Paychex (PAYX)

We’re cautious of Paychex. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think Paychex Will Underperform

Once known as the go-to service for small business payroll needs, Paychex (NASDAQ:PAYX) provides payroll processing, HR services, employee benefits administration, and insurance solutions to small and medium-sized businesses.

- Costs have risen faster than its revenue over the last year, causing its operating margin to decline by 4.2 percentage points

- Muted 8.7% annual revenue growth over the last five years shows its demand lagged behind its software peers

- A positive is that its excellent operating margin highlights the strength of its business model

Paychex doesn’t measure up to our expectations. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Paychex

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Paychex

At $87.37 per share, Paychex trades at 4.9x forward price-to-sales. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Paychex (PAYX) Research Report: Q4 CY2025 Update

Human capital management company Paychex (NASDAQ:PAYX) met Wall Streets revenue expectations in Q4 CY2025, with sales up 18.3% year on year to $1.56 billion. Its non-GAAP profit of $1.26 per share was 2.4% above analysts’ consensus estimates.

Paychex (PAYX) Q4 CY2025 Highlights:

- Revenue: $1.56 billion vs analyst estimates of $1.55 billion (18.3% year-on-year growth, in line)

- Adjusted EPS: $1.26 vs analyst estimates of $1.23 (2.4% beat)

- Adjusted EBITDA: $698.4 million vs analyst estimates of $703.1 million (44.8% margin, 0.7% miss)

- Operating Margin: 36.7%, down from 40.9% in the same quarter last year

- Free Cash Flow Margin: 24.6%, down from 43% in the previous quarter

- Market Capitalization: $41.11 billion

Company Overview

Once known as the go-to service for small business payroll needs, Paychex (NASDAQ:PAYX) provides payroll processing, HR services, employee benefits administration, and insurance solutions to small and medium-sized businesses.

Paychex operates as a comprehensive human capital management partner for businesses who typically lack the resources or expertise to handle complex HR functions. Its cloud-based Paychex Flex platform serves as the core of its technology offering, allowing clients to manage their workforce from recruitment through retirement with an integrated suite of solutions that can be customized to fit their specific needs.

The company's services extend beyond basic payroll to include time and attendance tracking, benefits administration, retirement plan services, insurance offerings, and regulatory compliance support. A team of over 650 HR professionals and 250 compliance experts backs these technical solutions, providing clients with specialized guidance on HR best practices and helping them navigate the complex landscape of employment regulations.

For a typical client—perhaps a local restaurant with 30 employees—Paychex might handle everything from processing bi-weekly payroll and tax filings to administering their 401(k) plan and helping them comply with labor laws. The company generates revenue through subscription fees for its software and services, with additional charges for premium offerings like PEO (Professional Employer Organization) services, where Paychex serves as a co-employer and shares certain employment responsibilities and liabilities.

Paychex reaches its customers through a direct sales force, virtual sales channels, and referral relationships with CPAs and banks. The company's business model benefits from high retention rates, as changing payroll and HR systems represents a significant undertaking for most businesses.

4. HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Paychex competes with ADP (NASDAQ:ADP), which serves businesses of all sizes with similar HR and payroll offerings, Paycom (NYSE:PAYC) and Paylocity (NASDAQ:PCTY), which focus on mid-sized employers with cloud-based solutions, as well as smaller providers like Gusto and Rippling.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Paychex’s sales grew at a sluggish 8.7% compounded annual growth rate over the last five years. This was below our standard for the software sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Paychex’s annualized revenue growth of 8.2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Paychex’s year-on-year revenue growth was 18.3%, and its $1.56 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.2% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Paychex to acquire new customers as its CAC payback period checked in at 78.7 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

7. Gross Margin & Pricing Power

For software companies like Paychex, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Paychex’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 73.4% gross margin over the last year. That means for every $100 in revenue, roughly $73.36 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Paychex has seen gross margins improve by 1.8 percentage points over the last 2 year, which is solid in the software space.

Paychex’s gross profit margin came in at 73.5% this quarter, marking a 2.3 percentage point increase from 71.2% in the same quarter last year. Paychex’s full-year margin has also been trending up over the past 12 months, increasing by 1.6 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Paychex has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 37.1%.

