Matrix Service (MTRX)

We’re skeptical of Matrix Service. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why Matrix Service Is Not Exciting

Founded in Oklahoma, Matrix Service (NASDAQ:MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

- Gross margin of 3.7% is below its competitors, leaving less money to invest in areas like marketing and R&D

- Historical operating margin losses point to an inefficient cost structure

- A consolation is that its market share is on track to rise over the next 12 months as its 14.5% projected revenue growth implies demand will accelerate from its two-year trend

Matrix Service doesn’t satisfy our quality benchmarks. There are better opportunities in the market.

Why There Are Better Opportunities Than Matrix Service

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Matrix Service

At $11.24 per share, Matrix Service trades at 16.7x forward P/E. Matrix Service’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Matrix Service (MTRX) Research Report: Q4 CY2025 Update

Industrial construction and maintenance company Matrix Service (NASDAQ:MTRX) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 12.5% year on year to $210.5 million. The company’s full-year revenue guidance of $900 million at the midpoint came in 0.9% below analysts’ estimates. Its non-GAAP loss of $0.02 per share was significantly below analysts’ consensus estimates.

Matrix Service (MTRX) Q4 CY2025 Highlights:

- Revenue: $210.5 million vs analyst estimates of $215.4 million (12.5% year-on-year growth, 2.3% miss)

- Adjusted EPS: -$0.02 vs analyst estimates of $0.04 (significant miss)

- Adjusted EBITDA: $2.42 million vs analyst estimates of $2.80 million (1.1% margin, relatively in line)

- The company reconfirmed its revenue guidance for the full year of $900 million at the midpoint

- Operating Margin: -1%, up from -3.4% in the same quarter last year

- Free Cash Flow Margin: 3%, down from 17.5% in the same quarter last year

- Backlog: $1.13 billion at quarter end

- Market Capitalization: $402.7 million

Company Overview

Founded in Oklahoma, Matrix Service (NASDAQ:MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Matrix Service was started in 1984 and has grown from a local tank repair business to a major service provider in the industrial and energy sectors.

Today, the company's offerings can be organized into distinct categories, each targeting a key area of industrial need. One area specializes in the construction and maintenance of storage solutions for gasses and liquids, featuring products like geodesic domes and floating roofs, essential for the safe and efficient storage of critical materials. Another segment focuses on construction and maintenance services within the utility sector, including projects like substations and emergency restoration, which are crucial for maintaining energy distribution infrastructure. The third segment addresses maintenance and construction needs for energy processing and production facilities, emphasizing adaptability to the evolving demands for sustainable energy solutions.

Revenue is primarily derived from project-based contracts across these segments, supplemented by long-term maintenance agreements that provide a recurring income stream. Cost structures are predominantly fixed, reflecting the project-based nature of the industry. This setup allows Matrix to manage seasonal fluctuations, such as energy demand or weather conditions including hurricanes, snowstorms, and abnormally low or high temperatures.

4. Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Competitors in the industrial and construction sectors include Fluor Corporation (NYSE:FLR), McDermott International (NYSE: MDR), and Chicago Bridge & Iron (NYSE:CBI)

