Take-Two (TTWO)

Take-Two is intriguing. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why Take-Two Is Interesting

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ:TTWO) is one of the world’s largest video game publishers.

- Market share is on track to rise over the next 12 months as its 27.9% projected revenue growth implies demand will accelerate from its three-year trend

- Excellent EBITDA margin highlights the strength of its business model

- On a dimmer note, its historically negative EPS is a worrisome sign for conservative investors and obscures its long-term earnings potential

Take-Two is solid, but not perfect. This is a good company to add to your watchlist.

Why Should You Watch Take-Two

High Quality

Investable

Underperform

Why Should You Watch Take-Two

Take-Two is trading at $196.25 per share, or 25.7x forward EV/EBITDA. Take-Two’s valuation is around the peer average across the sector.

We’re not buyers right now, but we’ll keep tabs on this stock. We’d rather own the higher-quality businesses trading at comparable valuations.

3. Take-Two (TTWO) Research Report: Q4 CY2025 Update

Video game publisher Take Two (NASDAQ:TTWO) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 24.9% year on year to $1.70 billion. On top of that, next quarter’s revenue guidance ($1.60 billion at the midpoint) was surprisingly good and 5.2% above what analysts were expecting. Its GAAP loss of $0.50 per share was 28.6% below analysts’ consensus estimates.

Take-Two (TTWO) Q4 CY2025 Highlights:

- Revenue: $1.70 billion vs analyst estimates of $1.58 billion (24.9% year-on-year growth, 7.5% beat)

- EPS (GAAP): -$0.50 vs analyst expectations of -$0.39 (28.6% miss)

- Adjusted EBITDA: $174.8 million vs analyst estimates of $250.4 million (10.3% margin, 30.2% miss)

- Revenue Guidance for Q1 CY2026 is $1.60 billion at the midpoint, above analyst estimates of $1.52 billion

- EPS (GAAP) guidance for the full year is -$1.92 at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the full year is $669 million at the midpoint, below analyst estimates of $1.01 billion

- Operating Margin: -2.3%, up from -9.7% in the same quarter last year

- Free Cash Flow Margin: 13.9%, up from 5.4% in the previous quarter

- Market Capitalization: $40.99 billion

Company Overview

Best known for its Grand Theft Auto and NBA 2K franchises, Take Two (NASDAQ:TTWO) is one of the world’s largest video game publishers.

Take Two develops video games for consoles, PCs, and mobile devices through its five main development studios: Rockstar Games, 2K, Private Division, Social Point, and Playdots. Take Two’s games range across multiple genres, from first person shooter, action, role-playing, strategy, sports and family/casual entertainment. It also employs a range of business models; Take Two sells full premium games along with free to play games with in game purchase, and subscription style content.

Unlike rivals EA and Activision, whose businesses are built on big releases of annualized content like Madden or Call of Duty, some of Take Two’s biggest franchises are released less frequently, with the company often taking years to develop new versions. Its biggest franchise, Grand Theft Auto’s last release was September 2013, while the October 2018 release of Red Dead Redemption II was in development for 8 years. Its NBA 2K series is its only major title with an annual release. The company also has a collection of mid-tier franchises that have more regular releases such as Bioshock, Borderlands, Mafia, and Sid Meier’s Civilization.

4. Video Gaming

Since videogames were invented in the 1970s, they have gradually taken more share of entertainment time. Ubiquitous mobile devices have powered a surge in “snackable” games that can be played on the go. Over time, games have developed more social engagement features where friends can play games together over the internet. The business models of games publishers have become less volatile due to digitization of distribution, in game monetization, and like Hollywood, an increasing dependence on surefire hit franchises. Covid driven lockdowns accelerated adoption and usage of videogames – a trend that has not slowed.

Take Two competes with other large video game companies such as Electronic Arts (NASDAQ:EA), Roblox (NYSE:RBLX), and Nintendo (TSE:7974).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Take-Two’s sales grew at a decent 10.7% compounded annual growth rate over the last three years. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Take-Two reported robust year-on-year revenue growth of 24.9%, and its $1.70 billion of revenue topped Wall Street estimates by 7.5%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 27.9% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

For gaming businesses like Take-Two, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include royalties to sports leagues or celebrities featured in games, fees paid to Alphabet or Apple for games downloaded in their digital app stores, and data center hosting expenses associated with delivering games over the internet.

