Plexus (PLXS)

We’re wary of Plexus. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Plexus Will Underperform

With over 20,000 team members across 26 global facilities, Plexus (NASDAQ:PLXS) designs, manufactures, and services complex electronic products for companies in aerospace/defense, healthcare, and industrial sectors.

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

- Adjusted operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

- A positive is that its incremental sales over the last five years have been more profitable as its earnings per share increased by 12.8% annually, topping its revenue gains

Plexus’s quality doesn’t meet our hurdle. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Plexus

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Plexus

Plexus’s stock price of $181.38 implies a valuation ratio of 24.6x forward P/E. This multiple is higher than most business services companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Plexus (PLXS) Research Report: Q3 CY2025 Update

Electronic manufacturing services company Plexus (NASDAQ:PLXS) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, but sales were flat year on year at $1.06 billion. Guidance for next quarter’s revenue was better than expected at $1.07 billion at the midpoint, 1.8% above analysts’ estimates. Its non-GAAP profit of $2.14 per share was 14.8% above analysts’ consensus estimates.

Plexus (PLXS) Q3 CY2025 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.05 billion (flat year on year, 1.1% beat)

- Adjusted EPS: $2.14 vs analyst estimates of $1.86 (14.8% beat)

- Revenue Guidance for Q4 CY2025 is $1.07 billion at the midpoint, above analyst estimates of $1.05 billion

- Adjusted EPS guidance for Q4 CY2025 is $1.73 at the midpoint, below analyst estimates of $1.81

- Operating Margin: 5%, in line with the same quarter last year

- Market Capitalization: $4.06 billion

Company Overview

With over 20,000 team members across 26 global facilities, Plexus (NASDAQ:PLXS) designs, manufactures, and services complex electronic products for companies in aerospace/defense, healthcare, and industrial sectors.

Plexus operates as a contract manufacturer that specializes in handling technically challenging products with demanding regulatory requirements. Unlike traditional electronics manufacturers that focus on high-volume consumer goods, Plexus targets complex, mission-critical products where precision and reliability are paramount.

The company provides end-to-end solutions throughout a product's lifecycle. This begins with design and development services at its six global design centers, where engineers create new products with manufacturability and serviceability in mind. Plexus then manages supply chain logistics, handles new product introductions, and conducts full-scale manufacturing at its facilities across the Americas, Asia-Pacific, and EMEA regions.

A medical device company might partner with Plexus to design and manufacture life-saving equipment like ventilators or patient monitoring systems. Plexus would handle everything from initial design to sourcing specialized components, manufacturing the devices in clean room environments, and providing ongoing repair services.

Plexus generates revenue primarily through manufacturing services, charging customers for both the production work and the procurement of materials. The company typically operates on a turnkey basis, where it purchases and manages all materials needed for assembly, though it sometimes works on a consignment model where customers provide materials.

All Plexus facilities maintain ISO9001:2015 quality certification, with additional capabilities to meet specialized regulatory requirements like FDA standards for medical devices. This focus on quality management and regulatory compliance allows Plexus to serve industries where product failures could have serious consequences.

4. Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

Plexus competes with other electronic manufacturing services providers including Jabil (NYSE:JBL), Flex (NASDAQ:FLEX), Benchmark Electronics (NYSE:BHE), and Celestica (NYSE:CLS), though Plexus differentiates itself by focusing specifically on complex, highly regulated products rather than high-volume consumer electronics.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

