Starbucks (SBUX)

Starbucks is up against the odds. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think Starbucks Will Underperform

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

- Weak same-store sales trends over the past two years suggest there may be few opportunities in its core markets to open new restaurants

- Estimated sales growth of 3.1% for the next 12 months implies demand will slow from its six-year trend

- Incremental sales over the last six years were much less profitable as its earnings per share fell by 4.7% annually while its revenue grew

Starbucks doesn’t meet our quality criteria. There are more appealing investments to be made.

Why There Are Better Opportunities Than Starbucks

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Starbucks

At $97.55 per share, Starbucks trades at 41x forward P/E. We consider this valuation aggressive considering the weaker revenue growth profile.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Starbucks (SBUX) Research Report: Q3 CY2025 Update

Coffeehouse chain Starbucks (NASDAQ:SBUX) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 5.5% year on year to $9.57 billion. Its non-GAAP profit of $0.52 per share was 6% below analysts’ consensus estimates.

A previous version of this article incorrectly stated that the company had 18,311 locations at the end of the quarter. This has been updated to reflect the correct count (40,990).

Starbucks (SBUX) Q3 CY2025 Highlights:

- Revenue: $9.57 billion vs analyst estimates of $9.33 billion (5.5% year-on-year growth, 2.6% beat)

- Adjusted EPS: $0.52 vs analyst expectations of $0.55 (6% miss)

- Adjusted EBITDA: $709 million vs analyst estimates of $1.36 billion (7.4% margin, 48% miss)

- Operating Margin: 2.9%, down from 14.4% in the same quarter last year

- Locations: 40,990 at quarter end, up from 40,199 in the same quarter last year

- Same-Store Sales rose 1% year on year (-7% in the same quarter last year)

- Market Capitalization: $95.68 billion

Company Overview

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

Specifically, the company was founded when Jerry Baldwin, Zev Siegl, and Gordon Bowker opened a humble coffee shop in 1971. Their goal was to create a unique, intimate coffeehouse experience where customers could savor freshly brewed coffee while connecting with their communities.

Starbucks’ growth trajectory hit an inflection point in 1982 when it hired Howard Schultz as its director of retail operations and marketing. Schultz played a pivotal role in the company’s expansion and broadened its offerings to include iced beverages, teas, seasonal specialties, food items, and merchandise, catering to a diverse range of tastes and preferences.

Today, Starbucks differentiates itself in a crowded field by focusing on quality, consistency, and customer experience. Each Starbucks store is designed to create a warm and inviting atmosphere, with cozy seating areas and high-speed Wi-Fi, encouraging customers to stay in the store for however long they wish.

Starbucks was also quick to recognize the power of technology. The company’s mobile app allows customers to pre-order items (enabling them to get in and out of the store in less than 30 seconds), pay through their smartphones, customize beverages, and earn compelling rewards.

4. Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Some competitors that sell caffeinated beverages and small bites include private company Dunkin’ as well as public companies Dutch Bros (NYSE:BROS), McDonald’s (NYSE:MCD), and Tim Hortons (owned by Restaurant Brands, NYSE:QSR).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $37.18 billion in revenue over the past 12 months, Starbucks is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing restaurant banners have penetrated most of the market. To accelerate system-wide sales, Starbucks likely needs to optimize its pricing or lean into new chains and international expansion.

