nCino (NCNO)

nCino faces an uphill battle. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think nCino Will Underperform

Born from the internal technology needs of a community bank in 2011, nCino (NASDAQ:NCNO) provides cloud-based software that helps financial institutions streamline client onboarding, loan origination, and account opening processes.

- Steep infrastructure costs and weaker unit economics for a software company are reflected in its low gross margin of 60.3%

- Estimated sales growth of 6.1% for the next 12 months implies demand will slow from its two-year trend

- Operating margin improvement of 2.2 percentage points over the last year demonstrates its ability to scale efficiently

nCino falls short of our expectations. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than nCino

High Quality

Investable

Underperform

Why There Are Better Opportunities Than nCino

nCino’s stock price of $24.20 implies a valuation ratio of 4.5x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. nCino (NCNO) Research Report: Q3 CY2025 Update

Banking software provider nCino (NASDAQ:NCNO) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 9.6% year on year to $152.2 million. The company expects next quarter’s revenue to be around $147.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.31 per share was 49.9% above analysts’ consensus estimates.

nCino (NCNO) Q3 CY2025 Highlights:

- Revenue: $152.2 million vs analyst estimates of $147.3 million (9.6% year-on-year growth, 3.3% beat)

- Adjusted EPS: $0.31 vs analyst estimates of $0.21 (49.9% beat)

- Adjusted Operating Income: $39.86 million vs analyst estimates of $32.74 million (26.2% margin, 21.8% beat)

- Revenue Guidance for Q4 CY2025 is $147.5 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $0.91 at the midpoint, a 15.3% increase

