Monster (MNST)

Monster is an amazing business. It consistently invests in attractive growth opportunities, generating substantial cash flows and returns.― StockStory Analyst Team

1. News

2. Summary

Why We Like Monster

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ:MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its operating leverage amplified its profits over the last year

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders, and its improved cash conversion implies it’s becoming a less capital-intensive business

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures

We’re fond of companies like Monster. This is one of the best consumer staples stocks in our coverage.

Is Now The Time To Buy Monster?

Is Now The Time To Buy Monster?

Monster is trading at $80.92 per share, or 37x forward P/E. There’s no arguing the market has lofty expectations given its premium multiple.

Are you a fan of the company and believe in the bull case? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Monster (MNST) Research Report: Q3 CY2025 Update

Energy drink company Monster Beverage (NASDAQ:MNST) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 16.8% year on year to $2.20 billion. Its non-GAAP profit of $0.56 per share was 17.5% above analysts’ consensus estimates.

Monster (MNST) Q3 CY2025 Highlights:

- Revenue: $2.20 billion vs analyst estimates of $2.11 billion (16.8% year-on-year growth, 4.3% beat)

- Adjusted EPS: $0.56 vs analyst estimates of $0.48 (17.5% beat)

- Operating Margin: 30.7%, up from 25.5% in the same quarter last year

- Market Capitalization: $66.27 billion

Company Overview

Founded in 2002 as a natural soda and juice company, Monster Beverage (NASDAQ:MNST) is a pioneer of the energy drink category, and its Monster Energy brand targets a young, active demographic.

The energy drink category was new and catered to a niche demographic early in the company’s history. Its beverages sought to disrupt the huge soda market as consumers began to shy away from drinks with too much sugar. Monster helped create and capitalized on the demand for better-for-you functional beverages.

The unique selling proposition of Monster Beverage is a reliable energy source with a refreshing taste. This is achieved through a proprietary blend of caffeine, taurine, B vitamins, and herbal extracts. Monster also partners with popular and alternative sports to further cement the brand image as one for active lifestyles, not couch potatoes who want something to wash down some fast food with.

Monster Beverage's products have achieved widespread distribution over time and can be found on the shelves of convenience stores, gas stations, supermarkets, and mass merchandise retailers. Sports arenas, movie theaters, and other venues also sell Monster's products. Lastly, the company launched its e-commerce platform in 2015, allowing consumers to purchase beverages and merchandise directly from their website.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors that offer energy drinks or alternatives to energy drinks include Rockstar Energy from PepsiCo (NASDAQ:PEP), Coca-Cola Energy and Full Throttle from Coca-Cola (NYSE:KO), and Celsius (NASDAQ:CELH).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

