StepStone Group (STEP)

We’re firm believers in StepStone Group. Its superb revenue growth indicates its market share is increasing.― StockStory Analyst Team

1. News

2. Summary

Why We Like StepStone Group

Operating as both an advisor and asset manager with over $100 billion in assets under management, StepStone Group (NASDAQ:STEP) is an investment firm that provides clients with access to private market investments across private equity, real estate, private debt, and infrastructure.

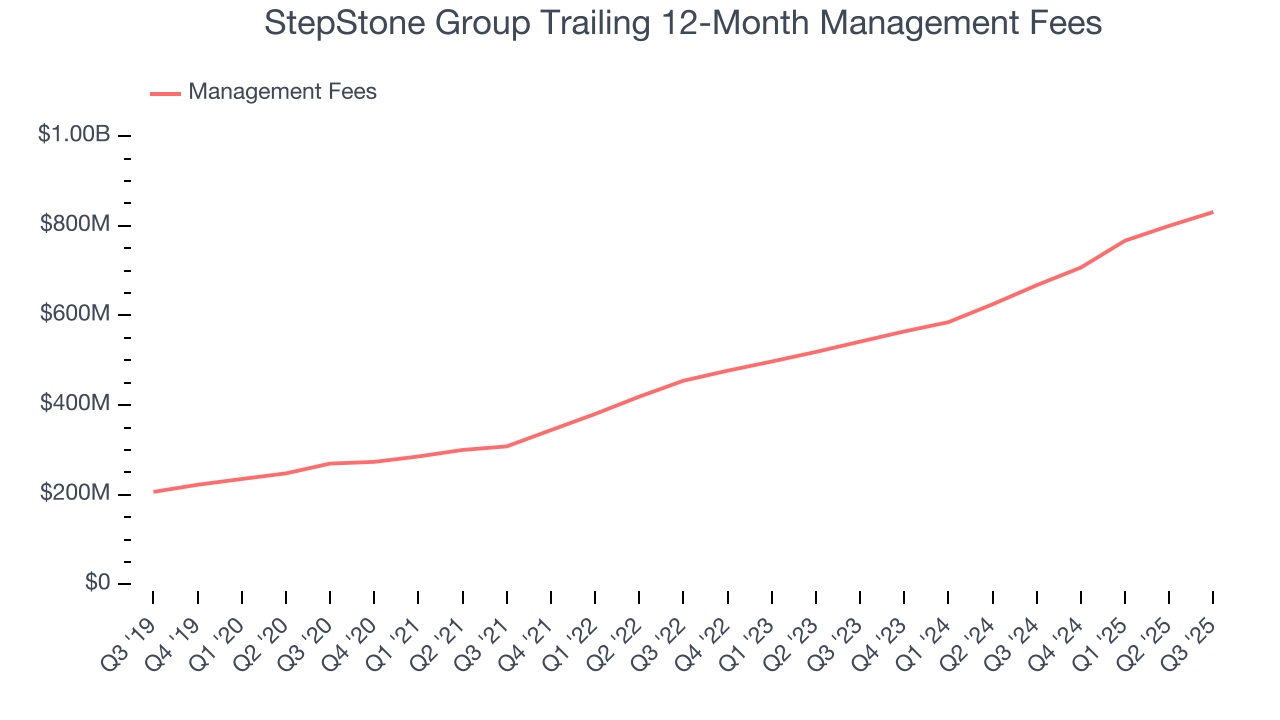

- Annual revenue growth of 27.5% over the last five years was superb and indicates its market share increased during this cycle

- Additional sales over the last two years increased its profitability as the 41.4% annual growth in its earnings per share outpaced its revenue

- The stock is expensive, but we’d argue it’s often wise to hold onto high-quality businesses for the long term

StepStone Group is a market leader. This is one of our top financials stocks.

Is Now The Time To Buy StepStone Group?

High Quality

Investable

Underperform

Is Now The Time To Buy StepStone Group?

StepStone Group’s stock price of $76.27 implies a valuation ratio of 33.2x forward P/E. The lofty multiple means expectations are high for this company over the next six to twelve months.