- Operating Margin: 7.7%, up from -0.6% in the same quarter last year

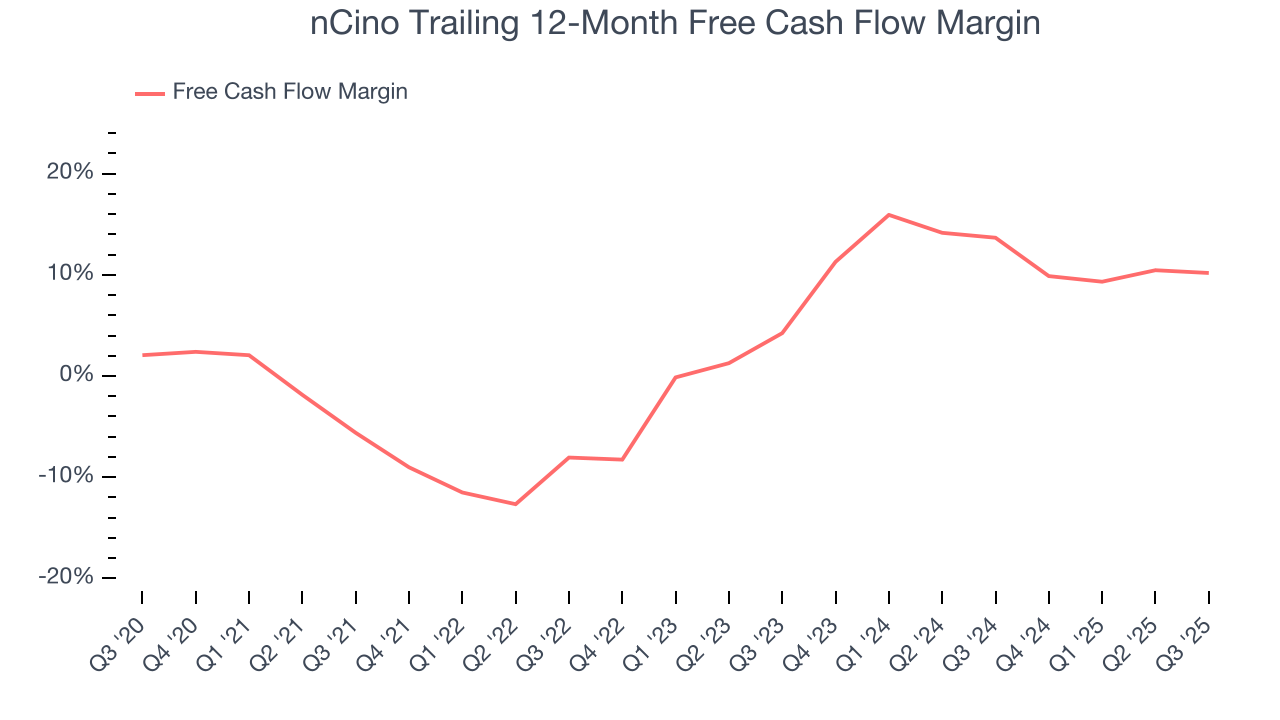

- Free Cash Flow Margin: 3.2%, down from 8.5% in the previous quarter

- Market Capitalization: $2.83 billion

Company Overview

Born from the internal technology needs of a community bank in 2011, nCino (NASDAQ:NCNO) provides cloud-based software that helps financial institutions streamline client onboarding, loan origination, and account opening processes.

nCino's flagship product, the nCino Bank Operating System, serves as a comprehensive digital platform that connects financial institution employees, clients, and third parties on a single cloud-based system. This eliminates the information silos common in banking and provides real-time visibility across operations. The platform integrates with core banking systems and third-party applications, functioning as a central hub for data and workflow management.

The company targets financial institutions of all sizes—from global banks like Bank of America and Santander to regional credit unions and community banks. nCino's software handles complex commercial lending processes, consumer loans, mortgage origination, and deposit account opening, with specialized features for regulatory compliance and risk management.

A key differentiator is nCino's artificial intelligence suite (nIQ), which automates time-consuming tasks like financial statement spreading and provides analytics for portfolio management and loan pricing. For example, a commercial relationship manager might use nCino to process a business loan application, with the system automatically extracting data from financial documents, calculating risk metrics, and suggesting appropriate pricing—all while maintaining a digital audit trail for compliance purposes.

nCino employs a subscription-based revenue model with multi-year contracts typically ranging from three to five years. The company has expanded beyond its U.S. origins to serve customers across global markets, with implementations typically taking three to eighteen months depending on the institution's size and complexity.

4. Banking Software

Consumers these days are accustomed to frictionless digital experiences from online shopping to ordering food or hailing a cab. Financial services firms are notoriously risk averse in adopting modern software, often lacking the resources or competency to develop the digital solutions in-house. That drives demand for software as a service platforms that allows banks and other finance institutions to offer the digital services without having to run or maintain them.

nCino competes with traditional banking software providers like Finastra, FIS (NYSE:FIS), and Jack Henry & Associates (NASDAQ:JKHY), as well as fintech companies such as Q2 Holdings (NYSE:QTWO) and Blend Labs (NYSE:BLND). Salesforce (NYSE:CRM), which provides the underlying platform for nCino's products, also offers some competing financial services cloud solutions.

