PacBio (PACB)

PacBio doesn’t excite us. Its sales have recently flopped and its historical cash burn means it has few resources to reignite growth.― StockStory Analyst Team

1. News

2. Summary

Why We Think PacBio Will Underperform

Pioneering what scientists call "HiFi long-read sequencing," recognized as Nature Methods' method of the year for 2022, Pacific Biosciences (NASDAQ:PACB) develops advanced DNA sequencing systems that enable scientists and researchers to analyze genomes with unprecedented accuracy and completeness.

- Persistent adjusted operating margin losses suggest the business manages its expenses poorly

- Cash-burning tendencies make us wonder if it can sustainably generate shareholder value

- Negative earnings profile makes it challenging to secure favorable financing terms from lenders

PacBio lacks the business quality we seek. There are more appealing investments to be made.

Why There Are Better Opportunities Than PacBio

High Quality

Investable

Underperform

Why There Are Better Opportunities Than PacBio

PacBio’s stock price of $1.67 implies a valuation ratio of 2.7x forward price-to-sales. The market typically values companies like PacBio based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

We’d rather invest in companies with elite fundamentals than questionable ones with open questions and big downside risks. The durable earnings power of high-quality businesses helps us sleep well at night.

3. PacBio (PACB) Research Report: Q4 CY2025 Update

Genomics company Pacific Biosciences of California (NASDAQ:PACB) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 13.8% year on year to $44.65 million. Its non-GAAP loss of $0.12 per share was 10.8% above analysts’ consensus estimates.

PacBio (PACB) Q4 CY2025 Highlights:

- Revenue: $44.65 million vs analyst estimates of $43.04 million (13.8% year-on-year growth, 3.7% beat)

- Adjusted EPS: -$0.12 vs analyst estimates of -$0.13 (10.8% beat)

- Adjusted EBITDA: -$41.01 million (-91.9% margin, 9.8% year-on-year growth)

- Operating Margin: -92.3%, up from -387% in the same quarter last year

- Market Capitalization: $555.5 million

Company Overview

Pioneering what scientists call "HiFi long-read sequencing," recognized as Nature Methods' method of the year for 2022, Pacific Biosciences (NASDAQ:PACB) develops advanced DNA sequencing systems that enable scientists and researchers to analyze genomes with unprecedented accuracy and completeness.

Pacific Biosciences' technology allows researchers to read longer stretches of DNA with high accuracy, solving problems that shorter-read technologies struggle with. The company offers two main sequencing approaches: its flagship HiFi long-read technology based on Single-Molecule Real-Time (SMRT) sequencing, and its newer Sequencing by Binding (SBB) short-read technology.

The company's product portfolio includes sequencing instruments like the Revio and Onso systems, along with consumables such as SMRT Cells, flow cells, and reagent kits that customers need to prepare and analyze DNA samples. For example, a cancer researcher might use Pacific Biosciences' technology to identify complex structural variations in tumor DNA that other sequencing methods might miss, potentially revealing new therapeutic targets.

Pacific Biosciences serves a diverse customer base including academic institutions, government research labs, pharmaceutical companies, agricultural businesses, and clinical research organizations. These customers use the company's technology for applications ranging from human genetics and cancer research to plant breeding and infectious disease studies.

The company generates revenue through instrument sales and the ongoing purchase of consumables needed for each sequencing run. This creates a razor-and-blade business model, where initial instrument placement leads to recurring revenue from consumables. Pacific Biosciences also continues to innovate, as evidenced by its 2023 acquisition of Apton Biosystems to accelerate development of high-throughput sequencing platforms and the launch of its Kinnex product line for optimizing RNA sequencing.

4. Genomics & Sequencing

Genomics and sequencing companies within the life sciences industry provide the technology for increasingly personalized medicine, drug discovery, and disease research. These firms leverage cutting-edge platforms for high-throughput sequencing and genomic analysis, enabling researchers and healthcare providers to better understand genetic underpinnings of diseases. While the industry enjoys high barriers to entry due to proprietary technology and intellectual property, the business model also faces significant R&D costs, reliance on continued innovation, and exposure to shifts in academic, biotech, and clinical research funding. Over the next few years, the subsector is well-positioned to benefit from tailwinds such as increasing adoption of precision medicine, expanded applications for sequencing technologies in areas like oncology and rare disease diagnostics, and growing use of genomic data in drug development. Advances in artificial intelligence could further enhance the speed and accuracy of genomic insights. However, potential headwinds include price sensitivity among research institutions and healthcare systems that are constantly trying to contain and lower costs. Additionally, regulations around data privacy and genomic testing are not yet set in stone, adding uncertainty to the industry.

