Monro (MNRO)

Monro keeps us up at night. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Monro Will Underperform

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

- Store closures and poor same-store sales reveal weak demand and a push toward operational efficiency

- Below-average returns on capital indicate management struggled to find compelling investment opportunities, and its decreasing returns suggest its historical profit centers are aging

- Smaller revenue base of $1.19 billion means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

Monro’s quality doesn’t meet our hurdle. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Monro

Why There Are Better Opportunities Than Monro

At $19.30 per share, Monro trades at 36.9x forward P/E. This multiple is quite expensive for the quality you get.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Monro (MNRO) Research Report: Q4 CY2025 Update

Auto services provider Monro (NASDAQ:MNRO) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 4% year on year to $293.4 million. Its non-GAAP profit of $0.16 per share was 17.6% above analysts’ consensus estimates.

Monro (MNRO) Q4 CY2025 Highlights:

- Revenue: $293.4 million vs analyst estimates of $295.2 million (4% year-on-year decline, 0.6% miss)

- Adjusted EPS: $0.16 vs analyst estimates of $0.14 (17.6% beat)

- Operating Margin: 6.3%, up from 3.3% in the same quarter last year

- Locations: 1,115 at quarter end, down from 1,263 in the same quarter last year

- Same-Store Sales rose 1.2% year on year (-1.9% in the same quarter last year)

- Market Capitalization: $601.3 million

Company Overview

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

The core customer is someone who relies on their cars for daily needs, which is most of suburban and rural America. Monro understands that these car owners have busy lives and may lack the expertise to diagnose and address issues with their automobiles. The company therefore aims to be a one-stop-shop for everything from periodic maintenance to more involved repairs.

Monro locations are moderate in size, typically 5,000 square feet and equipped with specialty tools and technology for auto repairs. These locations are strategically located in suburban areas, close to residential neighborhoods and major roadways. Even though you can’t have your car fixed online, Monro does have an e-commerce presence where customers can schedule appointments, access information Monro’s services, and even purchase products like tires and motor oil.

4. Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Auto parts and services providers include Advance Auto Parts (NYSE:AAP), AutoZone (NYSE:AZO), O’Reilly Automotive (NASDAQ:ORLY), and private company Pep Boys.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.18 billion in revenue over the past 12 months, Monro is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

