Mercury Systems (MRCY)

We wouldn’t buy Mercury Systems. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Mercury Systems Will Underperform

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Persistent operating margin losses suggest the business manages its expenses poorly

- ROIC of -0.5% reflects management’s challenges in identifying attractive investment opportunities, and its falling returns suggest its earlier profit pools are drying up

Mercury Systems is skating on thin ice. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Mercury Systems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Mercury Systems

Mercury Systems’s stock price of $88.68 implies a valuation ratio of 76.7x forward P/E. This valuation multiple seems a bit much considering the tepid revenue growth profile.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Mercury Systems (MRCY) Research Report: Q4 CY2025 Update

Aerospace and defense company Mercury Systems (NASDAQ:MRCY) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 4.4% year on year to $232.9 million. Its non-GAAP profit of $0.16 per share was significantly above analysts’ consensus estimates.

Mercury Systems (MRCY) Q4 CY2025 Highlights:

- Revenue: $232.9 million vs analyst estimates of $210.9 million (4.4% year-on-year growth, 10.4% beat)

- Adjusted EPS: $0.16 vs analyst estimates of $0.06 (significant beat)

- Adjusted EBITDA: $30.02 million vs analyst estimates of $21.25 million (12.9% margin, 41.2% beat)

- Operating Margin: -4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 19.6%, down from 36.7% in the same quarter last year

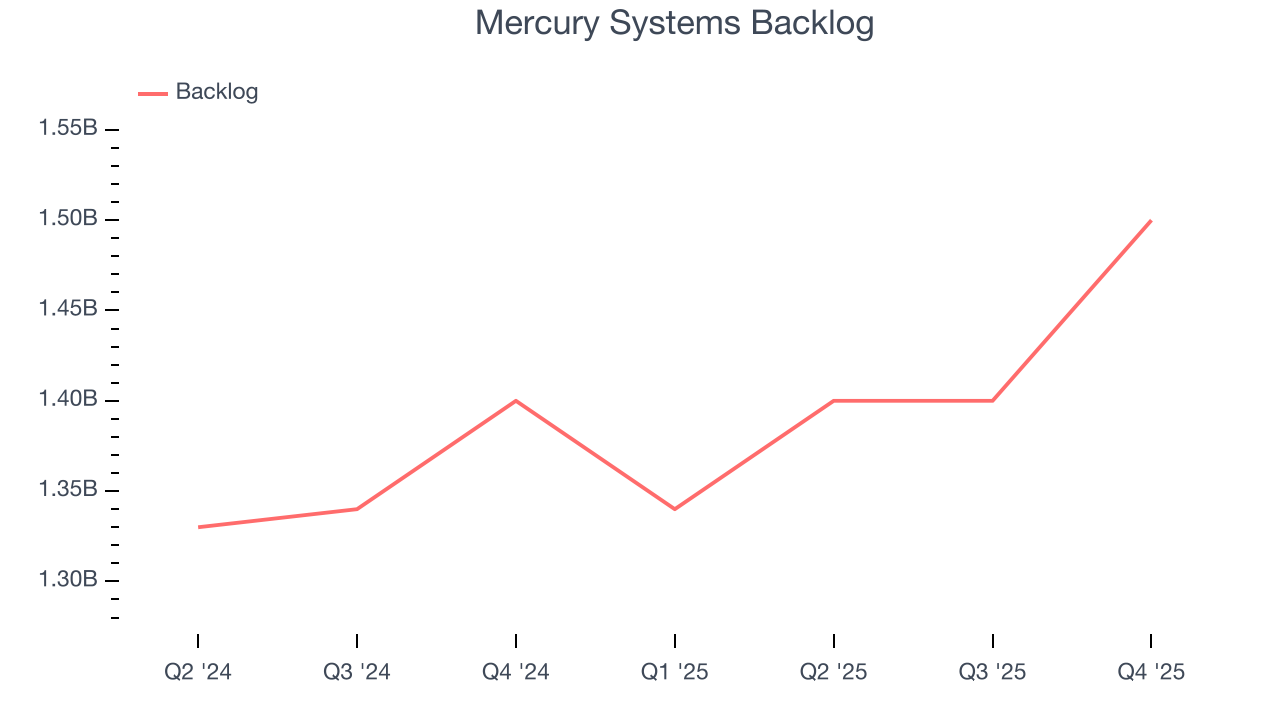

- Backlog: $1.5 billion at quarter end, up 7.1% year on year

- Market Capitalization: $5.64 billion

Company Overview

Founded in 1981, Mercury Systems (NASDAQ:MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems initially focused on digital signal and image processing tailored for defense applications. Over the years, the company transitioned towards more comprehensive aerospace and defense technologies, expanding its offerings to include pre-integrated processing systems, secure storage solutions, and other mission-critical technologies.