Looking at the trend in its profitability, Paychex’s operating margin decreased by 4.2 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Paychex generated an operating margin profit margin of 36.7%, down 4.1 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Paychex has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 33.9% over the last year.

Paychex’s free cash flow clocked in at $382.8 million in Q4, equivalent to a 24.6% margin. This result was good as its margin was 5.7 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Paychex’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 33.9% for the last 12 months will decrease to 31.6%.

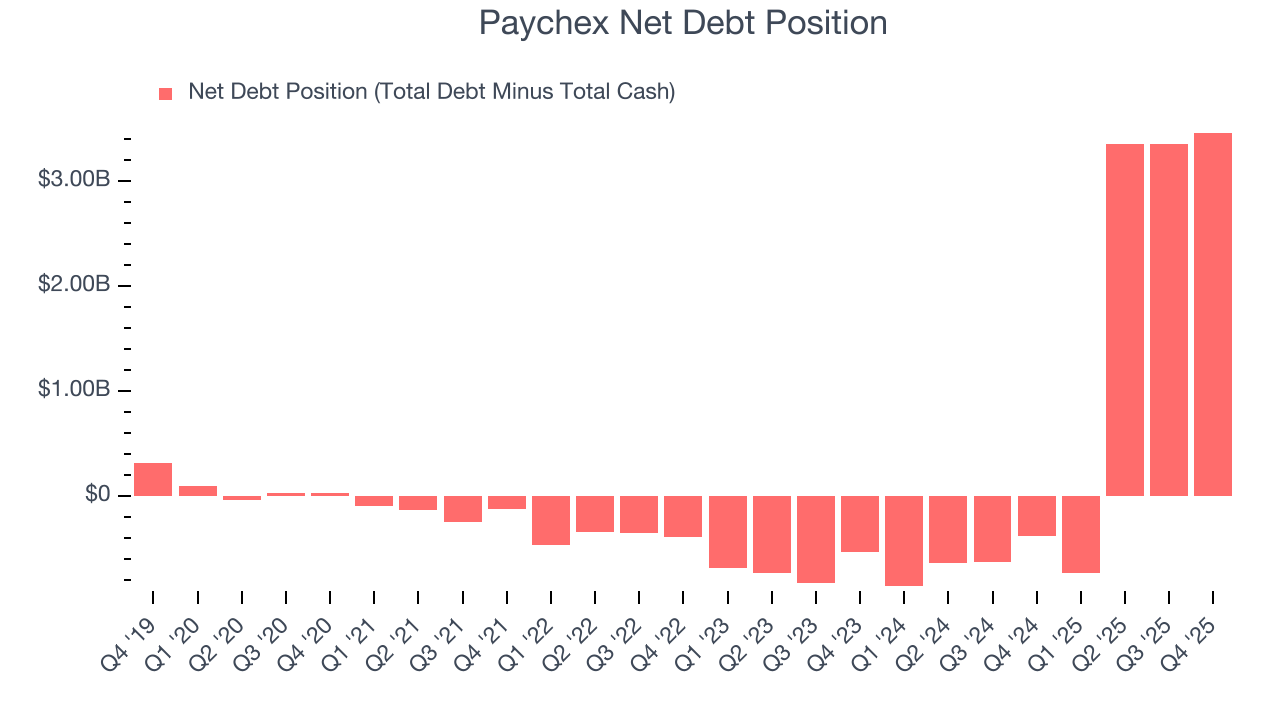

10. Balance Sheet Assessment

Paychex reported $1.57 billion of cash and $5.04 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.75 billion of EBITDA over the last 12 months, we view Paychex’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $167.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Paychex’s Q4 Results

Although revenue was in line, EPS managed to beat. Overall, this was a fine quarter. The stock traded up 3.1% to $117.76 immediately after reporting.

12. Is Now The Time To Buy Paychex?

Updated: February 23, 2026 at 9:01 PM EST

Before deciding whether to buy Paychex or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Paychex’s business quality ultimately falls short of our standards. First off, its revenue growth was weak over the last five years. And while Paychex’s impressive operating margins show it has a highly efficient business model, its declining operating margin shows it’s becoming less efficient at building and selling its software.

Paychex’s price-to-sales ratio based on the next 12 months is 4.9x. Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $119.07 on the company (compared to the current share price of $87.37).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.