Construction Partners (ROAD)

Construction Partners is in a league of its own. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why We Like Construction Partners

Founded in 2001, Construction Partners (NASDAQ:ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

- Impressive 30.7% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Earnings growth has massively outpaced its peers over the last five years as its EPS has compounded at 24.1% annually

- Expected revenue growth of 15.9% for the next year suggests its market share will rise

We expect great things from Construction Partners. The price seems fair in light of its quality, and we think now is a good time to buy.

Why Is Now The Time To Buy Construction Partners?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Construction Partners?

At $135.30 per share, Construction Partners trades at 44.9x forward P/E. Sure, the valuation multiple seems high and could make for some share price rockiness. But given its fundamentals, we think the multiple is justified.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Over the long term, entry price doesn’t matter nearly as much as business fundamentals.

3. Construction Partners (ROAD) Research Report: Q4 CY2025 Update

Civil infrastructure company Construction Partners (NASDAQ:ROAD) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 44.1% year on year to $809.5 million. The company’s full-year revenue guidance of $3.52 billion at the midpoint came in 1.9% above analysts’ estimates. Its GAAP profit of $0.31 per share was 20.8% above analysts’ consensus estimates.

Construction Partners (ROAD) Q4 CY2025 Highlights:

- Revenue: $809.5 million vs analyst estimates of $732.7 million (44.1% year-on-year growth, 10.5% beat)

- EPS (GAAP): $0.31 vs analyst estimates of $0.26 (20.8% beat)

- Adjusted EBITDA: $112.2 million vs analyst estimates of $96.83 million (13.9% margin, 15.9% beat)

- The company lifted its revenue guidance for the full year to $3.52 billion at the midpoint from $3.45 billion, a 2% increase

- EBITDA guidance for the full year is $542 million at the midpoint, above analyst estimates of $531.2 million

- Operating Margin: 6.2%, up from 2.5% in the same quarter last year

- Free Cash Flow Margin: 5.8%, up from 2.8% in the same quarter last year

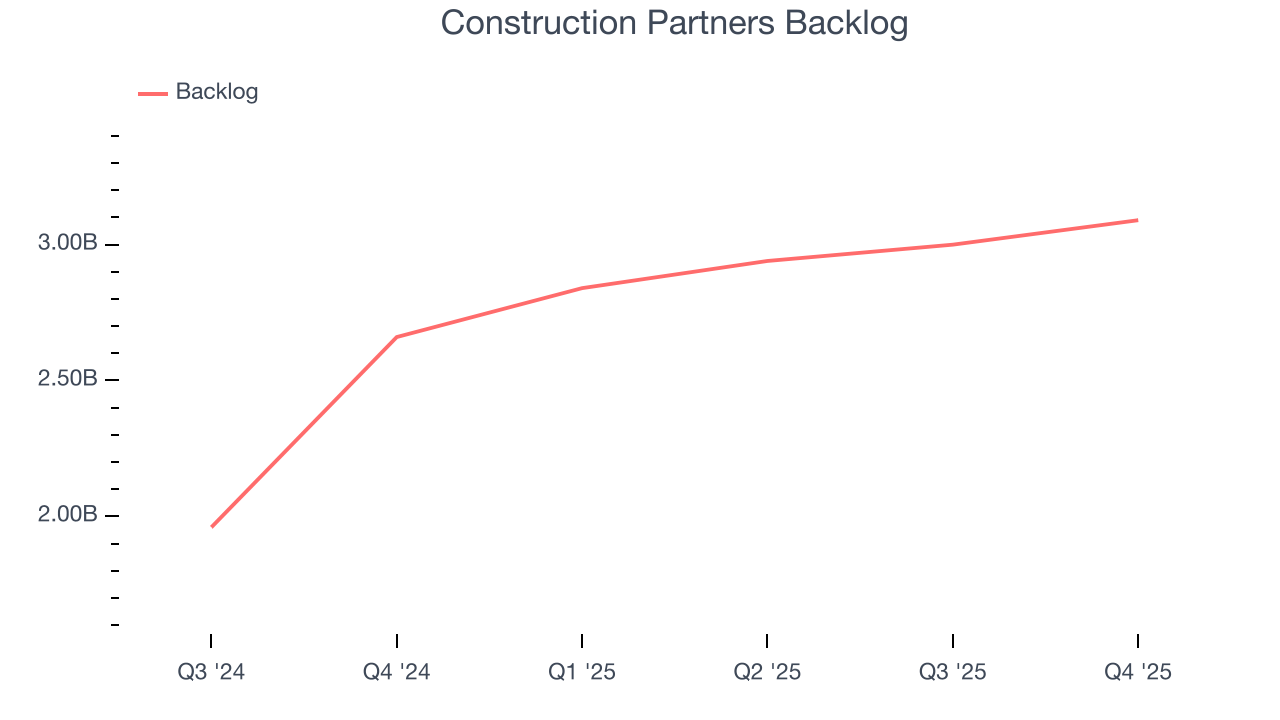

- Backlog: $3.09 billion at quarter end, up 16.2% year on year

- Market Capitalization: $6.49 billion

Company Overview

Founded in 2001, Construction Partners (NASDAQ:ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

