MarketAxess (MKTX)

We aren’t fans of MarketAxess. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think MarketAxess Will Underperform

Pioneering the shift from phone-based to electronic bond trading since 2000, MarketAxess (NASDAQ:MKTX) operates electronic trading platforms that enable institutional investors and broker-dealers to efficiently trade fixed-income securities like corporate and government bonds.

- Earnings per share were flat over the last five years while its revenue grew, showing its incremental sales were less profitable

- Annual revenue growth of 5.3% over the last five years was below our standards for the financials sector

- A consolation is that its stellar return on equity showcases management’s ability to surface highly profitable business ventures

MarketAxess doesn’t meet our quality criteria. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than MarketAxess

High Quality

Investable

Underperform

Why There Are Better Opportunities Than MarketAxess

At $162.82 per share, MarketAxess trades at 20.7x forward P/E. Not only does MarketAxess trade at a premium to companies in the financials space, but this multiple is also high for its top-line growth.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. MarketAxess (MKTX) Research Report: Q4 CY2025 Update

Electronic bond trading platform MarketAxess (NASDAQ:MKTX) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 3.5% year on year to $209.4 million. Its non-GAAP profit of $1.68 per share was 2.4% above analysts’ consensus estimates.

MarketAxess (MKTX) Q4 CY2025 Highlights:

- Revenue: $209.4 million vs analyst estimates of $211.2 million (3.5% year-on-year growth, 0.9% miss)

- Pre-tax Profit: $79.79 million (38.1% margin)

- Adjusted EPS: $1.68 vs analyst estimates of $1.64 (2.4% beat)

- Market Capitalization: $6.05 billion

Company Overview

Pioneering the shift from phone-based to electronic bond trading since 2000, MarketAxess (NASDAQ:MKTX) operates electronic trading platforms that enable institutional investors and broker-dealers to efficiently trade fixed-income securities like corporate and government bonds.

MarketAxess serves as a critical infrastructure provider in the traditionally fragmented bond markets, where its technology helps overcome the historical challenges of finding liquidity and price transparency. The company's platforms support trading across multiple fixed-income categories including U.S. high-grade corporate bonds, high-yield bonds, emerging market debt, municipal bonds, and U.S. government securities.

At the core of MarketAxess's offering is its Open Trading marketplace, an all-to-all trading solution that allows any participant to interact anonymously with potential counterparties. This creates a deeper liquidity pool than traditional dealer-to-client models, where investors were limited to trading with their established banking relationships. A portfolio manager at a pension fund, for example, might use MarketAxess to simultaneously request quotes from multiple dealers for a basket of corporate bonds, comparing prices to achieve best execution.

The company generates revenue primarily through commissions on transactions executed through its platforms. It also offers data products like CP+, which provides real-time bond pricing, and post-trade services that help clients with regulatory reporting requirements in various jurisdictions. MarketAxess has been expanding its automated trading capabilities, including AI-driven execution algorithms that help traders determine optimal trade timing, size, and counterparty selection.

With operations across the Americas, Europe, and Asia-Pacific, MarketAxess has positioned itself as a global electronic marketplace. The company continues to innovate with new trading protocols and data solutions while expanding into additional fixed-income products and geographies.

4. Financial Exchanges & Data

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

MarketAxess competes with Tradeweb (NASDAQ:TW) and Bloomberg in the electronic fixed-income trading space. Other competitors include Intercontinental Exchange (NYSE:ICE), Trumid, and CME Group (NASDAQ:CME) in various segments of the bond and rates markets.

