LendingTree (TREE)

1. News

2. LendingTree (TREE) Research Report: Q3 CY2025 Update

Financial marketplace platform LendingTree (NASDAQ:TREE) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 18% year on year to $307.8 million. On top of that, next quarter’s revenue guidance ($285 million at the midpoint) was surprisingly good and 7.2% above what analysts were expecting. Its non-GAAP profit of $1.70 per share was 46.8% above analysts’ consensus estimates.

LendingTree (TREE) Q3 CY2025 Highlights:

- Revenue: $307.8 million vs analyst estimates of $277.3 million (18% year-on-year growth, 11% beat)

- Adjusted EPS: $1.70 vs analyst estimates of $1.16 (46.8% beat)

- Adjusted EBITDA: $39.8 million vs analyst estimates of $35.19 million (12.9% margin, 13.1% beat)

- Revenue Guidance for Q4 CY2025 is $285 million at the midpoint, above analyst estimates of $265.8 million

- EBITDA guidance for the full year is $127 million at the midpoint, above analyst estimates of $123.2 million

- Operating Margin: 9.3%, up from 3.8% in the same quarter last year

- Free Cash Flow Margin: 8.3%, down from 10.1% in the previous quarter

- Market Capitalization: $704 million

Company Overview

Using the same comparison model that revolutionized travel booking, LendingTree (NASDAQ:TREE) operates an online platform that connects consumers with financial service providers across mortgages, personal loans, credit cards, insurance, and other financial products.

The company positions itself as a neutral marketplace where consumers can shop for financial products by submitting a single application and receiving multiple offers from competing providers. This approach allows consumers to compare rates, terms, and conditions side-by-side before making financial decisions. LendingTree earns revenue primarily through match fees when it connects consumers with its network of approximately 430 financial partners.

For example, a homebuyer seeking mortgage options can submit their information once and receive conditional loan offers from multiple lenders, allowing them to compare interest rates and terms without individually contacting each bank. Similarly, someone seeking auto insurance can receive quotes from various insurers after completing a single form.

LendingTree's business is organized into three primary segments: Home (mortgage loans and home equity products), Consumer (credit cards, personal loans, auto loans, and deposit accounts), and Insurance (comparison shopping for various insurance types). The company monetizes these connections primarily through upfront match fees, pay-per-click arrangements, and in some cases, commissions on policy sales through its agency businesses. LendingTree also offers supplementary tools like free credit scores to facilitate comparison shopping and build user engagement.

3. Financial Technology

Financial technology companies benefit from the increasing consumer demand for digital payments, banking, and finance. Tailwinds fueling this trend include e-commerce along with improvements in blockchain infrastructure and AI-driven credit underwriting, which make access to money faster and cheaper. Despite regulatory scrutiny and resistance from traditional financial institutions, fintechs are poised for long-term growth as they disrupt legacy systems by expanding financial services to underserved population segments.

LendingTree's competitors include other financial comparison platforms such as Credit Karma (owned by Intuit, NASDAQ:INTU), NerdWallet (NASDAQ:NRDS), and Bankrate (owned by Red Ventures), as well as specialized mortgage marketplaces like Rocket Companies (NYSE:RKT).

4. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, LendingTree struggled to consistently increase demand as its $1.06 billion of sales for the trailing 12 months was close to its revenue three years ago. This was below our standards and suggests it’s a low quality business.

This quarter, LendingTree reported year-on-year revenue growth of 18%, and its $307.8 million of revenue exceeded Wall Street’s estimates by 11%. Company management is currently guiding for a 9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

5. Gross Margin & Pricing Power

For fintech businesses like LendingTree, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include transaction/payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard customers, such as identity verification.