The company specializes exclusively in civil engineering infrastructure projects in the Southeastern United States. In addition to roads and highways, Construction Partners works on municipal projects like airport runways, sidewalks, bike paths, and drainage and sewer systems.

Its product and service offerings include the paving, grading, and construction processes of roads, highways, sidewalks, and drainage systems. These processes include implementing traffic control and safety measures for high-danger work areas on construction sites or asphalt production for the material needed to build infrastructure. The company also operates repair and upgrading services to existing bridges, roads, and other infrastructure.

Construction Partners generates revenue mostly through the construction and maintenance of public infrastructure. Revenue stems from contracts with state and local governments and includes the recurring maintenance needed to maintain the quality and safety of the infrastructure. The company also generates revenue through private sector projects requiring its paving, production, or engineering skills, like commercial site developments.

4. Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Companies competing against Construction Partners include Vulcan Materials (NYSE:VMC), Granite Construction (NYSE:GVA), and Martin Marietta Materials (NYSE:MLM)

5. Revenue Growth

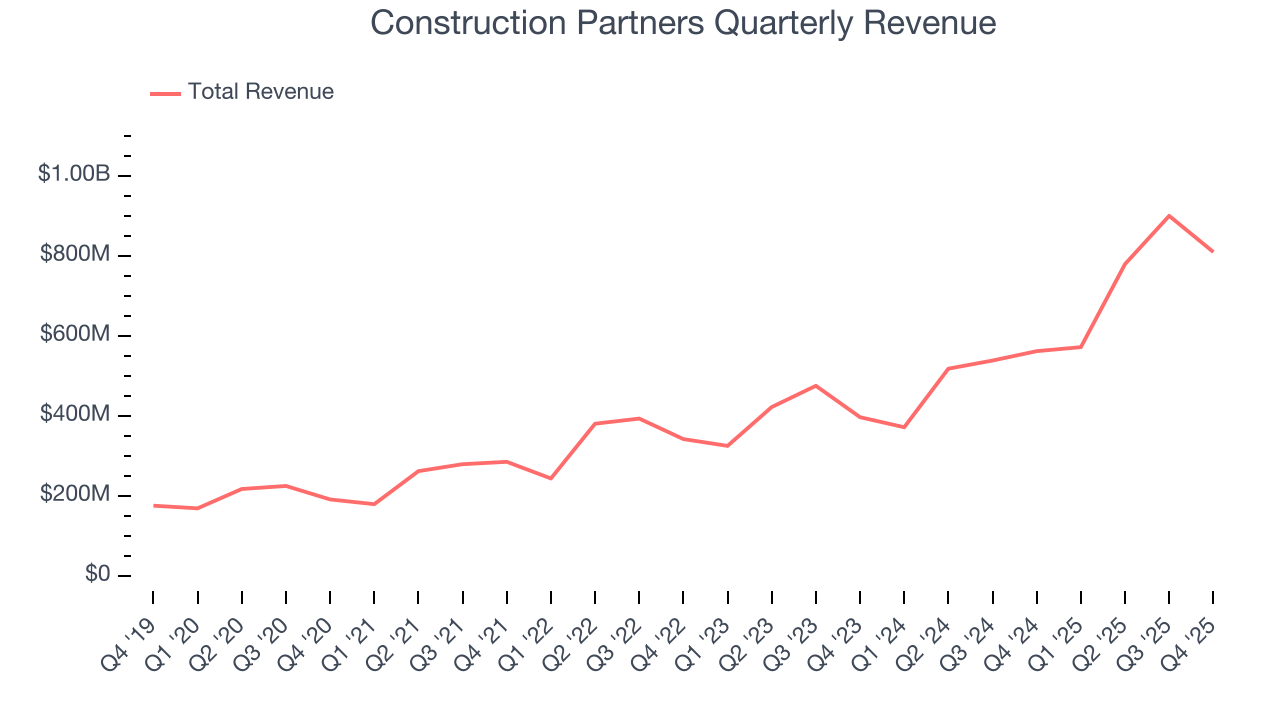

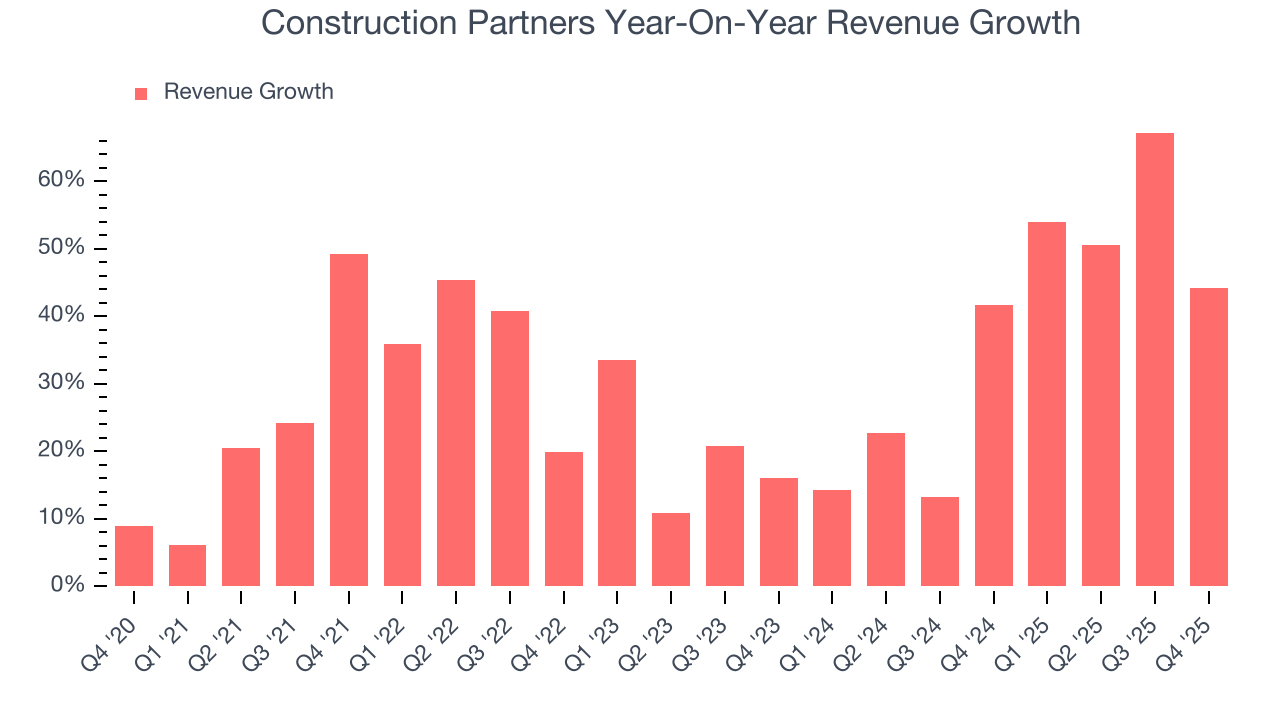

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Construction Partners grew its sales at an incredible 30.7% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Construction Partners’s annualized revenue growth of 37.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

Construction Partners also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Construction Partners’s backlog reached $3.09 billion in the latest quarter and averaged 34.6% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Construction Partners was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Construction Partners reported magnificent year-on-year revenue growth of 44.1%, and its $809.5 million of revenue beat Wall Street’s estimates by 10.5%.

Looking ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and indicates the market is baking in success for its products and services.

