MGP Ingredients (MGPI)

MGP Ingredients keeps us up at night. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think MGP Ingredients Will Underperform

Headquartered in Atchison, Kansas, MGP Ingredients (NASDAQ:MGPI) is a leading supplier of high-quality ingredients to the food and beverage industry

- Annual sales declines of 11.8% for the past three years show its products struggled to connect with the market

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

- Earnings per share have contracted by 17% annually over the last three years, a headwind for returns as stock prices often echo long-term EPS performance

MGP Ingredients doesn’t live up to our standards. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than MGP Ingredients

High Quality

Investable

Underperform

Why There Are Better Opportunities Than MGP Ingredients

MGP Ingredients is trading at $20.41 per share, or 10.5x forward P/E. This multiple is lower than most consumer staples companies, but for good reason.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. MGP Ingredients (MGPI) Research Report: Q4 CY2025 Update

Food and beverage supplier MGP Ingredients (NASDAQ:MGPI) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, but sales fell by 23.5% year on year to $138.3 million. On the other hand, the company’s full-year revenue guidance of $490 million at the midpoint came in 4.1% below analysts’ estimates. Its non-GAAP profit of $0.63 per share was 26% above analysts’ consensus estimates.

MGP Ingredients (MGPI) Q4 CY2025 Highlights:

- Revenue: $138.3 million vs analyst estimates of $134.2 million (23.5% year-on-year decline, 3.1% beat)

- Adjusted EPS: $0.63 vs analyst estimates of $0.50 (26% beat)

- Adjusted EBITDA: $26.1 million vs analyst estimates of $23.01 million (18.9% margin, 13.5% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.65 at the midpoint, missing analyst estimates by 32.4%

- EBITDA guidance for the upcoming financial year 2026 is $94 million at the midpoint, below analyst estimates of $105.7 million

- Operating Margin: -97.7%, down from -16.8% in the same quarter last year

- Free Cash Flow Margin: 17.5%, up from 5.8% in the same quarter last year

- Market Capitalization: $549.6 million

Company Overview

Headquartered in Atchison, Kansas, MGP Ingredients (NASDAQ:MGPI) is a leading supplier of high-quality ingredients to the food and beverage industry

Since its founding in 1941, MGP Ingredients’s bread and butter has been in the production of premium distilled spirits, including whiskey, bourbon, gin, and vodka. In addition to producing bulk spirits, the company has a portfolio of award-winning premium beverage brands such as Eight & Sand Blended Bourbon and George Remus Bourbon.

Given its expertise in the grain industry, MGP Ingredients is also a producer of specialty wheat proteins and starches. Its ingredients have critical applications in various industries like food and beverage, pet food, personal care, and pharmaceuticals.

The company sells its products to a global base of customers, placing a strong emphasis on understanding and meeting their unique needs. Its close collaboration with clients to develop tailored solutions builds trust and ensures a seamless sales process.

MGP Ingredients is also deeply committed to innovation and continuously improving its production process. The company invests in industrial technology and has rigorous quality assurance protocols to ensure that all products meet or exceed industry standards.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors selling distilled spirits include Brown-Forman (NYSE:BF.B) and Diageo (NYSE:DEO) while those selling specialty ingredients include Ingredion (NYSE:INGR) and private company Cargill.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $536.4 million in revenue over the past 12 months, MGP Ingredients is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, MGP Ingredients struggled to generate demand over the last three years. Its sales dropped by 11.8% annually, a poor baseline for our analysis.

This quarter, MGP Ingredients’s revenue fell by 23.5% year on year to $138.3 million but beat Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to decline by 4.4% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

MGP Ingredients has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 39.2% gross margin over the last two years. That means for every $100 in revenue, $60.83 went towards paying for raw materials, production of goods, transportation, and distribution.

MGP Ingredients produced a 34.9% gross profit margin in Q4 , marking a 6.3 percentage point decrease from 41.2% in the same quarter last year. MGP Ingredients’s full-year margin has also been trending down over the past 12 months, decreasing by 3.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

