1. News

2. Summary

Why TPG Is Interesting

Founded in 1992 and managing over 300 active portfolio companies across more than 30 countries, TPG (NASDAQ:TPG) is a global alternative asset management firm that invests across private equity, credit, real estate, and public market strategies.

- Annual revenue growth of 21.7% over the past five years was outstanding, reflecting market share gains this cycle

- Fee-related earnings improved by 21.7% annually over the last five years as it eliminated redundant costs

- A drawback is its flat earnings per share over the last three years lagged its peers

TPG is solid, but not perfect. Consider adding this company to your watchlist.

Why Should You Watch TPG

Why Should You Watch TPG

TPG is trading at $53.53 per share, or 18.8x forward P/E. TPG’s valuation is richer than that of other financials companies, on average.

If TPG strings together a few solid quarters and proves it can be a high-quality company, we’d be more open to investing.

3. TPG (TPG) Research Report: Q4 CY2025 Update

Global alternative asset manager TPG (NASDAQ:TPG) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 224% year on year to $1.49 billion. Its GAAP profit of $0.29 per share was 57.2% below analysts’ consensus estimates.

TPG (TPG) Q4 CY2025 Highlights:

- Assets Under Management: $303 billion vs analyst estimates of $297 billion (23.2% year-on-year growth, 2% beat)

- Revenue: $1.49 billion vs analyst estimates of $548.8 million (224% year-on-year growth, 172% beat)

- Fee-Related Earnings: $461.4 million vs analyst estimates of $552.1 million (16.4% miss)

- EPS (GAAP): $0.29 vs analyst expectations of $0.68 (57.2% miss)

- Market Capitalization: $8.59 billion

Company Overview

Founded in 1992 and managing over 300 active portfolio companies across more than 30 countries, TPG (NASDAQ:TPG) is a global alternative asset management firm that invests across private equity, credit, real estate, and public market strategies.

TPG operates through six multi-strategy investment platforms: Capital, Growth, Impact, TPG Angelo Gordon, Real Estate, and Market Solutions. Each platform houses specialized investment products targeting different market segments and opportunities. For example, the Capital platform focuses on large-scale control-oriented private equity investments, while the Growth platform targets earlier-stage companies and middle market opportunities.

The firm's investment professionals are organized into industry sector teams that share investment themes across platforms, creating an ecosystem of insight and collaboration. This structure allows TPG to identify patterns and opportunities across its diverse portfolio, which includes hundreds of active companies, real estate properties, and credit positions spanning more than 30 countries.

TPG's Impact platform is particularly distinctive, pursuing both competitive financial returns and measurable societal benefits through vehicles like The Rise Funds and TPG Rise Climate. The latter has partnered with 28 global corporations to form the TPG Rise Climate Coalition, which focuses on climate-related investment opportunities.

The firm expanded significantly in 2023 with its acquisition of Angelo Gordon, strengthening its capabilities in credit and real estate investing. This addition enhanced TPG's alternative credit products, which now span private and tradeable credit across corporate and asset-backed markets.

TPG generates revenue primarily through management fees based on assets under management and performance fees tied to investment returns. The firm's business model benefits from operating leverage, as its scaled infrastructure can support growth in assets without proportional increases in costs.

4. Asset Management

Asset management firms oversee investment portfolios for institutions and individuals. The industry benefits from the growing global wealth pool, retirement savings needs, and expansion into alternative investments (private equity, real estate, etc.). However, firms face significant pressure from the shift to lower-cost passive investment products, regulatory requirements for fee transparency, and increasing technology costs to stay competitive in portfolio management and client service.

TPG competes with other major alternative asset managers including Blackstone (NYSE:BX), KKR (NYSE:KKR), Apollo Global Management (NYSE:APO), The Carlyle Group (NASDAQ:CG), and Brookfield Asset Management (NYSE:BAM).