6. Gross Margin & Pricing Power

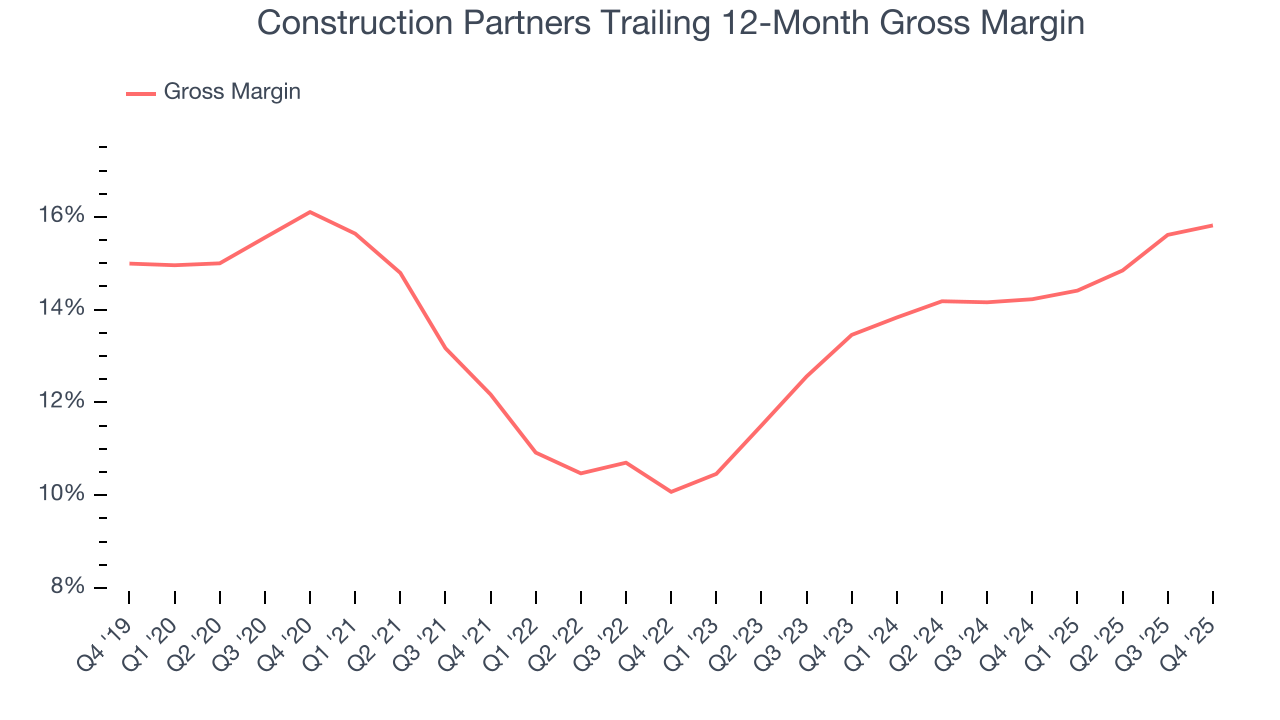

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Construction Partners has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.8% gross margin over the last five years. Said differently, Construction Partners had to pay a chunky $86.23 to its suppliers for every $100 in revenue.

In Q4, Construction Partners produced a 15% gross profit margin, marking a 1.4 percentage point increase from 13.6% in the same quarter last year. Construction Partners’s full-year margin has also been trending up over the past 12 months, increasing by 1.6 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