5. Revenue Growth

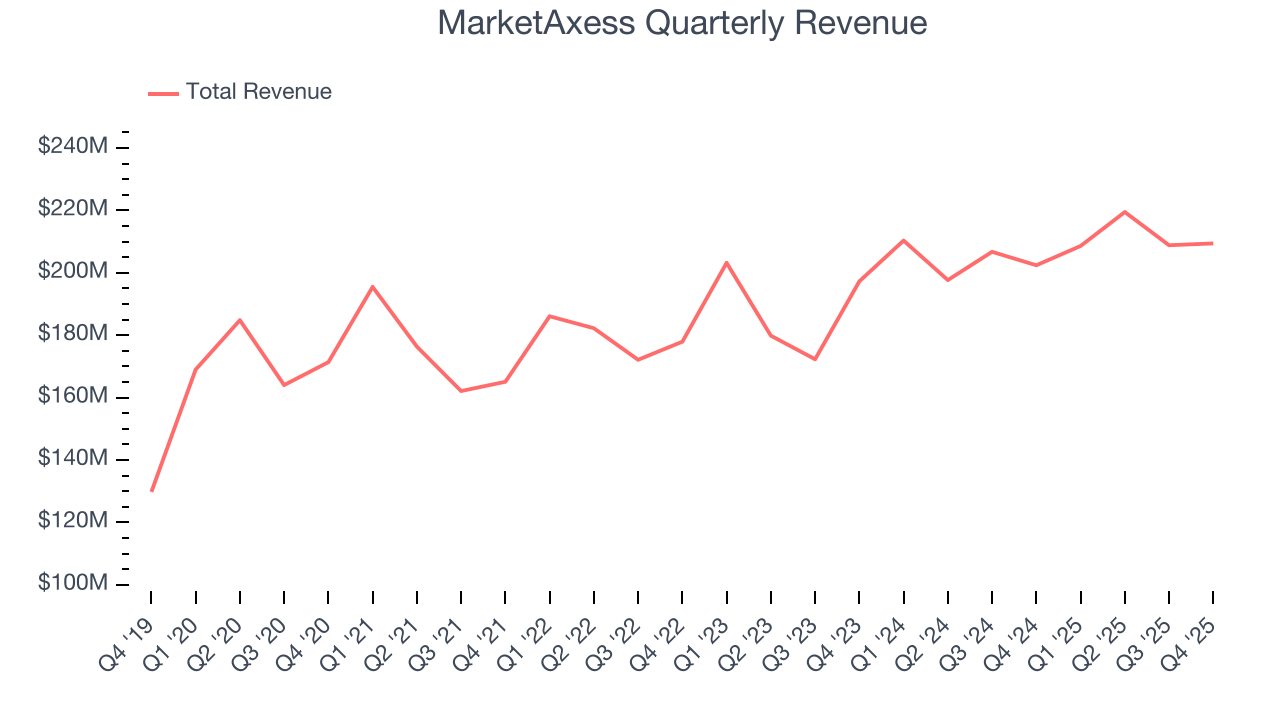

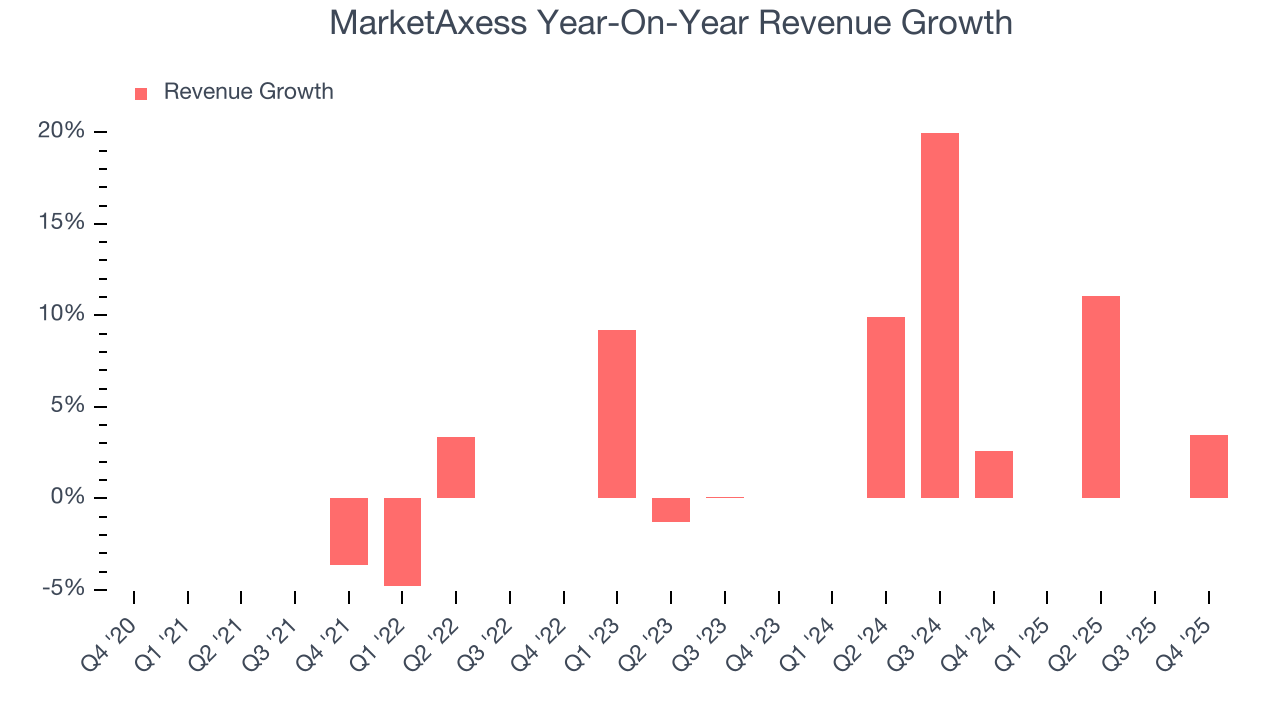

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, MarketAxess’s revenue grew at a sluggish 4.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the financials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. MarketAxess’s annualized revenue growth of 6% over the last two years is above its five-year trend, but we were still disappointed by the results.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, MarketAxess’s revenue grew by 3.5% year on year to $209.4 million, falling short of Wall Street’s estimates.

