Remitly (RELY)

Remitly sets the gold standard. Its ability to balance growth and profitability while maintaining a bright outlook makes it a gem.― StockStory Analyst Team

1. News

2. Summary

Why We Like Remitly

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ:RELY) is an online platform that enables consumers to safely and quickly send money globally.

- Market share has increased over the last three years as its 35.8% annual revenue growth was exceptional

- Growing active customers over the last two years create opportunities to boost monetization through new features and premium offerings

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 108% over the last three years outstripped its revenue performance

Remitly is at the top of our list. The price looks reasonable based on its quality, and we think now is the time to buy.

Why Is Now The Time To Buy Remitly?

Why Is Now The Time To Buy Remitly?

Remitly’s stock price of $16.44 implies a valuation ratio of 7.5x forward EV/EBITDA. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

A powerful double-play is a business that can both grow earnings and achieve a loftier multiple over time. Elite companies trading at meaningful discounts are good ways to set up this play.

3. Remitly (RELY) Research Report: Q4 CY2025 Update

Online money transfer platform Remitly (NASDAQ:RELY) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 25.7% year on year to $442.2 million. Guidance for next quarter’s revenue was better than expected at $437 million at the midpoint, 1.8% above analysts’ estimates. Its GAAP profit of $0.19 per share was significantly above analysts’ consensus estimates.

Remitly (RELY) Q4 CY2025 Highlights:

- Revenue: $442.2 million vs analyst estimates of $427.3 million (25.7% year-on-year growth, 3.5% beat)

- EPS (GAAP): $0.19 vs analyst estimates of $0.01 (significant beat)

- Adjusted EBITDA: $88.58 million vs analyst estimates of $51.49 million (20% margin, 72.1% beat)

- Revenue Guidance for Q1 CY2026 is $437 million at the midpoint, above analyst estimates of $429.2 million

- EBITDA guidance for the upcoming financial year 2026 is $350 million at the midpoint, above analyst estimates of $309.6 million

- Operating Margin: 8.8%, up from -1.1% in the same quarter last year

- Free Cash Flow Margin: 31.7%, up from 1.2% in the previous quarter

- Active Customers: 9.3 million, up 1.5 million year on year

- Market Capitalization: $2.73 billion

Company Overview

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ:RELY) is an online platform that enables consumers to safely and quickly send money globally.

The company is based in Seattle and was founded in 2011 and went public about a decade later. The product aims to give people access to financial services, especially those who are underserved by traditional banking systems.

The problem that Remitly solves is the difficulty and sometimes high cost of sending money overseas. Traditionally, people have relied on money transfer services that charge high fees and take several days to process. Remitly's platform offers a faster, more affordable option. The company's key customers tend to be people who need to send money to family and friends in other countries.

Remitly generates revenue through transaction fees, which vary depending on the amount and destination of the transfer. For example, if someone in the United States wants to send $500 to a family member in Mexico, Remitly might charge a fee of $3.99 for an economy transfer or $9.99 for an express transfer, which would arrive within minutes. Countries such as Vietnam may have higher fees. The company also makes money by offering different exchange rates for different currencies. By optimizing the exchange rate, Remitly can earn a margin on each transaction.

4. Financial Technology

Financial technology companies benefit from the increasing consumer demand for digital payments, banking, and finance. Tailwinds fueling this trend include e-commerce along with improvements in blockchain infrastructure and AI-driven credit underwriting, which make access to money faster and cheaper. Despite regulatory scrutiny and resistance from traditional financial institutions, fintechs are poised for long-term growth as they disrupt legacy systems by expanding financial services to underserved population segments.

Competitors offering online legal or document services include Western Union (NYSE:WU), Moneygram (NASDAQ:MGI), and private company WorldRemit.

