Plug Power (PLUG)

We aren’t fans of Plug Power. Its sales have recently flopped and its historical cash burn means it has few resources to reignite growth.― StockStory Analyst Team

1. News

2. Summary

Why Plug Power Is Not Exciting

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ:PLUG) provides hydrogen fuel cells used to power electric motors.

- Negative 54.9% gross margin means it loses money on every sale and must pivot or scale quickly to survive

- Persistent operating margin losses suggest the business manages its expenses poorly

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

Plug Power’s quality isn’t great. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Plug Power

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Plug Power

Plug Power is trading at $2.38 per share, or 3.2x forward price-to-sales. The market typically values companies like Plug Power based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Plug Power (PLUG) Research Report: Q3 CY2025 Update

Fuel cell technology Plug Power (NASDAQ:PLUG) met Wall Streets revenue expectations in Q3 CY2025, with sales up 1.9% year on year to $177.1 million. Its non-GAAP loss of $0.12 per share was 8.2% above analysts’ consensus estimates.

Plug Power (PLUG) Q3 CY2025 Highlights:

- Revenue: $177.1 million vs analyst estimates of $176.4 million (1.9% year-on-year growth, in line)

- Adjusted EPS: -$0.12 vs analyst estimates of -$0.13 (8.2% beat)

- Operating Margin: -197%, down from -124% in the same quarter last year

- Free Cash Flow was -$127.3 million compared to -$234.2 million in the same quarter last year

- Market Capitalization: $3.14 billion

Company Overview

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ:PLUG) provides hydrogen fuel cells used to power electric motors.

Plug Power was founded in 1997 and initially focused on developing fuel cell technology. Fuel cells are devices that generate electricity through a chemical reaction rather than by burning fuel. They work like a battery but instead of being recharged, they produce electricity as long as they have a hydrogen supply.

Since its founding, Plug Power has grown through the acquisitions, both small and large, that enhanced its technological capabilities. Notably, it acquired United Hydrogen Group and Giner ELX in 2020, which helped it make and supply more hydrogen essential for its fuel cell technology.

Today, Plug Power's GenDrive systems use fuel cells to power electric forklifts, delivery vans, and drones. To keep its fuel cells running, Plug Power provides GenFuel, a complete setup for producing, storing, and dispensing hydrogen on-site. This means companies don’t have to worry about where to get hydrogen or how to transport it. Lastly, it offers reliable backup power sources for places like data centers or communication towers.

Plug Power primarily engages in long-term contracts that outline agreements regarding equipment supply, maintenance services, hydrogen fuel delivery, and performance guarantees. These contracts often range from three to five years.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors of Plug Power include Ballard Power Systems (NASDAQ:BLDP), FuelCell Energy (NASDAQ:FCEL), and Bloom Energy (NYSE:BE).

