TTM Technologies (TTMI)

TTM Technologies catches our eye. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why TTM Technologies Is Interesting

As one of the world's largest printed circuit board manufacturers with facilities spanning North America and Asia, TTM Technologies (NASDAQ:TTMI) manufactures printed circuit boards (PCBs) and radio frequency (RF) components for aerospace, defense, automotive, and telecommunications industries.

- Earnings per share grew by 15.4% annually over the last five years, massively outpacing its peers

- Sales outlook for the upcoming 12 months implies the business will stay on its desirable two-year growth trajectory

- A downside is its underwhelming 6% return on capital reflects management’s difficulties in finding profitable growth opportunities

TTM Technologies has the potential to be a high-quality business. The stock is up 676% over the last five years.

Why Should You Watch TTM Technologies

High Quality

Investable

Underperform

Why Should You Watch TTM Technologies

TTM Technologies is trading at $108.18 per share, or 36.5x forward P/E. TTM Technologies’s valuation represents a premium to other names in the business services sector.

TTM Technologies could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. TTM Technologies (TTMI) Research Report: Q4 CY2025 Update

PCB manufacturing company TTM Technologies (NASDAQ:TTMI) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 18.9% year on year to $774.3 million. On top of that, next quarter’s revenue guidance ($790 million at the midpoint) was surprisingly good and 7% above what analysts were expecting. Its non-GAAP profit of $0.70 per share was 2.6% above analysts’ consensus estimates.

TTM Technologies (TTMI) Q4 CY2025 Highlights:

- Revenue: $774.3 million vs analyst estimates of $752.3 million (18.9% year-on-year growth, 2.9% beat)

- Adjusted EPS: $0.70 vs analyst estimates of $0.68 (2.6% beat)

- Adjusted EBITDA: $126.2 million vs analyst estimates of $119.9 million (16.3% margin, 5.2% beat)

- Revenue Guidance for Q1 CY2026 is $790 million at the midpoint, above analyst estimates of $738.5 million

- Adjusted EPS guidance for Q1 CY2026 is $0.67 at the midpoint, above analyst estimates of $0.61

- Operating Margin: 10.4%, up from 1.4% in the same quarter last year

- Free Cash Flow Margin: 1.5%, down from 5.1% in the same quarter last year

- Market Capitalization: $11.12 billion

Company Overview

As one of the world's largest printed circuit board manufacturers with facilities spanning North America and Asia, TTM Technologies (NASDAQ:TTMI) manufactures printed circuit boards (PCBs) and radio frequency (RF) components for aerospace, defense, automotive, and telecommunications industries.

TTM operates through two main segments: PCB fabrication and RF & Specialty Components. The company specializes in complex, high-layer count circuit boards that serve as the foundation for most electronic devices. Its offerings range from conventional PCBs to advanced high-density interconnect (HDI) boards, flexible circuits that can bend to fit tight spaces, and substrate-like PCBs with extremely fine circuitry for cutting-edge applications.

Beyond circuit boards, TTM produces sophisticated radar systems for maritime surveillance, identification friend-or-foe (IFF) systems for air traffic control, and specialized communications equipment for military applications. The company's RF components business manufactures parts essential for wireless signal transmission and reception used in everything from cellular networks to satellite communications.

A typical customer might be a defense contractor needing radar components for naval vessels, an automotive manufacturer requiring flexible circuits for dashboard displays, or a telecommunications company sourcing components for 5G infrastructure. TTM's engineering teams often collaborate with customers early in the design process, providing expertise on manufacturability and performance optimization.

TTM generates revenue through both prototype production with quick turnaround times and volume manufacturing. The company maintains specialized facilities with clean room environments for its most advanced products, particularly those serving aerospace and defense applications where precision and reliability are paramount.

With approximately 1,500 customers worldwide, TTM serves as a critical link in the electronics supply chain, bridging the gap between component manufacturers and the companies that build finished electronic products. The company's global footprint includes manufacturing facilities across North America and Asia, allowing it to serve customers in various regions while maintaining the specialized capabilities needed for high-reliability applications.