Pacific Biosciences competes with other DNA sequencing technology providers, primarily Illumina (NASDAQ:ILMN), which dominates the short-read sequencing market, Oxford Nanopore Technologies (LSE:ONT), which offers portable long-read sequencing solutions, and Element Biosciences, a private company focused on affordable, high-quality sequencing.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $160 million in revenue over the past 12 months, PacBio is a tiny company in an industry where scale matters. This makes it difficult to succeed because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

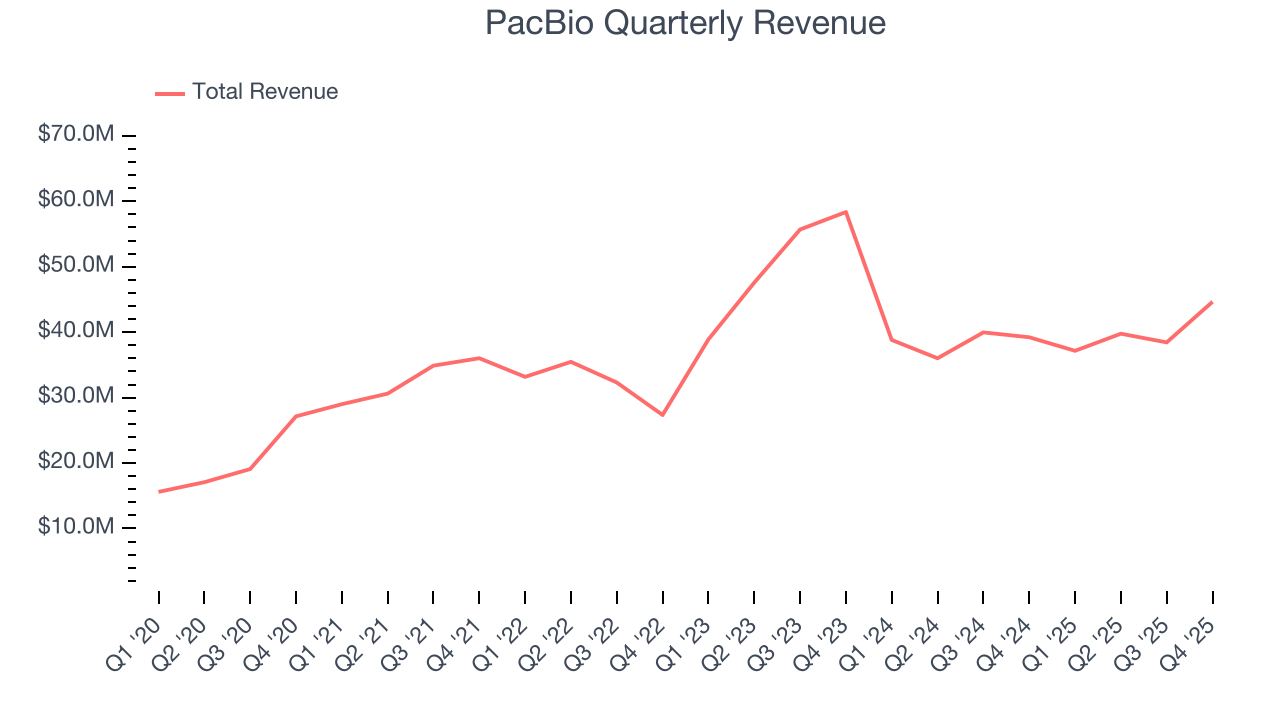

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, PacBio’s 15.2% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. PacBio’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 10.7% over the last two years.

This quarter, PacBio reported year-on-year revenue growth of 13.8%, and its $44.65 million of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 11.5% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will fuel better top-line performance.

