Nextpower (NXT)

Nextpower is an amazing business. Its fusion of high growth and profitability makes it an unstoppable force with big upside.― StockStory Analyst Team

1. News

2. Summary

Why We Like Nextpower

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dhabi solar farm project, Nextpower (NASDAQ:NXT) is a provider of solar tracker systems that help solar panels follow the sun.

- Annual revenue growth of 24.7% over the last five years was superb and indicates its market share increased during this cycle

- Incremental sales over the last two years have been highly profitable as its earnings per share increased by 65.3% annually, topping its revenue gains

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures, and its returns are growing as it capitalizes on even better market opportunities

Nextpower is a remarkable business. The price looks reasonable when considering its quality, and we think now is an opportune time to buy the stock.

Why Is Now The Time To Buy Nextpower?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Nextpower?

Nextpower is trading at $107.45 per share, or 25x forward P/E. Scanning the industrials landscape, we think this multiple is reasonable - arguably even attractive - for the quality you get.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. If you can get an attractive entry price, that’s icing on the cake.

3. Nextpower (NXT) Research Report: Q4 CY2025 Update

Solar tracker company Nextpower (NASDAQ:NXT) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 33.9% year on year to $909.4 million. The company expects the full year’s revenue to be around $3.46 billion, close to analysts’ estimates. Its non-GAAP profit of $1.10 per share was 17.1% above analysts’ consensus estimates.

Nextpower (NXT) Q4 CY2025 Highlights:

- Revenue: $909.4 million vs analyst estimates of $813.8 million (33.9% year-on-year growth, 11.7% beat)

- Adjusted EPS: $1.10 vs analyst estimates of $0.94 (17.1% beat)

- Adjusted EBITDA: $213.6 million vs analyst estimates of $179.8 million (23.5% margin, 18.8% beat)

- The company lifted its revenue guidance for the full year to $3.46 billion at the midpoint from $3.38 billion, a 2.6% increase

- Management raised its full-year Adjusted EPS guidance to $4.31 at the midpoint, a 4% increase

- EBITDA guidance for the full year is $820 million at the midpoint, above analyst estimates of $811.2 million

- Operating Margin: 19.4%, down from 22.1% in the same quarter last year

- Free Cash Flow Margin: 13%, down from 19.9% in the same quarter last year

- Market Capitalization: $15.92 billion

Company Overview

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dhabi solar farm project, Nextpower (NASDAQ:NXT) is a provider of solar tracker systems that help solar panels follow the sun.

The company started as a division of Solaria before becoming an independent entity in 2013. Since spinning off, it has grown through the targeted acquisition of smaller companies to improve its technological capabilities and expand its product offerings.

Today, Nextpower designs and manufactures solar tracking systems that increase the energy output of solar power plants by following the sun’s movement across the sky throughout the day. Its flagship product, the NX Horizon, automatically tilts the solar panels to follow the sun and is used by solar project developers and independent power producers.

In addition to the NX Horizon, Nextracker offers a range of complementary products and services. This includes software that tracks the operation of the panels to predict when they need maintenance. Additionally, its TrueCapture system uses machine learning and sensor data to improve the tracking of the NX Horizon by compensating for environmental factors such as terrain undulation, shading, and cloud cover.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors offering similar products include Array (NASDAQ:ARRY), First Solar (NASDAQ:FSLR), and SolarEdge (NASDAQ:SEDG).

