Sleep Number (SNBR)

Sleep Number faces an uphill battle. Not only is its demand weak but also its falling returns on capital suggest it’s becoming less profitable.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sleep Number Will Underperform

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

- Ongoing store closures and lackluster same-store sales indicate sluggish demand and a focus on consolidation

- Products aren't resonating with the market as its revenue declined by 11.9% annually over the last three years

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

Sleep Number doesn’t pass our quality test. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Sleep Number

Why There Are Better Opportunities Than Sleep Number

Sleep Number is trading at $8.25 per share, or 14.9x forward EV-to-EBITDA. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Sleep Number (SNBR) Research Report: Q3 CY2025 Update

Bedding manufacturer and retailer Sleep Number (NASDAQ:SNBR) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 19.6% year on year to $342.9 million. The company’s full-year revenue guidance of $1.4 billion at the midpoint came in 2.8% below analysts’ estimates. Its GAAP loss of $1.73 per share was significantly below analysts’ consensus estimates.

Sleep Number (SNBR) Q3 CY2025 Highlights:

- Revenue: $342.9 million vs analyst estimates of $362.5 million (19.6% year-on-year decline, 5.4% miss)

- EPS (GAAP): -$1.73 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $13.25 million vs analyst estimates of $31.4 million (3.9% margin, 57.8% miss)

- The company dropped its revenue guidance for the full year to $1.4 billion at the midpoint from $1.45 billion, a 3.4% decrease

- EBITDA guidance for the full year is $70 million at the midpoint, below analyst estimates of $108.1 million

- Operating Margin: -11.8%, down from 2% in the same quarter last year

- Locations: 611 at quarter end, down from 643 in the same quarter last year

- Same-Store Sales fell 20% year on year (-1% in the same quarter last year)

- Market Capitalization: $125.2 million

Company Overview

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

The core customer is typically a homeowner who cares about quality sleep and has strong preferences when it comes to mattress feel. These customers can include a married couple where one spouse prefers a softer mattress whereas the other prefers a firmer one–Sleep Number offers mattresses where each half’s firmness can be adjusted. These customers can also include those who want more data on their sleep quality–Sleep Number offers smart mattress technology that can register movement and interpret sleep depth.

Sleep Number stores are fairly small, roughly 4,000 square feet. They are typically located in suburban shopping centers or retail districts. The stores feature products in bedroom-like settings to create an inviting atmosphere. Trying out mattresses is encouraged given how important it is for customers to find the right firmness and feel.

A dynamic unique to Sleep Number and other mattress retailers is how infrequently the average consumer is in the market for a new bed or mattress–roughly five to ten years. On the other hand, these purchases tend to be pretty big-ticket in nature, and Sleep Number products are on the more costly end of the price spectrum given the technology features.

4. Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Bedding and mattress competitors include Tempur Sealy (NYSE:TPX), Leggett & Platt (NYSE:LEG), and Purple Innovation (NASDAQ:PRPL).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.44 billion in revenue over the past 12 months, Sleep Number is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Sleep Number’s revenue declined by 2.4% per year over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it closed stores and observed lower sales at existing, established locations.

This quarter, Sleep Number missed Wall Street’s estimates and reported a rather uninspiring 19.6% year-on-year revenue decline, generating $342.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months. While this projection indicates its newer products will fuel better top-line performance, it is still below average for the sector.