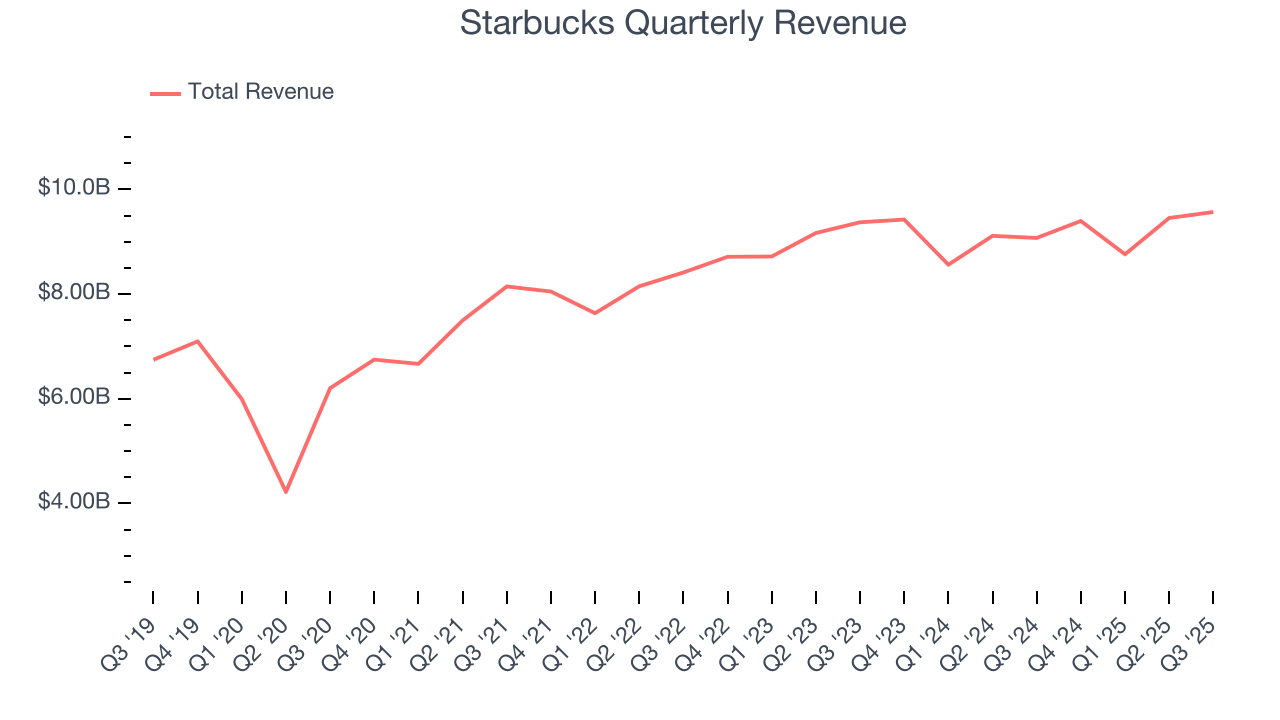

As you can see below, Starbucks’s sales grew at a tepid 5.8% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Starbucks reported year-on-year revenue growth of 5.5%, and its $9.57 billion of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a slight deceleration versus the last six years. This projection doesn't excite us and indicates its menu offerings will face some demand challenges.

