Sunrun (RUN)

Sunrun piques our interest, but the state of its balance sheet makes us slightly uncomfortable.― StockStory Analyst Team

1. News

2. Summary

Why Sunrun Is Not Exciting

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ:RUN) provides residential solar electricity, specializing in panel installation and leasing services.

- Projected sales decline of 7.9% for the next 12 months points to a tough demand environment ahead

- Suboptimal cost structure is highlighted by its history of operating margin losses

- 23× net-debt-to-EBITDA ratio makes lenders less willing to extend additional capital, potentially necessitating dilutive equity offerings

Sunrun has some noteworthy aspects, but we’d refrain from investing until its EBITDA can comfortably support its debt.

Why There Are Better Opportunities Than Sunrun

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Sunrun

Sunrun is trading at $13.08 per share, or 37.7x forward EV-to-EBITDA. We consider this valuation aggressive considering the business fundamentals.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Sunrun (RUN) Research Report: Q4 CY2025 Update

Residential solar energy company Sunrun (NASDAQ:RUN) announced better-than-expected revenue in Q4 CY2025, with sales up 124% year on year to $1.16 billion. Its GAAP profit of $0.38 per share was significantly above analysts’ consensus estimates.

Sunrun (RUN) Q4 CY2025 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $602.7 million (124% year-on-year growth, 92.3% beat)

- EPS (GAAP): $0.38 vs analyst estimates of -$0.06 (significant beat)

- Adjusted EBITDA: $310.1 million vs analyst estimates of $95 million (26.8% margin, significant beat)

- Operating Margin: 8.4%, up from -628% in the same quarter last year

- Free Cash Flow was -$312.7 million compared to -$259 million in the same quarter last year

- Customers: 1.17 million, up from 1.14 million in the previous quarter

- Market Capitalization: $4.54 billion

Company Overview

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ:RUN) provides residential solar electricity, specializing in panel installation and leasing services.

Sunrun focuses on the design, installation, leasing, and financing of these home solar energy systems. Unlike some competitors, it does not manufacture its own solar panels – it instead sources its panels from various manufacturers, notably LG Electronic and Jinko Solar.

The company’s revenue generators include the direct sale of solar panel systems to customers, offering them the complete package of mounting hardware, installation services, and other required accessories like inverters. A significant portion of its revenue also comes from the leasing of its products, or setting up power purchase agreements (PPAs) with homeowners. These homeowners pay a monthly recurring fee to Sunrun for using its systems.

These contracts serve as a strong source of recurring revenue for Sunrun, as opposed to its industry competitors who have more of a one-time purchase business model. Sunrun holds some other revenue streams, including participating in regulated energy markets where it can sell excess energy.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors of Sunrun include Tesla (NASDAQ:TSLA), SunPower (NASDAQ:SPWR), and Vivint Solar, which is now part of Sunnova Energy (NYSE:NOVA).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Sunrun’s 26.2% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Sunrun’s annualized revenue growth of 14.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 1.17 million in the latest quarter. Over the last two years, Sunrun’s customer base averaged 979% year-on-year growth. Because this number is better than its revenue growth, we can see the average customer spent less money each year on the company’s products and services.

This quarter, Sunrun reported magnificent year-on-year revenue growth of 124%, and its $1.16 billion of revenue beat Wall Street’s estimates by 92.3%.

Looking ahead, sell-side analysts expect revenue to decline by 13% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Sunrun has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 17.3% gross margin over the last five years. Said differently, Sunrun had to pay a chunky $82.73 to its suppliers for every $100 in revenue.