5. Revenue Growth

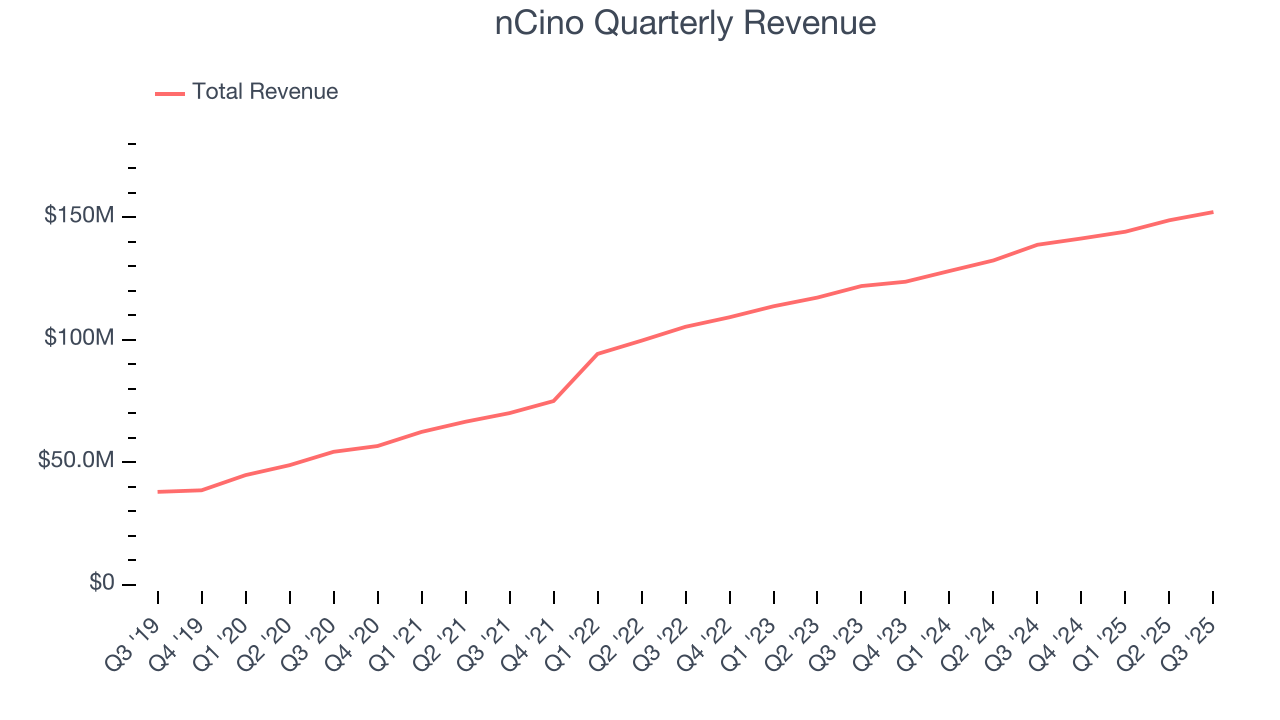

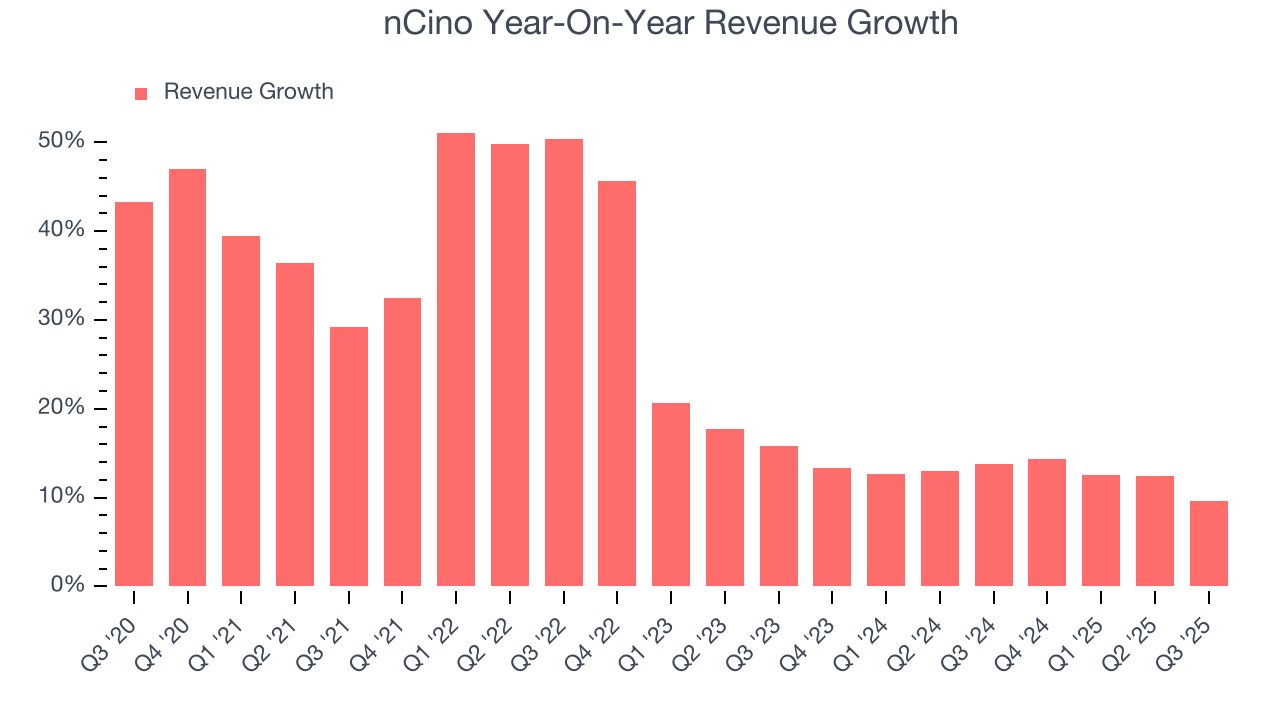

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, nCino grew its sales at a solid 25.8% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. nCino’s recent performance shows its demand has slowed as its annualized revenue growth of 12.7% over the last two years was below its five-year trend.

This quarter, nCino reported year-on-year revenue growth of 9.6%, and its $152.2 million of revenue exceeded