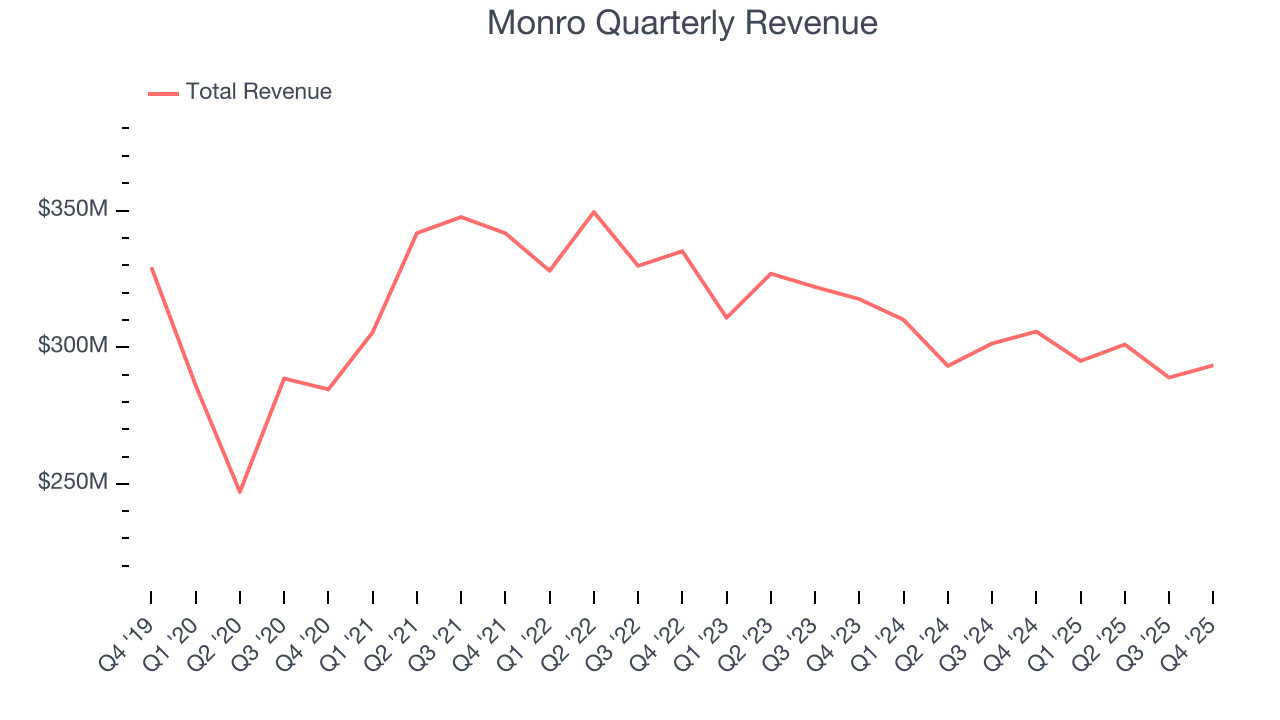

As you can see below, Monro’s revenue declined by 4.3% per year over the last three years as it closed stores and observed lower sales at existing, established locations.

This quarter, Monro missed Wall Street’s estimates and reported a rather uninspiring 4% year-on-year revenue decline, generating $293.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months. Although this projection suggests its newer products will fuel better top-line performance, it is still below average for the sector.

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

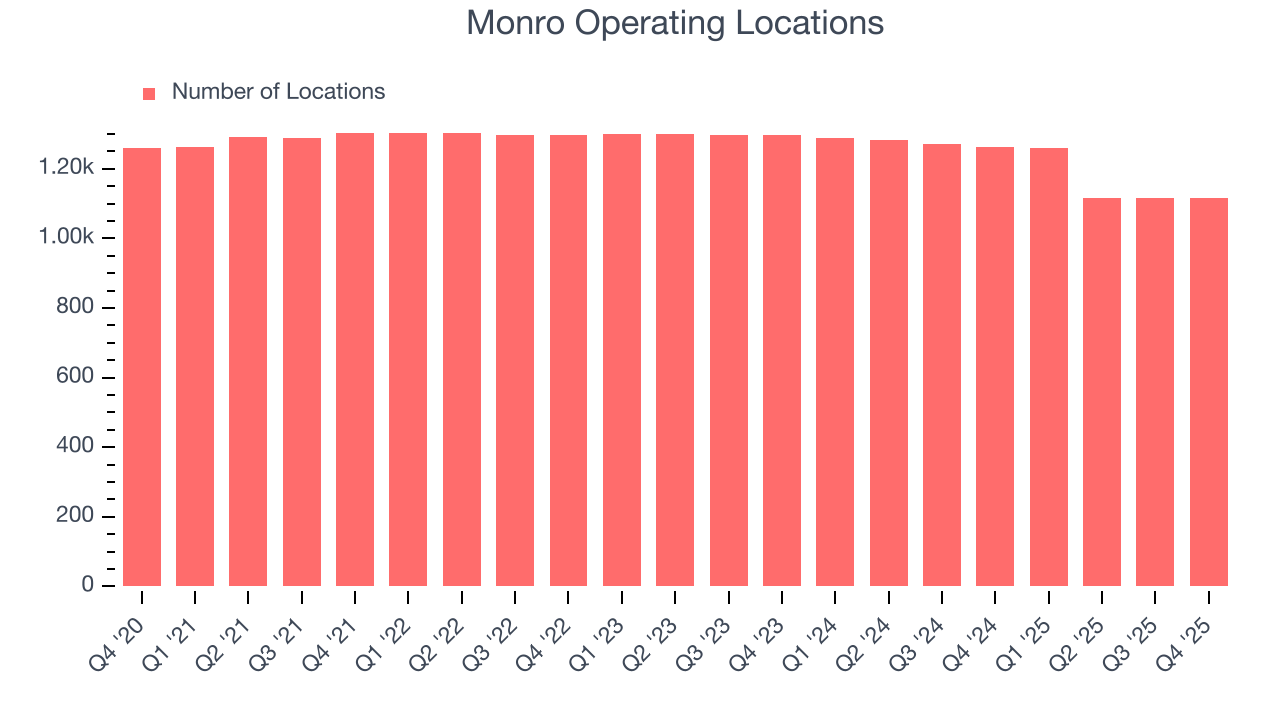

Monro operated 1,115 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 5.7% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