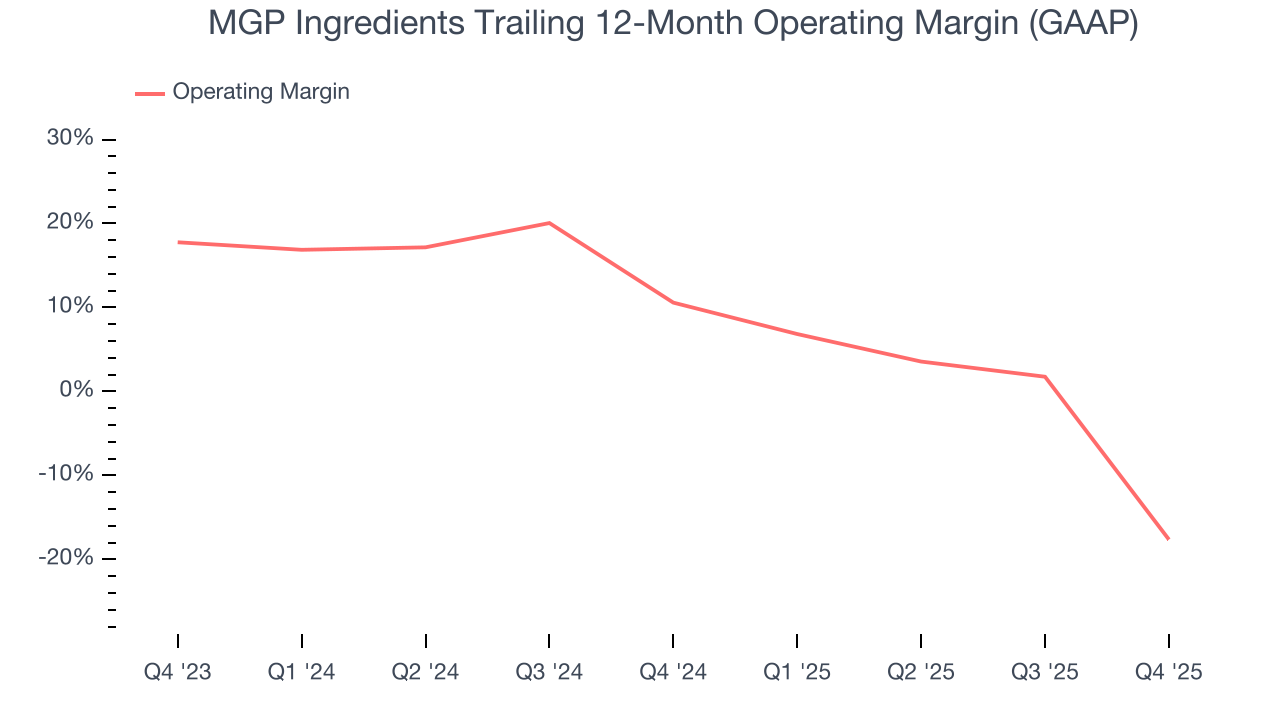

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, MGP Ingredients was one of them over the last two years as its high expenses contributed to an average operating margin of negative 1.6%.

Looking at the trend in its profitability, MGP Ingredients’s operating margin decreased by 28.2 percentage points over the last year. MGP Ingredients’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, MGP Ingredients generated a negative 97.7% operating margin. The company's consistent lack of profits raise a flag.