4. Electronic Components & Manufacturing

The sector could see higher demand as the prevalence of advanced electronics increases in industries such as automotive, healthcare, aerospace, and computing. The high-performance components and contract manufacturing expertise required for autonomous vehicles and cloud computing datacenters, for instance, will benefit companies in the space. However, headwinds include geopolitical risks, particularly U.S.-China trade tensions that could disrupt component sourcing and production as the Trump administration takes an increasingly antagonizing stance on foreign relations. Additionally, stringent environmental regulations on e-waste and emissions could force the industry to pivot in potentially costly ways.

TTM Technologies competes with several global PCB and RF component manufacturers including Unimicron Technology, Sanmina Corporation, Shennan Circuits, and WUS Printed Circuit. In the RF systems and defense electronics space, its competitors include BAE Systems, Mercury Systems, Cobham, and Thales Group.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.91 billion in revenue over the past 12 months, TTM Technologies is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

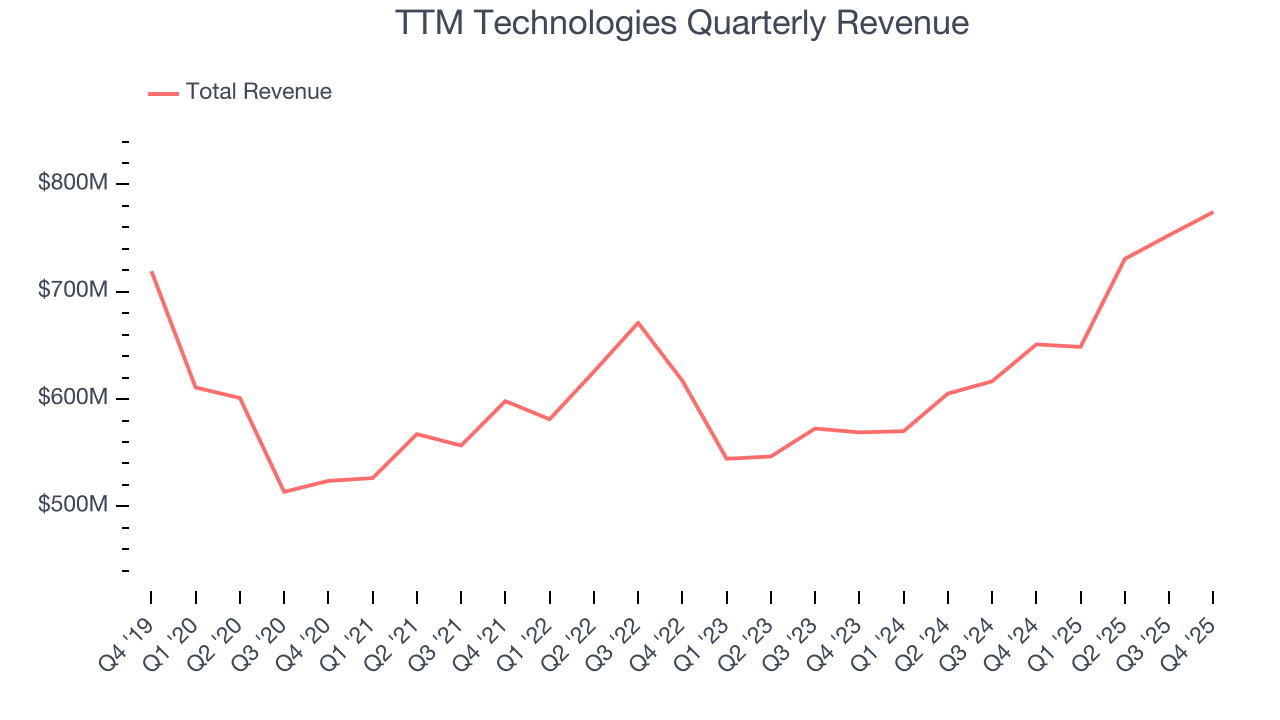

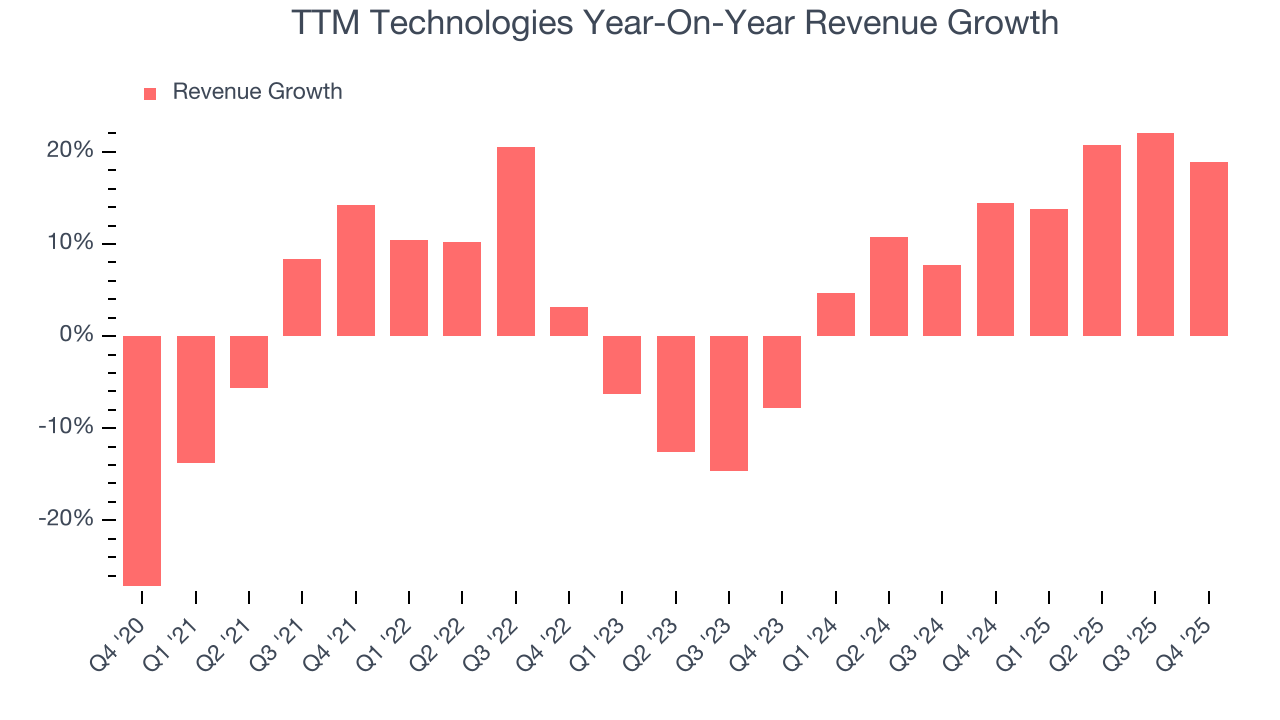

As you can see below, TTM Technologies’s 5.3% annualized revenue growth over the last five years was decent. This shows its offerings generated slightly more demand than the average business services company, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. TTM Technologies’s annualized revenue growth of 14.1% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, TTM Technologies reported year-on-year revenue growth of 18.9%, and its $774.3 million of revenue exceeded Wall Street’s estimates by 2.9%. Company management is currently guiding for a 21.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and suggests the market is forecasting success for its products and services.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