6. Restaurant Performance

Number of Restaurants

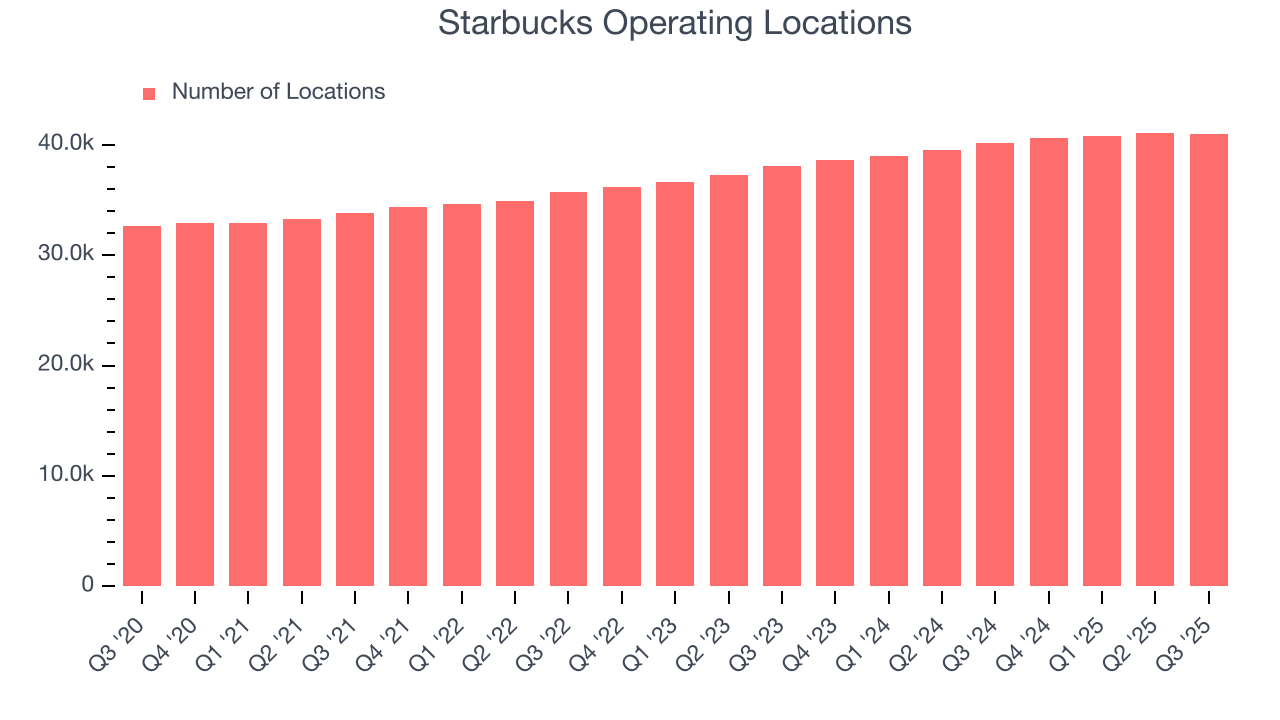

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Starbucks sported 40,990 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 5.1% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

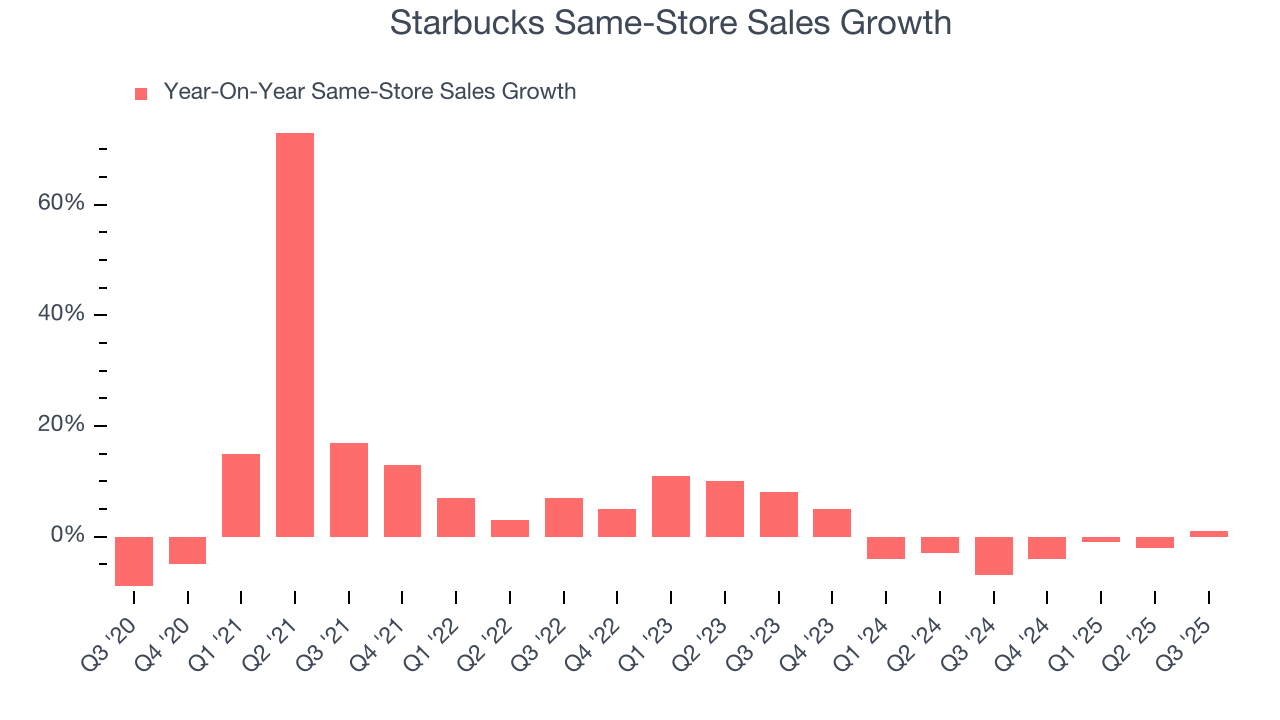

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Starbucks’s demand has been shrinking over the last two years as its same-store sales have averaged 1.9% annual declines. This performance is concerning - it shows Starbucks artificially boosts its revenue by building new restaurants. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its restaurant base.

In the latest quarter, Starbucks’s same-store sales rose 1% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

7. Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate pricing power and differentiation, whether it be the dining experience or quality and taste of food.