5. Revenue Growth

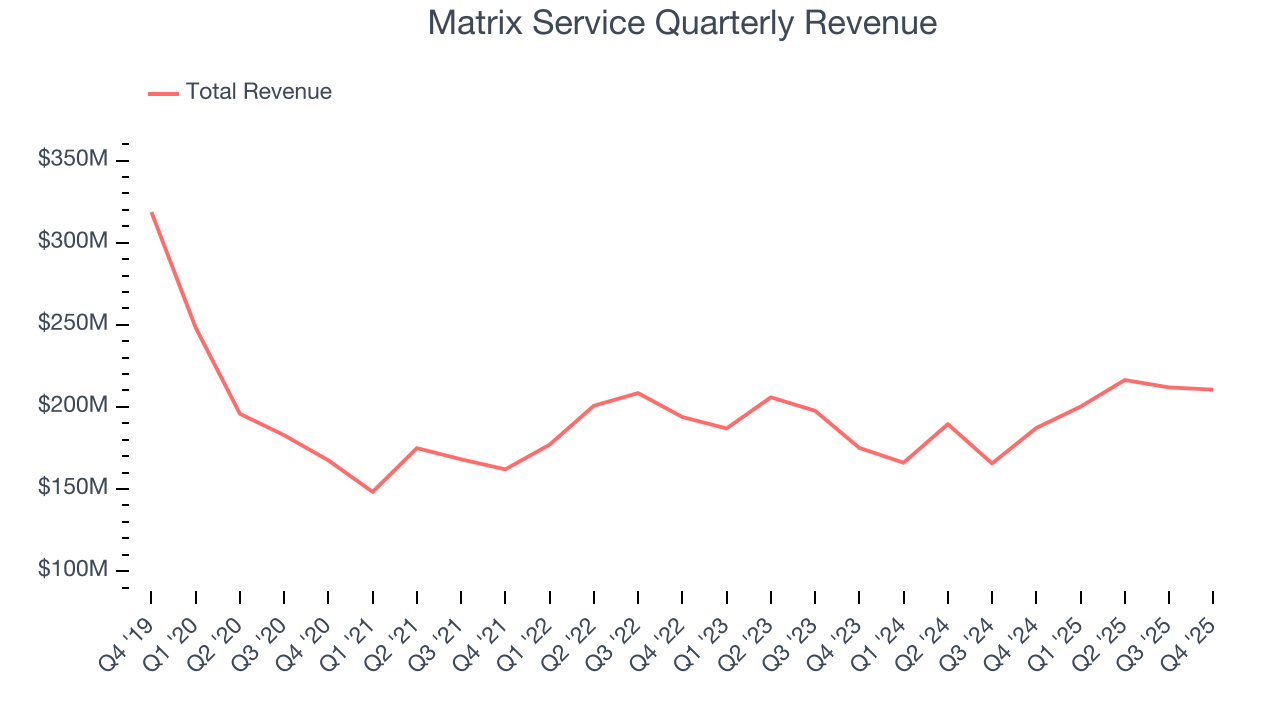

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Matrix Service’s sales grew at a weak 1.1% compounded annual growth rate over the last five years. This was below our standards and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Matrix Service’s annualized revenue growth of 4.7% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Matrix Service’s revenue grew by 12.5% year on year to $210.5 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 17% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will spur better top-line performance.

6. Gross Margin & Pricing Power

Matrix Service has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 3.7% gross margin over the last five years. Said differently, Matrix Service had to pay a chunky $96.26 to its suppliers for every $100 in revenue.

In Q4, Matrix Service produced a 6.2% gross profit margin, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