5. Revenue Growth

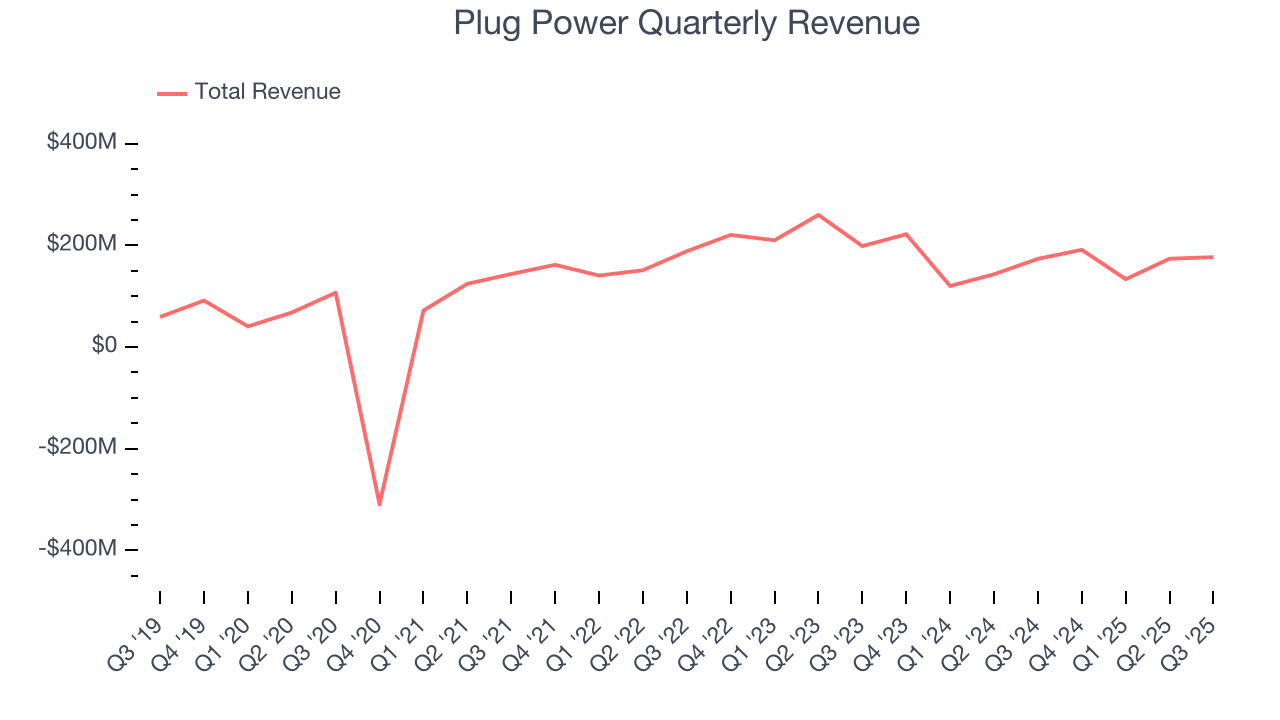

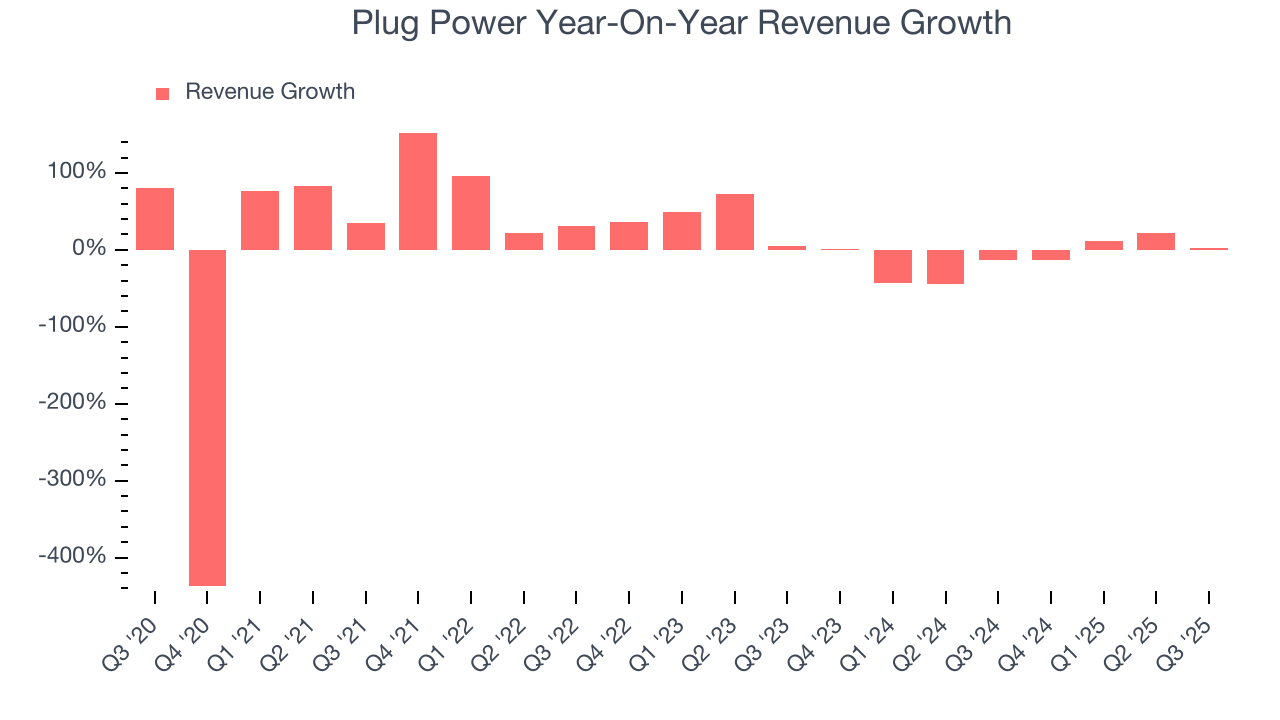

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Plug Power grew its sales at an incredible 17.1% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Plug Power’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 12.8% over the last two years.

This quarter, Plug Power grew its revenue by 1.9% year on year, and its $177.1 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 25.3% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Plug Power has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a negative 66.8% gross margin over the last five years. That means Plug Power lost $66.76 for every $100 in revenue.