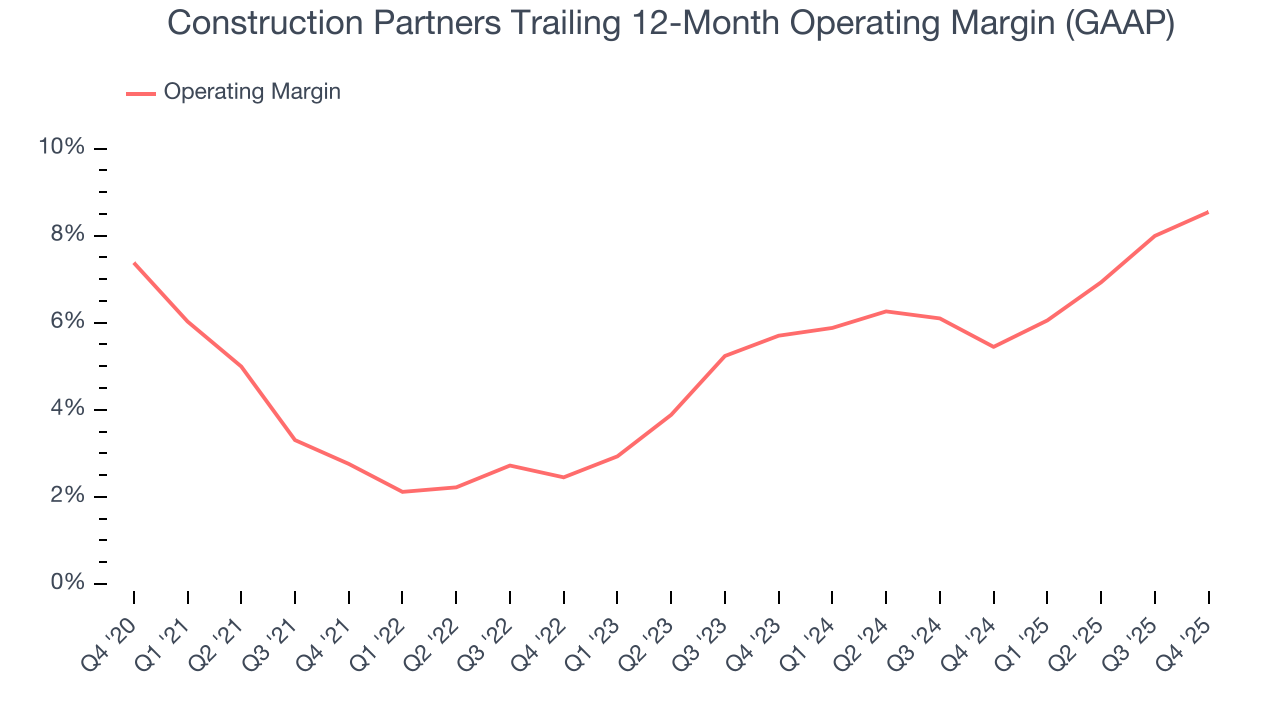

7. Operating Margin

Construction Partners was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Construction Partners’s operating margin rose by 5.8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Construction Partners generated an operating margin profit margin of 6.2%, up 3.8 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

