Sonos (SONO)

We wouldn’t recommend Sonos. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sonos Will Underperform

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

- Products and services fail to spark excitement with consumers, as seen in its flat sales over the last five years

- Sales over the last five years were less profitable as its earnings per share fell by 3.3% annually while its revenue was flat

- Historical operating margin losses point to an inefficient cost structure

Sonos doesn’t meet our quality standards. There are more promising alternatives.

Why There Are Better Opportunities Than Sonos

Why There Are Better Opportunities Than Sonos

Sonos’s stock price of $14.88 implies a valuation ratio of 1.2x forward price-to-sales. The market typically values companies like Sonos based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

We’d rather pay up for companies with elite fundamentals than get a bargain on poor ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Sonos (SONO) Research Report: Q4 CY2025 Update

Audio technology Sonos company (NASDAQ:SONO) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales were flat year on year at $545.7 million. Its non-GAAP profit of $0.93 per share was 36.8% above analysts’ consensus estimates.

Sonos (SONO) Q4 CY2025 Highlights:

- Revenue: $545.7 million vs analyst estimates of $537.5 million (flat year on year, 1.5% beat)

- Adjusted EPS: $0.93 vs analyst estimates of $0.68 (36.8% beat)

- Adjusted EBITDA: $132.1 million vs analyst estimates of $117.2 million (24.2% margin, 12.8% beat)

- Operating Margin: 18.4%, up from 8.7% in the same quarter last year

- Free Cash Flow Margin: 28.8%, up from 26% in the same quarter last year

- Market Capitalization: $1.78 billion

Company Overview

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

Each of the company's smart speakers, soundbars, and home theater equipment products emphasize superior sound quality, sleek design, and user-friendly technology.

The company's products are engineered to work seamlessly together, allowing users to create a customized audio environment in their homes. This approach enables customers to play music synchronously in multiple rooms or different tracks in each room, all controlled through the Sonos mobile app. The app integrates a variety of music streaming services, providing users access to a vast library of music and other audio content.

The company invests heavily in research and development to increase its audio performance. One such technology the company has patented is Trueplay, which tunes speakers to the specific acoustics of the room they are in, ensuring optimal sound quality.

Sonos’s design aesthetic is a critical aspect of its brand identity. The company's speakers and audio equipment feature a modern, minimalist design, making them a stylish addition to any home. This design-centric philosophy extends to the digital world as Sonos's app has garnered positive reviews for its intuitive interface and ease of use.

4. Consumer Electronics

Consumer electronics companies aim to address the evolving leisure and entertainment needs of consumers, who are increasingly familiar with technology in everyday life. Whether it’s speakers for the home or specialized cameras to document everything from a surfing session to a wedding reception, these businesses are trying to provide innovative, high-quality products that are both useful and cool to own. Adding to the degree of difficulty for these companies is technological change, where the latest smartphone could disintermediate a whole category of consumer electronics. Companies that successfully serve customers and innovate can enjoy high customer loyalty and pricing power, while those that struggle with these may go the way of the VHS tape.

Sonos's primary competitors include Apple (NASDAQ:AAPL), Google (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Samsung (KRX: 005930), and private company Bose.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Sonos struggled to consistently increase demand as its $1.44 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Sonos’s recent performance shows its demand remained suppressed as its revenue has declined by 5.1% annually over the last two years.

Sonos also breaks out the revenue for its most important segments, Speakers and Components, which are 84.2% and 11.9% of revenue. Over the last two years, Sonos’s Speakers revenue (main product) averaged 1.7% year-on-year declines. On the other hand, its Components revenue (ancillary product) averaged 7.9% growth.

