Paylocity (PCTY)

We aren’t fans of Paylocity. Its decelerating growth shows demand is falling and its weak gross margin indicates it has bad unit economics.― StockStory Analyst Team

1. News

2. Summary

Why Paylocity Is Not Exciting

Operating in a field where companies traditionally juggled multiple disconnected systems, Paylocity (NASDAQ:PCTY) provides cloud-based human capital management and payroll software solutions that help businesses manage their workforce and HR processes.

- Operating profits increased over the last year as the company gained some leverage on its fixed costs and became more efficient

- Estimated sales growth of 7.2% for the next 12 months implies demand will slow from its two-year trend

- On the plus side, its disciplined cost controls and effective management have materialized in a strong operating margin, and it turbocharged its profits by achieving some fixed cost leverage

Paylocity’s quality doesn’t meet our bar. There are more promising prospects in the market.

Why There Are Better Opportunities Than Paylocity

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Paylocity

Paylocity is trading at $126.12 per share, or 3.9x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Paylocity (PCTY) Research Report: Q4 CY2025 Update

HR and payroll software provider Paylocity (NASDAQ:PCTY) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 10.4% year on year to $416.1 million. Guidance for next quarter’s revenue was better than expected at $489.5 million at the midpoint, 1.1% above analysts’ estimates. Its non-GAAP profit of $1.85 per share was 15.9% above analysts’ consensus estimates.

Paylocity (PCTY) Q4 CY2025 Highlights:

- Revenue: $416.1 million vs analyst estimates of $408.6 million (10.4% year-on-year growth, 1.9% beat)

- Adjusted EPS: $1.85 vs analyst estimates of $1.60 (15.9% beat)

- Adjusted Operating Income: $119.1 million vs analyst estimates of $109.3 million (28.6% margin, 8.9% beat)

- The company slightly lifted its revenue guidance for the full year to $1.74 billion at the midpoint from $1.72 billion

- EBITDA guidance for the full year is $626.5 million at the midpoint, above analyst estimates of $620.8 million

- Operating Margin: 16.9%, up from 12.4% in the same quarter last year

- Free Cash Flow Margin: 3.8%, down from 16.5% in the previous quarter

- Annual Recurring Revenue: $387 million (11.3% year-on-year growth)

- Market Capitalization: $6.89 billion

Company Overview

Operating in a field where companies traditionally juggled multiple disconnected systems, Paylocity (NASDAQ:PCTY) provides cloud-based human capital management and payroll software solutions that help businesses manage their workforce and HR processes.

Paylocity's platform encompasses a comprehensive suite of tools designed to address the entire employee lifecycle. Its core offerings include payroll processing, tax services, and time tracking capabilities, supplemented by modules for talent management, benefits administration, and employee engagement. These solutions work together to help organizations streamline administrative tasks, ensure compliance with various regulations, and foster workplace culture.

The company serves thousands of businesses across the United States, ranging from small organizations to large enterprises across diverse sectors including healthcare, financial services, manufacturing, and technology. Clients typically migrate to Paylocity from legacy systems or adopt it as their first digital HR solution, seeking to replace manual processes and disconnected software.

A hospital system might use Paylocity to manage complex shift scheduling for nurses and doctors, automate payroll calculations including overtime and differentials, and provide mobile access for employees to view schedules or request time off. Meanwhile, the HR team could use the platform's analytics to track turnover trends and manage compliance requirements.

Paylocity generates revenue through a subscription model based on the number of client employees and the specific modules implemented. The company complements its software with implementation teams and ongoing support from specialists who assist with setup, training, and tax compliance. This combination of technology and expertise has helped Paylocity build its client base to approximately 39,050 organizations as of mid-2024.

4. HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Paylocity competes in the human capital management and payroll software market against larger players like ADP (NASDAQ:ADP), Paychex (NASDAQ:PAYX), Workday (NASDAQ:WDAY), and UKG (Ultimate Kronos Group), as well as growth-focused competitors such as Paycom (NYSE:PAYC) and Paycor (NASDAQ:PYCR).

