Novavax (NVAX)

We’re skeptical of Novavax. Its decelerating revenue growth and historical cash burn don’t give us much confidence in a potential turnaround.― StockStory Analyst Team

1. News

2. Summary

Why We Think Novavax Will Underperform

Pioneering a nanoparticle technology that mimics the molecular structure of disease pathogens, Novavax (NASDAQ:NVAX) develops and commercializes protein-based vaccines for infectious diseases, with a primary focus on its COVID-19 vaccine and combination respiratory vaccine candidates.

- Estimated sales decline of 66.2% for the next 12 months implies a challenging demand environment

- Historical adjusted operating margin losses point to an inefficient cost structure

- The good news is that its earnings per share grew by 19.8% annually over the last five years and beat its peers

Novavax’s quality is insufficient. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Novavax

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Novavax

At $9.49 per share, Novavax trades at 4.4x forward price-to-sales. The market typically values companies like Novavax based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Novavax (NVAX) Research Report: Q4 CY2025 Update

Vaccine biotechnology company Novavax (NASDAQ:NVAX) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 66.6% year on year to $147.1 million. Its GAAP profit of $0.11 per share was significantly above analysts’ consensus estimates.

Novavax (NVAX) Q4 CY2025 Highlights:

- Revenue: $147.1 million vs analyst estimates of $93.49 million (66.6% year-on-year growth, 57.4% beat)

- EPS (GAAP): $0.11 vs analyst estimates of -$0.49 (significant beat)

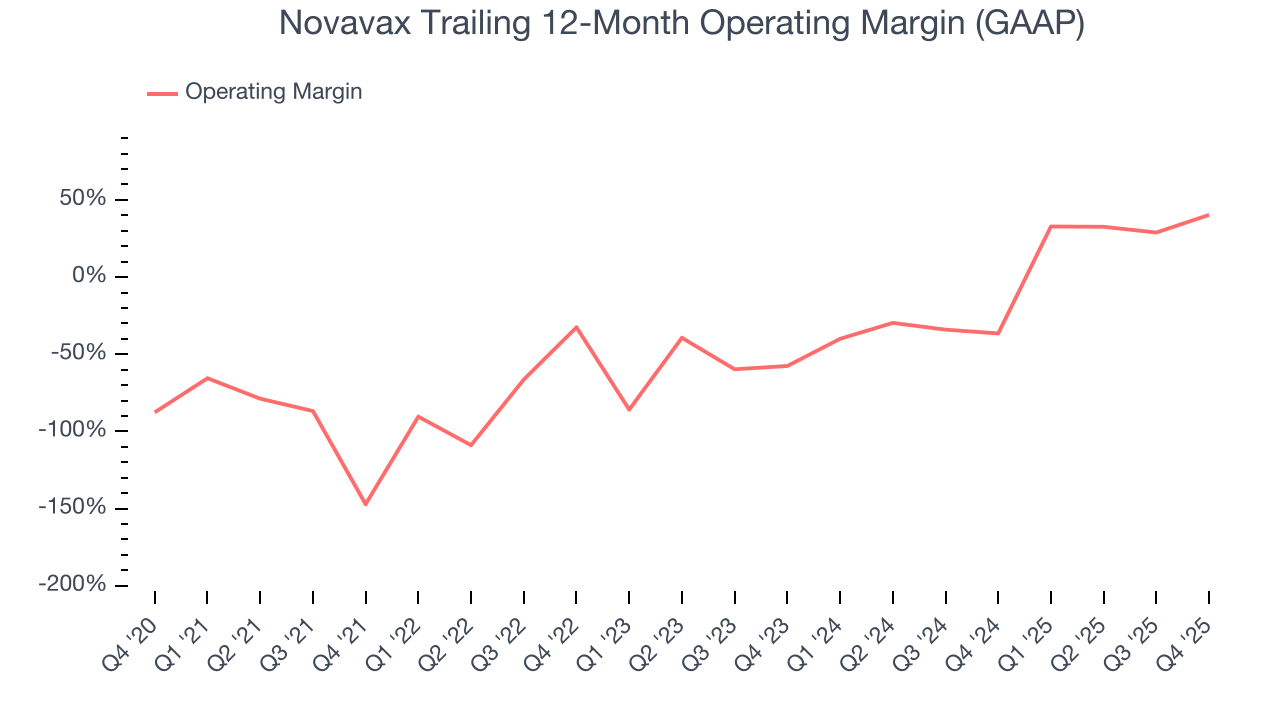

- Operating Margin: 9.7%, up from -148% in the same quarter last year

- Market Capitalization: $1.55 billion

Company Overview

Pioneering a nanoparticle technology that mimics the molecular structure of disease pathogens, Novavax (NASDAQ:NVAX) develops and commercializes protein-based vaccines for infectious diseases, with a primary focus on its COVID-19 vaccine and combination respiratory vaccine candidates.

The company's innovative platform creates vaccines by engineering recombinant proteins that form nanoparticles, structurally resembling the targeted pathogens. This approach triggers robust immune responses without containing live viruses. Novavax enhances these responses with its proprietary Matrix-M adjuvant, a saponin-based compound that stimulates both antibody production and cellular immunity.

Novavax's COVID-19 vaccine received authorization in over 40 countries worldwide. Unlike mRNA-based alternatives, it uses traditional protein-based technology, positioning it as an option for those who prefer established vaccine approaches. The company routinely updates its COVID-19 vaccine to address emerging variants, with its 2023-2024 formula authorized by major regulatory agencies including the FDA and European Commission.