Take-Two’s unit economics are higher than the typical consumer internet business and signal that it has competitive products and services. As you can see below, it averaged a decent 58.1% gross margin over the last two years. Said differently, Take-Two paid its providers $41.92 for every $100 in revenue.

Take-Two produced a 55.7% gross profit margin in Q4, in line with the same quarter last year. Zooming out, Take-Two’s full-year margin has been trending up over the past 12 months, increasing by 1.5 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

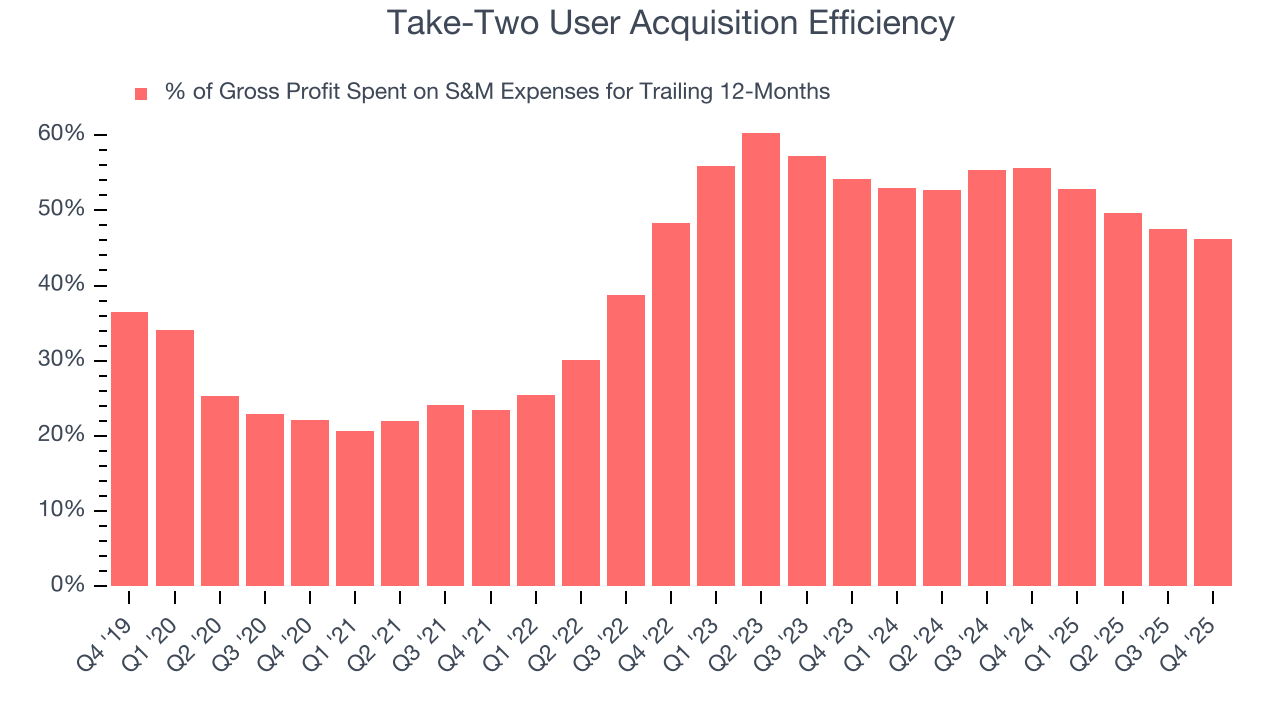

7. User Acquisition Efficiency

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Take-Two grow from a combination of product virality, paid advertisement, and incentives.

It’s relatively expensive for Take-Two to acquire new users as the company has spent 46.2% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that Take-Two operates in a competitive market and must continue investing to maintain an acceptable growth trajectory.

8. EBITDA

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Take-Two has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 13.7%.