7. Operating Margin

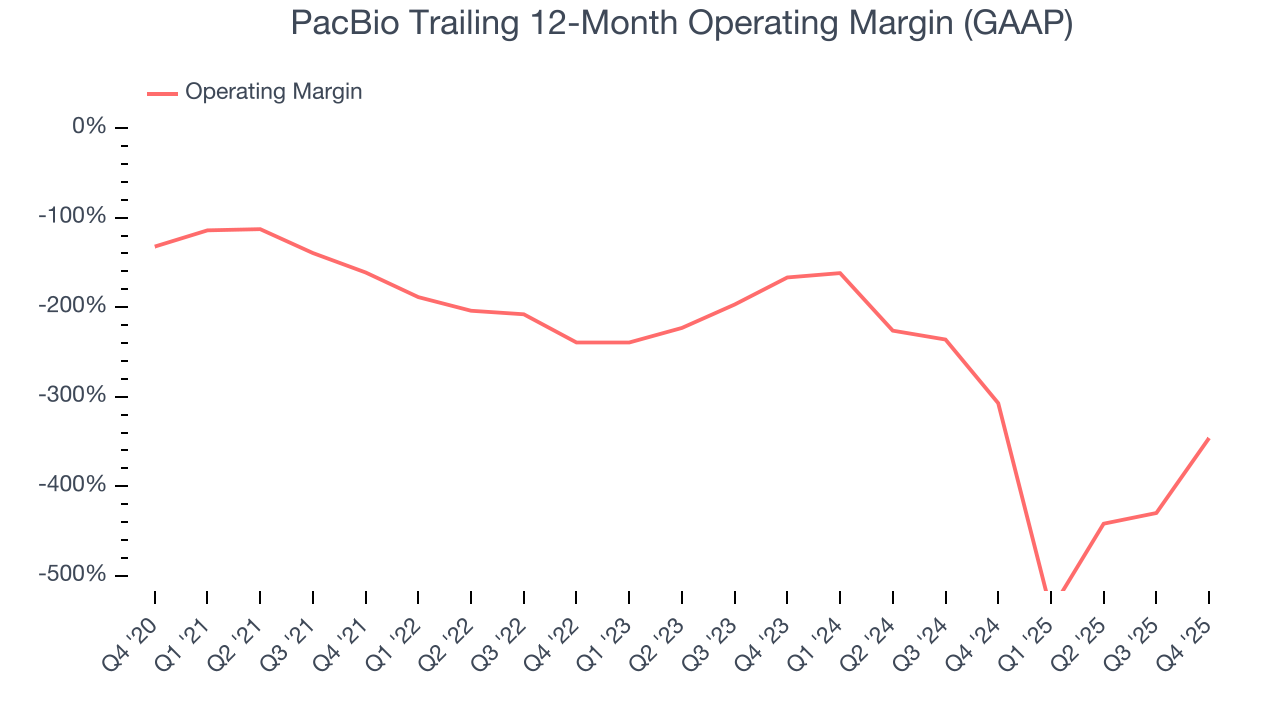

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

PacBio’s high expenses have contributed to an average operating margin of negative 243% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, PacBio’s operating margin decreased significantly over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 179.4 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

PacBio’s operating margin was negative 92.3% this quarter.