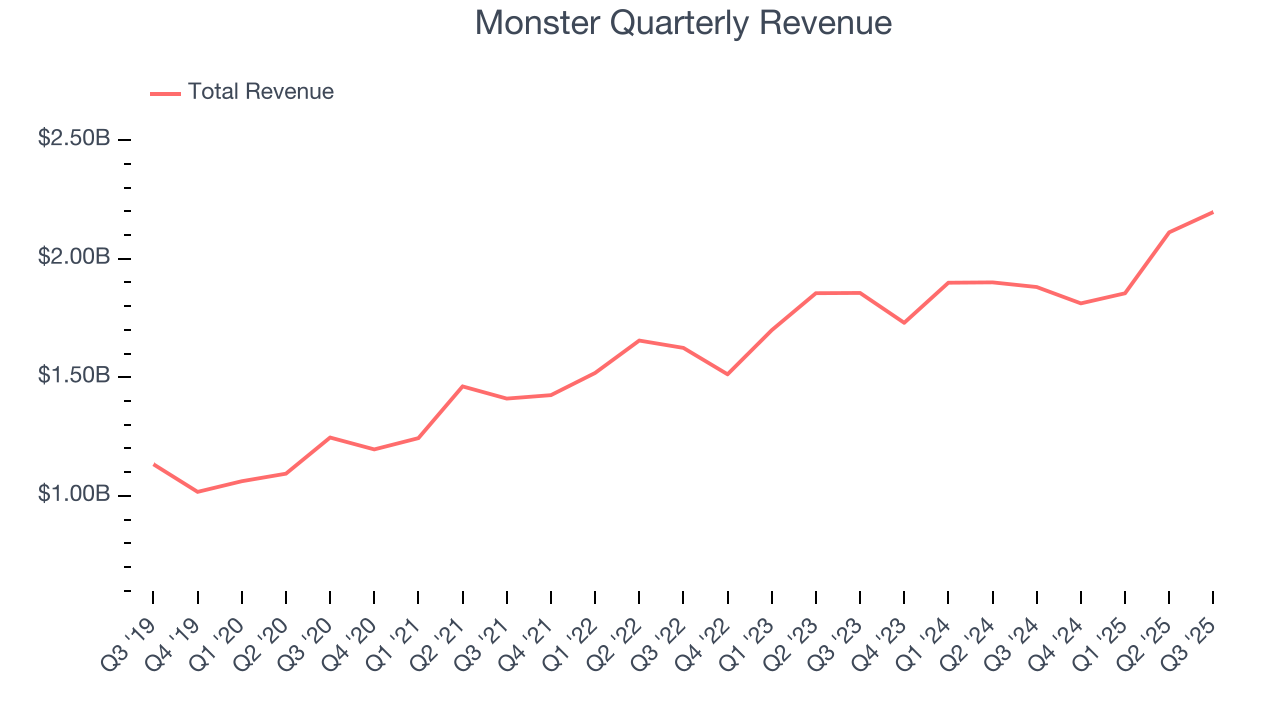

With $7.98 billion in revenue over the past 12 months, Monster is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Monster’s 8.6% annualized revenue growth over the last three years was decent. This shows its offerings generated slightly more demand than the average consumer staples company, a helpful starting point for our analysis.

This quarter, Monster reported year-on-year revenue growth of 16.8%, and its $2.20 billion of revenue exceeded Wall Street’s estimates by 4.3%.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, similar to its three-year rate. This projection is above the sector average and implies its newer products will help sustain its historical top-line performance.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