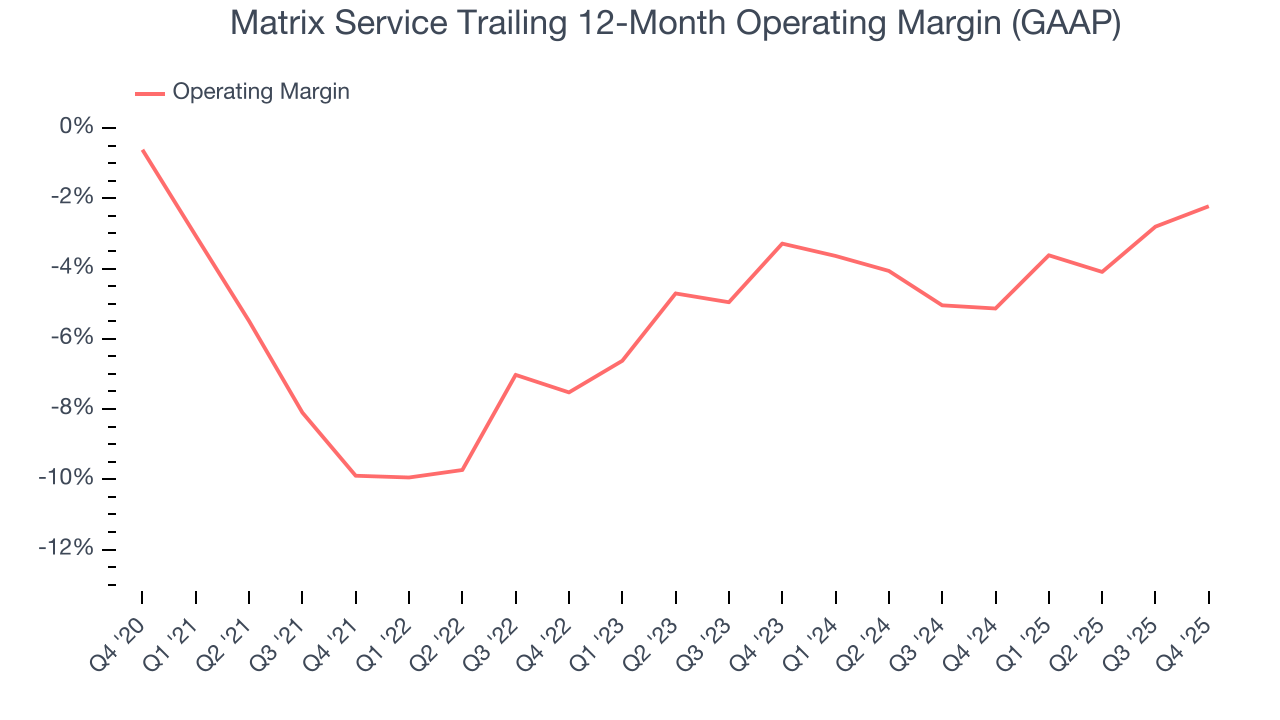

Matrix Service’s high expenses have contributed to an average operating margin of negative 5.4% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Matrix Service’s operating margin rose by 7.7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Matrix Service generated a negative 1% operating margin. The company's consistent lack of profits raise a flag.

