Progyny (PGNY)

Progyny doesn’t impress us. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Progyny Is Not Exciting

Pioneering a data-driven approach to family building that has achieved an industry-leading patient satisfaction score of +80, Progyny (NASDAQ:PGNY) provides comprehensive fertility and family building benefits solutions to employers, helping employees access quality fertility treatments and support services.

- Smaller revenue base of $1.29 billion means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- Poor expense management has led to an operating margin that is below the industry average

- One positive is that its annual revenue growth of 30.2% over the last five years was superb and indicates its market share increased during this cycle

Progyny’s quality is lacking. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Progyny

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Progyny

Progyny is trading at $20.79 per share, or 11x forward P/E. This multiple is cheaper than most healthcare peers, but we think this is justified.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Progyny (PGNY) Research Report: Q4 CY2025 Update

Fertility benefits company Progyny (NASDAQ:PGNY) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 6.7% year on year to $318.4 million. On the other hand, next quarter’s revenue guidance of $325.5 million was less impressive, coming in 5.1% below analysts’ estimates. Its non-GAAP profit of $0.48 per share was 19.9% above analysts’ consensus estimates.

Progyny (PGNY) Q4 CY2025 Highlights:

- Revenue: $318.4 million vs analyst estimates of $308.4 million (6.7% year-on-year growth, 3.2% beat)

- Adjusted EPS: $0.48 vs analyst estimates of $0.40 (19.9% beat)

- Adjusted EBITDA: $51.39 million vs analyst estimates of $50.91 million (16.1% margin, 0.9% beat)

- Revenue Guidance for Q1 CY2026 is $325.5 million at the midpoint, below analyst estimates of $343 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.89 at the midpoint, missing analyst estimates by 3.4%

- EBITDA guidance for the upcoming financial year 2026 is $231.5 million at the midpoint, below analyst estimates of $240.2 million

- Operating Margin: 4.8%, in line with the same quarter last year

- Free Cash Flow Margin: 15.3%, down from 16.8% in the same quarter last year

- Sales Volumes were flat year on year

- Market Capitalization: $1.84 billion

Company Overview

Pioneering a data-driven approach to family building that has achieved an industry-leading patient satisfaction score of +80, Progyny (NASDAQ:PGNY) provides comprehensive fertility and family building benefits solutions to employers, helping employees access quality fertility treatments and support services.

Progyny's innovative approach centers on its proprietary "Smart Cycle" benefits design, which bundles all necessary fertility treatment components into comprehensive packages. Unlike traditional insurance that may impose dollar limits or restrict treatment options, Smart Cycles allow members to pursue personalized treatment paths with their chosen fertility specialists without worrying about coverage limitations mid-treatment.

Each Progyny member receives support from a dedicated Patient Care Advocate (PCA) who provides end-to-end guidance throughout their fertility journey. These PCAs offer logistical assistance, clinical education, and emotional support, interacting with members an average of 15 times during treatment. This high-touch approach helps members navigate the complex and often emotionally challenging fertility process.

The company maintains a selective network of over 950 fertility specialists practicing at more than 650 clinic locations nationwide, including 44 of the top 50 U.S. fertility practices. This carefully curated network ensures members receive high-quality care from leading specialists.

For clients who opt for the integrated pharmacy solution, Progyny Rx, the company streamlines medication management with simplified authorization processes, timely delivery, and seven-day-a-week clinical support. This integration addresses a critical component of fertility treatment, as medication timing and administration are crucial to success.

Progyny collects comprehensive data directly from providers on treatment protocols and outcomes, enabling it to actively manage its network and ensure adherence to best practices. This data-driven approach allows the company to continuously improve its services and provide clients with detailed reports on program utilization and outcomes.

The company generates revenue through contracts with employers, who typically purchase a specific number of Smart Cycle units per eligible employee. Progyny's client base spans over 450 employers across more than 40 industries, representing approximately 6.4 million covered lives. The company has maintained exceptionally high client retention rates since launching its fertility benefits solution in 2016.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Progyny competes with traditional health insurance carriers that offer fertility coverage, specialized fertility benefit managers like Carrot Fertility and Maven Clinic, and general employee benefits platforms that have expanded into fertility services.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.29 billion in revenue over the past 12 months, Progyny is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Progyny’s sales grew at an incredible 30.2% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Progyny’s annualized revenue growth of 8.8% over the last two years is below its five-year trend, but we still think the results were respectable.

We can dig further into the company’s revenue dynamics by analyzing its number of units sold, which reached 15,927 in the latest quarter. Over the last two years, Progyny’s units sold averaged 6.4% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Progyny reported year-on-year revenue growth of 6.7%, and its $318.4 million of revenue exceeded Wall Street’s estimates by 3.2%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.2% over the next 12 months, similar to its two-year rate. This projection is admirable and indicates the market is baking in success for its products and services.

