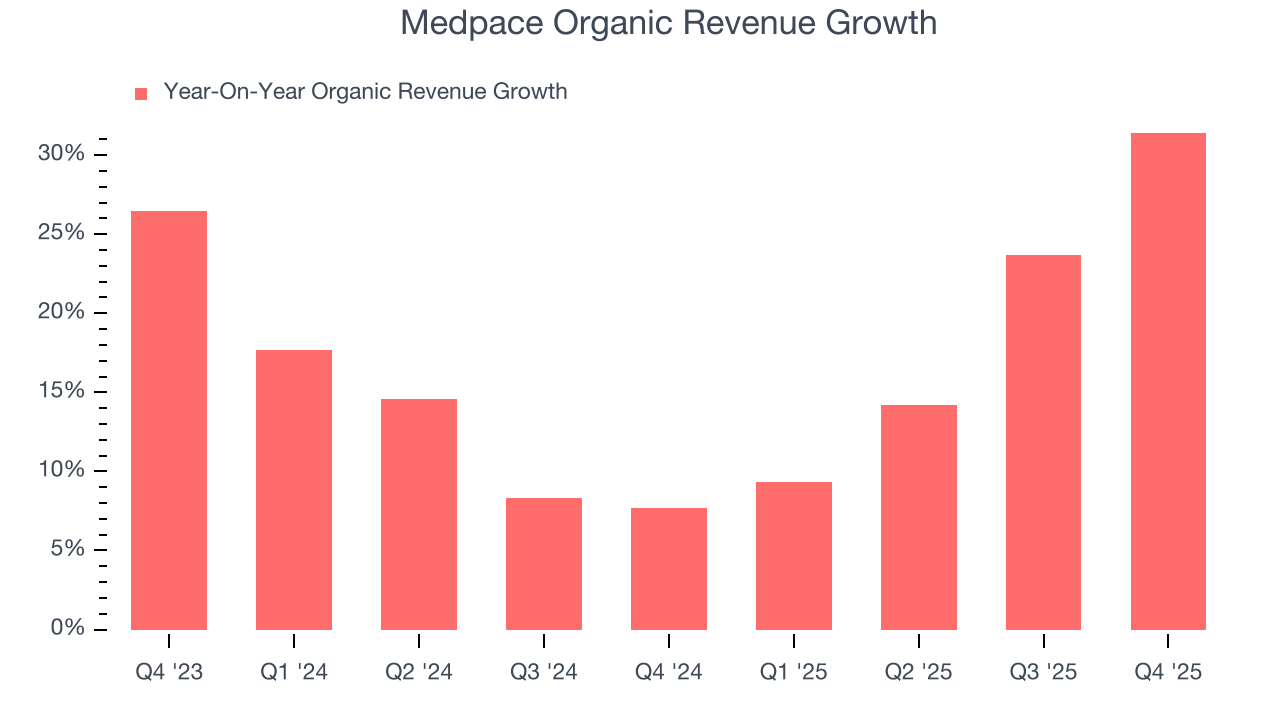

- Organic Revenue rose 31.4% year on year (beat)

- Market Capitalization: $15.27 billion

Company Overview

Founded in 1992 as a scientifically-driven alternative to traditional contract research organizations, Medpace (NASDAQ:MEDP) provides outsourced clinical trial management and research services to help pharmaceutical, biotechnology, and medical device companies develop new treatments.

Medpace specializes in managing the complex process of bringing new medical treatments from laboratory testing to market approval. The company offers end-to-end services covering all phases of clinical development (Phase I through IV), with particular expertise in designing and executing challenging trials that require specialized medical and scientific knowledge.

The company's services include study design, regulatory guidance, patient recruitment, clinical monitoring, data management, biostatistics, laboratory testing, and safety reporting. What sets Medpace apart is its physician-led approach, where therapeutic experts provide strategic direction for clinical trials and work directly with investigators and regulatory agencies. This medical leadership is integrated throughout the entire clinical development process.

For example, a small biotechnology company developing a novel cancer treatment might engage Medpace to design their clinical trial protocol, identify appropriate research sites, recruit qualified patients, monitor the study's progress, analyze the resulting data, and prepare regulatory submissions—all while ensuring compliance with complex international regulations.

Medpace generates revenue through contracts with pharmaceutical, biotechnology, and medical device companies of all sizes. These clients range from small startups developing their first product to global pharmaceutical giants running multiple concurrent trials. The company operates globally with facilities across North America, Europe, and Asia-Pacific regions, allowing it to conduct multinational clinical trials.