5. Revenue Growth

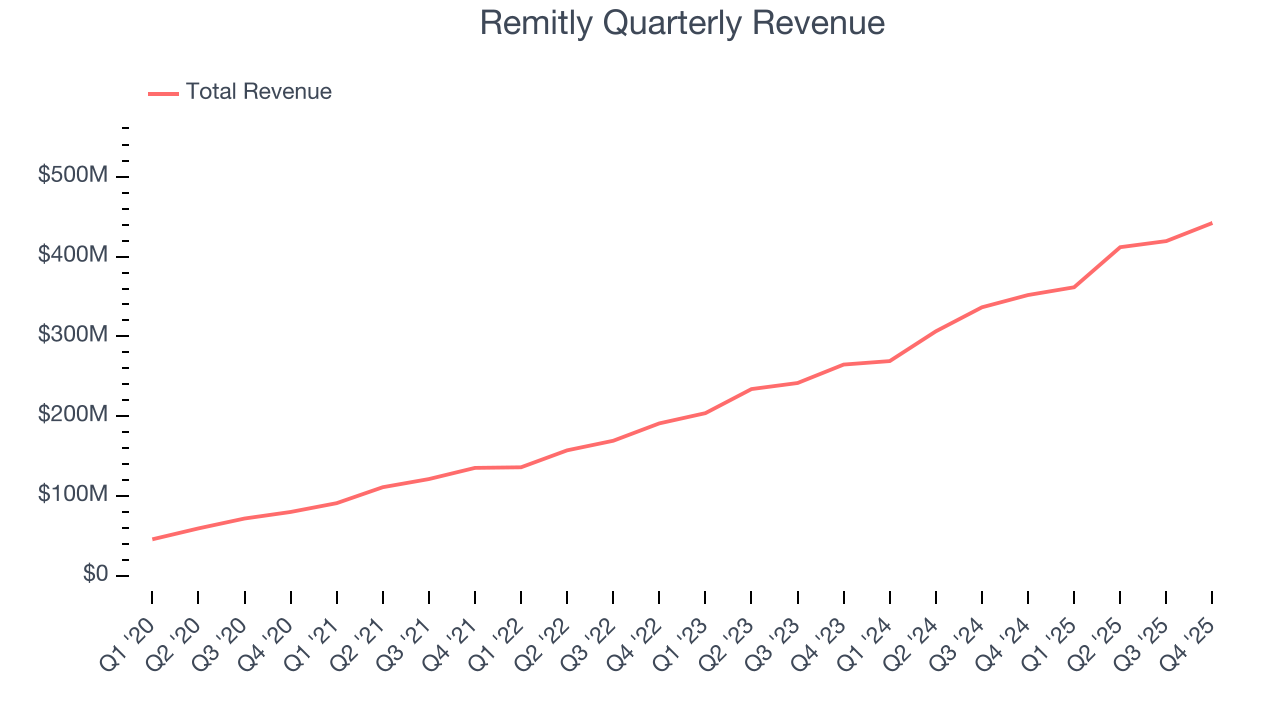

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Remitly grew its sales at an incredible 35.8% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Remitly reported robust year-on-year revenue growth of 25.7%, and its $442.2 million of revenue topped Wall Street estimates by 3.5%. Company management is currently guiding for a 20.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 17.7% over the next 12 months, a deceleration versus the last three years. Still, this projection is healthy and implies the market is baking in success for its products and services.

6. Active Customers

Customer Growth

As a fintech company, Remitly generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

