Scholastic (SCHL)

We wouldn’t buy Scholastic. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Scholastic Will Underperform

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ:SCHL) is an international company specializing in children's publishing, education, and media services.

- Muted 4.9% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

Scholastic doesn’t pass our quality test. There are more appealing investments to be made.

Why There Are Better Opportunities Than Scholastic

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Scholastic

Scholastic is trading at $32.57 per share, or 22.8x forward P/E. Not only does Scholastic trade at a premium to companies in the consumer discretionary space, but this multiple is also high for its top-line growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Scholastic (SCHL) Research Report: Q4 CY2025 Update

Educational publishing and media company Scholastic (NASDAQ:SCHL) missed Wall Street’s revenue expectations in Q4 CY2025 as sales only rose 1.2% year on year to $551.1 million. Its non-GAAP profit of $2.57 per share was 24.2% above analysts’ consensus estimates.

Scholastic (SCHL) Q4 CY2025 Highlights:

- Revenue: $551.1 million vs analyst estimates of $556.7 million (1.2% year-on-year growth, 1% miss)

- Adjusted EPS: $2.57 vs analyst estimates of $2.07 (24.2% beat)

- Adjusted EBITDA: $122.5 million vs analyst estimates of $109.8 million (22.2% margin, 11.6% beat)

- EBITDA guidance for the full year is $151 million at the midpoint, below analyst estimates of $159.9 million

- Operating Margin: 15%, in line with the same quarter last year

- Free Cash Flow Margin: 10.7%, up from 7.8% in the same quarter last year

- Market Capitalization: $720.2 million

Company Overview

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ:SCHL) is an international company specializing in children's publishing, education, and media services.

Scholastic was founded in 1920 with the launch of "The Western Pennsylvania Scholastic" magazine, aimed at enriching the educational experience of students and teachers. This initial step marked the beginning of Scholastic's journey toward becoming a key player in children's education through the production of materials and content for young readers.

Today, Scholastic's offerings encompass books, magazines, educational software, and digital resources, addressing the challenge of keeping children engaged and informed. These products and services cater to both classroom and home education environments, promoting literacy and creativity.

Scholastic's revenue is derived from book sales, subscriptions to educational programs, and content distribution and licensing. Its business model combines educational value with entertainment, making Scholastic a preferred choice among educators, parents, and children.

4. Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Competitors in the publishing industry include John Wiley & Sons (NYSE:JW.A), Disney (NYSE:DIS), and The New York Times (NYSE:NYT).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Scholastic’s 4.9% annualized revenue growth over the last five years was weak. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Scholastic’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Scholastic’s revenue grew by 1.2% year on year to $551.1 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Scholastic’s operating margin has been trending up over the last 12 months and averaged 1.6% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

In Q4, Scholastic generated an operating margin profit margin of 15%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Scholastic broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Scholastic’s free cash flow clocked in at $59.2 million in Q4, equivalent to a 10.7% margin. This result was good as its margin was 3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

8. Balance Sheet Assessment

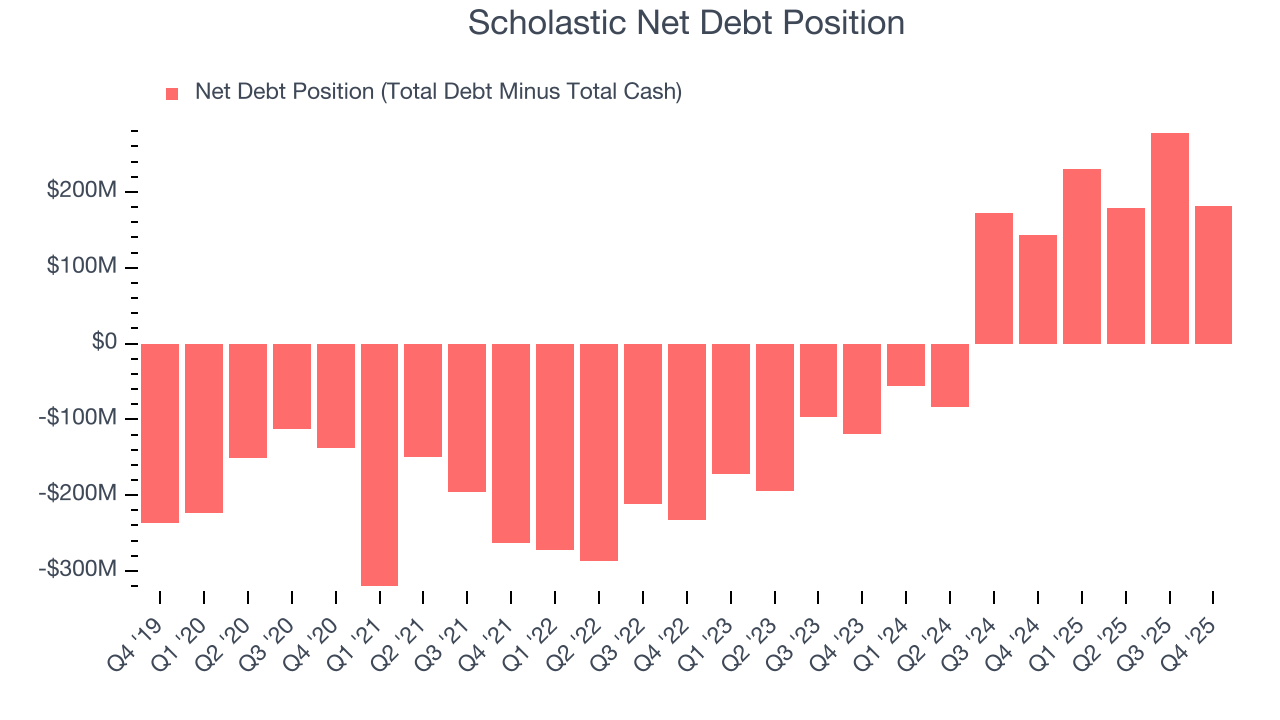

Scholastic reported $99.3 million of cash and $280.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $164 million of EBITDA over the last 12 months, we view Scholastic’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $18.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

9. Key Takeaways from Scholastic’s Q4 Results

It was good to see Scholastic beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its revenue fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $29.15 immediately after reporting.

10. Is Now The Time To Buy Scholastic?

Updated: February 23, 2026 at 10:10 PM EST

Are you wondering whether to buy Scholastic or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Scholastic falls short of our quality standards. While its projected EPS for the next year implies the company will start generating shareholder value, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its low free cash flow margins give it little breathing room.

Scholastic’s P/E ratio based on the next 12 months is 22.8x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $36 on the company (compared to the current share price of $32.57).