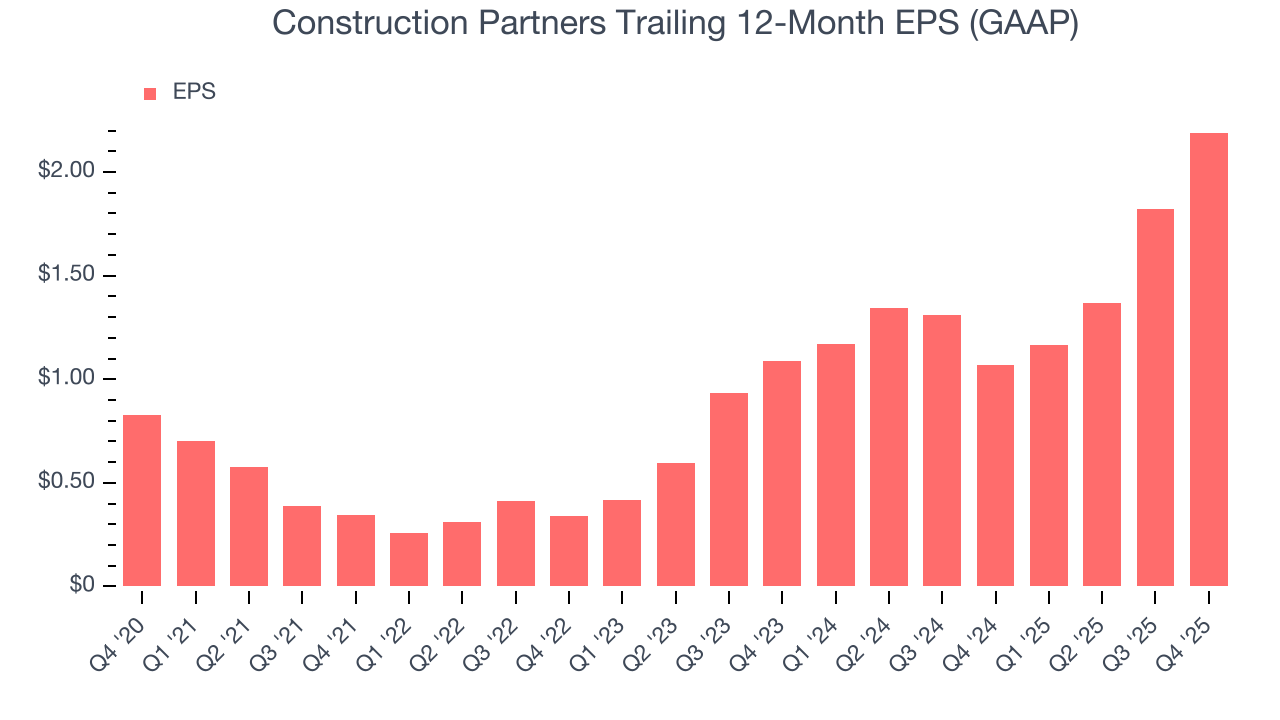

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

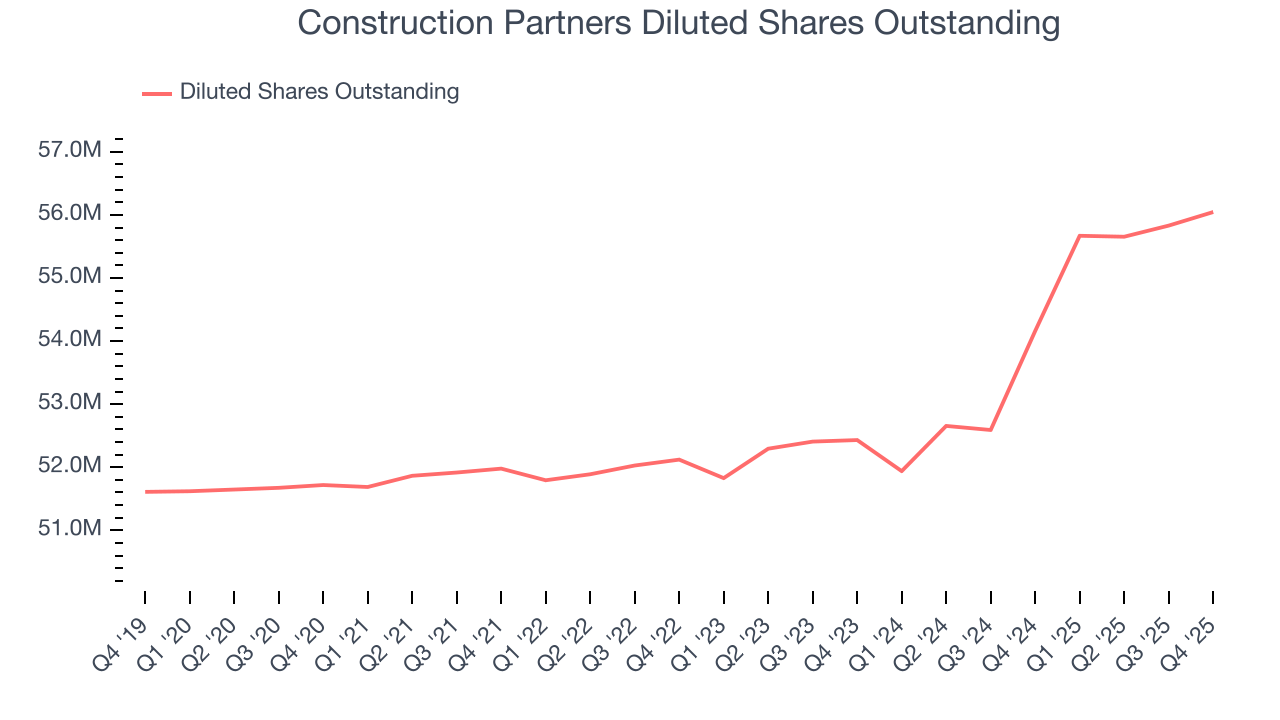

Construction Partners’s EPS grew at an astounding 21.5% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 30.7% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

We can take a deeper look into Construction Partners’s earnings quality to better understand the drivers of its performance. A five-year view shows Construction Partners has diluted its shareholders, growing its share count by 8.4%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Construction Partners, its two-year annual EPS growth of 42% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Construction Partners reported EPS of $0.31, up from negative $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Construction Partners’s full-year EPS of $2.19 to grow 33.3%.