Are you a fan of the business model? If so, we suggest a small position as the long-term outlook seems promising. Keep in mind that StepStone Group’s lofty valuation could result in short-term volatility based on both macro and company-specific factors.

3. StepStone Group (STEP) Research Report: Q3 CY2025 Update

Private markets investment firm StepStone Group (NASDAQ:STEP) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 118% year on year to $454.2 million. Its non-GAAP profit of $0.54 per share was 10.6% above analysts’ consensus estimates.

StepStone Group (STEP) Q3 CY2025 Highlights:

Company Overview

Operating as both an advisor and asset manager with over $100 billion in assets under management, StepStone Group (NASDAQ:STEP) is an investment firm that provides clients with access to private market investments across private equity, real estate, private debt, and infrastructure.

StepStone serves institutional investors such as pension funds, sovereign wealth funds, insurance companies, and high-net-worth individuals who seek exposure to private markets but may lack the resources or expertise to invest directly. The firm offers these clients customized portfolio management, specialized fund solutions, and advisory services tailored to their specific investment goals and risk profiles.

The company employs a multi-faceted approach to private markets investing. It creates funds-of-funds that invest across multiple underlying private equity or real estate funds, makes direct investments alongside fund managers in specific companies or assets, and provides secondary market solutions where it purchases existing private market investments from other investors. This flexibility allows clients to gain diversified exposure to private markets through a single relationship.

For example, a state pension fund might engage StepStone to build a customized private equity program that includes commitments to various fund managers, co-investments in specific companies, and opportunistic secondary purchases—all managed through StepStone's platform.

StepStone generates revenue through management fees based on committed or invested capital, performance-based fees (carried interest) when investments exceed certain return thresholds, and advisory fees for its consulting services. The firm's global footprint includes offices across North America, Europe, Asia, and Australia, allowing it to source investment opportunities worldwide and provide localized expertise to its global client base.

The company's proprietary technology platform, SPI (StepStone Private markets Intelligence), supports its investment process by collecting and analyzing data on thousands of fund managers and private market investments.

4. Custody Bank

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

StepStone Group competes with other private markets investment firms including Blackstone (NYSE:BX), KKR (NYSE:KKR), Hamilton Lane (NASDAQ:HLNE), and Partners Group (SWX:PGHN), as well as the alternative asset management divisions of traditional asset managers like BlackRock (NYSE:BLK).