5. Revenue Growth

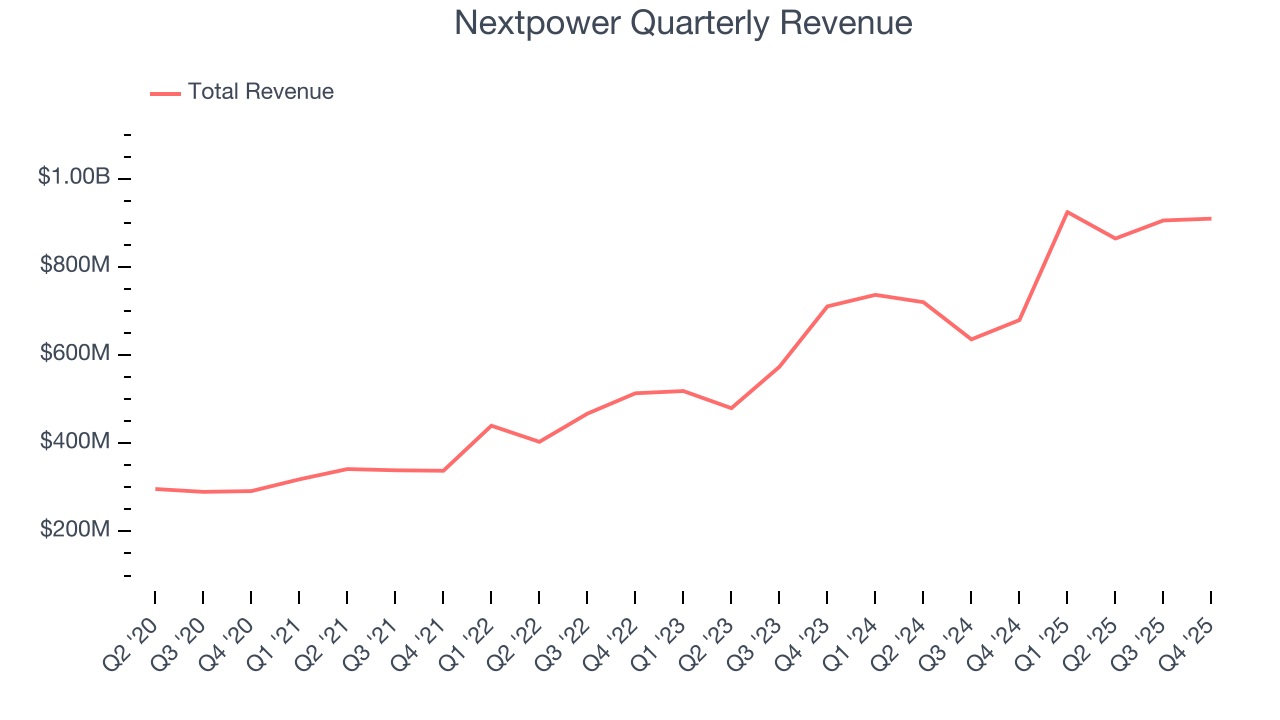

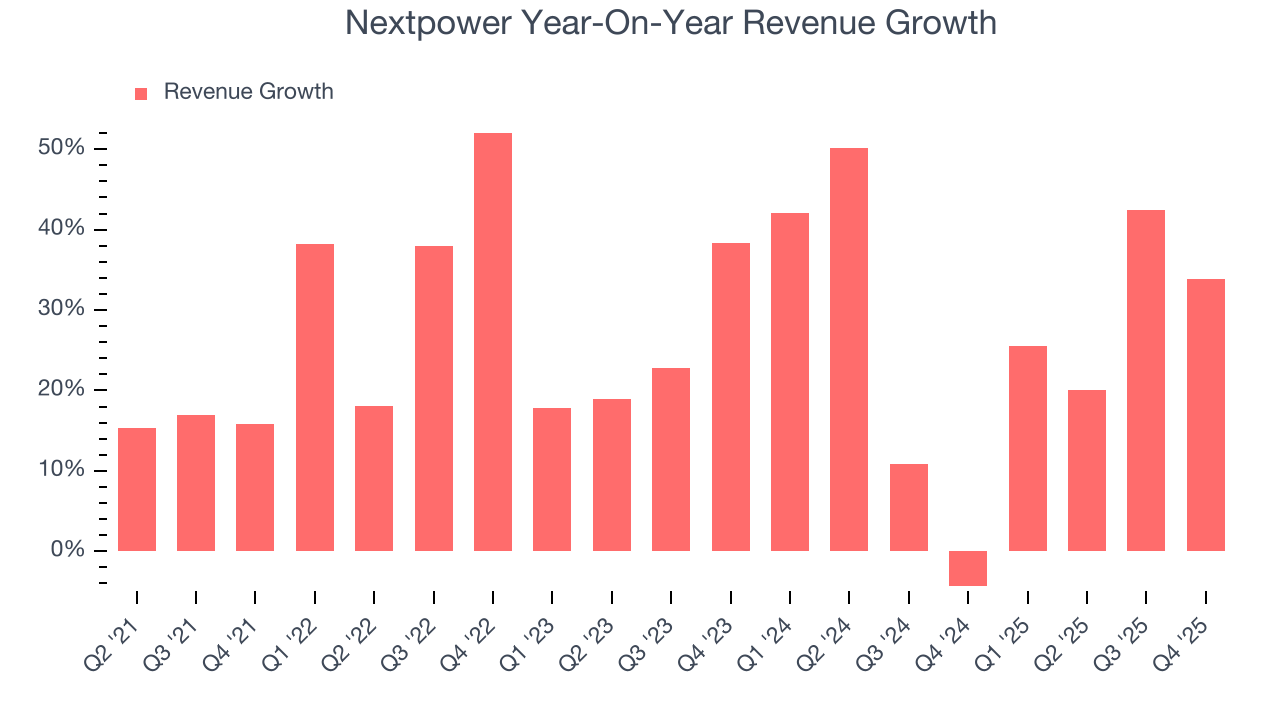

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Nextpower grew its sales at an incredible 25% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Nextpower’s annualized revenue growth of 25.7% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Nextpower reported wonderful year-on-year revenue growth of 33.9%, and its $909.4 million of revenue exceeded Wall Street’s estimates by 11.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