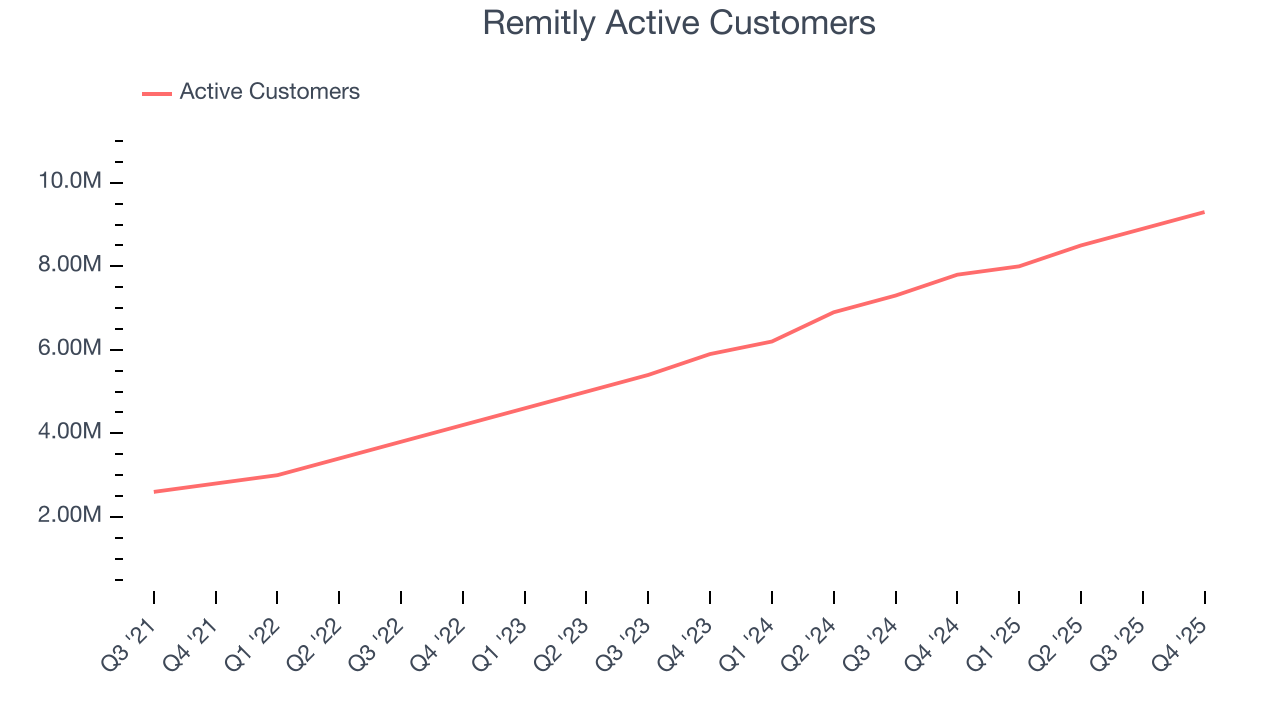

Over the last two years, Remitly’s active customers, a key performance metric for the company, increased by 29.2% annually to 9.3 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q4, Remitly added 1.5 million active customers, leading to 19.2% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating customer growth just yet.