5. Revenue Growth

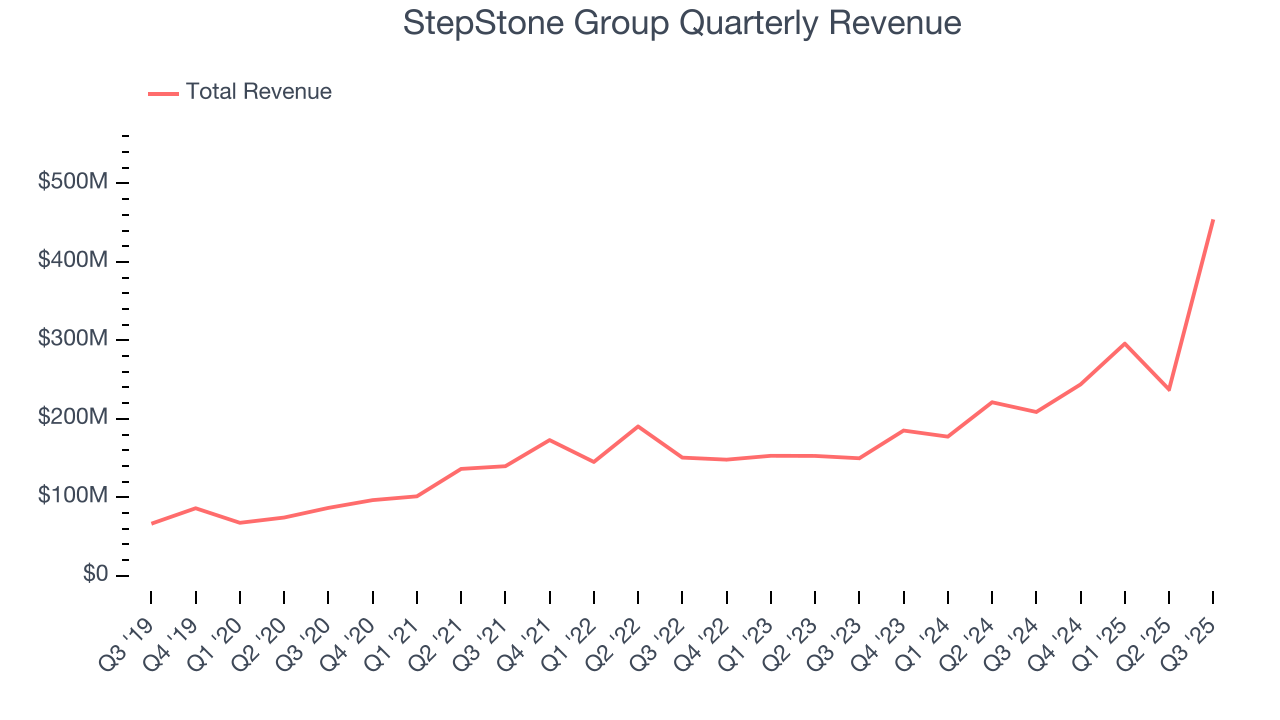

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, StepStone Group’s revenue grew at an incredible 31.4% compounded annual growth rate over the last five years. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. StepStone Group’s annualized revenue growth of 42.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, StepStone Group reported magnificent year-on-year revenue growth of 118%, and its $454.2 million of revenue beat Wall Street’s estimates by 71.1%.