Wall Street’s estimates by 3.3%. Company management is currently guiding for a 4.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

6. Billings

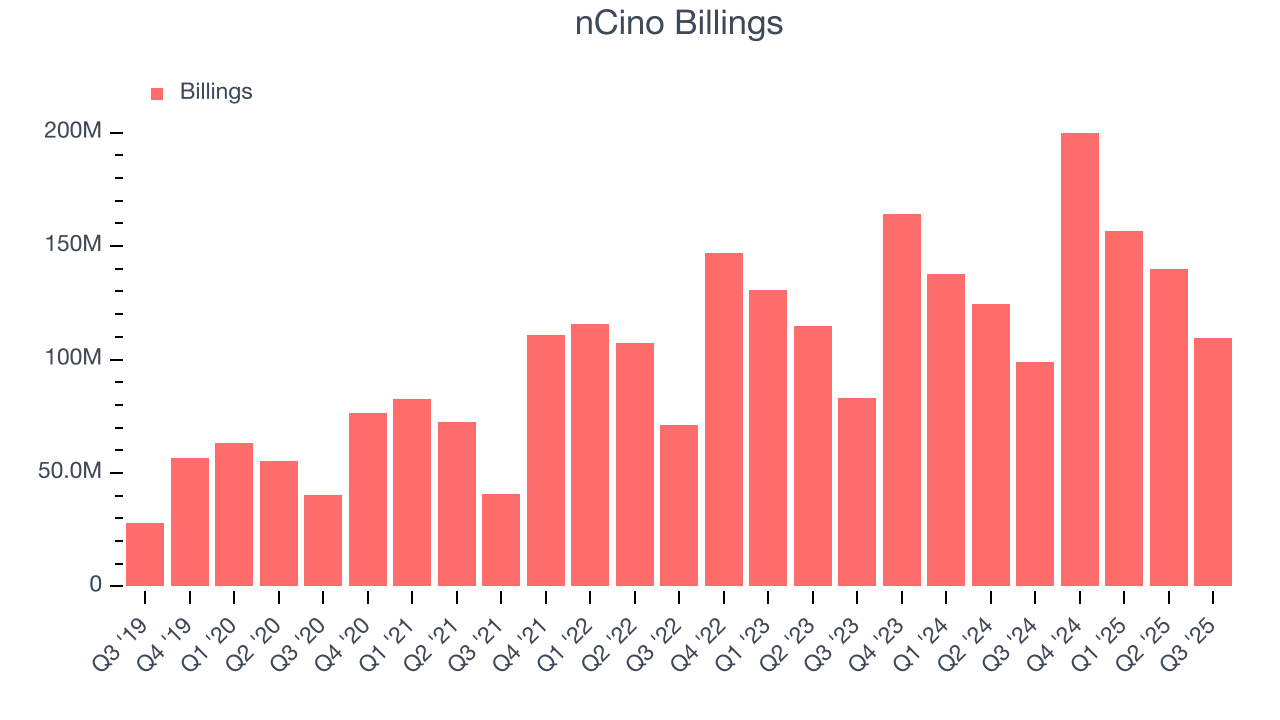

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

nCino’s billings came in at $109.3 million in Q3, and over the last four quarters, its growth slightly lagged the sector as it averaged 14.6% year-on-year increases. However, this alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Customer Acquisition Efficiency