6. Store Performance

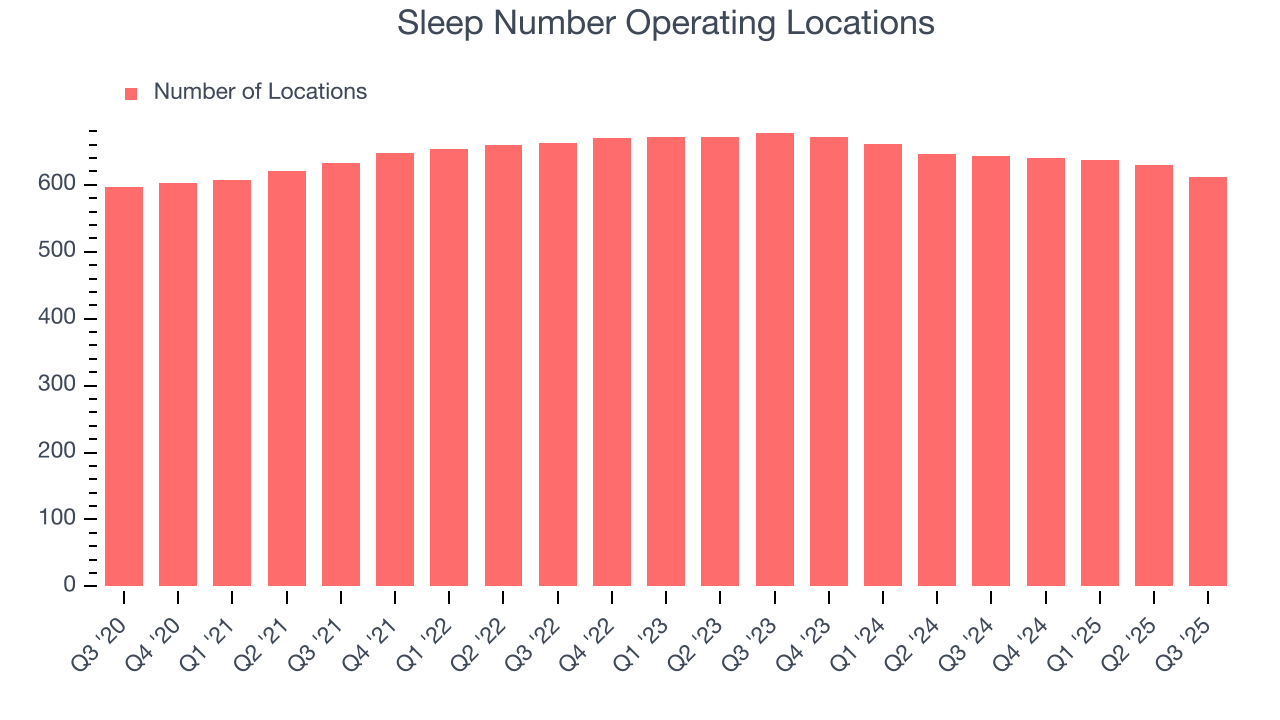

Number of Stores

Sleep Number operated 611 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 3.3% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Sleep Number’s demand has been shrinking over the last two years as its same-store sales have averaged 3% annual declines. This performance isn’t ideal, and Sleep Number is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Sleep Number’s same-store sales fell by 20% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Sleep Number has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 59.4% gross margin over the last two years. That means Sleep Number only paid its suppliers $40.64 for every $100 in revenue.

In Q3, Sleep Number produced a 59.9% gross profit margin, in line with the same quarter last year. On a wider time horizon, Sleep Number’s full-year margin has been trending up over the past 12 months, increasing by 1.3 percentage points. If this move continues, it could suggest the company has less pressure to discount products and is realizing better unit economics due to stable or shrinking input costs (such as labor and freight expenses to transport goods).

