Tradeweb Markets (TW)

Tradeweb Markets is a great business. Its revenue and EPS are soaring, showing it can grow quickly and become more profitable as it scales.― StockStory Analyst Team

1. News

2. Summary

Why We Like Tradeweb Markets

Founded in 1996 as one of the pioneers in electronic bond trading, Tradeweb Markets (NASDAQ:TW) builds and operates electronic marketplaces that connect financial institutions for trading across rates, credit, equities, and money markets.

- Market share has increased this cycle as its 23.8% annual revenue growth over the last two years was exceptional

- Additional sales over the last five years increased its profitability as the 22.6% annual growth in its earnings per share outpaced its revenue

- The stock is slightly expensive, but we’d argue it’s often wise to hold onto high-quality businesses for the long term

Tradeweb Markets is a top-tier company. This is one of our top financials stocks.

Is Now The Time To Buy Tradeweb Markets?

High Quality

Investable

Underperform

Is Now The Time To Buy Tradeweb Markets?

Tradeweb Markets’s stock price of $109.54 implies a valuation ratio of 25.5x forward P/E. The pricey valuation means expectations are high for this company over the near to medium term.

Are you a fan of the business model? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Tradeweb Markets (TW) Research Report: Q4 CY2025 Update

Electronic trading platform Tradeweb Markets (NASDAQ:TW) announced better-than-expected revenue in Q4 CY2025, with sales up 12.5% year on year to $521.2 million. Its non-GAAP profit of $0.69 per share was 18% below analysts’ consensus estimates.

Tradeweb Markets (TW) Q4 CY2025 Highlights:

- Volume: $2.83 trillion vs analyst estimates of $2.84 trillion (23.3% year-on-year growth, in line)

- Revenue: $521.2 million vs analyst estimates of $517.2 million (12.5% year-on-year growth, 0.8% beat)

- Pre-tax Profit: $456.7 million (87.6% margin)

- Adjusted EPS: $0.69 vs analyst expectations of $0.84 (18% miss)

- Market Capitalization: $23.38 billion

Company Overview

Founded in 1996 as one of the pioneers in electronic bond trading, Tradeweb Markets (NASDAQ:TW) builds and operates electronic marketplaces that connect financial institutions for trading across rates, credit, equities, and money markets.

Tradeweb's network spans more than 3,000 clients across institutional, wholesale, retail, and corporate sectors, including asset managers, hedge funds, insurance companies, central banks, and dealers. The company's platforms facilitate trading through various protocols such as request-for-quote (RFQ), central limit order books, and session-based trading, each designed to address specific market needs and trading preferences.

The company's business is organized around four client sectors. The Tradeweb Institutional platform serves asset managers and central banks trading products like government bonds and interest rate swaps. Dealerweb focuses on the wholesale community, connecting dealers and financial institutions. Tradeweb Direct provides retail brokerages and their clients access to bond liquidity. The recently acquired ICD Portal allows corporate treasurers to research and trade money market funds and other short-term investments.

For example, a pension fund manager might use Tradeweb to request competitive quotes from multiple dealers when purchasing $50 million in Treasury bonds, comparing prices instantly rather than making multiple phone calls. Meanwhile, a corporate treasurer could use the ICD Portal to efficiently deploy excess cash into money market funds.

Tradeweb generates revenue primarily through transaction fees when trades are executed on its platforms. It also earns subscription fees for access to its marketplaces and data services. The company's technology infrastructure is deeply integrated with clients' systems, including order management, risk systems, and clearinghouses, creating significant switching costs and helping maintain client relationships.

4. Financial Exchanges & Data

Financial exchanges and data providers operate trading platforms and sell market information. They enjoy relatively stable revenue from trading fees and subscriptions, increasing demand for data analytics, and expansion opportunities in emerging markets. Challenges include regulatory oversight of market structure, competition from alternative trading venues, and substantial technology investments needed to maintain low-latency trading infrastructure and data security.

Tradeweb's competitors include MarketAxess and Bloomberg in credit markets; Bloomberg, Euronext (MTS), and CME Group in rates markets; and BNY Mellon, State Street, and J.P. Morgan in money market portals. The company also competes with traditional exchanges like ICE and inter-dealer brokers such as TP ICAP and BGC Partners.