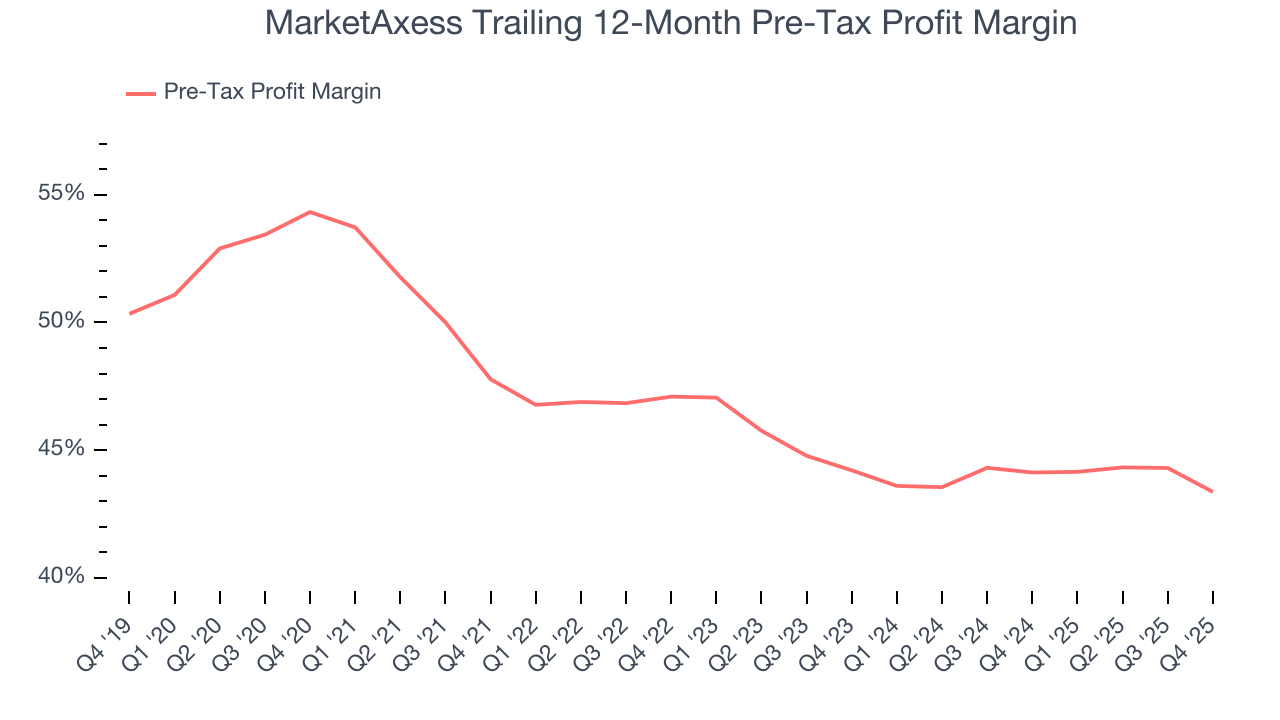

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Financial Exchanges & Data companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, MarketAxess’s pre-tax profit margin has risen by 11 percentage points, going from 47.8% to 43.4%. Expenses have stabilized more recently as the company’s pre-tax profit margin was flat on a two-year basis.

MarketAxess’s pre-tax profit margin came in at 38.1% this quarter. This result was 3.7 percentage points worse than the same quarter last year.

7. Earnings Per Share

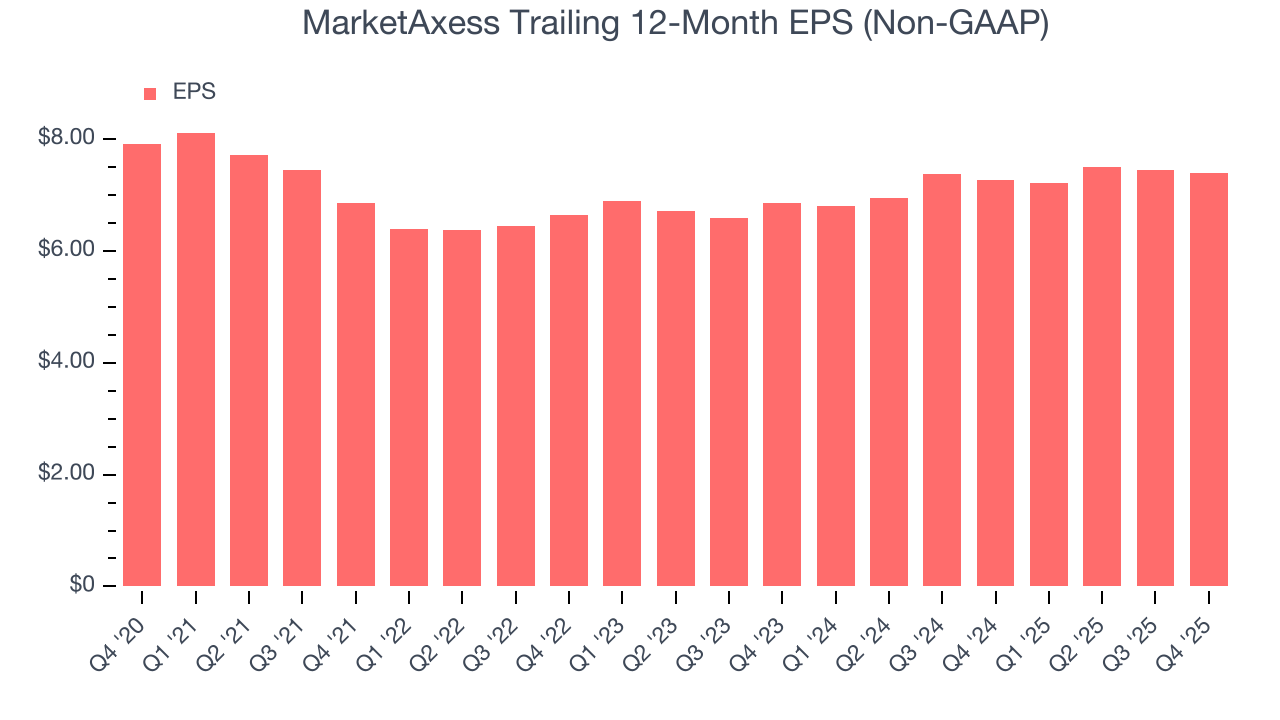

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for MarketAxess, its EPS declined by 1.3% annually over the last five years while its revenue grew by 4.2%. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For MarketAxess, its two-year annual EPS growth of 3.9% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, MarketAxess reported adjusted EPS of $1.68, down from $1.73 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.4%. Over the next 12 months, Wall Street expects MarketAxess’s full-year EPS of $7.39 to grow 10.5%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, MarketAxess has averaged an ROE of 21.8%, excellent for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for MarketAxess.

