Marvell Technology (MRVL)

We see potential in Marvell Technology. Its revenue and EPS are soaring, showing it can grow quickly and become more profitable as it scales.― StockStory Analyst Team

1. News

2. Summary

Why Marvell Technology Is Interesting

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

- Annual revenue growth of 22% over the past five years was outstanding, reflecting market share gains this cycle

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 26.8% annually, topping its revenue gains

- On the other hand, its negative returns on capital show management lost money while trying to expand the business

Marvell Technology almost passes our quality test. If you believe in the company, the valuation looks reasonable.

Why Is Now The Time To Buy Marvell Technology?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Marvell Technology?

Marvell Technology is trading at $81.42 per share, or 24.6x forward P/E. Marvell Technology’s multiple is lower than that of many semiconductor companies. Even so, we think it is justified for the top-line growth you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Marvell Technology (MRVL) Research Report: Q3 CY2025 Update

Networking chips designer Marvell Technology (NASDAQ: MRVL) met Wall Streets revenue expectations in Q3 CY2025, with sales up 36.8% year on year to $2.07 billion. The company expects next quarter’s revenue to be around $2.2 billion, coming in 1% above analysts’ estimates. Its non-GAAP profit of $0.76 per share was 3% above analysts’ consensus estimates.

Marvell Technology (MRVL) Q3 CY2025 Highlights:

- Revenue: $2.07 billion vs analyst estimates of $2.07 billion (36.8% year-on-year growth, in line)

- Adjusted EPS: $0.76 vs analyst estimates of $0.74 (3% beat)

- Adjusted EBITDA: $596.8 million vs analyst estimates of $834 million (28.8% margin, 28.4% miss)

- Revenue Guidance for Q4 CY2025 is $2.2 billion at the midpoint, above analyst estimates of $2.18 billion

- Adjusted EPS guidance for Q4 CY2025 is $0.79 at the midpoint, above analyst estimates of $0.77