8. Earnings Per Share

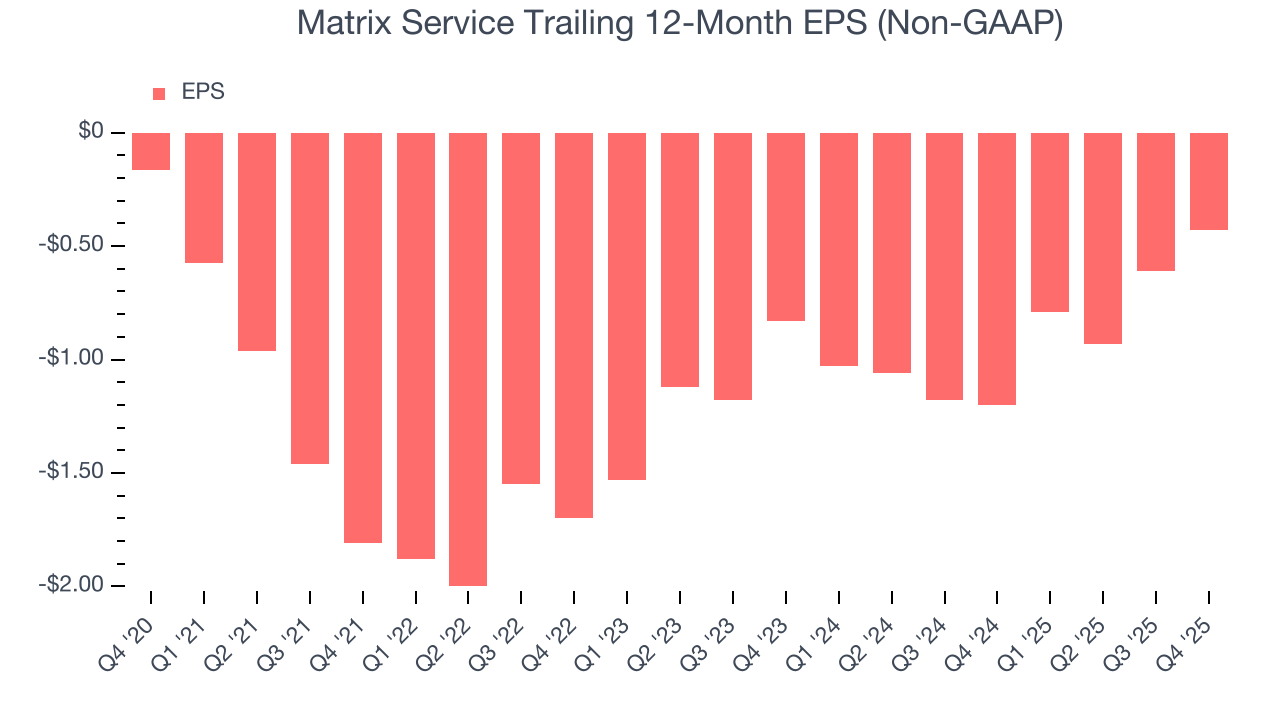

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Matrix Service’s earnings losses deepened over the last five years as its EPS dropped 21.4% annually. However, it’s bucked its trend as of late, increasing its EPS over the last three years. We’ll see if it can maintain its growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Matrix Service, its two-year annual EPS growth of 28% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q4, Matrix Service reported adjusted EPS of negative $0.02, up from negative $0.20 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Matrix Service’s full-year EPS of negative $0.43 will flip to positive $0.70.

9. Cash Is King

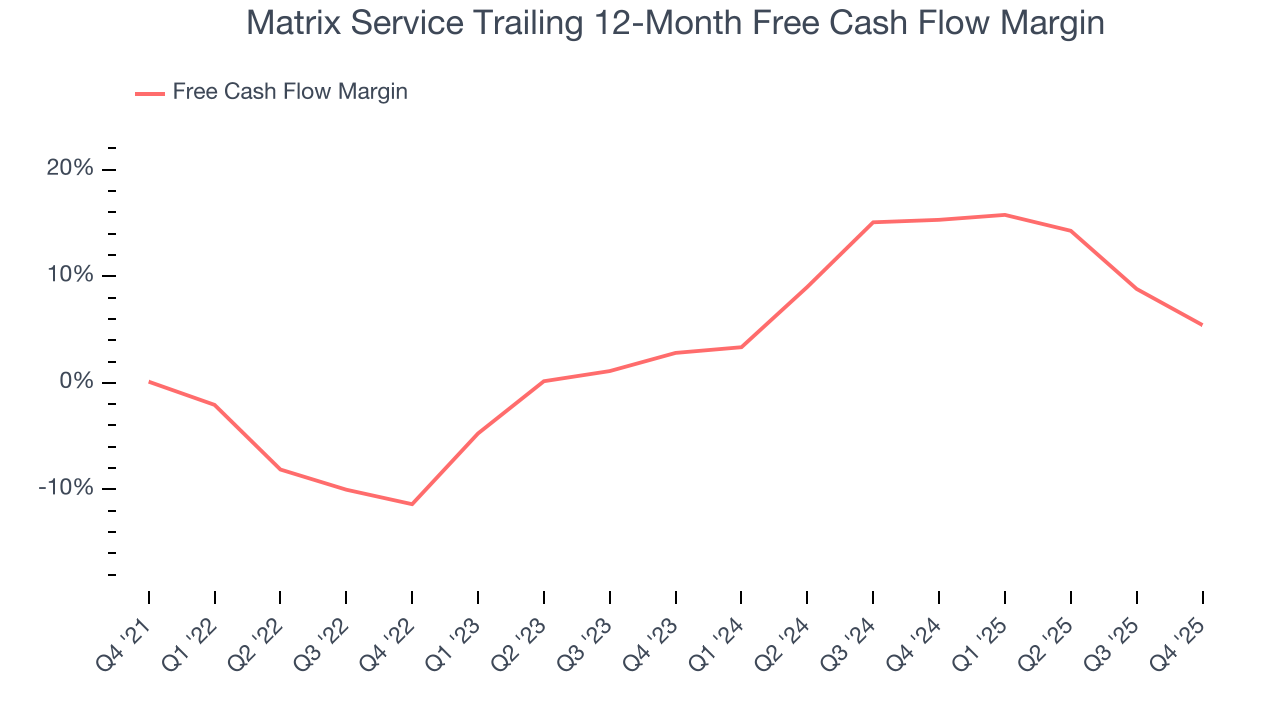

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Matrix Service has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, lousy for an industrials business.