5. Revenue Growth

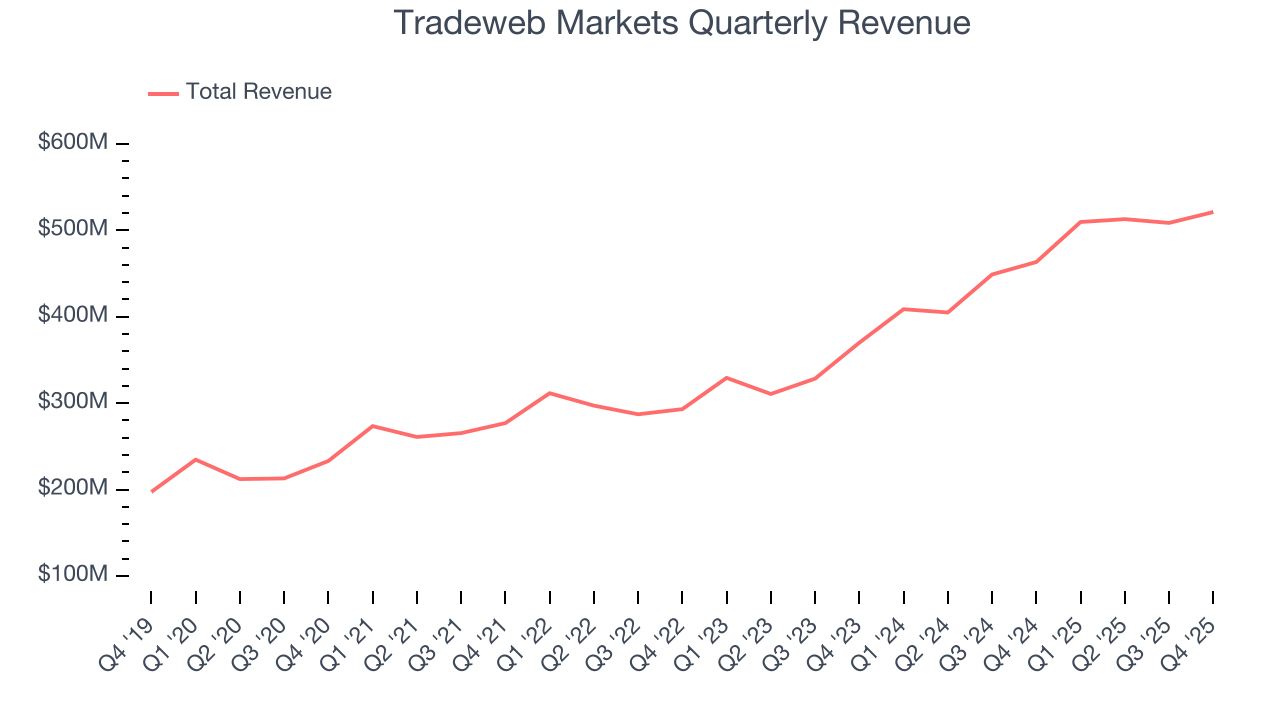

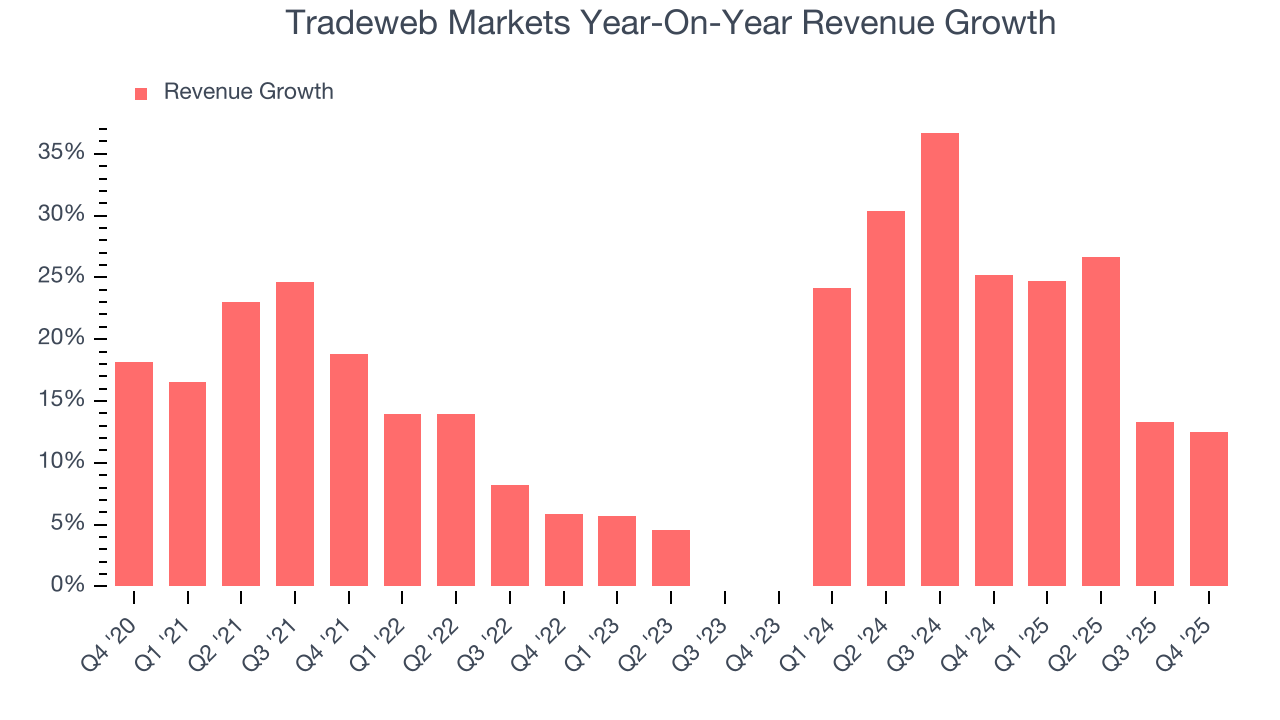

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Tradeweb Markets grew its revenue at an excellent 18.1% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Tradeweb Markets’s annualized revenue growth of 23.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Tradeweb Markets reported year-on-year revenue growth of 12.5%, and its $521.2 million of revenue exceeded Wall Street’s estimates by 0.8%.