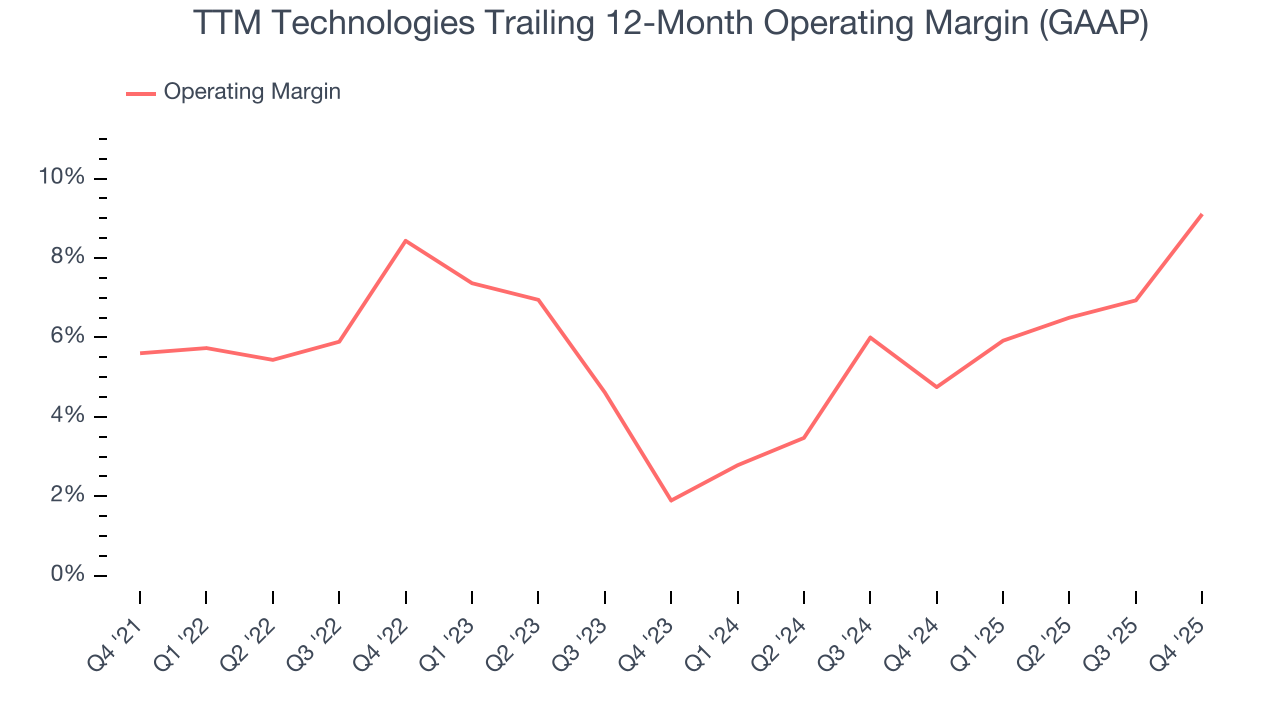

TTM Technologies was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.2% was weak for a business services business.

On the plus side, TTM Technologies’s operating margin rose by 3.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, TTM Technologies generated an operating margin profit margin of 10.4%, up 9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

