Morningstar (MORN)

Morningstar is one of our favorite stocks. Its eye-popping 30.4% annualized EPS growth over the last three years has significantly outpaced its peers.― StockStory Analyst Team

1. News

2. Summary

Why We Like Morningstar

Founded in 1984 by Joe Mansueto with just $80,000 in personal savings, Morningstar (NASDAQ:MORN) provides independent investment data, research, and analysis tools that help investors, advisors, and institutions make informed financial decisions.

- Earnings per share have massively outperformed its peers over the last three years, increasing by 30.4% annually

- Market-beating return on equity illustrates that management has a knack for investing in profitable ventures

- Solid 12% annual revenue growth over the last five years indicates its offering’s solve complex business issues

We see a bright future for Morningstar. The price seems reasonable in light of its quality, and we think now is a good time to buy.

Why Is Now The Time To Buy Morningstar?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Morningstar?

Morningstar’s stock price of $154.09 implies a valuation ratio of 14.9x forward P/E. This valuation is fair - even cheap depending on how much you like the story - for the quality you get.

By definition, where you buy a stock impacts returns. Compared to entry price, business quality matters much more for long-term market outperformance. Buying in at a great price helps, nevertheless.

3. Morningstar (MORN) Research Report: Q4 CY2025 Update

Investment research firm Morningstar (NASDAQ:MORN) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 8.5% year on year to $641.1 million. Its GAAP profit of $2.83 per share was 31% above analysts’ consensus estimates.

Morningstar (MORN) Q4 CY2025 Highlights:

- Revenue: $641.1 million vs analyst estimates of $627.5 million (8.5% year-on-year growth, 2.2% beat)

- Pre-tax Profit: $150.9 million (23.5% margin)

- EPS (GAAP): $2.83 vs analyst estimates of $2.16 (31% beat)

- Market Capitalization: $6.39 billion

Company Overview

Founded in 1984 by Joe Mansueto with just $80,000 in personal savings, Morningstar (NASDAQ:MORN) provides independent investment data, research, and analysis tools that help investors, advisors, and institutions make informed financial decisions.

Morningstar operates through five key segments: Data and Analytics, PitchBook, Wealth, Credit, and Retirement. The company's core strength lies in its proprietary data, research methodologies, and ratings systems that evaluate investment products across asset classes. Its flagship tools include the Morningstar Rating (the "star rating"), the Morningstar Style Box, and the Morningstar Medalist Rating, which have become industry standards for evaluating investment options.

The company serves diverse client groups including financial advisors, asset managers, institutional investors, and individual investors. For advisors, Morningstar provides tools like Advisor Workstation that streamline investment research and portfolio construction. Asset managers use Morningstar's data and analytics to develop and market investment products. Through its PitchBook platform, the company offers comprehensive data on private capital markets, including venture capital, private equity, and M&A activities.

Morningstar's credit rating agency, Morningstar DBRS, provides independent credit ratings for financial institutions, corporations, and structured finance products. The company has also expanded its environmental, social, and governance (ESG) capabilities through Morningstar Sustainalytics, which offers ESG risk ratings and research covering thousands of companies worldwide.

Revenue is generated primarily through subscription-based licenses to its platforms and data, asset-based fees from investment management services, and transaction-based fees. Morningstar Managed Portfolios allows financial advisors to outsource investment management using model portfolios built with Morningstar's research. The company's wealth platforms provide end-to-end digital investing experiences for advisors and their clients, including risk assessments, proposals, and account management tools.

4. Financial Exchanges & Data

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

Morningstar's competitors include Bloomberg, FactSet, and LSEG (Refinitiv) in data and analytics; MSCI, S&P Global, and Moody's in research and ratings; Envestnet and SEI Investments in wealth management platforms; and CB Insights and Preqin in private market data.