This quarter, Plug Power’s gross profit margin was negative 67.9%. The company’s full-year margin was also negative, suggesting it needs to change its business model quickly.

7. Operating Margin

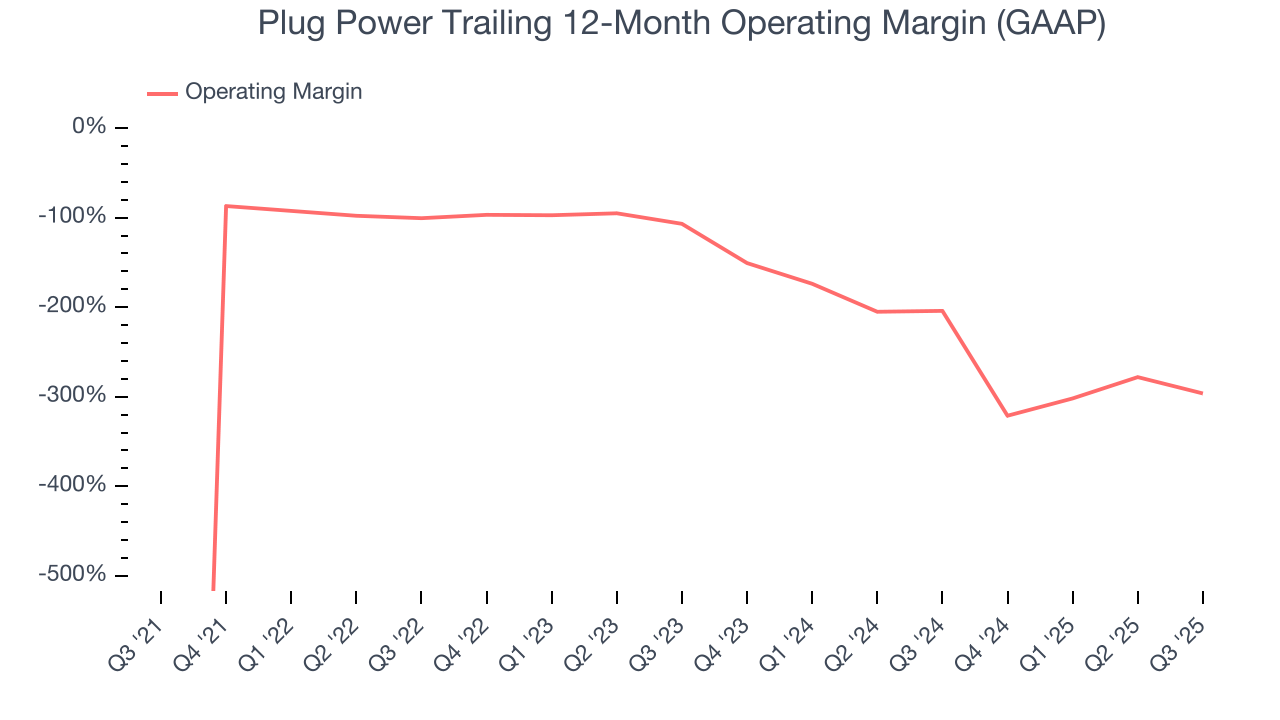

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Plug Power’s high expenses have contributed to an average operating margin of negative 195% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Plug Power’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Plug Power generated a negative 197% operating margin.