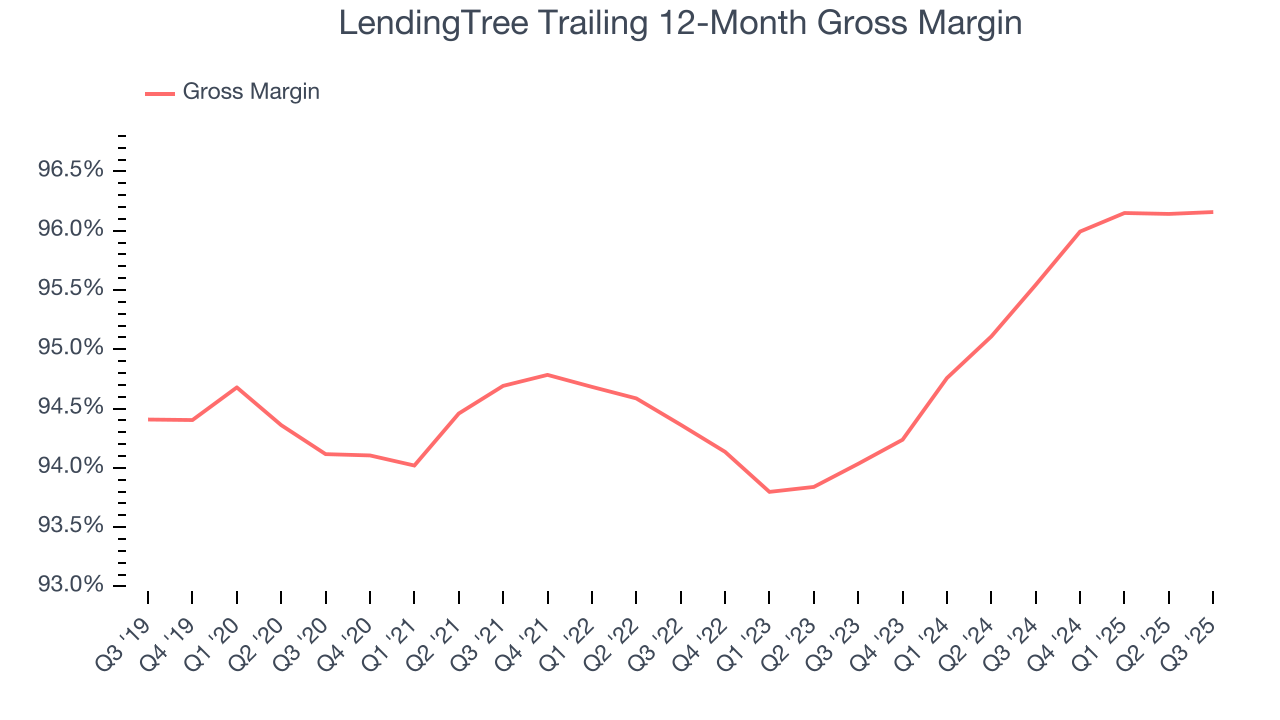

LendingTree’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 95.9% gross margin over the last two years. That means LendingTree only paid its providers $4.10 for every $100 in revenue.

In Q3, LendingTree produced a 96.4% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

6. User Acquisition Efficiency

Consumer internet businesses like LendingTree grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