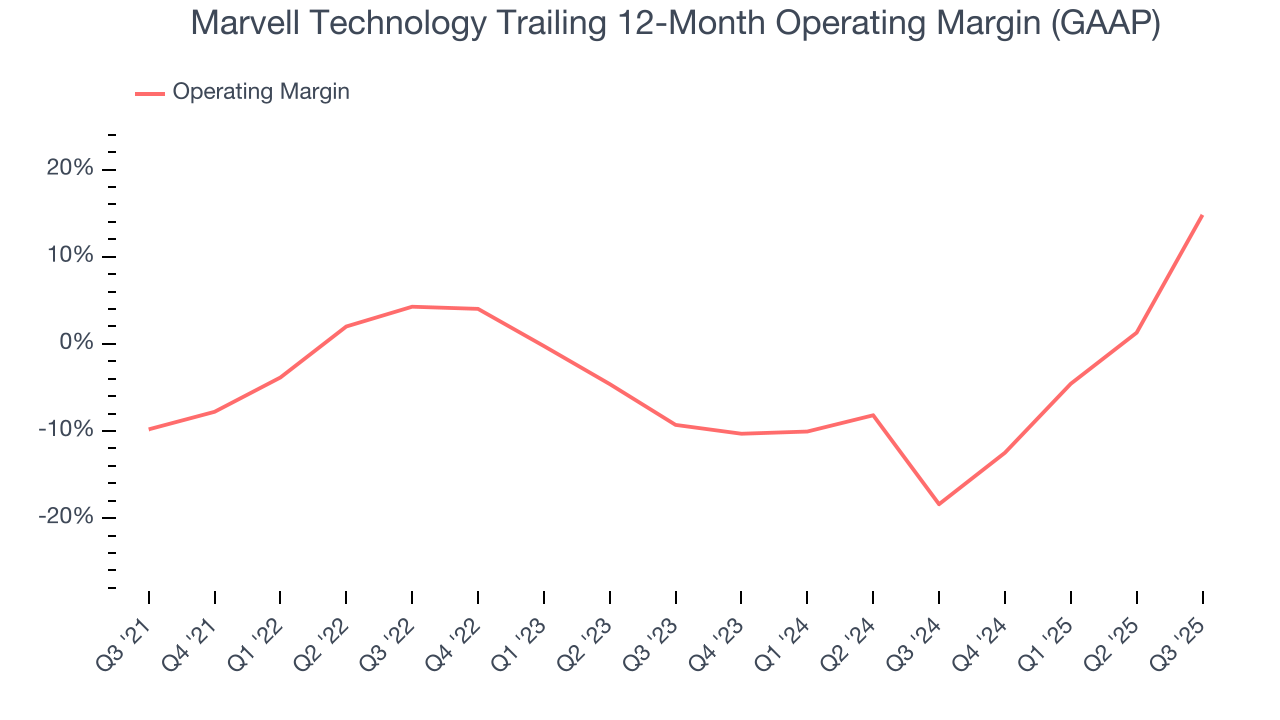

- Operating Margin: 17.2%, up from -46.4% in the same quarter last year

- Free Cash Flow Margin: 24.5%, down from 30.4% in the same quarter last year

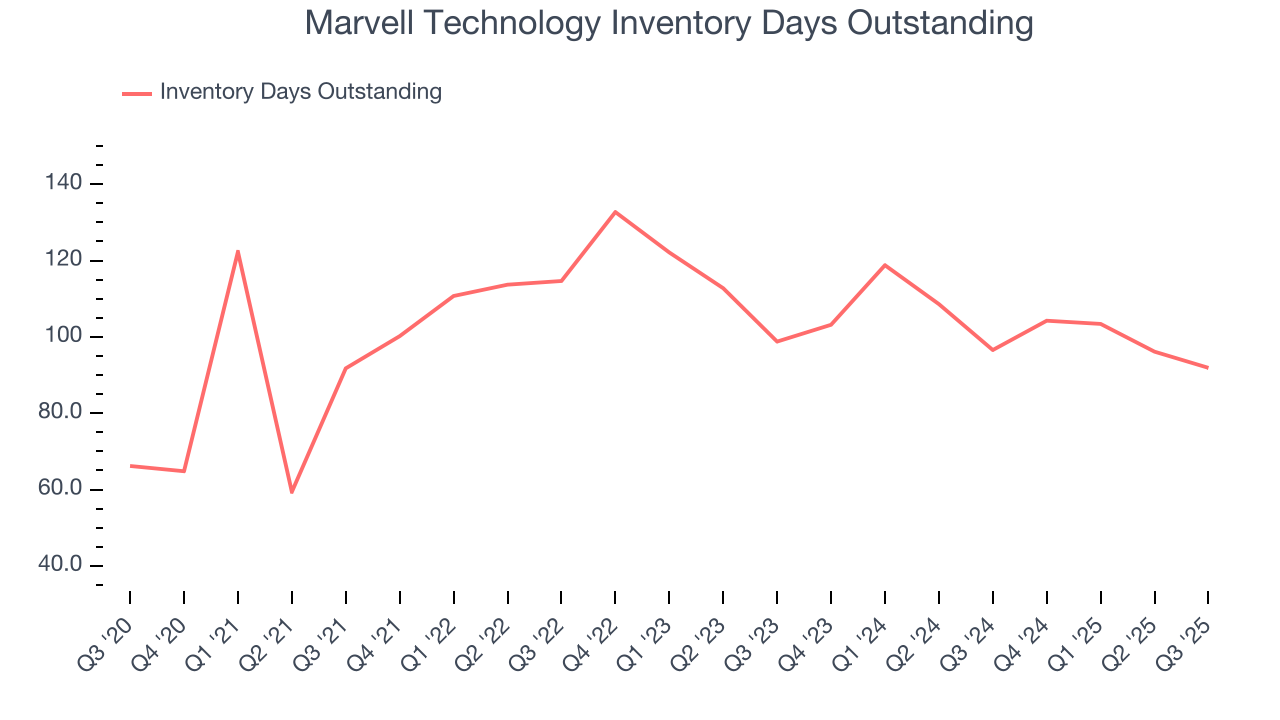

- Inventory Days Outstanding: 92, down from 96 in the previous quarter

- Market Capitalization: $78.54 billion

Company Overview

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell was founded in 1995 by Dr. Sehat Sutardja, his wife, and his brother, and for the first two decades was focused on chips used to run storage devices like disk drives and networking equipment like ethernet switches. It also supplied Wi-Fi chipsets used in mobile devices like the iPhone and Google’s Chromecast. In 2016, in the wake of an internal accounting investigation activist investor Starboard Value acquired a minority stake and ousted Dr. Sutardja and his wife, installing Matt Murphy as CEO.

Murphy quickly exited low margin businesses like the consumer hard drives and Wi-Fi chips and refocused R&D efforts to focus on the higher margin networking business. He made multiple transformative acquisitions: Cavium in 2018, Avera and Aquantia in 2019, and Inphi and Innovium in 2021. The result is a company with leading chipsets that enable data transfer – within and between datacenters, across 5G cellular networks, and throughout autos.

The chips used to power today’s cloud data centers are no longer just general purpose CPUs like we think of that run a PC, but there is also a range of chips that are customized for specific tasks like AI used to scan online videos or machine learning used to make ecommerce recommendations. Marvell specializes in these types of chipsets, known as customized ASICs. Marvell also increasingly competes with chip heavyweights Intel and Nvidia with its Octeon data processing units or “DPUs” which is an ARM-based CPU that offloads networking, storage, security, and other infrastructure workloads from the CPU in the server and accelerates them, saving CPU capacity for other tasks, like running applications.

Marvell’s peers and competitors include AMD (NASDAQ:AMD), Broadcom (NASDAQ:AVGO), Intel (NASDAQ:INTC), and Nvidia (NASDAQ: NDVA).

4. Analog Semiconductors