8. Earnings Per Share

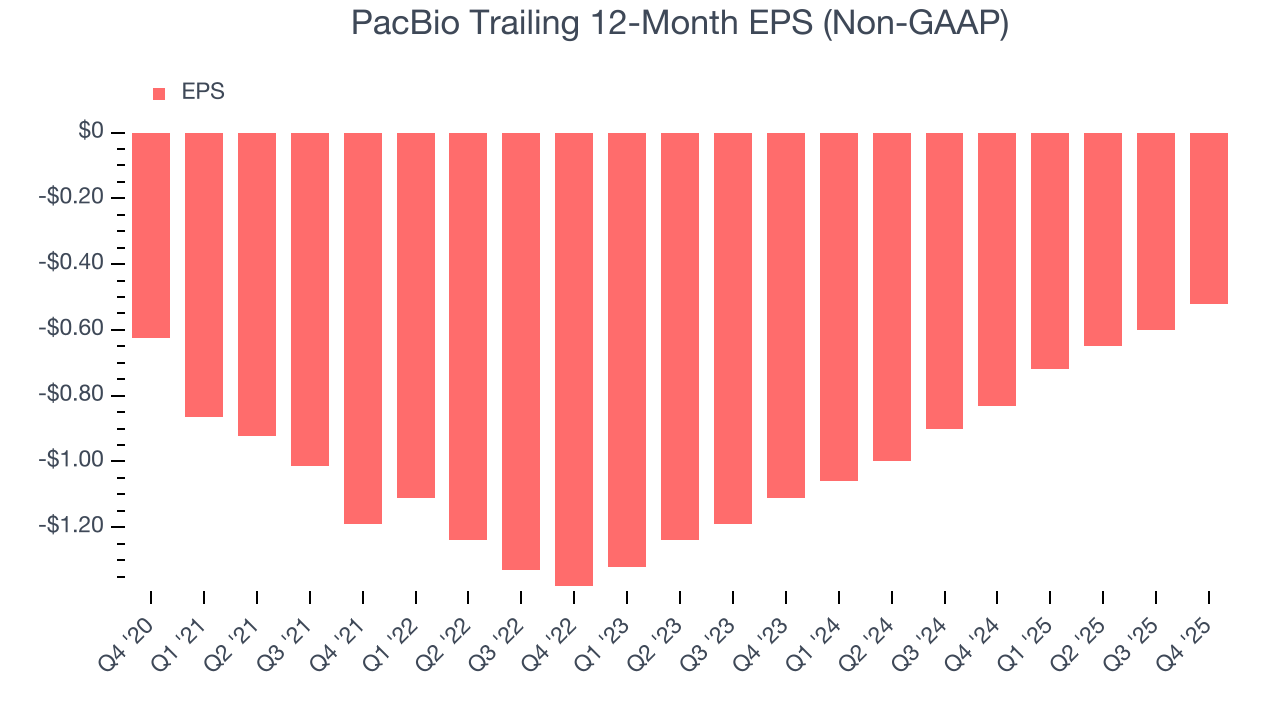

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although PacBio’s full-year earnings are still negative, it reduced its losses and improved its EPS by 3.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, PacBio reported adjusted EPS of negative $0.12, up from negative $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects PacBio to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.52 will advance to negative $0.51.

9. Cash Is King

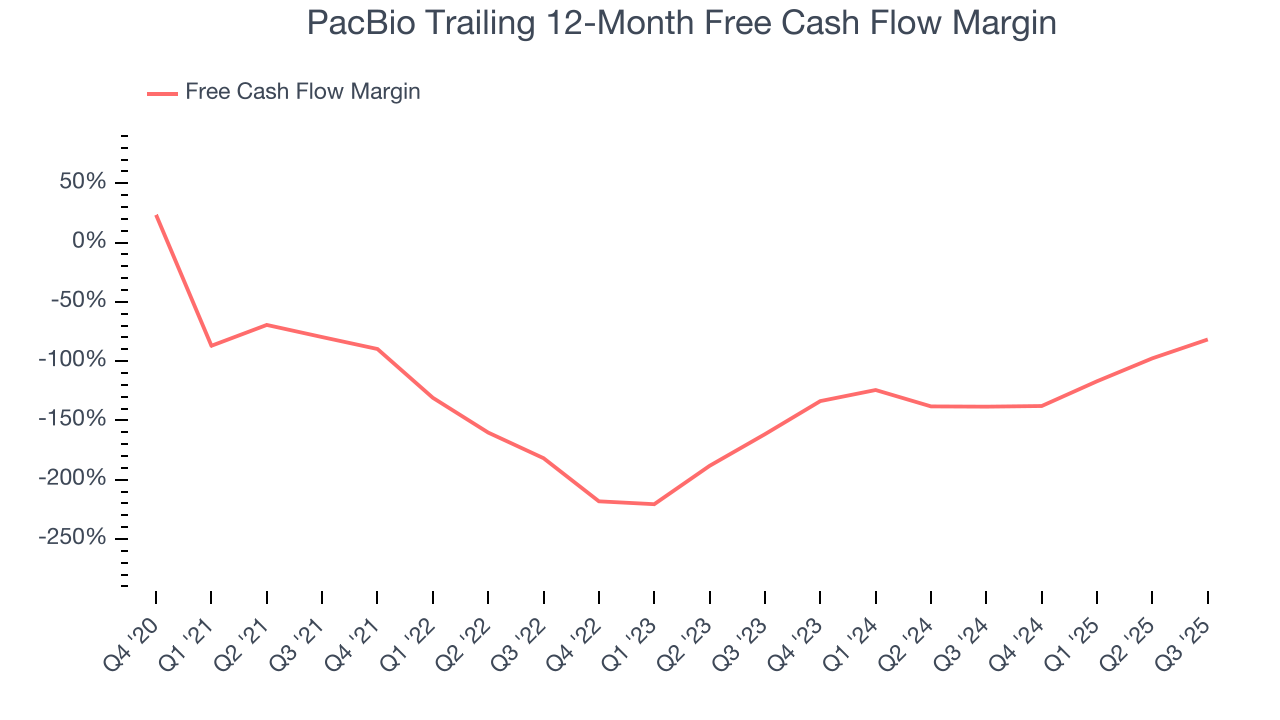

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

PacBio’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 133%, meaning it lit $133.29 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that PacBio’s margin expanded by 5.9 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