In Q4, Sunrun produced a 37.6% gross profit margin, up 18.8 percentage points year on year. Sunrun’s full-year margin has also been trending up over the past 12 months, increasing by 14.2 percentage points. If this move continues, it could suggest a less competitive environment where the company has better pricing power and leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

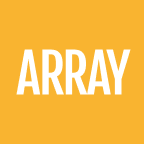

Although Sunrun was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 63.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Sunrun’s operating margin rose by 37.1 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

In Q4, Sunrun generated an operating margin profit margin of 8.4%, up 636.4 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

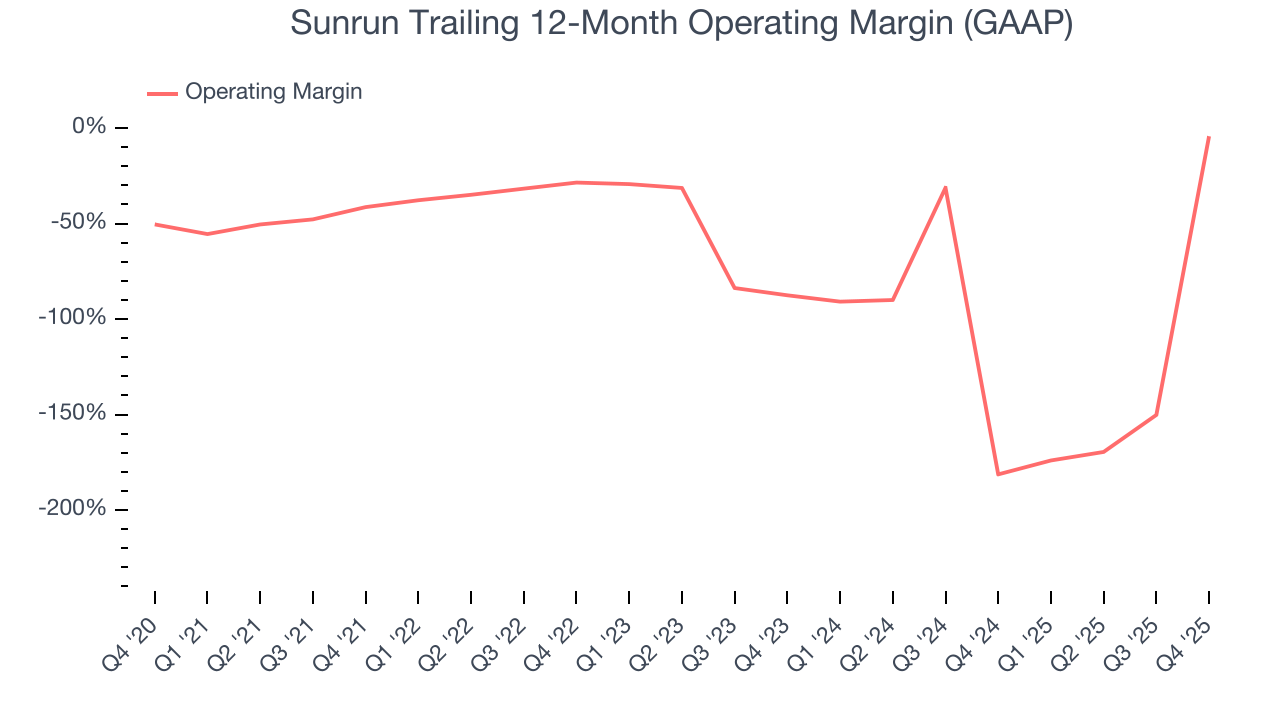

Sunrun’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Sunrun, its two-year annual EPS growth of 49.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Sunrun reported EPS of $0.38, up from negative $12.51 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Sunrun to perform poorly. Analysts forecast its full-year EPS of $1.70 will invert to negative negative $0.12.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Sunrun’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 37%, meaning it lit $36.97 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Sunrun’s margin expanded by 23.1 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

Sunrun burned through $312.7 million of cash in Q4, equivalent to a negative 27% margin. The company’s cash burn increased from $259 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Sunrun’s five-year average ROIC was negative 10.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Sunrun’s ROIC decreased by 1.7 percentage points annually each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