6. Volume

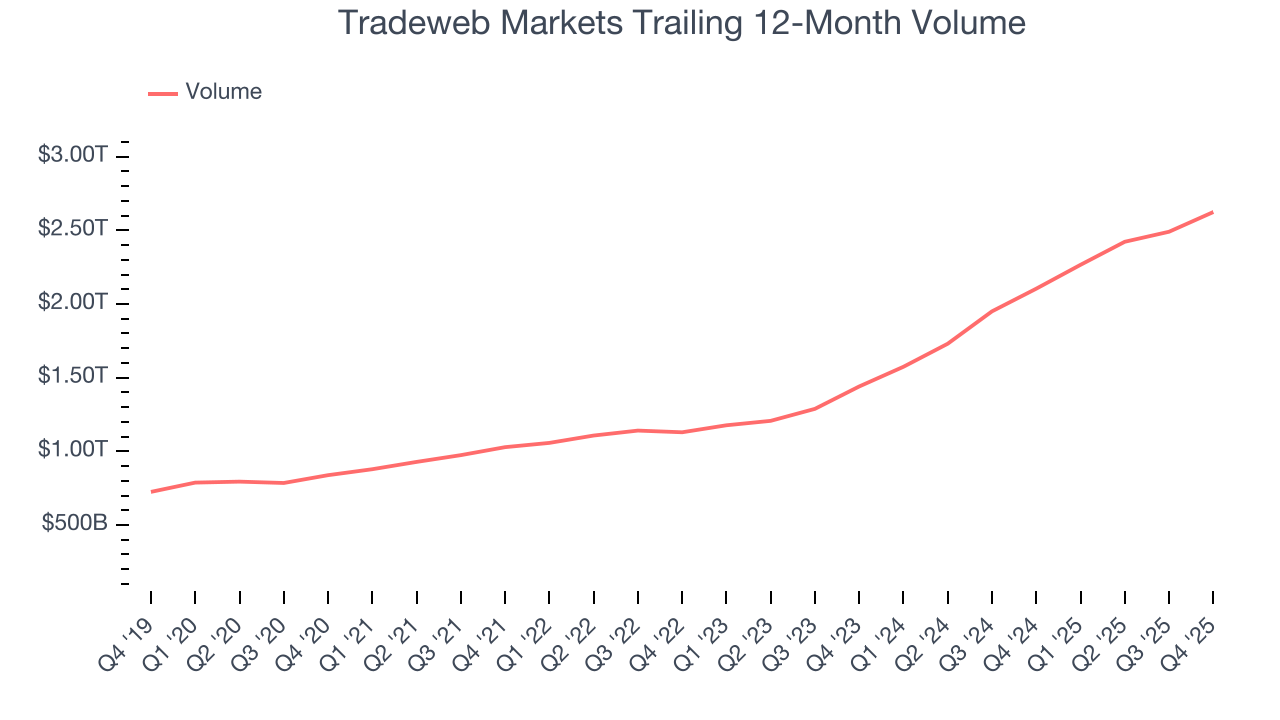

Financial services companies rely heavily on the total number of transactions and loan originations to drive top-line growth. Understanding these volumes is essential for finding winners in the sector.

Tradeweb Markets’s volumes have grown at an annual rate of 25.6% over the last five years, much better than the broader financials industry and faster than its total revenue. When analyzing Tradeweb Markets’s volumes over the last