5. Revenue Growth

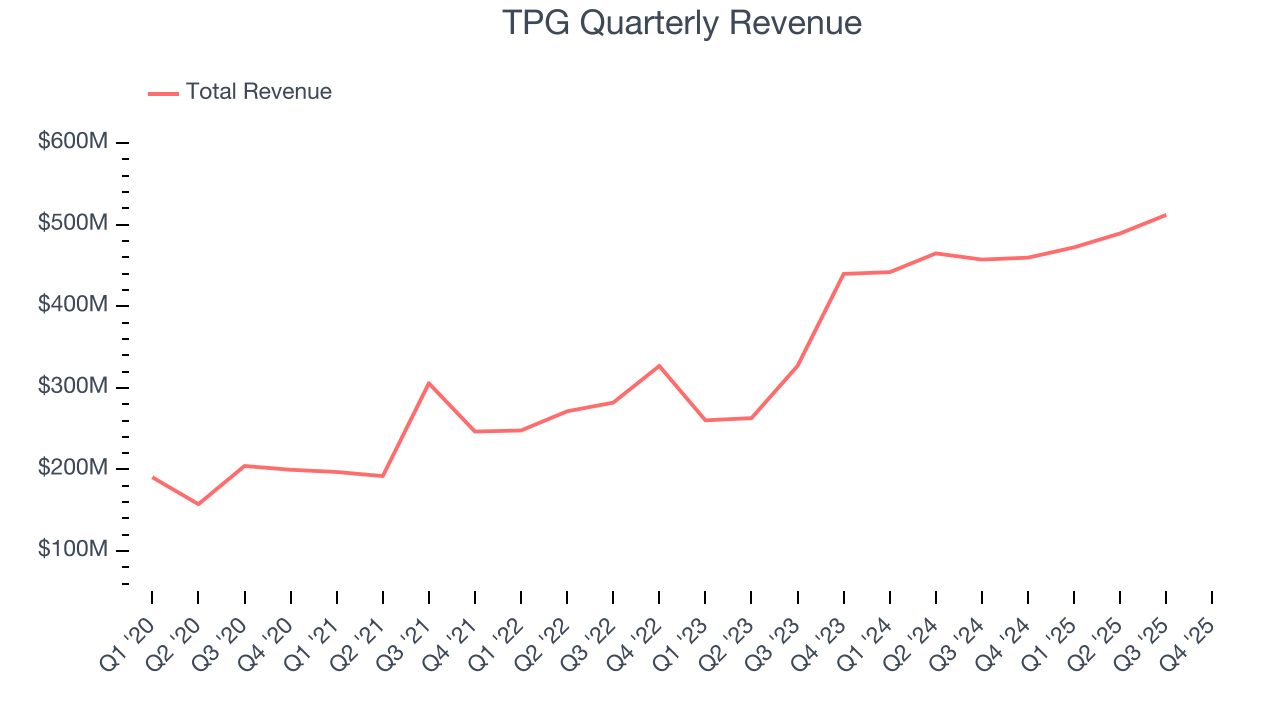

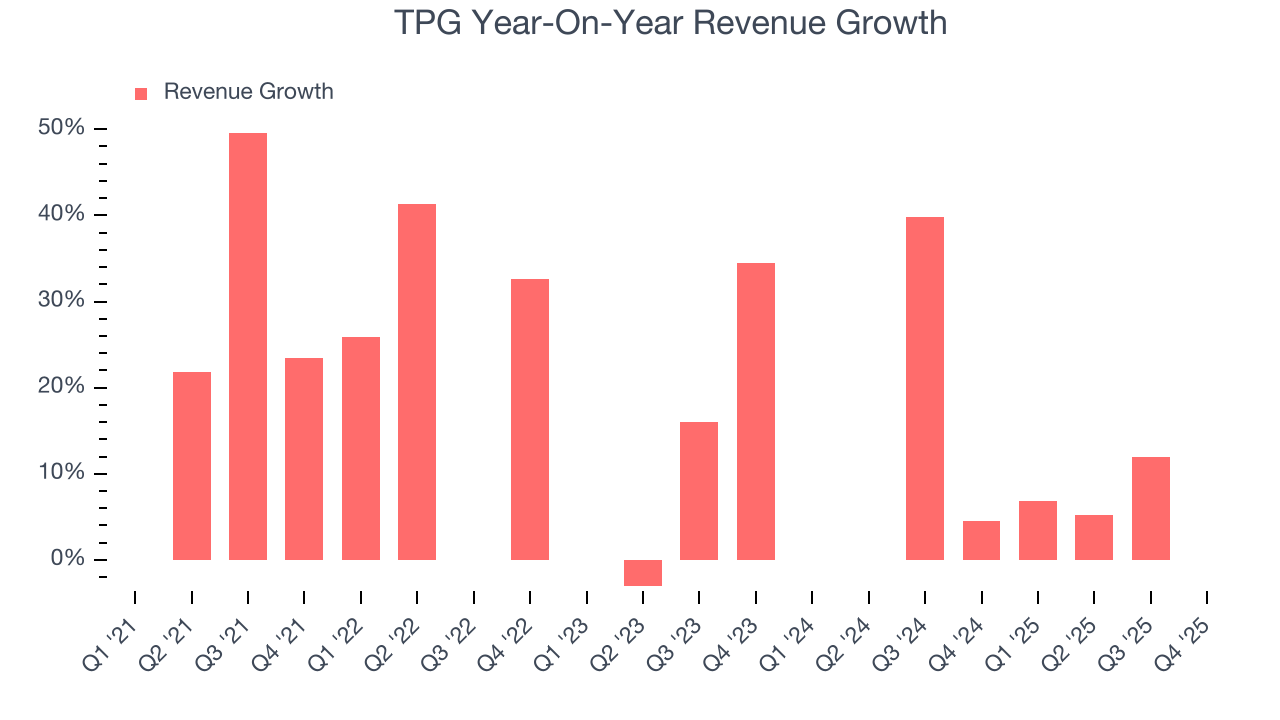

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, TPG grew its revenue at an exceptional 21.7% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. TPG’s annualized revenue growth of 31.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, TPG reported magnificent year-on-year revenue growth of 224%, and its $1.49 billion of revenue beat Wall Street’s estimates by 172%.