5. Revenue Growth

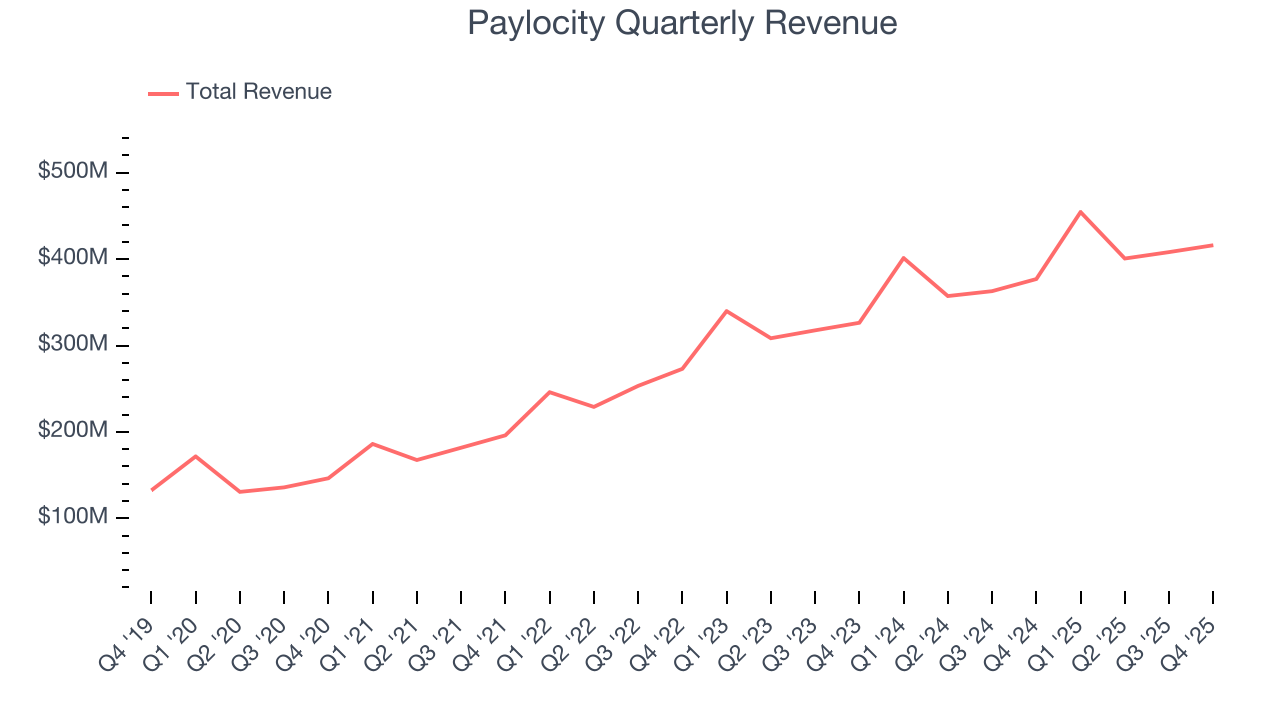

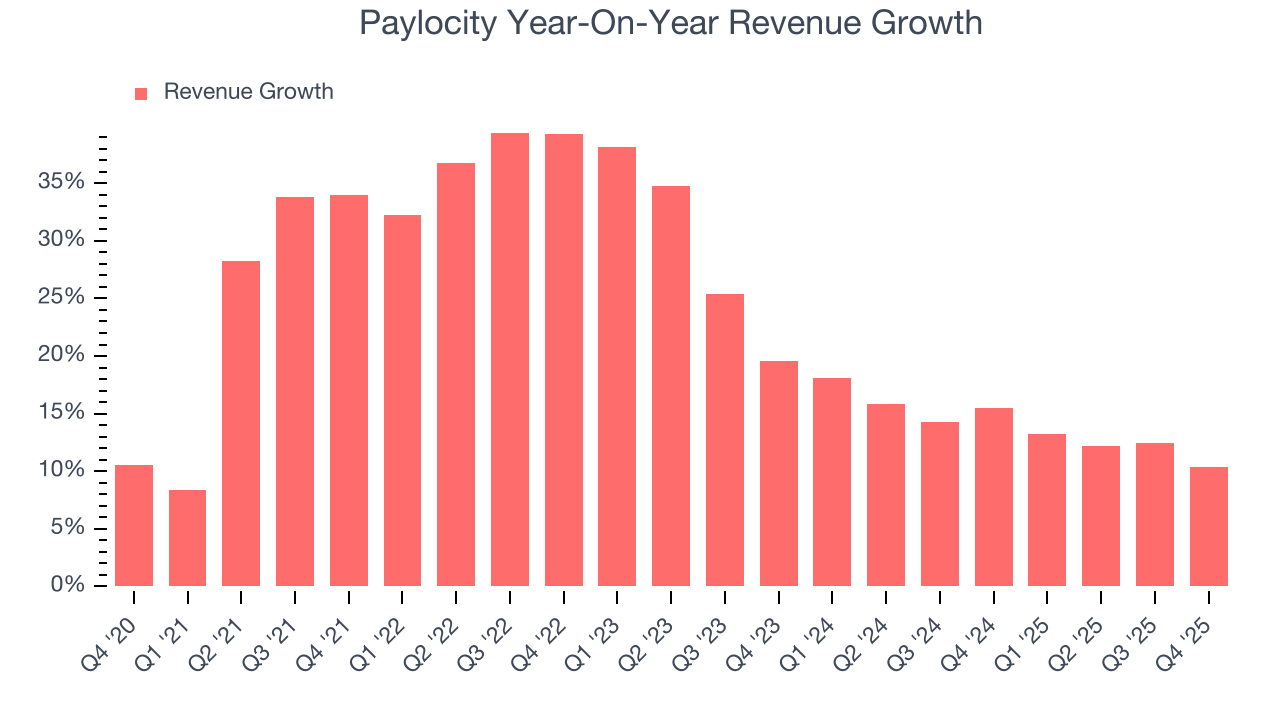

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Paylocity’s sales grew at a solid 23.5% compounded annual growth rate over the last five years. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Paylocity’s recent performance shows its demand has slowed as its annualized revenue growth of 14% over the last two years was below its five-year trend.