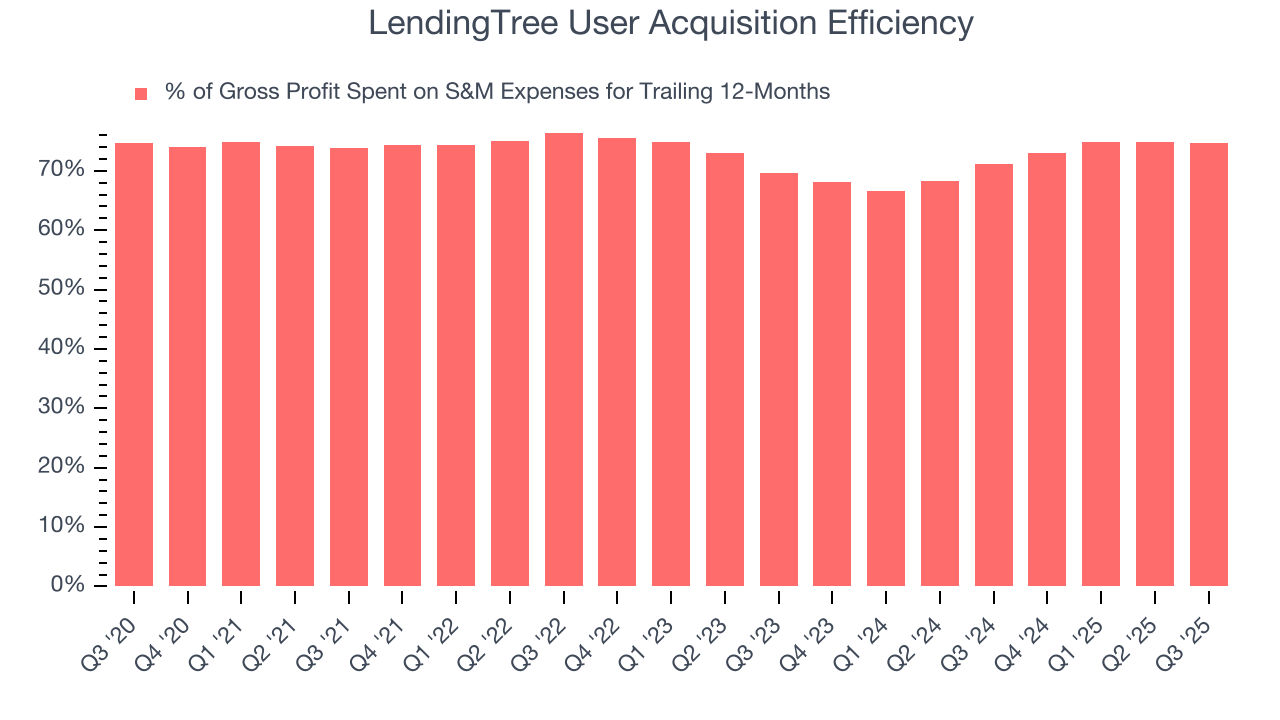

It’s very expensive for LendingTree to acquire new users as the company has spent 74.6% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between LendingTree and its peers.