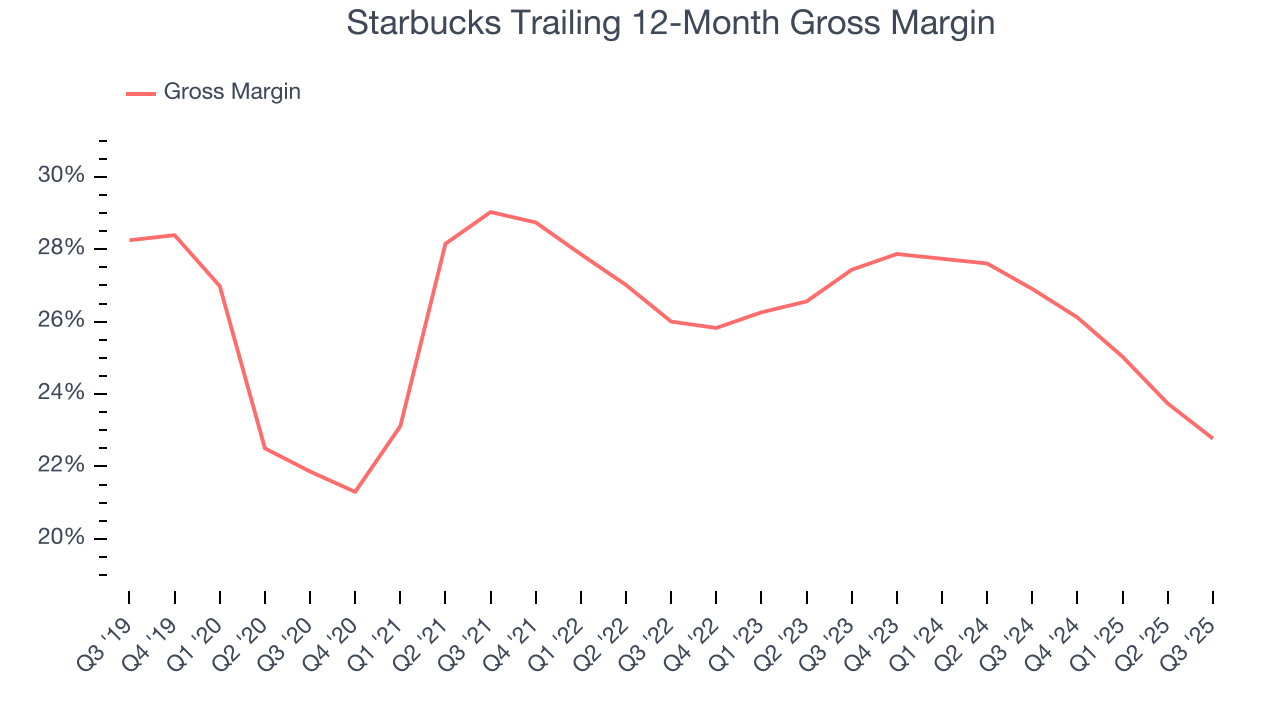

Starbucks’s gross margin is slightly below the average restaurant company, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 24.8% gross margin over the last two years. Said differently, Starbucks had to pay a chunky $75.19 to its suppliers for every $100 in revenue.

In Q3, Starbucks produced a 22.6% gross profit margin, marking a 3.9 percentage point decrease from 26.5% in the same quarter last year. Starbucks’s full-year margin has also been trending down over the past 12 months, decreasing by 4.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as ingredients and transportation expenses).