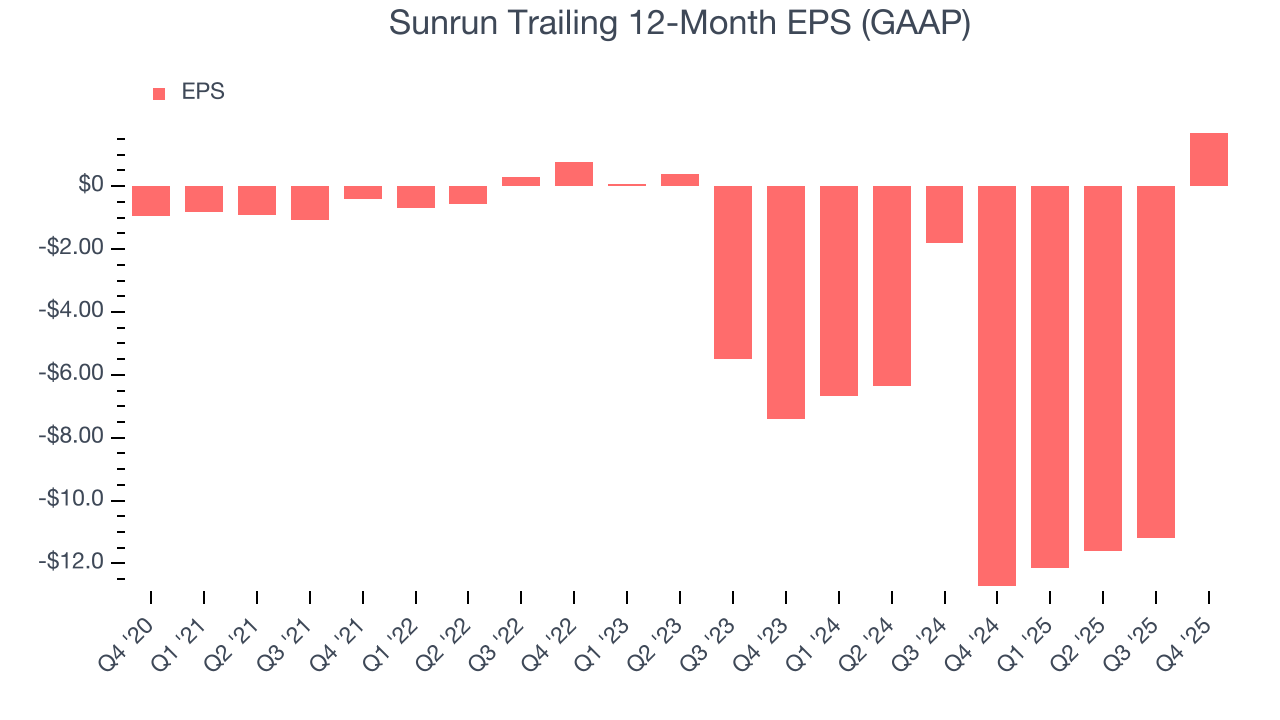

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Sunrun burned through $833.6 million of cash over the last year, and its $14.75 billion of debt exceeds the $1.24 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Sunrun’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Sunrun until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from Sunrun’s Q4 Results

It was good to see Sunrun beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock remained flat at $20.17 immediately following the results.

13. Is Now The Time To Buy Sunrun?

Updated: February 28, 2026 at 11:15 PM EST

Are you wondering whether to buy Sunrun or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Aside from its balance sheet, Sunrun is a pretty decent company. To kick things off, its revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its customer growth has been marvelous. On top of that, its rising cash profitability gives it more optionality.

Sunrun’s P/E ratio based on the next 12 months is 120.9x. Certain aspects of its fundamentals are attractive, but we aren’t investing at the moment because its balance sheet makes us uneasy. If you’re interested in buying the stock, wait until it generates sufficient cash flows or raises some money.

Wall Street analysts have a consensus one-year price target of $22.74 on the company (compared to the current share price of $13.08).