This quarter, Sonos’s $545.7 million of revenue was flat year on year but beat Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Sonos’s operating margin has been trending up over the last 12 months, but it still averaged negative 2.7% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q4, Sonos generated an operating margin profit margin of 18.4%, up 9.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

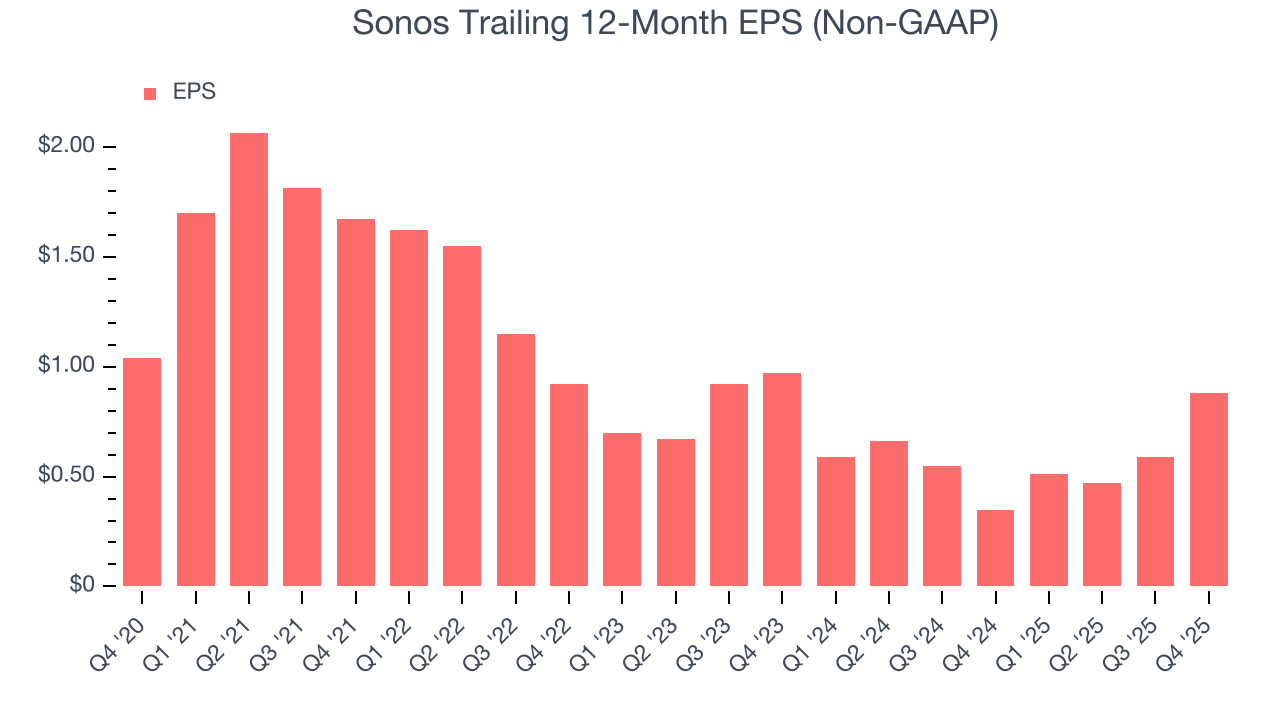

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Sonos, its EPS declined by 3.3% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q4, Sonos reported adjusted EPS of $0.93, up from $0.64 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Sonos has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.5%, lousy for a consumer discretionary business.

Sonos’s free cash flow clocked in at $157.3 million in Q4, equivalent to a 28.8% margin. This result was good as its margin was 2.9 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Sonos’s four-year average ROIC was negative 10.7%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Sonos’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Sonos is a profitable, well-capitalized company with $363.5 million of cash and $52.1 million of debt on its balance sheet. This $311.4 million net cash position is 17.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Sonos’s Q4 Results

It was good to see Sonos beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $14.71 immediately after reporting.

12. Is Now The Time To Buy Sonos?

Updated: February 24, 2026 at 10:04 PM EST

Before investing in or passing on Sonos, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Sonos falls short of our quality standards. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Sonos’s forward price-to-sales ratio is 1.2x. The market typically values companies like Sonos based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $19.38 on the company (compared to the current share price of $14.88).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.