7. Operating Margin

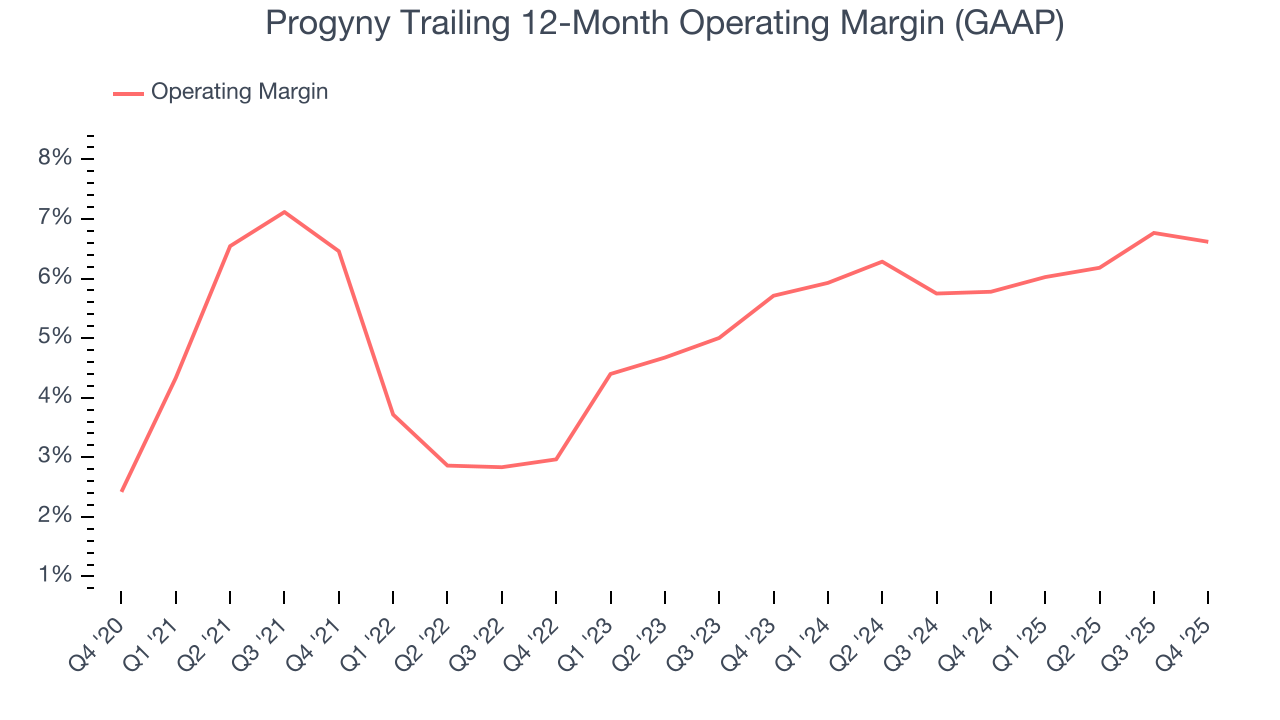

Progyny’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 5.6% over the last five years. This profitability was paltry for a healthcare business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Progyny’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Progyny generated an operating margin profit margin of 4.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Progyny’s EPS grew at an astounding 60.5% compounded annual growth rate over the last five years, higher than its 30.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Progyny’s earnings can give us a better understanding of its performance. A five-year view shows that Progyny has repurchased its stock, shrinking its share count by 9.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Progyny reported adjusted EPS of $0.48, up from $0.42 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Progyny’s full-year EPS of $1.89 to grow 2.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Progyny has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.5% over the last five years, better than the broader healthcare sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Progyny’s margin expanded by 10.1 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Progyny’s free cash flow clocked in at $48.59 million in Q4, equivalent to a 15.3% margin. The company’s cash profitability regressed as it was 1.6 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Progyny’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Progyny’s ROIC averaged 2.7 percentage point decreases each year over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Progyny is a profitable, well-capitalized company with $310.1 million of cash and $24 million of debt on its balance sheet. This $286.1 million net cash position is 15.6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Progyny’s Q4 Results

It was good to see Progyny beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.3% to $21.75 immediately after reporting.

13. Is Now The Time To Buy Progyny?

Updated: February 26, 2026 at 11:28 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Progyny.

Progyny isn’t a bad business, but we have other favorites. To kick things off, its revenue growth was exceptional over the last five years. And while Progyny’s subscale operations give it fewer distribution channels than its larger rivals, its rising cash profitability gives it more optionality.

Progyny’s P/E ratio based on the next 12 months is 11x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $30.82 on the company (compared to the current share price of $20.79).