Today, Mercury Systems delivers processing solutions tailored for challenging aerospace and defense applications. Its offerings span from advanced embedded security and rugged display technologies to high-performance computing and secure networking. For instance, the company’s signal processing technology is integral in systems like the Patriot missile defense system, which is crucial for rapid threat detection and response. Another key product is its high-definition, rugged display technology, utilized in military aircraft cockpits and armored vehicles.

Mercury Systems primarily serves defense prime contractors, the U.S. government, and commercial aerospace companies. Its engagement with customers early in the design cycle often leads to long-term production contracts, creating a steady stream of revenue from these partnerships.

Since 2014, Mercury Systems has actively pursued an aggressive acquisition strategy. The company's approach has been both horizontal, entering adjacent markets, and vertical, increasing content and capabilities in core areas such as integrated subsystems for defense applications and microelectronics. This strategic expansion has allowed Mercury to delve deeper into sophisticated markets like electronic warfare, weapons systems, and mission computing.

4. Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Mercury System’s competitors include Kratos Defense and Security (NASDAQ:KTOS), Lockheed Martin (NYSE:LMT) , and Textron (NYSE:TXT)

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Mercury Systems grew its sales at a sluggish 2.3% compounded annual growth rate. This fell short of our benchmarks and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Mercury Systems’s annualized revenue growth of 2.6% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Mercury Systems’s backlog reached $1.5 billion in the latest quarter and averaged 5.6% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Mercury Systems’s products and services but raises concerns about capacity constraints.

This quarter, Mercury Systems reported modest year-on-year revenue growth of 4.4% but beat Wall Street’s estimates by 10.4%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

6. Operating Margin

Mercury Systems’s high expenses have contributed to an average operating margin of negative 2.8% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Mercury Systems’s operating margin decreased by 5.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Mercury Systems’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Mercury Systems generated a negative 4.6% operating margin. The company's consistent lack of profits raise a flag.

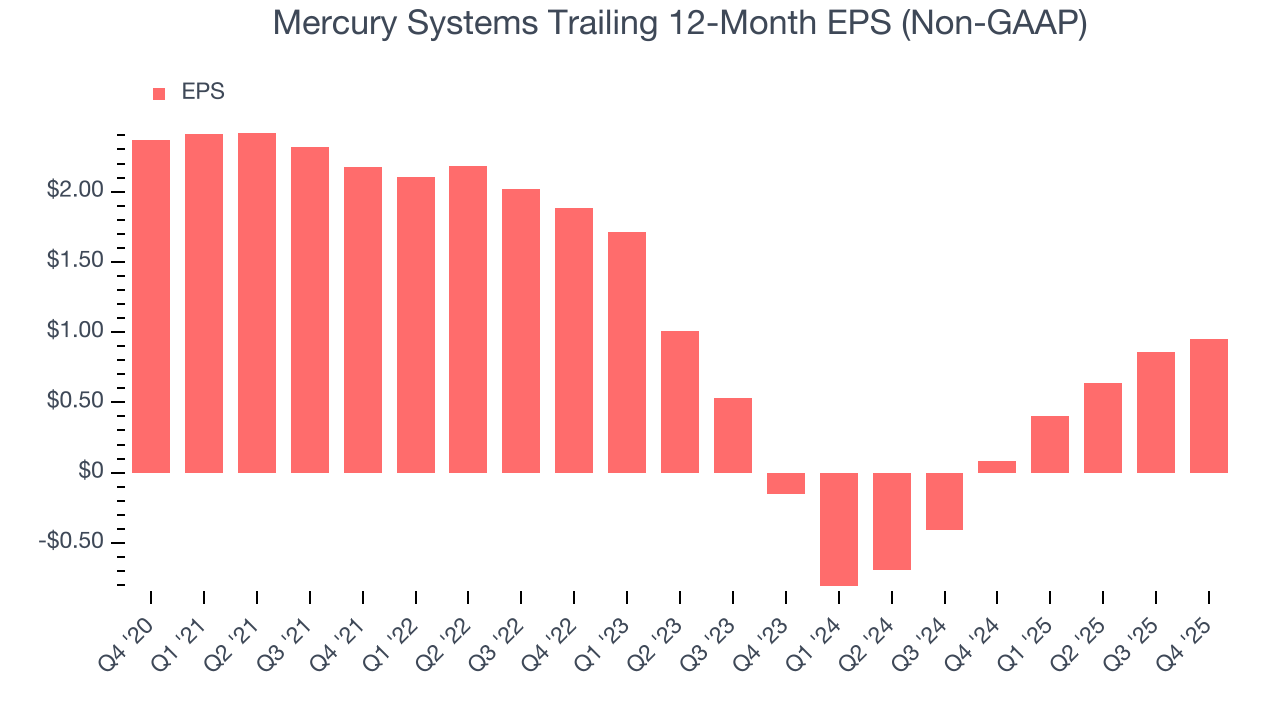

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Mercury Systems, its EPS declined by 16.7% annually over the last five years while its revenue grew by 2.3%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Mercury Systems’s earnings to better understand the drivers of its performance. As we mentioned earlier, Mercury Systems’s operating margin was flat this quarter but declined by 5.4 percentage points over the last five years. Its share count also grew by 7.2%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Mercury Systems, its two-year annual EPS growth of 189% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q4, Mercury Systems reported adjusted EPS of $0.16, up from $0.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Mercury Systems’s full-year EPS of $0.95 to grow 24.9%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Mercury Systems has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, lousy for an industrials business.