This quarter, Paylocity reported year-on-year revenue growth of 10.4%, and its $416.1 million of revenue exceeded Wall Street’s estimates by 1.9%. Company management is currently guiding for a 7.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

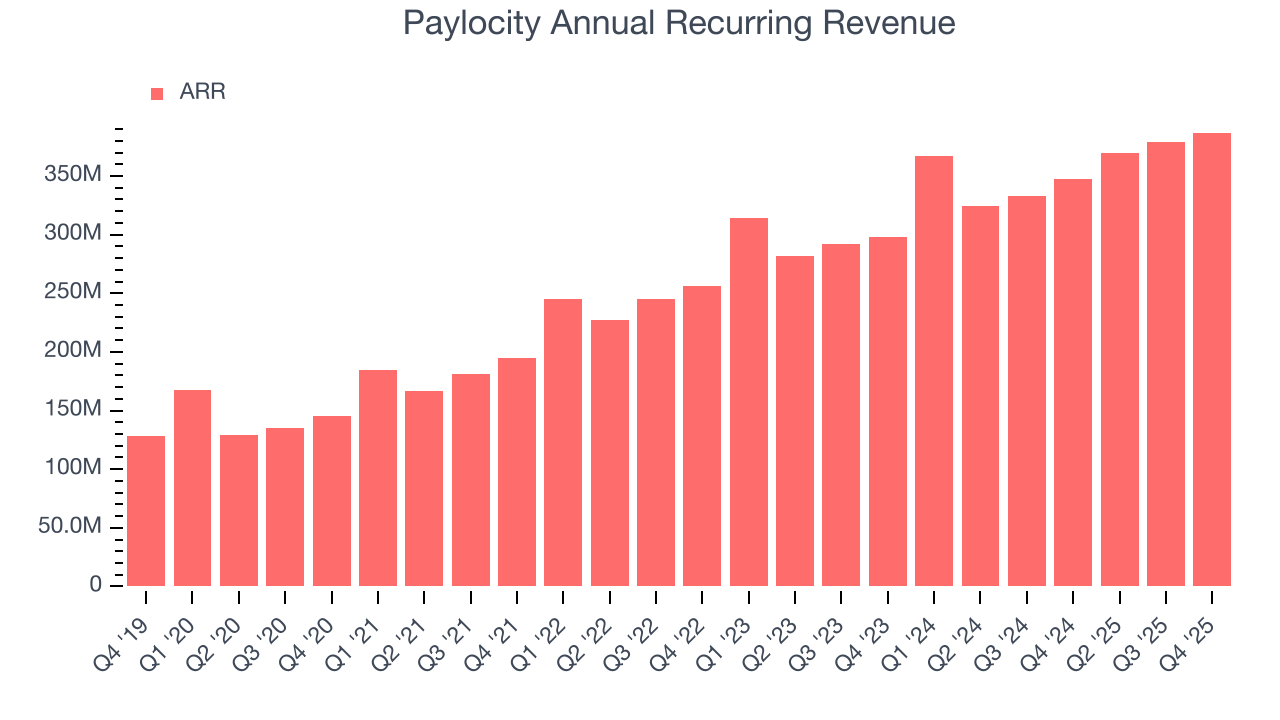

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Paylocity’s ARR came in at $387 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 13% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