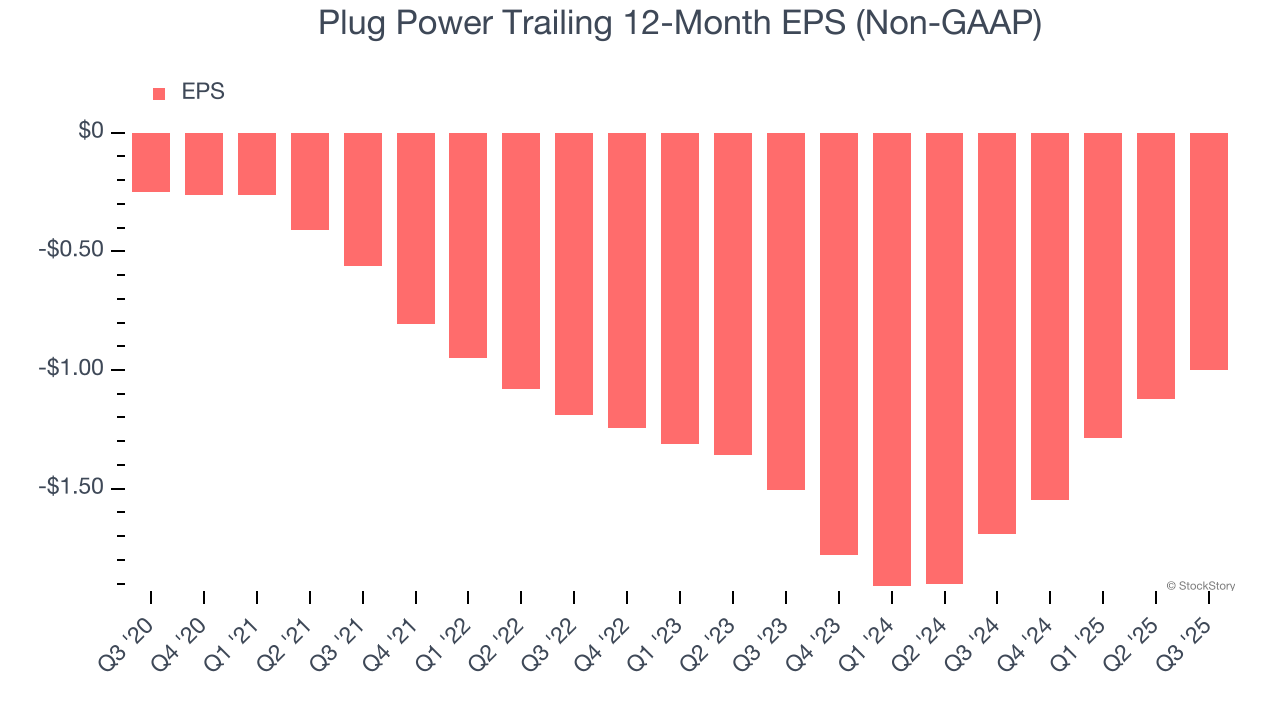

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Plug Power’s earnings losses deepened over the last five years as its EPS dropped 31.8% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Plug Power, its two-year annual EPS growth of 18.5% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q3, Plug Power reported adjusted EPS of negative $0.12, up from negative $0.24 in the same quarter last year. This print beat analysts’ estimates by 8.2%. Over the next 12 months, Wall Street expects Plug Power to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.00 will advance to negative $0.37.