6. Assets Under Management (AUM)

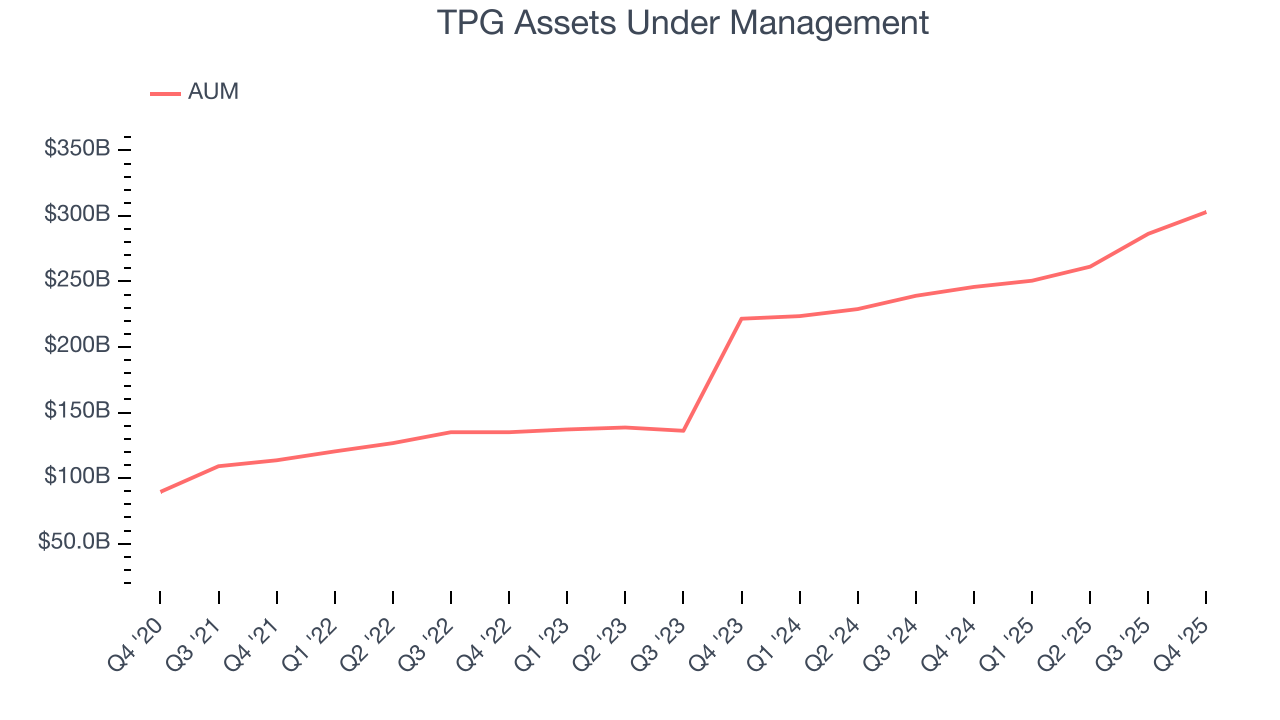

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

TPG’s AUM has grown at an annual rate of 31.9% over the last two years, much better than the broader financials industry and mirrored its total revenue.

TPG’s AUM punched in at $303 billion this quarter, beating analysts’ expectations by 2%. This print was 23.2% higher than the same quarter last year.