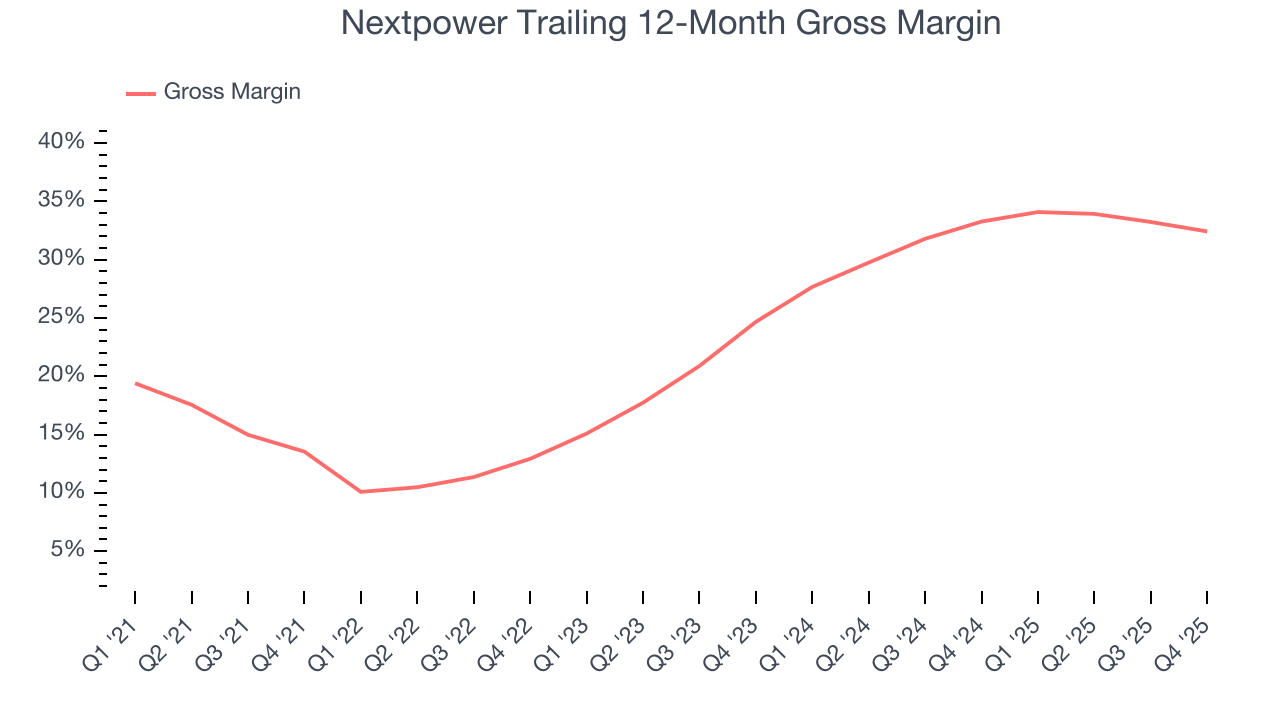

Nextpower has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26% gross margin over the last five years. That means Nextpower paid its suppliers a lot of money ($74.02 for every $100 in revenue) to run its business.

Nextpower’s gross profit margin came in at 31.7% this quarter, marking a 3.8 percentage point decrease from 35.5% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