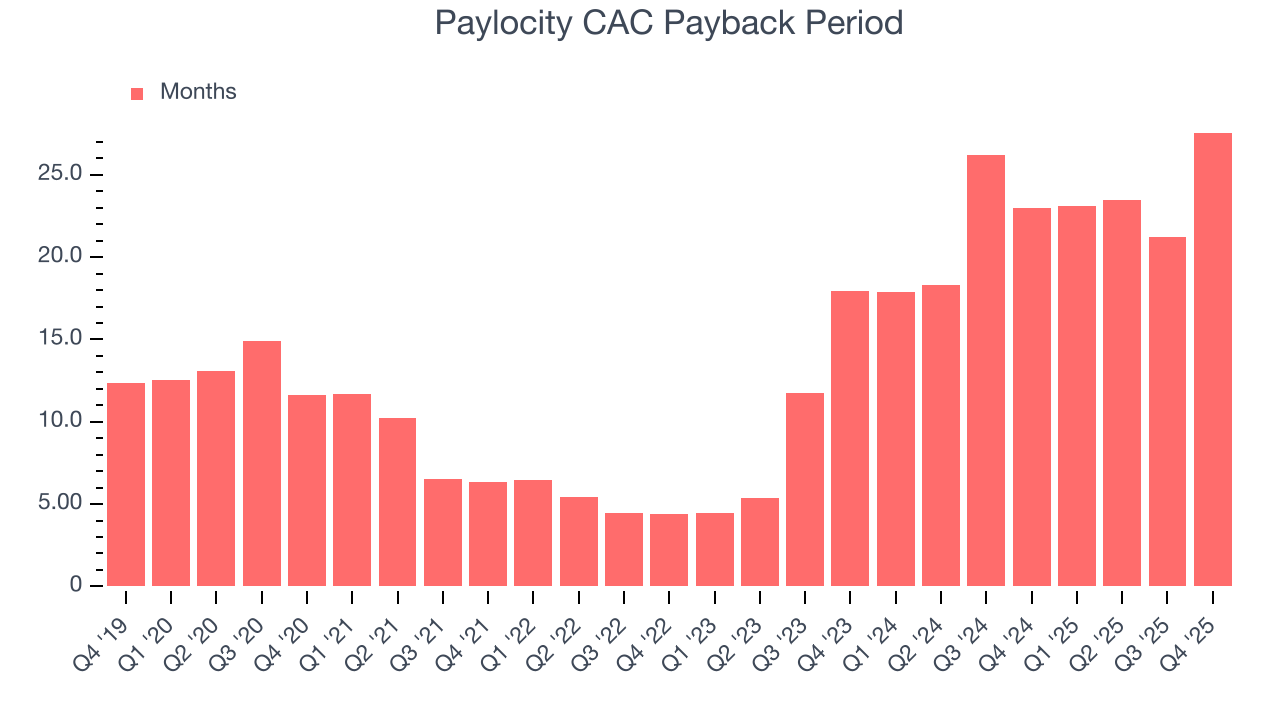

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Paylocity is very efficient at acquiring new customers, and its CAC payback period checked in at 27.6 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Paylocity, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