7. Fee-Related Earnings

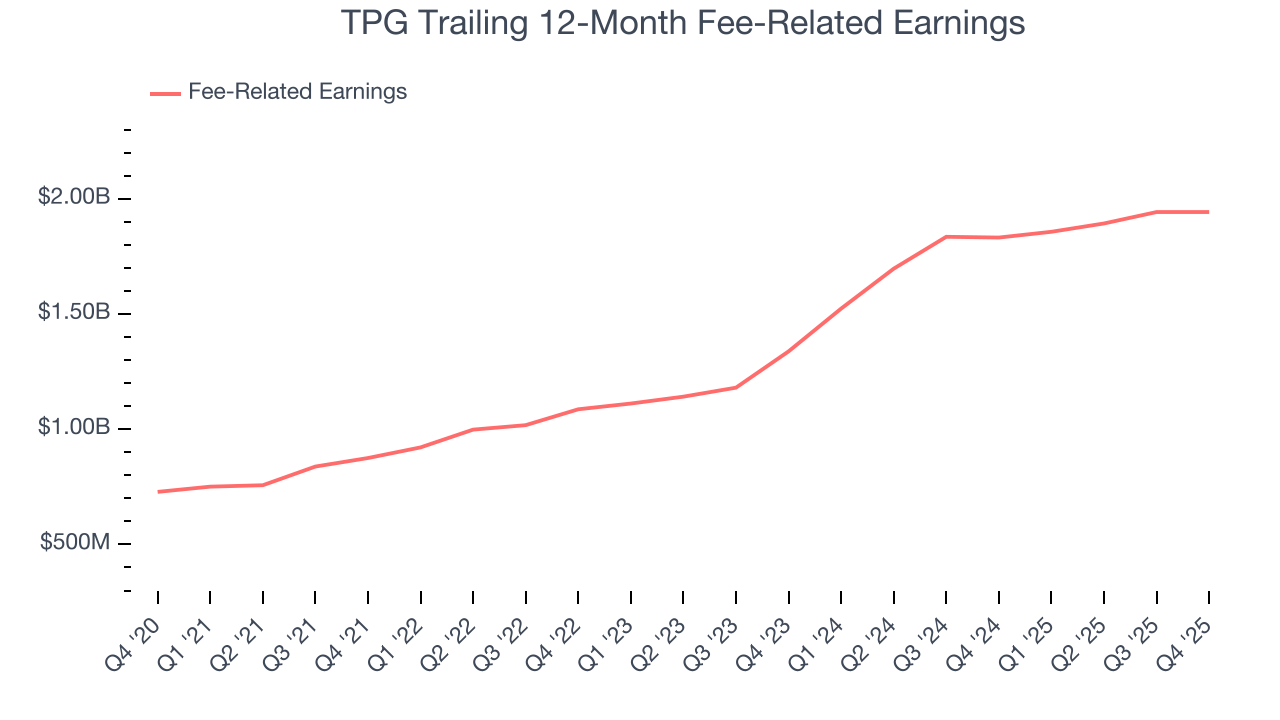

While revenue growth captures attention, the quality of that growth is what truly drives shareholder value. For asset management firms, fee-related earnings represent the stable, predictable profits from their core fee-based services, excluding the more unpredictable elements like performance fees and investment returns. This metric reveals the sustainable earnings power of the business.