9. Balance Sheet Assessment

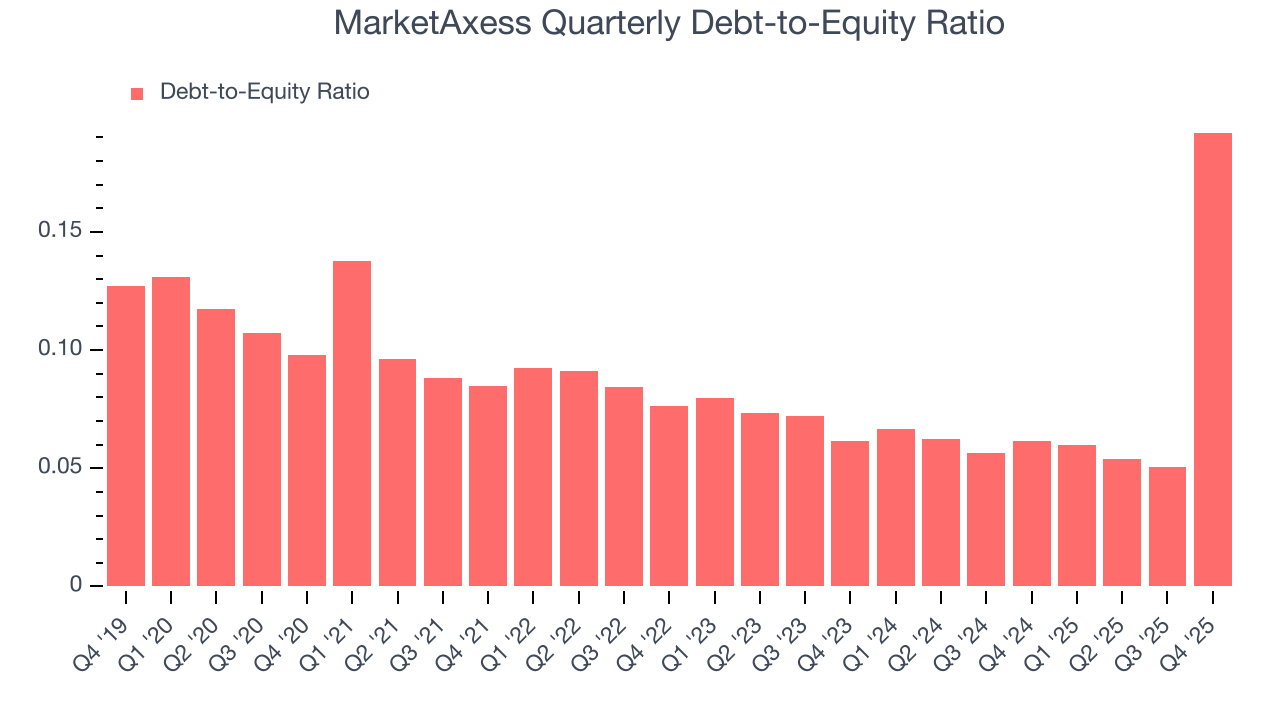

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

MarketAxess currently has $220 million of debt and $1.15 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from MarketAxess’s Q4 Results

It was good to see MarketAxess beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, this quarter could have been better. The stock remained flat at $162.82 immediately following the results.

11. Is Now The Time To Buy MarketAxess?

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies supporting the economy, but in the case of MarketAxess, we’ll be cheering from the sidelines. To kick things off, its revenue growth was uninspiring over the last five years. And while its stellar ROE suggests it has been a well-run company historically, the downside is its declining pre-tax profit margin shows the business has become less efficient. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

MarketAxess’s P/E ratio based on the next 12 months is 19.9x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $196.10 on the company (compared to the current share price of $162.82).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.