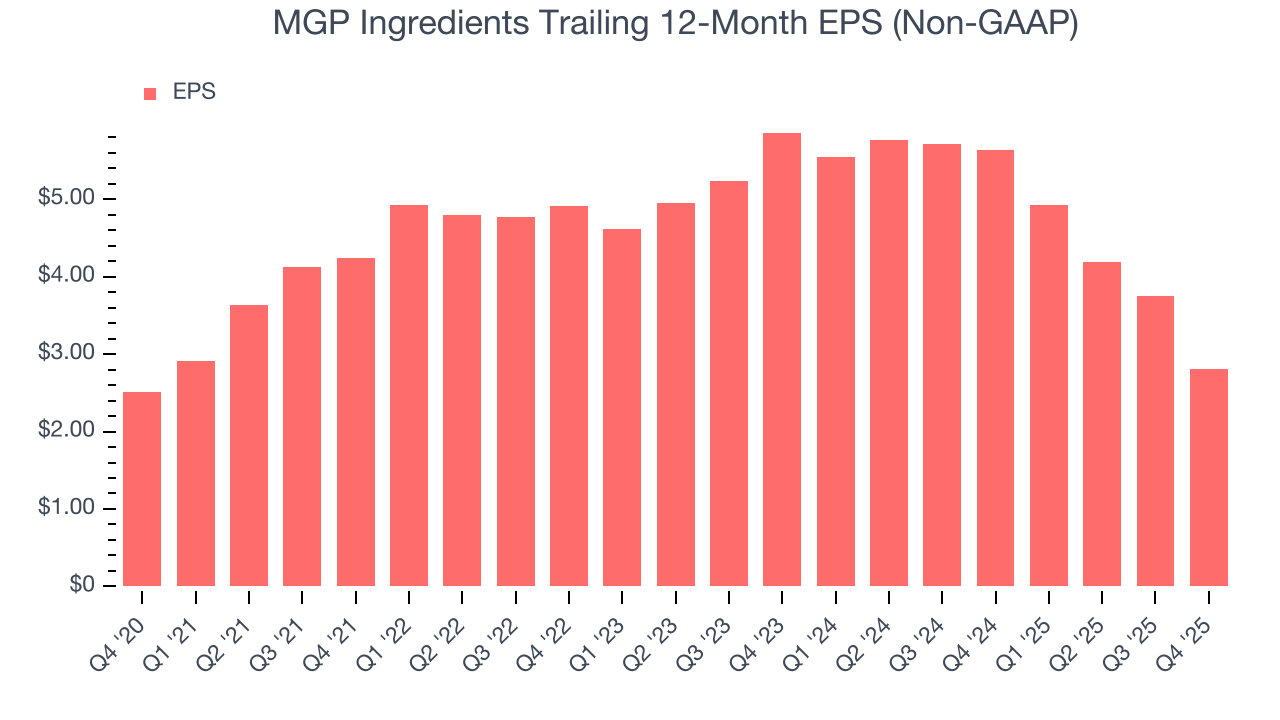

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for MGP Ingredients, its EPS declined by 17% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, MGP Ingredients reported adjusted EPS of $0.63, down from $1.57 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects MGP Ingredients’s full-year EPS of $2.81 to shrink by 8.4%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

MGP Ingredients has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.6% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that MGP Ingredients’s margin expanded by 9.8 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

MGP Ingredients’s free cash flow clocked in at $24.27 million in Q4, equivalent to a 17.5% margin. This result was good as its margin was 11.8 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

MGP Ingredients historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.9%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

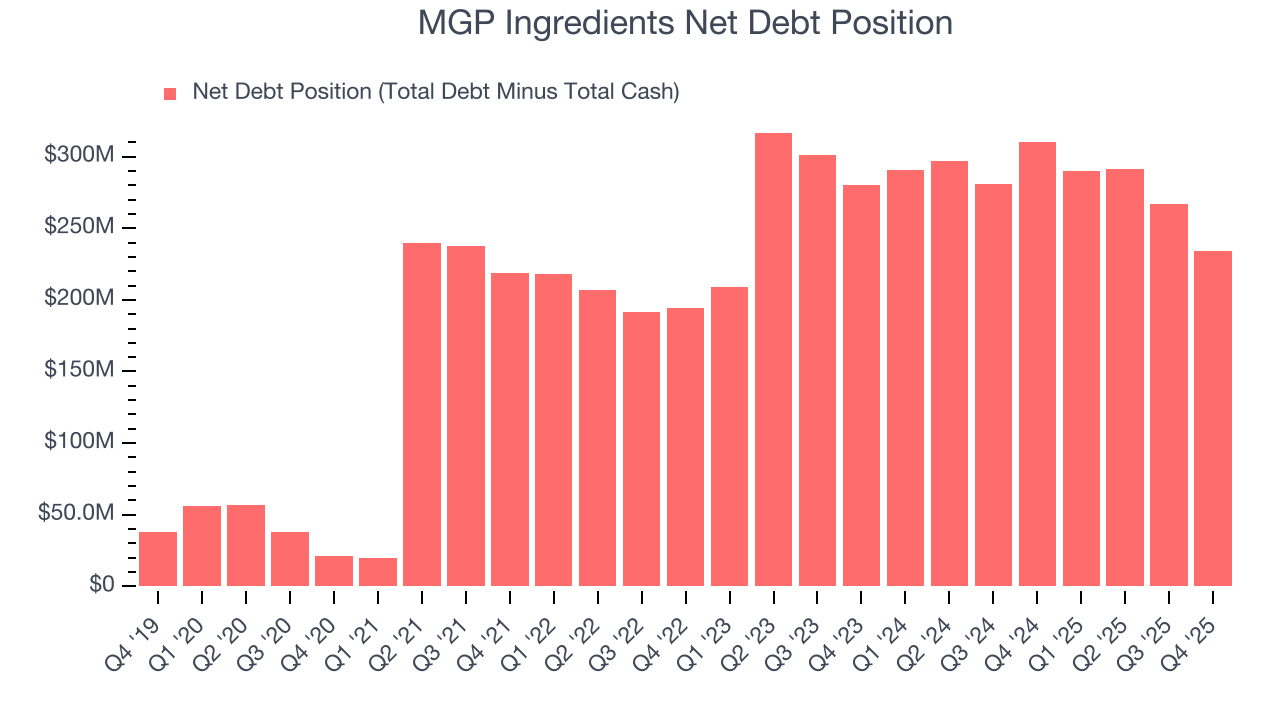

11. Balance Sheet Assessment

MGP Ingredients reported $18.46 million of cash and $252.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $116 million of EBITDA over the last 12 months, we view MGP Ingredients’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $7.04 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from MGP Ingredients’s Q4 Results

We were impressed by how significantly MGP Ingredients blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 11.5% to $22.85 immediately after reporting.

13. Is Now The Time To Buy MGP Ingredients?

Updated: February 26, 2026 at 10:02 PM EST

When considering an investment in MGP Ingredients, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of MGP Ingredients, we’ll be cheering from the sidelines. To begin with, its revenue has declined over the last three years. While its rising cash profitability gives it more optionality, the downside is its declining operating margin shows the business has become less efficient. On top of that, its declining EPS over the last three years makes it a less attractive asset to the public markets.

MGP Ingredients’s EV-to-EBITDA ratio based on the next 12 months is 7.1x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now.