The company's proprietary technology platform, ClinTrak, serves as an integrated information management system that enables real-time tracking of all aspects of a clinical trial, from patient recruitment to data collection and analysis. This technology infrastructure helps Medpace deliver consistent quality across its worldwide operations while maintaining regulatory compliance in different jurisdictions.

4. Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

Medpace competes with larger clinical research organizations including IQVIA Holdings (NYSE:IQV), ICON plc (NASDAQ:ICLR), Fortrea (NASDAQ:FTRE), and the clinical research division of Thermo Fisher Scientific (NYSE:TMO) which acquired PPD, Inc.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $2.53 billion in revenue over the past 12 months, Medpace has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

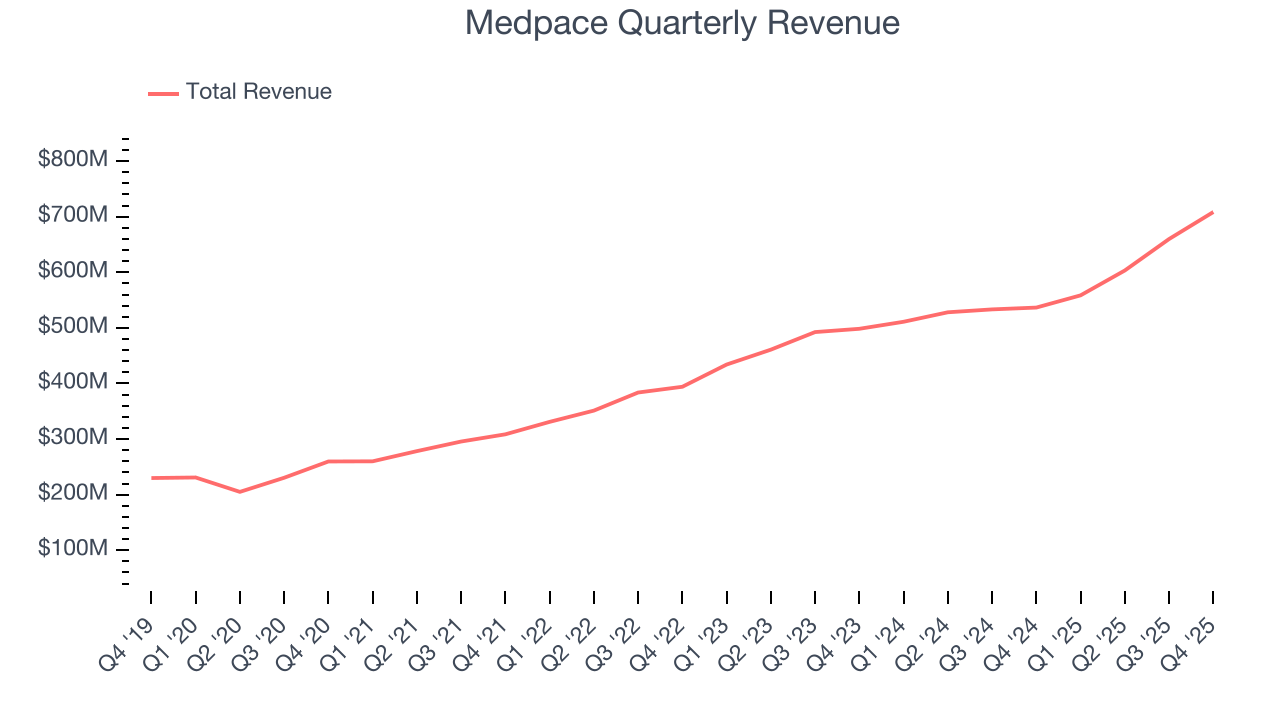

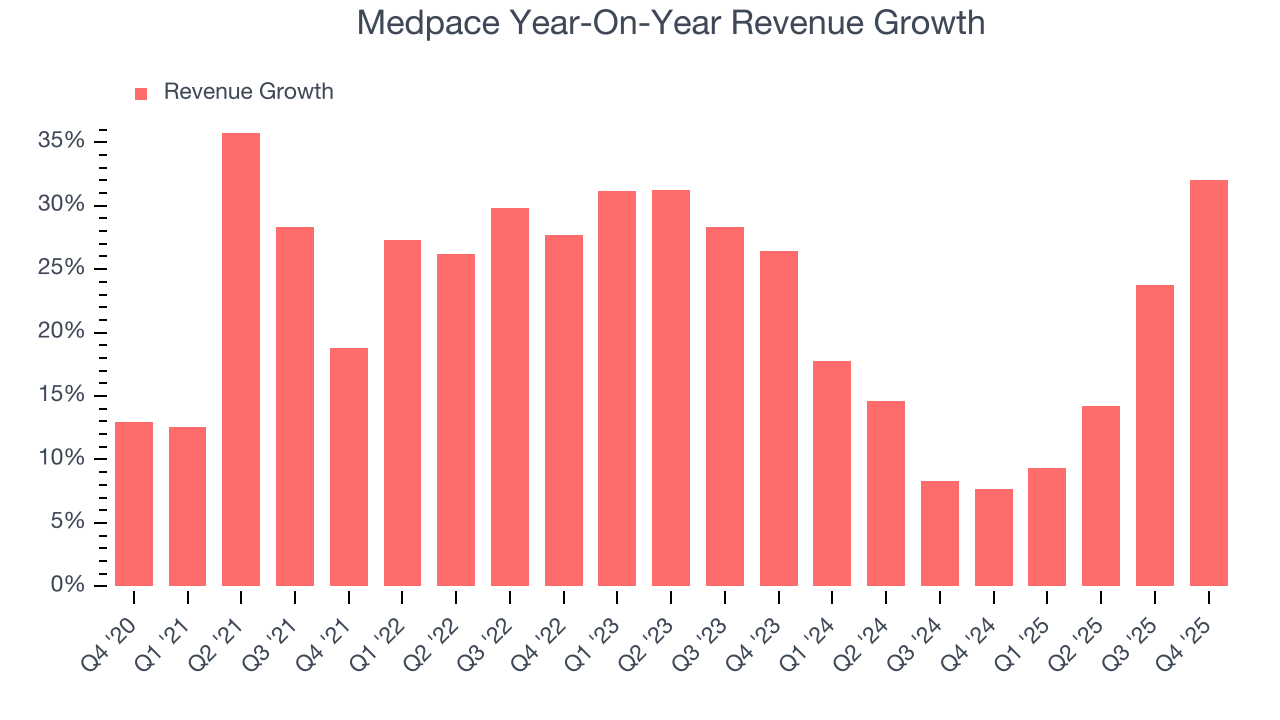

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Medpace’s 22.3% annualized revenue growth over the last five years was excellent. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Medpace’s annualized revenue growth of 15.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Medpace’s organic revenue averaged 15.9% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Medpace reported wonderful year-on-year revenue growth of 32%, and its $708.5 million of revenue exceeded Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to grow 10.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and implies the market sees success for its products and services.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