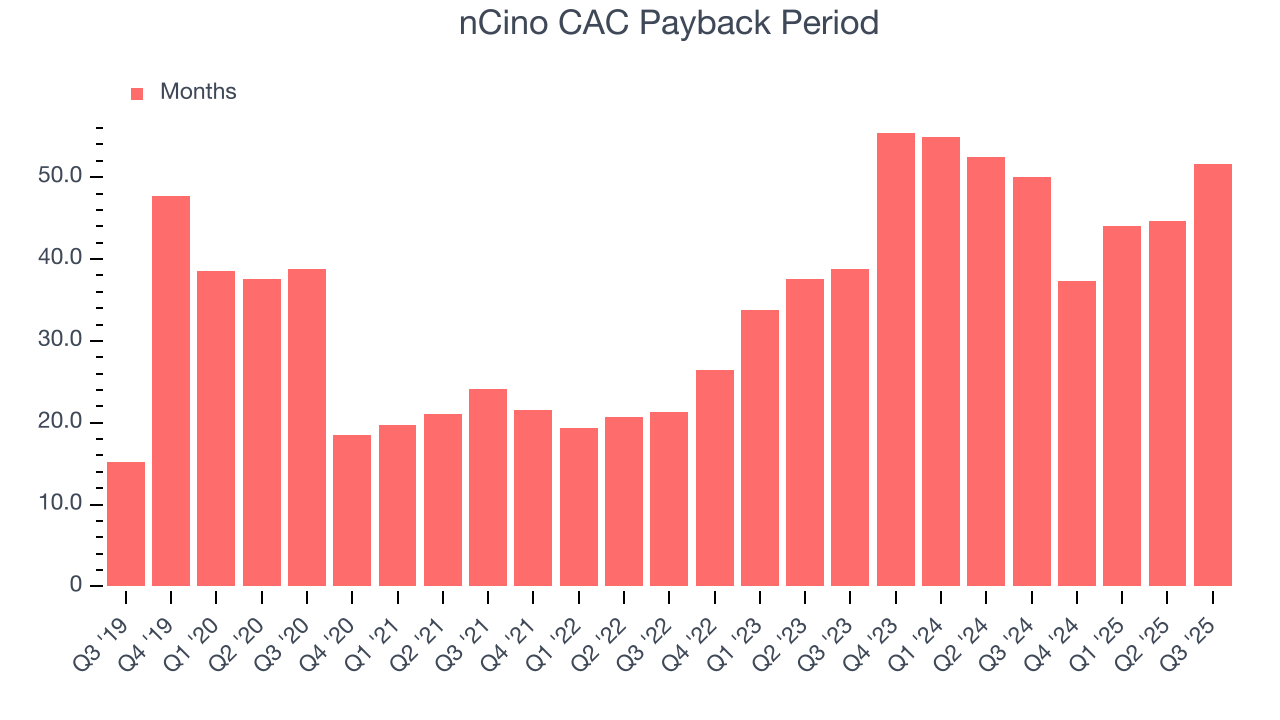

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for nCino to acquire new customers as its CAC payback period checked in at 51.6 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

8. Gross Margin & Pricing Power

For software companies like nCino, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

nCino’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 60.3% gross margin over the last year. That means nCino paid its providers a lot of money ($39.67 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. nCino has seen gross margins improve by 0.8 percentage points over the last 2 year, which is slightly better than average for software.

nCino’s gross profit margin came in at 61.6% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

nCino was roughly breakeven when averaging the last year of quarterly operating profits, mediocre for a software business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, nCino’s operating margin rose by 2.2 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, nCino generated an operating margin profit margin of 7.7%, up 8.3 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

nCino has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 10.2%, subpar for a software business.

nCino’s free cash flow clocked in at $4.90 million in Q3, equivalent to a 3.2% margin. This cash profitability was in line with the comparable period last year but below its one-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict nCino’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 10.2% for the last 12 months will increase to 18.6%, it options for capital deployment (investments, share buybacks, etc.).