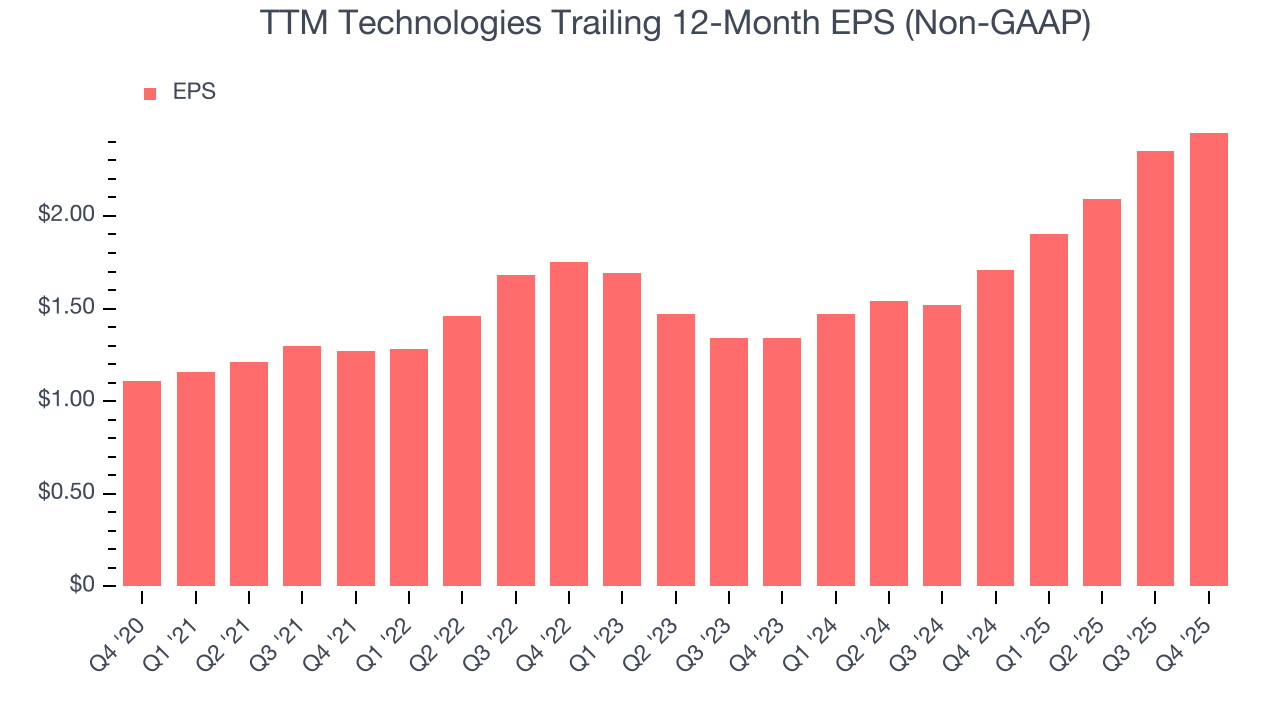

TTM Technologies’s EPS grew at an astounding 17.2% compounded annual growth rate over the last five years, higher than its 5.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