Looking at the trend in its profitability, Take-Two’s EBITDA margin decreased by 1.9 percentage points over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Take-Two generated an EBITDA margin profit margin of 10.3%, down 5.1 percentage points year on year. Since Take-Two’s EBITDA margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

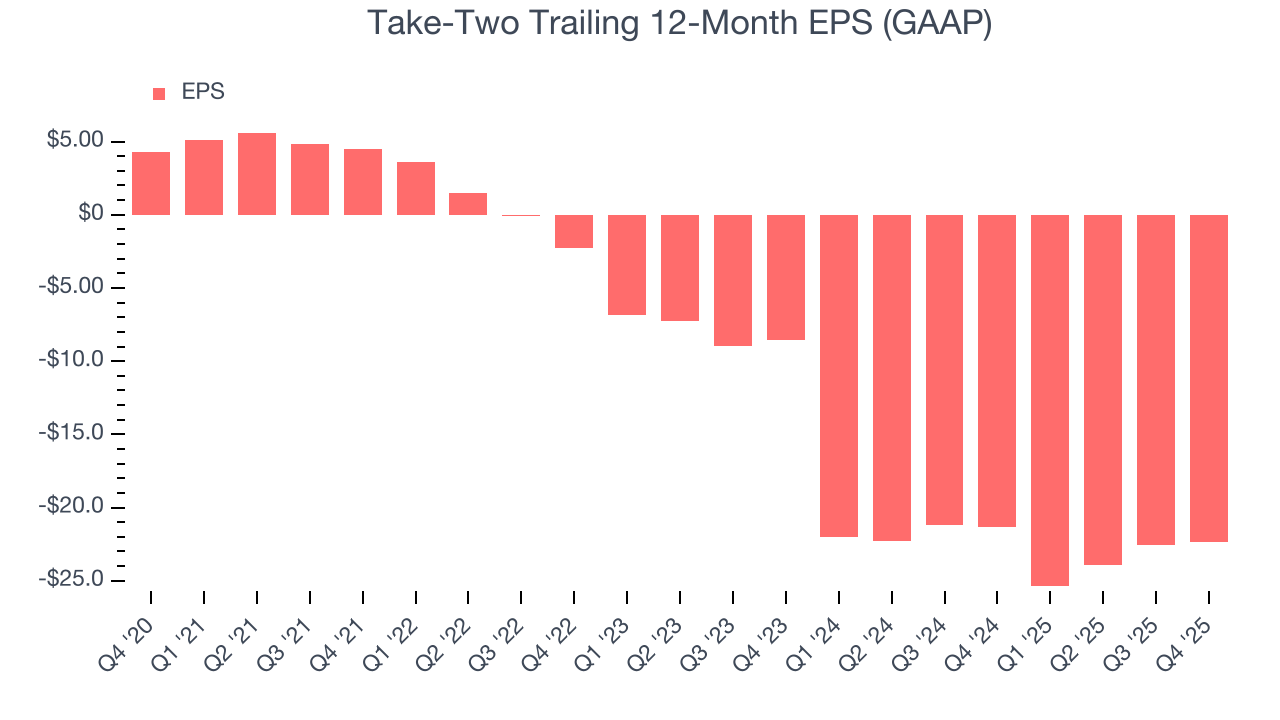

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Take-Two’s earnings losses deepened over the last three years as its EPS dropped 115% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q4, Take-Two reported EPS of negative $0.50, up from negative $0.71 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Take-Two’s full-year EPS of negative $22.38 will flip to positive $1.14.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Take-Two broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders. The divergence from its good EBITDA margin stems from its capital-intensive business model, which requires Take-Two to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Taking a step back, an encouraging sign is that Take-Two’s margin expanded by 5.1 percentage points over the last few years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Take-Two’s free cash flow clocked in at $236.2 million in Q4, equivalent to a 13.9% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

11. Balance Sheet Assessment

Take-Two reported $2.37 billion of cash and $3.51 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.06 billion of EBITDA over the last 12 months, we view Take-Two’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $27.7 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Take-Two’s Q4 Results

It was great to see Take-Two’s revenue guidance for next quarter top analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 3.9% to $220.45 immediately after reporting.

13. Is Now The Time To Buy Take-Two?

Updated: February 23, 2026 at 9:22 PM EST

Before investing in or passing on Take-Two, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

In our opinion, Take-Two is a solid company. First off, its revenue growth was good over the last three years and is expected to accelerate over the next 12 months. And while its declining EPS over the last three years makes it a less attractive asset to the public markets, its projected EPS for the next year implies the company’s fundamentals will improve. On top of that, its strong EBITDA margins show it’s a well-run business.

Take-Two’s EV/EBITDA ratio based on the next 12 months is 25.7x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $278.42 on the company (compared to the current share price of $196.25).