6. Management Fees

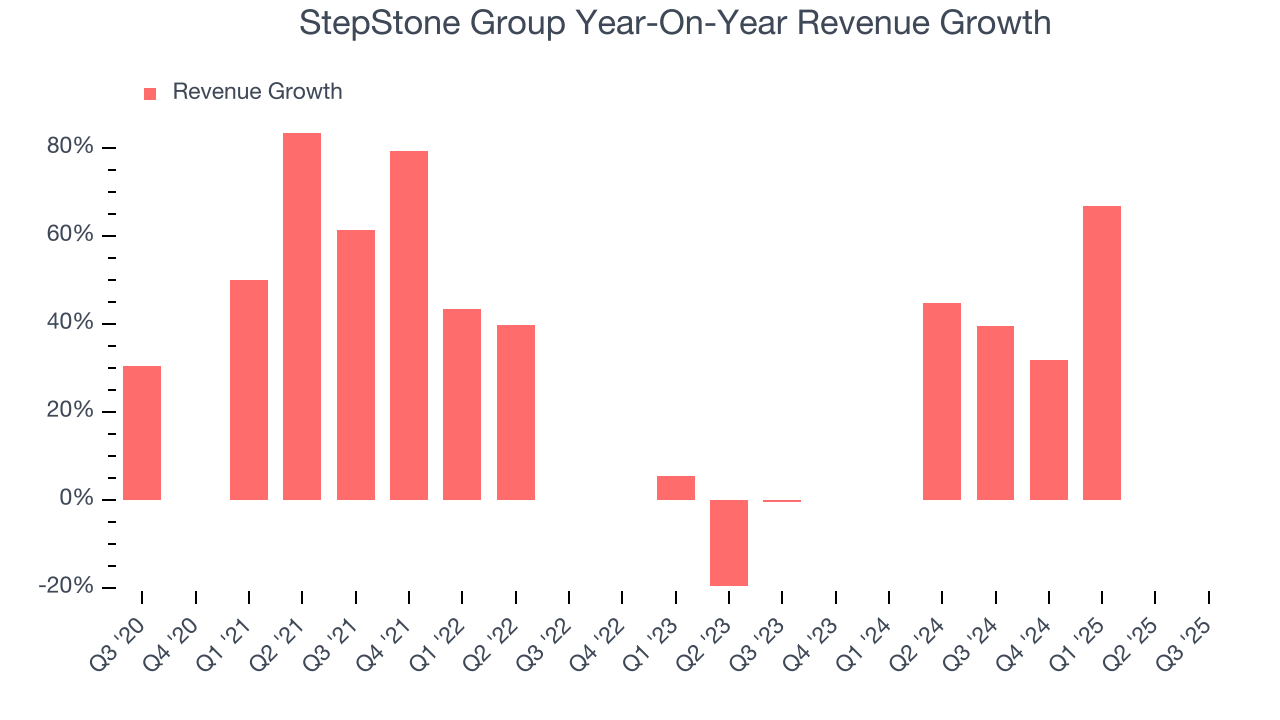

While assets under management are the committed capital by clients - not revenue itself - they directly influence how much firms can earn in the form of management fees, which are charged as a percentage of AUM.

StepStone Group’s management fees have grown at an annual rate of 25.2% over the last five years, much better than the broader financials industry but slower than its total revenue. Ignoring performance fees that typically range from 10-20% of investment gains, this tells us its asset management division was a net detractor to the company. When analyzing StepStone Group’s management fees over the last two years, we can see that growth decelerated to 23.8% annually.

StepStone Group’s management fees punched in at $215.5 million this quarter, beating analysts’ expectations by 5.5%. This print was 16.6% higher than the same quarter last year.

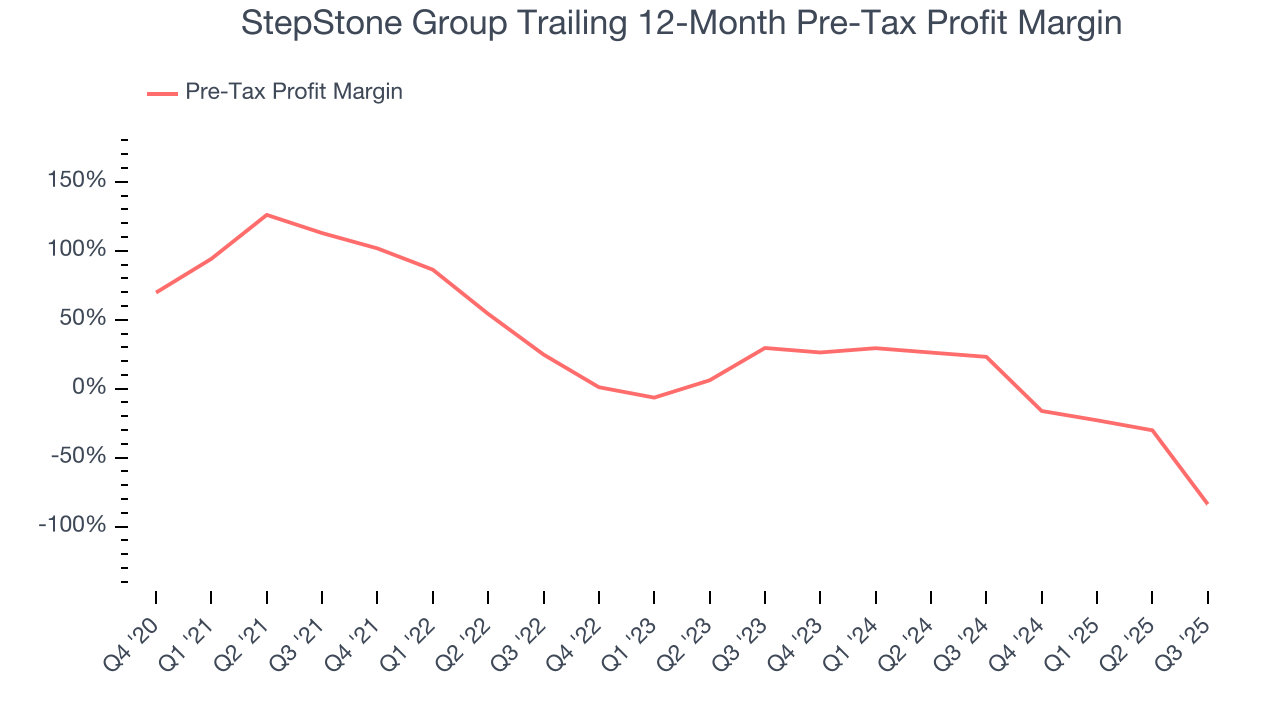

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Custody Bank companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