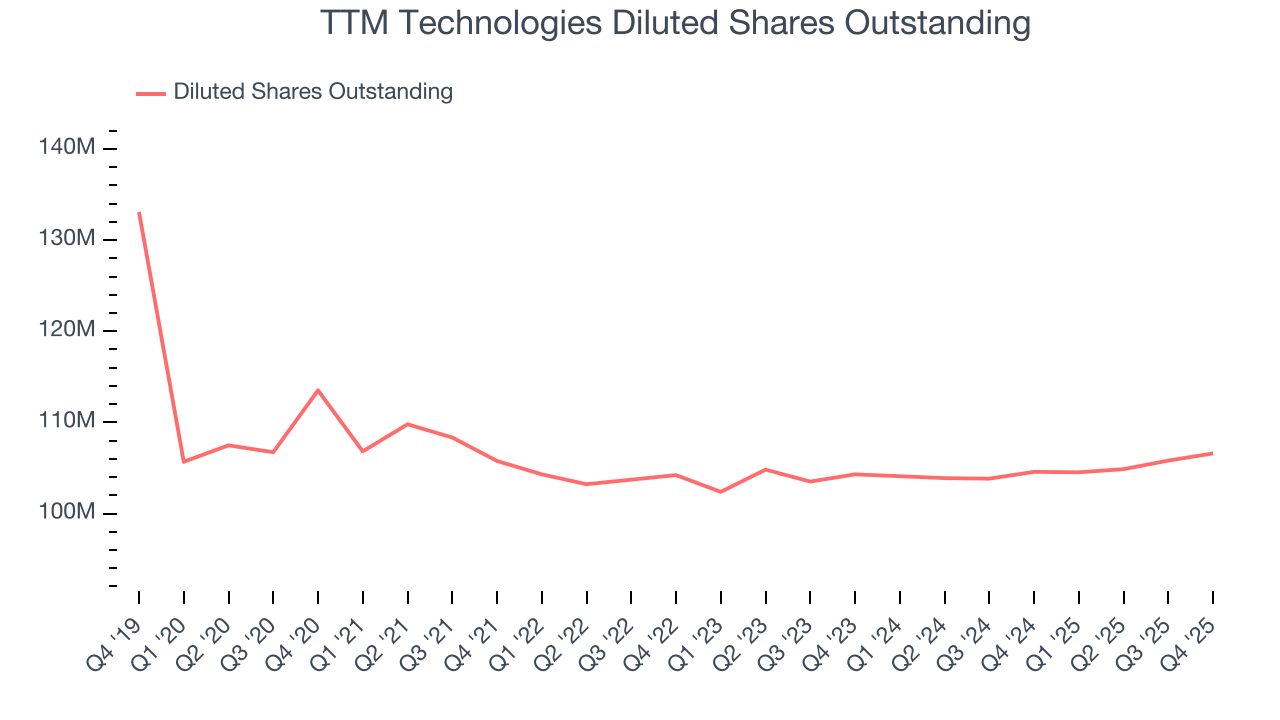

We can take a deeper look into TTM Technologies’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, TTM Technologies’s operating margin expanded by 3.5 percentage points over the last five years. On top of that, its share count shrank by 6.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For TTM Technologies, its two-year annual EPS growth of 35.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, TTM Technologies reported adjusted EPS of $0.70, up from $0.60 in the same quarter last year. This print beat analysts’ estimates by 2.6%. Over the next 12 months, Wall Street expects TTM Technologies’s full-year EPS of $2.45 to grow 23.6%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

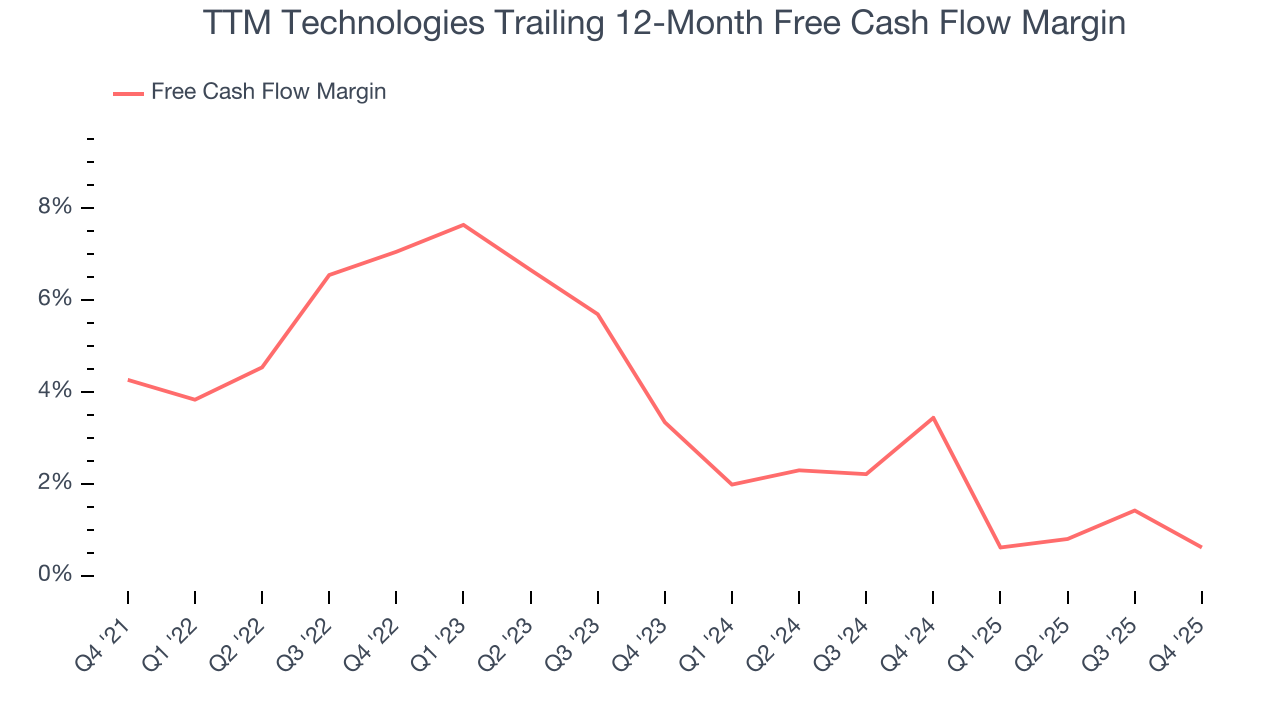

TTM Technologies has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.6%, subpar for a business services business.