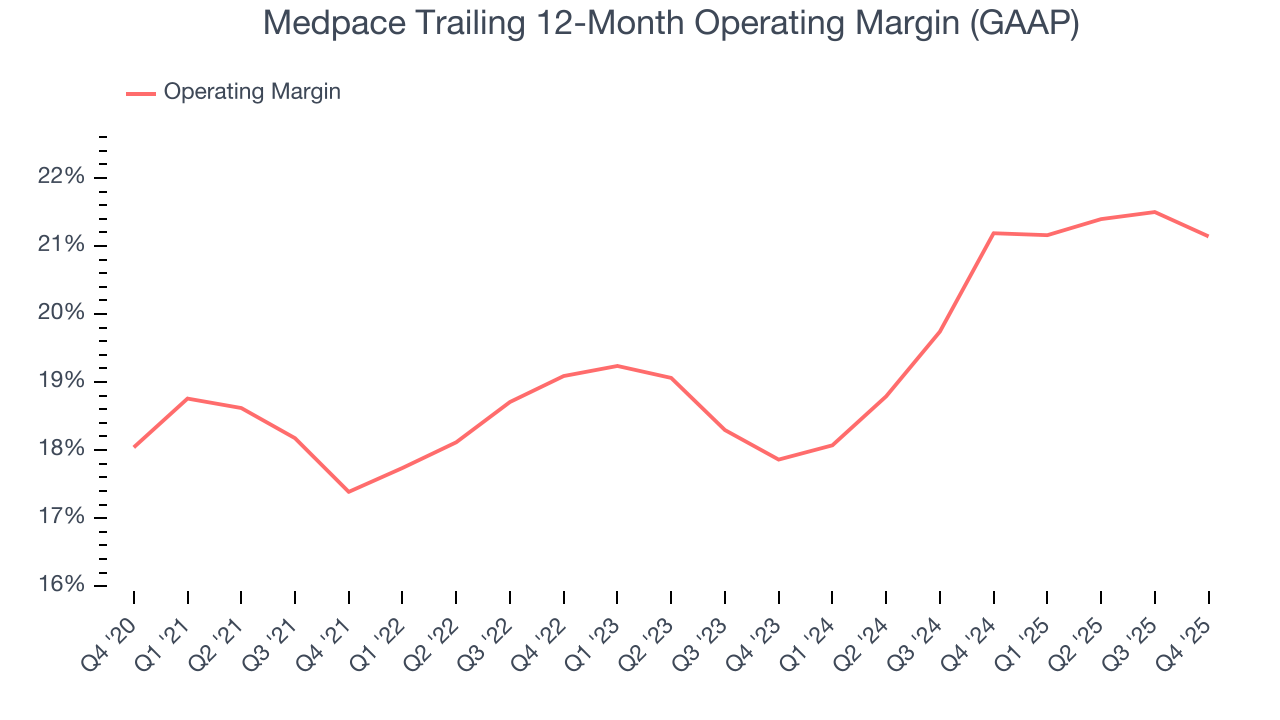

Medpace has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 19.7%.

Looking at the trend in its profitability, Medpace’s operating margin rose by 3.8 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements. These data points are very encouraging and show momentum is on its side.

This quarter, Medpace generated an operating margin profit margin of 21.6%, down 1.7 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Medpace’s EPS grew at an astounding 31.7% compounded annual growth rate over the last five years, higher than its 22.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

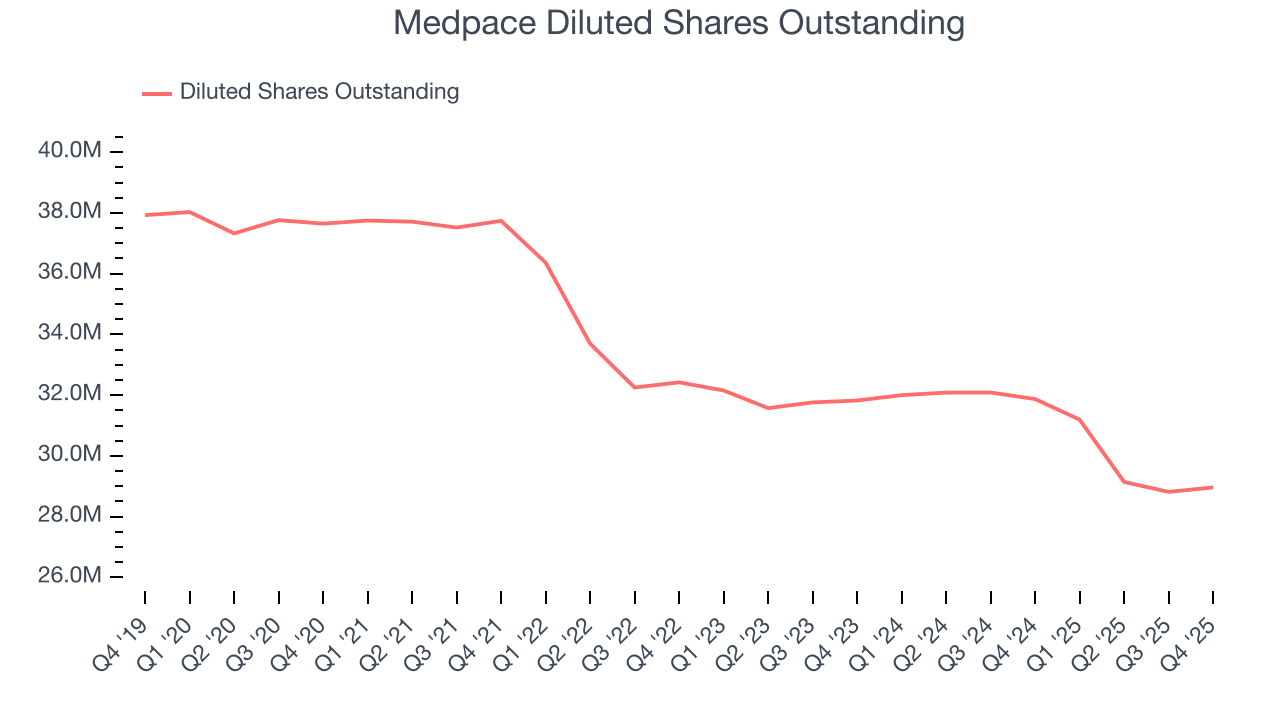

We can take a deeper look into Medpace’s earnings to better understand the drivers of its performance. As we mentioned earlier, Medpace’s operating margin declined this quarter but expanded by 3.8 percentage points over the last five years. Its share count also shrank by 23.1%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Medpace reported EPS of $4.67, up from $3.67 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Medpace’s full-year EPS of $15.30 to grow 9.5%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Medpace has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 24.5% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Medpace’s margin expanded by 6.4 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Medpace’s free cash flow clocked in at $188.1 million in Q4, equivalent to a 26.6% margin. The company’s cash profitability regressed as it was 7.6 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