5. Revenue Growth

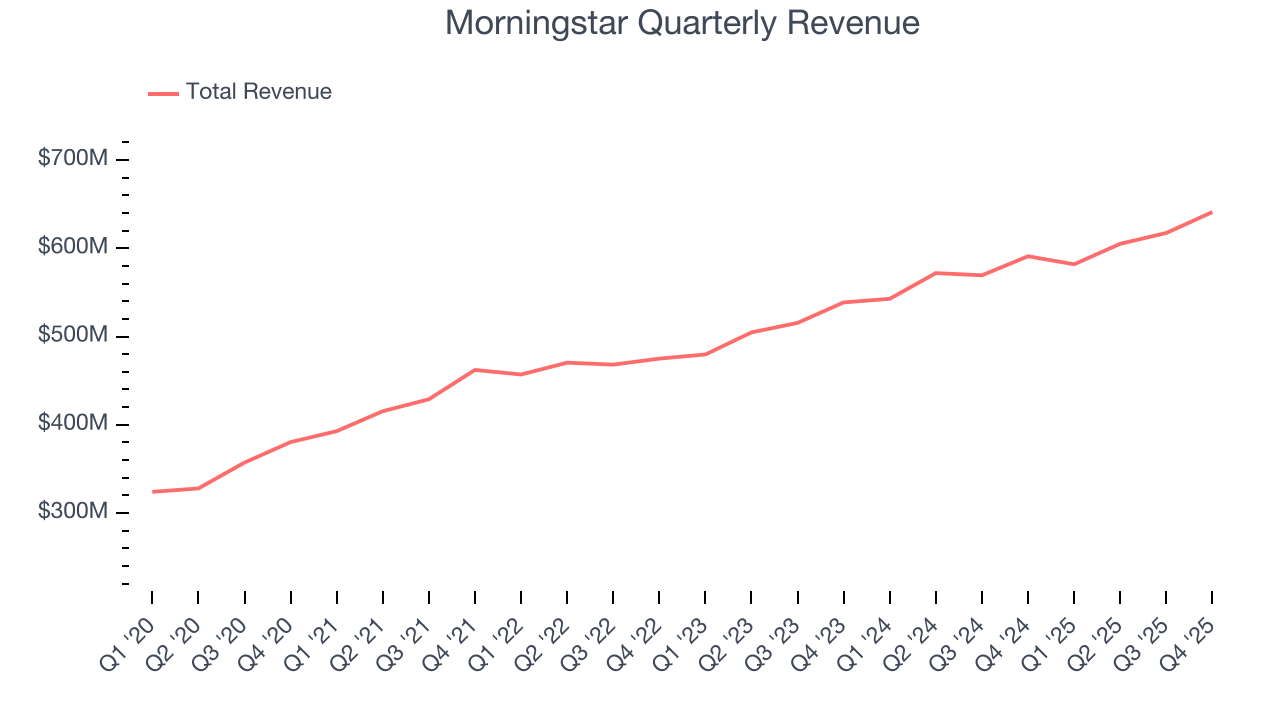

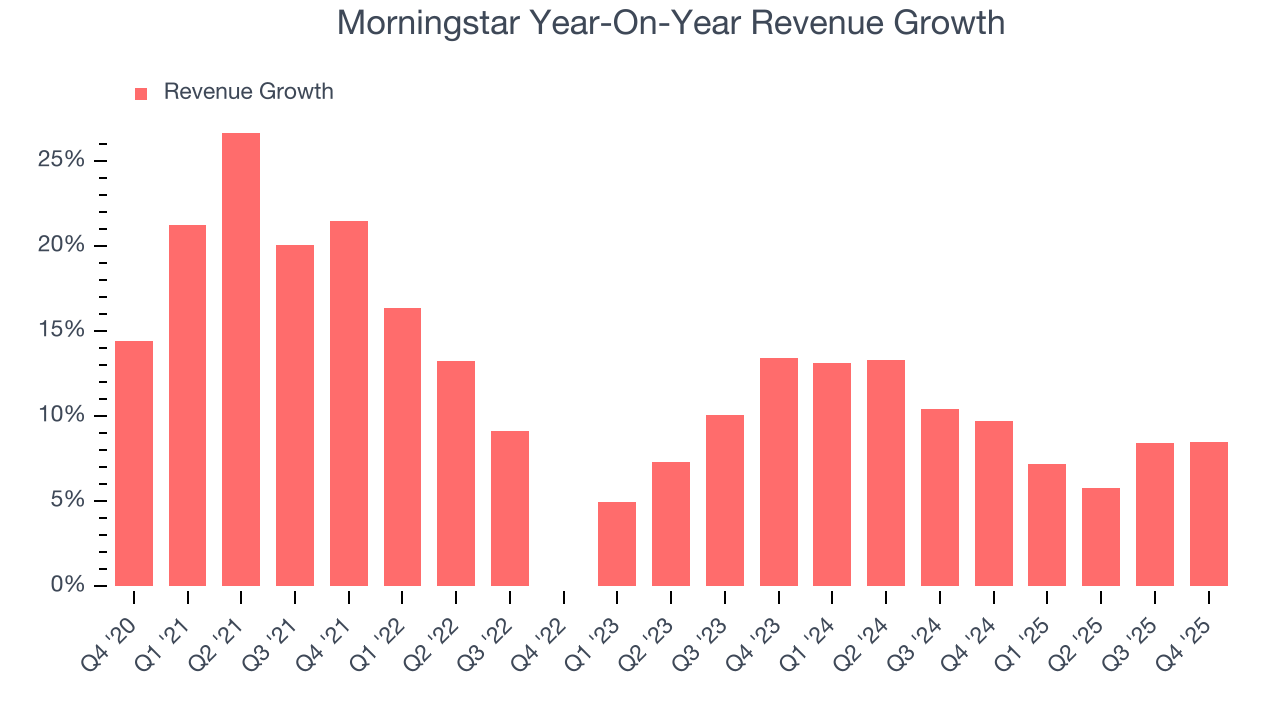

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Morningstar’s 12% annualized revenue growth over the last five years was solid. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Morningstar’s annualized revenue growth of 9.5% over the last two years is below its five-year trend, but we still think the results were respectable.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Morningstar reported year-on-year revenue growth of 8.5%, and its $641.1 million of revenue exceeded Wall Street’s estimates by 2.2%.