Taking a step back, we can see that TTM Technologies’s margin dropped by 3.6 percentage points during that time. If the trend continues, it could signal it’s in the middle of an investment cycle.

TTM Technologies’s free cash flow clocked in at $11.68 million in Q4, equivalent to a 1.5% margin. The company’s cash profitability regressed as it was 3.6 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

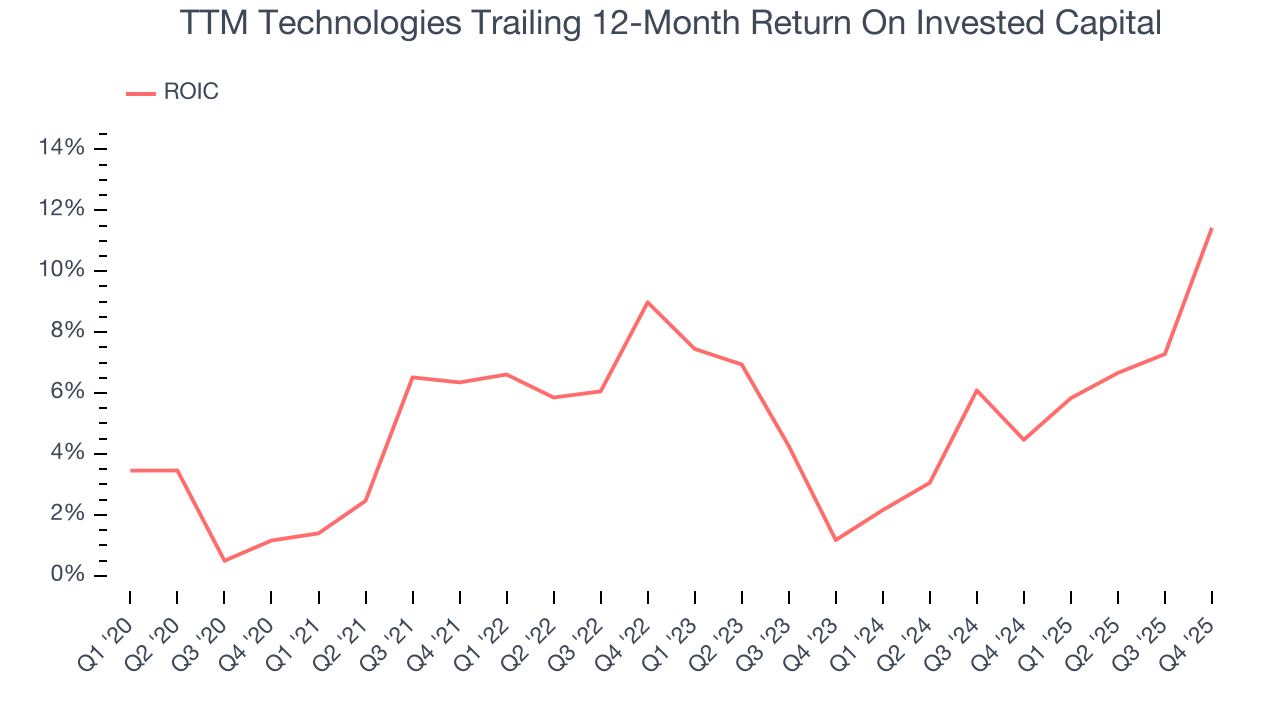

Although TTM Technologies has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.5%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, TTM Technologies’s ROIC has stayed the same over the last few years. We still think it’s a good business, but if the company wants to reach the next level, it must improve its returns.