TPG’s annual fee-related earnings growth over the last five years was 21.7%, a top-notch result.

As you’ve seen throughout this report, we supplement with a two-year look because a five-year view may miss recent changes in the business. Over the last two years, TPG’s fee-related earnings grew at an annualized pace of 20.5%, an impressive result.

TPG’s fee-related earnings came in at $461.4 million this quarter, falling short of analysts’ expectations by 16.4%. These results were in line with the prior-year quarter.

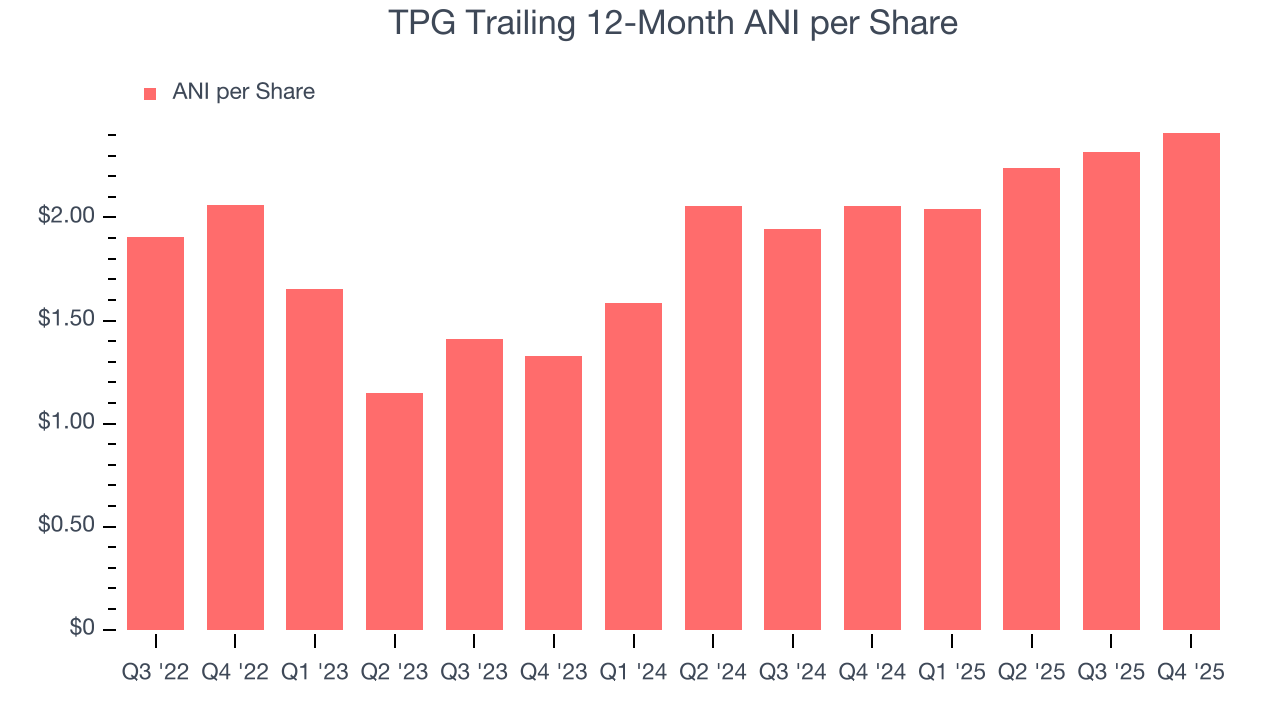

8. Adjusted Net Earnings per Share (ANI per Share)

Asset managers report ANI per share, which stands for adjusted net income per share. Make no mistake, this is essentially just the adjusted EPS that many other companies across various industries report.