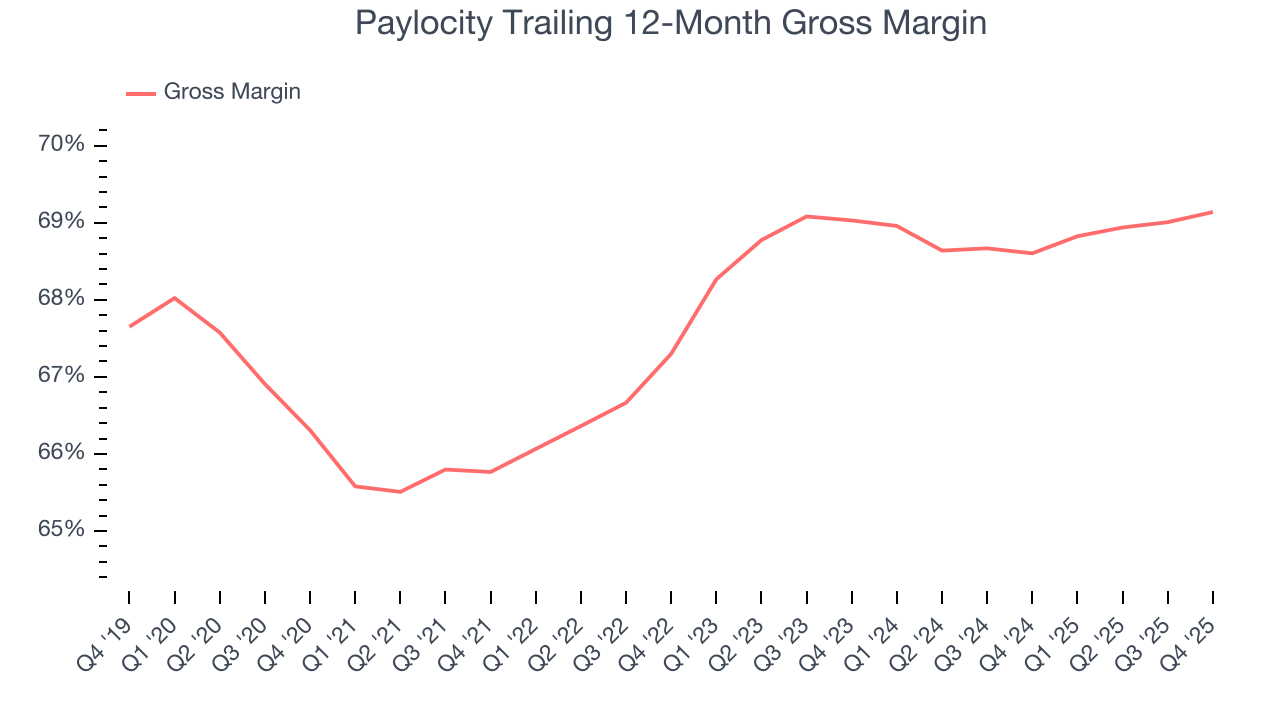

Paylocity’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 69.1% gross margin over the last year. Said differently, Paylocity had to pay a chunky $30.86 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Paylocity has seen gross margins improve by 0.1 percentage points over the last 2 year, which is slightly better than average for software.

Paylocity produced a 67.8% gross profit margin in Q4, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