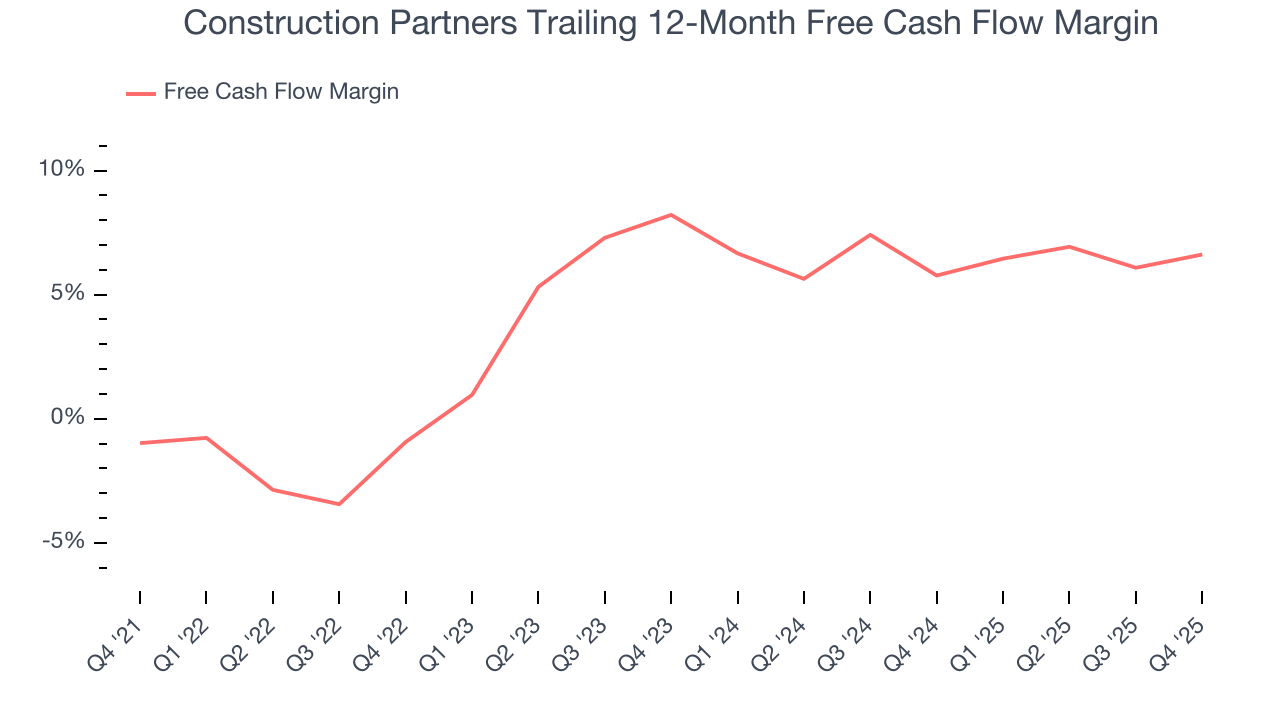

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Construction Partners has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.7%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Construction Partners’s margin expanded by 7.6 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Construction Partners’s free cash flow clocked in at $47.1 million in Q4, equivalent to a 5.8% margin. This result was good as its margin was 3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

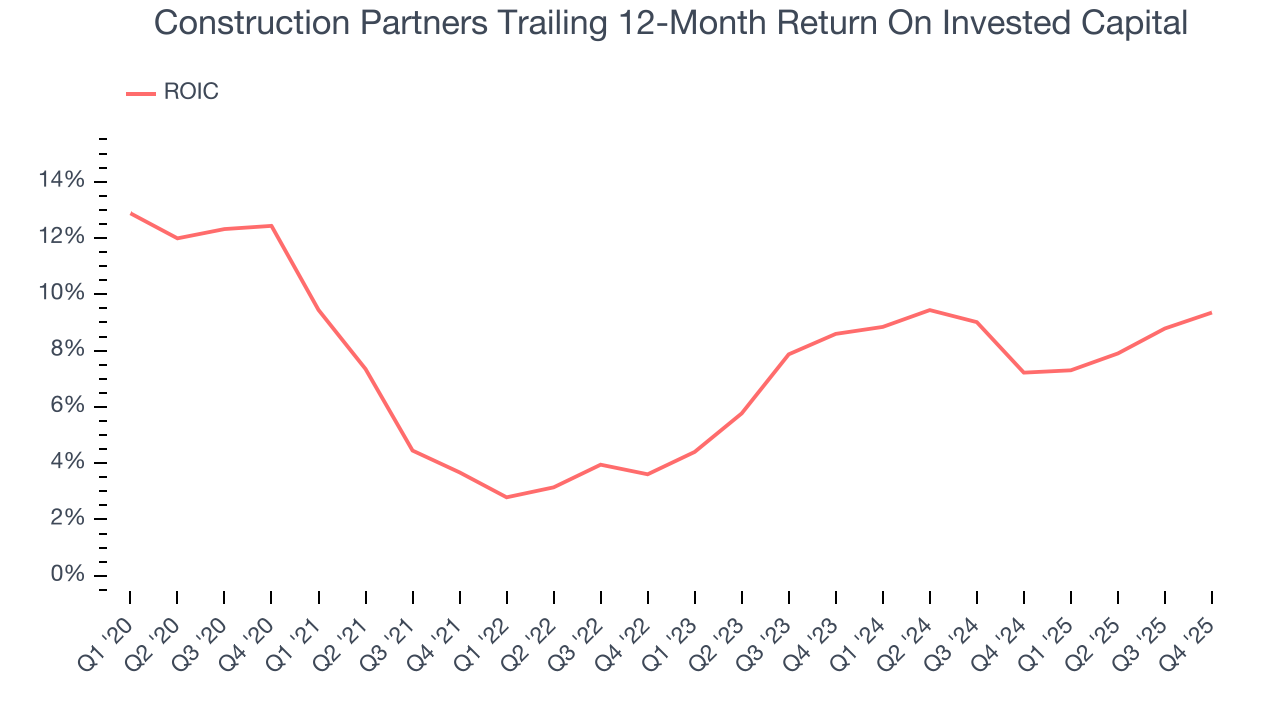

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Construction Partners has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.5%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Construction Partners’s ROIC averaged 4.6 percentage point increases each year. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