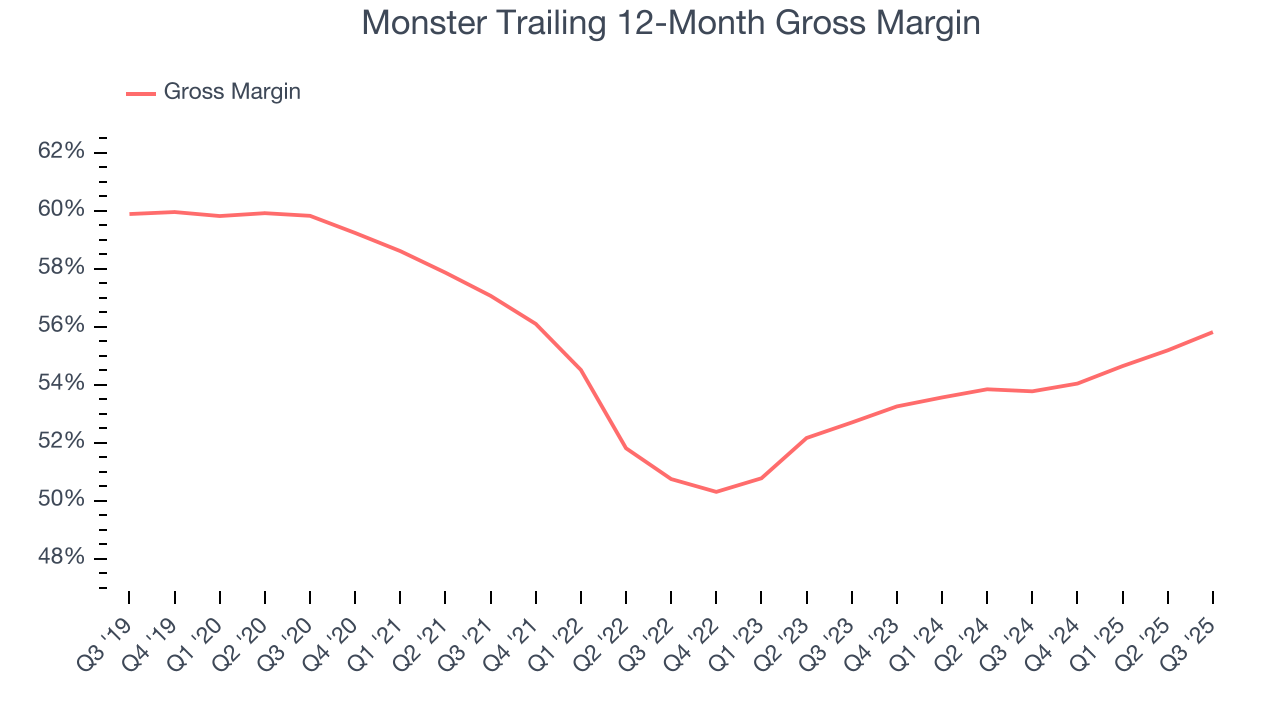

Monster has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 54.8% gross margin over the last two years. That means for every $100 in revenue, only $45.17 went towards paying for raw materials, production of goods, transportation, and distribution.

In Q3, Monster produced a 55.7% gross profit margin, marking a 2.6 percentage point increase from 53.2% in the same quarter last year. Monster’s full-year margin has also been trending up over the past 12 months, increasing by 2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

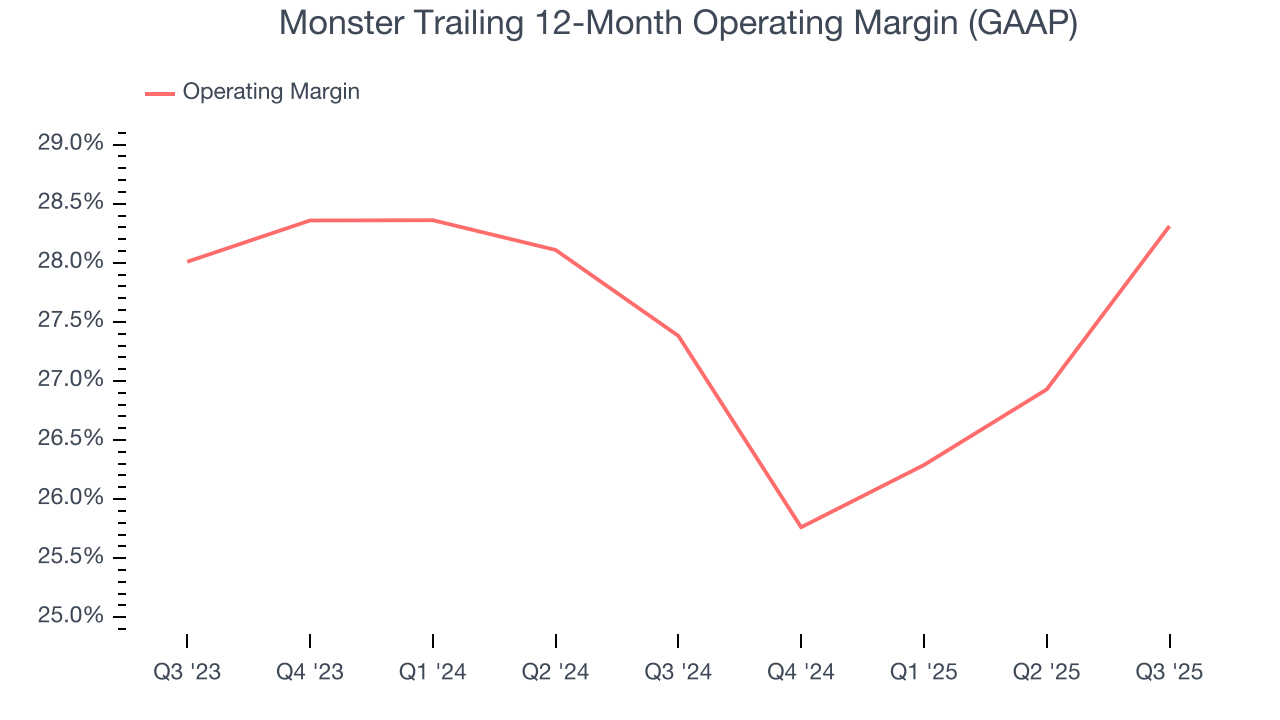

Monster’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 27.9% over the last two years. This profitability was elite for a consumer staples business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Monster’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Monster generated an operating margin profit margin of 30.7%, up 5.2 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