Revenue Per Customer

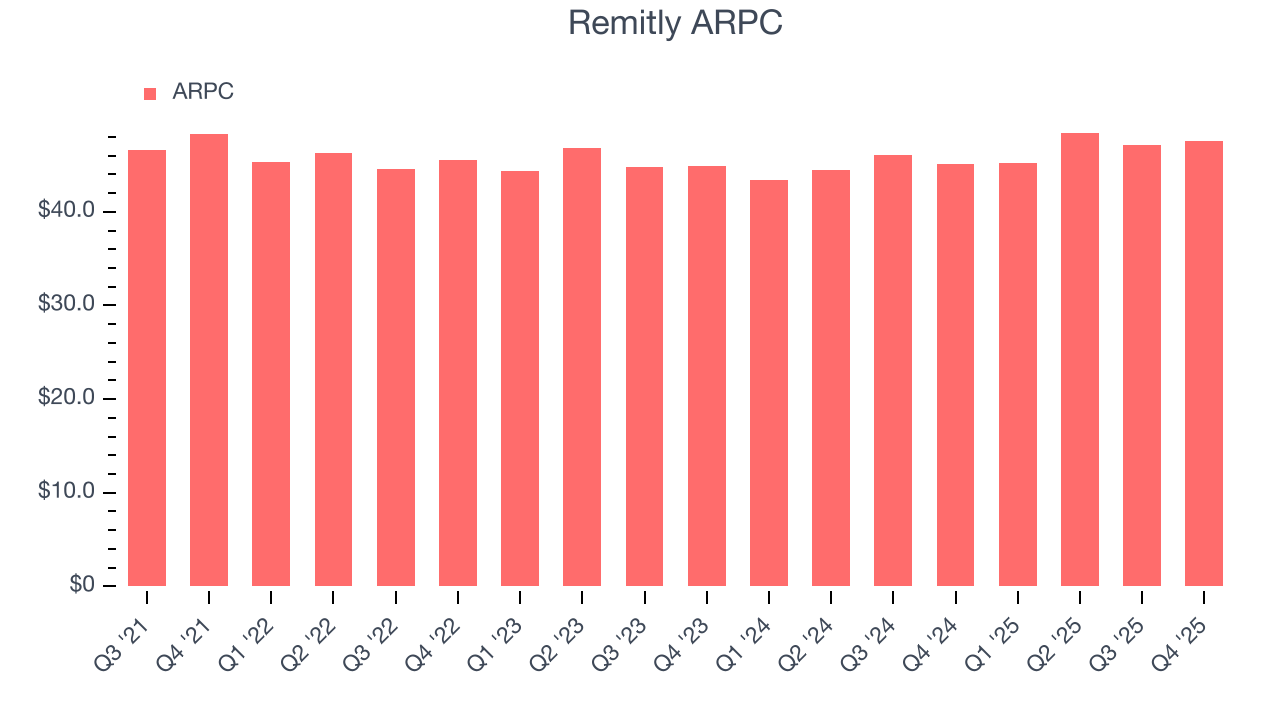

Average revenue per customer (ARPC) is a critical metric to track because it measures how much the company earns in fees from each user. ARPC also gives us unique insights into the average transaction size on Remitly’s platform and the company’s take rate, or "cut", on each transaction.

Remitly’s ARPC growth has been subpar over the last two years, averaging 2.2%. This isn’t great, but the increase in active customers is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Remitly tries boosting ARPC by taking a more aggressive approach to monetization, it’s unclear whether customers can continue growing at the current pace.

This quarter, Remitly’s ARPC clocked in at $47.55. It grew by 5.4% year on year, slower than its customer growth.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For fintech businesses like Remitly, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include transaction/payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard customers, such as identity verification.

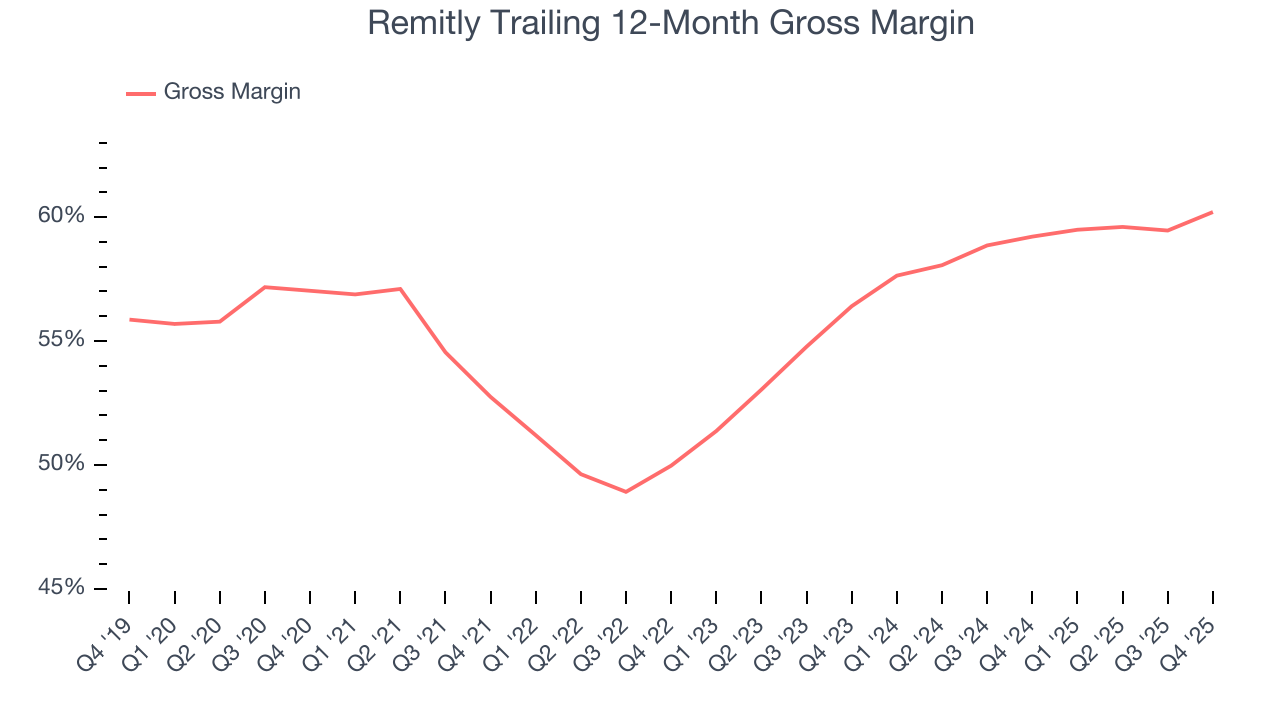

Remitly’s unit economics are higher than the typical consumer internet business and signal that it has competitive products and services. As you can see below, it averaged a decent 59.8% gross margin over the last two years. That means for every $100 in revenue, roughly $59.77 was left to spend on selling, marketing, and R&D.