ANI per share gives us a clearer picture of sustainable profitability by removing volatile investment gains/losses and exceptional expenses. The per-share calculation also reflects the impact of share repurchases or dilutive issuances, which directly affects what shareholders actually own.

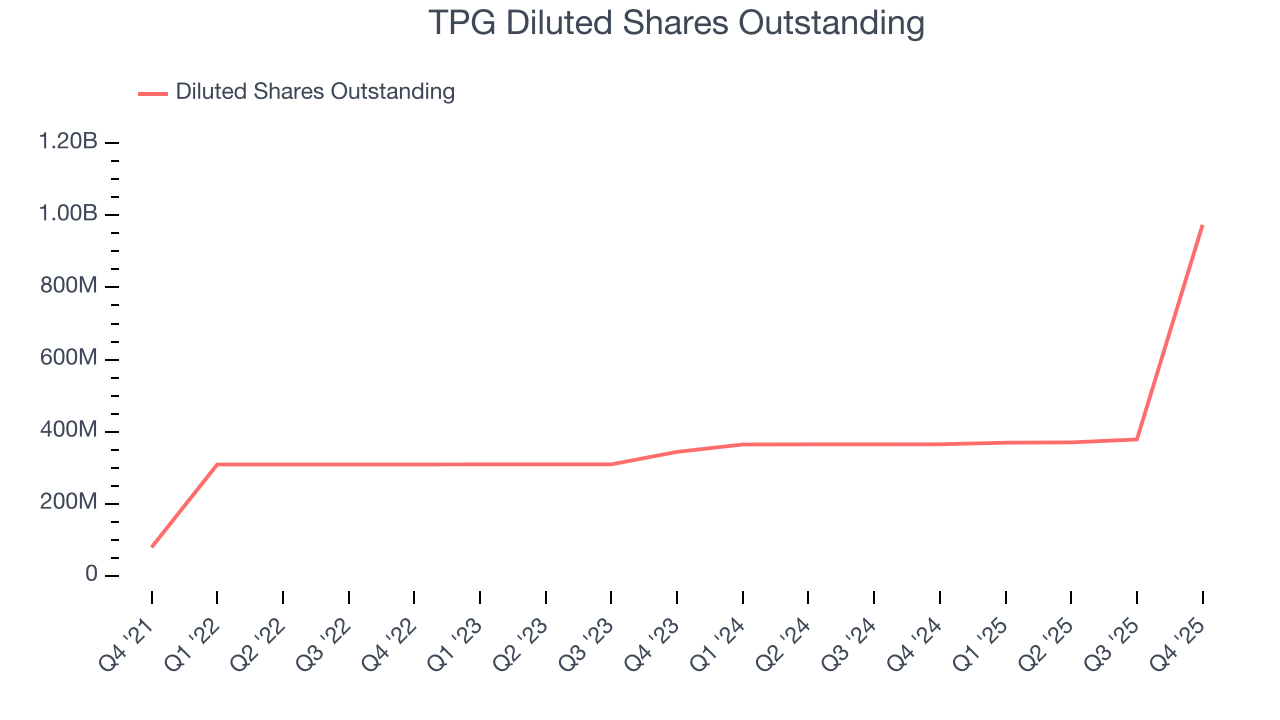

Over the last three years, TPG’s flat ANI per share was weak. It also diluted shareholders across this stretch, a headwind for its results.

On a two-year basis, TPG’s annualized ANI per share growth accelerated to 34.6%. This performance was fantastic and better than its fee-related earnings over the same period. We note the company continued diluting shareholders during this timeframe, suppressing its ANI per share.

In Q4, TPG reported ANI per share of $0.71, up from $0.62 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results.

9. A Word on Book Value and ROE

You may wonder when we will analyze book value and return on equity (ROE) since TPG is a financials company. We pay less attention to these metrics for asset managers because they are not great measures of business quality.

Asset managers are fee-based, capital light firms that manage client capital rather than their own, so they are not balance sheet businesses. Additionally, book value fails to capture the value of brands, investment track records, and other intangibles, thus understating intrinsic value, while ROE can look artificially high due to the relatively smaller bases of equity capital needed to operate the business compared to banks and insurers.