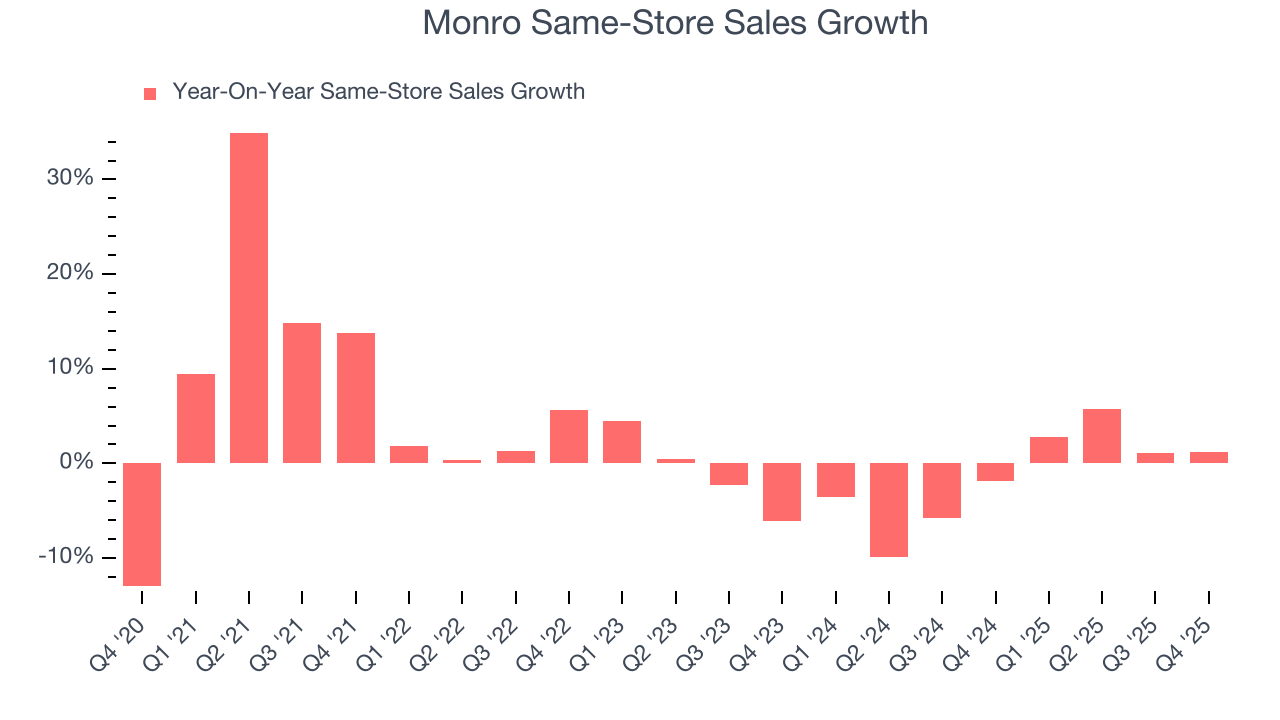

Monro’s demand has been shrinking over the last two years as its same-store sales have averaged 1.3% annual declines. This performance isn’t ideal, and Monro is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Monro’s same-store sales rose 1.2% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