Taking a step back, an encouraging sign is that Matrix Service’s margin expanded by 5.3 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Matrix Service’s free cash flow clocked in at $6.28 million in Q4, equivalent to a 3% margin. The company’s cash profitability regressed as it was 14.5 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Balance Sheet Assessment

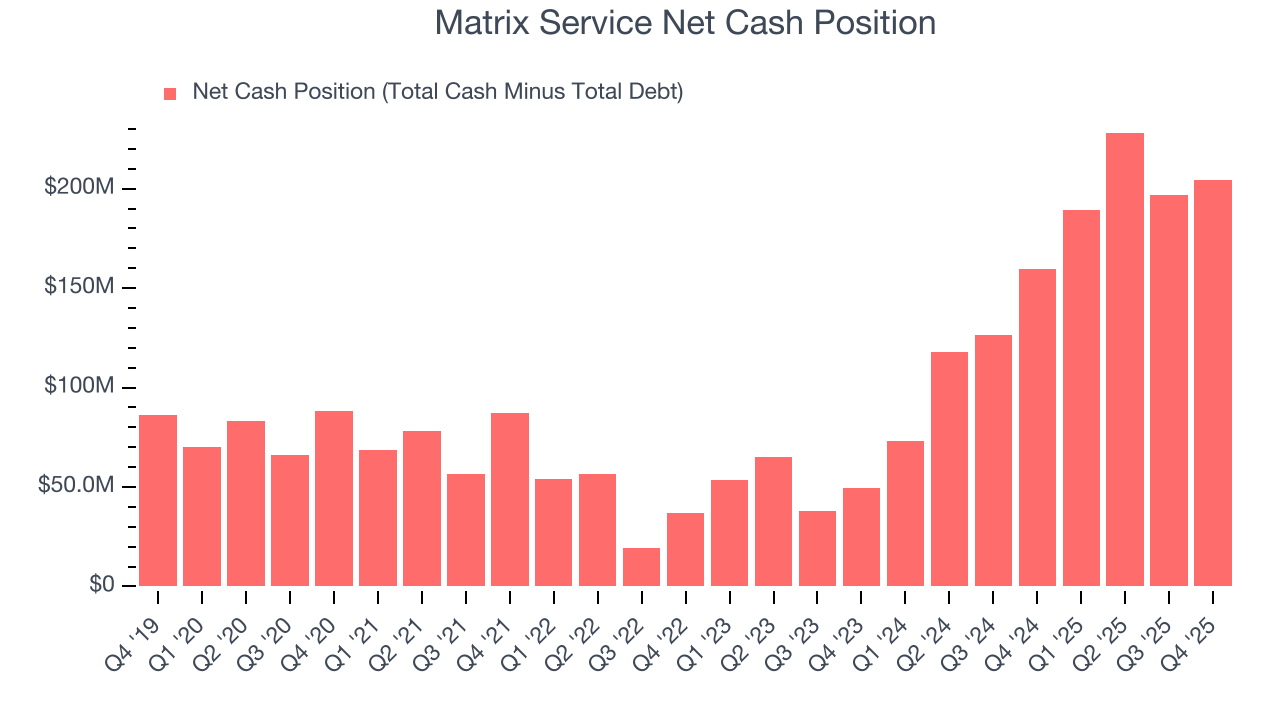

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Matrix Service is a well-capitalized company with $224 million of cash and $19.39 million of debt on its balance sheet. This $204.6 million net cash position is 50.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Matrix Service’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $13.48 immediately following the results.

12. Is Now The Time To Buy Matrix Service?

Updated: March 5, 2026 at 10:49 PM EST

Before investing in or passing on Matrix Service, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Matrix Service isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue growth was weak over the last five years. While its rising cash profitability gives it more optionality, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its operating margins reveal poor profitability compared to other industrials companies.

Matrix Service’s P/E ratio based on the next 12 months is 16.7x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $19 on the company (compared to the current share price of $11.24).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.