This quarter, Remitly’s gross profit margin was 62.7% , marking a 2.6 percentage point increase from 60.1% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

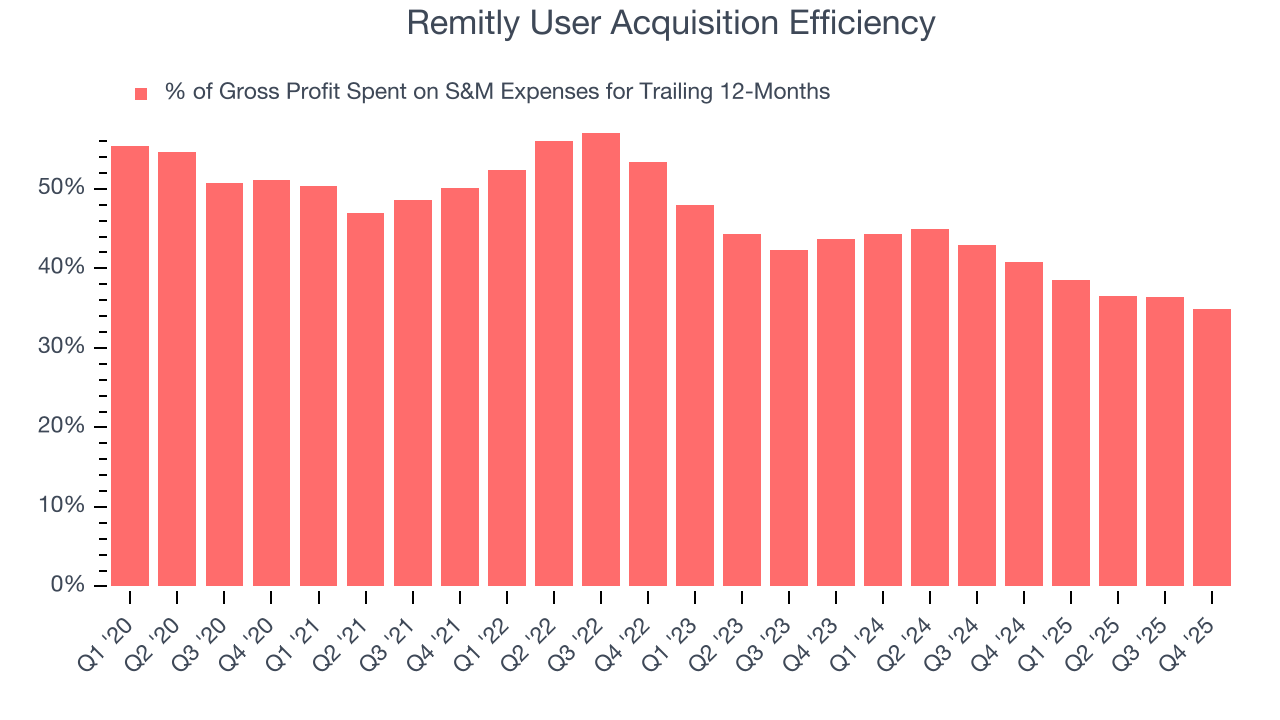

8. User Acquisition Efficiency

Consumer internet businesses like Remitly grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Remitly is efficient at acquiring new users, spending 34.8% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates relatively solid competitive positioning, giving Remitly the freedom to invest its resources into new growth initiatives.