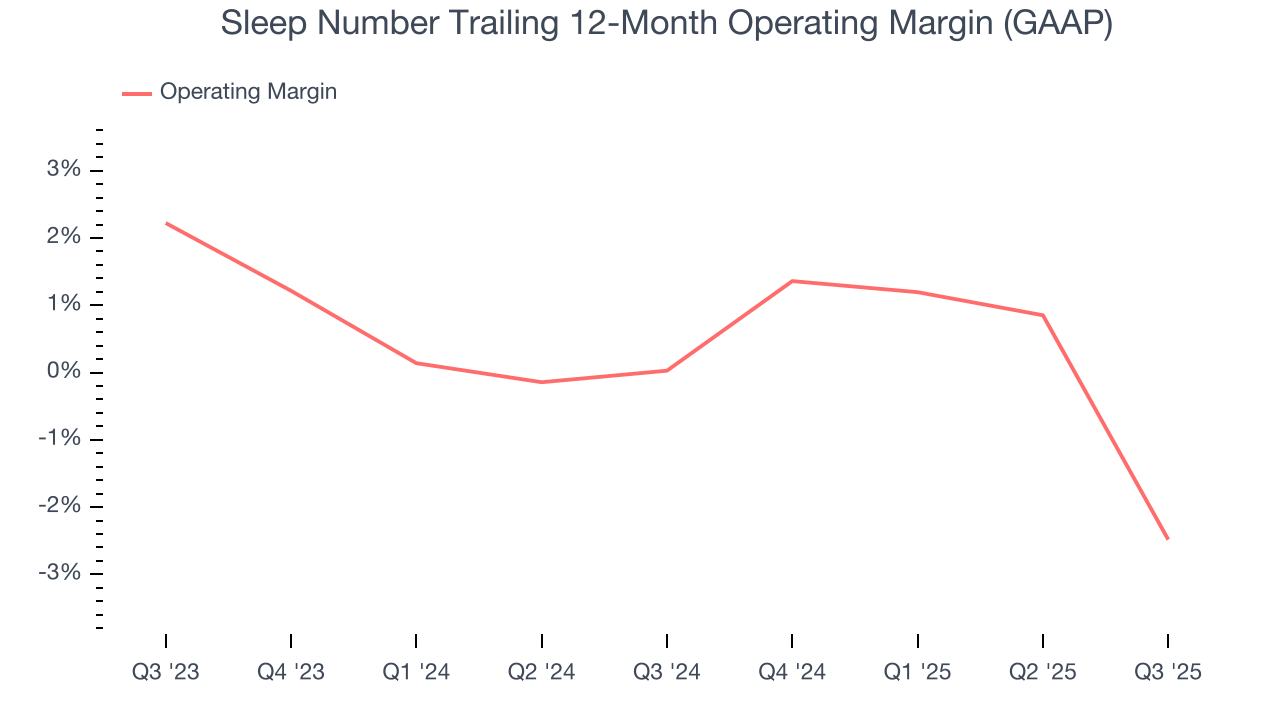

8. Operating Margin

Despite the consumer retail industry’s secular decline, unprofitable public companies are few and far between. Unfortunately, Sleep Number was one of them over the last two years as its high expenses contributed to an average operating margin of negative 1.1%.

Looking at the trend in its profitability, Sleep Number’s operating margin decreased by 2.5 percentage points over the last year. Sleep Number’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

Sleep Number’s operating margin was negative 11.8% this quarter. The company's consistent lack of profits raise a flag.

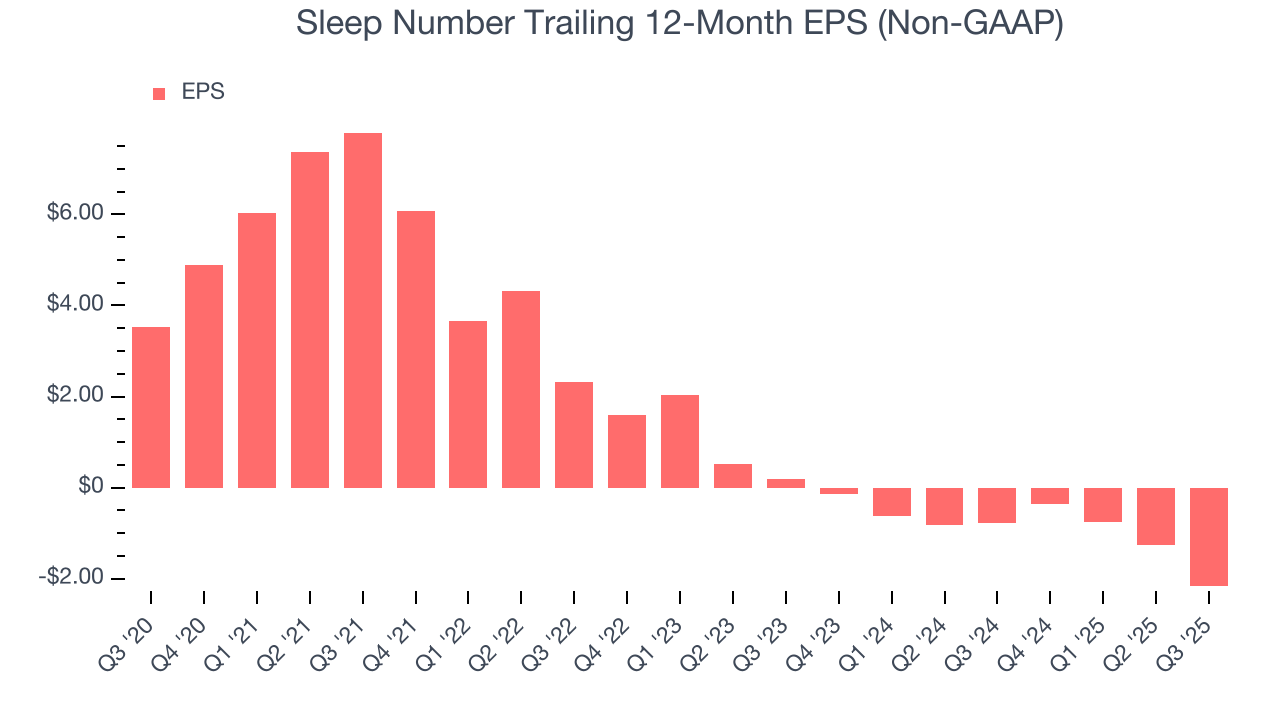

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Sleep Number, its EPS declined by 43.2% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q3, Sleep Number reported adjusted EPS of negative $0.98, down from negative $0.07 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Sleep Number to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.17 will advance to negative $0.55.