two years, we can see that growth accelerated to 35% annually. Its recent performance could be a sign of better days to come.

In Q4, Tradeweb Markets’s volumes were $2.83 trillion, meeting analysts’ expectations. This print was 23.3% higher than the same quarter last year.

7. Pre-Tax Profit Margin

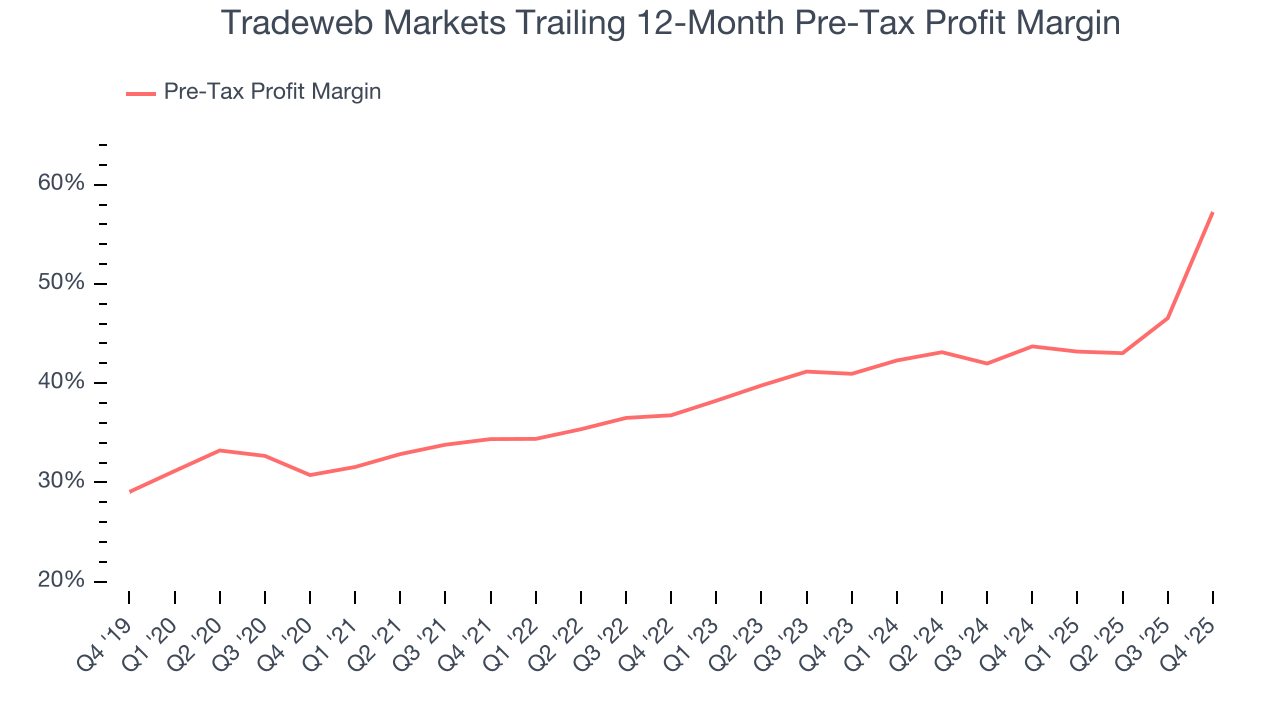

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Financial Exchanges & Data companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