Over the last four years, StepStone Group’s pre-tax profit margin has risen by 196.5 percentage points, going from 113% to negative 83.7%. It has also declined by 113.2 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

StepStone Group’s pre-tax profit margin came in at negative 149% this quarter. This result was 176.5 percentage points worse than the same quarter last year.

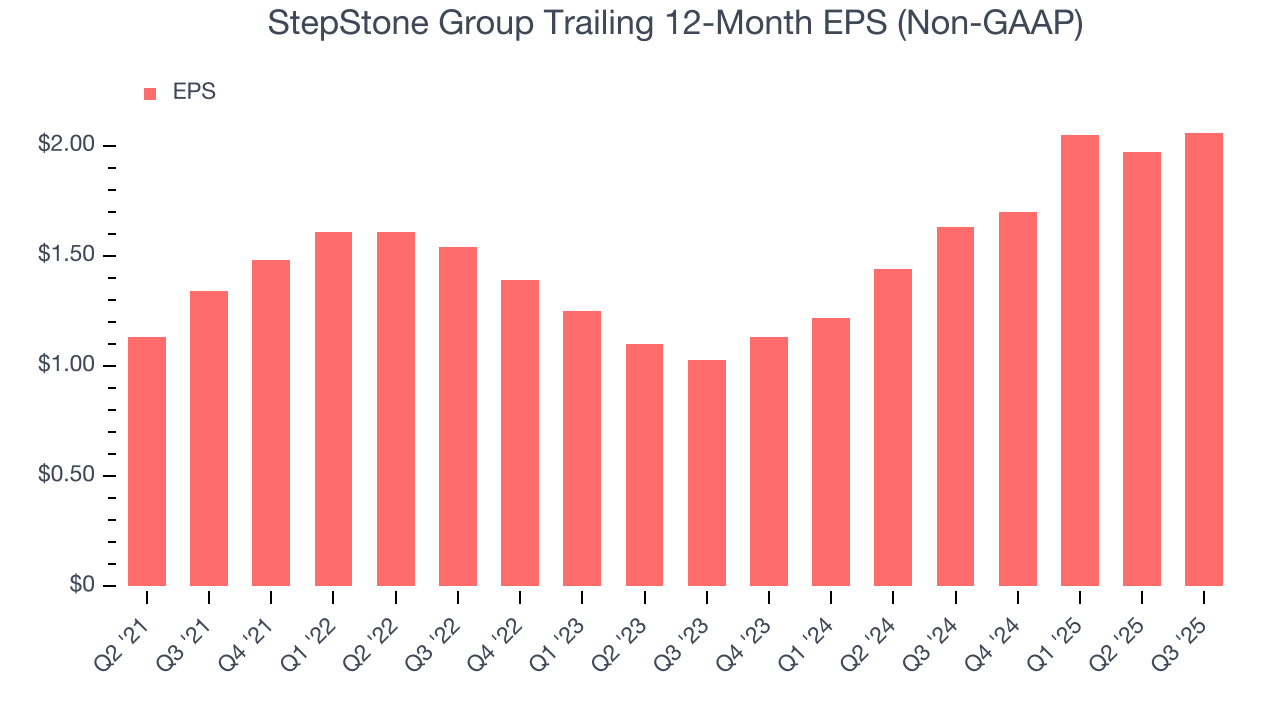

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

StepStone Group’s full-year EPS grew at a decent 11.4% compounded annual growth rate over the last four years, in line with the broader financials sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

StepStone Group’s astounding 41.4% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

In Q3, StepStone Group reported adjusted EPS of $0.54, up from $0.45 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects StepStone Group’s full-year EPS of $2.06 to grow 5.4%.