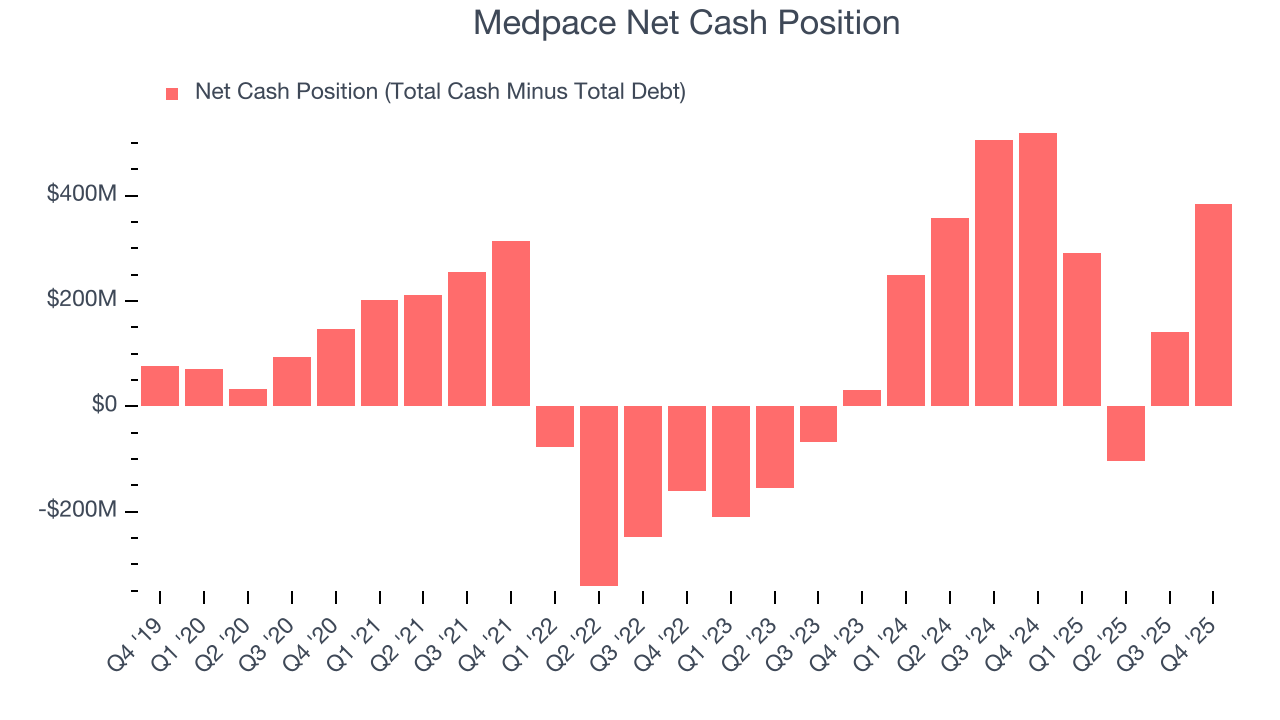

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Medpace is a profitable, well-capitalized company with $497 million of cash and $113.6 million of debt on its balance sheet. This $383.4 million net cash position is 2.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Medpace’s Q4 Results

We were impressed by how significantly Medpace blew past analysts’ organic revenue expectations this quarter. We were also glad its full-year EPS guidance outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. Investors were likely hoping for more, and shares traded down 3.6% to $512.14 immediately after reporting.

12. Is Now The Time To Buy Medpace?

Updated: February 10, 2026 at 11:06 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Medpace.

Medpace possesses a number of positive attributes. First off, its revenue growth was impressive over the last five years. On top of that, Medpace’s rising cash profitability gives it more optionality, and its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Medpace’s P/E ratio based on the next 12 months is 31x. At this valuation, there’s a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $507.67 on the company (compared to the current share price of $447.49).