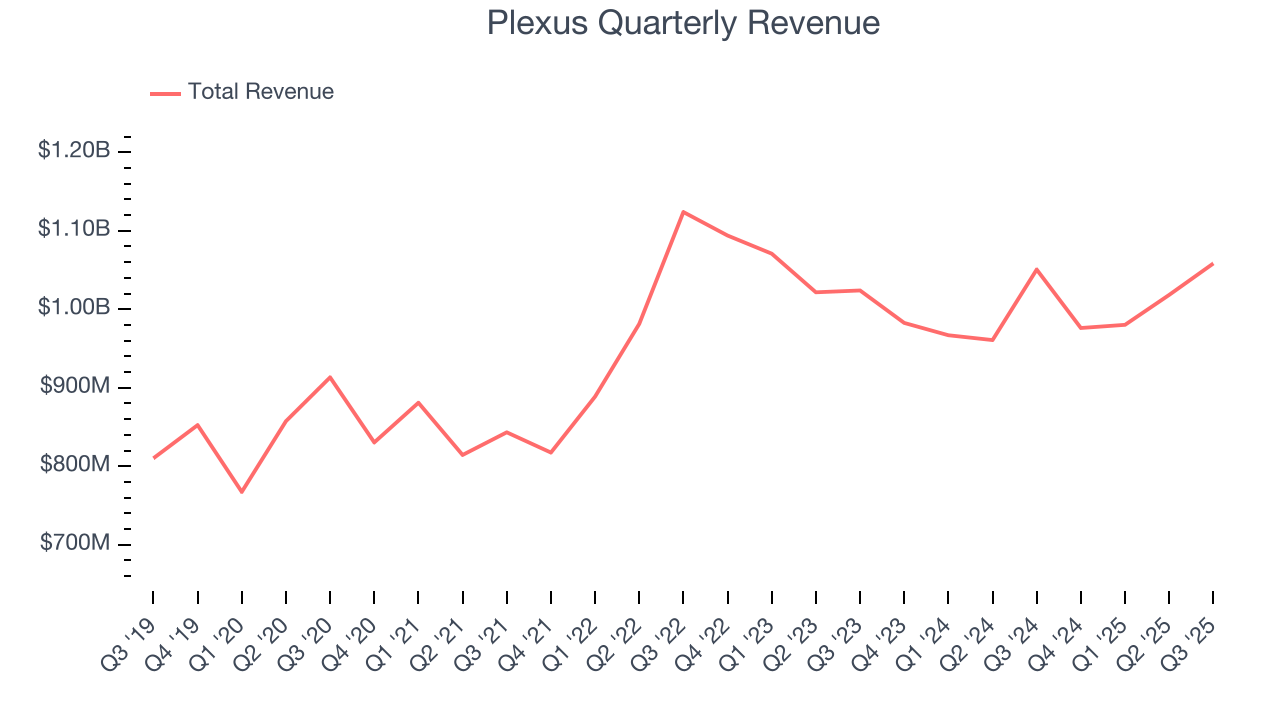

With $4.03 billion in revenue over the past 12 months, Plexus is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