7. EBITDA

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

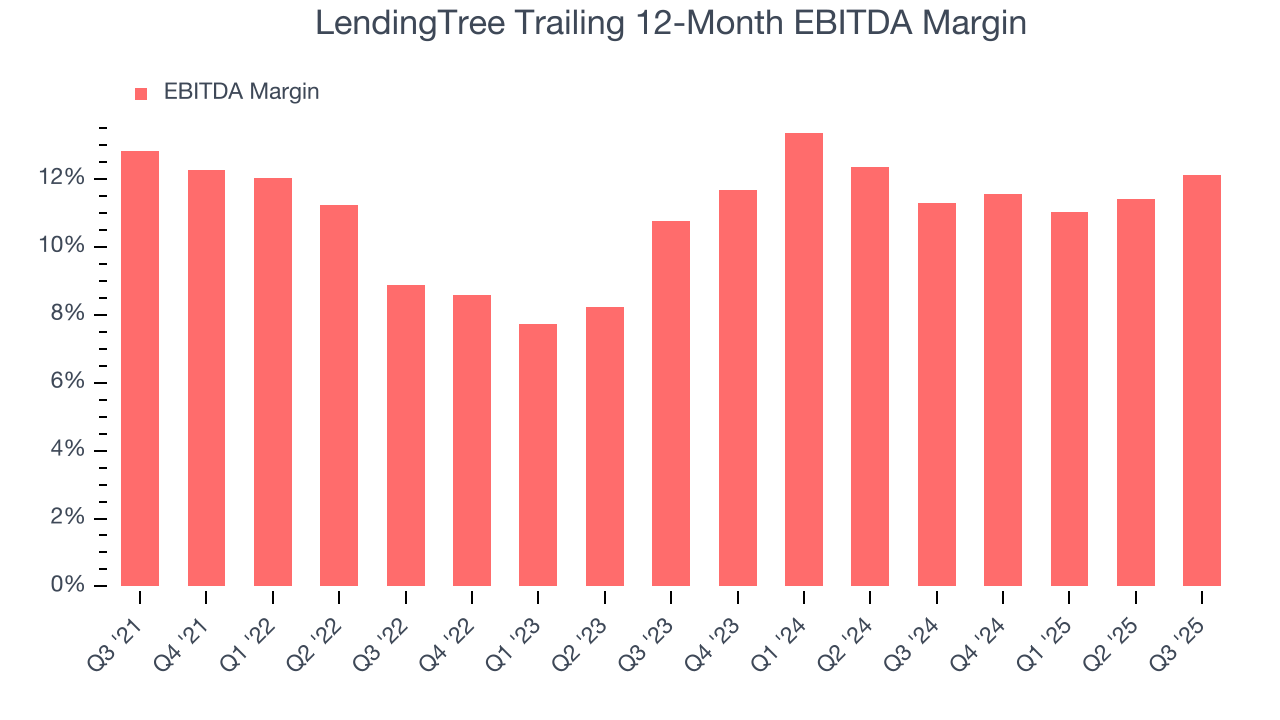

LendingTree has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 11.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, LendingTree’s EBITDA margin rose by 3.2 percentage points over the last few years, showing its efficiency has improved.

This quarter, LendingTree generated an EBITDA margin profit margin of 12.9%, up 2.6 percentage points year on year. The increase was encouraging, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

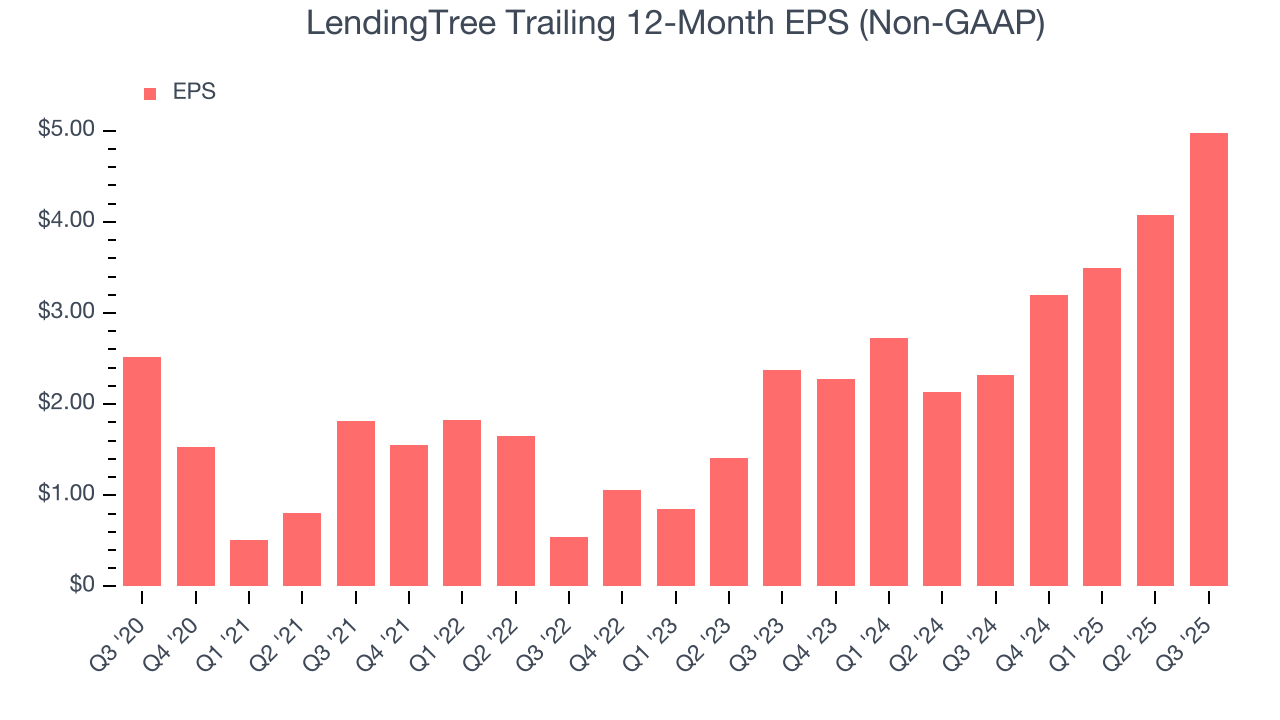

Diving into LendingTree’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, LendingTree’s EBITDA margin expanded by 3.2 percentage points over the last three years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, LendingTree reported adjusted EPS of $1.70, up from $0.80 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects LendingTree’s full-year EPS of $4.98 to shrink by 9.8%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

LendingTree has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.4% over the last two years, slightly better than the broader consumer internet sector.