7. Gross Margin & Pricing Power

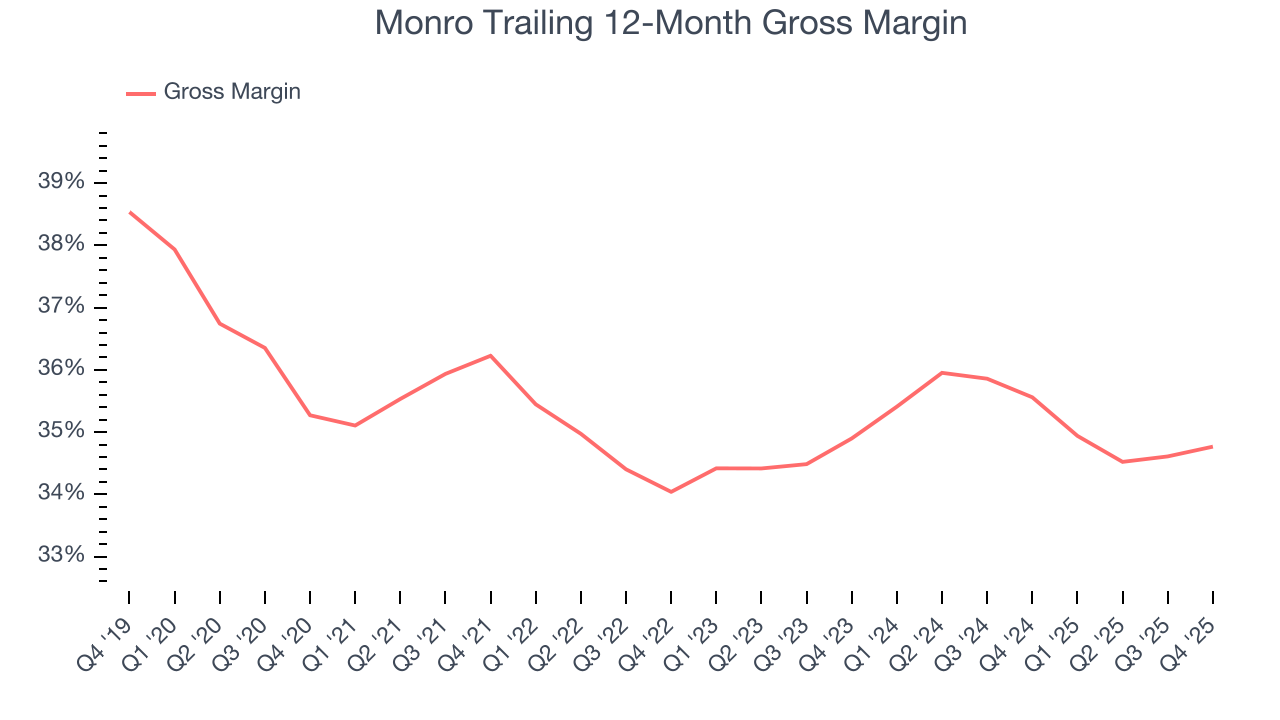

Monro has bad unit economics for a retailer, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 35.2% gross margin over the last two years. Said differently, Monro had to pay a chunky $64.83 to its suppliers for every $100 in revenue.

Monro’s gross profit margin came in at 34.9% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