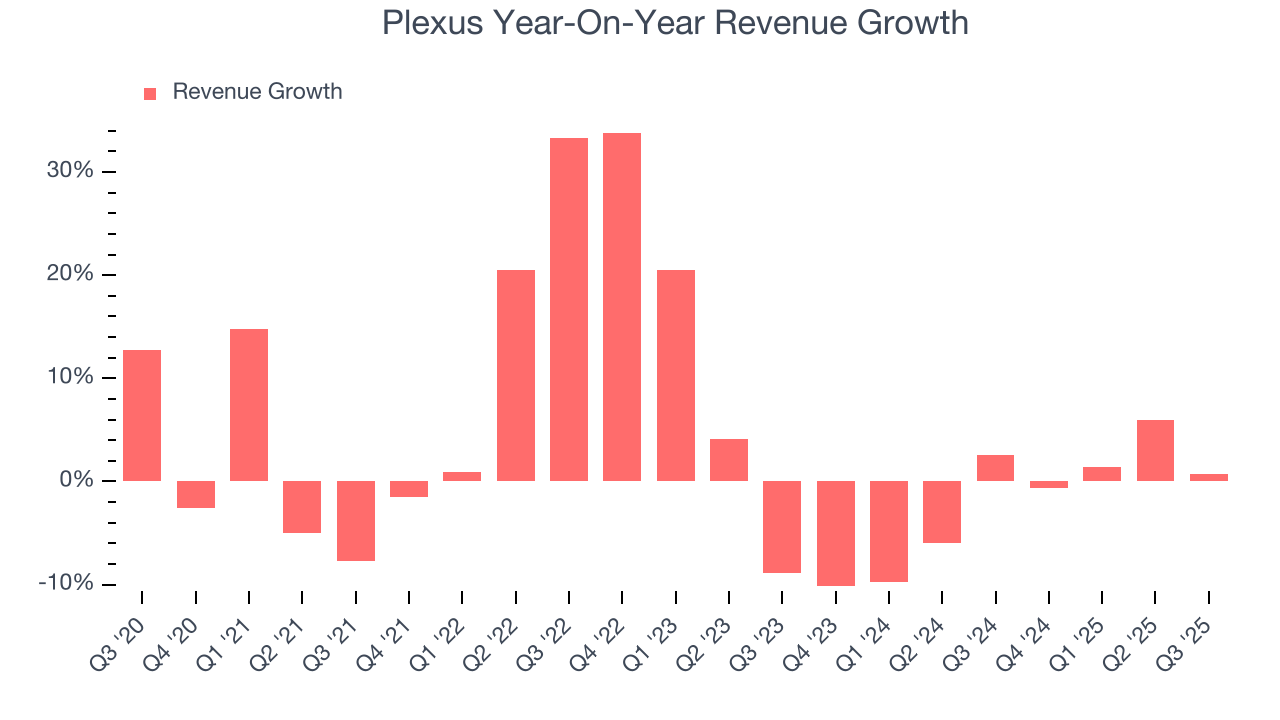

As you can see below, Plexus’s sales grew at a tepid 3.5% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Plexus’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.1% annually.

This quarter, Plexus’s $1.06 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.1%. Company management is currently guiding for a 9.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.6% over the next 12 months, an improvement versus the last two years. This projection is healthy and indicates its newer products and services will fuel better top-line performance.

6. Operating Margin

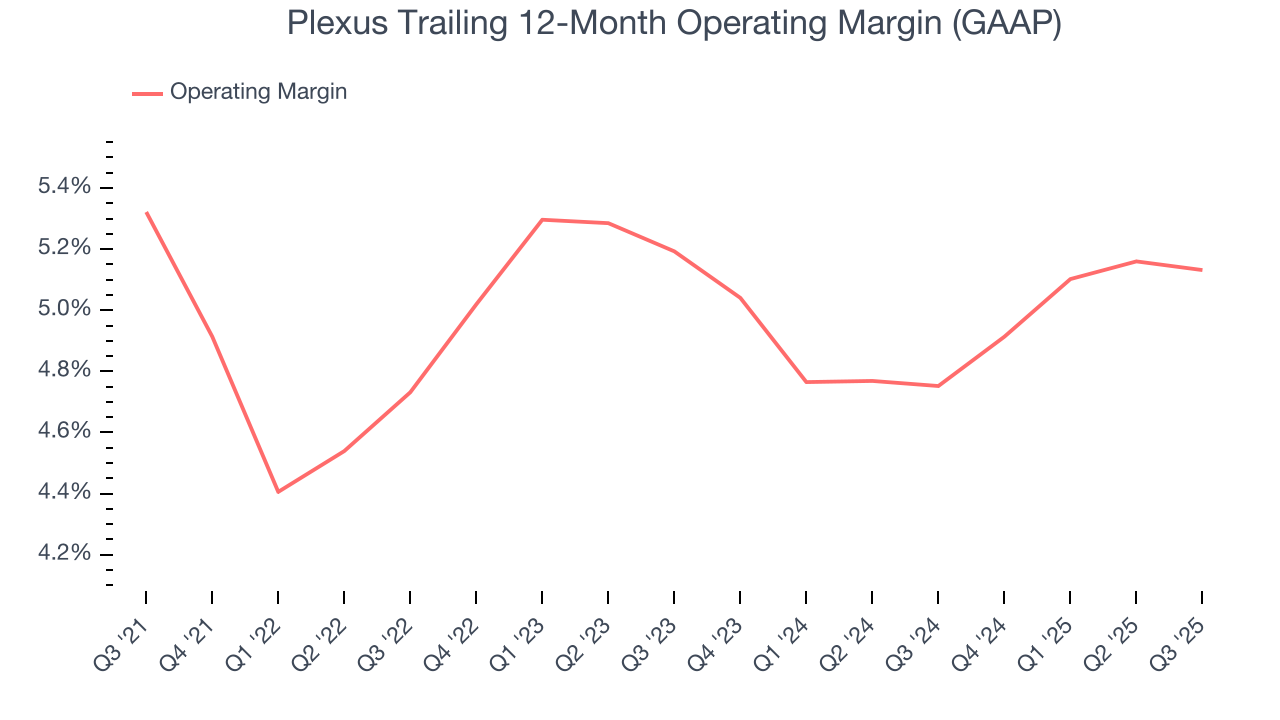

Plexus’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 5% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, Plexus’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Plexus generated an operating margin profit margin of 5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