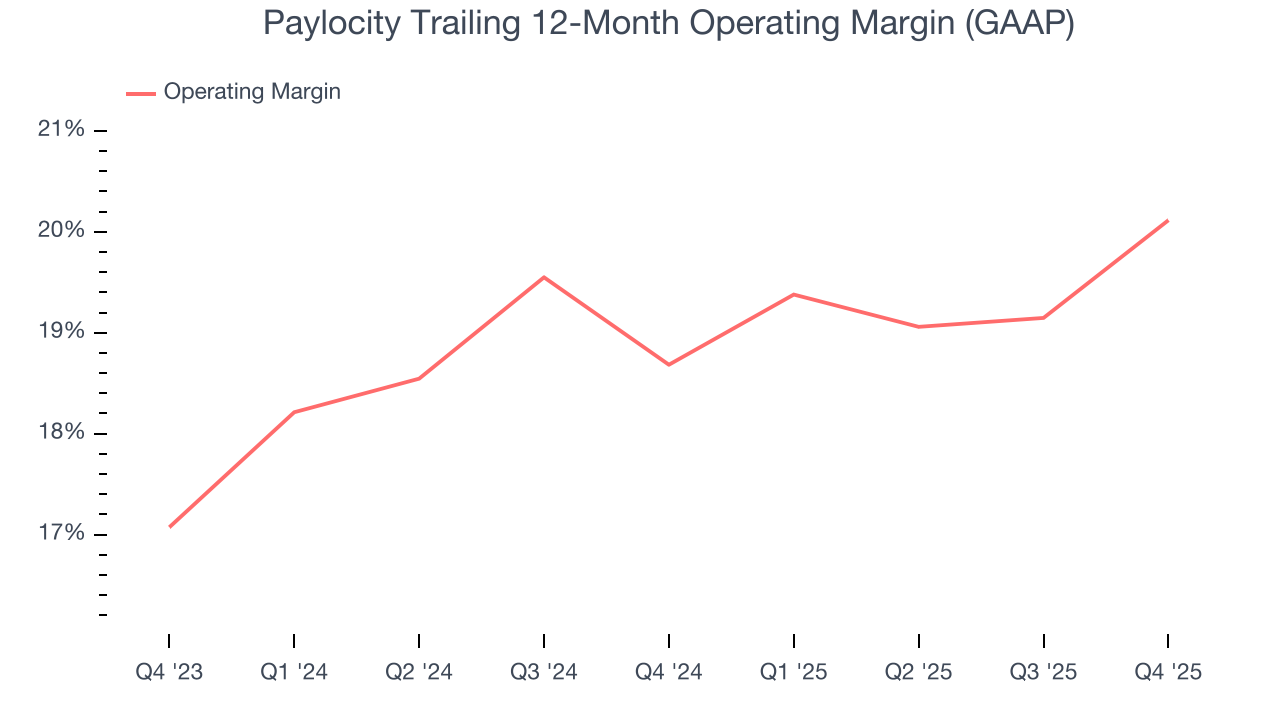

Paylocity has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 20.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Paylocity’s operating margin rose by 1.4 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, Paylocity generated an operating margin profit margin of 16.9%, up 4.5 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

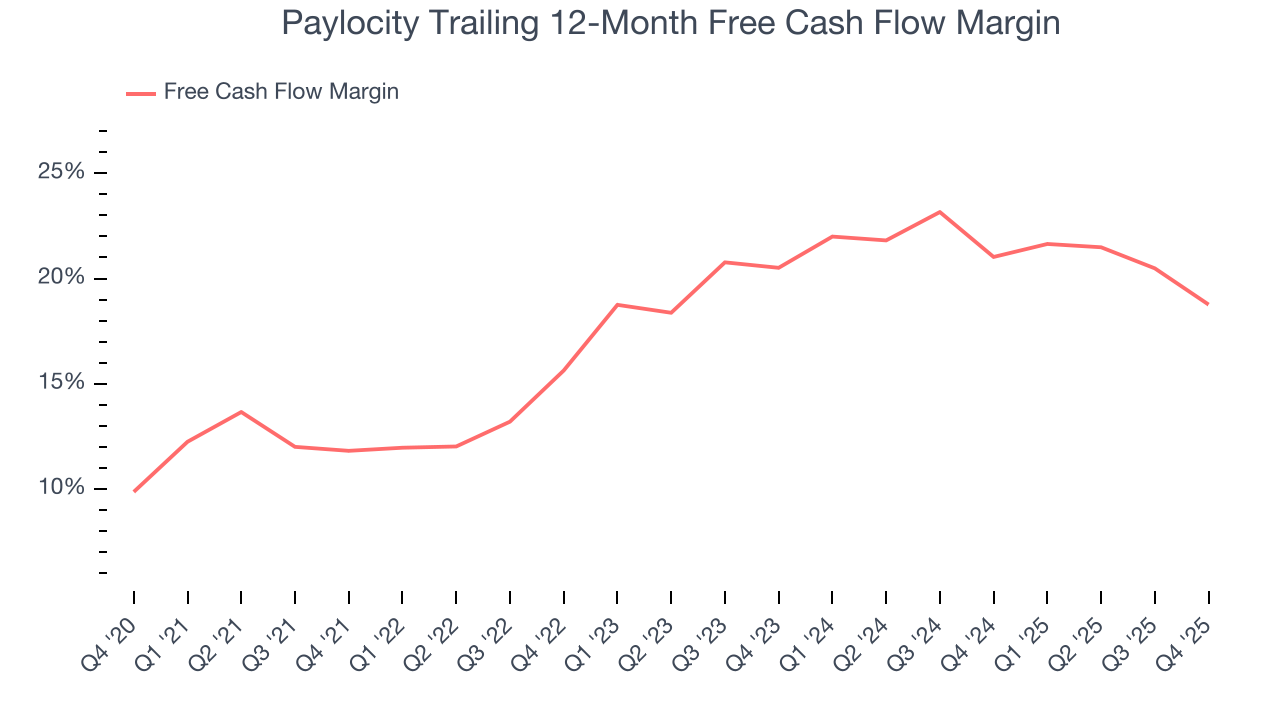

Paylocity has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 18.8% over the last year, slightly better than the broader software sector.