Beyond COVID-19, Novavax is advancing a COVID-19-Influenza Combination (CIC) vaccine candidate, potentially offering protection against both respiratory viruses in a single shot. The company also supplies its Matrix-M adjuvant for partner-developed vaccines, most notably the R21/Matrix-M malaria vaccine that received WHO prequalification in 2023 after demonstrating high efficacy in clinical trials.

Novavax manufactures its Matrix-M adjuvant in Sweden and partners with contract manufacturers like SIIPL for large-scale production of its vaccines. The company generates revenue through direct vaccine sales, advance purchase agreements with governments, and licensing deals with regional partners like SK bioscience in South Korea.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Novavax's competitors include major COVID-19 vaccine producers Pfizer/BioNTech (NYSE:PFE/NASDAQ:BNTX), Moderna (NASDAQ:MRNA), and Johnson & Johnson (NYSE:JNJ), as well as other vaccine developers like GSK (NYSE:GSK), Sanofi (NASDAQ:SNY), and Emergent BioSolutions (NYSE:EBS).

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.12 billion in revenue over the past 12 months, Novavax is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Novavax’s 18.8% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Novavax’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 6.9% over the last two years was well below its five-year trend.

This quarter, Novavax reported magnificent year-on-year revenue growth of 66.6%, and its $147.1 million of revenue beat Wall Street’s estimates by 57.4%.

Looking ahead, sell-side analysts expect revenue to decline by 55.6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

7. Operating Margin

Although Novavax was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 45.5% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Novavax’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 97.9 percentage points on a two-year basis.

This quarter, Novavax generated an operating margin profit margin of 9.7%, up 158.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Novavax’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Novavax reported EPS of $0.11, up from negative $0.51 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Novavax’s full-year EPS of $2.38 to shrink by 56%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Novavax’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 23%, meaning it lit $23.00 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Novavax’s margin dropped by 89 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

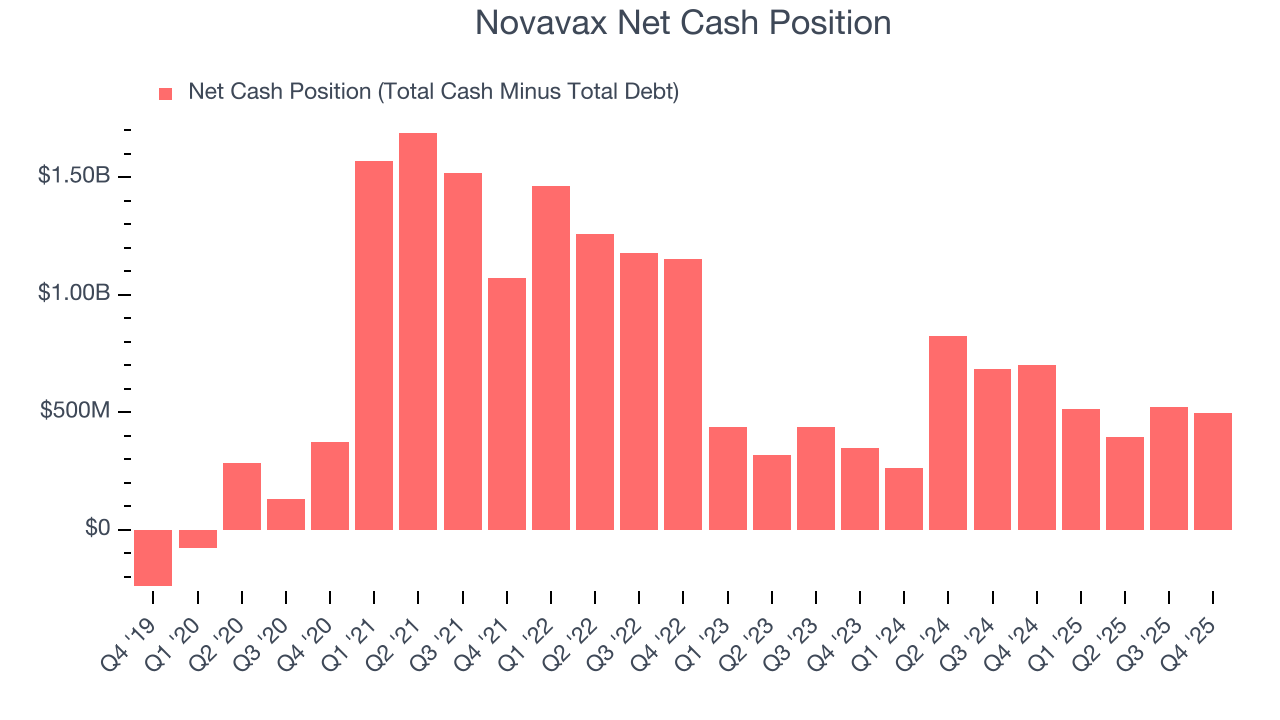

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Novavax is a well-capitalized company with $746 million of cash and $248.8 million of debt on its balance sheet. This $497.1 million net cash position is 27.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Novavax’s Q4 Results

It was good to see Novavax beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 2.2% to $9.34 immediately after reporting.

12. Is Now The Time To Buy Novavax?

Updated: March 3, 2026 at 11:52 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Novavax.

Novavax isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its cash profitability fell over the last five years. And while the company’s expanding adjusted operating margin shows the business has become more efficient, the downside is its operating margins reveal poor profitability compared to other healthcare companies.

Novavax’s forward price-to-sales ratio is 4.4x. The market typically values companies like Novavax based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $13.78 on the company (compared to the current share price of $9.49).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.