LendingTree’s free cash flow clocked in at $25.57 million in Q3, equivalent to a 8.3% margin. The company’s cash profitability regressed as it was 7.9 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

10. Balance Sheet Assessment

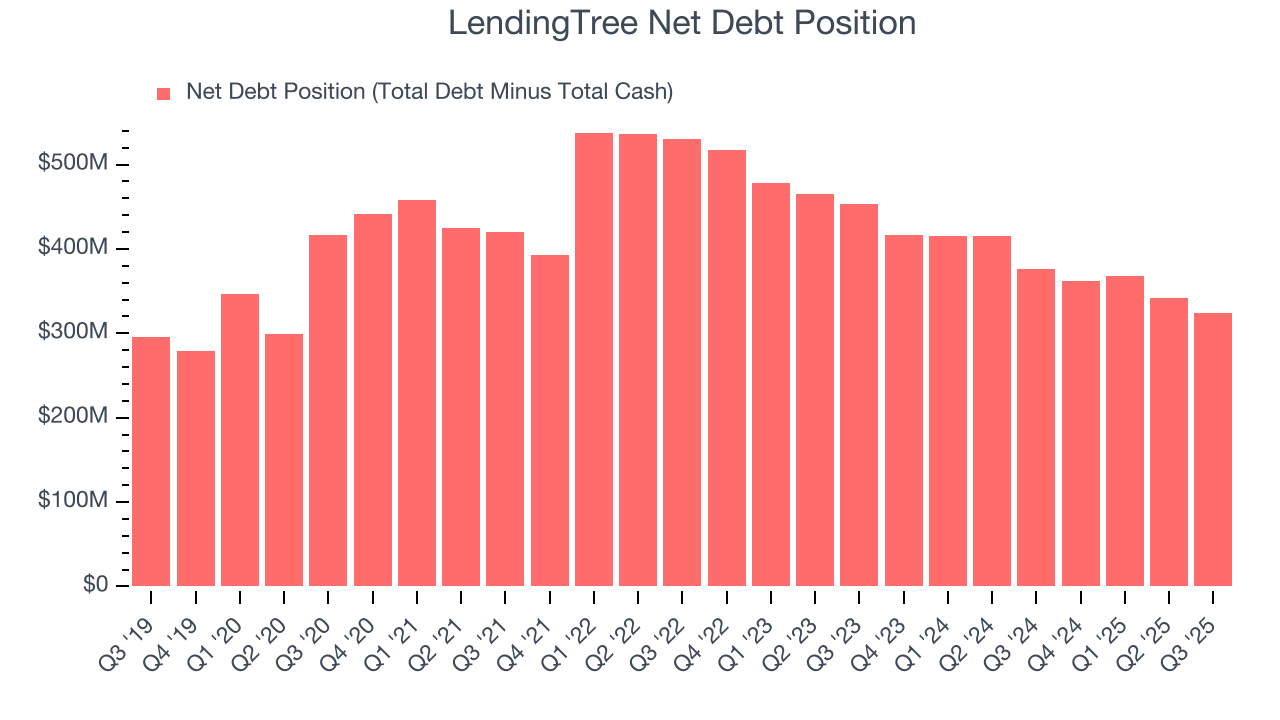

LendingTree reported $68.58 million of cash and $392.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $128.4 million of EBITDA over the last 12 months, we view LendingTree’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $47.94 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from LendingTree’s Q3 Results

We were impressed by how significantly LendingTree blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EBITDA guidance for next quarter missed. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $51.55 immediately following the results.

12. Is Now The Time To Buy LendingTree?

Before investing in or passing on LendingTree, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

LendingTree falls short of our quality standards. To begin with, its revenue was flat over the last three years. And while its admirable gross margins are a wonderful starting point for the overall profitability of the business, the downside is its projected EPS for the next year is lacking. On top of that, its sales and marketing spend is very high compared to other consumer internet businesses.

LendingTree’s EV/EBITDA ratio based on the next 12 months is 7.6x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $81.33 on the company (compared to the current share price of $51.55).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.