6. Pre-Tax Profit Margin

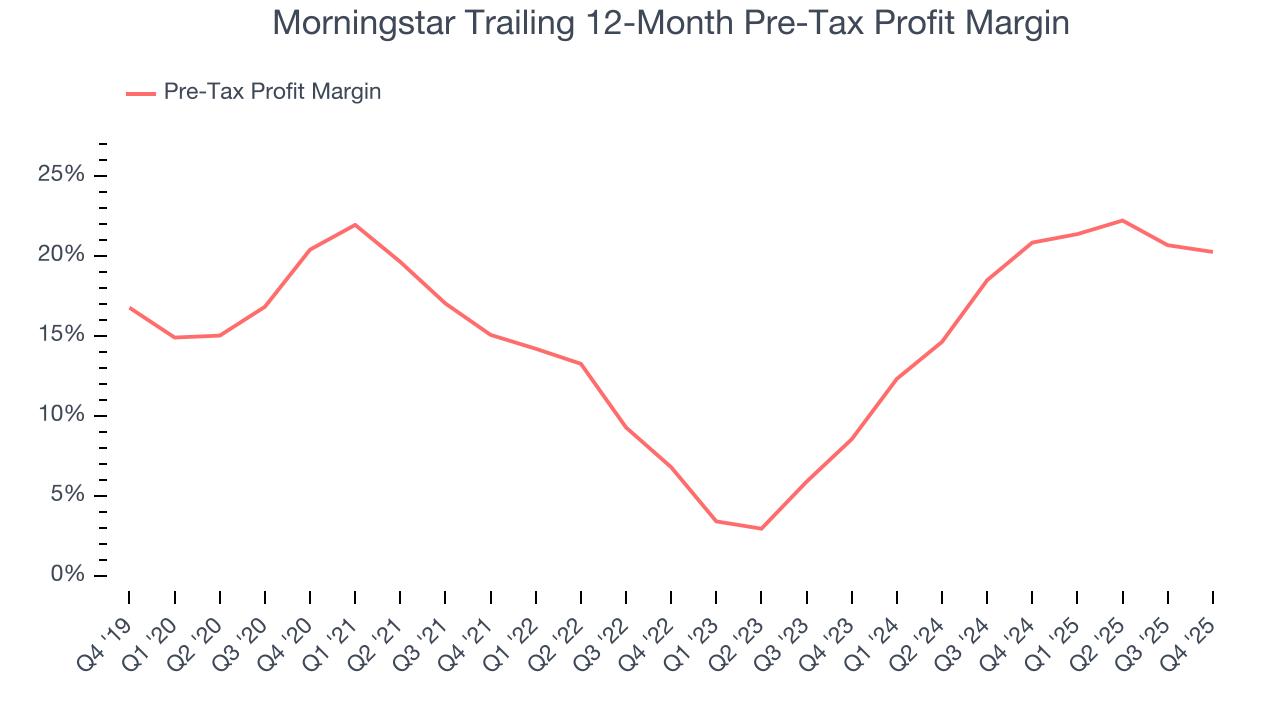

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Financial Exchanges & Data companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Morningstar’s pre-tax profit margin couldn’t build momentum, hanging around 20.2%. Luckily, it seems the company has recently taken steps to address its expense base as its pre-tax profit margin expanded by 11.7 percentage points on a two-year basis.

In Q4, Morningstar’s pre-tax profit margin was 23.5%. This result was 2 percentage points worse than the same quarter last year.

7. Earnings Per Share