Over the last five years, Tradeweb Markets’s pre-tax profit margin has fallen by 26.5 percentage points, going from 34.4% to 57.2%. It has also expanded by 16.3 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Tradeweb Markets’s pre-tax profit margin came in at 87.6% this quarter. This result was 42.3 percentage points better than the same quarter last year.

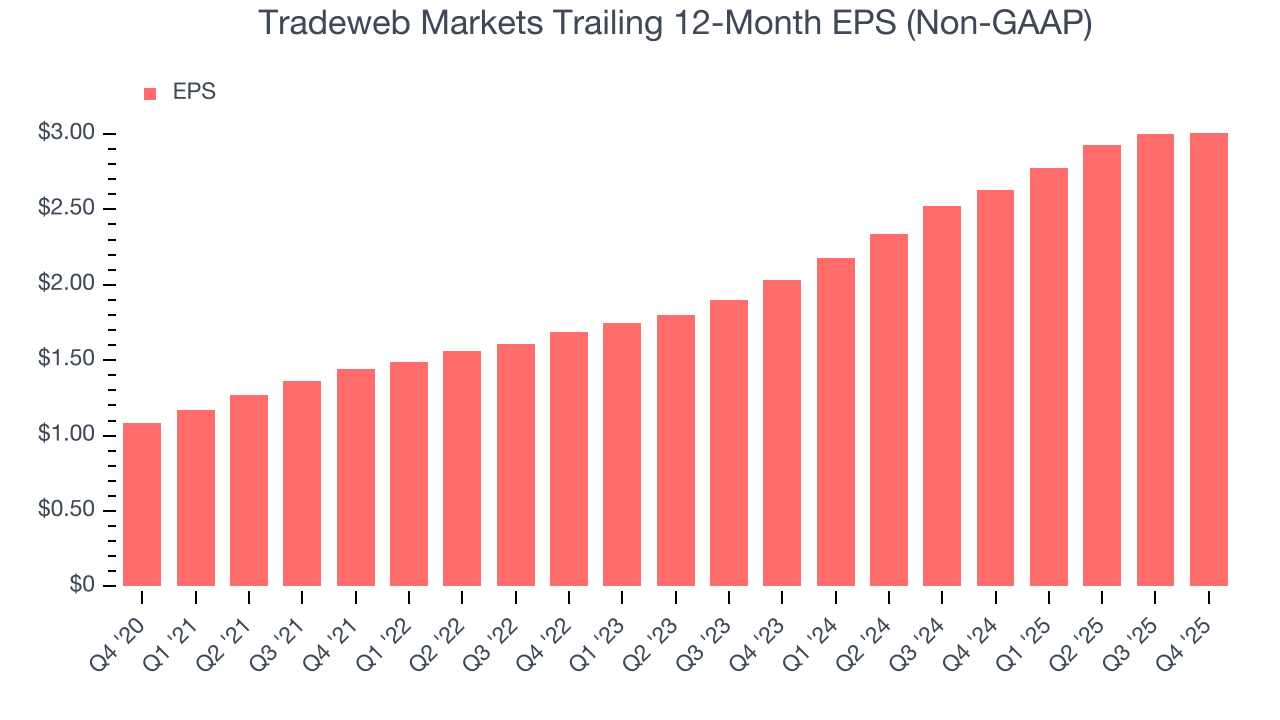

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Tradeweb Markets’s EPS grew at a spectacular 22.6% compounded annual growth rate over the last five years, higher than its 18.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Tradeweb Markets, its two-year annual EPS growth of 21.7% is similar to its five-year trend, implying strong and stable earnings power.

In Q4, Tradeweb Markets reported adjusted EPS of $0.69, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Tradeweb Markets’s full-year EPS of $3.01 to grow 31.3%.

9. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Tradeweb Markets has averaged an ROE of 7.8%, uninspiring for a company operating in a sector where the average shakes out around 10%. We’re optimistic Tradeweb Markets can turn the ship around given its success in other measures of financial health.

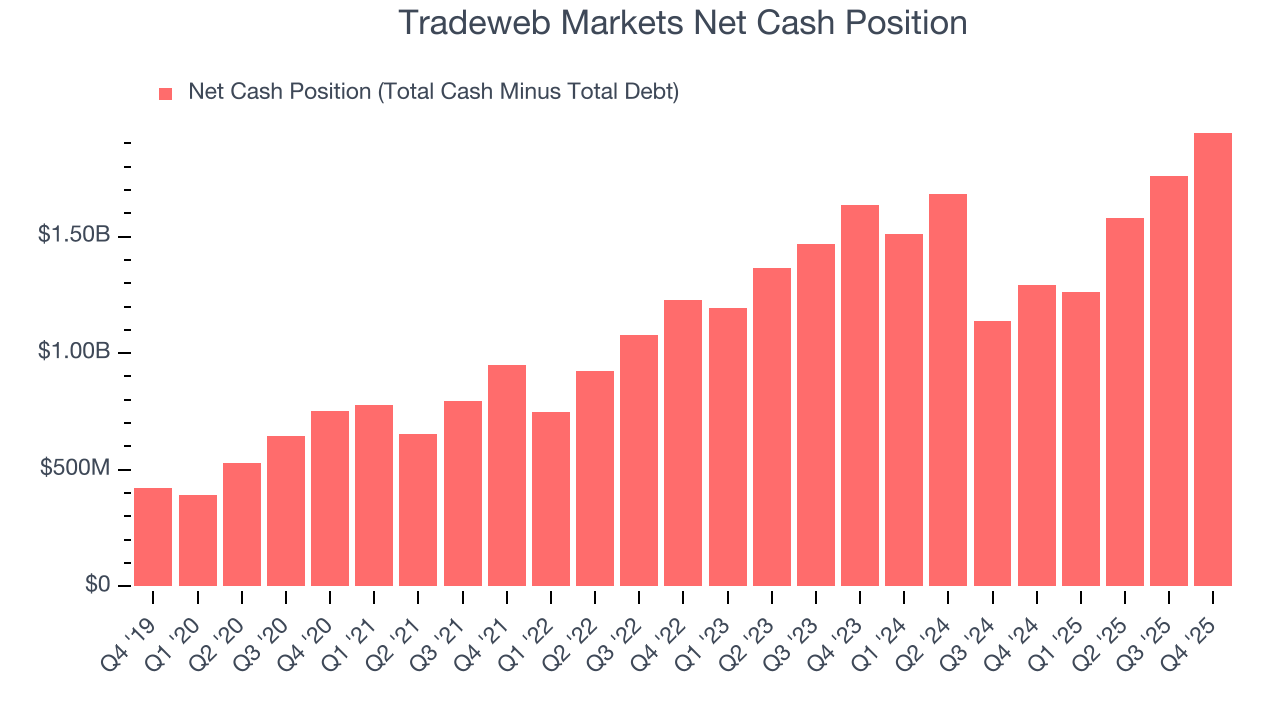

10. Balance Sheet Assessment

Tradeweb Markets reported $2.08 billion of cash and $139.2 million of debt on its balance sheet in the most recent quarter.

Given the company has more cash than debt, leverage is not an issue here.

11. Key Takeaways from Tradeweb Markets’s Q4 Results

It was encouraging to see Tradeweb Markets beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed and its transaction volumes was in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $109.54 immediately after reporting.

12. Is Now The Time To Buy Tradeweb Markets?

Updated: February 5, 2026 at 11:49 PM EST

Before making an investment decision, investors should account for Tradeweb Markets’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are multiple reasons why we think Tradeweb Markets is an amazing business. For starters, its revenue growth was impressive over the last five years. On top of that, its transaction volume growth was exceptional over the last five years, and its expanding pre-tax profit margin shows the business has become more efficient.

Tradeweb Markets’s P/E ratio based on the next 12 months is 25.5x. This multiple isn’t necessarily cheap, but we’ll happily own Tradeweb Markets as its fundamentals shine bright. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $127.08 on the company (compared to the current share price of $109.54).