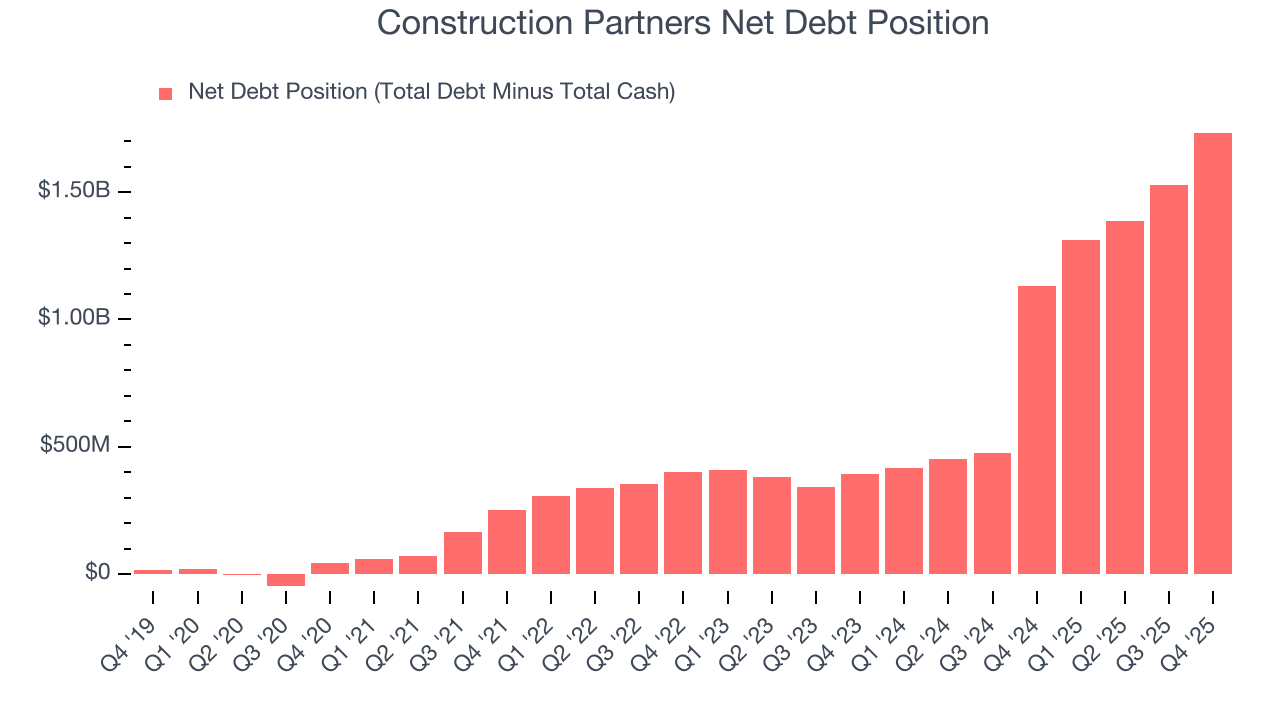

11. Balance Sheet Assessment

Construction Partners reported $104.2 million of cash and $1.84 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $467.1 million of EBITDA over the last 12 months, we view Construction Partners’s 3.7× net-debt-to-EBITDA ratio as safe. We also see its $109.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Construction Partners’s Q4 Results

We were impressed by how significantly Construction Partners blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 3.5% to $118.78 immediately after reporting.

13. Is Now The Time To Buy Construction Partners?

Updated: February 17, 2026 at 10:18 PM EST

Before deciding whether to buy Construction Partners or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are numerous reasons why we think Construction Partners is one of the best industrials companies out there. First of all, the company’s revenue growth was exceptional over the last five years. And while its low gross margins indicate some combination of competitive pressures and high production costs, its rising cash profitability gives it more optionality. Additionally, Construction Partners’s expanding operating margin shows the business has become more efficient.

Construction Partners’s P/E ratio based on the next 12 months is 44.9x. This valuation may appear high at first glance, but the multiple is deserved because Construction Partners’s fundamentals clearly illustrate it’s an elite business. We think the stock is attractive here.

Wall Street analysts have a consensus one-year price target of $133.29 on the company (compared to the current share price of $135.30).