Longer manufacturing duration allows analog chip makers to generate greater efficiencies, leading to structurally higher gross margins than their fabless digital peers. The downside of vertical integration is that cyclicality can be more pronounced for analog chipmakers, as capacity utilization upsides work in reverse during down periods.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Marvell Technology’s sales grew at an exceptional 22% compounded annual growth rate over the last five years. Its growth beat the average semiconductor company and shows its offerings resonate with customers, a helpful starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Marvell Technology’s annualized revenue growth of 19% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Marvell Technology’s year-on-year revenue growth of 36.8% was wonderful, and its $2.07 billion of revenue was in line with Wall Street’s estimates. Beyond meeting estimates, this marks 5 straight quarters of growth, implying that Marvell Technology is in the middle of its cycle - a typical upcycle generally lasts 8-10 quarters. Company management is currently guiding for a 21.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 17% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market is forecasting success for its products and services.

6. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Marvell Technology’s DIO came in at 92, which is 11 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

7. Gross Margin & Pricing Power

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Marvell Technology’s unit economics are roughly in line with other semiconductor businesses, pointing to a lack of significant pricing pressure and the effectiveness of its products. As you can see below, it averaged a decent 48.9% gross margin over the last two years. That means for every $100 in revenue, roughly $48.88 was left to spend on selling, marketing, R&D, and general administrative overhead.

In Q3, Marvell Technology produced a 51.6% gross profit margin, up 5 percentage points year on year. Marvell Technology’s full-year margin has also been trending up over the past 12 months, increasing by 4.5 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

8. Operating Margin

Marvell Technology was profitable over the last two years but held back by its large cost base. Its average operating margin of 1.3% was weak for a semiconductor business.