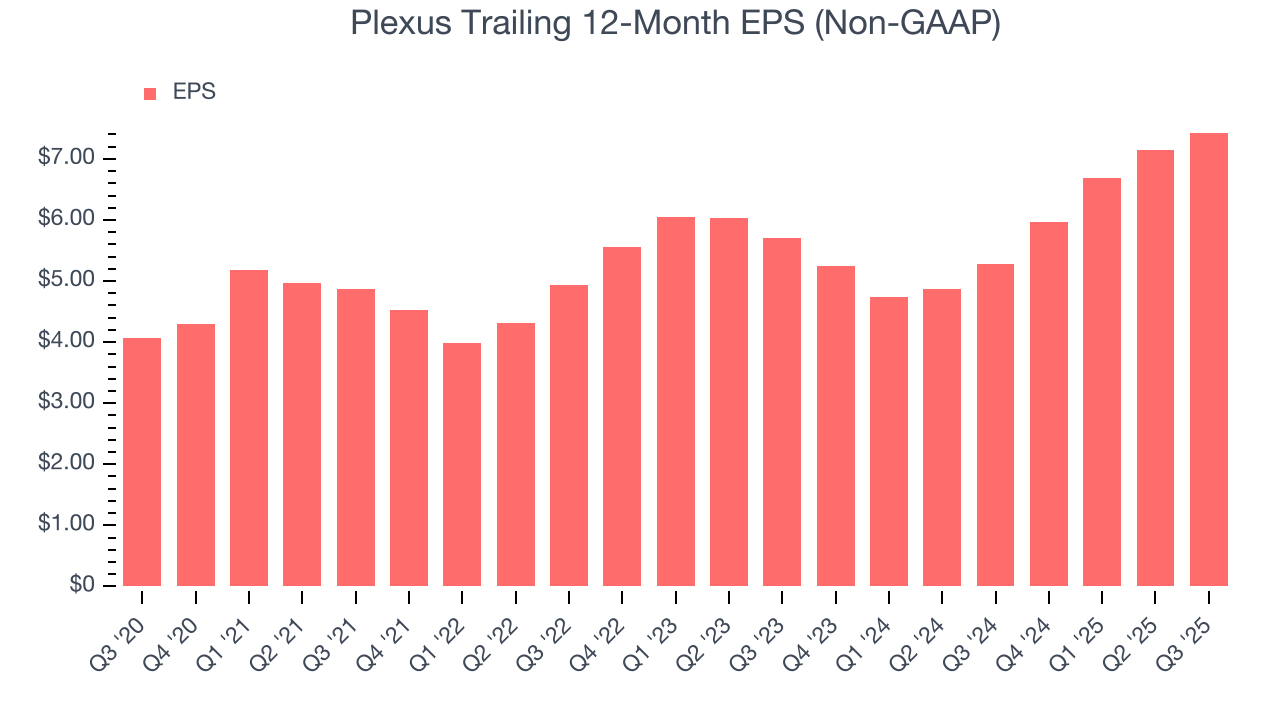

Plexus’s EPS grew at a spectacular 12.8% compounded annual growth rate over the last five years, higher than its 3.5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Plexus, its two-year annual EPS growth of 14.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Plexus reported adjusted EPS of $2.14, up from $1.85 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Plexus’s full-year EPS of $7.43 to grow 2.1%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