Paylocity’s free cash flow clocked in at $15.94 million in Q4, equivalent to a 3.8% margin. The company’s cash profitability regressed as it was 5.9 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Paylocity’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 18.8% for the last 12 months will increase to 24.6%, it options for capital deployment (investments, share buybacks, etc.).

11. Balance Sheet Assessment

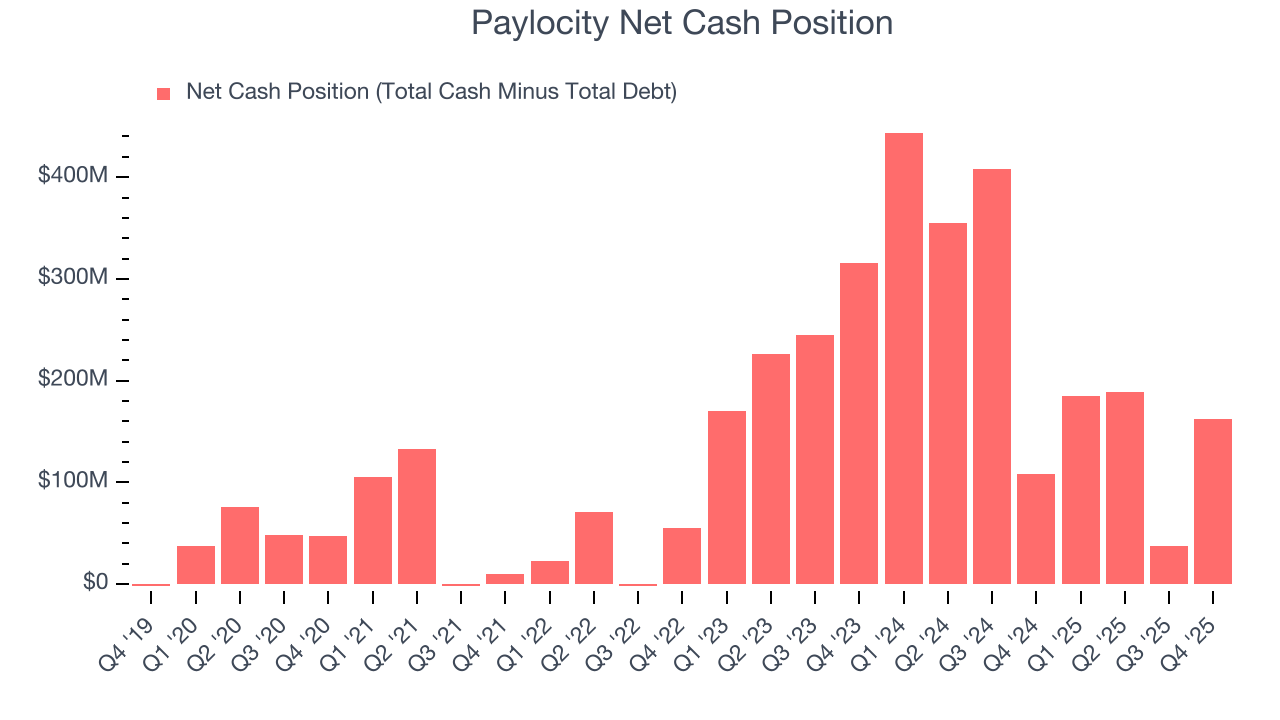

Companies with more cash than debt have lower bankruptcy risk.

Paylocity is a profitable, well-capitalized company with $162.5 million of cash and no debt. This position is 2.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Paylocity’s Q4 Results

We enjoyed seeing Paylocity beat analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 1.4% to $125.51 immediately after reporting.

13. Is Now The Time To Buy Paylocity?

Updated: February 5, 2026 at 9:25 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Paylocity.

Paylocity’s business quality ultimately falls short of our standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its expanding operating margin shows it’s becoming more efficient at building and selling its software. And while the company’s impressive operating margins show it has a highly efficient business model, the downside is its gross margin is below our standards.

Paylocity’s price-to-sales ratio based on the next 12 months is 3.9x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $191 on the company (compared to the current share price of $126.12).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.