On the plus side, Marvell Technology’s operating margin rose by 24.6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Marvell Technology generated an operating margin profit margin of 17.2%, up 63.6 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

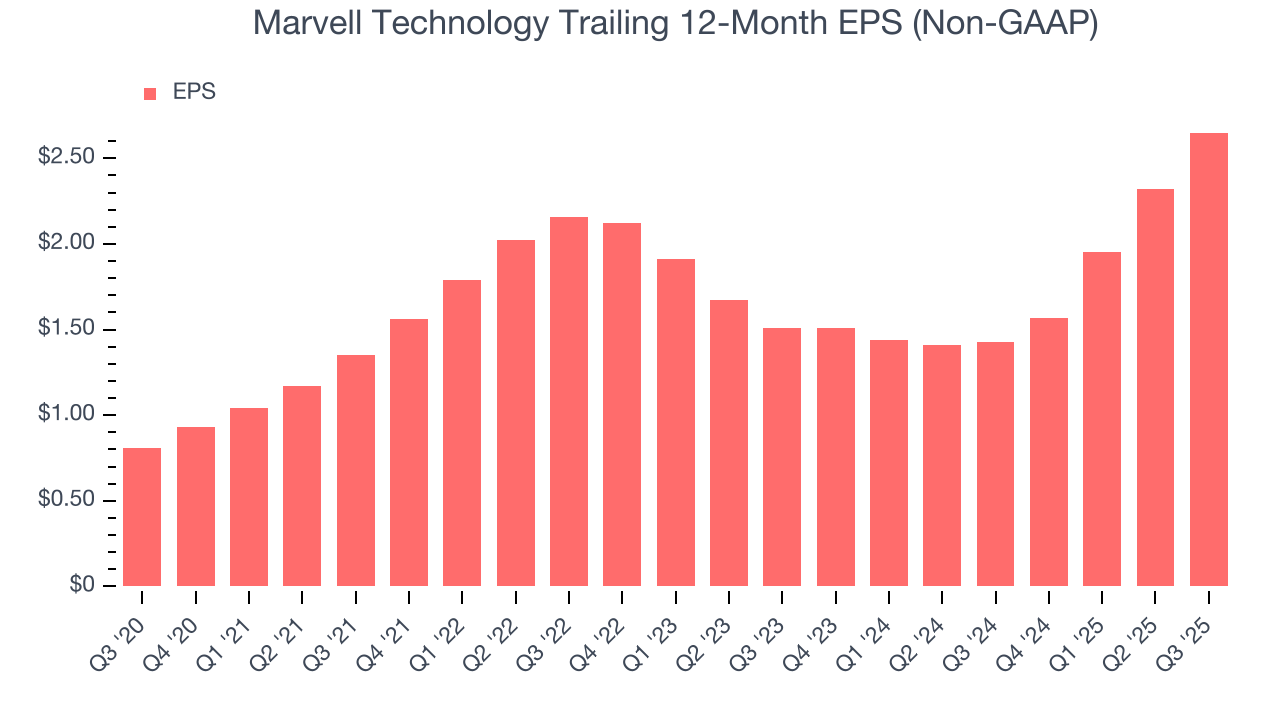

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Marvell Technology’s EPS grew at a spectacular 26.8% compounded annual growth rate over the last five years, higher than its 22% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Marvell Technology’s earnings can give us a better understanding of its performance. As we mentioned earlier, Marvell Technology’s operating margin expanded by 24.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Marvell Technology reported adjusted EPS of $0.76, up from $0.43 in the same quarter last year. This print beat analysts’ estimates by 3%. Over the next 12 months, Wall Street expects Marvell Technology’s full-year EPS of $2.65 to grow 20.7%.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Marvell Technology has shown robust cash profitability, and if it can maintain this level of cash generation, will be in a fine position to ride out cyclical downturns while investing in plenty of new products and returning capital to investors. The company’s free cash flow margin averaged 22.8% over the last two years, quite impressive for a semiconductor business.

Taking a step back, we can see that Marvell Technology’s margin expanded by 8 percentage points over the last five years. This is encouraging because it gives the company more optionality.

Marvell Technology’s free cash flow clocked in at $508.8 million in Q3, equivalent to a 24.5% margin. The company’s cash profitability regressed as it was 5.9 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends are more important.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Marvell Technology has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 1.4%, meaning management lost money while trying to expand the business.