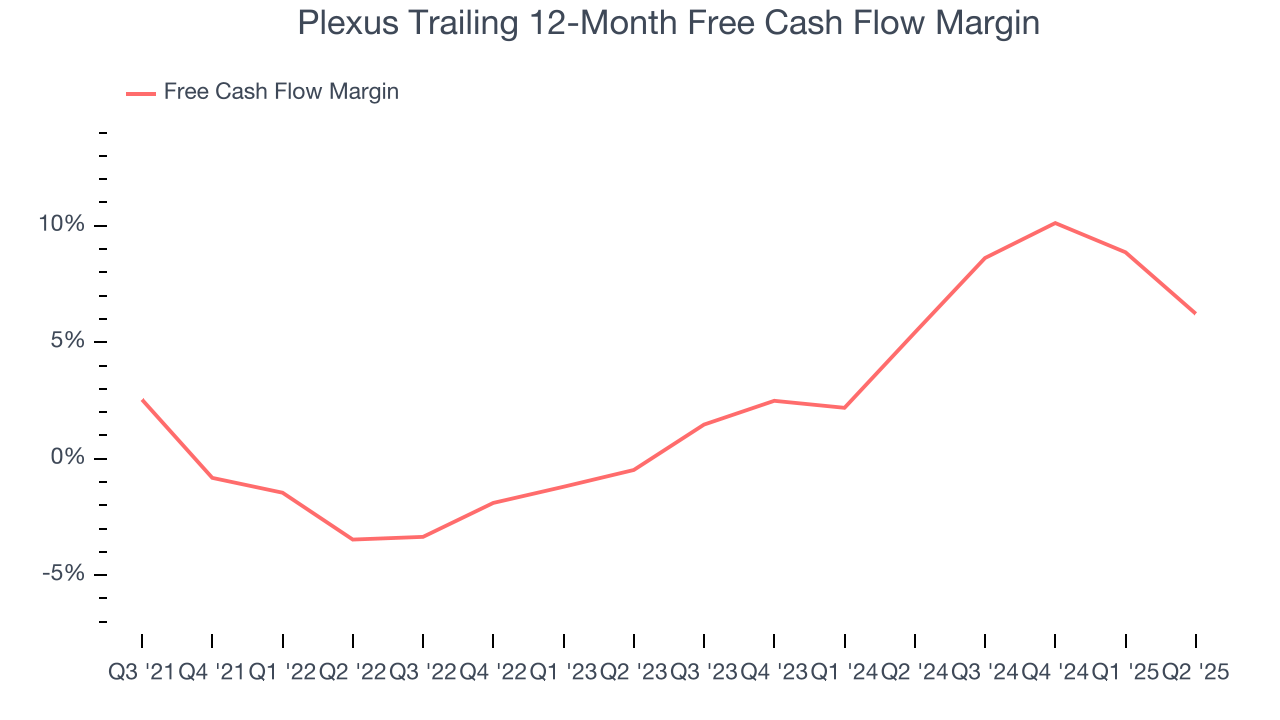

Plexus has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, lousy for a business services business.

Taking a step back, we can see that Plexus’s margin dropped by 1.9 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

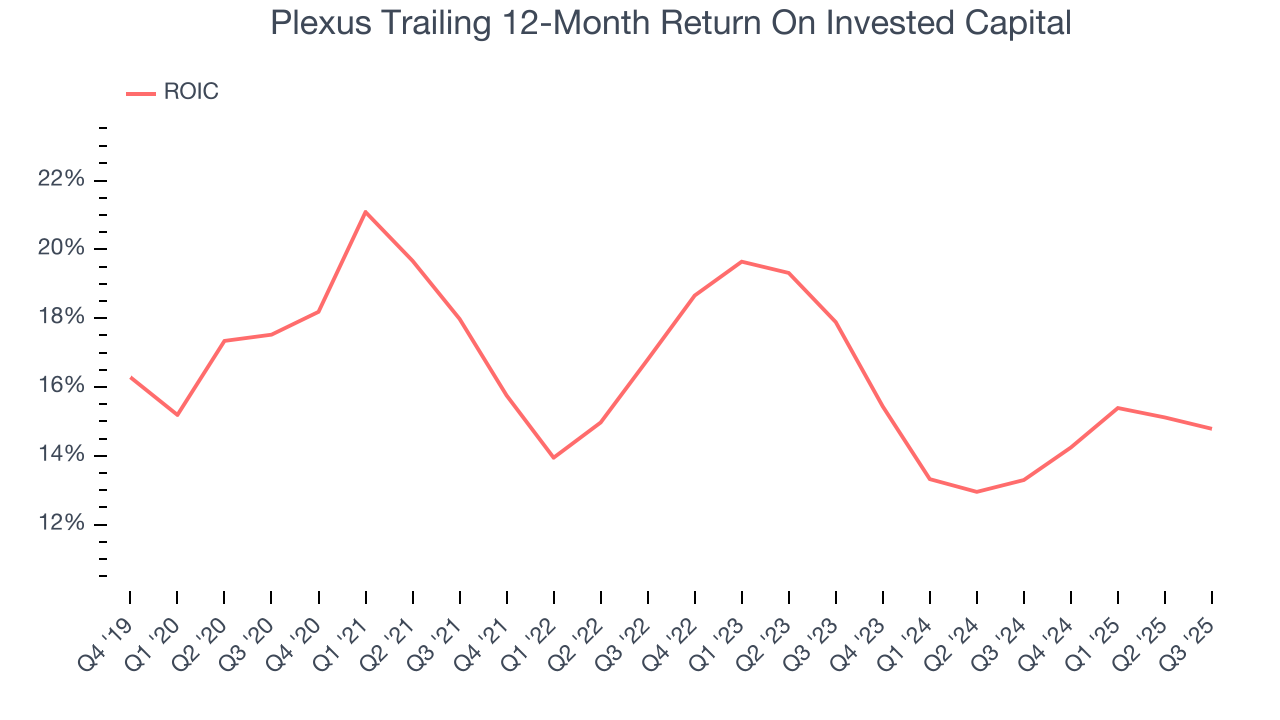

Plexus’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 16.2%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Plexus’s ROIC averaged 3.3 percentage point decreases over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