Taking a step back, an encouraging sign is that Mercury Systems’s margin expanded by 8.3 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Mercury Systems’s free cash flow clocked in at $45.71 million in Q4, equivalent to a 19.6% margin. The company’s cash profitability regressed as it was 17.1 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Mercury Systems’s five-year average ROIC was negative 0.5%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Mercury Systems’s ROIC decreased by 2.8 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

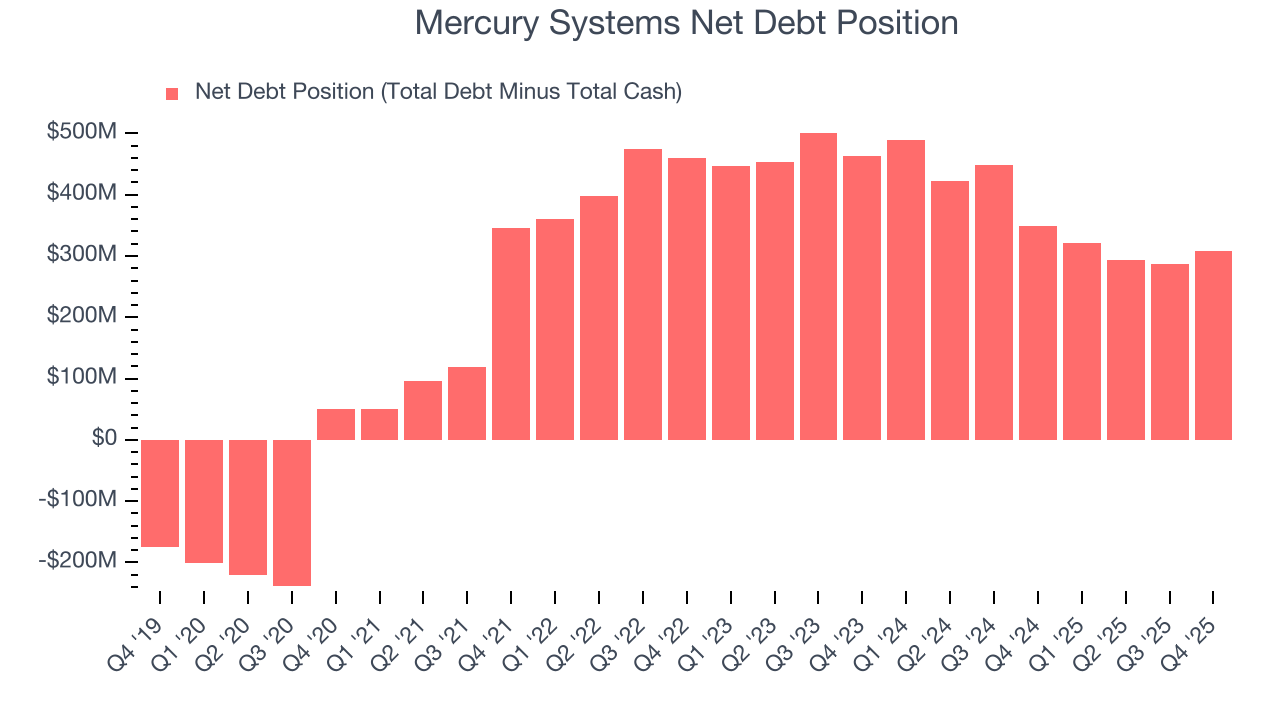

10. Balance Sheet Assessment

Mercury Systems reported $335 million of cash and $642.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $141.5 million of EBITDA over the last 12 months, we view Mercury Systems’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $16.62 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Mercury Systems’s Q4 Results

It was good to see Mercury Systems beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock remained flat at $98.96 immediately following the results.

12. Is Now The Time To Buy Mercury Systems?

Updated: March 9, 2026 at 12:10 AM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Mercury Systems, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies making their customers lives easier, but in the case of Mercury Systems, we’ll be cheering from the sidelines. To kick things off, its revenue growth was weak over the last five years. While its rising cash profitability gives it more optionality, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Mercury Systems’s P/E ratio based on the next 12 months is 76.7x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $97.50 on the company (compared to the current share price of $88.68).