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

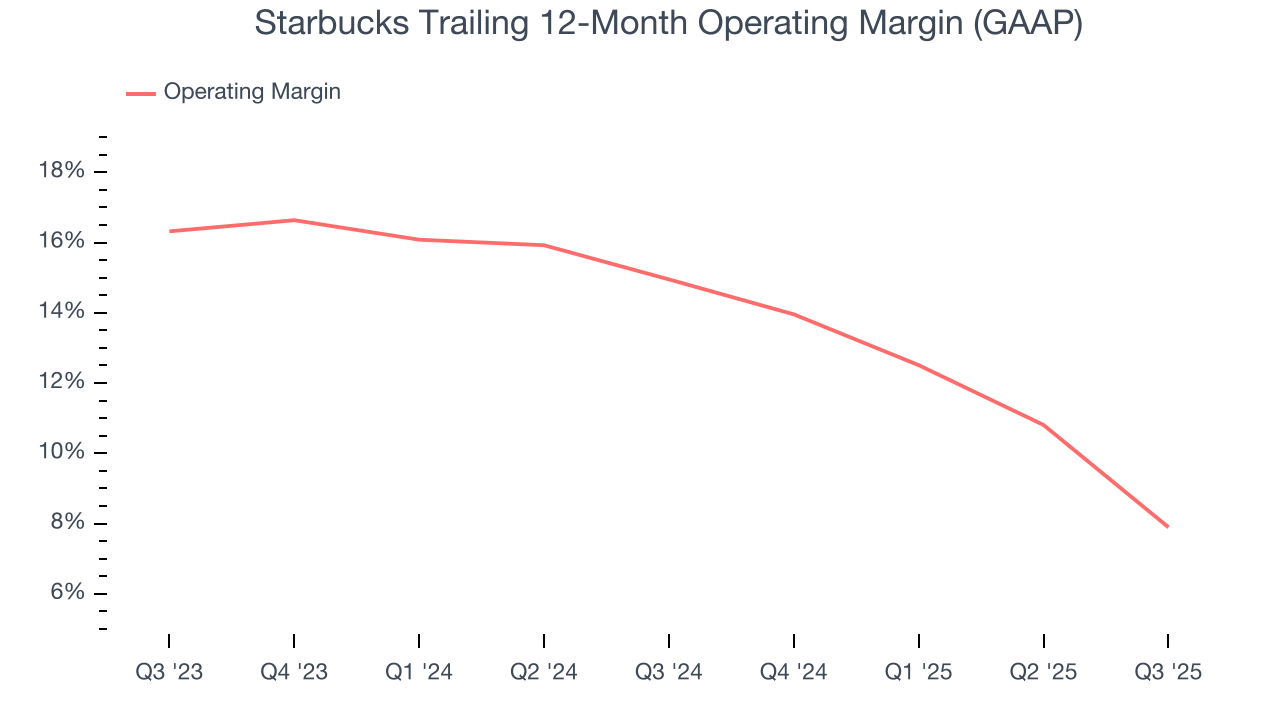

Starbucks has done a decent job managing its cost base over the last two years. The company has produced an average operating margin of 11.4%, higher than the broader restaurant sector.

Looking at the trend in its profitability, Starbucks’s operating margin decreased by 7.1 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Starbucks generated an operating margin profit margin of 2.9%, down 11.5 percentage points year on year. Since Starbucks’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