11. Balance Sheet Assessment

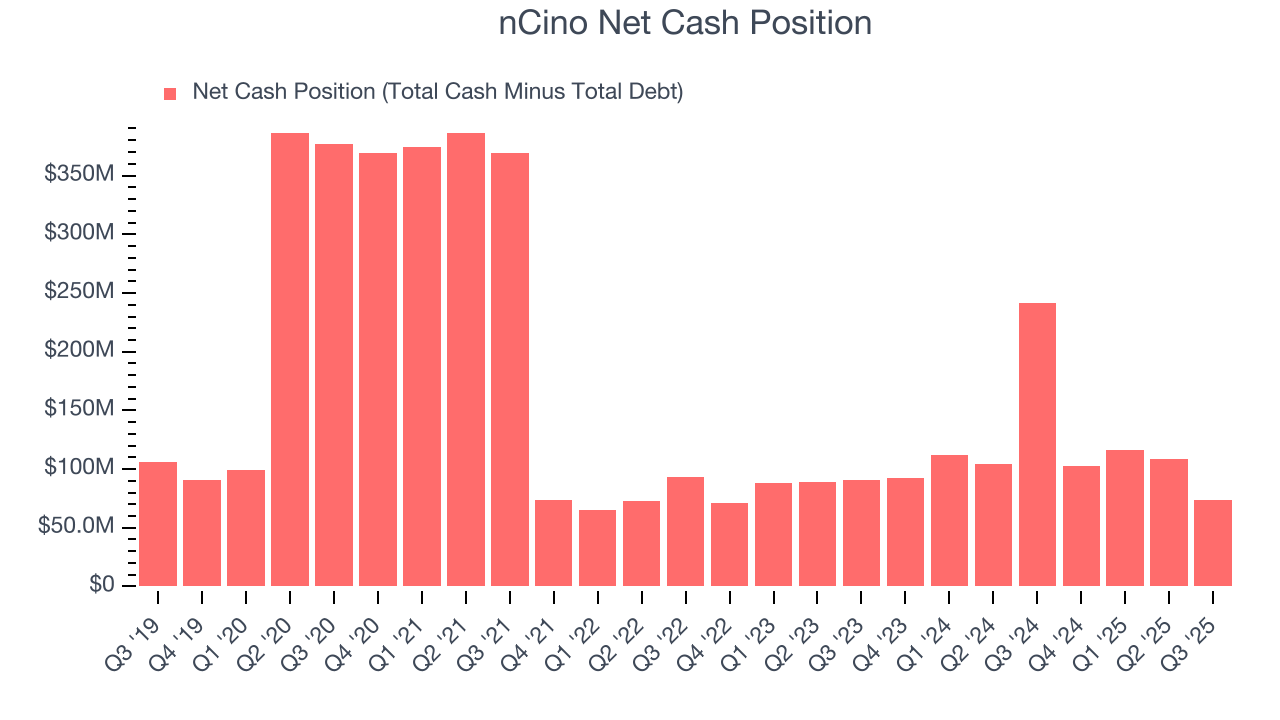

Companies with more cash than debt have lower bankruptcy risk.

nCino is a well-capitalized company with $87.59 million of cash and $14.26 million of debt on its balance sheet. This $73.33 million net cash position is 2.6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from nCino’s Q3 Results

We were impressed by nCino’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 5.5% to $26.97 immediately following the results.

13. Is Now The Time To Buy nCino?

Updated: January 24, 2026 at 9:16 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in nCino.

nCino doesn’t pass our quality test. Although its revenue growth was strong over the last five years, it’s expected to deteriorate over the next 12 months and its gross margins show its business model is much less lucrative than other companies. On top of that, the company’s expanding operating margin shows it’s becoming more efficient at building and selling its software.

nCino’s price-to-sales ratio based on the next 12 months is 4.5x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $34.14 on the company (compared to the current share price of $24.20).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.