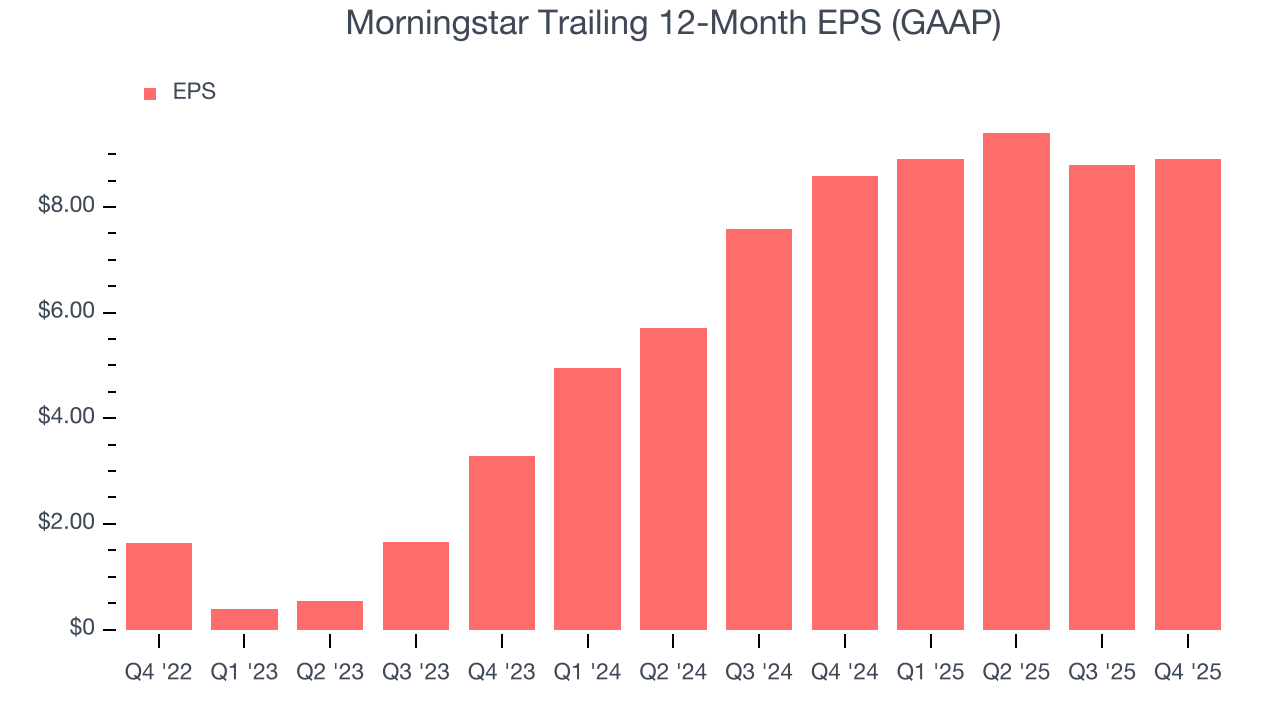

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Morningstar’s full-year EPS grew at an astounding 30.4% compounded annual growth rate over the last three years, better than the broader financials sector.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Morningstar, its two-year annual EPS growth of 64.7% was higher than its three-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Morningstar reported EPS of $2.83, up from $2.71 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Morningstar’s full-year EPS of $8.91 to grow 17.3%.

8. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Morningstar has averaged an ROE of 15.1%, healthy for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Morningstar has a decent competitive moat.

9. Balance Sheet Assessment

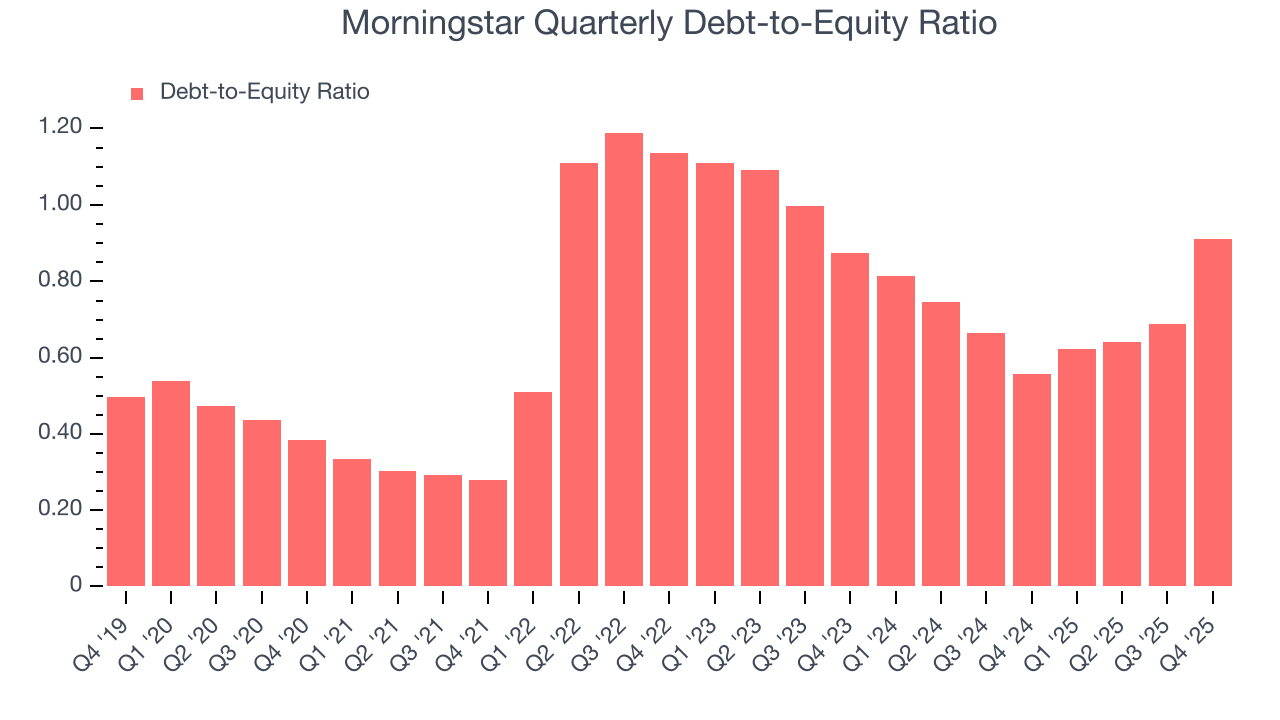

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Morningstar currently has $1.11 billion of debt and $1.22 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.7×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Morningstar’s Q4 Results

It was good to see Morningstar beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $153.39 immediately following the results.

11. Is Now The Time To Buy Morningstar?

Updated: February 12, 2026 at 11:49 PM EST

Before making an investment decision, investors should account for Morningstar’s business fundamentals and valuation in addition to what happened in the latest quarter.

Morningstar is an amazing business ranking highly on our list. For starters, its revenue growth was solid over the last five years. On top of that, its astounding EPS growth over the last three years shows its profits are trickling down to shareholders, and its solid ROE suggests it has grown profitably in the past.

Morningstar’s P/E ratio based on the next 12 months is 14.9x. Looking at the financials space today, Morningstar’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $280.67 on the company (compared to the current share price of $154.09), implying they see 82.2% upside in buying Morningstar in the short term.