10. Balance Sheet Assessment

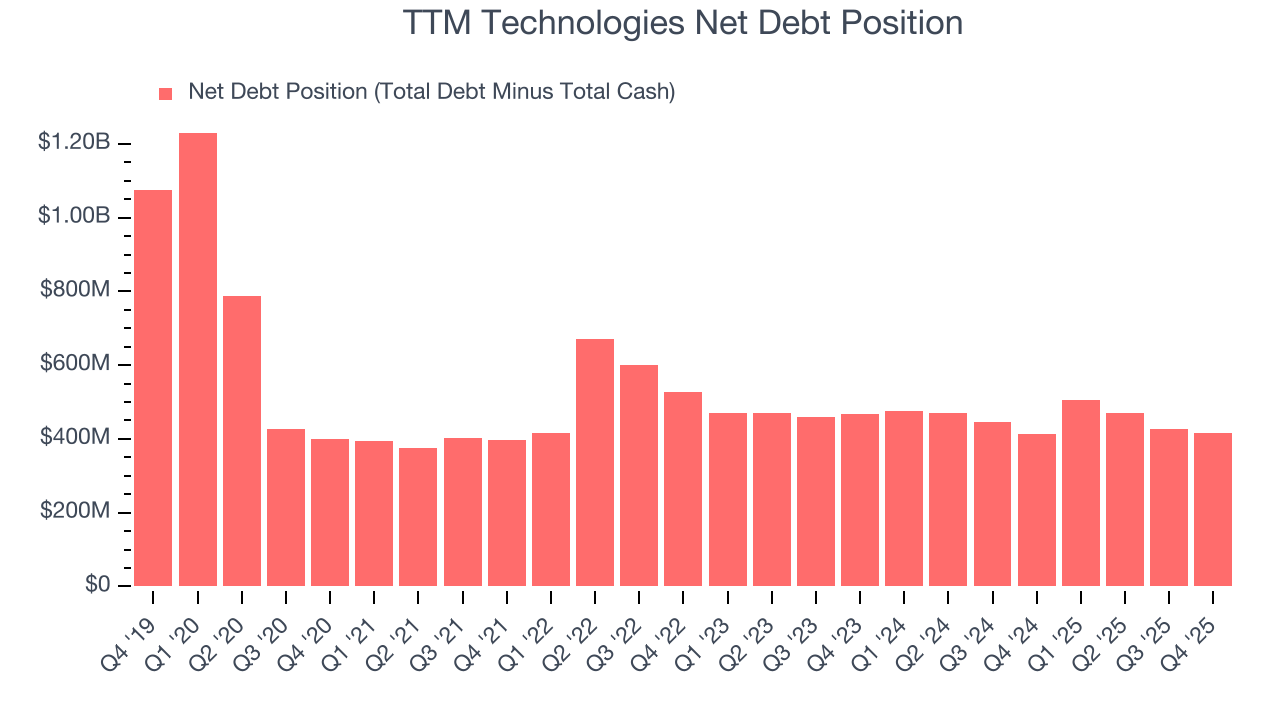

TTM Technologies reported $501.2 million of cash and $916.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $456.3 million of EBITDA over the last 12 months, we view TTM Technologies’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $20.58 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from TTM Technologies’s Q4 Results

We were impressed by how significantly TTM Technologies blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 3.8% to $99.83 immediately following the results.

12. Is Now The Time To Buy TTM Technologies?

Updated: February 4, 2026 at 5:15 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in TTM Technologies.

There are definitely a lot of things to like about TTM Technologies. First off, its revenue growth was decent over the last five years and is expected to accelerate over the next 12 months. And while its cash profitability fell over the last five years, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its projected EPS for the next year implies the company’s fundamentals will improve.

TTM Technologies’s P/E ratio based on the next 12 months is 31.8x. This valuation tells us that a lot of optimism is priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $103.25 on the company (compared to the current share price of $99.83).