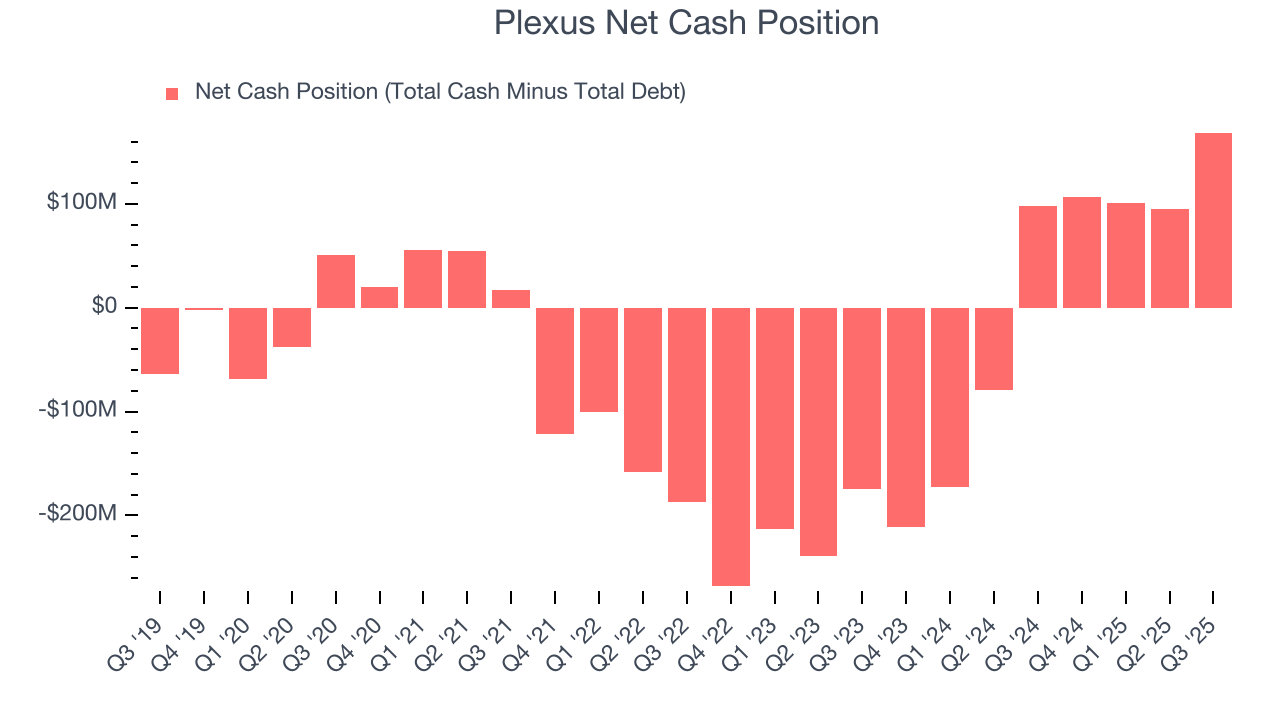

Plexus is a profitable, well-capitalized company with $306.5 million of cash and $137.8 million of debt on its balance sheet. This $168.7 million net cash position is 4.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Plexus’s Q3 Results

It was good to see Plexus beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, we think this was a mixed quarter with some key areas of upside but also some areas of disappointment. The stock remained flat at $145 immediately following the results.

12. Is Now The Time To Buy Plexus?

Updated: January 22, 2026 at 10:49 PM EST

Before deciding whether to buy Plexus or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Plexus isn’t a terrible business, but it isn’t one of our picks. First off, its revenue growth was uninspiring over the last five years. And while its spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking. On top of that, its low free cash flow margins give it little breathing room.

Plexus’s P/E ratio based on the next 12 months is 24.6x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $159 on the company (compared to the current share price of $181.38), implying they don’t see much short-term potential in Plexus.