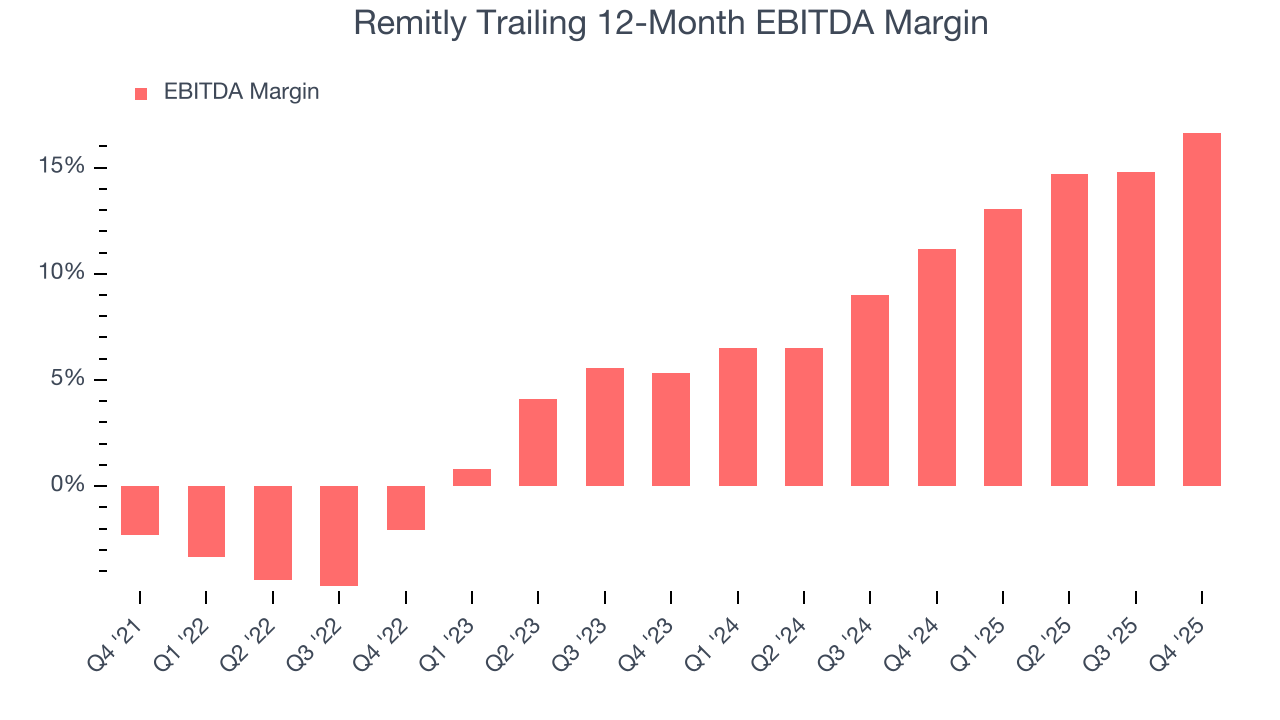

9. EBITDA

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Remitly has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 14.3%.

Looking at the trend in its profitability, Remitly’s EBITDA margin rose by 18.7 percentage points over the last few years, as its sales growth gave it immense operating leverage.

This quarter, Remitly generated an EBITDA margin profit margin of 20%, up 7.3 percentage points year on year. The increase was solid, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