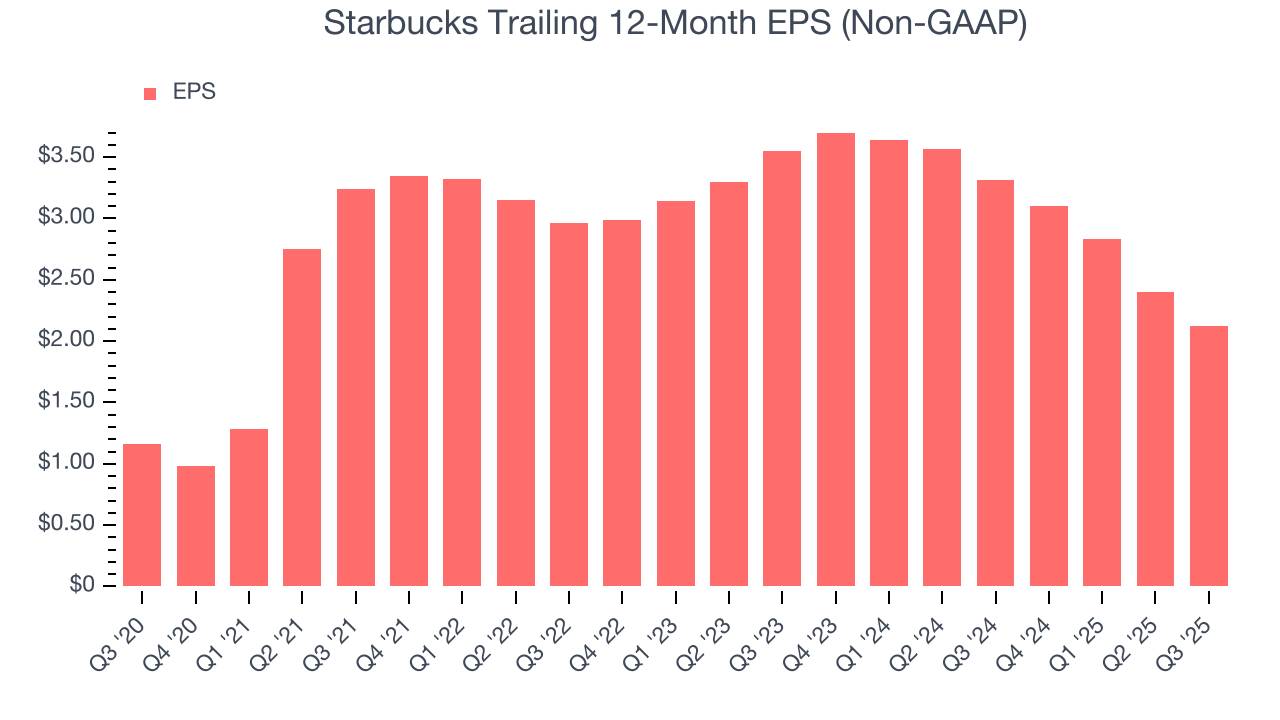

Sadly for Starbucks, its EPS declined by 4.7% annually over the last six years while its revenue grew by 5.8%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q3, Starbucks reported adjusted EPS of $0.52, down from $0.80 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Starbucks’s full-year EPS of $2.12 to grow 19.3%.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

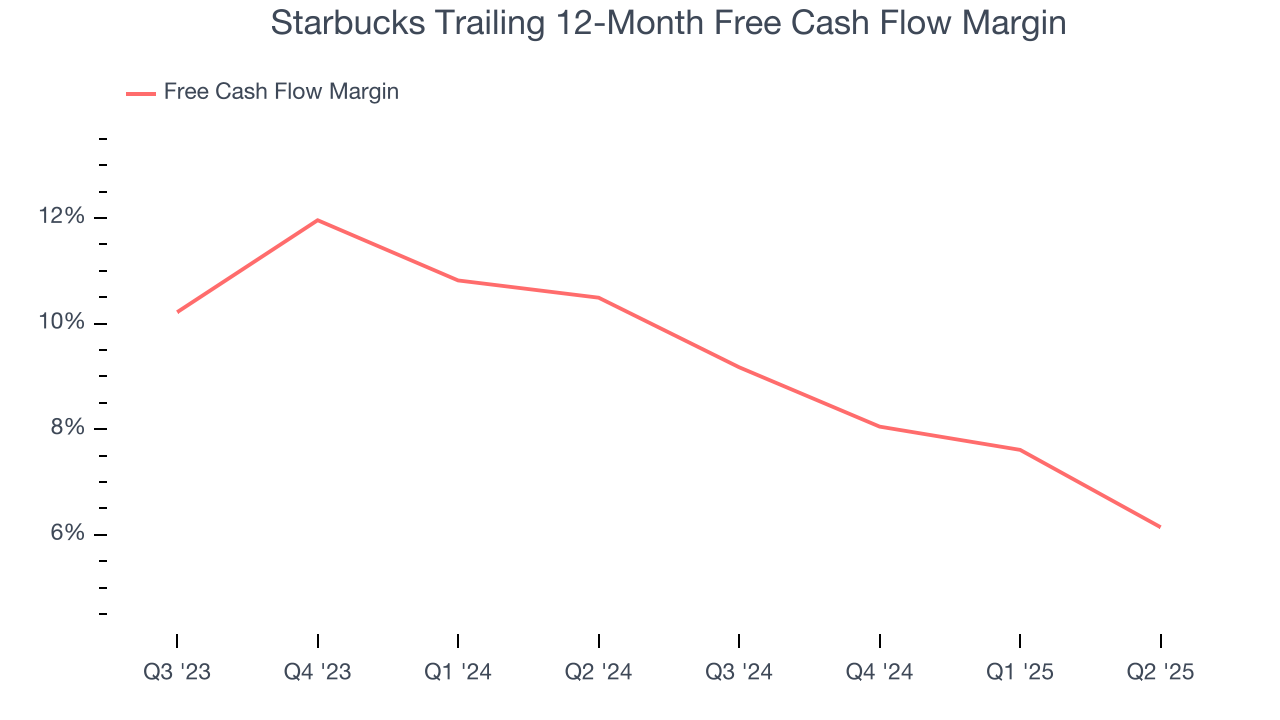

Starbucks has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.6% over the last two years, better than the broader restaurant sector.