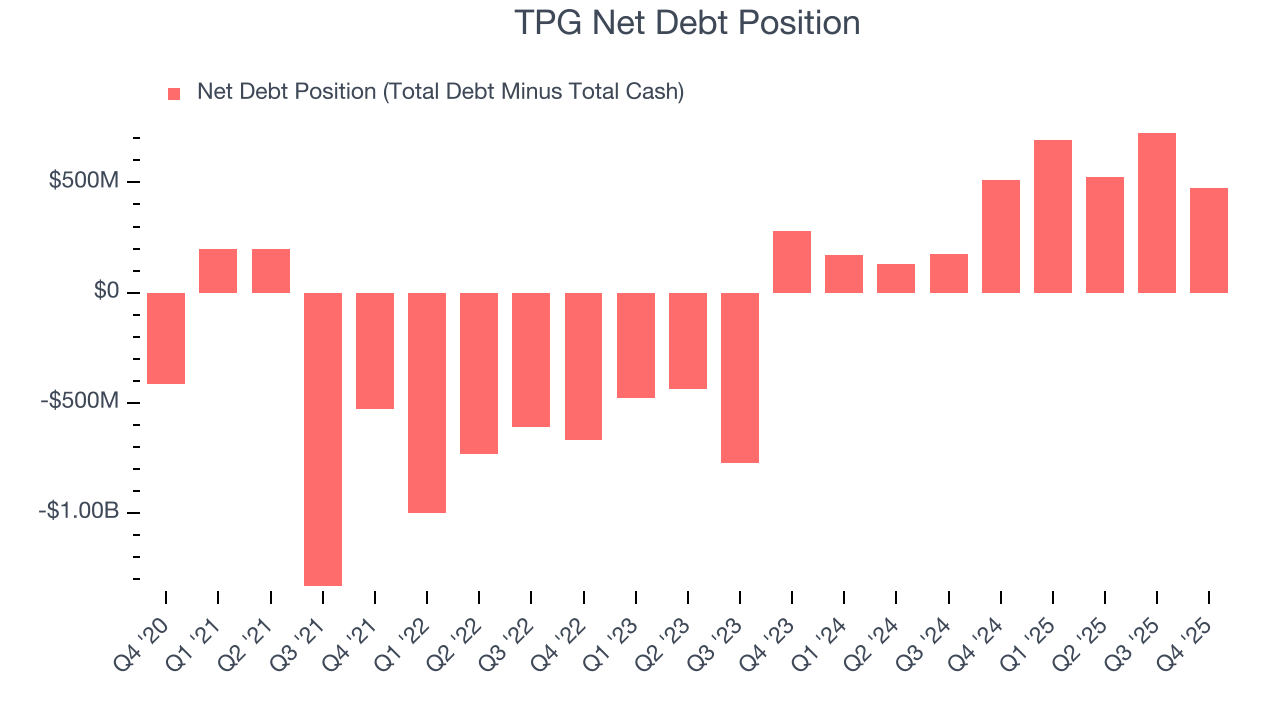

10. Balance Sheet Assessment

TPG reported $808 million of cash and $1.28 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $1.94 billion of fee-related earnings over the last 12 months, we view TPG’s 0.2× net-debt-to-earnings ratio as safe. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from TPG’s Q4 Results

We were impressed by how significantly TPG blew past analysts’ revenue expectations this quarter. We were also glad its AUM outperformed Wall Street’s estimates. On the other hand, its EPS missed and its fee-related earnings fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $56.26 immediately following the results.

12. Is Now The Time To Buy TPG?

Updated: February 5, 2026 at 11:28 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in TPG.

TPG is a fine business. To kick things off, its revenue growth was exceptional over the last five years. And while its weak EPS growth over the last three years shows it’s failed to produce meaningful profits for shareholders, its AUM growth was exceptional over the last two years. On top of that, its expanding fee-related earnings shows the asset management business is generating more profits.

TPG’s P/E ratio based on the next 12 months is 18.8x. This valuation tells us that a lot of optimism is priced in. TPG is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $73.50 on the company (compared to the current share price of $53.53).