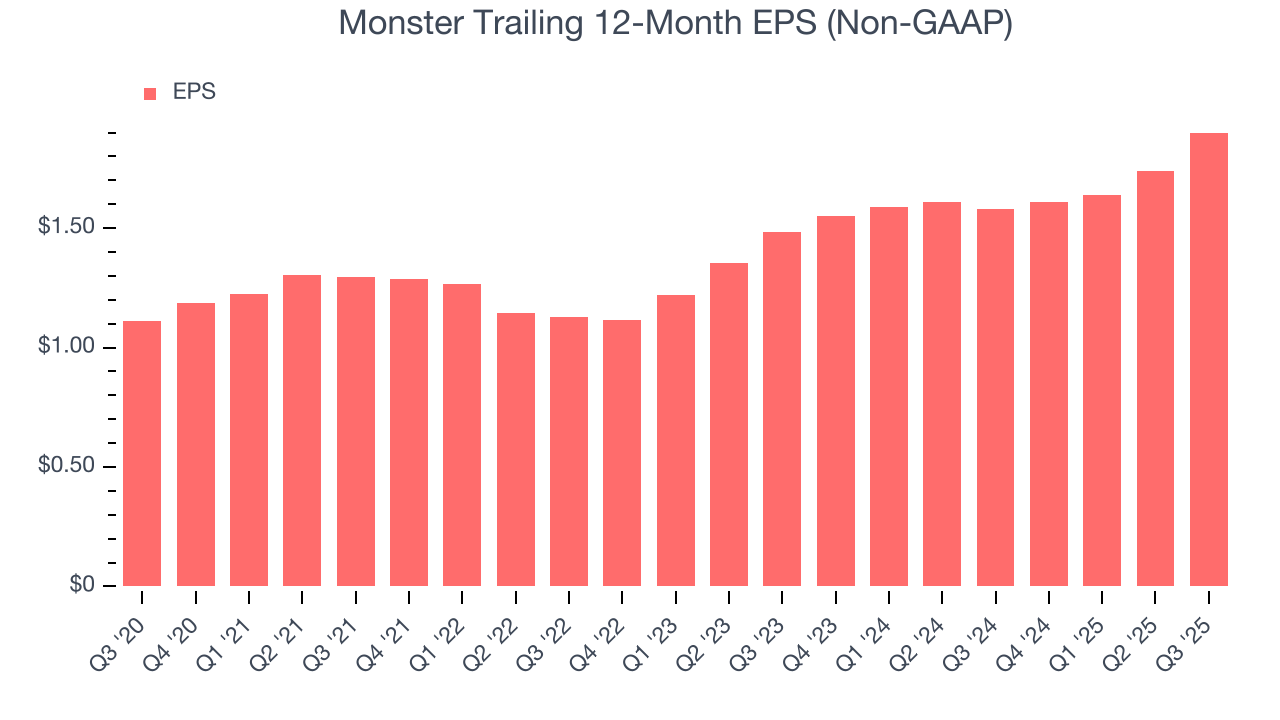

In Q3, Monster reported adjusted EPS of $0.56, up from $0.40 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Monster’s full-year EPS of $1.90 to grow 9.8%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