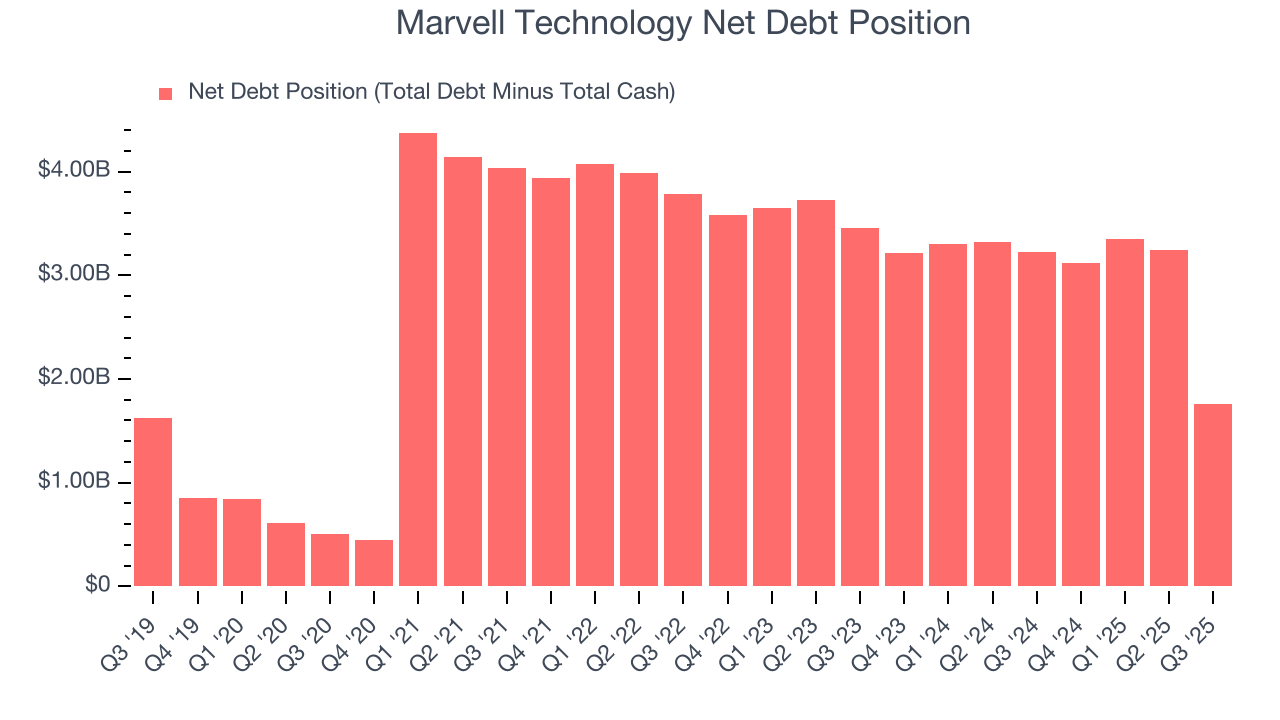

12. Balance Sheet Assessment

Marvell Technology reported $2.71 billion of cash and $4.47 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.8 billion of EBITDA over the last 12 months, we view Marvell Technology’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $1.73 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Marvell Technology’s Q3 Results

A highlight during the quarter was Marvell Technology’s improvement in inventory levels. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 5.2% to $87.84 immediately after reporting.

14. Is Now The Time To Buy Marvell Technology?

Updated: February 28, 2026 at 9:26 PM EST

When considering an investment in Marvell Technology, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We think Marvell Technology is a solid business. First off, its revenue growth was exceptional over the last five years, and analysts believe it can continue growing at these levels. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its expanding operating margin shows the business has become more efficient. On top of that, its rising cash profitability gives it more optionality.

Marvell Technology’s P/E ratio based on the next 12 months is 24.6x. When scanning the semiconductor space, Marvell Technology trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $115.65 on the company (compared to the current share price of $81.42), implying they see 42% upside in buying Marvell Technology in the short term.