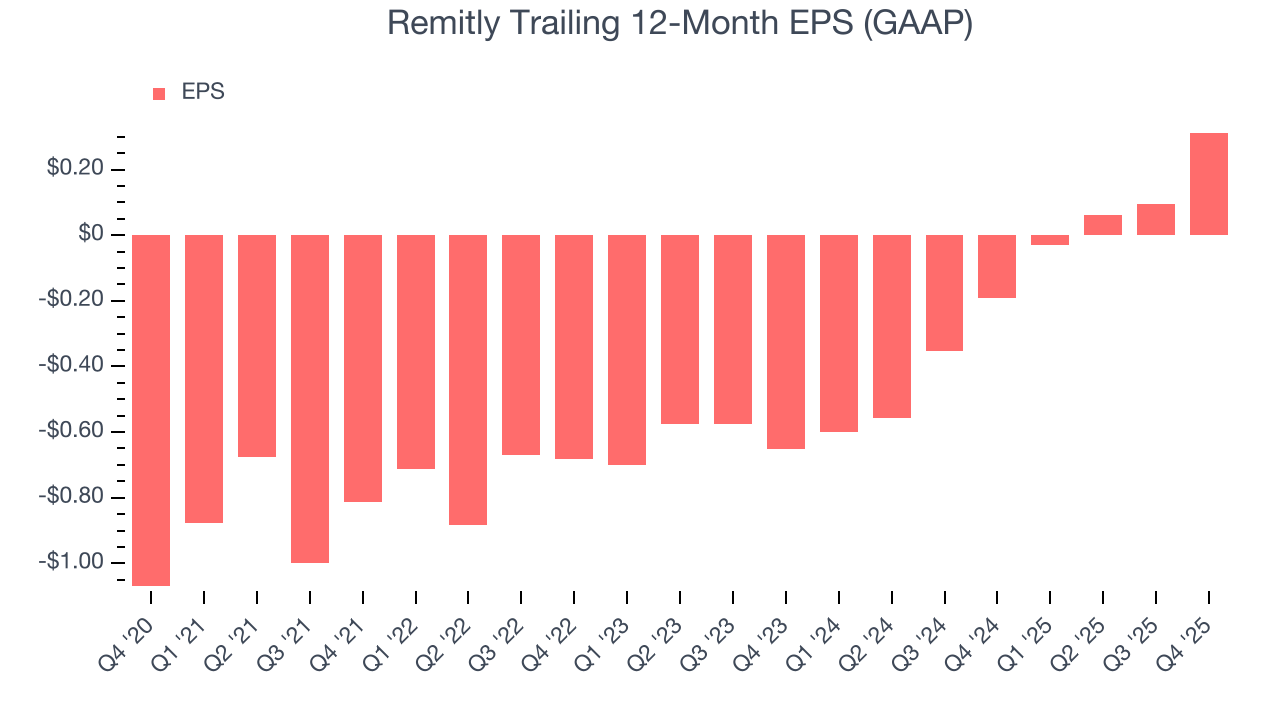

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Remitly’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

In Q4, Remitly reported EPS of $0.19, up from negative $0.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Remitly’s full-year EPS of $0.31 to grow 15.1%.

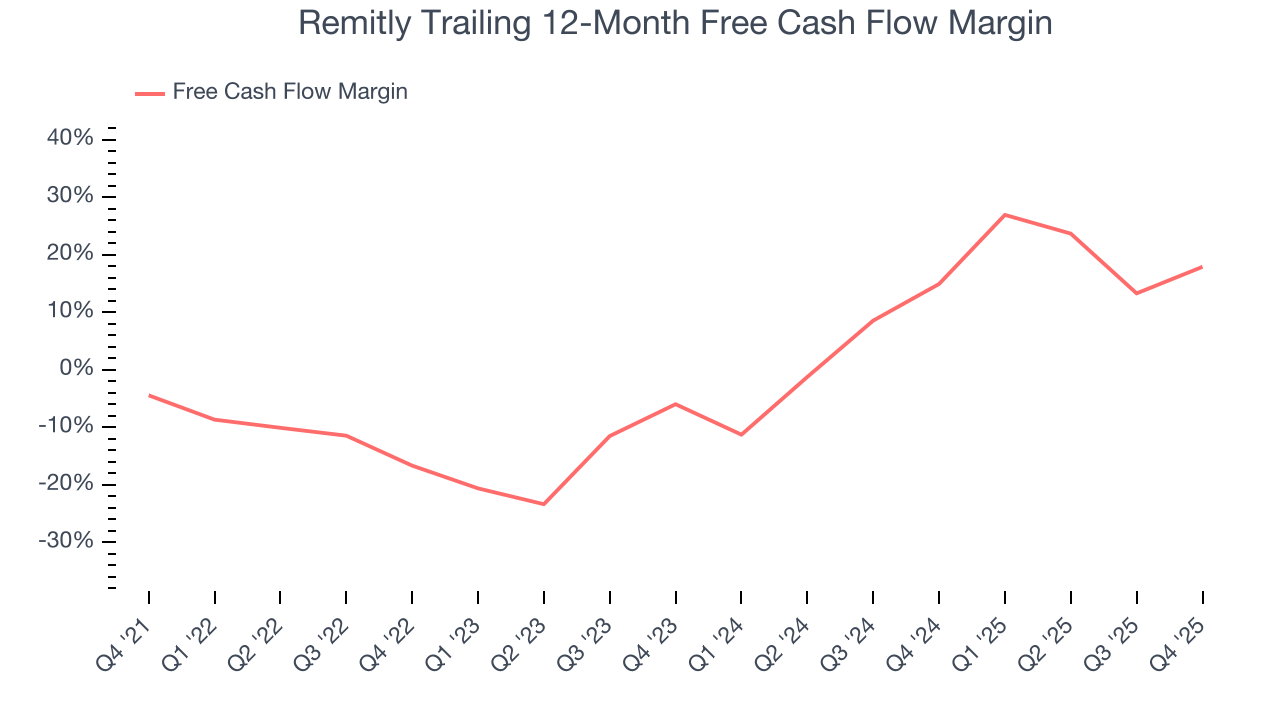

11. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Remitly has shown robust cash profitability, driven by its cost-effective customer acquisition strategy that enables it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 16.6% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Remitly’s margin expanded by 34.5 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Remitly’s free cash flow clocked in at $140.2 million in Q4, equivalent to a 31.7% margin. This result was good as its margin was 16.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