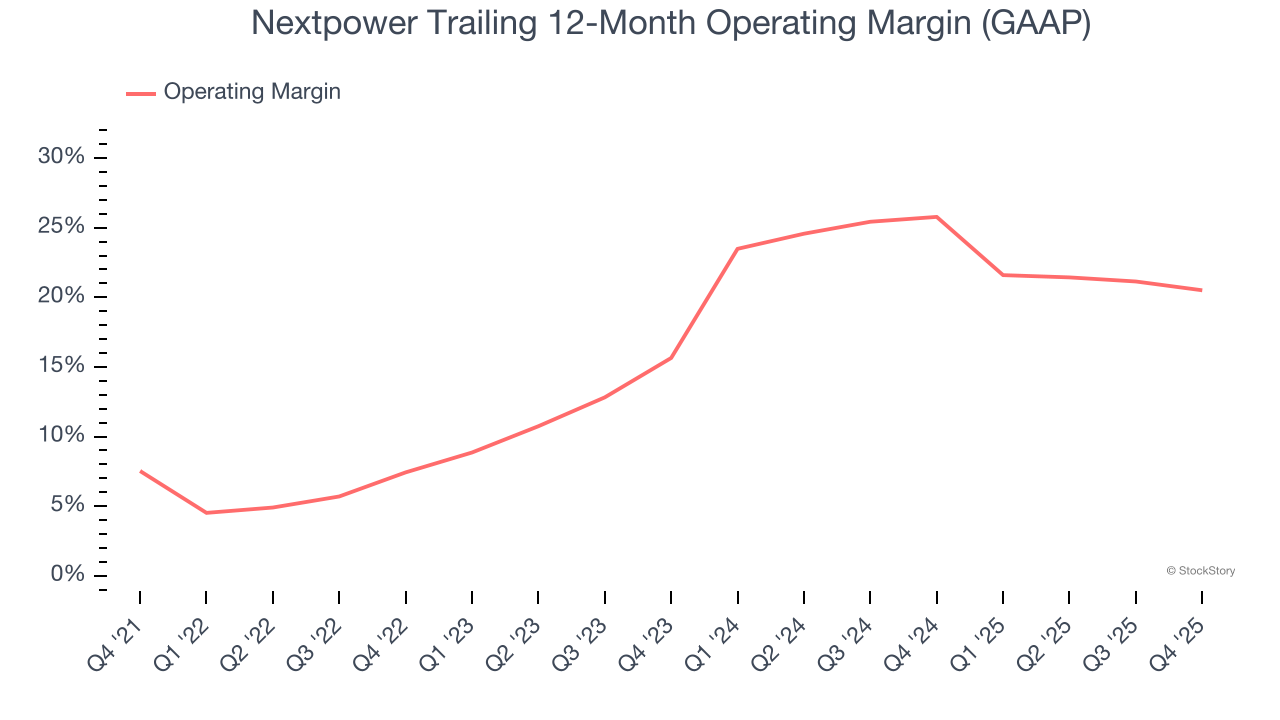

Nextpower has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Nextpower’s operating margin rose by 13 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Nextpower generated an operating margin profit margin of 19.4%, down 2.7 percentage points year on year. Since Nextpower’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

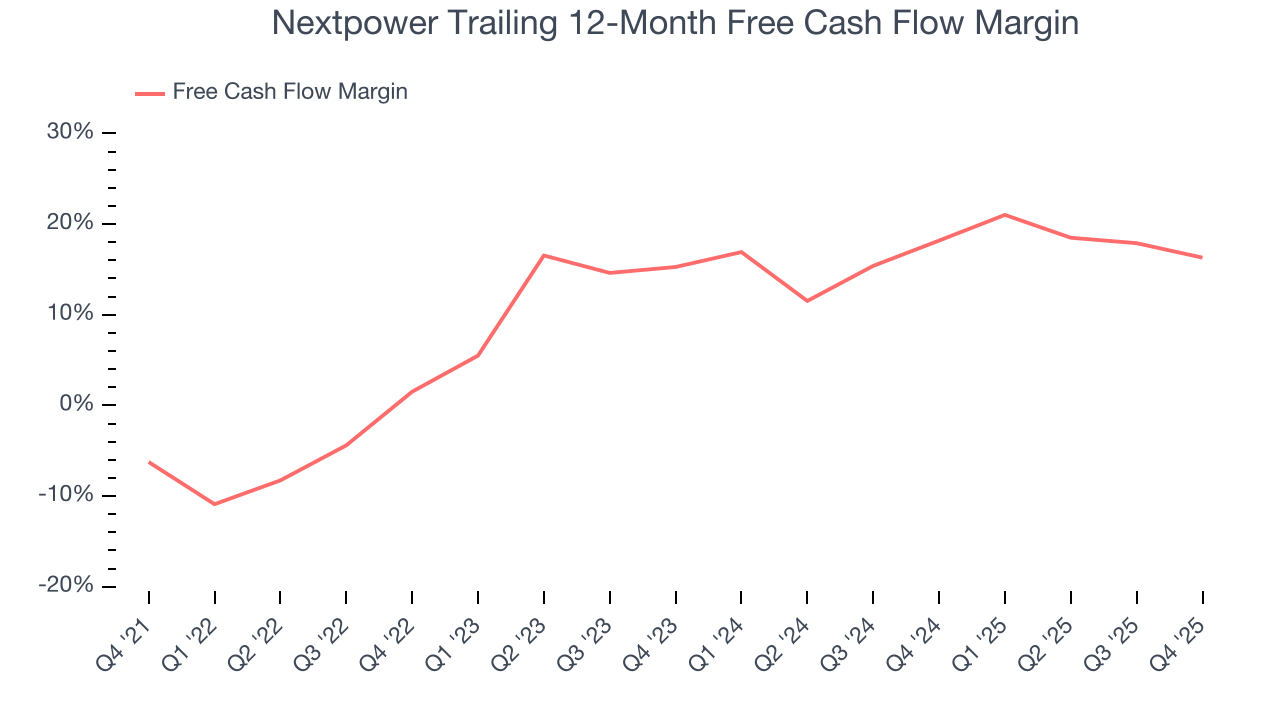

Nextpower has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 11.7% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Nextpower’s margin expanded by 22.5 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Nextpower’s free cash flow clocked in at $118.5 million in Q4, equivalent to a 13% margin. The company’s cash profitability regressed as it was 6.8 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

9. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

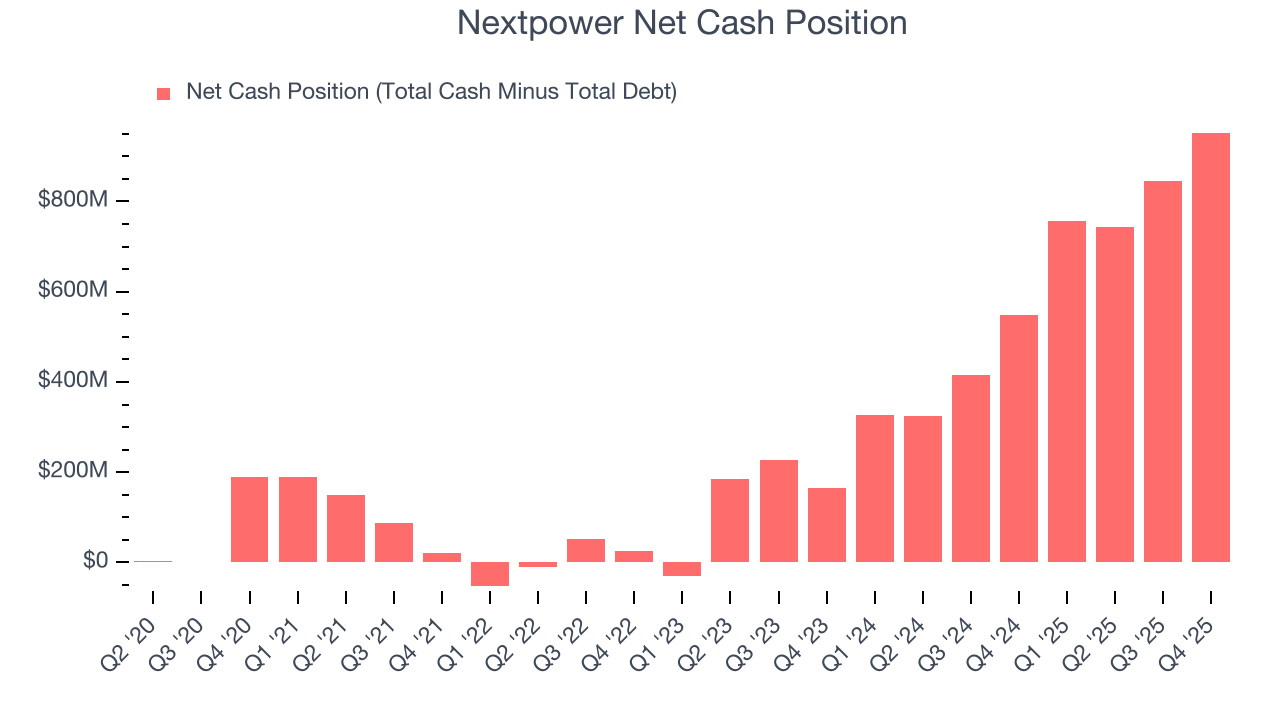

Nextpower is a profitable, well-capitalized company with $952.6 million of cash and no debt. This position is 6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from Nextpower’s Q4 Results

We were impressed by how significantly Nextpower blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 5.4% to $111.60 immediately after reporting.

11. Is Now The Time To Buy Nextpower?

Updated: January 27, 2026 at 4:25 PM EST

Before investing in or passing on Nextpower, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There are numerous reasons why we think Nextpower is one of the best industrials companies out there. First of all, the company’s revenue growth was exceptional over the last five years. And while its projected EPS for the next year is lacking, its backlog growth has been marvelous. Additionally, Nextpower’s rising cash profitability gives it more optionality.

Nextpower’s P/E ratio based on the next 12 months is 23.9x. Looking at the industrials space today, Nextpower’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $104.23 on the company (compared to the current share price of $111.60).