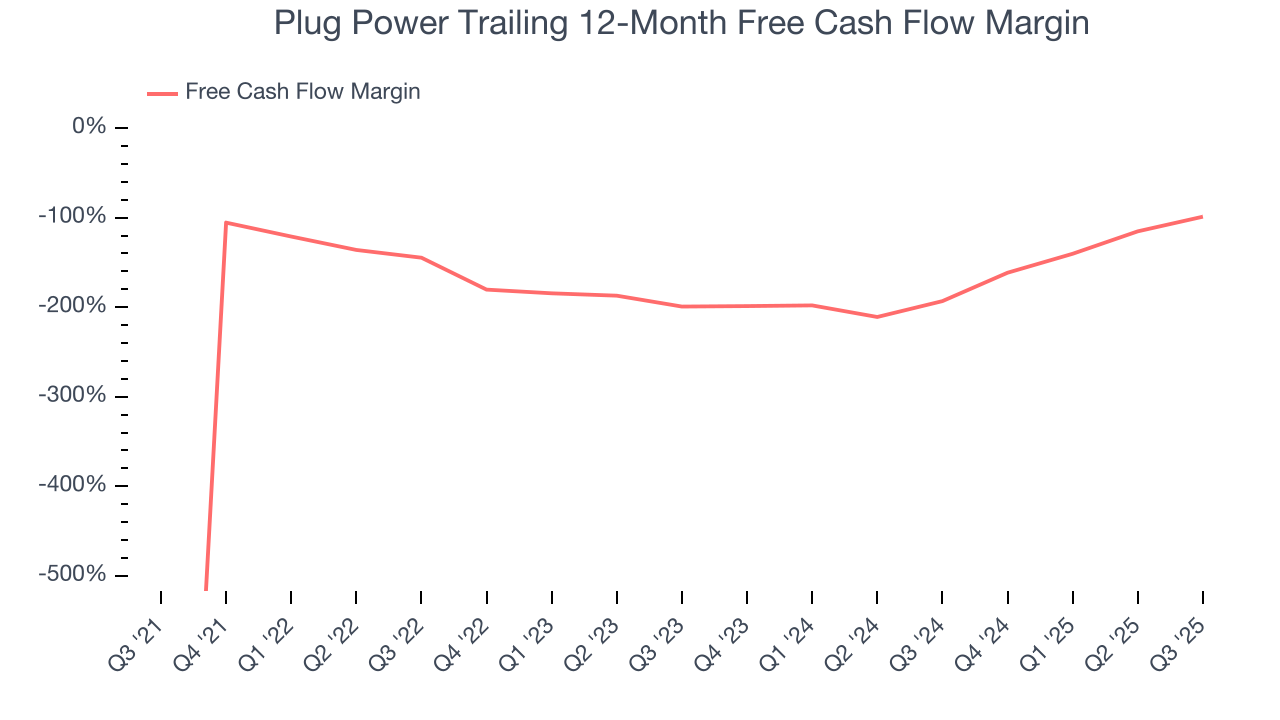

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Plug Power’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 176%, meaning it lit $175.78 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Plug Power’s margin expanded during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Plug Power burned through $127.3 million of cash in Q3, equivalent to a negative 71.9% margin. The company’s cash burn slowed from $234.2 million of lost cash in the same quarter last year.

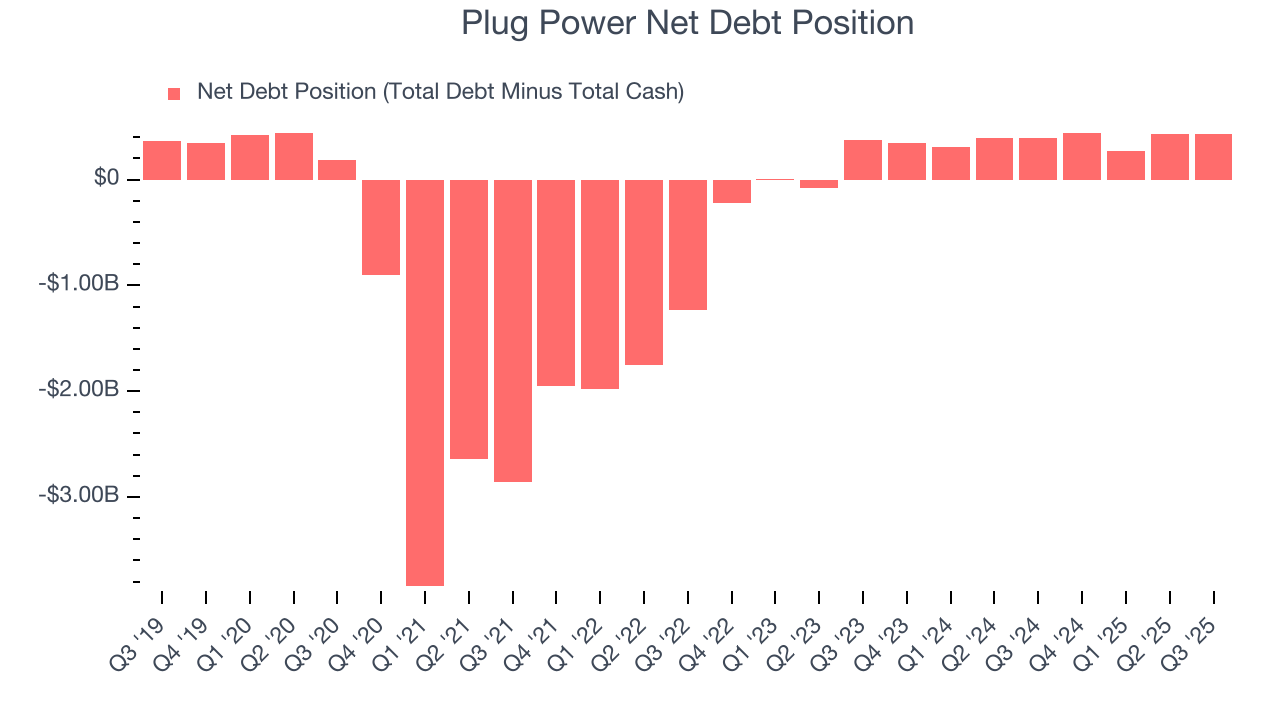

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Plug Power burned through $659.2 million of cash over the last year, and its $598.3 million of debt exceeds the $165.9 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Plug Power’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Plug Power until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from Plug Power’s Q3 Results

It was good to see Plug Power beat analysts’ EPS expectations this quarter. We were also happy its revenue was in line with Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 1.3% to $2.59 immediately following the results.

12. Is Now The Time To Buy Plug Power?

Updated: January 17, 2026 at 10:15 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Plug Power.

Plug Power’s business quality ultimately falls short of our standards. Although its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months, its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s rising cash profitability gives it more optionality, the downside is its declining operating margin shows the business has become less efficient.

Plug Power’s forward price-to-sales ratio is 3.2x. The market typically values companies like Plug Power based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $2.67 on the company (compared to the current share price of $2.38).