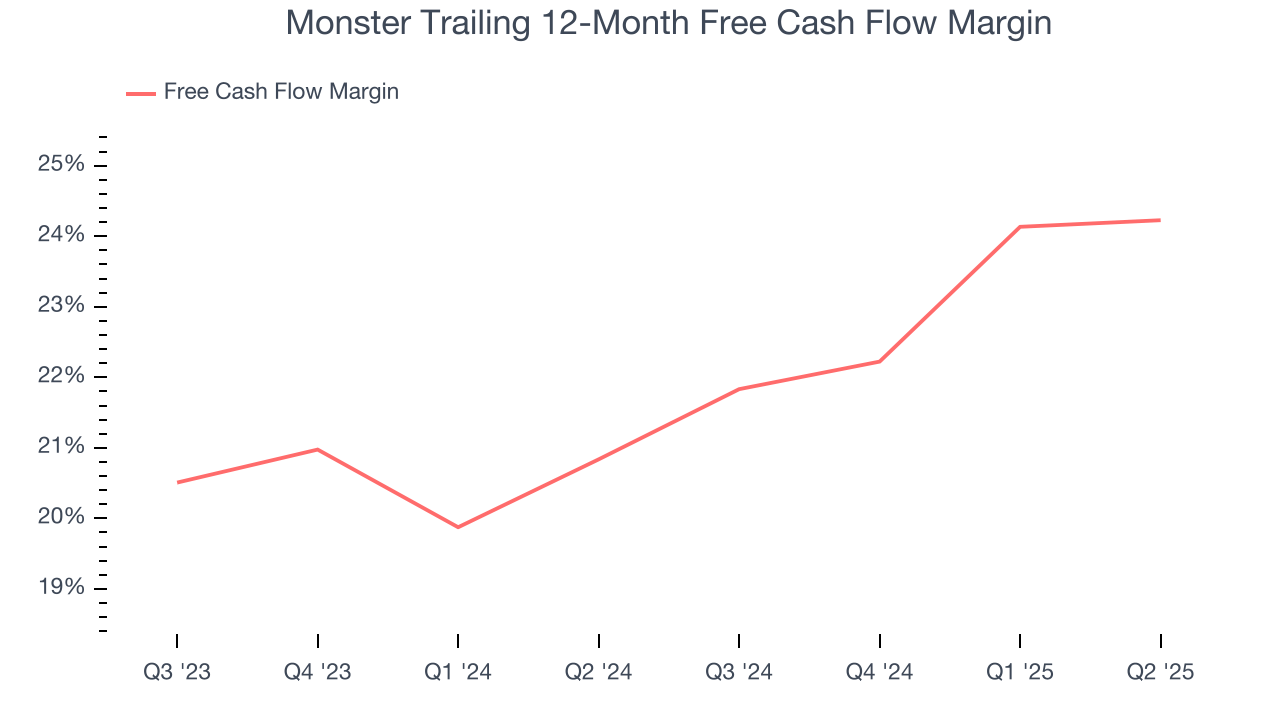

Monster has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 22% over the last two years.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

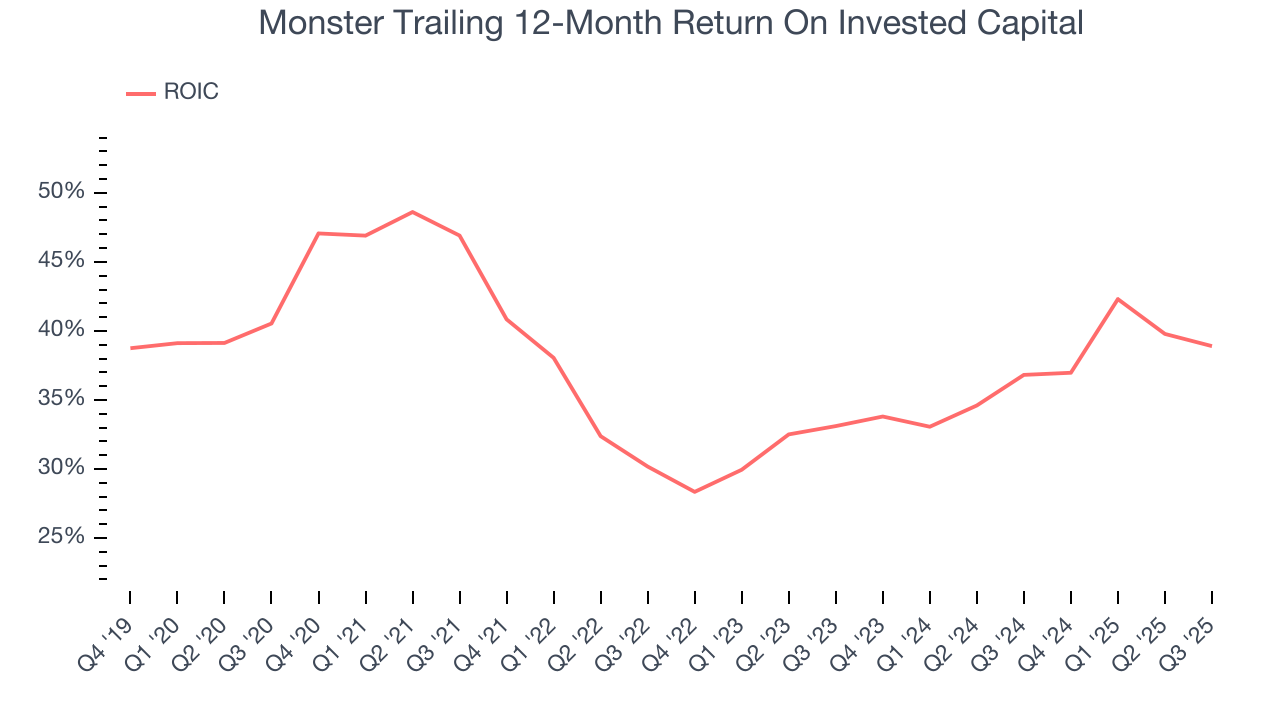

Monster’s five-year average ROIC was 37.2%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