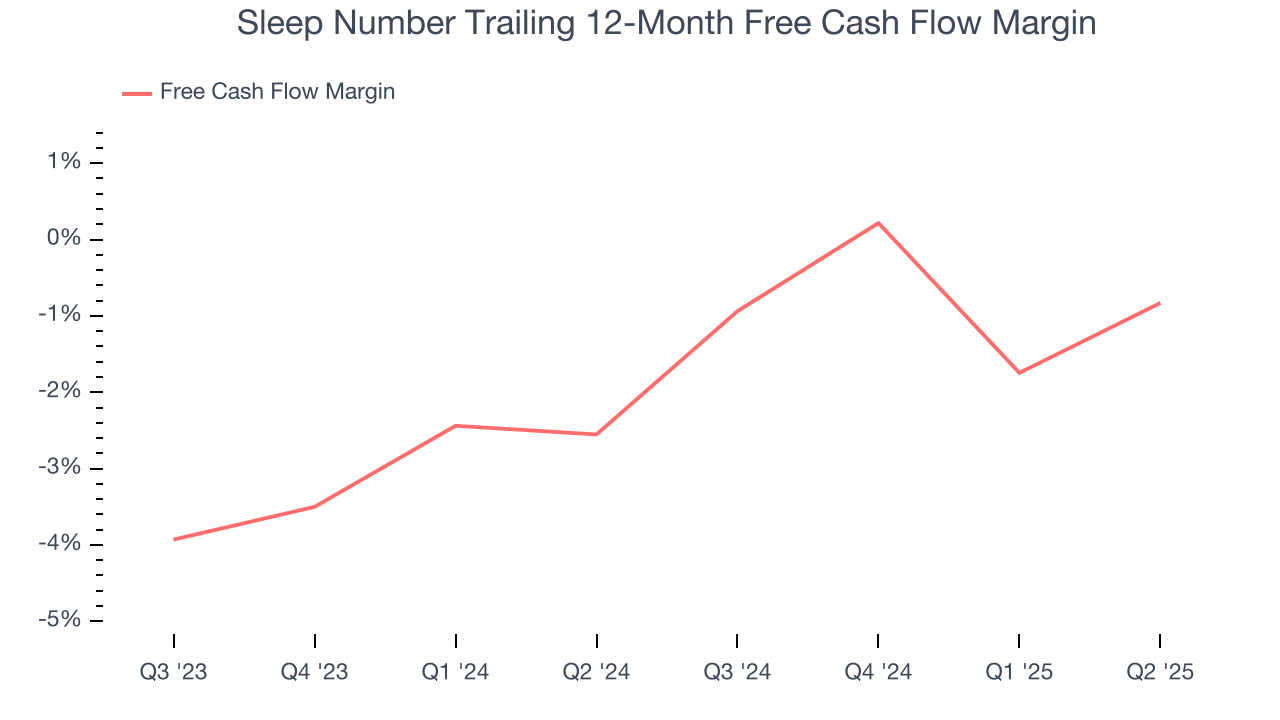

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Sleep Number’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 1.9%. This means it lit $1.87 of cash on fire for every $100 in revenue.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Sleep Number’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 16.3%, slightly better than typical consumer retail business.

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Sleep Number’s $940.5 million of debt exceeds the $1.26 million of cash on its balance sheet. Furthermore, its 11× net-debt-to-EBITDA ratio (based on its EBITDA of $85.06 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Sleep Number could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Sleep Number can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

13. Key Takeaways from Sleep Number’s Q3 Results

We struggled to find many positives in these results. Same-store sales cratered this quarter. Its full-year EBITDA guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a very bad quarter. The stock traded down 30.1% to $3.86 immediately following the results.

14. Is Now The Time To Buy Sleep Number?

Updated: February 25, 2026 at 9:44 PM EST

Are you wondering whether to buy Sleep Number or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Sleep Number doesn’t pass our quality test. To begin with, its revenue has declined over the last three years. While its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its operating margins reveal poor profitability compared to other retailers.

Sleep Number’s EV-to-EBITDA ratio based on the next 12 months is 14.9x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $11 on the company (compared to the current share price of $8.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.