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, StepStone Group has averaged an ROE of 18.1%, impressive for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows StepStone Group has a strong competitive moat.

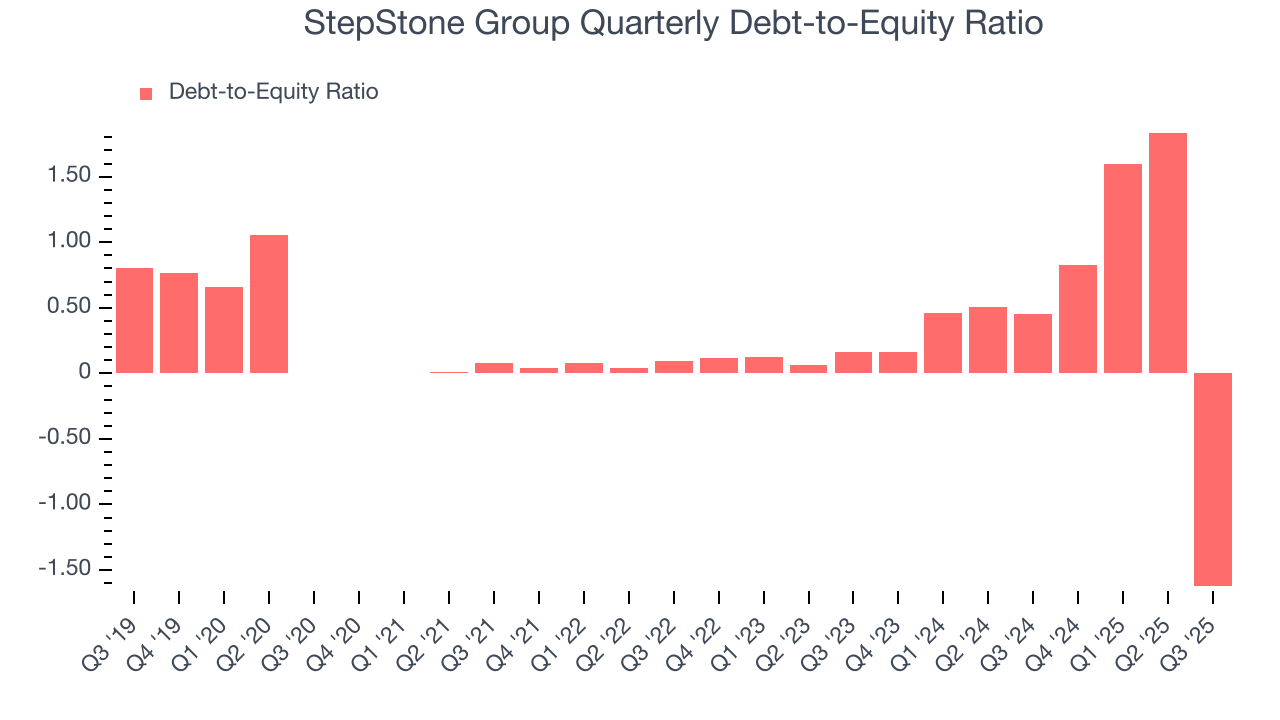

10. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

StepStone Group currently has $379.4 million of debt and $233.5 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.7×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

11. Key Takeaways from StepStone Group’s Q3 Results

We were impressed by how significantly StepStone Group blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $62.24 immediately following the results.

12. Is Now The Time To Buy StepStone Group?

Updated: January 19, 2026 at 11:14 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in StepStone Group.

StepStone Group is an amazing business ranking highly on our list. First of all, the company’s revenue growth was exceptional over the last five years. And while its declining pre-tax profit margin shows the business has become less efficient, its management fee growth was exceptional over the last five years. On top of that, StepStone Group’s AUM growth was exceptional over the last four years.

StepStone Group’s P/E ratio based on the next 12 months is 33.2x. Some good news is baked into the stock given its multiple, but we’ll happily own StepStone Group as its fundamentals really stand out. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $79.14 on the company (compared to the current share price of $76.27).