11. Balance Sheet Assessment

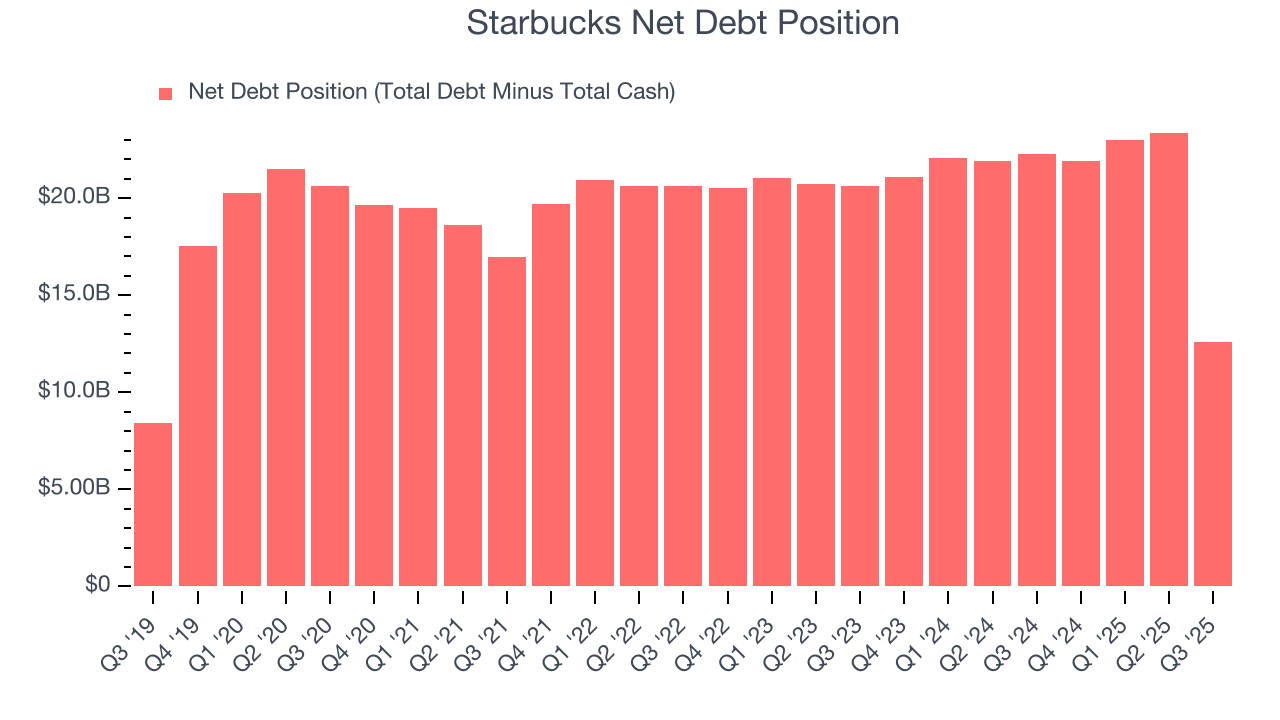

Starbucks reported $3.47 billion of cash and $16.07 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $4.76 billion of EBITDA over the last 12 months, we view Starbucks’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $199.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Starbucks’s Q3 Results

We enjoyed seeing Starbucks beat analysts’ revenue expectations this quarter. We were also glad its same-store sales outperformed Wall Street’s estimates. This was the first positive growth in roughly two years, which is something the market will cheer. On the other hand, its EPS fell short of Wall Street’s estimates. Overall, this print was mixed. The stock traded up 2.2% to $85.98 immediately following the results.

13. Is Now The Time To Buy Starbucks?

Updated: January 21, 2026 at 9:45 PM EST

Before investing in or passing on Starbucks, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Starbucks doesn’t pass our quality test. To kick things off, its revenue growth was a little slower over the last six years, and analysts expect its demand to deteriorate over the next 12 months. And while its new restaurant openings have increased its brand equity, the downside is its shrinking same-store sales tell us it will need to change its strategy to succeed. On top of that, its declining EPS over the last six years makes it a less attractive asset to the public markets.

Starbucks’s P/E ratio based on the next 12 months is 39.7x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $95.32 on the company (compared to the current share price of $96.43).