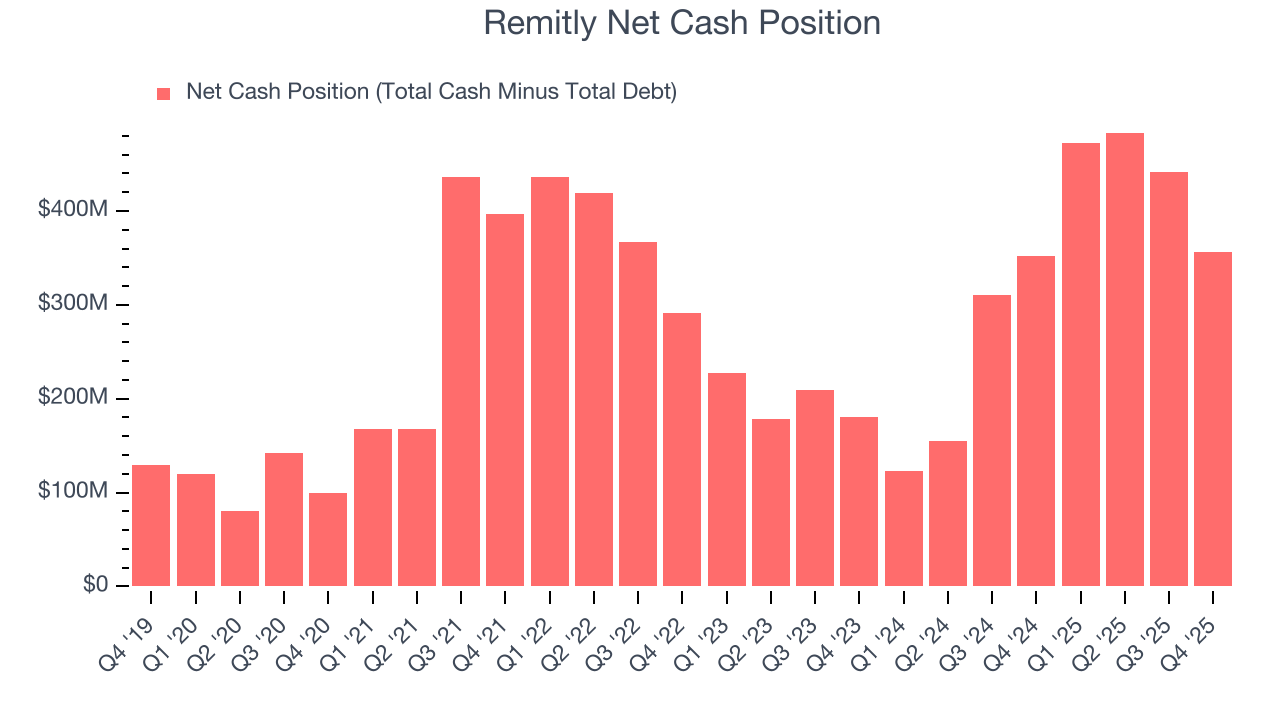

Remitly is a profitable, well-capitalized company with $542.4 million of cash and $186 million of debt on its balance sheet. This $356.5 million net cash position is 13% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Remitly’s Q4 Results

We were impressed by Remitly’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 11.3% to $15.17 immediately after reporting.

14. Is Now The Time To Buy Remitly?

Updated: February 18, 2026 at 9:27 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Remitly, you should also grasp the company’s longer-term business quality and valuation.

Remitly is a high-quality business worth owning. First of all, the company’s revenue growth was exceptional over the last three years. On top of that, its rising cash profitability gives it more optionality, and its expanding EBITDA margin shows the business has become more efficient.

Remitly’s EV/EBITDA ratio based on the next 12 months is 7.5x. Scanning the consumer internet landscape today, Remitly’s fundamentals really stand out, and we like it at this bargain price.

Wall Street analysts have a consensus one-year price target of $19.63 on the company (compared to the current share price of $16.44), implying they see 19.4% upside in buying Remitly in the short term.