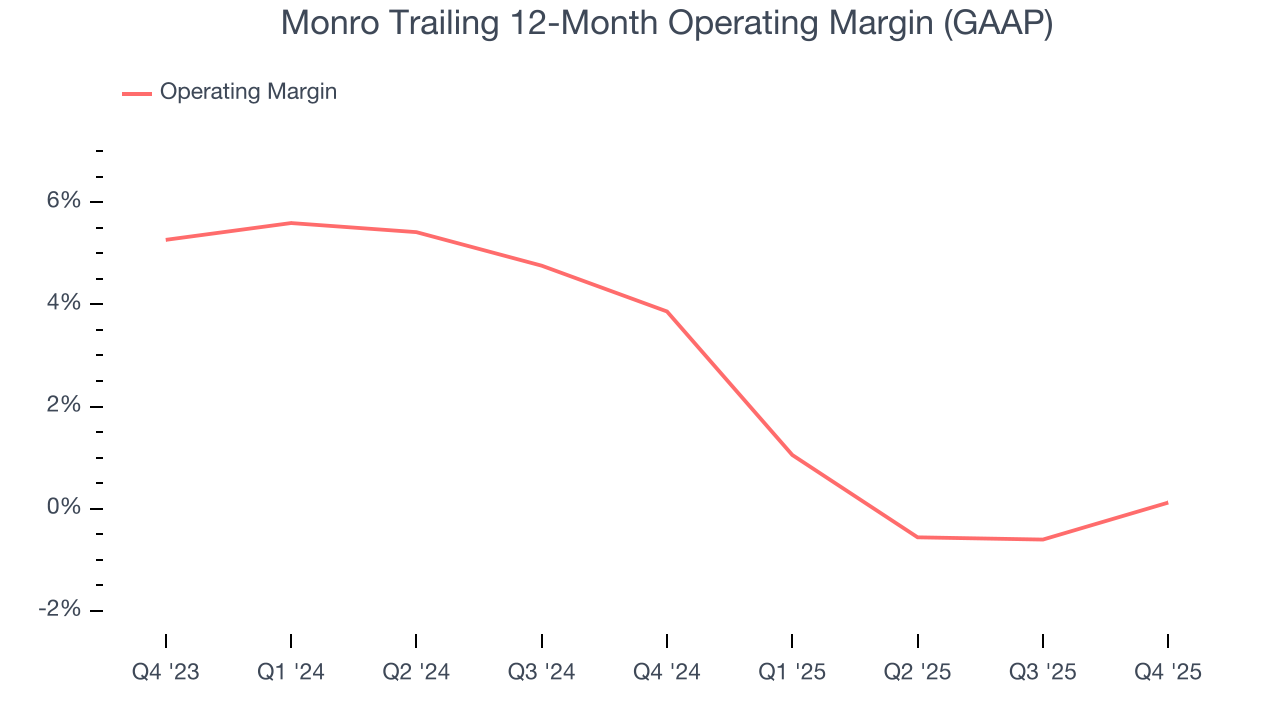

Monro was profitable over the last two years but held back by its large cost base. Its average operating margin of 2% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Monro’s operating margin decreased by 3.7 percentage points over the last year. Monro’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Monro generated an operating margin profit margin of 6.3%, up 3.1 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

9. Cash Is King

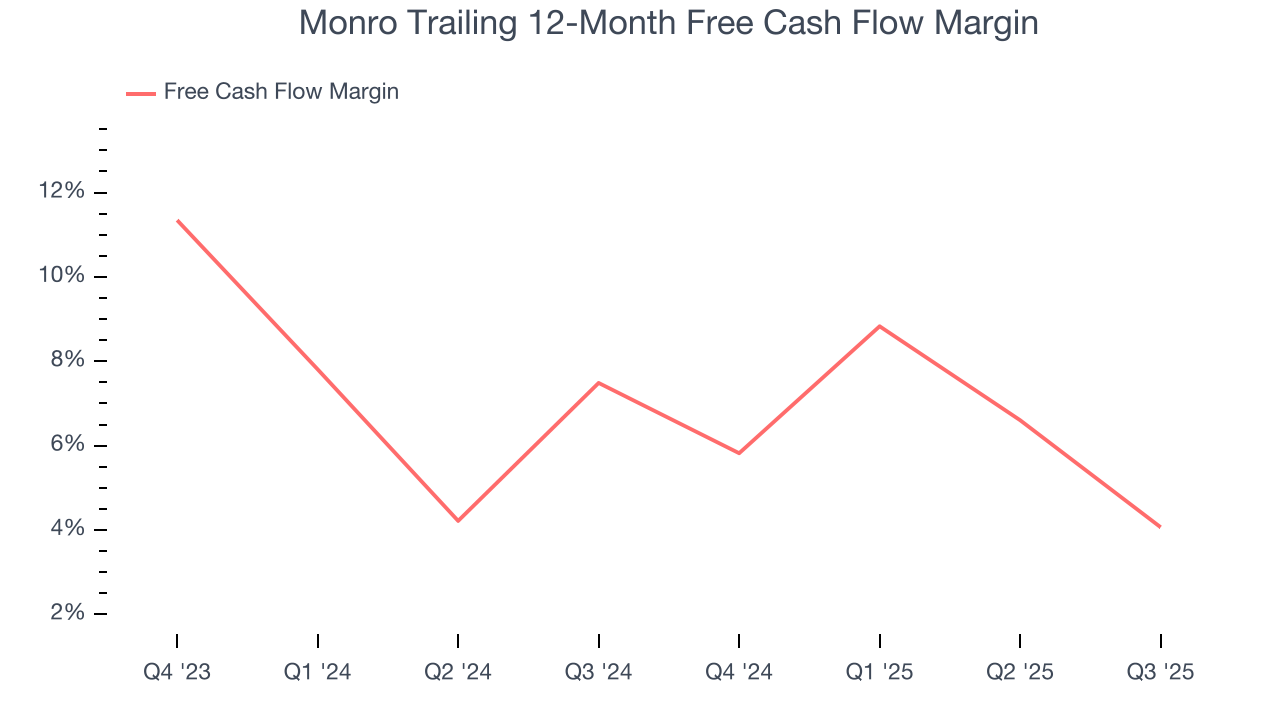

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Monro has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.3% over the last two years, better than the broader consumer retail sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Monro historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.9%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

11. Key Takeaways from Monro’s Q4 Results

It was good to see Monro beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, this print was mixed. The stock remained flat at $20.06 immediately following the results.

12. Is Now The Time To Buy Monro?

Updated: January 28, 2026 at 7:46 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Monro.

We see the value of companies helping consumers, but in the case of Monro, we’re out. To begin with, its revenue has declined over the last three years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Monro’s P/E ratio based on the next 12 months is 32.5x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $20.67 on the company (compared to the current share price of $20.06).