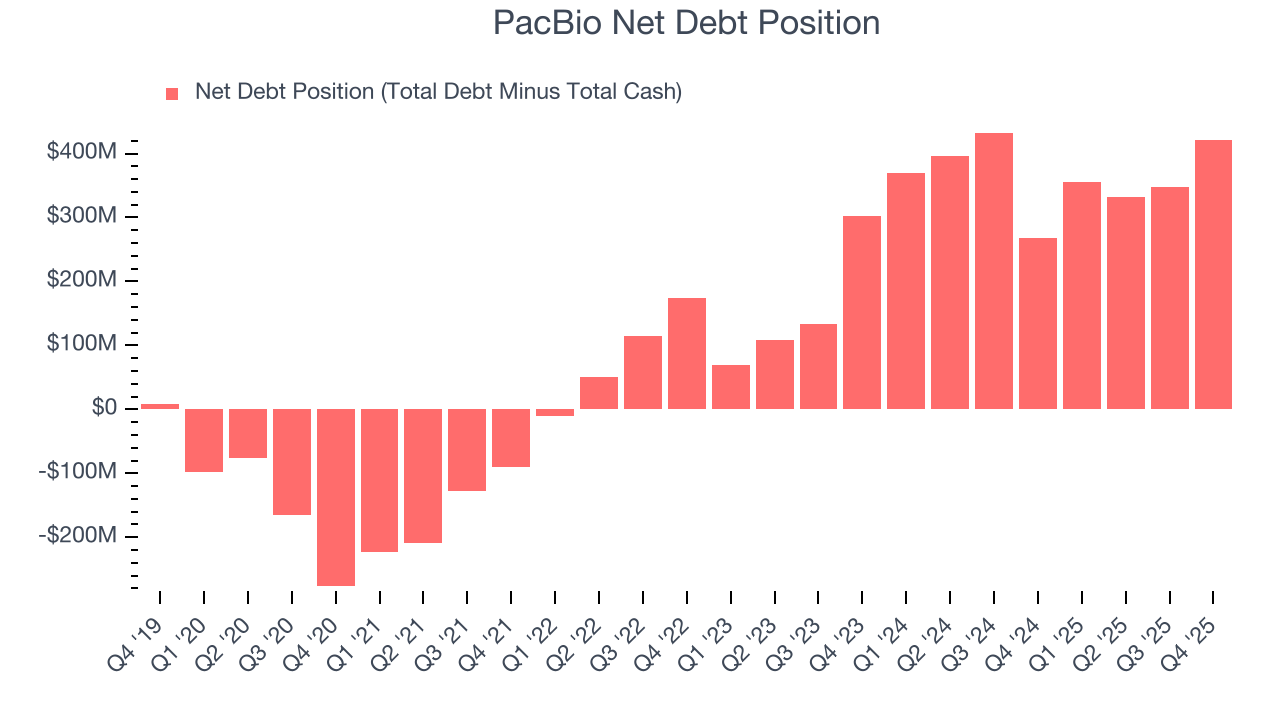

PacBio posted negative $149.5 million of EBITDA over the last 12 months, and its $702.4 million of debt exceeds the $281.1 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

We implore our readers to tread carefully because credit agencies could downgrade PacBio if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope PacBio can improve its profitability and remain cautious until then.

11. Key Takeaways from PacBio’s Q4 Results

We enjoyed seeing PacBio beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $1.85 immediately after reporting.

12. Is Now The Time To Buy PacBio?

Updated: February 24, 2026 at 11:15 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own PacBio, you should also grasp the company’s longer-term business quality and valuation.

PacBio isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its operating margins reveal poor profitability compared to other healthcare companies. And while the company’s rising cash profitability gives it more optionality, the downside is its cash burn raises the question of whether it can sustainably maintain growth.

PacBio’s forward price-to-sales ratio is 2.7x. The market typically values companies like PacBio based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $2.50 on the company (compared to the current share price of $1.67).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.