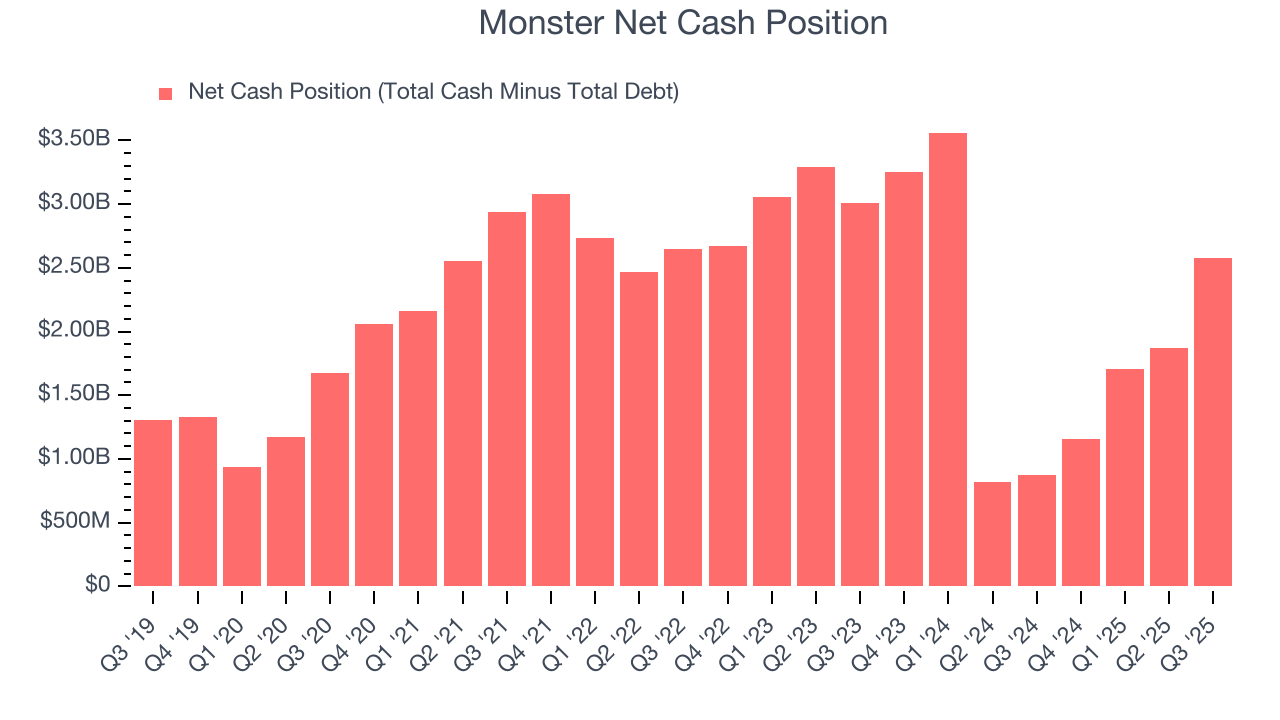

Monster is a profitable, well-capitalized company with $2.58 billion of cash and no debt. This position is 3.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Monster’s Q3 Results

We enjoyed seeing Monster beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 4.2% to $69.22 immediately after reporting.

13. Is Now The Time To Buy Monster?

Updated: February 16, 2026 at 9:52 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Monster.

Monster is a cream-of-the-crop consumer staples company. For starters, its revenue growth was decent over the last three years and is expected to accelerate over the next 12 months. On top of that, its impressive operating margins show it has a highly efficient business model, and its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Monster’s P/E ratio based on the next 12 months is 37x. This multiple isn’t necessarily cheap, but we’ll happily own Monster as its fundamentals illustrate it’s clearly doing something special. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $80.77 on the company (compared to the current share price of $80.92).